Beruflich Dokumente

Kultur Dokumente

Exchange Rates, Monetary Policy, and Sovereign Risk

Hochgeladen von

luizfleaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exchange Rates, Monetary Policy, and Sovereign Risk

Hochgeladen von

luizfleaCopyright:

Verfügbare Formate

Exchange Rates, Monetary Policy, and Sovereign Risk

Luiz Felipe L. E. do Amaral

(leitees2@illinois.edu)

Department of Economics - University of Illinois at Urbana-Champaign

March 4, 2016

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

1 / 26

I. Introduction

Introduction

Perhaps the most important variable in international economics is the

exchange rate.

In this lecture, well build a model of exchange rate determination.

Moreover, well see how this model can be used to:

1. Study how monetary policy affects the exchange rate.

2. Study how sovereign risk affects the exchange rate.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

2 / 26

II. Definitions

Exchange Rates

It is useful to start with some definitions.

Exchange rates are the relative price of one currency in terms of

another.

They are called exchange rates because they are rates of exchange

between currencies.

Here in the U.S. we can interpret exchange rates as the price (in

U.S. dollars) of other currencies (e.g., euros, yen, pounds,...).

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

3 / 26

II. Definitions

Exchange Rates

Exchange rates are quoted as foreign currency per unit of domestic

currency or domestic currency per unit of foreign currency.

How much can be exchanged for one dollar? U89.40/US$.

How much can be exchanged for one yen? US$0.011185/U.

Exchange rates also change over time.

If a currency becomes more valuable it is said to appreciate.

Other currencies then become cheaper.

If a currency becomes less valuable, it is said to depreciate.

Other currencies then become more expensive.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

4 / 26

II. Definitions

Exchange Rates

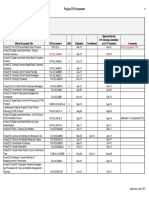

Figure 1: Exchange Rates

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

5 / 26

II. Definitions

Monetary Policy

All over the world, Central Banks determine the amount of currency

circulating in the economy, this is the money supply, M S .

On the other side of the market, households and firms determine the

money demand: M D = P L(R, Y ).

Part of the money demand is the real demand for liquidity,

L(R, Y ): the amount of currency in real terms i.e., measured in

goods and services instead of dollars that agents want to hold.

It depends negatively on the interest rate, R: the larger the interest

rate, the more agents will want to keep their wealth in

interest-earning deposits and not in currency.

It depends positively on income, Y : the larger the income, the more

agents will want to consume and, therefore, they will need to carry

more currency.

Part of the money demand is the price level, P : higher prices

imply that agents must carry more currency to buy the same

basket of goods.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

6 / 26

II. Definitions

Monetary Policy

Together, the money demand and the money supply make the money

market.

The money market is in equilibrium when the money demand is

equal to the money supply:

M D = M S P L(R, Y ) = M S

MS

= L(R, Y )

P

This equilibrium determines the equilibrium interest rate.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

7 / 26

II. Definitions

Monetary Policy

Figure 2: Determination of the Equilibrium Interest Rate

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

8 / 26

II. Definitions

Monetary Policy

The money market equilibrium depends on the money supply, which is

determined by the Central Bank.

Changes that the Central Bank make to the money supply are

called monetary policy.

When the money supply increases, the monetary policy is

expansionary.

An expansionary monetary policy decreases the interest rate.

When the money supply decreases, the monetary policy is

contractionary.

A contractionary monetary policy increases the interest rate.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof4,Illinois

2016 at Urbana-C

9 / 26

II. Definitions

Sovereign Risk

Sovereign risk is the risk that a government could default on its debt

(sovereign debt) or other obligations. Also, the risk generally

associated with investing in a particular country, or providing funds to

its government. Also called country risk.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 10

Urbana-C

/ 26

III. Exchange Rate Determination

The Foreign Exchange Market

The market in which international currency trades take place is called

the foreign exchange market.

The main participants are commercial banks, non-bank financial

institutions, non-bank businesses that operate internationally, and

central banks.

But buying and selling in the foreign exchange market are

dominated by commercial and investment banks (interbank

trade)

It takes place in many financial centers, but is concentrated in major

cities like London, New York, Tokyo, Frankfurt and Singapore.

