Beruflich Dokumente

Kultur Dokumente

Summary Annual Report For Restaurant Technologies, Inc. Employee Flexible Spending Accounts Plan

Hochgeladen von

Yosbany0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten1 Seitekyf

Originaltitel

SAR Plan 505 Flexible Spending Account 2015.6.23.16

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenkyf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten1 SeiteSummary Annual Report For Restaurant Technologies, Inc. Employee Flexible Spending Accounts Plan

Hochgeladen von

Yosbanykyf

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

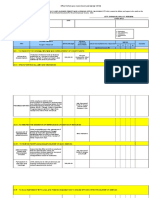

SUMMARY ANNUAL REPORT

For Restaurant Technologies, Inc. Employee Flexible Spending Accounts Plan

This is a summary of the annual report of the Restaurant Technologies, Inc. Employee Flexible Spending

Accounts Plan, EIN 41-1873256, Plan No. 505, for the period January 1, 2015 through December 31, 2015. The

annual report has been filed with the Employee Benefits Security Administration, U.S. Department of Labor, as

required under the Employee Retirement Income Security Act of 1974 (ERISA).

Restaurant Technologies, Inc. has committed itself to pay certain FSA claims incurred under the terms of the

plan.

Your Rights To Additional Information

You have the right to receive a copy of the full annual report.

To obtain a copy of the full annual report, or any part thereof, write or call the office of Restaurant

Technologies, Inc. in care of Brian E. McGonegal who is Plan Administrator at 2250 Pilot Knob Road, Suite

100, Mendota Heights, MN 55120, or by telephone at (651) 796-1631. The charge to cover copying costs will

be $0.00 for the full annual report, or $0.00 per page for any part thereof.

You also have the legally protected right to examine the annual report at the main office of the plan (Restaurant

Technologies, Inc., 2250 Pilot Knob Road, Suite 100, Mendota Heights, MN 55120) and at the U.S. Department

of Labor in Washington, D.C., or to obtain a copy from the U.S. Department of Labor upon payment of copying

costs. Requests to the Department should be addressed to: Public Disclosure Room, Room N1513, Employee

Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue, N.W., Washington, D.C.

20210.

Das könnte Ihnen auch gefallen

- Summary Annual Report For Restaurant Technologies, Inc. Employee Life and LTD PlanDokument1 SeiteSummary Annual Report For Restaurant Technologies, Inc. Employee Life and LTD PlanYosbanyNoch keine Bewertungen

- Westfall Technik Inc. 2021 Summary Annual Report 501Dokument2 SeitenWestfall Technik Inc. 2021 Summary Annual Report 501Miguel FrancoNoch keine Bewertungen

- 401K 2015 Restaurant Technologies, Inc. - SAR (ID 368546)Dokument2 Seiten401K 2015 Restaurant Technologies, Inc. - SAR (ID 368546)TreverisNoch keine Bewertungen

- 2014 SARReportDokument2 Seiten2014 SARReportshwegontherNoch keine Bewertungen

- Summary Annual Report For Officer Retirement PlanDokument3 SeitenSummary Annual Report For Officer Retirement PlanEsther Manvarimb MuluaneNoch keine Bewertungen

- Audit Risk Alert 2010Dokument93 SeitenAudit Risk Alert 2010harrybear1937Noch keine Bewertungen

- Sar Jbss 780569 01Dokument2 SeitenSar Jbss 780569 01Jamcy CasanovaNoch keine Bewertungen

- CFO or Controller or Accounting ManagerDokument2 SeitenCFO or Controller or Accounting Managerapi-122240370Noch keine Bewertungen

- Letter For Employers 2-6-2015Dokument1 SeiteLetter For Employers 2-6-2015Jing Dela CruzNoch keine Bewertungen

- 401 (K) Enrollment BookDokument40 Seiten401 (K) Enrollment BookSwisskelly1Noch keine Bewertungen

- District Expenditure Survey (Govt Funds) District Health Office QuestionnaireDokument3 SeitenDistrict Expenditure Survey (Govt Funds) District Health Office QuestionnairejamazalaleNoch keine Bewertungen

- IRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?Dokument8 SeitenIRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?api-284589375Noch keine Bewertungen

- Barriers To Entry (With Links)Dokument3 SeitenBarriers To Entry (With Links)Wayne TysonNoch keine Bewertungen

- The Information in These Reports Does Not Change Your Current Benefits. These Reports AreDokument4 SeitenThe Information in These Reports Does Not Change Your Current Benefits. These Reports AreLoganBohannonNoch keine Bewertungen

- Module 4 - Starting Your BusinessDokument8 SeitenModule 4 - Starting Your BusinessJHERICA SURELLNoch keine Bewertungen

- Module 4 - Starting Your BusinessDokument8 SeitenModule 4 - Starting Your BusinessJHERICA SURELLNoch keine Bewertungen

