Beruflich Dokumente

Kultur Dokumente

Banking BPO Market Forecast 2014-2018 - Nelson Hall

Hochgeladen von

Utkarsh RaiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banking BPO Market Forecast 2014-2018 - Nelson Hall

Hochgeladen von

Utkarsh RaiCopyright:

Verfügbare Formate

Banking BPO

Market Forecast:

2014 2018

NelsonHall 2013

Month Year

NelsonHall Proprietary Not for distribution without permission

BANKING BPO MARKET FORECAST: 2014-2018

About NelsonHall

NelsonHall provides buy-side and sell-side organizations with deeper research and analyses in front

office, mid-office and back office BPO than any other research firm in the world. The companys

subscription-based model provides subscribers with robust market analyses, case studies, vendor

assessments, contract analyses, market reports and access to a content-rich BPO contracts database.

The firm covers a wide range of industries including financial services, government and utilities sectors,

and tracks worldwide and regional BPO activity. NelsonHalls home page is www.nelson-hall.com.

The company tracks business services activity. In particular, NelsonHall focuses on the following business

services and process areas:

Front-office banking BPO

Middle Office industry-specific processing services such as network and work management

Back office support services such as HR services, finance & accounting services, and procurement

services

NelsonHall provides information to its clients in a variety of forms, including within:

NelsonHalls BPO subscription services, to assist organizations in developing sourcing strategies and

in supporting individual sourcing projects including vendor short-list development

Workshops, to assist organizations in identifying the most appropriate areas of BPO for their

organization

Business case development, to assist organizations in deciding whether BPO is appropriate for

individual processes

Custom assessments, to assist buy-side organizations in benchmarking individual processes and to

assist vendors in successfully taking BPO concepts to market.

For more details, contact:

U.S.

Riverside Center

275 Grove Street

Suite 2-400

Newton, MA 02466

Phone:(617) 663 5737

U.K.

Atrium Court

The Ring

Bracknell

RG12 1BW

Phone:+44 (0)1344 393036

France

NelsonHall

4 Place Louis Armand

Tour de lHorloge

75012 Paris

Phone:+33 1 72 76 26 54

NelsonHall 2014

1

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Abstract

The purpose of this study is to provide vendors and users with a market forecast of the global banking

BPO market by geography and service type.

The study complements the market assessments and analyses that are produced within NelsonHalls

BPO Subscription Services, and is designed for:

Marketing, sales and business managers developing strategies to target service opportunities within

the BPO market

Executives in purchasing organizations seeking an understanding of:

Banking BPO market size & growth by geography

Banking BPO market segmentation

Banking BPO vendor market shares globally and by geography

Consultants advising clients on vendor selection

Financial analyst specializing in the support services sector.

The term business process outsourcing (BPO) is defined as the outsourcing of business functions or

processes. In order to qualify under this definition BPO contracts must involve the vendor taking

responsibility for operational management of the business activity. For the purposes of this definition, IT

services do not count as a business function.

Potential BPO activities include:

Front-office services

Document management including billing services

Customer management services BPO

Middle-office administration services

Industry-specific processing services e.g. card processing services

Back-office support services

Finance & accounting services, including purchase-to-pay, order-to-cash, and record-to-report

HR Services including payroll services, HR administration services, managed recruitment services

and training provision and administration

Services for procurement of indirect goods and services

Copyright 2014 by NelsonHall. All rights reserved. Printed in the United Kingdom. No part of the publication may be

reproduced or distributed in any form, or by any means, or stored in a database or retrieval system, without the prior

written permission of the publisher.

The information provided in this report shall be used only by the employees of and within the current corporate structure of

NelsonHalls clients, and will not be disclosed to any other organization or person including parent, subsidiary, or affiliated

organization without prior written consent of NelsonHall.

NelsonHall exercises its best efforts in preparation of the information provided in this report and believe the information

contained herein to be accurate. However, NelsonHall shall have no liability for any loss or expense that may result from

incompleteness or inaccuracy of the information provided.

NelsonHall 2014

2

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Table of Contents

Abstract

Introduction

A. Objectives

B. Scope and Definitions

C. Methodology

10

D. Structure of the Report

12

Banking BPO Forecast by Region

13

A. Global Overview

13

B. North America

14

C. EMEA

17

D. Asia Pacific

24

E. Latin America

25

Banking BPO Vendor Market Shares and Market Forecast by Service Type

26

A. Banking BPO

26

B. Core Banking

38

C. Mortgage BPO

41

D. Payment Services

47

E. Securities Processing

56

Appendix

62

A. EMEA

62

B. Asia Pacific

69

C. Latin America

73

Reconciliation

77

Global Overview

77

North America

78

United States

78

Canada

79

EMEA

79

United Kingdom

80

France

80

Germany

81

Italy

81

RoEMEA

82

Asia Pacific

82

Central and Latin America

83

NelsonHall 2014

3

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

List of Exhibits

Banking BPO Market Forecast by Market Segment Global: 2014 2018

13

Banking BPO Market Forecast by Market Segment North America: 2014 2018

14

Banking BPO Market Forecast by Market Segment United States: 2014 2018

15

Banking BPO Market Forecast by Market Segment Canada: 2014 2018

16

Banking BPO Market Forecast by Market Segment EMEA: 2014 2018

17

Banking BPO Market Forecast by Market Segment United Kingdom: 2014 2018

18

Banking BPO Market Forecast by Market Segment Germany: 2014 2018

19

Banking BPO Market Forecast by Market Segment France: 2014 2018

20

Banking BPO Market Forecast by Market Segment Italy: 2014 2018

21

Banking BPO Market Forecast by Market Segment RoCE: 2014 2018

22

Banking BPO Market Forecast by Market Segment Africa & Middle East: 2014 2018

23

Banking BPO Market Forecast by Market Segment Asia Pacific: 2014 2018

24

Banking BPO Market Forecast by Market Segment Central & Latin America: 2014 2018

25

Global BPO Market Forecast by Region: 2014 2018

26

Estimated Banking BPO Market Shares Global: 2013

27

Estimated Banking BPO Market Shares North America: 2013

29

Estimated Banking BPO Market Shares United States: 2013

30

Estimated Banking BPO Market Shares Canada: 2013

31

Estimated Banking BPO Market Shares EMEA: 2013

32

Estimated Banking BPO Market Shares United Kingdom: 2013

33

Estimated Banking BPO Market Shares France: 2013

34

Estimated Banking BPO Market Shares Germany: 2013

34

Estimated Banking BPO Market Shares Italy: 2013

35

Estimated Banking BPO Market Shares RoCE: 2013

35

Estimated Banking BPO Market Shares Africa & Middle East: 2013

36

Estimated Banking BPO Market Shares Asia Pacific: 2013

36

Estimated Banking BPO Market Shares Central & Latin America: 2013

37

Global Core Banking BPO Market Forecast by Region: 2014 2018

38

Estimated Core Banking BPO Market Shares Global: 2013

38

Estimated Core Banking BPO Market Shares North America: 2013

39

Estimated Core Banking BPO Market Shares United States: 2013

39

NelsonHall 2014

4

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Estimated Core Banking BPO Market Shares EMEA: 2013