It moves daily an amount of US$4 trillion dollars (April 2010). In April

1989, this value was US$600 billion.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 11

Urbana-C

/ 26

III. Exchange Rate Determination

The Foreign Exchange Market

Since the foreign exchange market looks very much like a global market

for a financial asset, it is natural to model exchange rates as assets.

Then, factors that affect the demand for assets should also affect

the demand for foreign currency.

But what affects the demand for an asset?

Return.

Risk.

Liquidity.

To keep things simple, lets assume (for now) that all currencies bear

the same risk, and are equally as liquid, so that we can focus on the

rates of return.

The rate of return of a currency (say, the euro) is just the interest

rate on euro deposits.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 12

Urbana-C

/ 26

III. Exchange Rate Determination

Exchange Rates and Asset Returns

However, is it enough to compare interest rates between two

currencies?

In other words, should individuals simply hold their wealth in the

currency with the highest interest rate?

Suppose that the dollar interest rate is 2% per year and the euro

interest rate is 4% per year. Suppose that the exchange rate today is

$1/e, and in a year it is expected to be $0.97/e. Should agents hold

their wealth in dollars or in euros?

A year from now, a $100 deposit in dollars will be worth $102

($100 1.02 = $102).

But how much will a $100 deposit in euros be worth?

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 13

Urbana-C

/ 26

III. Exchange Rate Determination

Exchange Rates and Asset Returns

Suppose that today an agent with $100 makes a deposit in euros.

Since today the exchange rate is $1/e, a $100 deposit in euros is

worth today e100.

Since the deposit is in euros, it will earn the euro interest rate.

Thus, in a year, this deposit will be worth e104.

However, a year from now the exchange rate is expected to be

$0.97/e. Therefore, in a year e104 will be worth $100.88

(0.97 104 = 100.88).

Even though euros pay a higher interest rate, by the end of the year

dollar deposits are worth more than euro deposits.

In fact, the return on a dollar deposit is 2%, whereas the return on

a euro deposit is (100.88 100)/100 = 0.88%.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 14

Urbana-C

/ 26

III. Exchange Rate Determination

Exchange Rates and Asset Returns

So, a year from now, those who invest in dollars will have earned a 2%

return, whereas those who invest in euros will have earned a 0.88%

return.

Can this be an equilibrium?

No! Otherwise, no one would hold euros.

In equilibrium, the return on dollars must be equal to the return on

euros (when they are both measured in terms of the same currency).

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 15

Urbana-C

/ 26

III. Exchange Rate Determination

Exchange Rates and Asset Returns

The return on dollars (measured in dollars) is simply the dollar interest

rate, R.

The return on euros (measured in dollars) is more complex, and

comprised of two terms:

The interest rate on euros, R .

By how much the euro is expected to appreciate against the dollar,

e E

E$/e

$/e

,

E$/e

where E denotes the exchange rate of euros in terms of

dollars (i.e., the price of euros).

Then in equilibrium we have the so called interest parity condition:

R = R +

e

E$/e

E$/e

E$/e

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 16

Urbana-C

/ 26

III. Exchange Rate Determination

The Interest Parity Condition

Lets understand the interest parity condition better.

Suppose that it doesnt hold.

e

In particular, assume that R > R + (E$/e

E$/e )/E$/e .

Then, the return on dollars in higher than the return on euros.

As a consequence, no one will want euros, so people will want to

trade euros for dollars.

As people trade euros for dollars, the exchange rate (i.e., the price

of euros, E) falls.

As E falls, the expected appreciation of the euro,

e

e /E

(E$/e

E$/e )/E$/e , increases (it is equal to ((E$/e

$/e ) 1).

Therefore, the return on euros increases.

e

The process is the opposite if R < R + (E$/e

E$/e )/E$/e , so that in

this case the return on euros falls.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 17

Urbana-C

/ 26

III. Exchange Rate Determination

The Equilibrium Exchange Rate

Figure 3: Determination of the Equilibrium Dollar/Euro Exchange

Rate

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 18

Urbana-C

/ 26

IV. Monetary Policy and Exchange Rates

Monetary Policy and Exchange Rates

How can monetary policy affect the exchange rate?

Through its effect on interest rates.

