Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

CIN : L40109TG1986PLC006745

Lalgad i Malakpet, Shameerpet Mandai,

R.R. Dist., Hyd erabad - 500 078 . T.S. INDIA

Phone : + 91 -8418- 301640-49 (10 Lines)

Fax No. 91-8148- 301 6 52

E-mail : contact@hbl.in

HBL

HBL Power Systems Ltd.

12 December 2016

The Department of Corporate Services

Bombay Stock Exchange Limited

Phiroze Jeejeebhoy Towers

Dalal Street

Mumbai - 400 001

Fax No: 022-2272 1919/ 2272 2041

The Listing Department

National Stock Exchange of India Limited

Exchange Plaza, Bandra Kurla Complex

Bandra (East)

Mumbai - 400 051

Fax No: 022-2659 8237 /38

BSE STOCK CODE: 517271

NSE CODE: HBLPOWER

Dear sir I madam,

OUTCOME OF THE BOARD MEETING HELD ON 12TH DECEMBER 2016

UNAUDITED FINANCIAL RESULTS (STAND ALONE ) FOR TH E QUARTER AND HALF

YEAR ENDED ON 30TH SEPTEMB ER 20 16.

At a meeting of the Board of Directors of the Company held on 121h December 2016,

the Board inter-alia approved (standalone) unaudited financial results of the

Company for the quarter and half year ended on 30th September 2016. A copy of the

same in enclosed.

This intimation is sent pursuant to Regulation 34(2), 47(1) and 53 of SEBI (LOADR)

Regulations 2015 read with SEB I circular CIR/CFD/FAC/62/2016 dated 5th July 2016

vide para 2.6.1 (i) .

Please take the above information on records and confirm.

Thanking You

Yours faithfully

For HBL POWER SYSTEMS LI MITED

MVSS Kumar

Company Secretary

HBL Power Systems Ltd

CIN: L40109TG1986PLC006745

8-2-601, Road No .10

Banjara Hills

Hyderabad- 500 034

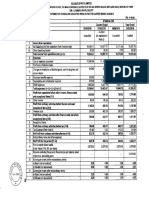

Unaudited Financial Results for the half year ended 30th September 2016

HBL

Half year ended

Quarter ending

Particulars

1 Income from operations

(a) Sales I Income from operations

2

3

4

5

6

7

(b) Other Operating Income

Expenditure

a) Cost of Materials Consumed

b) Purchase of Stock-in-Trade

c) (Increase) I Decrease in Fin ished goods,

work in Progress and stock-in-trade

d) Employee Benefits expense

e) Depreciation and Amortisation expense

f) Other Expenses

Total Expens!S

Profit/(Loss) from operations before other income,

finance costs & exceptional Items (1-2)

Other Income

Profit/(Loss) from ordinary activities before

finance costs & exceptional Items (3+4)

Finance Costs

Profit/(Loss) from ordinary act ivites after

finance costs but before exceptional Items (5-6)

8 Exceptional items- {Income) I Expenditure

9 Profit/(Loss) from ordinary activities

before Tax (7-8)

10 Tax Expense I (credit)

Rs in Lakhs

For the Year

30-Sep-16

(Unaudited)

30-Jun-16

(Unaudited)

30-Sep-1S

(Unaudited)

30-Sep-16

(Unaudited)

30-Sep-15

(Unaudited)

37686.19

33162.79

34399.32

70848.98

68165.28

ended

31-Mar-16

(Audited)

128835.88

25422.29

289.62

22042.92

67.22

17453.87

47465.21

356 .84

41615 .95

76366.53

349.33

{1567.71)

2231.05

1363.11

7768.89

35507.25

(996.72)

2288.96

1268.41

6583.90

31254.69

4230.72

2342.22

1161.05

6976.81

32164.67

{2564.43)