40

Estimated Core Banking BPO Market Shares U.K.: 2013

40

Estimated Core Banking BPO Market Shares Asia-Pac: 2013

40

Global Mortgage BPO Market Forecast by Region: 2014 2018

41

Estimated Mortgage BPO Market Shares Global: 2013

42

Estimated Mortgage BPO Market Shares North America: 2013

43

Estimated Mortgage BPO Market Shares United States: 2013

44

Estimated Mortgage BPO Market Shares EMEA: 2013

45

Estimated Mortgage BPO Market Shares U.K: 2013

46

Estimated Mortgage BPO Market Shares Asia-Pac: 2013

46

Global Payment BPO Market Forecast by Region: 2014 2018

47

Estimated Payment BPO Market Shares Global: 2013

48

Estimated Payment BPO Market Shares North America: 2013

49

Estimated Payment BPO Market Shares United States: 2013

50

Estimated Payment BPO Market Shares Canada: 2013

50

Estimated Payment BPO Market Shares EMEA: 2013

51

Estimated Payment BPO Market Shares United Kingdom: 2013

52

Estimated Payment BPO Market Shares France: 2013

52

Estimated Payment BPO Market Shares Germany: 2013

53

Estimated Payment BPO Market Shares Italy: 2013

53

Estimated Payment BPO Market Shares RoCE: 2013

54

Estimated Payment BPO Market Shares Africa & Middle East: 2013

54

Estimated Payment BPO Market Shares Asia Pacific: 2013

55

Estimated Payment BPO Market Shares Central & Latin America: 2012

55

Global Securities Processing Market Forecast by Region: 2014 2018

56

Estimated Securities BPO Market Shares Global: 2013

57

Estimated Securities BPO Market Shares North America: 2013

57

Estimated Securities BPO Market Shares United States: 2013

58

Estimated Securities BPO Market Shares Canada: 2013

58

Estimated Securities BPO Market Shares EMEA: 2013

59

Estimated Securities BPO Market Shares United Kingdom: 2013

59

Estimated Securities BPO Market Shares Germany: 2013

60

NelsonHall 2014

5

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Estimated Securities BPO Market Shares France: 2013

60

Estimated Securities BPO Market Shares RoCE: 2013

61

Estimated Securities BPO Market Shares Asia Pacific: 2013

61

Banking BPO Market Forecast by Market Segment Switzerland & Austria: 2014 2018

62

Banking BPO Market Forecast by Market Segment Eastern Europe: 2014 2018

63

Banking BPO Market Forecast by Market Segment Nordics & Finland: 2014 2018

64

Banking BPO Market Forecast by Market Segment Benelux: 2014 2018

65

Banking BPO Market Forecast by Market Segment Other Europe: 2014 2018

66

Banking BPO Market Forecast by Market Segment Africa: 2014 2018

67

Banking BPO Market Forecast by Market Segment Middle East: 2014 2018

68

Banking BPO Market Forecast by Market Segment China: 2014 2018

69

Banking BPO Market Forecast by Market Segment India: 2014 2018

70

Banking BPO Market Forecast by Market Segment Japan: 2014 2018

71

Banking BPO Market Forecast by Market Segment Other Asia: 2014 2018

72

Banking BPO Market Forecast by Market Segment Argentina: 2014 2018

73

Banking BPO Market Forecast by Market Segment Brazil: 2014 2018

74

Banking BPO Market Forecast by Market Segment Mexico: 2014 2018

75

Banking BPO Market Forecast by Market Segment Other Latin America: 2014 2018

76

Global Banking BPO Market Reconciliation by Service Type

77

North America Banking BPO Market Reconciliation by Service Type

78

United States Banking BPO Market Reconciliation by Service Type

78

Canada Banking BPO Market Reconciliation by Service Type

79

EMEA Banking BPO Market Reconciliation by Service Type

79

United Kingdom Banking BPO Market Reconciliation by Service Type

80

France Banking BPO Market Reconciliation by Service Type

80

Germany Banking BPO Market Reconciliation by Service Type

81

Italy Banking BPO Market Reconciliation by Service Type

81

RoEMEA Banking BPO Market Reconciliation by Service Type

82

Asia Pacific Banking BPO Market Reconciliation by Service Type

82

Central and Latin America Banking BPO Market Reconciliation by Service Type

83

NelsonHall 2014

6

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Introduction

A. Objectives

The purpose of this study is to provide vendors and users with a view of the current and future market

size of the global Banking BPO marketplace by geography and market segment.

The study complements the market assessments and analyses that are produced within NelsonHalls

Banking BPO subscription program, and is designed for:

Marketing, sales and business managers developing strategies to target service opportunities within

the BPO market

Executives in purchasing organizations seeking an understanding of:

Banking BPO market size & growth by geography

Banking BPO market segmentation

Banking BPO vendor market shares globally and by geography

Consultants advising clients on vendor selection

Financial analysts specializing in the support services sector.

NelsonHall 2014

7

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

B. Scope and Definitions

This study covers industry-specific banking business process outsourcing (BPO).

Business process outsourcing is defined as the outsourcing of business functions or processes. In order

to qualify under this definition, BPO contracts must involve the vendor in taking responsibility for the

delivery of the function concerned. For the purposes of this definition, stand-alone IT services do not

count as a business function, though there may be a significant IT services component embedded within

a wider business process outsourcing service.

Core Banking BPO

Core banking BPO covers the outsourcing of core account administration in support of deposit services,

client data services (CIF), general ledger services, loan services, and reporting services. However, the

outsourcing of account administration services in support of mortgage processing, payments processing,

securities processing, and channel management services are specifically excluded from core banking

BPO and are included elsewhere within these definitions.

Mortgage & Loan BPO

This service line consists of BPO services in support of mortgage origination and administration services

for prime residential, sub-prime residential, and commercial mortgages and loan origination and

administration in support of personal loans e.g. automotive loans. The mortgage and loan BPO market is

broken down into two segments:

Origination Services, covering the outsourcing of customer acquisition, underwriting services

account set-up and data entry, and credit and compliance checking in support of mortgages and

personal loans

Sales, process of marketing and sales of mortgages and loans to consumers

Fulfilment services, process of gathering data, completing applications, conducting due diligence,

and closing mortgages and loans

Mortgage and loan administration, covering the outsourcing of:

Servicing, including both customer servicing such as name changes, customer service and

correspondence handling, and secondary market services, including securitization, portfolio

servicing, and investor reporting

Default and collections, including collections, payment processing, loan accounting, and

foreclosure services.

Payment Processing

This service line consists of the outsourcing of those processes involved in banking payment

processes including support for customer initiation and vendor validation of payment request,

transmission of payment to target institutions, and crediting of target accounts. The payments

processing BPO market is broken down into three segments:

Check processing, covering outsourcing of transaction capture, transaction execution including check

presentment, and transaction posting and reconciliation

Credit card processing, covering outsourcing of card issuing and merchant acceptance services in

addition to transaction capture, execution, and posting services

EFT services, covering the outsourcing of transaction capture, execution, and posting for electronic

funds transfer such as debit and credit transfers and ATM outsourcing.