- Set PoliciesDokument5 SeitenSet Policiesbloop carrotNoch keine Bewertungen

- Send Different or New Documents 2Dokument5 SeitenSend Different or New Documents 2ymtfyjywzfNoch keine Bewertungen

- Comp of Adj Profit or LossDokument1 SeiteComp of Adj Profit or Lossharsh143352Noch keine Bewertungen

- Barton IdentityDokument18 SeitenBarton IdentityHoai Tran BuiNoch keine Bewertungen

- FEIN Assignment LetterDokument2 SeitenFEIN Assignment LetterKealamākia Foundation0% (1)

- Amro Faisal ResumeDokument3 SeitenAmro Faisal ResumeAmroNoch keine Bewertungen

- Chain Restaurant QuestionnaireDokument15 SeitenChain Restaurant QuestionnairemirwaseemNoch keine Bewertungen

- Ca38 2014 2015Dokument72 SeitenCa38 2014 2015chc011133Noch keine Bewertungen

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Von EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Noch keine Bewertungen

- Performance Audit Case Study (Unit 5)Dokument6 SeitenPerformance Audit Case Study (Unit 5)International Consortium on Governmental Financial Management0% (1)

- Bonagua: Patrick JohnDokument1 SeiteBonagua: Patrick JohnRivera T DariNoch keine Bewertungen

- Guide Applying For Food Premises ApprovalDokument3 SeitenGuide Applying For Food Premises ApprovalSai Ram ChanduriNoch keine Bewertungen

- WastableDokument164 SeitenWastableFredKapuaNoch keine Bewertungen

- BSBFIM501A Assessment 21042015 1Dokument10 SeitenBSBFIM501A Assessment 21042015 1Anonymous YGpyYSH0% (2)

- OSHA Citation of Fairview Contractors Inc. of Lee, Ma.Dokument15 SeitenOSHA Citation of Fairview Contractors Inc. of Lee, Ma.Patrick JohnsonNoch keine Bewertungen

- f5 2012 Jun Q PDFDokument7 Seitenf5 2012 Jun Q PDFcatcat1122Noch keine Bewertungen

- Official Seal or Stamp of Service/Employing Agency (If None, ADokument2 SeitenOfficial Seal or Stamp of Service/Employing Agency (If None, Aมดน้อย ผู้น่ารักNoch keine Bewertungen

- Sena Order TemplateDokument3 SeitenSena Order TemplatepetercariazoNoch keine Bewertungen

- PML 2014 009Dokument5 SeitenPML 2014 009jon_ortizNoch keine Bewertungen

- Account Eligibility Approved PC Only PDFDokument11 SeitenAccount Eligibility Approved PC Only PDFMelv CookNoch keine Bewertungen

- IAM District 15 - Redacted HWMDokument68 SeitenIAM District 15 - Redacted HWMAnonymous kprzCiZNoch keine Bewertungen

- Software Publisher Business PlanDokument44 SeitenSoftware Publisher Business PlanDenis OdhiamboNoch keine Bewertungen

- PS Query Business OfficersDokument19 SeitenPS Query Business OfficersNEKRONoch keine Bewertungen

- Launch of New ProductsDokument6 SeitenLaunch of New ProductsReezal KafalahNoch keine Bewertungen

- Bplo - OpcrDokument6 SeitenBplo - OpcrMecs Nid67% (3)

- Sun Pharma Philippines Inc.Dokument27 SeitenSun Pharma Philippines Inc.Allan BatiancilaNoch keine Bewertungen

- Running Head: Excello Telecommunications 1Dokument6 SeitenRunning Head: Excello Telecommunications 1Jennifer Edwards OxleyNoch keine Bewertungen

- 2015.05.06 Wells Fargo FrankDokument16 Seiten2015.05.06 Wells Fargo FrankkunalwarwickNoch keine Bewertungen

- Beacon O - S A: Frequently Asked QuestionsDokument8 SeitenBeacon O - S A: Frequently Asked QuestionsRowell JaoNoch keine Bewertungen

- Southwest Airlines 10-K, 2015Dokument43 SeitenSouthwest Airlines 10-K, 2015jameslee42Noch keine Bewertungen

- Crisil: Budget AnalysisDokument16 SeitenCrisil: Budget AnalysisneerajvijayranjanNoch keine Bewertungen

- 941 2008-1Dokument47 Seiten941 2008-1lionkingae100% (1)

- Withholding TaxDokument21 SeitenWithholding TaxTres SanicamNoch keine Bewertungen

- Janitorial Services Business PlanDokument32 SeitenJanitorial Services Business PlankatariamanojNoch keine Bewertungen

- Payroll ObjectivesDokument9 SeitenPayroll ObjectivesfiredevilNoch keine Bewertungen

- MoneyWorks Proposal38yoDokument5 SeitenMoneyWorks Proposal38yoMorg ActusNoch keine Bewertungen

- Territory Revenue Office Life Insurance Return: Stamp Duty ActDokument20 SeitenTerritory Revenue Office Life Insurance Return: Stamp Duty ActPandurang UpparamaniNoch keine Bewertungen

