Beruflich Dokumente

Kultur Dokumente

Dissolution Test

Hochgeladen von

Ravi UdeshiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dissolution Test

Hochgeladen von

Ravi UdeshiCopyright:

Verfügbare Formate

Ravi Sirs Nimble Education for ISC,CBSE,ICSE, IB, AS & A

Levels

Contact : 9033311500, 8866611600

------------------------------------------------------------------------------------------------------------------------------------------------MM : 36

Dissolution

Time: 1.5 hrs

------------------------------------------------------------------------------------------------------------------------------------------------Q1. The following is the Balance sheet of A & B 3:1 as on 31.3.14

Liabilities

Amount

Assets

Amount

Creditors

30,000 Cash

500

Bills payable

8,000 Bank

8,000

Mrs. As Loan

5,000 Stock

5,000

Mrs. Bs Loan

10,000 Investment

10,000

General Reserve

10,000 Debtors

20,000

Investment Reserve

1,000 (-)Provisions

(2,000)

18,000

As Capital

10,000 Plant

20,000

Bs Capital

10,000 Building

15,000

Goodwill

4,000

Advertisement Suspense

3,500

84,000

84,000

The firm was dissolved on Balance sheet date on following terms:

(i)A paid Mrs. As Loan & took stock at Rs 4,000. B took half of the investments at 10% discount.

(ii)Debtors realized Rs 19,000. Creditors & Bills payable were payable were due on an average one month

after balance sheet date, but were paid immediately at 6% discount.

(iii)Plant realized Rs 25,000, Building Rs 40,000, Goodwill Rs 6,000 & remaining investments Rs 4,500.

(iv)There is an old typewriter in the firm completely written off, taken over by B at Rs 300.

(v)A was to be credited with Rs 2,000 for undertaking dissolution process and was to bear the dissolution

expenses. Actual dissolution expenses paid by firm Rs 5,000.

Prepare Realization a/c, Capital a/c & Bank a/c.

[12]

Q2.A,B & C are partners in the ratio of 3:1:1.

Liabilities

Amount

Creditors

6,000

Loan

1,500

Capital A

27,500

B

10,000

C

7,000

Assets

Cash

Debtors

Less :Provision

Stock

Furniture

Sundry Assets

Amount

3,200

25,000

(2,000)

23,000

7,800

1,000

17,000

52,000

52,000

The following terms were agreed upon:

A agreed to take over furniture at Rs 800 & Debtors amounting to Rs 20,000 at Rs 17,200. The creditors of Rs

6,000 were paid by him. B took over stock at Rs 7,000 & some sundry assets at Rs 7,200 being 90% of book

value. C took remaining sundry assets at 90% less Rs 100 as discount & assume the responsibility for the

discharge of loan together with outstanding interest of Rs 30(interest not appearing in balance sheet). The

expenses of dissolution were Rs 270. Remaining debtors were sold for 50%.

Prepare Journals.

[12]

Ravi Sirs Nimble Education for ISC,CBSE,ICSE, IB, AS & A

Levels

Contact : 9033311500, 8866611600

Ravi Sirs Nimble Education for ISC,CBSE,ICSE, IB, AS & A

Levels

Contact : 9033311500, 8866611600

Q3.X & Y started business with Rs 100,000 and Rs 75,000 respectively on 1.4.2015. For the year ended

31.3.2016 their profits were Rs 120,000. Interest on drawings was allowed @ 10% pa. Their drawings were

Rs 20,000 each. There were difference of opinion and they decided to dissolve the firm. On the day of

dissolution liability of the firm apart from partners capital were : Creditors Rs 30,000, outstanding expenses

Rs 20,000. X had taken a loan from firm Rs 10,000. Cash balance was Rs 5,000.

The assets of the firm realized Rs 200,000 and there was a contingent liability of Rs 15,000 which had to be

settled. Dissolution expenses amounted to Rs 5,000.

Prepare Memorandum Balance sheet and other relevant accounts.