NelsonHall 2014

8

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Securities Processing

Securities processing BPO consists of outsourcing elements of the processing of financial securities such

as shares. Securities processing BPO is broken down into two segments:

Portfolio Services, including the outsourcing of transfer agency, fund accounting and administration,

and custody services. This service line is further broken down into:

Reference data management, covering the management, processing, and distribution of

reference and pricing data, which are tables of static data (primarily price data) providing historic

information for future analysis

Portfolio accounting and reporting, consisting of

Reconciliation services, covering transaction and valuation dispute resolution. An

accounting process used to compare two sets of records to ensure the figures are in

agreement and are accurate

Other portfolio accounting, covering custody, transfer agency, securities lending,

securities positions, valuations, gains/losses, portfolio income, corporate actions

processing, shareholder accounting, portfolio reporting, compliance reporting, and

performance attribution/analytics.

Trade Services, including the outsourcing of trade execution & capture, order routing, and trade

matching and settlement services.

Geographic Coverage

North America

United States

Canada

EMEA

United Kingdom

France

Germany

Italy

Other EMEA

Asia Pacific

Latin America

NelsonHall 2014

9

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

C. Methodology

NelsonHalls market sizing and forecasting for each service line is primarily carried out by analysts

specializing in, and constantly researching, the service line through ongoing senior executive interviews

and production of detailed service line market analyses and vendor assessments.

NelsonHall market sizing and forecasting is based on the following steps:

Establish base year BPO revenues for each vendor by service line

The first step in NelsonHalls methodology is to establish the base year (in this case 2012) global

revenues for each vendor by service line.

These base year vendor revenue figures are estimated for each service line in turn by the NelsonHall

analyst responsible for that service line. NelsonHall is unique in having analysts specifically dedicated to

each BPO domain, e.g. HR outsourcing, F&A outsourcing, procurement outsourcing, banking industryspecific BPO, insurance industry-specific BPO, government industry-specific BPO, banking BPO, with

recent market analysis studies typically having been carried out within the major service lines within

each BPO domain e.g. within HR outsourcing, NelsonHall has recently carried out market analyses and

vendor assessments for each of payroll outsourcing, benefits administration, recruitment process

outsourcing, and learning BPO.

The basis of the service line base year revenue estimate for each vendor is the following sources:

Published financial information from annual reports, SEC filings, and financial analyst presentations.

For example many of the leading banking BPO vendors such as Teleperformance and Convergys

publish financial accounts clearly showing their global CMS revenues. Elsewhere for example in many

areas of industry-specific BPO, F&A outsourcing, and HR outsourcing, this published financial

information is less available

Vendor senior executive interviewing by BPO service line, together with NelsonHalls vendor

assessments and market analyses by BPO service line. For example, each year a NelsonHall analyst

interviews all the major RPO vendors obtaining revenue estimates for their RPO businesses as part of

the production of RPO vendor assessments and the RPO market analysis. Similar senior executive

interviewing by service line takes place within NelsonHalls HR Outsourcing program for payroll

outsourcing, benefits administration, and learning BPO, with similar patterns of analyst activity across

NelsonHalls other BPO programs. This coverage of the individual service lines within BPO at the

market analysis and vendor assessment level is vital in supporting the base year vendor revenues by

service line, since this senior executive interviewing by the analyst responsible for the service line is a

primary source of vendor revenue data by service line. Accordingly NelsonHall has unequalled access

to detailed vendor BPO service line revenues due to its dedicated analyst focus on each of these

areas.

These base year figures by service line are then reconciled with the estimates of overall BPO revenues

for each vendor to ensure that double counting or other sources of error have not occurred and final

global BPO service line base year revenues are established for each vendor across all applicable BPO

service lines.

Establish base year BPO revenues for each vendor by service line and geography

Once the global base year revenue for each vendor has been established by BPO service line, then the

NelsonHall analyst specializing in that service line allocates the global service line revenues for each

vendor by geography.

This allocation is based as before on:

Published financial information from annual reports, SEC filings, and financial analyst presentations,

where available

Vendor senior executive interviewing by BPO service line, together with NelsonHalls vendor

assessments and market analyses by BPO service line. The NelsonHall analyst specializing in the

NelsonHall 2014

10

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

service line will typically have already estimated vendor revenues by geography based on senior

executive interviewing when producing market analyses and vendor assessments for that service

line and this knowledge and experience is vital in establishing accurate vendor revenues by BPO

service line and geography

Vendor contract activity by service line and geography. Here NelsonHall analysts capture all available

(publicly or otherwise) contract data by service line and geography. Again the contracts are typically

captured by the analyst specializing in, and dedicated to, the individual service line

Establish base year market sizes by service line and geography

The steps above deliver a series of vendor revenues for each combination of service line and geography.

The next step is to produce base year market sizes for each combination of service line and geography.

This is done individually by country and service line with the NelsonHall market analyst specializing in

that service line estimating the market concentration (i.e. market share accounted for by the known

vendors in that market) for each combination of service line and geography. Again this is typically

supported by the fact that that the analyst has recently produced a global market analysis covering the

service line and so has already developed a perspective on the market concentrations within the service

line for each country.

Where necessary however, the market concentration is adjusted at this stage and correspondingly the

market size for the combination of service line and geography revised.

The individual service line market sizes by country and geography are then aggregated from the bottom

up to give regional and global market sizes by BPO service line.

At this point the base year market sizes and vendor market shares by service line are established by

country and region.

Subcontracting

Vendor revenues have been quoted including all revenues from contracts, including those where

services are subcontracted to other BPO vendor organizations.

Estimates

All vendor revenues quoted within this report are NelsonHall estimates, and have been rounded as

appropriate. In addition, all estimates are for the latest published financial year at the time the report

data was gathered.

Exchange Rates

All exchange rates used within this report are $1.24=1 and $1.52=1

NelsonHall 2014

11

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

D. Structure of the Report

The report is structure into the following chapters:

Chapter I: Introduction

Chapter II: Banking Market Forecast by Region, including:

Global Overview

North America

EMEA

Asia Pacific

Latin America.

Chapter III: Banking Market Forecast by Service Type, including:

Banking BPO

Core Banking

Mortgage BPO

Payment Services

Securities Processing

Chapter IV: Appendix

Chapter V: Reconciliation

NelsonHall 2014

12

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Banking BPO Forecast by Region

A. Global Overview

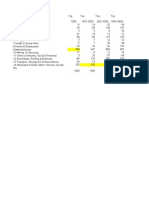

Exhibit II-1 provides the estimated size and forecasted growth of the industry-specific banking BPO

market by market segment.