Figure 4: Money Markets/Exchange Rate Linkages

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 19

Urbana-C

/ 26

IV. Monetary Policy and Exchange Rates

Monetary Policy and Exchange Rates

Figure 5: Simultaneous Equilibrium in the U.S. Money Market and

the Foreign Exchange Market

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 20

Urbana-C

/ 26

IV. Monetary Policy and Exchange Rates

Monetary Policy and Exchange Rates

Consider an increase in the supply of U.S. dollars:

If the supply of dollars increase, in the U.S. money market, the

U.S. interest rate will fall.

The fall in the dollar interest rate decreases the return on dollars,

decreasing the demand for dollars. Thus, the dollar depreciates

(E$/e increases).

Finally, consider a increase in the supply of euros.

If the supply of euros increase, in the E.U. money market, the

E.U. interest rate will fall.

The fall in the euro interest rate decreases the return on euros,

increasing the demand for dollars. Thus, the dollar appreciates

(E$/e decreases).

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 21

Urbana-C

/ 26

IV. Monetary Policy and Exchange Rates

Monetary Policy and Exchange Rates

Figure 6: Effect on the Dollar/Euro Exchange Rate and the Dollar

Interest Rate of an Increase in the U.S. Money Supply

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 22

Urbana-C

/ 26

IV. Monetary Policy and Exchange Rates

Monetary Policy and Exchange Rates

Figure 6: Effect of an Increase in the European Money Supply on the

Dollar/Euro Exchange Rate

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 23

Urbana-C

/ 26

V. Sovereign Risk and Exchange Rates

Sovereign Risk and Exchange Rates

The preceding analysis is based on the assumption that all currencies

bear the same risk.

What are the consequences of dropping this assumption?

We start with two assumptions:

1. Euros are riskier than U.S. dollars.

2. The interest parity condition holds:

R = R +

e

E$/e

E$/e

E$/e

Can this be an equilibrium?

No! If the return (in dollars) of euros and dollars are the same,

but euros are riskier, no one will hold euros.

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 24

Urbana-C

/ 26

V. Sovereign Risk and Exchange Rates

Sovereign Risk and Exchange Rates

So investors will not hold euros because they can earn the same return

holding dollars while bearing a smaller risk.

Therefore, to convince investors to hold euros, the return on euros

must be higher than the return on dollars, that is euros must pay

a risk premium relative to U.S. dollars.

Denote this risk premium by , what will the equilibrium look like?

The foreign exchange market will be in equilibrium if the return

on dollars is equal to the return on euros plus the risk premium.

The interest parity condition then becomes:

R = R +

e

E$/e

E$/e

E$/e

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 25

Urbana-C

/ 26

V. Sovereign Risk and Exchange Rates

Sovereign Risk and Exchange Rates

Some questions remain unanswered:

What determines ?

Should be larger the more risky a currency is?

Should it be smaller the more international reserves the Central

Bank owns?

How can monetary policy affect the exchange rate when there is

sovereign risk?

How can the Central Bank reduce sovereign risk? Should it do so?

These are all question for another time...

Luiz Felipe L. E. do Amaral (leitees2@illinois.edu)

Exchange Rates,

(Department

Monetary of

Policy,

Economics

and Sovereign

- University

March

Riskof

4, Illinois

2016

at 26

Urbana-C

/ 26

Das könnte Ihnen auch gefallen

- Financial Markets and Economic Performance: A Model for Effective Decision MakingVon EverandFinancial Markets and Economic Performance: A Model for Effective Decision MakingNoch keine Bewertungen

- Unconventional Policies and Their Effects On Financial Markets PDFDokument36 SeitenUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNoch keine Bewertungen

- Preserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4Von EverandPreserving Wealth in Inflationary Times - Strategies for Protecting Your Financial Future: Alex on Finance, #4Noch keine Bewertungen

- Microeconomics AeroDokument4 SeitenMicroeconomics AeroDiestro Lyka Mae L.Noch keine Bewertungen

- Risks and Vulnerabilities of the US Economy Due to Overspending and Printing DollarsVon EverandRisks and Vulnerabilities of the US Economy Due to Overspending and Printing DollarsNoch keine Bewertungen

- Martin EKMSDokument64 SeitenMartin EKMSLucas OrdoñezNoch keine Bewertungen

- Literature Review On Foreign ExchangeDokument6 SeitenLiterature Review On Foreign ExchangeChetan Sahu0% (2)

