Beruflich Dokumente

Kultur Dokumente

Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

kaveni seed GomPenY limited

l3tr,December 201,6

koveri seeds'

Bombay Stock Exchange Ltd.,

1't Floor New Trading Ring

Rotimda Building

P.J.Towers, Dalal Street, Fort,

National Stock exchange of India Ltd.

MUMBAI ,4OO OO1

MUMBAI -

Scrip Code :532899

Scrip Code: KSCL

Exchange Plaza, 5th Floor,

Plot No.C/l, G Block,

Bandra Kurla Complex, Bandra (E)

4OO OO51

Dear Sir,

Sub : Outcome of the Board Meeting dated L3th December 2076 - Reg.

Ref:- Regulation 30 and 33 of the Listing Regulations.

1.

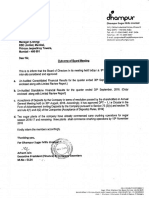

Pursuant to Regulation 33 of SEBI (Listing Obligation and Disclosure Requirements)

Regulations, 2015 (Listing Regulations), we are enclosing herewith the Un-Audited

Standalone Financial Results of the Company for the Quarter and Half Year ended 30th

September 201.6,which have been reviewed and reconunended by the Audit Committee

and approved by the Board at its meeting held today i.e., 13tt December 2016 and also

the Limited Review Report furnished by the Statutory Auditors of the company.

2. The results are also being published

in the newspapers, in the prescribed format under

Regulation 47 of tllre SEBI (Listing Obligation and Disclosure Requirements) Regulations,

20]5.

3.

The Board of Directors have approved to terminate the Employee Stock Option

Scheme 2009 and noted '1,,40,825 options were lapsed out of the total options

granted under this Scheme.

The meeting of the Board of Directors of the company corunenced at 4.00 PM on and concluded

at 5.00 PM.

Request you to take the above information on record

Thanking you,

Yours faithfully,

KA

SEED

,ffffi"*'

,U,N

,o

!\

(,

Cil'iDERALAD

LIMITED

RAO

AGING DIRECTOR

Encls: a/a.

Regd. Office : # 513-B, 5th Floor, Minerva Complex, S.D. Road, Secunderabad - 500 003. Telangana, lndia

Tel :+91-40-27842998,27842405 Fax:+91-40-2781 1237 e-mail :info@kaveriseeds.in

CIN : L01 1 20AP1 986PLC006728

www

kaveniseeds

in

kaveri seed company limited

CIN:

I-01

20AP1 986P1-C005728

Regd.offr 5138, 5th Floor, Minerva Complex, S.D.Road, Secunderabacl-o3, IS, w*'w.kaverisccrls.in

STATEMENT OF UN AUDITED STANDALONE TINANCIAL RESULTS FOR THE QUARTER AND HALf YEAR ENDED 3OTH SEPTEMBER 2016

(Rs in Lakh6)

Ouarler Ended

s.No

HalfYar Ended

30/09/2016

30t06t2016

30/09/2015

30/09/2016

30/09/2015

Unaudltd

Unaudiled

Unaudited

Unaudited

Unauditcd

lReler Note 1(a)l

1

6,630.14

56,173.85

60.566.84

84.895 51

Tolallncome from ODerations (net)

6,776.113

19,397.42

6,530.14

56.173.85

60,566.84

84,895.51

10,093.01

5,733.61

8,179.83

15,826.62

14,471.70

39,451_32

i5,971.54)

21.719.10

19.084.18

1.074.84

317.98

658.14

15,747.56

784_74

T,859 54

1,280.80

(1,003.94)

3,122.99

Expenss

724.51

779.87

527 _27

1.504 39

1.047 90

2.493.03

(f) Other expenses

1,532.71

5,043.90

1.S35.38

6.576 61

'L62t.11

24.128-41

Total Erponsos

7,163.39

34.351.32

11,6'18.60

11,514.71

43,511.75

68,191.81

(386.96)

1,704.70

15.046.10

543.86

(4,988.46)

292.74

14,659.13

2,248.56

't7,055.09

16,703.70

501.29

1,595.66

1,31f.71

15,589.96

i4,695.72)

