Beruflich Dokumente

Kultur Dokumente

Assignment

Hochgeladen von

Hoang PhuCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment

Hochgeladen von

Hoang PhuCopyright:

Verfügbare Formate

SEMESTER 2016

MANAGERIAL FINANCE

ASSIGNMENT (60%)

As a financial analyst, you have been asked to analyze a firm. Your task is to make a

recommendation as to whether or not to invest in this firm given the analysis you undertake.

Assignment format

Written report

o About 6000 words using size 12 Times New Roman. Not including tables and figures.

o Double spacing

Assignment details

This assignment provides an opportunity to get some practical experience in applying corporate

finance principles to real firms. In the process, you will get a chance to:

Evaluate the risk profile of the firm, and examine the sources of risk

Analyze the firms stockholders

Examine the firms investment choices

The firm

The firm must be listed on the Ho Chi Minh City Stock Exchange (VN100) or the New York

Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotations

(NASDAQ).

Select a firm that has plenty of publicly available information

Objectives of assessment task:

Develop critical and analytical skills related to the topic areas addressed in the course

Develop various research synthesizing skills

Communicate clearly and effectively

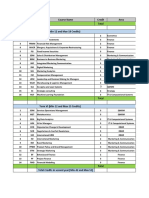

Assessment guide:

The assignment is to be done individually

The assignment is to be presented as a business report. Your analysis should provide the support

for your recommendations.

The assessment criteria are attached

Questions to guide your analysis

1. Ownership structure

Who is the average investor in this firm? (Individual or pension fund, taxable or tax-exempt,

small or large, domestic or foreign)

Is this a company where there is a separation between management and ownership? If so, is

there evidence of conflict of interest between management and shareholders?

2. Risk and performance

What is the risk profile of your firm? (How much overall risk is there in this firm? Interest rate

risk, exchange rate risk, market risk, operational risk, and so on)?

Based on its stock price, do you think this company has performed well over the past five years

(please show the chart of the stock price in the past five years? Why)?

3. Investments

Is there a typical project for this firm? If yes, what would it look like in terms of life (long term

or short term), investment needs, and cash flow patterns?

How profitable are the projects that the firm has on its books currently?

Are the projects in the future likely to look like the projects in the past? Why or why not?

4. Dividend policy

. How did the firm conduct the dividend policy in the past five years? Is it good or bad, why?

5. Capital structure

. Present capital structure of the firm; explain if that structure is good or bad, why? (student

should make comparison with the other firms in the same industry)

6. Valuation

Do you think that the firm is correctly valued by the market? Why?

Das könnte Ihnen auch gefallen

- Applied Finance - Project DescriptionDokument10 SeitenApplied Finance - Project DescriptionApurba Krishna DasNoch keine Bewertungen

- Project Description AnswerDokument22 SeitenProject Description AnswerJitendra_Khatri_2012Noch keine Bewertungen

- How To Analyse A Case StudyDokument22 SeitenHow To Analyse A Case Studyumangds100% (1)

- Unit 02Dokument40 SeitenUnit 02ravi1992088Noch keine Bewertungen

- Corporate Finance - Project 2019 MOBAYDokument6 SeitenCorporate Finance - Project 2019 MOBAYNordia BarrettNoch keine Bewertungen

- MM Presentation of Case StudyDokument21 SeitenMM Presentation of Case StudyPrathamesh PatilNoch keine Bewertungen

- Venture Capital .FundsDokument44 SeitenVenture Capital .Fundskeshav_26Noch keine Bewertungen

- Guide Strategic Audit Structure 2023 REVISEDDokument10 SeitenGuide Strategic Audit Structure 2023 REVISEDZayra AndayaNoch keine Bewertungen

- IFSA Round1 TaskDokument4 SeitenIFSA Round1 Taskkunalkumarsahu192Noch keine Bewertungen

- Private Equity Investment CriteriaDokument6 SeitenPrivate Equity Investment CriteriaJack Jacinto100% (5)

- Corporate Analysis Project BA 505: Financial AccountingDokument6 SeitenCorporate Analysis Project BA 505: Financial AccountingfredmanntraNoch keine Bewertungen

- Stock Pitch Tips and HelpDokument2 SeitenStock Pitch Tips and HelpShrikant SahasrabudheNoch keine Bewertungen

