Beruflich Dokumente

Kultur Dokumente

Case

Hochgeladen von

Elaine MateoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case

Hochgeladen von

Elaine MateoCopyright:

Verfügbare Formate

3

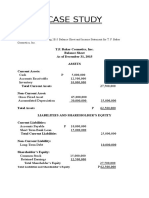

CASE STUDY

Instruction:

Review the following 2015 Balance Sheet and Income Statement for T. F. Baker

Cosmetics, Inc.

T.F. Baker Cosmetics, Inc.

Balance Sheet

As of December 31, 2015

ASSETS

Current Assets:

Cash

Accounts Receivable

Inventory

Total Current Assets

5,000,000

12,500,000

10,000,000

27,500,000

Non-Current Asset:

Gross Fixed Asset

Accumulated Depreciation

65,000,000

30,000,000

Total Assets

35,000,000

P

62,500,000

LIABILITIES AND SHAREHOLDERS EQUITY

Current Liabilities:

Accounts Payable

Short Term Bank Loan

Total Current Liabilities

10,000,000

15,000,000

25,000,000

Non-Current Liability:

Long-Term Debt

Shareholders Equity:

Common Stock

Retained Earnings

Total Shareholders Equity

Total Liabilities and Shareholders Equity

10,000,000

15,000,000

12,500,000

27,500,000

P 62,500,000

T.F. Baker Cosmetics, Inc.

Income Statement

For the year ended December 31, 2015

Net Sales

Cost of goods sold

Gross profit

Expenses:

Operating Expenses

Depreciation Expense

Interest Expense

P 150,000,000

(120,000,000)

30,000,000

15,000,000

5,000,000

2,000,000

22,000,000

Income before Tax

Income Tax Expense (35%)

Net Income

8,000,000

(2,800,000)

P

5,200,000

Additional Information:

At a recent board meeting, the firm set the following objectives for 2016:

1) The firm would increase liquidity. For competitive reasons, accounts receivable and

inventory balances were expected to continue their historical relationships with sales and

cost of goods sold, respectively, but the Board felt that the company should double its

cash holdings.

2) The firm would accelerate payments to suppliers. This would have two effects. First, by

paying more rapidly, the firm would be able to take advantage of early payment

discounts, which would increase its gross margin from 20 percent to 22 percent. Second,

by paying earlier, the firms accounts payable balance, which historically averaged about

one twelfth of cost of goods sold, would decline to 4 percent of cost of goods sold.

3) The firm would expand its warehouse, which would require an investment in fixed assets

of P10,000,000. This would increase projected depreciation expense from P5,000,000 in

2015 to P7,000,000 in 2016.

4) The firm would issue no new common stock during the year, and it would initiate a

dividend payments in 2016 would total P1,200,000.

5) Operating expenses would remain at 10% of sales.

6) The firm did not expect to retire any long-term debt, and it was willing to borrow up to

the limit of its current credit line with the bank, P20,000,000. The interest rate on its

outstanding debts would average 8%.

7) The firm set a sales target for 2016 of P200,000,000.

Requirement: Develop a set of Pro Forma Financial Statements to determine whether or not T.F.

Baker Cosmetics can achieve all these goals simultaneously.

ANSWERS

T.F. Baker Cosmetics, Inc.

Income Statement

Net Sales

Cost of Goods Sold

Gross Profit

Less: Expenses:

Operating Expense

Depreciation Expense

Operating Profit

Interest Expense

Income before Tax

Income Tax Expense

NET INCOME

2015

150,000,000

(120,000,000)

30,000,000

2016

200,000,000

(156,000,000)

44,000,000

(15,000,000)

(5,000,000)

10,000,000

(2,000,000)

8,000,000

(2,800,000)

5,200,000

(20,000,000)

(7,000,000)

17,000,000

(2,400,000)

14,600,000

(5,110,000)

9,490,000

T.F. Baker Cosmetics, Inc.

Balance Sheet

Current Assets

Cash

Accounts Receivable

Inventory

Non-current Assets:

Gross Fixed Asset

Accumulated Depreciation

TOTAL ASSETS

Current Liabilities:

Accounts Payable

Short Term Bank Loan

Non-current Liabilities:

Long-Term Debt

Shareholders Equity:

Common Stock

Retained Earnings

*External Financing Required

TOTAL LIABILITIES and SHAREHOLDERS

EQUITY

SOLUTIONS

2015

2016

5,000,000

12,500,000

10,000,000

10,000,000

16,666,667

13,000,000

65,000,000

(30,000,000)

62,500,000

75,000,000

(37,000,000)

77,666,667

10,000,000

15,000,000

6,240,000

20,000,000

10,000,000

10,000,000

15,000,000

12,500,000

15,000,000

20,790,000

5,636,667

77,666,667

62,500,000

COST OF GOODS SOLD

Sales

2015

Gross

Profit

Gross

Margin

150,000,00

0

30,000,000

Sales

2016

Gross

Margin

Gross

Profit

200,000,00

0

22%

Sales

2016

COGS

(squeeze)