Exhibit II-1

Banking BPO Market Forecast by Market Segment

Global: 2014 2018

Est.

market

size 2013

Service Type

Banking

Est.

market

size 2014

Est.

market

size 2018

Growth

2013 2014

CAAGR

2014 - 2018

90,318

94,105

108,550

4.2%

3.6%

_Core Banking

4,024

4,177

4,850

3.8%

3.8%

_Mortgage and Loan BPO

8,961

9,287

10,665

3.6%

3.5%

__Origination Services

2,453

2,537

2,905

3.4%

3.4%

491

506

573

3.1%

3.2%

___Fulfilment

1,962

2,031

2,332

3.5%

3.5%

__Mortgage and Loan Administration

6,508

6,750

7,760

3.7%

3.6%

___Servicing

4,776

4,964

5,785

3.9%

3.9%

___Default and collections

1,732

1,786

1,975

3.1%

2.6%

31,820

32,886

37,593

3.3%

3.4%

1,556

1,525

1,407

-2.0%

-2.0%

__Credit card processing

27,023

28,010

32,357

3.7%

3.7%

___Merchant acquiring

18,352

19,147

22,681

4.3%

4.3%

___Card issuing

8,671

8,863

9,676

2.2%

2.2%

__EFT Services

3,241

3,350

3,830

3.4%

3.4%

_Securities

45,513

47,755

55,442

4.9%

3.8%

__Portfolio Services

37,439

39,316

45,368

5.0%

3.6%

425

454

555

6.7%

5.2%

37,014

38,862

44,813

5.0%

3.6%

560

590

728

5.4%

5.4%

36,454

38,272

44,085

5.0%

3.6%

8,074

8,439

10,074

4.5%

4.5%

___Sales

_Payment

__Check processing

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

13

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

B. North America

Exhibits II-2 to II-4 provides details of the industry-specific banking BPO market forecasts by segment for

North America, incorporating the United States and Canada.

Exhibit II-2

Banking BPO Market Forecast by Market Segment

North America: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

46,629

48,540

55,806

4.1%

3.6%

_Core Banking

1,136

1,175

1,346

3.5%

3.5%

_Mortgage and Loan BPO

5,901

6,114

7,010

3.6%

3.5%

__Origination Services

1,282

1,325

1,513

3.4%

3.4%

___Sales

256

264

297

3.0%

3.0%

___Fulfilment

1,026

1,061

1,217

3.5%

3.5%

__Mortgage and Loan Administration

4,619

4,789

5,497

3.7%

3.5%

___Servicing

3,233

3,362

3,929

4.0%

4.0%

___Default and collections

1,386

1,427

1,568

3.0%

2.4%

19,958

20,657

23,730

3.5%

3.5%

479

469

433

-2.0%

-2.0%

__Credit card processing

17,433

18,070

20,867

3.7%

3.7%

___Merchant acquiring

_Payment

__Check processing

11,691

12,213

14,527

4.5%

4.4%

___Card issuing

5,742

5,857

6,340

2.0%

2.0%

__EFT Services

2,046

2,118

2,430

3.5%

3.5%

_Securities

19,634

20,594

23,720

4.9%

3.6%

__Portfolio Services

15,475

16,238

18,481

4.9%

3.3%

215

230

279

6.8%

5.0%

15,260

16,009

18,202

4.9%

3.3%

220

233

292

5.8%

5.8%

15,040

15,776

17,910

4.9%

3.2%

4,159

4,356

5,239

4.7%

4.7%

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

14

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-3

Banking BPO Market Forecast by Market Segment

United States: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

42,883

44,658

51,419

4.1%

3.6%

_Core Banking

1,033

1,069

1,227

3.5%

3.5%

_Mortgage and Loan BPO

5,726

5,934

6,809

3.6%

3.5%

__Origination Services

1,226

1,268

1,449

3.4%

3.4%

___Sales

245

253

284

3.0%

3.0%

___Fulfilment

__Mortgage and Loan

Administration

___Servicing

981

1,015

1,165

3.5%

3.5%

4,500

4,667

5,360

3.7%

3.5%

3,150

3,276

3,832

4.0%

4.0%

___Default and collections

1,350

1,391

1,527

3.0%

2.4%

18,552

19,208

22,110

3.5%

3.6%

400

392

362

-2.0%

-2.0%

__Credit card processing

16,245

16,842

19,484

3.7%

3.7%

___Merchant acquiring

10,894

11,384

13,576

4.5%

4.5%

___Card issuing

5,351

5,458

5,908

2.0%

2.0%

__EFT Services

1,907

1,974

2,265

3.5%

3.5%

_Securities

17,572

18,447

21,273

5.0%

3.6%

__Portfolio Services

13,811

14,507

16,530

5.0%

3.3%

_Payment

__Check processing

___Reference data management

___Portfolio accounting and

reporting

____Reconciliation services

195

209

254

7.0%

5.0%

13,616

14,299

16,276

5.0%

3.3%

200

212

268

6.0%

6.0%

____Other portfolio accounting

13,416

14,087

16,009

5.0%

3.3%

3,761

3,940

4,743

4.8%

4.8%

__Trade Services

NelsonHall 2014

15

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-4

Banking BPO Market Forecast by Market Segment

Canada: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

3,746

3,882

4,387

3.6%

3.1%

_Core Banking

103

106

119

3.0%

3.0%

_Mortgage and Loan BPO

175

180

201

2.7%

2.9%

__Origination Services

56

58

64

2.8%

2.8%

___Sales

11

11

12

2.0%

2.0%

___Fulfilment

45

46

52

3.0%

3.0%

119

122

137

2.7%

2.9%

___Servicing

83

86

97

3.0%

3.0%

___Default and collections

36

36

40

2.0%

2.6%

1,406

1,449

1,619

3.1%

2.8%

79

77

71

-2.0%

-2.0%

__Mortgage and Loan Administration

_Payment

__Check processing

__Credit card processing

1,188

1,228

1,383

3.3%

3.0%

___Merchant acquiring

797

829

951

4.0%

3.5%

___Card issuing

391

399

432

2.0%

2.0%

__EFT Services

139

144

165

3.5%

3.5%

_Securities

2,062

2,147

2,447

4.1%

3.3%

__Portfolio Services

1,664

1,731

1,951

4.0%

3.0%

20

21

26

5.0%

5.0%

1,644

1,710

1,925

4.0%

3.0%

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

20

21

24

4.0%

4.0%

1,624

1,689

1,901

4.0%

3.0%

398

416

496

4.5%

4.5%

16

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

C. EMEA

Exhibits II-5 to II-11 provides details of the industry-specific banking BPO market forecasts by market

segment for EMEA overall and additionally for the U.K., France, Germany, and Italy.