- Frbny ReportDokument38 SeitenFrbny ReportSheidaHaNoch keine Bewertungen

- Title PageDokument37 SeitenTitle PagefrancogenioNoch keine Bewertungen

- Exchange Rate Dissertation TopicsDokument4 SeitenExchange Rate Dissertation TopicsCustomizedPaperPortland100% (1)

- Principles of MacroeconomicsDokument52 SeitenPrinciples of Macroeconomicsmoaz21100% (1)

- Interest Rate ParityDokument5 SeitenInterest Rate Parityrosario correiaNoch keine Bewertungen

- International Monetary Asymmetries and The Central BankDokument31 SeitenInternational Monetary Asymmetries and The Central BankJuan Carlos Lara GallegoNoch keine Bewertungen

- Economics Thesis PDFDokument8 SeitenEconomics Thesis PDFaouetoiig100% (3)

- Danielsson ValenzuelaDokument42 SeitenDanielsson ValenzuelakabbalahhNoch keine Bewertungen

- International FinanceDokument6 SeitenInternational FinancetawandaNoch keine Bewertungen

- Quantity Theory of MoneyDokument12 SeitenQuantity Theory of MoneyNuurNoch keine Bewertungen

- Departamento de EconomiaDokument55 SeitenDepartamento de EconomiameetwithsanjayNoch keine Bewertungen

- Usa Policy y GlobalizationDokument11 SeitenUsa Policy y GlobalizationmayuNoch keine Bewertungen

- DầdsáđầDokument30 SeitenDầdsáđầMinh KhoaNoch keine Bewertungen

- Modern Monetary TheoryDokument31 SeitenModern Monetary TheoryorivilNoch keine Bewertungen

- A. Money and The Banking SystemDokument9 SeitenA. Money and The Banking SystemShoniqua JohnsonNoch keine Bewertungen

- Dont Worry Over CurrenciesDokument8 SeitenDont Worry Over CurrenciesbenmackNoch keine Bewertungen

- Secondary Currency: An Empirical AnalysisDokument70 SeitenSecondary Currency: An Empirical Analysismegan_fowler_14Noch keine Bewertungen

- Toxic Loans StrategieDokument43 SeitenToxic Loans StrategieperchenicNoch keine Bewertungen

- IFM AssignmentDokument3 SeitenIFM AssignmentUsmanNoch keine Bewertungen

- Jorge CarreraDokument39 SeitenJorge CarreraMariano FélizNoch keine Bewertungen

- Financial Markets and Economic Performance A Model For Effective Decision Making 1St Edition John E Silvia Full ChapterDokument52 SeitenFinancial Markets and Economic Performance A Model For Effective Decision Making 1St Edition John E Silvia Full Chapterlorraine.montgomery895100% (15)

- Full Download Financial Reporting and Analysis Revsine 6th Edition Solutions Manual PDF Full ChapterDokument36 SeitenFull Download Financial Reporting and Analysis Revsine 6th Edition Solutions Manual PDF Full Chapterfourb.rohobb086100% (17)

- The External Financial Restricton. Esteban Pérez CaldenteyDokument16 SeitenThe External Financial Restricton. Esteban Pérez CaldenteyAlejandro VieiraNoch keine Bewertungen

- Inflation Targeting and Optimal Level of ItDokument6 SeitenInflation Targeting and Optimal Level of Itsukumarnandi@hotmail.comNoch keine Bewertungen

- The International Dollar Standard and The Sustainability of The U.S. Current Account DeficitDokument14 SeitenThe International Dollar Standard and The Sustainability of The U.S. Current Account Deficitpmm1989Noch keine Bewertungen

- Case Study Series Dark Side of Distribution Policies: Venezuelan Hyperinflation CrisisDokument13 SeitenCase Study Series Dark Side of Distribution Policies: Venezuelan Hyperinflation CrisisVaibhav RajoreNoch keine Bewertungen

- The Empirics of Currency and Banking Crises Barry Eichengreen and Andrew RoseDokument14 SeitenThe Empirics of Currency and Banking Crises Barry Eichengreen and Andrew RoseFelix NazombeNoch keine Bewertungen

- 01DUBROVDokument41 Seiten01DUBROVNikolay PavlovichNoch keine Bewertungen

- Thesis Title For Economics UndergraduateDokument6 SeitenThesis Title For Economics Undergraduatenadugnlkd100% (2)