Gross

Profit

200,000,00

0

156,000,00

0

44,000,000

20%

=5,000,000 x 2

=10,000,000

ACCOUNTS RECEIVABLE

PERCENTAGE OF SALES

= ACCOUNTS RECEIVABLE

2015 / SALES 2015

=12,500,000 / 150,000,000

=0.8333333333 OR 8.33333333%

ACCOUNTS RECEIVABLE

=SALES 2016 X 8.3333%

=200,000,000 X 8.33333%

=16,666,667

INVENTORY

PERCENT OF COGS

=10,000,000 / 120,000,000

=0.08333333 OR 8.333333%

INVENTORY 2016

=COGS 2016 X 0.8333333%

=156,000,000 X 0.83333333%

=13,000,000

GROSS FIXED ASSET

65,000,000 + 10,000,000

=75,000,000

ACCUMULATED

DEPRECIATION

=30,000,000 + 7,000,000

=37,000,000

ACCOUNTS PAYABLE

=COGS X 4%

=156,000,000 X 4%

=6,240,000

SHORT TERM BANK LOAN

The firm was willing to borrow up to

the limit of its credit line with the

bank, 20,000,000

RETAINED EARNINGS

=RETAINED EARNINGS 2015 +

NET PROFIT DIVIDEND

PAYMENT

=12,500,000 + 9,490,000

1,200,000 =20,790,000

44,000,000

OPERATING EXPENSES

=SALES 2016 X 10%

=200,000,000 X 10%

=20,000,0000

CASH

INTEREST EXPENSE

=OUTSTANDING DEBTS X 8%

=(SHORT TERM BANK LOAN +

LONG TERM DEBT) X 8%

=(20,000,000 + 10,000,000) X 8%

=2,400,000

INCOME TAX EXPENSE

=INCOME TAX EXPENSE 2015

/INCOME BEFORE TAX 2015

=2,800,000 / 8,000,000

=0.35 OR 35%

INCOME TAX EXPENSE 2016

=14,600,000 X 35%

=5,110,000

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Grange Fencing Garden Products Brochure PDFDokument44 SeitenGrange Fencing Garden Products Brochure PDFDan Joleys100% (1)

- UntitledDokument17 SeitenUntitledSedat100% (1)

- (Essential Skills For Nurses Series) Philippa Sully - Joan Dallas-Essential Communication Skills For Nursing and Midwifery-Mosby - Elsevier (2010) PDFDokument250 Seiten(Essential Skills For Nurses Series) Philippa Sully - Joan Dallas-Essential Communication Skills For Nursing and Midwifery-Mosby - Elsevier (2010) PDFRetno SumaraNoch keine Bewertungen

- Volleyball Unit PlanDokument4 SeitenVolleyball Unit Planapi-214597204Noch keine Bewertungen

- The Impact of Social Networking Sites To The Academic Performance of The College Students of Lyceum of The Philippines - LagunaDokument15 SeitenThe Impact of Social Networking Sites To The Academic Performance of The College Students of Lyceum of The Philippines - LagunaAasvogel Felodese Carnivora64% (14)

- Sample Engagement LetterDokument5 SeitenSample Engagement Letterprincess_camarilloNoch keine Bewertungen

- Review of Related Literature and Related StudiesDokument23 SeitenReview of Related Literature and Related StudiesReynhard Dale100% (3)

- BZY Series Tension Meter ManualDokument29 SeitenBZY Series Tension Meter ManualJORGE SANTANDER0% (1)

- DU30Dokument5 SeitenDU30Elaine MateoNoch keine Bewertungen

- 5ec7660621062 - 1590126086 - Cpa Dreams Recommended Schedule For Self ReviewDokument15 Seiten5ec7660621062 - 1590126086 - Cpa Dreams Recommended Schedule For Self ReviewElaine MateoNoch keine Bewertungen

- Eco 200 - Principles of Macroeconomics: Chapter 6: National Income AccountingDokument10 SeitenEco 200 - Principles of Macroeconomics: Chapter 6: National Income AccountingElaine MateoNoch keine Bewertungen

- 5ec7660621062 - 1590126086 - Cpa Dreams Recommended Schedule For Self ReviewDokument15 Seiten5ec7660621062 - 1590126086 - Cpa Dreams Recommended Schedule For Self ReviewElaine MateoNoch keine Bewertungen

- Chapter 5: The Public SectorDokument15 SeitenChapter 5: The Public SectorJudz SawadjaanNoch keine Bewertungen

- CaseDokument5 SeitenCaseElaine MateoNoch keine Bewertungen

- Able of Ontents: Cash Flow and Financial Planning Title PageDokument1 SeiteAble of Ontents: Cash Flow and Financial Planning Title PageElaine MateoNoch keine Bewertungen