Exhibit II-5

Banking BPO Market Forecast by Market Segment

EMEA: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

29,603

30,906

35,647

4.4%

3.6%

1,791

1,858

2,149

3.7%

3.7%

_Mortgage and Loan BPO

960

993

1,132

3.4%

3.3%

__Origination Services

421

436

501

3.5%

3.6%

_Core Banking

___Sales

84

87

98

3.2%

3.2%

___Fulfilment

337

349

403

3.6%

3.7%

__Mortgage and Loan Administration

539

557

631

3.3%

3.2%

___Servicing

377

390

446

3.4%

3.4%

___Default and collections

162

167

185

3.3%

2.6%

8,808

9,075

10,255

3.0%

3.1%

772

757

698

-2.0%

-2.0%

__Credit card processing

7,211

7,467

8,591

3.5%

3.6%

___Merchant acquiring

5,014

5,216

6,113

4.0%

4.1%

___Card issuing

2,197

2,251

2,478

2.4%

2.4%

825

851

967

3.2%

3.2%

_Securities

18,044

18,980

22,111

5.2%

3.9%

__Portfolio Services

15,259

16,074

18,664

5.3%

3.8%

165

176

216

6.5%

5.3%

15,094

15,898

18,448

5.3%

3.8%

280

294

358

5.1%

5.1%

14,814

15,604

18,089

5.3%

3.8%

2,785

2,906

3,448

4.4%

4.4%

_Payment

__Check processing

__EFT Services

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

17

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-6

Banking BPO Market Forecast by Market Segment

United Kingdom: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

8,026

8,391

9,658

4.6%

3.6%

_Core Banking

500

519

600

3.7%

3.7%

_Mortgage and Loan BPO

514

530

599

3.2%

3.1%

__Origination Services

262

271

310

3.4%

3.4%

52

54

61

3.0%

3.0%

___Fulfilment

210

217

249

3.5%

3.5%

__Mortgage and Loan Administration

252

260

290

3.0%

2.8%

___Servicing

176

182

205

3.0%

3.0%

76

78

85

3.0%

2.3%

2,368

2,434

2,728

2.8%

2.9%

305

299

276

-2.0%

-2.0%

__Credit card processing

1,838

1,903

2,189

3.5%

3.6%

___Merchant acquiring

1,285

1,336

1,563

4.0%

4.0%

___Card issuing

553

567

626

2.5%

2.5%

__EFT Services

225

232

263

3.2%

3.2%

_Securities

4,644

4,908

5,731

5.7%

4.0%

__Portfolio Services

3,699

3,920

4,554

6.0%

3.8%

65

70

85

7.0%

5.3%

3,634

3,851

4,468

6.0%

3.8%

___Sales

___Default and collections

_Payment

__Check processing

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

120

126

153

5.0%

5.0%

3,514

3,725

4,315

6.0%

3.8%

945

988

1,178

4.5%

4.5%

18

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-7

Banking BPO Market Forecast by Market Segment

Germany: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

_Core Banking

4,781

5,009

5,775

4.8%

3.6%

215

224

262

4.0%

4.0%

_Mortgage and Loan BPO

76

78

89

3.2%

3.2%

__Origination Services

26

27

30

3.0%

3.0%

3.1%

3.0%

___Fulfilment

21

21

24

3.0%

3.0%

__Mortgage and Loan Administration

50

52

59

3.4%

3.3%

___Servicing

35

36

42

3.5%

3.5%

___Default and collections

15

15

17

3.0%

2.8%

1,730

1,785

2,024

3.2%

3.2%

80

78

72

-2.0%

-2.0%

__Credit card processing

1,500

1,551

1,774

3.4%

3.4%

___Merchant acquiring

1,044

1,086

1,270

4.0%

4.0%

___Card issuing

456

465

503

2.0%

2.0%

__EFT Services

150

155

178

3.5%

3.5%

_Securities

2,760

2,923

3,400

5.9%

3.9%

__Portfolio Services

2,580

2,735

3,176

6.0%

3.8%

___Sales

_Payment

__Check processing

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

30

32

39

6.0%

5.3%

2,550

2,703

3,137

6.0%

3.8%

50

53

67

6.0%

6.0%

2,500

2,650

3,070

6.0%

3.8%

180

188

224

4.5%

4.5%

19

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-8

Banking BPO Market Forecast by Market Segment

France: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

5,523

5,729

6,473

3.7%

3.1%

161

166

187

3.0%

3.0%

_Mortgage and Loan BPO

27

28

31

2.7%

2.6%

__Origination Services

_Core Banking

10

10

11

2.8%

2.8%

___Sales

2.0%

2.0%

___Fulfilment

3.0%

3.0%

__Mortgage and Loan Administration

17

17

19

2.6%

2.5%

___Servicing

12

12

13

2.5%

2.5%

2.9%

2.5%

1,275

1,312

1,477

2.9%

3.0%

100

98

90

-2.0%

-2.0%

___Default and collections

_Payment

__Check processing

__Credit card processing

1,035

1,070

1,223

3.4%

3.4%

___Merchant acquiring

716

745

871

4.0%

4.0%

___Card issuing

319

325

352

2.0%

2.0%

__EFT Services

140

144

164

3.1%

3.2%

_Securities

4,060

4,223

4,779

4.0%

3.1%

__Portfolio Services

3,560

3,703

4,170

4.0%

3.0%

20

21

25

5.0%

4.3%

3,540

3,682

4,146

4.0%

3.0%

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

40

42

49

4.0%

4.0%

3,500

3,640

4,097

4.0%

3.0%

500

520

608

4.0%

4.0%

20

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-9

Banking BPO Market Forecast by Market Segment

Italy: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

1,123

1,171

1,340

4.3%

3.4%

_Core Banking

59

61

69

3.3%

3.3%

_Mortgage and Loan BPO

32

33

37

3.3%

3.1%

__Origination Services

3.1%

3.1%

___Sales

3.7%

3.4%

___Fulfilment

3.0%

3.0%

__Mortgage and Loan Administration

24

25

28

3.3%

3.1%

___Servicing

17

17

20

3.5%

3.5%

3.1%

2.3%

437

448

498

2.6%

2.7%

37

36

33

-2.0%

-2.0%

__Credit card processing

350

361

407

3.0%

3.1%

___Merchant acquiring

244

253

290

3.5%

3.5%

___Card issuing

106

108

117

2.0%

2.0%

__EFT Services

50

51

58

2.5%

3.1%

_Securities

595

629

736

5.7%

4.0%

__Portfolio Services

515

546

638

6.0%

4.0%

___Default and collections

_Payment

__Check processing

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

6.0%

4.8%

510

540

632

6.0%

4.0%

10

10

12

4.0%

3.3%

500

530

620

6.0%

4.0%

80

83

97

4.0%

4.0%

21

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-10

Banking BPO Market Forecast by Market Segment

RoCE: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

8,777

9,157

10,612

4.3%

3.8%

_Core Banking

722

746

848

3.4%

3.3%

_Mortgage and Loan BPO

171

176

200

3.2%

3.1%

__Origination Services

55

57

64

3.0%

3.0%

___Sales

11

11

13

2.6%

2.6%

___Fulfilment

44

45

51

3.1%

3.1%

116

120

136

3.2%

3.2%

___Servicing

81

84

95

3.2%

3.3%

___Default and collections

35

36

40

3.3%

3.0%

2,414

2,480

2,768

2.7%

2.8%

200

196

181

-2.0%

-2.0%

__Credit card processing

1,979

2,042

2,317

3.2%

3.2%

___Merchant acquiring

1,372

1,421

1,640

3.6%

3.6%

___Card issuing

607

621

678

2.2%

2.2%

__EFT Services

235

242

270

2.8%

2.8%

_Securities

5,470

5,754

6,797

5.2%

4.3%

__Portfolio Services

4,520

4,763

5,622

5.4%

4.2%

40

43

53

6.8%

5.7%

4,480

4,721

5,569

5.4%

4.2%

__Mortgage and Loan Administration

_Payment

__Check processing

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

30

32

38

5.1%

4.9%

4,450

4,689

5,531

5.4%

4.2%

950

991

1,175

4.3%

4.3%

22

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit II-11

Banking BPO Market Forecast by Market Segment

Africa & Middle East: 2014 2018

Est.