- C: H T A C S: Ontagion OW HE Sian Risis PreadDokument17 SeitenC: H T A C S: Ontagion OW HE Sian Risis PreadrohitkoliNoch keine Bewertungen

- Dagdag Trabaho TsssDokument3 SeitenDagdag Trabaho TsssLeslie Jean SangalangNoch keine Bewertungen

- Newly Observed Financial WordsDokument5 SeitenNewly Observed Financial WordsProkash MondalNoch keine Bewertungen

- Literature Review On Exchange Rate DeterminationDokument5 SeitenLiterature Review On Exchange Rate Determinationea8m12smNoch keine Bewertungen

- Determinants of Exchange Rate Fluctuations For Venezuela: Application of An Extended Mundell-Fleming ModelDokument8 SeitenDeterminants of Exchange Rate Fluctuations For Venezuela: Application of An Extended Mundell-Fleming ModelNavneet JaiswalNoch keine Bewertungen

- UntitledDokument153 SeitenUntitledaaronNoch keine Bewertungen

- Allen F. y D. Gale. Comparative Financial SystemsDokument80 SeitenAllen F. y D. Gale. Comparative Financial SystemsCliffordTorresNoch keine Bewertungen

- Feenstra Taylor Chapter 1Dokument10 SeitenFeenstra Taylor Chapter 1sankalpakashNoch keine Bewertungen

- Chapter OneDokument7 SeitenChapter Oneal muwaajaha almuwajahaNoch keine Bewertungen

- InternationalTreasurer1997Apr28 Dollar StrengthDokument2 SeitenInternationalTreasurer1997Apr28 Dollar StrengthitreasurerNoch keine Bewertungen

- International Political Economy DissertationDokument7 SeitenInternational Political Economy DissertationCustomPapersOnlineSaltLakeCity100% (1)

- Impact of Currency Fluctuations On Indian Stock MarketDokument5 SeitenImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNoch keine Bewertungen

- Literature Review On Exchange Rate RegimeDokument8 SeitenLiterature Review On Exchange Rate Regimegw2cgcd9100% (1)

- CH - 08 - Financial CrisesDokument9 SeitenCH - 08 - Financial CrisesSurya RanaNoch keine Bewertungen

- U.S. Monetary Policy'S Impact On Latin America'S Structure of Production (1960-2010)Dokument22 SeitenU.S. Monetary Policy'S Impact On Latin America'S Structure of Production (1960-2010)xsxsxsxsxsNoch keine Bewertungen

- FinalDokument7 SeitenFinalNecky SairahNoch keine Bewertungen

- Inflation at Risk - 1-37Dokument37 SeitenInflation at Risk - 1-37Ibnu SaturaeNoch keine Bewertungen

- Work 695Dokument43 SeitenWork 695TBP_Think_Tank100% (1)

- International Finance 3RD HANDOUT DEC 2018Dokument15 SeitenInternational Finance 3RD HANDOUT DEC 2018Williamae FriasNoch keine Bewertungen

- The Journal of Finance - 2018 - DU - Deviations From Covered Interest Rate ParityDokument43 SeitenThe Journal of Finance - 2018 - DU - Deviations From Covered Interest Rate Paritytanis cuiNoch keine Bewertungen

- Special ProblemDokument9 SeitenSpecial ProblemALI SHER HaidriNoch keine Bewertungen

- Financial Crisis Ppt1Dokument11 SeitenFinancial Crisis Ppt1Lopa BhowmikNoch keine Bewertungen

- Escaping The Great - RecessionDokument30 SeitenEscaping The Great - RecessionJorge Luis MortonNoch keine Bewertungen

- Yared-Structural Disruptions in The Global Economy Sp24 SyllabusDokument5 SeitenYared-Structural Disruptions in The Global Economy Sp24 SyllabusGrace KimNoch keine Bewertungen

- Propert 447-445Dokument11 SeitenPropert 447-445LUNA100% (1)

- Yadea User Manual For e Scooter 1546004910Dokument44 SeitenYadea User Manual For e Scooter 1546004910Danthe ThenadNoch keine Bewertungen

- Trends in FoodDokument3 SeitenTrends in FoodAliNoch keine Bewertungen

- Sheet Metal Manufacturing Companies NoidaDokument9 SeitenSheet Metal Manufacturing Companies NoidaAmanda HoldenNoch keine Bewertungen