4520.01

2631.52

14352.79

66761.94

1176.76

4752.77

2434.76

13363.57

63343.81

599.98

10280.99

4958.96

28049.85

120605.64

2178.94

524.89

1908.10

204.69

2234.65

276.26

4087.04

729.58

4821.47

441 .11

8230.24

1208.05

2703.83

1400.25

2112.79

1441.10

2510.91

1767.30

4816.62

2841.35

5262.58

3731.98

9438.29

5264.70

1303.58

42.38

671.69

743.61

1975.27

42.38

1530.60

1261.20

330.03

671.69

120.00

743.61

170.00

1932.89

450.03

1530.60

390.00

3277.43

1334.44

931.17

551.69

573.61

1482.86

1140.60

1942.99

931.17

{88.45)

842.72

551.69

(88.47)

463.22

573.61

(69.98)

503.63

1482.86

{176.92)

1305.94

1140.60

(139.96)

1000.64

1942.99

2530.00

2530.00

4173.59

896.16

11 Net Profit/(Loss) from ordinary activities

after Tax (9-10)

12 Extraordinary Items (net of tax expense)

13 Net Profit/(Loss) for the period (11-12)

14 Other Comprehensive Income (Net of tax)

15 Total Compre!hensive Income ( 13+14)

16 Paid-up equity share capital

(Face Value Re 1/- each)

17 Reserves excluding reva luation reserves

(as per Balance sheet of previous accounting year)

18 i Earnings Per Share (before extraordinary items)

2530.00

2530.00

2530.00

1942.99

2530.00

57415.11

(of Re 1/- each) (not annualised):

a) Basic

b) Diluted

ii Earnings Per Share (after extraordinary items)

(of Re 1/- each) (not annua lised):

a) Basic

b) Diluted

0.33

0.18

0.20

0.52

0.40

0.77

0.33

0.18

0.20

0.52

0.40

0.77

0.33

0.33

0.18

0.18

0.20

0.20

0.52

0.52

0.40

0.40

0.77

0.77

1 The company adopted Indian Accounting Standards (lnd AS) from April 1, 2016 as prescribed under Section 133 of the Companies Act, 2013

read together with the relevent rules issued thereunder and the Generally Accepted Accounting Principles in India . The date of transition to lnd

AS is April1, 2015. The financial results for the previous year ended March 31, 2016 are not lnd AS Compliant.

2 The Unaudited results for the quarter ended September 30, 2016 were reviewed by the Audit Committee in its meeting held on December 12,

2016 and approved by the Board of Directors at the meeting held on December 12, 2016. The results for the quarter/ha lf year ended 30th

September 2015 have not been subjected to review or audit. However, the management has exercised necessary due diligence to ensure that

the financial results provide a true and fair viewof its affairs.

3

Figures of the previous quarters have been regrouped, wherever necessary to correspond with the current quarter

which was adopted by the company with effect from April1, 2016.

period in terms of lnd AS

Reconciliatio n of Statement of Profit & Loss between Indian GAAP as previously reported and the Total Comprehsive Income as per lnd As is as

follows:

Particulars

Quarter ending

Half Year ending

30-Sep-15

30-Sep-15

Net Profit reported under Indian GAAP

557.95

1,228.99

Adjustments :

(392. 74)

Effect on Finance Cost due to Fari Valuation of Interest Free Loans

Effect on Employee Benefits due to constructive obligations

(785.48)

(5.99)

(0.32)

286.37

271.77

Effect of change in Inventory under lnd AS Adjustment

Effect of Deferred Government Grants

13.98

27.96

Effect of lnd AS Adjustment on Service In come

71.46

287.42

69.98

139.96

Acturial Gains I (Losses) recognised in OCI

Others

(18.47)

Net Profit as per lnd AS

573.61

Other Comprehensive Income

(69.98)

Total Comprehensive Income under lnd AS

503.63

By order of the Board

for HBL Power Systems Ltd

(38.63)

1,140.60

(139.96)

1,000.64

For Rao & Kumar

Chartered Accountants

Firm

'

- lj- \--,~

(,),.,~

R~istration No. OJP

.3 _895/. . --~)~~

A

J~

~-~~Dr. A J Prasa d

Chairman & Managing Director

Anirban Pal

Place: Hyderabad

Date: 12/12/2016

Place: Hyderabad

Date: 12/12/2016

Partner

M.No: 214919

-'

)~-~,s \c:')

,( :.~.,s)1.'> ~

'\\ . '_ "<:~"'1'0'~>'/,, f

\\

~..