[12]

***************************

BEST OF LUCK

Ravi Sirs Nimble Education for ISC,CBSE,ICSE, IB, AS & A

Levels

Contact : 9033311500, 8866611600

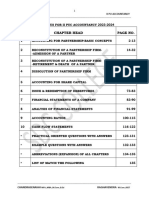

Das könnte Ihnen auch gefallen

- Contact: 9033311500, 8866611600: Best of LuckDokument1 SeiteContact: 9033311500, 8866611600: Best of LuckRavi UdeshiNoch keine Bewertungen

- Chap 14 Eco TestDokument1 SeiteChap 14 Eco TestRavi UdeshiNoch keine Bewertungen

- Chap 15 Eco TestDokument1 SeiteChap 15 Eco TestRavi UdeshiNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument6 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Abhyudaya Bank 2009-10Dokument10 SeitenAbhyudaya Bank 2009-10Nilesh_Tiwari2010Noch keine Bewertungen

- Ratio TestDokument1 SeiteRatio TestRavi UdeshiNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- M B A PDFDokument169 SeitenM B A PDFAshwini ketkariNoch keine Bewertungen

- Assignment On GrameenPhoneDokument31 SeitenAssignment On GrameenPhoneShantanu Das75% (4)

- Baj Audit Account 1.0Dokument8 SeitenBaj Audit Account 1.0vrlthaker6128Noch keine Bewertungen

- Depatmental Exam Study Materials - KalvikuralDokument71 SeitenDepatmental Exam Study Materials - KalvikuralasectionklkNoch keine Bewertungen

- Qbank 23-24 Npo RemovedDokument135 SeitenQbank 23-24 Npo Removedramu gowdaNoch keine Bewertungen

- Journals TestDokument1 SeiteJournals TestRavi UdeshiNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Volume 4 Derivatives IRRM & RMDokument168 SeitenVolume 4 Derivatives IRRM & RMTejas jogadeNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Addya MaDokument13 SeitenAddya Mapradip-1953Noch keine Bewertungen

- Learning Note of BUPGB, Raebareli-Uday Kumar, Asst. ManagerDokument8 SeitenLearning Note of BUPGB, Raebareli-Uday Kumar, Asst. ManagerUday KumarNoch keine Bewertungen

- Revised Financial Results For June 30, 2016 (Result)Dokument4 SeitenRevised Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Navarathnamala RD in TMBDokument3 SeitenNavarathnamala RD in TMBSelvaraj MurugesanNoch keine Bewertungen

- Dina Nath Kumar: Nse Symbol: Indianb BSE Scrip Code-532814Dokument15 SeitenDina Nath Kumar: Nse Symbol: Indianb BSE Scrip Code-532814dipesh.shopNoch keine Bewertungen

- SFM MarathonDokument87 SeitenSFM MarathonCharmi KotechaNoch keine Bewertungen

- 200 500 Full Company Update 20230227Dokument155 Seiten200 500 Full Company Update 20230227Contra Value BetsNoch keine Bewertungen

- Presentation of Binani CementDokument31 SeitenPresentation of Binani CementSushil KumarNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- TDS PresentationDokument16 SeitenTDS Presentationgamers SatisfactionNoch keine Bewertungen

- Questions - Rebate On Bills DiscountedDokument4 SeitenQuestions - Rebate On Bills DiscountedJiss Palelil0% (1)

- Term Test MR CollegeDokument6 SeitenTerm Test MR CollegeManoj MadushanthaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Presentation ON Analysis of Financial Trends of S.J.V.N.Ltd. (SHIMLA)Dokument15 SeitenPresentation ON Analysis of Financial Trends of S.J.V.N.Ltd. (SHIMLA)Pushp Raj ThakurNoch keine Bewertungen

- Balance Sheet of Reliance PowerDokument10 SeitenBalance Sheet of Reliance PowerJoe SharmaNoch keine Bewertungen

- Retirement Planning: Part - 1: Your Monthly Expenses - Now & ThenDokument4 SeitenRetirement Planning: Part - 1: Your Monthly Expenses - Now & ThensridharNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Earnings Update Q2FY16 (Company Update)Dokument44 SeitenEarnings Update Q2FY16 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument12 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- KLNIRMVPDokument4 SeitenKLNIRMVPDena ElizabethNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Worksheet On Profit and Loss AppropriationDokument66 SeitenWorksheet On Profit and Loss AppropriationAditya ShrivastavaNoch keine Bewertungen

- Small Savings: ObjectivesDokument5 SeitenSmall Savings: ObjectivesGuruRajNoch keine Bewertungen

- State Bank of PatialaDokument5 SeitenState Bank of PatialaBaljinderrai7Noch keine Bewertungen

- Shezan International Limited ReportDokument75 SeitenShezan International Limited ReportUsman AnjumNoch keine Bewertungen