- Binet Kamat Test For General Mental AbilitiesDokument54 SeitenBinet Kamat Test For General Mental AbilitiesSana Siddiq100% (14)

- Raspberry Pi 3 and BeagleBone Black For Engineers - UpSkill Learning 124Dokument124 SeitenRaspberry Pi 3 and BeagleBone Black For Engineers - UpSkill Learning 124Dragan IvanovNoch keine Bewertungen

- YellowstoneDokument1 SeiteYellowstoneOana GalbenuNoch keine Bewertungen

- Thermoplastic Tubing: Catalogue 5210/UKDokument15 SeitenThermoplastic Tubing: Catalogue 5210/UKGeo BuzatuNoch keine Bewertungen

- Fret Position Calculator - StewmacDokument1 SeiteFret Position Calculator - StewmacJuan Pablo Sepulveda SierraNoch keine Bewertungen

- Frontinus - Water Management of RomeDokument68 SeitenFrontinus - Water Management of RomezElfmanNoch keine Bewertungen

- Communication Models in Internet of Things: A SurveyDokument5 SeitenCommunication Models in Internet of Things: A SurveyIJSTENoch keine Bewertungen

- Mini-Case 1 Ppe AnswerDokument11 SeitenMini-Case 1 Ppe Answeryu choong100% (2)

- HY-TB3DV-M 3axis Driver PDFDokument10 SeitenHY-TB3DV-M 3axis Driver PDFjoelgcrNoch keine Bewertungen

- Convection Concentric Annulus Vertical Cylinders Filling Porous MediaDokument17 SeitenConvection Concentric Annulus Vertical Cylinders Filling Porous MediakarthikeyanNoch keine Bewertungen

- Marketing Management 4th Edition Winer Test BankDokument35 SeitenMarketing Management 4th Edition Winer Test Bankapneaocheryzxs3ua100% (24)

- Design Documentation ChecklistDokument8 SeitenDesign Documentation ChecklistGlenn Stanton100% (1)

- Poems Prescribed For 2012-2014 English B CSEC ExamsDokument24 SeitenPoems Prescribed For 2012-2014 English B CSEC ExamsJorge Martinez Sr.100% (2)

- Final Thesis - Aris PotliopoulosDokument94 SeitenFinal Thesis - Aris PotliopoulosCristinaNoch keine Bewertungen

- Of The Month Is Live. 100+ Subjects. Participate Now!: Sanfoundry Certification ContestDokument4 SeitenOf The Month Is Live. 100+ Subjects. Participate Now!: Sanfoundry Certification ContestBaydaa QaidyNoch keine Bewertungen

- Rido, Rudini - Paediatric ECGDokument51 SeitenRido, Rudini - Paediatric ECGFikriYTNoch keine Bewertungen

- 1ST SUMMATIVE TEST FOR G10finalDokument2 Seiten1ST SUMMATIVE TEST FOR G10finalcherish austriaNoch keine Bewertungen

- The Unofficial Aterlife GuideDokument33 SeitenThe Unofficial Aterlife GuideIsrael Teixeira de AndradeNoch keine Bewertungen

- Overall Method StatementDokument33 SeitenOverall Method Statementsaranga100% (1)

- Approved Project 25 StandardsDokument5 SeitenApproved Project 25 StandardsepidavriosNoch keine Bewertungen

- SPM 1449 2006 Mathematics p2 BerjawapanDokument18 SeitenSPM 1449 2006 Mathematics p2 Berjawapanpss smk selandar71% (7)

- Natural Disasters Vocabulary Exercises Fun Activities Games Icebreakers Oneonone Activiti 42747Dokument2 SeitenNatural Disasters Vocabulary Exercises Fun Activities Games Icebreakers Oneonone Activiti 42747Andrea Tercero VillarroelNoch keine Bewertungen

- PEDokument12 SeitenPEMae Ann Base RicafortNoch keine Bewertungen

- Leadership Games and ActivitiesDokument38 SeitenLeadership Games and ActivitiesWilliam Oliss100% (1)

- Engineering Structures: C.X. Dong, A.K.H. Kwan, J.C.M. HoDokument14 SeitenEngineering Structures: C.X. Dong, A.K.H. Kwan, J.C.M. HoElieser SinagaNoch keine Bewertungen

- Salem RPGDokument16 SeitenSalem RPGabstockingNoch keine Bewertungen