Beruflich Dokumente

Kultur Dokumente

Balance of Payments - Accounting Concepts of Foreign Trade - Clear IAS

Hochgeladen von

PayalGuptaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Balance of Payments - Accounting Concepts of Foreign Trade - Clear IAS

Hochgeladen von

PayalGuptaCopyright:

Verfügbare Formate

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

This article was originally published at Clear IAS (www.clearias.com). This printer-friendly version is made available for your personal and non-commercial use

only. Obtain prior permission for commercial use.

Balance of Payments: Accounting Concepts of Foreign Trade

Balance of Payments (BoP) and Balance of Trade (BoT) are two confusing concepts for even economics graduates. These

terms are connected withinternational trade accounting. In this post, we provide a mind-map approach to study Balance of

Payments. We hope the same would help in quick understandingand revision.

What is Balance of Payments (BoP)?

The balance of payments (BoP) record the transactions in goods, services and assets between residents of a country with

the rest of the world for a specified time period typically a year.

It represents a summation of countrys current demand and supply of the claims on foreign currencies and of foreign

claims on its currency.

There are two main accounts in the BoP the current account and the capital account.

Current Account: The current account records exports and imports in goods, trade in services and transfer payments.

Capital Account: The capital account records all international purchases and sales of assets such as money, stocks,

bonds, etc. It includes foriegn investments and loans.

Note:The IMF accounting standards of theBOP statement divides international transactions into three accounts: the

current account, the capital account and the financial account, where the current account should be balanced by capital

account and financial account transactions. But, in countries like India the financial account is included in the capital

account itself.

http://www.clearias.com/balance-of-payments/

1/9

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

Balance of Payments: Mindmap

http://www.clearias.com/balance-of-payments/

2/9

12/17/2016

http://www.clearias.com/balance-of-payments/

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

3/9

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

What would happen if a country spends more than it receives from abroad?

What would happen if anindividual spends more than his income? He must finance the same by some other means, right? It

maybe by borrowing or by selling assets.

Also read: India's New GDP Series 2011-12: Everything You Need To Know

The same way, if a country has a deficit in its current account (spending more abroad than it receives from sales to the rest of

the world), it must finance it by borrowing abroad or selling assets.Thus, any current account deficit is of necessity

financed by a net capital inflow.

Filling Current Account Deficit with Foreign Exchange Reserves

A country could also engage in official reserve transactions, running down its reserves of foreign exchange, in the case of a

deficit by selling foreign currency in the foreign exchange market. But,official reserve transactions are more relevant under a

regime of pegged exchange rates than when exchange rates are floating.

A country is said to be in balance of payments equilibrium when the sum of its current account and its non-reserve capital

account equals zero, so that the current account balance is financed entirely by international lending without reserve

movements.

Note:A BOP surplus is accompanied by an accumulation offoreign exchange reserves by the central bank.

http://www.clearias.com/balance-of-payments/

4/9

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

Ideally, BoP should be Zero! How?

From a balance of international payments point of view, a surplus on the current account would allow a deficit to be run on

the capital account. For example, surplus foreign currency can be used to fund investment in assets located overseas. Also, if

a country has a current account deficit (trade deficit), it will borrow from abroad.

In reality, the accounts do not exactly offset each other, because of statistical discrepancies, accounting conventions and

exchange rate movements that change the recorded value of transactions.

http://www.clearias.com/balance-of-payments/

5/9

12/17/2016

http://www.clearias.com/balance-of-payments/

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

6/9

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

BoP Deficit or Surplus

843

Shares

The decrease (increase) in official reserves is called the overall balance of payments deficit (surplus).

The balance of payments deficit or surplus is obtained after adding the current and capital account balances.

Balance of payments surplus will be considered asaddition to official reserves (reserve use).

654

Also read: WTO, Trade Facilitation Agreement and Indian Stand

3

BoP Crisis

Countries with current account deficits can run into difficulties. If the deficit is large and the economy is not able to

attract enough inflows of foreign investment, then their currency reserves will dwindle.

There may come a point when the country needs to seek emergency borrowing from institutions such as the

International Monetary Fund, that may lead to external debt.

Countries with deficits in their current accounts will build up increasing debt and/or see increased foreign ownership of

their assets.

BoP crisis is also known as currency crisis.

Autonomous Transactions vsAccommodating Transactions

International economic transactions are called autonomous when transactions are made independently of the state of

the BoP (for instance due to profit motive).