- FAC511S - Financial Accounting 101 - 1st Opportunity - June 2016Dokument6 SeitenFAC511S - Financial Accounting 101 - 1st Opportunity - June 2016Uno VeiiNoch keine Bewertungen

- Financial Management 1Dokument36 SeitenFinancial Management 1nirmljn100% (1)

- SaharaDokument103 SeitenSaharaMahesh TejaniNoch keine Bewertungen

- Quality Circle Forum of India: Qcfihq@qcfi - In. Support@qcfi - inDokument1 SeiteQuality Circle Forum of India: Qcfihq@qcfi - In. Support@qcfi - inAnkurNoch keine Bewertungen

- Earning's Call - Canara BankDokument31 SeitenEarning's Call - Canara BankArijit MukherjeeNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation (Company Update)Dokument37 SeitenInvestor Presentation (Company Update)Shyam SunderNoch keine Bewertungen

- Interest Certificate: Shivam Garg and Ramkrishna GargDokument1 SeiteInterest Certificate: Shivam Garg and Ramkrishna GargShivamNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Amalgamation IIDokument26 SeitenAmalgamation IIMumtazAhmadNoch keine Bewertungen

- Human Resources DepartmentDokument4 SeitenHuman Resources DepartmentHemant KawalkarNoch keine Bewertungen

- Outdoor Play Materials MS 2020-2021Dokument2 SeitenOutdoor Play Materials MS 2020-2021Pazhamalairajan KaliyaperumalNoch keine Bewertungen

- Abhishek Soni: Curriculam Vitae Sub: - For Industrial Training Career ObjectiveDokument2 SeitenAbhishek Soni: Curriculam Vitae Sub: - For Industrial Training Career ObjectiveSANJAY SINGH RATHORENoch keine Bewertungen

- Axis Bank FinalDokument109 SeitenAxis Bank Finalashu1630100% (9)

- Advisory Channels Case Studies: Las Vegas Hotels & Royal Bank of Mid - Western CanadaVon EverandAdvisory Channels Case Studies: Las Vegas Hotels & Royal Bank of Mid - Western CanadaNoch keine Bewertungen

- Fiscal and Monetary PolicyDokument41 SeitenFiscal and Monetary PolicyRavi UdeshiNoch keine Bewertungen

- ISC Commerce Syllabus PDFDokument9 SeitenISC Commerce Syllabus PDFRavi UdeshiNoch keine Bewertungen

- Ledger & Trial BalanceDokument1 SeiteLedger & Trial BalanceRavi UdeshiNoch keine Bewertungen

- ISC Commerce Syllabus PDFDokument9 SeitenISC Commerce Syllabus PDFRavi UdeshiNoch keine Bewertungen

- Basic Identification of Accounts and ClassificationDokument6 SeitenBasic Identification of Accounts and ClassificationRavi UdeshiNoch keine Bewertungen

- CBSE Class 11 Accountancy WorksheetDokument1 SeiteCBSE Class 11 Accountancy WorksheetRavi UdeshiNoch keine Bewertungen

- Student Details Form 2017-18: SL No Name of Student School Student Contact No Father's Contact No Mother's Contact NoDokument1 SeiteStudent Details Form 2017-18: SL No Name of Student School Student Contact No Father's Contact No Mother's Contact NoRavi UdeshiNoch keine Bewertungen

- Journals TestDokument1 SeiteJournals TestRavi UdeshiNoch keine Bewertungen

- Cashbook WorksheetDokument3 SeitenCashbook WorksheetRavi UdeshiNoch keine Bewertungen

- Contact 9033311500, 8866611600Dokument2 SeitenContact 9033311500, 8866611600Ravi UdeshiNoch keine Bewertungen

- Basic Identification of Accounts and ClassificationDokument6 SeitenBasic Identification of Accounts and ClassificationRavi UdeshiNoch keine Bewertungen

- Benz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsDokument1 SeiteBenz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsRavi UdeshiNoch keine Bewertungen

- Accounting EquationsDokument2 SeitenAccounting EquationsRavi UdeshiNoch keine Bewertungen

- Benz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsDokument1 SeiteBenz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsRavi UdeshiNoch keine Bewertungen

- IG BEP & Finance TestDokument2 SeitenIG BEP & Finance TestRavi UdeshiNoch keine Bewertungen