- 2015 Ast Corporation Benefits SummaryDokument4 Seiten2015 Ast Corporation Benefits SummarySam GobNoch keine Bewertungen

- NSIC ListDokument769 SeitenNSIC ListManav Hota0% (1)

- Employers Guide CurrentDokument62 SeitenEmployers Guide Currentglamom100% (3)

- Food Safety Law Reform Bill New Zealand 2015Dokument39 SeitenFood Safety Law Reform Bill New Zealand 2015KarloAdrianoNoch keine Bewertungen

- The Essential Controller: An Introduction to What Every Financial Manager Must KnowVon EverandThe Essential Controller: An Introduction to What Every Financial Manager Must KnowNoch keine Bewertungen

- Employment Practices Liability: Guide to Risk Exposures and Coverage, 2nd EditionVon EverandEmployment Practices Liability: Guide to Risk Exposures and Coverage, 2nd EditionNoch keine Bewertungen

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19Von EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Noch keine Bewertungen

- 2016 07 Cares Committee Monthly EmailDokument1 Seite2016 07 Cares Committee Monthly EmailYosbanyNoch keine Bewertungen

- Employee Referral Award Form - FinalDokument1 SeiteEmployee Referral Award Form - FinalYosbanyNoch keine Bewertungen

- Adam's Trumpet StudiesDokument15 SeitenAdam's Trumpet StudiesMichael P. Walters91% (22)

- 2016 12 Cares Committee Monthly Email PDFDokument1 Seite2016 12 Cares Committee Monthly Email PDFYosbanyNoch keine Bewertungen

- 2016-2018 FocusDokument1 Seite2016-2018 FocusYosbanyNoch keine Bewertungen

- 2016 08 Cares Committee Monthly EmailDokument1 Seite2016 08 Cares Committee Monthly EmailYosbanyNoch keine Bewertungen

- Join Us For A: Monday, Oct 31st 11:30am-1pmDokument3 SeitenJoin Us For A: Monday, Oct 31st 11:30am-1pmTreverisNoch keine Bewertungen

- Join Us For A: Monday, Oct 31st 11:30am-1pmDokument3 SeitenJoin Us For A: Monday, Oct 31st 11:30am-1pmTreverisNoch keine Bewertungen

- 2016 08 Cares Committee Monthly EmailDokument1 Seite2016 08 Cares Committee Monthly EmailYosbanyNoch keine Bewertungen

- 2016 07 Cares Committee Monthly EmailDokument1 Seite2016 07 Cares Committee Monthly EmailYosbanyNoch keine Bewertungen

- 2016-2018 FocusDokument1 Seite2016-2018 FocusYosbanyNoch keine Bewertungen

- Makalah Penelitian Tentang LingkunganDokument1 SeiteMakalah Penelitian Tentang LingkunganDedi IrhandiNoch keine Bewertungen

- 2016 08 Cares Committee Monthly EmailDokument1 Seite2016 08 Cares Committee Monthly EmailYosbanyNoch keine Bewertungen

- Employee Authorization & Release 2016Dokument2 SeitenEmployee Authorization & Release 2016YosbanyNoch keine Bewertungen

- 2016 07 Cares Committee Monthly EmailDokument1 Seite2016 07 Cares Committee Monthly EmailYosbanyNoch keine Bewertungen

- Open Positions 07.08.16Dokument1 SeiteOpen Positions 07.08.16YosbanyNoch keine Bewertungen

- Open Positions 09.16.16 PDFDokument1 SeiteOpen Positions 09.16.16 PDFYosbanyNoch keine Bewertungen

- Open Positions 07.18.16Dokument1 SeiteOpen Positions 07.18.16YosbanyNoch keine Bewertungen

- Internal Applicants Should Reach Out Directly To Nick Noack or Nacole JohnsonDokument1 SeiteInternal Applicants Should Reach Out Directly To Nick Noack or Nacole JohnsonYosbanyNoch keine Bewertungen

- Corporate Denim For Dollars Program 2017 PDFDokument2 SeitenCorporate Denim For Dollars Program 2017 PDFYosbanyNoch keine Bewertungen

- RTI - Welcome GuideDokument8 SeitenRTI - Welcome GuideYosbanyNoch keine Bewertungen

- Internal Applicants Should Reach Out Directly To Nick Noack or Nacole JohnsonDokument1 SeiteInternal Applicants Should Reach Out Directly To Nick Noack or Nacole JohnsonYosbanyNoch keine Bewertungen

- 2017 Benefit Guide Flip The Switch FINAL 10.28.16Dokument16 Seiten2017 Benefit Guide Flip The Switch FINAL 10.28.16YosbanyNoch keine Bewertungen

- Open Positions 11.11.16 PDFDokument1 SeiteOpen Positions 11.11.16 PDFYosbanyNoch keine Bewertungen