'

0'

~<:.>

\;,;:~ED~'-'

\,-.-,<?..

HBL Power Systems Ltd

8-2-601, Road No.lO

Banj ara Hills, Hyderabad - 500 034

( Rs In lakhs )

StatPment of Assets & Liabilities

Particulars

lsi.No

A

1

39397.39

40273.05

Capital Wo rks in Progress

Other Inta ngible Assets

2017.10

2039.94

1661.57

1859.61

Intangible Assets under development

Financi al Asset s

2798.41

(ii)

Investments

Loans

(iii)

Other Financial Assets

1465.02

1069.58

1668.41

(f)

Other Non Current Assets

(c)

{d)

(e)

(i)

Sub-total - Non-Current Assets

Current Assets

(a) Inventories

(b) Financial Assets

{ii)

Trade Receivables

Cash and cash equivalents

(iii)

Bank Balances others

(i)

(iv)

Loans

(v)

Other Financial Assets

(c)

Other Current Assets

Sub-tot al - Current Assets

TOTAL ASSETS

B

EQUITY AND LIABILITIES

Equity

(a)

Equity Sha re Capital

(b) Other Equity

Sub-total - Shareholders' funds

70.75

46252.84

3513.01

47307.24

2274.98

1197.36

2088.51

4273.76

169.43

5730.29

50526.60

53037.53

43388.25

48982.76

39386.55

1007.95

1795.55

486.62

39534.96

960.84

2524.90

642.56

1327.47

7022.45

6658.58

93729.93

100806.21

144256.53

153843.74

2530.00

55644.73

60501.25

58174.73

63031.25

17343.38

16277.73

816.70

2530.00

Non Current Liabilities

(a)

Financial Liabilities

(i)

Borrowings

(b) Provisions

(c)

Deferred Tax Liabilities (Net)

(d) Other non-current liabilities

Sub-total - Non-Current Liabilities

3

(Unaudited)

ASSETS

(b)

(Unaudited)

As at 30-09-2015

Non Current Assets

(a) Property, Plant and Equipment

As at 30-09-2016

188.55

227.89

1270.D7

1596.16

195.73

251.65

18997.73

18353.43

37657.04

37828.23

15080.17

Current Liabilities

(a) Financial Liabilities

(i) Borrowings

(ii) Trade Payables

(iii) Other financial liabilities

(b) Other Current Liabilities

(c)

Provisions

Sub-total - Current Liabilities

TOTAL - EQUITY AND LIABILITIES

18964.90

3278.78

6234.22

5314.48

1868.87

11364.71

1951.72

67084.07

72459.06

144256.53

153843.74

The above figures are re-stated In compli ance with lnd AS requirement and are hence not comparable with the

results pulished earlier.

By order ofthe Board

For Rao & Kumar

For HBL Power Systems Ltd

Chartered Accountants

Firm Registration No. 0308 ~~

/~~~~

~' ,_-J~

{\2~ ~~'0~~~-l

Dr. A J Prasad

Chairman & Managing Director

~JA~i~

Partner

M.No : 214919

~~<:P~0-!>

f5

%.._'fro':::'~

,P

~RTE?-:t.~

HBl POWER SYSTJS lTD

HBL

Segment-wise Revlnue, Results and Capital Employed

(Rs in Lakhs)

For the quarter en ded 30st September 2016

Half year ended

Quarter ended

30-Sep-16

(Unaudited)

30-Jun-16

(Unaudited)

30-Sep-15

(Unaudited)

30-Sep-16

(Unaudited)

30-Sep-15

(Unaudited)

31-Mar-16

(Audited)

Segment Revenue

Batteries

Electronics

Unallocated

Total

Less: lntersegn ent Revenue

33490.28

2339.10

1862.34

37691.72

Sales/Income rom Operations

5.53

21076.82

10016.98

2109.48

33203.28

40.49

28902.93

2045.79

3711.77

34660.49

261.17

54567.10

12356.08

3971.82

70895.00

46.02

60366.56

3315.94

5297.62

68980.12

814.84

103325.61

15898.33

10044.27

129268.21

432.33

37686.19

33162.79

34399.32

70848.98

68165.28

128835.88

Segment Results

3659.71

(60.71)