These items are called above the line items in the BoP.

http://www.clearias.com/balance-of-payments/

7/9

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

The balance of payments is said to be in surplus (deficit) if autonomous receipts are greater (less) than autonomous

payments.

Accommodating transactions (termed below the line items), on the other hand, are determined by the net

consequences of the autonomous items, that is, whether the BoP is in surplus or deficit.

The official reserve transactions are seen as the accommodating item in the BoP (all others being autonomous).

Errors and Omissions

Errors and Omissions constitute the third element in the BoP (apart from the current and capital accounts) which is the

balancing item reflecting our inability to record all international transactions accurately.

BoTvs BoP

Balance of Trade (BoT) or Trade Balance is a part of the Balance of Payments (BoP). BoT just includes the balance

between export and import of goods.

BoP not only adds the service-trade, but also many other components in the current account (Eg: Transfer payments) and

capital account (FDI, loans etc).

Also read: Union Budget of India 2014-15 Highlights and Analysis

Rupee Convertibility

Indian rupee is fully convertible only in the current account and not in the capital account.

http://www.clearias.com/balance-of-payments/

8/9

12/17/2016

Balance of Payments: Accounting Concepts of Foreign Trade - Clear IAS

Things to note:

If an Indian investors earns interest or dividend in his investment abroad, that will be included in the current account of

India.

If FDI is done by an American company in India, that investment will be accounted in the capital account of India.

NRI deposits are calculated under Capital Accounts while Private Remitances are calculated under Current Account.

In general, National Income (Y) = Private Consumption Expenditure (C)+ Investment (I) + Government Expenditure (G).

In a closed economy, Savings (S) = Investment (I).

In an open economy, Savings (S) = Investment (I) + Net Exports (E)

OR, Net Exports = Savings Investment. This is actually the Balance of Trade (Trade Balance).

Copyright: www.clearias.com.

http://www.clearias.com/balance-of-payments/

9/9

Das könnte Ihnen auch gefallen

- Cornell Dyson Wp0610Dokument31 SeitenCornell Dyson Wp0610PayalGuptaNoch keine Bewertungen

- Balanced Literacy Handbook Revised 2017Dokument43 SeitenBalanced Literacy Handbook Revised 2017PayalGuptaNoch keine Bewertungen

- The Thankful SongDokument1 SeiteThe Thankful SongCarleta Alexiana SîrbuNoch keine Bewertungen

- Ambitious Girl Lit LessonDokument1 SeiteAmbitious Girl Lit LessonPayalGuptaNoch keine Bewertungen

- TODDLER - Preparing Your Home For A Toddler (18 Months - 3 Years)Dokument6 SeitenTODDLER - Preparing Your Home For A Toddler (18 Months - 3 Years)PayalGuptaNoch keine Bewertungen

- A Balanced Literacy Numeracy Approach CompleteDokument12 SeitenA Balanced Literacy Numeracy Approach CompletePayalGuptaNoch keine Bewertungen

- Independence Through Caring For Self Activities - Checklist and TipsDokument5 SeitenIndependence Through Caring For Self Activities - Checklist and TipsGabriela DascalescuNoch keine Bewertungen

- Reading Phonics Vocabulary Workbook PDFDokument43 SeitenReading Phonics Vocabulary Workbook PDFRaluca Socoteanu100% (6)

- Spelling Champ - Grade 4Dokument23 SeitenSpelling Champ - Grade 4Chibuzo Ajibola100% (3)

- Spelling Champ - Grade 4Dokument23 SeitenSpelling Champ - Grade 4Chibuzo Ajibola100% (3)

- Reading Phonics Vocabulary Workbook PDFDokument43 SeitenReading Phonics Vocabulary Workbook PDFRaluca Socoteanu100% (6)

- Voracious Vocabulary Grade 5 Reading and Writing WorkbookDokument23 SeitenVoracious Vocabulary Grade 5 Reading and Writing WorkbookPayalGuptaNoch keine Bewertungen

- 25 Interesting Facts On India That You Had No Idea AboutDokument5 Seiten25 Interesting Facts On India That You Had No Idea AboutPayalGuptaNoch keine Bewertungen

- KING SIZE (Presentation On Itc)Dokument25 SeitenKING SIZE (Presentation On Itc)PayalGuptaNoch keine Bewertungen

- Case Analysis PNB PDFDokument39 SeitenCase Analysis PNB PDFPayalGuptaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Tutorial 3Dokument4 SeitenTutorial 3Nguyễn Quan Minh PhúNoch keine Bewertungen