- AnswerDokument1 SeiteAnswerElaine MateoNoch keine Bewertungen

- CopyDokument2 SeitenCopyElaine MateoNoch keine Bewertungen

- Learning Objectives: A. Objectives of Cash Flow StatementDokument2 SeitenLearning Objectives: A. Objectives of Cash Flow StatementElaine MateoNoch keine Bewertungen

- Basic Programming LanguangeDokument13 SeitenBasic Programming LanguangeElaine MateoNoch keine Bewertungen

- AteDokument19 SeitenAteElaine MateoNoch keine Bewertungen

- Learning Objectives: A. Objectives of Cash Flow StatementDokument2 SeitenLearning Objectives: A. Objectives of Cash Flow StatementElaine MateoNoch keine Bewertungen

- Pro Forma Statements: John Mark Emerson G. Dizon BSA-3BDokument22 SeitenPro Forma Statements: John Mark Emerson G. Dizon BSA-3BElaine MateoNoch keine Bewertungen

- IFRS8Dokument11 SeitenIFRS8Elaine MateoNoch keine Bewertungen

- Able of Ontents: Cash Flow and Financial Planning Title PageDokument1 SeiteAble of Ontents: Cash Flow and Financial Planning Title PageElaine MateoNoch keine Bewertungen

- Cash PlanningDokument3 SeitenCash PlanningElaine Mateo100% (1)

- ProblemsDokument7 SeitenProblemsElaine MateoNoch keine Bewertungen

- Define TaxationDokument3 SeitenDefine TaxationElaine MateoNoch keine Bewertungen

- International Rice Research Newsletter Vol12 No.4Dokument67 SeitenInternational Rice Research Newsletter Vol12 No.4ccquintosNoch keine Bewertungen

- Introduction To Regional PlanningDokument27 SeitenIntroduction To Regional Planningadeeba siddiquiNoch keine Bewertungen

- Interection 2 Reading Teacher's Book PDFDokument165 SeitenInterection 2 Reading Teacher's Book PDFتركي الزهراني0% (1)

- Introduction To Physiotherapy PracticeDokument22 SeitenIntroduction To Physiotherapy PracticejNoch keine Bewertungen

- APS PresentationDokument32 SeitenAPS PresentationRozack Ya ZhackNoch keine Bewertungen

- Chapter 3 Mine Ventialtion ProblemDokument3 SeitenChapter 3 Mine Ventialtion ProblemfahimNoch keine Bewertungen

- Manual Bms8n2 e LowDokument58 SeitenManual Bms8n2 e Lowzoranbt80_324037655Noch keine Bewertungen

- Gel Electrophoresis Worksheet Teacher AnswersDokument3 SeitenGel Electrophoresis Worksheet Teacher AnswersChris FalokunNoch keine Bewertungen

- Stating Like and DislikesDokument2 SeitenStating Like and DislikesDavid ArdiantoNoch keine Bewertungen

- Review Problems On Gas TurbineDokument9 SeitenReview Problems On Gas TurbinejehadyamNoch keine Bewertungen

- DTS Nozzles R3Dokument2 SeitenDTS Nozzles R3meilia teknikNoch keine Bewertungen

- Components of Vectors Prepared By: Victor Rea OribeDokument17 SeitenComponents of Vectors Prepared By: Victor Rea OribeGerone Tolentino AtienzaNoch keine Bewertungen

- Auburn Bsci ThesisDokument5 SeitenAuburn Bsci Thesisafksaplhfowdff100% (1)

- File 1) GRE 2009 From - Nov - 18 PDFDokument84 SeitenFile 1) GRE 2009 From - Nov - 18 PDFhuyly34Noch keine Bewertungen

- QLD Plan Draft Review Raw DataDokument242 SeitenQLD Plan Draft Review Raw DataRohit Jain100% (1)

- Basic: M1736N Model: MW73VR Model Code: Mw73Vr/BwtDokument42 SeitenBasic: M1736N Model: MW73VR Model Code: Mw73Vr/Bwtsantiago962Noch keine Bewertungen

- Impeller Velocity TrianglesDokument2 SeitenImpeller Velocity TrianglesLorettaMayNoch keine Bewertungen

- 2019q123.ev3-Descon Engro Level Gauges-QDokument7 Seiten2019q123.ev3-Descon Engro Level Gauges-Qengr_umer_01Noch keine Bewertungen

- MT4 EA Installation Guide Digital - EnglishDokument7 SeitenMT4 EA Installation Guide Digital - EnglishThe Trading PitNoch keine Bewertungen

- Portfolio Eelco Maan - 06-2017Dokument25 SeitenPortfolio Eelco Maan - 06-2017tungaas20011Noch keine Bewertungen

- The King's Avatar - Chapter 696 - Guild Feature - Gravity TalesDokument5 SeitenThe King's Avatar - Chapter 696 - Guild Feature - Gravity TalesMayhaaaNoch keine Bewertungen

- EPA NCP Technical Notebook PDFDokument191 SeitenEPA NCP Technical Notebook PDFlavrikNoch keine Bewertungen