16.907.70

17,556.38

18.299.36

2.20

1_52

372

LT5

16.90

't,3't5.54

15.588.44

(4,703.73)

16,903.98

17,547.23

18.282.46

1,315.54

15,588.44

151.54

(4,703.73)

18.242.46

114.10

16.903.98

692.63

17.547.23

541.0S

452.11

574_27

771.15

15,436.89

(4,8't7.83)

16,211.35

.t7,095.11

17,712.19

(76.34)

591.10

570.65

514.76

698.12

16,028.00

i4,247.18)

16,726.11

17,981.56

17,712.19

698.12

16,028.00

(4,247.181

16,726.'11

17,981.56

17,712.19

1,381.10

1,381.'t0

1,381.10

1.381.10

1,381.10

Profil trom oporatlons bfor oth6r lncome,

Profit from ordlnary 6ctlvltl63 bofor6 financo

costs and excpllonal ltems (3 + d)

6

7

Profit from ordinary activlties after financ

costs but bfore xceDllonal items (5 - 8)

Exceptional ltms

Prolt / (Lo!3) Irom ordln.ry actlvltles beforc

10

Not Profit / (Loss)from ordinary activities after

tax (9 + 10)

Other Comprehensive lncome (afler tax)

'11

15

t6

886.44

Net Profit / (Loss) tor tho period rftr

Comprehenslv lncoms (11 + 12)

Share of Profit / {loss) ofassociates'

Mlnorily lntersl'

Net Prollt / (Loss) afrr taxs, minority lnterest

and 3hare ot proflt / (los3) of as3oclatos (13 + '14

+

17

8.01

ta!

(74)

13

IRerer Nore 1(d)l

49,397 42

Olher lncome

11

IRefer Nore r(b)I

6,776 43

flntnce costs and sxceptlonal ltemr (1.2)

(a)]

(a) Net Sales/lncome lrom Operanons

(b) Other Operating lncome

(e) Deprecial on and amorUsalon

lncome from Operations

(a) Cost of l,4aterials consumed

(b) Purchase of slock-in-trade

(c) Changes in invntories of tinished Ooods, workin-progrsss and slock-in-trade

(d) Employee benellts expense

lReler Note

3110312016

15)'

Pald-up equlty 3harc

c.pltsl

(Fece Value Rs.2/1,381.10

18

Rasarv oxcludlng Revaluation Ressrvgs a3 psr

19

b.lance sheol ofpreviouB accounting yoar

l. Earnlng3 Per Share (of 'tu.z/. each) (not

90.181.49

annuallsed)i

(a)Basic

b Diluled

1-12

22.35

22.35

1.12

(6.98)

(6.98)

23.44

23.48

24.76

25 65

24.76

25.65

STANDALONE UN.AUDITED STATEMENT OF ASSETS AND LIABILIT!ES

30.09.2016

31.03.2016

IRerer Nol 1(a)l

lRerer Nor 1(d)]

1,381.10

109,543.53

1't0,924.63

90,181.49

91,562.59

A. EOUITY AND LIABILITIES

ShareholdeB' funds

(a)Sharc capital

'1

(b) ReseNes and surplus

sub-total - sharoholders' funds

1,381.',l0

2. share aDolicatlon monoy pndlnq allotmont

3. Mlnority interest

4. Non-curreni llabilities

(a) Long-t6m bonowings

(b) Deferred tax liabililies (net)

(c) Other long-lerm liabililies

(d) Long-term provisions

Sub-total - Non-current llabllltieB

5. Current liabllitlos

(a) Shorl-term borrowinqs

(b)Trade payables

(c )Other cunenl liabililies

(d) Short-lsm provisions

Sub-total - curr6nt liabillties

TOTAL. EQUITY AND LIABILITIES

163.86

163.86

11.57

496.23

469.63

660.09

645.06

17,969.25

19,090.56

5.78S.37

7,862_54

19,232.01

714 04

39,036.61

3't,621.16

11i,205.88

131,211.27

20,243.32

21.400-o4

2,244.85

2,222.69

B, ASSETS

1, Non-currcnt assots

(b) Goodwill on consolidation

(c) Non-current investments

(d) Defened lar assels (nel)