market

size 2013

Est.

market

size 2014

Est.

market

size 2018

Growth

2013 2014

CAAGR

2014 - 2018

1,373

1,449

1,788

5.5%

5.4%

_Core Banking

134

143

184

6.5%

6.5%

_Mortgage and Loan BPO

140

147

176

4.9%

4.7%

__Origination Services

60

63

77

5.1%

5.1%

___Sales

12

13

15

4.7%

4.7%

___Fulfilment

48

50

62

5.2%

5.2%

__Mortgage and Loan Administration

80

84

99

4.7%

4.4%

___Servicing

56

59

71

4.8%

4.8%

___Default and collections

24

25

29

4.5%

3.4%

584

616

760

5.4%

5.4%

50

49

45

-2.0%

-2.0%

__Credit card processing

509

540

680

6.1%

6.0%

___Merchant acquiring

353

375

478

6.2%

6.3%

___Card issuing

156

165

202

5.7%

5.2%

Service Type

Banking

_Payment

__Check processing

__EFT Services

25

27

34

6.3%

6.4%

_Securities

515

544

668

5.6%

5.3%

__Portfolio Services

385

407

503

5.8%

5.4%

7.0%

6.5%

380

402

496

5.8%

5.4%

30

32

40

5.8%

5.8%

____Other portfolio accounting

350

370

457

5.8%

5.4%

__Trade Services

130

136

165

4.9%

4.9%

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

NelsonHall 2014

23

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

D. Asia Pacific

Exhibits II-12 provides details of the industry-specific banking BPO market forecasts by market segment

for Asia Pacific.

Exhibit II-12

Banking BPO Market Forecast by Market Segment

Asia Pacific: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

10,378

10,786

12,537

3.9%

3.8%

766

797

936

4.1%

4.1%

1,350

1,398

1,602

3.6%

3.5%

__Origination Services

500

516

588

3.3%

3.3%

___Sales

100

103

117

3.2%

3.3%

___Fulfilment

400

413

471

3.3%

3.3%

__Mortgage and Loan Administration

850

882

1,014

3.7%

3.6%

___Servicing

765

794

914

3.8%

3.6%

85

88

100

3.4%

3.4%

2,307

2,381

2,717

3.2%

3.4%

250

245

226

-2.0%

-2.0%

__Credit card processing

1,757

1,827

2,142

4.0%

4.1%

___Merchant acquiring

_Core Banking

_Mortgage and Loan BPO

___Default and collections

_Payment

__Check processing

1,214

1,266

1,499

4.2%

4.3%

___Card issuing

543

561

644

3.4%

3.5%

__EFT Services

300

309

349

3.0%

3.1%

_Securities

5,955

6,210

7,282

4.3%

4.1%

__Portfolio Services

5,075

5,293

6,203

4.3%

4.1%

35

37

47

7.1%

5.5%

5,040

5,255

6,157

4.3%

4.0%

40

42

53

5.9%

5.7%

5,000

5,213

6,104

4.3%

4.0%

880

917

1,079

4.2%

4.1%

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

24

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

E. Latin America

Exhibits II-13 provides details of the industry-specific banking BPO market forecasts by market segment

for Latin America

Exhibit II-13

Banking BPO Market Forecast by Market Segment

Central & Latin America: 2014 2018

Est. market Est. market Est. market

Growth CAAGR 2014

size 2013

size 2014

size 2018 2013 - 2014

- 2018

Service Type

Banking

3,708

3,873

4,559

4.4%

4.2%

_Core Banking

331

347

418

4.8%

4.8%

_Mortgage and Loan BPO

750

782

920

4.2%

4.2%

__Origination Services

250

260

302

3.8%

3.8%

50

52

61

3.9%

3.9%

___Fulfilment

200

208

241

3.8%

3.8%

__Mortgage and Loan Administration

500

522

618

4.5%

4.3%

___Servicing

400

418

497

4.6%

4.4%

___Default and collections

100

104

122

4.0%

4.0%

_Payment

747

773

891

3.5%

3.6%

___Sales

__Check processing

55

54

50

-2.0%

-2.0%

__Credit card processing

622

646

757

3.9%

4.0%

___Merchant acquiring

433

453

543

4.6%

4.7%

___Card issuing

189

194

214

2.4%

2.5%

__EFT Services

70

73

85

3.9%

3.9%

_Securities

1,880

1,971

2,329

4.8%

4.3%

__Portfolio Services

1,630

1,711

2,021

4.9%

4.3%

10

11

13

7.3%

5.6%

1,620

1,700

2,007

4.9%

4.2%

20

21

25

4.7%

4.8%

1,600

1,679

1,982

4.9%

4.2%

250

260

308

4.2%

4.3%

___Reference data management

___Portfolio accounting and reporting

____Reconciliation services

____Other portfolio accounting

__Trade Services

NelsonHall 2014

25

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Banking BPO Vendor Market Shares and Market Forecast by

Service Type

A. Banking BPO

Exhibits III-1 to III-14 provide market forecasts and vendor market shares for banking BPO.

Exhibit III-1

Global BPO Market Forecast by Region:

2014 2018

Region/Country

Est. market

size 2013

Est. market

size 2014

Est. market

size 2018

Growth 2013 CAAGR 2014

- 2014

- 2018

Global

90,318

94,105

108,550

4.2%

3.6%

_North America

46,629

48,540

55,806

4.1%

3.6%

__US

42,883

44,658

51,419

4.1%

3.6%

3,746

3,882

4,387

3.6%

3.1%

_EMEA

29,603

30,906

35,647

4.4%

3.6%

___UK

8,026

8,391

9,658

4.6%

3.6%

____Germany

4,781

5,009

5,775

4.8%

3.6%

____France

5,523

5,729

6,473

3.7%

3.1%

____Italy

1,123

1,171

1,340

4.3%

3.4%

____RoCE

8,777

9,157

10,612

4.3%

3.8%

__Africa & Middle East

1,373

1,449

1,788

5.5%

5.4%

10,378

10,786

12,537

3.9%

3.8%

3,708

3,873

4,559

4.4%

4.2%

__Canada

_Asia-Pac

_Central & Latin America

NelsonHall 2014

26

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-2

Estimated Banking BPO Market Shares

Global: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

BNY Mellon

6,691

7.4%

First Data Corporation

6,464

7.2%

State Street

5,080

5.6%

JP Morgan

3,800

4.2%

Broadridge

2,500

2.8%

Heartland Payment Systems

2,000

2.2%

Global Payments

1,850

2.0%

Ocwen

1,824

2.0%

BNP Paribas

1,820

2.0%

FIS

1,710

1.9%

TSYS

1,630

1.8%

Elavon

1,460

1.6%

Fiserv

1,328

1.5%

Societe Generale

1,230

1.4%

Northern Trust

1,175

1.3%

Euronet

1,059

1.2%

Atos

1,050

1.2%

Alliance Data Systems

760

0.8%

HSBC

700

0.8%

Brown Brothers Harriman

700

0.8%

UBS

655

0.7%

Equens

605

0.7%

Tata Consultancy Services (TCS)