- Demand LetterDokument2 SeitenDemand LetterHimanshu RantiyaNoch keine Bewertungen

- Promissory NoteDokument10 SeitenPromissory NoteIsh ChavanNoch keine Bewertungen

- 1551881771258PfLpwrL9IDegaTlV PDFDokument5 Seiten1551881771258PfLpwrL9IDegaTlV PDFNishant PatelNoch keine Bewertungen

- Braden River High School BandsDokument2 SeitenBraden River High School BandsAlex MoralesNoch keine Bewertungen

- A Project Report OnDokument27 SeitenA Project Report OnHarshika DaswaniNoch keine Bewertungen

- Fabm Summative 1Dokument3 SeitenFabm Summative 1jelay agresorNoch keine Bewertungen

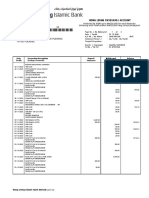

- Bank Reconciliation Statement:: Unit - 6Dokument4 SeitenBank Reconciliation Statement:: Unit - 6deepshrmNoch keine Bewertungen

- Does Stock Split Influence To Liquidity and Stock ReturnDokument9 SeitenDoes Stock Split Influence To Liquidity and Stock ReturnBhavdeepsinh JadejaNoch keine Bewertungen

- Working Capital ManagementDokument14 SeitenWorking Capital Managementgopalagarwal2387Noch keine Bewertungen

- Fund Flow Statement: Dr. Varsha RayanadeDokument18 SeitenFund Flow Statement: Dr. Varsha RayanadeNishikant RayanadeNoch keine Bewertungen

- 811 Banking SQP T1Dokument7 Seiten811 Banking SQP T1nirmalabehera8Noch keine Bewertungen

- Ummary of Study Objectives: 198 Financial StatementsDokument5 SeitenUmmary of Study Objectives: 198 Financial StatementsYun ChandoraNoch keine Bewertungen

- LLM Final BUsiness and CorporateDokument143 SeitenLLM Final BUsiness and CorporateASHU KNoch keine Bewertungen

- Types of MoneyDokument2 SeitenTypes of MoneyE-kel Anico Jaurigue0% (1)

- Pdic Law (R.A. 3591 As Amended by R.A 7400, R.A. 9302 (2004), R.A. 9576 (2009), and R.A. 10845 (2016) ) QuizDokument5 SeitenPdic Law (R.A. 3591 As Amended by R.A 7400, R.A. 9302 (2004), R.A. 9576 (2009), and R.A. 10845 (2016) ) QuizJornel MandiaNoch keine Bewertungen

- Summer Internship Project ReportDokument77 SeitenSummer Internship Project ReportSagar GohelNoch keine Bewertungen

- HLB Receipt 289062Dokument3 SeitenHLB Receipt 289062devanboy 2007Noch keine Bewertungen

- 39 1 Vijay KelkarDokument14 Seiten39 1 Vijay Kelkargrooveit_adiNoch keine Bewertungen

- Swot AnalysisDokument6 SeitenSwot Analysissouvikrock12Noch keine Bewertungen

- Sri InternationalDokument46 SeitenSri InternationalKshitij PalNoch keine Bewertungen

- Financial Performance of Kerala Gramin Bank Special Reference To Southern AreaDokument81 SeitenFinancial Performance of Kerala Gramin Bank Special Reference To Southern AreaPriyanka Ramath100% (1)

- Playconomics 4 - MacroeconomicsDokument302 SeitenPlayconomics 4 - MacroeconomicsMinhNoch keine Bewertungen

- SBI Life - Smart Platina Plus - Cr1 Handbill - SIBDokument1 SeiteSBI Life - Smart Platina Plus - Cr1 Handbill - SIBKiran JohnNoch keine Bewertungen

- Monetary PolicyDokument22 SeitenMonetary PolicyHema BobadeNoch keine Bewertungen

- Basel3 QIS 202004 PDFDokument198 SeitenBasel3 QIS 202004 PDFsh_chandraNoch keine Bewertungen

- Assignment Final AccountsDokument9 SeitenAssignment Final Accountsjasmine chowdhary50% (2)

- Home Activity 3Dokument6 SeitenHome Activity 3Don LopezNoch keine Bewertungen

- CMA B4.8 FactoringDokument7 SeitenCMA B4.8 FactoringZeinabNoch keine Bewertungen