() Long{em loans and advances

(f) Other non-curent asssts

Sub-total - Non-curr6nt assets

2 Current a$et3

a)C!rrenl inveslments

(b)lnventones

(c)Trade receivables

(d)Cash and cash equivalents

(e)Short-lorm loans and advances

(0Other cunent assets

Sub'total - Current assets

131.40

379.93

23,039.49

56,228.50

34.703.79

25,017.57

1,117.60

119.05

2.979.89

120,166.39

113,205.88

338.29

23,961.01

48.634.07

49.749.10

6.314.72

691.82

47 _64

1,845.90

'107,283.26

131,211.27

,$9t

(a)

Th6 lndlan Accounling Standads (lnd AS), as nolilisd undsr the Companis ( lndian Accounting Slandards) Rules, 2015, are applicable to the

Company foa psriods commencing on or aftsr Apri|01,2016, Ths resulls for lhe quarlrand halfysarndd Sptember 30,2016 and th6

quarler ndsd June 30, 2016 are as psr lho notiliod lnd AS.

(b)

Pursuant to ths SEBlcirculat ClRiCFOlFACl62l2016 daled July 05,2016, the published ligurs for th qua(erand half ysar ended Seplember

30, 2015 have been Bcast to lnd AS to tho extent applicable to the Company and have been prspared in eccordance wilh the Cornpanies

(lndian Accounting Standards) Rules, 2015. The results have not been subject to limited revie audit. However, the management has exercised

necessary due deligence to ensuro thal ths financialresults provid6 a tru and fair oftho company affairs.

ic)

A roconciliation btwn th protlls as rponed 6arli6l and th6lnd AS rocast profils for the quarlerand half year and quarter ended Sp 30,

2015 is given below

Rs. ln Lekhs

Particulars

Quarter snded

30.09.2015

Net Profit repo.led as per IGAAP

(i) Recognition of Biologica I assets

(4,67s.2s)

57.43

(ii) Reslalemenl oI Grant and Subsidies

(iii)Fa r value adjustment of FinancialAssets

(iv) Tax on above adjustments

(v) Profit on sale of Investments

Net proflt r6ca3t to lnd As forth qua(er endod

HalfYear

30.09.2015

17.412.43

(105.99)

(0.s6)

(0.38)

55.90

l.254.97l,

(4,8'r7.83)

.1.14)

(3.s0)

't7.88

/.254.97\

17,095.11

(d)

Reporling of lnd AS complianl linancial results for lhe year ended Msrch 31 , 2016, not being mafldatory, arc in accordence with Accounling

Standards nolilied under th6 Companis (Accounling Standards) Rules, 2006 and are as repoded earlier.

The abov6 resulls have ben reviewed by the Audit Comm tt6e and approved bythe Eoard ofDireclors ofthe Company in their meotings held

on Oecember 13, 2016, Tho Statutory Audilors have canied oul a limitsd roview o[ results for the quarter and half year ended Seplember 30,

2016

Th compan/s operatlons primadly consists otsslling Ssed3 and there ere no olher rsponabb sgments und6r lnd As 108 'Operating

Segmnts',

Amount of'Sales Schemes'grouped under "Other Expenses'in S.No:2(0 above, represenling amounts in the nature of discounls and rebates

have been reduced from Net Sales in S.Nor1(a) as a result of lnd-AS adjustment for the quartrs nded 30.09.2016, 30.06.2016, 30.0S.2015

and for lhe haf yars endod 30.09.2016 and 30.09.2015. The said adjuslment has not been carried oul for year end figures of March 31,2016

\ hich has beon disclosed in accordanco wilh accounting standards notified under the Companis(Accouflting Standards) Rules, 2006.