565

0.6%

Bank of America

525

0.6%

Berkadia

470

0.5%

NETS

440

0.5%

PHH Mortgage

436

0.5%

Genpact

400

0.4%

HP Enterprise Services

375

0.4%

Accenture

300

0.3%

First American

280

0.3%

Xerox Services

280

0.3%

IBM Global Services

250

0.3%

Unisys

230

0.3%

Xchanging

179

0.2%

Cognizant

160

0.2%

Firstsource

150

0.2%

DekaBank

144

0.2%

Official Payments

140

0.2%

Serco

130

0.1%

NelsonHall 2014

27

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Postbank BCB

130

0.1%

ConCardis

112

0.1%

Wipro Ltd

100

0.1%

HML

88

0.1%

Capita

75

0.1%

NelsonHall 2014

28

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-3

Estimated Banking BPO Market Shares

North America: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

First Data Corporation

5,096

11.6%

BNY Mellon

3,106

7.0%

State Street

2,778

6.3%

JP Morgan

2,706

6.1%

Broadridge

2,280

5.2%

Heartland Payment Systems

1,900

4.3%

FIS

1,850

4.2%

Global Payments

1,548

3.5%

Fiserv

1,250

2.8%

TSYS

988

2.2%

Elavon

820

1.9%

Ocwen

800

1.8%

Northern Trust

600

1.4%

Brown Brothers

588

1.3%

Alliance Data Systems

550

1.2%

Berkadia

440

1.0%

PHH Mortgage

440

1.0%

Bank of America

410

0.9%

Tata Consultancy Services (TCS)

338

0.8%

First American

305

0.7%

Accenture

300

0.7%

Xerox Services

300

0.7%

Genpact

283

0.6%

CGI

250

0.6%

HSBC

217

0.5%

HP Enterprise Services

175

0.4%

Cognizant

152

0.3%

Official Payments

135

0.3%

Firstsource

123

0.3%

Euronet

103

0.2%

Sub Total

30,830

69.9%

Total

44,105

100.0%

NelsonHall 2014

29

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-4

Estimated Banking BPO Market Shares

United States: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

First Data Corporation

4,977

11.6%

BNY Mellon

3,475

8.1%

JP Morgan

3,040

7.1%

State Street

2,745

6.4%

Broadridge

2,250

5.2%

Heartland Payment Systems

2,000

4.7%

Ocwen

1,824

4.3%

FIS

1,710

4.0%

Fiserv

1,328

3.1%

Global Payments

1,075

2.5%

TSYS

880

2.1%

Elavon

850

2.0%

Northern Trust

645

1.5%

Brown Brothers Harriman

588

1.4%

Berkadia

470

1.1%

Alliance Data Systems

449

1.0%

PHH Mortgage

436

1.0%

Genpact

326

0.8%

Bank of America

325

0.8%

Tata Consultancy Services (TCS)

316

0.7%

Accenture

300

0.7%

First American

280

0.7%

Xerox Services

280

0.7%

HP Enterprise Services

212

0.5%

HSBC

175

0.4%

Official Payments

140

0.3%

Cognizant

139

0.3%

IBM Global Services

80

0.2%

Firstsource

67

0.2%

Wipro Ltd

57

0.1%

UBS

45

0.1%

Infosys

35

0.1%

CGI

32

0.1%

iGATE

27

0.1%

Jack Henry & Associates

25

0.1%

Subtotal

31,661

74.0%

Total

42,883

100.0%

NelsonHall 2014

30

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-5

Estimated Banking BPO Market Shares

Canada: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

Alliance Data Systems

295

7.9%

Global Payments

240

6.4%

Broadridge

225

6.0%

TSYS

193

5.2%

State Street

155

4.1%

First Data Corporation

129

3.4%

Elavon

70

1.9%

BNY Mellon

66

1.8%

iGATE

10

0.3%

CGI

0.2%

Infosys

0.2%

Subtotal

1,398

37.4%

Total

3,746

100.0%

NelsonHall 2014

31

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-6

Estimated Banking BPO Market Shares

EMEA: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

BNY Mellon

2,016

6.8%

BNP Paribas

1,820

6.1%

State Street

1,525

5.2%

Societe Generale

1,230

4.2%

Atos

1,005

3.4%

First Data Corporation

818

2.8%

Euronet

752

2.5%

UBS

610

2.1%

Equens

605

2.0%

JP Morgan

570

1.9%

Elavon

500

1.7%

NETS

440

1.5%

Global Payments

405

1.4%

Northern Trust

375

1.3%

TSYS

374

1.3%

HSBC

280

0.9%

Xchanging

179

0.6%

Tata Consultancy Services (TCS)

157

0.5%

DekaBank

144

0.5%

Postbank BCB

130

0.4%

Unisys

120

0.4%

ConCardis

112

0.4%

Serco

110

0.4%

Bank of America

105

0.4%

HML

88

0.3%

Capita

75

0.3%

Firstsource

67

0.2%

Tessi

65

0.2%

Genpact

63

0.2%

Wipro Ltd

41

0.1%

Brown Brothers Harriman

38

0.1%

Indra Sistemas

31

0.1%

WNS Global Services

26

0.1%

Broadridge

25

0.1%

Cognizant

21

0.1%

HCL Technologies

15

0.1%

Subtotal

15,015

50.6%

Total

29,603

100.0%

NelsonHall 2014

32

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-7

Estimated Banking BPO Market Shares

United Kingdom: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

BNY Mellon

735

9.2%

JP Morgan

570

7.1%

Northern Trust

375

4.7%

First Data Corporation

355

4.4%

Atos

328

4.1%

Societe Generale

310

3.9%

HSBC

280

3.5%

Global Payments

275

3.4%

State Street

275

3.4%

TSYS

163

2.0%

Tata Consultancy Services (TCS)