- Ratio TestDokument1 SeiteRatio TestRavi UdeshiNoch keine Bewertungen

- Chapter # 5 Financial RatiosDokument30 SeitenChapter # 5 Financial RatiosRooh Ullah KhanNoch keine Bewertungen

- Capital Gearing RatioDokument13 SeitenCapital Gearing RatioRajesh AvanthiNoch keine Bewertungen

- BHM 657 Principles of Accounting IDokument182 SeitenBHM 657 Principles of Accounting Itaola100% (1)

- FMDokument99 SeitenFMvinit1117Noch keine Bewertungen

- Chapter Six: 6. Bond MarketsDokument55 SeitenChapter Six: 6. Bond MarketsNhatty WeroNoch keine Bewertungen

- Introduction To Valuation: The Time Value of Money (Formulas)Dokument35 SeitenIntroduction To Valuation: The Time Value of Money (Formulas)Sanjna ChimnaniNoch keine Bewertungen

- Chapter Three FA II DawudDokument11 SeitenChapter Three FA II DawudHussen AbdulkadirNoch keine Bewertungen

- Chapter 5 PowerpointDokument37 SeitenChapter 5 Powerpointapi-248607804Noch keine Bewertungen

- Mat112 Business MathematicsDokument6 SeitenMat112 Business MathematicsSaya Bintang100% (8)

- Bootstrapping Spot RateDokument37 SeitenBootstrapping Spot Ratevirgoss8100% (1)

- Tutorial 8 (Extra)Dokument6 SeitenTutorial 8 (Extra)Clement TanNoch keine Bewertungen

- L0 BFS MaterialDokument263 SeitenL0 BFS MaterialsnpalveNoch keine Bewertungen

- Group 9 PPT PresentationDokument58 SeitenGroup 9 PPT PresentationJoy JjoyNoch keine Bewertungen

- Venture Capital Method: Investment ScenariosDokument2 SeitenVenture Capital Method: Investment ScenariosShivani KarkeraNoch keine Bewertungen

- Accounting - NotesDokument2 SeitenAccounting - NotesRica CamonNoch keine Bewertungen

- Lecture Notes On Revaluation and ImpairmentDokument6 SeitenLecture Notes On Revaluation and Impairmentjudel ArielNoch keine Bewertungen

- INTACT2 - Handout No. 2Dokument7 SeitenINTACT2 - Handout No. 2Charlyn Jewel OlaesNoch keine Bewertungen

- Arithmetic Shortcuts Cetking WorkshopDokument38 SeitenArithmetic Shortcuts Cetking WorkshopAadi WeleNoch keine Bewertungen

- Business Law Final ProjectDokument41 SeitenBusiness Law Final ProjectUsman TariqNoch keine Bewertungen

- Eicher MotorsDokument12 SeitenEicher MotorsPreet Jain100% (1)

- Assignment 4 Credit Policies.Dokument2 SeitenAssignment 4 Credit Policies.Mohammad WaleedNoch keine Bewertungen

- Basic College Mathematics 5th Edition Martin Gay Test BankDokument41 SeitenBasic College Mathematics 5th Edition Martin Gay Test Banksamuelfintanult1jj100% (29)

- MBF14e Chap06 Parity Condition PbmsDokument23 SeitenMBF14e Chap06 Parity Condition Pbmsanon_355962815Noch keine Bewertungen

- Stock Valuation Case Report SampleDokument14 SeitenStock Valuation Case Report SampleSravanthi Dusi100% (2)

- Investment Model QuestionsDokument12 SeitenInvestment Model Questionssamuel debebe0% (1)

- Tata Motors ValuationDokument32 SeitenTata Motors ValuationraaunakNoch keine Bewertungen

- Bsais ReviewerDokument4 SeitenBsais ReviewerJun Martine SalcedoNoch keine Bewertungen

- The Intermediate Accounting Series Volume 2 2016 Empleo Robles Solman CompressDokument86 SeitenThe Intermediate Accounting Series Volume 2 2016 Empleo Robles Solman CompressAubrey Shaiyne OfianaNoch keine Bewertungen

- ACCA F9 Workbook Questions 1.1 PDFDokument92 SeitenACCA F9 Workbook Questions 1.1 PDFYashvin Alwar100% (1)

- Mathematical Reasoning Part 2 MaterialDokument22 SeitenMathematical Reasoning Part 2 MaterialNizam generalNoch keine Bewertungen