187.69

2006 .50

1004.16

187.70

2509.46

(85.32)

785.40

5666.21

943.45

375.39

6855 .22

(678.46)

722.56

11198.18

750.8 5

574.46

3786.69

1400.25

3198.36

1441.10

6985.05

2841.35

6899.32

3731.98

12523.49

5264.70

42.38

1607.75

524.89

1290.26

204.69

3209.54

1767.30

-

974.89

276.26

42.38

2898.01

729.58

2077 .85

441.11

896.16

4293.25

1208.05

1261.20

671.69

743.61

1932.89

1530.60

3277.43

Segment Assets

Batteries

101913.12

92715.13

114154.09

101913.12

114154.09

99927.91

Electronics

Unallocated

16189.24

26154.16

21310.58

30086.54

20232.43

19457.22

16189.24

26154. 16

20232.43

19457.22

20798.67

23794.62

144256.52

144112.25

153843.74

144256.52

153843.74

144521.20

16597.40

13179.81

21411.98

16597.40

21411.98

15707.69

5005.67

6175 .65

8339.21

5005.67

8339.21

5868.2 1

64480.72

64348.45

61061.30

64480.72

61061.30

63000.19

86083.79

83703.91

90812.49

86083.79

90812.49

84576.09

Batteries

Electronics

Unallocated

Total

Less: i) lnterTt

ii ) Excep ionalltems-(lncome)/Expense

ii) Unallo cable Expenditure net of

iii) Unallocable Income

1

Total Profit B fore Tax after Extraordinary

Items

Segment Liabilities

Batteries

Electronics

Unallocated

Total

Notes:

( a ) The company' operations include Batteries of different types, Electronics, Railway Signalling contracts etc. Except for Batteries and El ectro nics,

the segment r venue, the segments results and the segments assets and liabilities of other activities are individually below the threshold limit of

10% as provid d in AS-17 "Segment Reporting". Accordingly, Batteries and Electronics segments are shown separately as reportable segmen ts

and others are included in Unallocated segments.

( b ) Batteries and lectronics segment comprises of various types of products for defence, aviation, telecom and industrial application.

(c) Inter segment evenue is measured at the market price at which the products are sold to external Customers

By order of the Board

For HBL Power Systems Ltd

A. -:r:

~o.J...

s0:

Dr. A J Prasad

Chairman & Managing Director

0'

<:::.

~ HYDERABAD ~

..>-

Place: HyderatJad

Date: 12/12/2 16

sv.src::~

if

RAO & KU~~Jf:~

I@

\.

.CHARTERED ACCOUJNJl~JS

~~:r:~ :~. _.; .r:: ~;. :~:r

Limited Review Report

Review Repo t to

The Board of Directors

Partner

M.No. 214919

Visakhapatnam :

Door No: 10-50-19/4

Soudhamani, Sil'ipuram

Visakhapatnam- 530 003

Phone: +91 891 -2755327,2759369

Fax : +91 891 2738554.

Das könnte Ihnen auch gefallen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Dokument3 SeitenAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument6 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Corrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Dokument4 SeitenCorrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Revised Financial Results For June 30, 2016 (Result)Dokument4 SeitenRevised Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument11 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Dokument7 SeitenAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report, Earning Release For December 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report, Earning Release For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Legal Profession Cases CompilationDokument13 SeitenLegal Profession Cases CompilationManuelMarasiganMismanosNoch keine Bewertungen

- Echegaray Vs Secretary of JusticeDokument12 SeitenEchegaray Vs Secretary of JusticeCherry BepitelNoch keine Bewertungen

- Technical Report 2014 0055Dokument25 SeitenTechnical Report 2014 0055Trisno SupriyantoroNoch keine Bewertungen

- A Critical Look at Tanzani's Development Vision 2025Dokument4 SeitenA Critical Look at Tanzani's Development Vision 2025Haron KombeNoch keine Bewertungen