157

2.0%

Serco

110

1.4%

Elavon

100

1.2%

Euronet

95

1.2%

Unisys

90

1.1%

HML

88

1.1%

Capita

75

0.9%

Firstsource

67

0.8%

Genpact

63

0.8%

UBS

55

0.7%

BNP Paribas

55

0.7%

Bank of America

47

0.6%

Wipro Ltd

39

0.5%

Brown Brothers Harriman

38

0.5%

WNS Global Services

26

0.3%

Broadridge

25

0.3%

Cognizant

21

0.3%

HCL Technologies

15

0.2%

Infosys

13

0.2%

Steria

12

0.1%

HP Enterprise Services

0.1%

Vertex

0.1%

EXL Service

0.1%

Subtotal

4,881

60.9%

Total

8,026

100.0%

NelsonHall 2014

33

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-8

Estimated Banking BPO Market Shares

France: 2013

Vendor

Estd Revs 2013 ($m)

BNP Paribas

Market Share (%)

1,130

20.5%

Societe Generale

515

9.3%

Atos

335

6.1%

Elavon

200

3.6%

BNY Mellon

132

2.4%

State Street

101

1.8%

Tessi

65

1.2%

UBS

35

0.6%

First Data Corporation

18

0.3%

Bank of America

10

0.2%

Subtotal

2,541

46.0%

Total

5,523

100.0%

Exhibit III-9

Estimated Banking BPO Market Shares

Germany: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

Euronet

328

6.9%

Societe Generale

318

6.7%

Equens

295

6.2%

UBS

290

6.1%

BNY Mellon

199

4.2%

Xchanging

179

3.7%

DekaBank

144

3.0%

Postbank BCB

130

2.7%

Atos

116

2.4%

ConCardis

112

2.3%

State Street

101

2.1%

Elavon

100

2.1%

BNP Paribas

55

1.2%

TSYS

48

1.0%

First Data Corporation

40

0.8%

Bank of America

10

0.2%

0.2%

Alliance Data Systems

Subtotal

2,473

51.8%

Total

4,781

100.0%

NelsonHall 2014

34

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-10

Estimated Banking BPO Market Shares

Italy: 2013

Vendor

Estd Revs 2013 ($m)

Equens

Market Share (%)

155

13.8%

State Street

60

5.3%

Euronet

54

4.8%

First Data Corporation

40

3.6%

BNP Paribas

33

2.9%

Bank of America

10

0.9%

0.2%

354

31.5%

1,123

100.0%

Indra Sistemas

Subtotal

Total

Exhibit III-11

Estimated Banking BPO Market Shares

RoCE: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

State Street

988

11.3%

BNY Mellon

940

10.7%

BNP Paribas

462

5.3%

NETS

440

5.0%

Euronet

239

2.7%

Atos

226

2.6%

UBS

225

2.6%

First Data Corporation

220

2.5%

Equens

155

1.8%

Global Payments

130

1.5%

Elavon

100

1.1%

Societe Generale

87

1.0%

TSYS

78

0.9%

Unisys

30

0.3%

Indra Sistemas

29

0.3%

Bank of America

28

0.3%

Quion

13

0.2%

0.1%

Subtotal

4,398

50.2%

Total

8,777

100.0%

CGI

NelsonHall 2014

35

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-12

Estimated Banking BPO Market Shares

Africa & Middle East: 2013

Vendor

Estd Revs 2013 ($m)

First Data Corporation

Market Share (%)

145

10.6%

BNP Paribas

85

6.2%

TSYS

85

6.2%

Euronet

36

2.6%

BNY Mellon

10

0.7%

UBS

0.4%

Wipro Ltd

0.1%

368

26.8%

1,373

100.0%

Subtotal

Total

Exhibit III-13

Estimated Banking BPO Market Shares

Asia Pacific: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

BNY Mellon

869

8.4%

State Street

510

4.9%

First Data Corporation

410

4.0%

Euronet

265

2.6%

HSBC

245

2.4%

JP Morgan

190

1.8%

IBM Global Services

170

1.6%

HP Enterprise Services

155

1.5%

Northern Trust

155

1.5%

TSYS

133

1.3%

Global Payments

130

1.3%

Unisys

110

1.1%

Tata Consultancy Services (TCS)

79

0.8%

Brown Brothers Harriman

74

0.7%

Bank of America

42

0.4%

Atos

39

0.4%

Serco

20

0.2%

Firstsource

16

0.2%

Infosys

12

0.1%

Genpact

11

0.1%

HCL Technologies

10

0.1%

3,651

35.4%

10,378

100.0%

Subtotal

Total

NelsonHall 2014

36

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Exhibit III-14

Estimated Banking BPO Market Shares

Central & Latin America: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

BNY Mellon

265

7.1%

State Street

145

3.9%

First Data Corporation

130

3.5%

Bank of America

53

1.4%

TSYS

50

1.3%

Euronet

42

1.1%

Elavon

40

1.1%

Indra Sistemas

14

0.4%

Tata Consultancy Services (TCS)

13

0.4%

Alliance Data Systems

0.2%

Atos

0.2%

766

20.6%

3,708

100.0%

Subtotal

Total

NelsonHall 2014

37

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

B. Core Banking

Exhibits III-15 to III-21 provide market forecasts and vendor market shares for core banking BPO.

Exhibit III-15

Global Core Banking BPO Market Forecast by Region:

2014 2018

Est. market

size 2013

Est. market

size 2014

Est. market

size 2018

Global

4,024

4,177

4,850

3.8%

3.8%

_North America

1,136

1,175

1,346

3.5%

3.5%

__US

1,033

1,069

1,227

3.5%

3.5%

103

106

119

3.0%

3.0%

_EMEA

1,791

1,858

2,149

3.7%

3.7%

___UK

500

519

600

3.7%

3.7%

____Germany

215

224

262

4.0%

4.0%

____France

161

166

187

3.0%

3.0%

____Italy

59

61

69

3.3%

3.3%

____RoCE

722

746

848

3.4%

3.3%

__Africa & Middle East

134

143

184

6.5%

6.5%

_Asia-Pac

766

797

936

4.1%

4.1%

_Central & Latin America

331

347

418

4.8%

4.8%

Region/Country

__Canada

Growth 2013 CAAGR 2014

- 2014

- 2018

Exhibit III-16

Estimated Core Banking BPO Market Shares

Global: 2013

Vendor

Estd Revs 2013 ($m)

Market Share (%)

Atos

250

6.2%

Genpact

235

5.8%

FIS

180

4.5%

Tata Consultancy Services (TCS)

145

3.6%

IBM Global Services

60

1.5%

Serco

55

1.4%

Fiserv

37

0.9%

Jack Henry & Associates

25

0.6%

iGATE

19

0.5%

Firstsource

13

0.3%

Unisys

10

0.2%

Cognizant

10

0.2%

Infosys

0.2%

NIIT Technologies

0.1%

WNS Global Services

0.1%

EXL Service

0.1%

NelsonHall 2014

38

NelsonHall Proprietary Not for distribution without permission

July 2014

BANKING BPO MARKET FORECAST: 2014-2018

Subtotal

1,062

26.2%

Total

4,024

100.0%

Exhibit III-17

Estimated Core Banking BPO Market Shares

North America: 2013

Vendor