Royalty on Sal of Bt Colton is provided alRs.49/. (including srvice tax)per packel for lh6 halfyear ended September 30,20'16 as per lhe

Cotton Seeds Price Control Order,2o1s(CSPCO) and the Notification dated 08 March 20'16(Price Notification) issued by lhe trtinislry of

ag cullure. Union of lndia - The selling price of 8t Cotion s6ed is also rduced lo Rs.800l as per the CSPCO and Price Notilication. To thar

extent Sales values ar6 effectod for the quarter and hatf year snded September 30,2016.

For the Financial Year 2015-16 the company, based on Notifications of th various State Governments, has provided Royahy of Rs 3809.14

Lakhs for the year 6nd6d 31d March 2016 as agaiosl the Royalty Payable amounl ol Rs 10359.71 Lakhs as per lhe Agrement with service

Providr and thus the oxpenses ar sho( provided by Rs 6550.57 Lekhs.

Fair valurtion lot Flnanciel Assols: The Company has valued linancialassels (other than investmenl in subsidiaries which are accounted al

cost), al fair value. lmpact of fair vahJe changes as on the dat oftransition, is recognised tn opning reserves and changes lhereafter are

recognised in Prolll and Loss Account or Other Comprehensive lncom, as the case may b.

eDco

Bv Order of lhe Board

,1@""'

Placc: Secund6rabad

Date:13.12.2016

ttto

.oMPANY LrD

G V AHAST\AR RAO

MANAGING OIRECTOR

P. R. REDDY & CO.

Date

Chartered Accountants

Limited Review Report to the Board of Directors of Kaveri

Seed Company Limited

We have reviewed the accompanying statement of Standalone Un-Audited Financial

Results of KAYERJ SEED COMPANY LIMITED ("the Company") for the Quarter

and Half Year ended 30th September 2016 ("the Statement"), being submitted by the

Company pursuant to the requirement of Regulation 33 of the SEBI (Listing Obligations

and disclosure Requirements) Regulations, 2015, read with SEBI Circular

No.CIR/CFD/FACl6212016 dated 5'h July 2016. This statement is the responsibility of the

Company's Management and has been approved by the Board of Directors. Our

responsibility is to issue a report on these financial statements based on our review.

We conducted our review of the Statement in accordance with the Standard on Review

Engagement (SRE) 2410, "Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate

assurance as to whether the financial statements are free of material misstatement. A

review is limited primarily to inquiries ofcompany personnel and an anal).tical procedure

applied to financial data and thus provides less assurance than an audit. We have not

performed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us

to believe that the accompanying statement of Un-Audited Financial Results for the

Quarter and Half Year ended 30th September 2016 prepared in accordance with

Accounting Standards specified under Section 133 of the Companies Act, 2013 read with

Rule 7 of the Companies (Accounts) Rules 2014 and other recognized accounting

practices and policies, has not disclosed the information required to be disclosed in terms

of Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015, read with SEBI Circular No.CIR/CFD/FAC:62|2O16 dated 5th July

2016 including the manner in which it is to be disclosed, or that it contains any material

misstatement.

for P. R. REDDY & CO

Chartered Accountan

Firm Registratio No.

685)

Br 0 0

P.

Place: Hyderabad,

Date: 13.12.2016

I +?

RAGHUN

Partner

Membership N

3758

icc l'J

No. 7-70141, Street No. 8, Maheshwari Nagar, Habsiguda, Hyderabad - 500 007.

Mobile : 98660 70506 Email : preddyandco@gmail.com

Das könnte Ihnen auch gefallen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Sabic DirectoryDokument9 SeitenSabic DirectoryPranabesh MallickNoch keine Bewertungen

- Compromise Pocso Delhi HC 391250Dokument9 SeitenCompromise Pocso Delhi HC 391250Iasam Groups'sNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- TTR RRL: LimitedDokument5 SeitenTTR RRL: LimitedShyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument8 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument3 SeitenAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Dokument6 SeitenAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Consolidated Financial StatementsDokument78 SeitenConsolidated Financial StatementsAbid HussainNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument6 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument3 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Dokument7 SeitenAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 28 Consolidated Financial Statements 2013Dokument47 Seiten28 Consolidated Financial Statements 2013Amrit TejaniNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Commonly Asked Questions in An InterviewDokument1 SeiteCommonly Asked Questions in An InterviewlovemoreworrylessNoch keine Bewertungen