- TIP Report 2015Dokument17 SeitenTIP Report 2015SamNoch keine Bewertungen

- 13 GARCIA v. VILLARDokument1 Seite13 GARCIA v. VILLARGSSNoch keine Bewertungen

- Duterte's 1st 100 Days: Drug War, Turning from US to ChinaDokument2 SeitenDuterte's 1st 100 Days: Drug War, Turning from US to ChinaALISON RANIELLE MARCONoch keine Bewertungen

- Jurnal Deddy RandaDokument11 SeitenJurnal Deddy RandaMuh Aji Kurniawan RNoch keine Bewertungen

- AFN 132 Homework 1Dokument3 SeitenAFN 132 Homework 1devhan12Noch keine Bewertungen

- Biography On Mahatma Gandhi MitaliDokument11 SeitenBiography On Mahatma Gandhi Mitaligopal kesarwaniNoch keine Bewertungen

- Proposed Rule: Income Taxes: Partnership Equity For ServicesDokument9 SeitenProposed Rule: Income Taxes: Partnership Equity For ServicesJustia.comNoch keine Bewertungen

- IBPS Clerk RecruitmentDokument47 SeitenIBPS Clerk RecruitmentTopRankersNoch keine Bewertungen

- G.R. No. 152295 Montesclaros vs. COMELECDokument2 SeitenG.R. No. 152295 Montesclaros vs. COMELECRia N. HipolitoNoch keine Bewertungen

- BasketballDokument24 SeitenBasketballnyi waaaah rahNoch keine Bewertungen

- For Session DTD 5th Sep by CA Alok Garg PDFDokument46 SeitenFor Session DTD 5th Sep by CA Alok Garg PDFLakshmi Narayana Murthy KapavarapuNoch keine Bewertungen

- NBIMS-US V3 2.4.4.7 OmniClass Table 31 PhasesDokument8 SeitenNBIMS-US V3 2.4.4.7 OmniClass Table 31 Phasesmahmoud mokhtarNoch keine Bewertungen

- Spec Pro Case DoctrinesDokument4 SeitenSpec Pro Case DoctrinesRalph Christian UsonNoch keine Bewertungen

- Digital Forensic Tools - AimigosDokument12 SeitenDigital Forensic Tools - AimigosKingNoch keine Bewertungen

- DPC Cookie GuidanceDokument17 SeitenDPC Cookie GuidanceshabiumerNoch keine Bewertungen

- 1.statement of Financial Position (SFP)Dokument29 Seiten1.statement of Financial Position (SFP)Efrelyn Grethel Baraya Alejandro100% (4)

- JNU Prospectus 2014Dokument97 SeitenJNU Prospectus 2014Rakesh KashyapNoch keine Bewertungen

- Premachandra and Dodangoda v. Jayawickrema andDokument11 SeitenPremachandra and Dodangoda v. Jayawickrema andPragash MaheswaranNoch keine Bewertungen

- Summary - Best BuyDokument4 SeitenSummary - Best BuySonaliiiNoch keine Bewertungen

- CAF608833F3F75B7Dokument47 SeitenCAF608833F3F75B7BrahimNoch keine Bewertungen

- Abella Vs Cabañero, 836 SCRA 453. G.R. No. 206647, August 9, 2017Dokument4 SeitenAbella Vs Cabañero, 836 SCRA 453. G.R. No. 206647, August 9, 2017Inday LibertyNoch keine Bewertungen

- Life of Nelson Mandela, Short Biography of Nelson Mandela, Nelson Mandela Life and Times, Short Article On Nelson Mandela LifeDokument4 SeitenLife of Nelson Mandela, Short Biography of Nelson Mandela, Nelson Mandela Life and Times, Short Article On Nelson Mandela LifeAmit KumarNoch keine Bewertungen

- Grievance Machinery ReportDokument16 SeitenGrievance Machinery ReportRoseMantuparNoch keine Bewertungen

- Why Some Like The New Jim Crow So Much - A Critique (4!30!12)Dokument14 SeitenWhy Some Like The New Jim Crow So Much - A Critique (4!30!12)peerlesspalmer100% (1)

- Garden of LoversDokument10 SeitenGarden of LoversAmy100% (1)

- Traffic CitationsDokument1 SeiteTraffic Citationssavannahnow.comNoch keine Bewertungen