- Capital BudgetingDokument24 SeitenCapital BudgetingHassaan NasirNoch keine Bewertungen

- Commercial Banks in IndiaDokument14 SeitenCommercial Banks in IndiaAnonymous UwYpudZrANoch keine Bewertungen

- Descriptive Text TaskDokument12 SeitenDescriptive Text TaskM Rhaka FirdausNoch keine Bewertungen

- Mini Flour Mill KarnalDokument9 SeitenMini Flour Mill KarnalAnand Kishore100% (2)

- Quality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection StandardsDokument29 SeitenQuality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection Standardsjohn432questNoch keine Bewertungen

- Lambda Exercises - Copy (11Dokument6 SeitenLambda Exercises - Copy (11SamNoch keine Bewertungen

- Sources of Criminal LawDokument7 SeitenSources of Criminal LawDavid Lemayian SalatonNoch keine Bewertungen

- MBA621-SYSTEM ANALYSIS and DESIGN PROPOSAL-Bryon-Gaskin-CO - 1Dokument3 SeitenMBA621-SYSTEM ANALYSIS and DESIGN PROPOSAL-Bryon-Gaskin-CO - 1Zvisina BasaNoch keine Bewertungen

- David - sm15 - Inppt - 01Dokument33 SeitenDavid - sm15 - Inppt - 01ibeNoch keine Bewertungen

- APH Mutual NDA Template - V1Dokument4 SeitenAPH Mutual NDA Template - V1José Carlos GarBadNoch keine Bewertungen

- 137684-1980-Serrano v. Central Bank of The PhilippinesDokument5 Seiten137684-1980-Serrano v. Central Bank of The Philippinespkdg1995Noch keine Bewertungen

- Bakst - Music and Soviet RealismDokument9 SeitenBakst - Music and Soviet RealismMaurício FunciaNoch keine Bewertungen

- H8 Pro: Pan & Tilt Wi-Fi CameraDokument12 SeitenH8 Pro: Pan & Tilt Wi-Fi CameravalladaresoscarNoch keine Bewertungen

- Code of Ethics For Public School Teacher: A. ResponsibiltyDokument6 SeitenCode of Ethics For Public School Teacher: A. ResponsibiltyVerdiebon Zabala Codoy ArtigasNoch keine Bewertungen

- Unit 14 Opinion Full EssayDokument1 SeiteUnit 14 Opinion Full EssayQuân Lê ĐàoNoch keine Bewertungen

- The Ery Systems of South India: BY T.M.MukundanDokument32 SeitenThe Ery Systems of South India: BY T.M.MukundanDharaniSKarthikNoch keine Bewertungen

- Dax CowartDokument26 SeitenDax CowartAyu Anisa GultomNoch keine Bewertungen

- Kuki KukaDokument3 SeitenKuki KukaDikiNoch keine Bewertungen

- Trends and Challenges Facing The LPG IndustryDokument3 SeitenTrends and Challenges Facing The LPG Industryhailu ayalewNoch keine Bewertungen

- Soal Soal ERPDokument31 SeitenSoal Soal ERPAnggitNoch keine Bewertungen

- Ict: Advantages & Disadvantages: Presentation PlanDokument11 SeitenIct: Advantages & Disadvantages: Presentation PlanLe FleauNoch keine Bewertungen

- Treasury Management - PrelimDokument5 SeitenTreasury Management - PrelimAlfonso Joel GonzalesNoch keine Bewertungen

- Property Tables AnnexDokument3 SeitenProperty Tables AnnexkdescallarNoch keine Bewertungen

- Social Inequality and ExclusionDokument3 SeitenSocial Inequality and ExclusionAnurag Agrawal0% (1)

- Double JeopardyDokument5 SeitenDouble JeopardyDeepsy FaldessaiNoch keine Bewertungen

- Percentage and Profit and LossDokument7 SeitenPercentage and Profit and LossMuhammad SamhanNoch keine Bewertungen