- Portfolio AnalysisDokument36 SeitenPortfolio Analysissalman200867100% (2)

- Corporate Finance:Project Help Manual: Submission Required. No PDF SubmissionDokument4 SeitenCorporate Finance:Project Help Manual: Submission Required. No PDF SubmissionHari AtharshNoch keine Bewertungen

- Unit 4 SMDokument28 SeitenUnit 4 SMpriyachand0723Noch keine Bewertungen

- Ch9-Managing Strategy: Syed Far Abid HossainDokument15 SeitenCh9-Managing Strategy: Syed Far Abid HossainMahmudul HasanNoch keine Bewertungen

- Corporate Finance ProjectDokument14 SeitenCorporate Finance ProjectAli Mukhtar ShigriNoch keine Bewertungen

- Ch05 Investment Analysis and Portfolio MGT MDokument77 SeitenCh05 Investment Analysis and Portfolio MGT MJenilyn VergaraNoch keine Bewertungen

- Week 4: Chapter 3: Resources and Capabilities Example of Hundai's Development ProcessDokument4 SeitenWeek 4: Chapter 3: Resources and Capabilities Example of Hundai's Development ProcessMichael KemifieldNoch keine Bewertungen

- Case Study AnalysisDokument4 SeitenCase Study Analysisanupama8Noch keine Bewertungen

- Financial Management 1 - Group WorkDokument3 SeitenFinancial Management 1 - Group WorkHà Cẩm TúNoch keine Bewertungen

- CORPORATE FINANCE 1 - Group WorkDokument3 SeitenCORPORATE FINANCE 1 - Group WorkVânAnh NguyễnNoch keine Bewertungen

- Strategy Frameworks Part1 HandoutDokument23 SeitenStrategy Frameworks Part1 HandoutMOIDEEN NAZAIF VMNoch keine Bewertungen

- Mejik Pengganti QuizDokument3 SeitenMejik Pengganti Quizshierley rosalinaNoch keine Bewertungen

- Unit 6Dokument61 SeitenUnit 6Mulenga NkoleNoch keine Bewertungen

- GE MatrixDokument48 SeitenGE MatrixZandro Umangay IcoNoch keine Bewertungen

- Unit 9 Establishing Company Direction Concept of Strategic VisionDokument7 SeitenUnit 9 Establishing Company Direction Concept of Strategic VisionPradip HamalNoch keine Bewertungen

- Module 5Dokument21 SeitenModule 5Jhaister Ashley LayugNoch keine Bewertungen

- Live Case Study - Lssues For AnalysisDokument4 SeitenLive Case Study - Lssues For AnalysisNhan PhNoch keine Bewertungen

- Situation Analysis and Strategic Choice BDokument64 SeitenSituation Analysis and Strategic Choice BSagun Lal AmatyaNoch keine Bewertungen

- Research Project - Case Analysis Outline S23Dokument3 SeitenResearch Project - Case Analysis Outline S23sahrish farhaanNoch keine Bewertungen

- Business Strategy - L01 To L05Dokument25 SeitenBusiness Strategy - L01 To L05Prateek RajNoch keine Bewertungen

- Group and Individual WorkDokument4 SeitenGroup and Individual WorkMohd FirdausNoch keine Bewertungen

- LB170 - Class 3 Session 5 March 2021 + TAB Use ThisDokument44 SeitenLB170 - Class 3 Session 5 March 2021 + TAB Use ThisAhmed DahiNoch keine Bewertungen

- LB170 - Class 3 Session 5 March 2021 + TAB Use ThisDokument44 SeitenLB170 - Class 3 Session 5 March 2021 + TAB Use ThisAhmed DahiNoch keine Bewertungen

- SFM - Sem 3Dokument219 SeitenSFM - Sem 3Yogesh AnaghanNoch keine Bewertungen

- Swot Analysis FrameworkDokument6 SeitenSwot Analysis FrameworkkalyanichaurasiaNoch keine Bewertungen

- SWOT MatrixDokument18 SeitenSWOT Matrixtanmoy2000100% (1)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument78 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownNoreenakhtar100% (1)

- Strategic Management Case StudyDokument7 SeitenStrategic Management Case StudyJojo ContiNoch keine Bewertungen

- 27 Swot AnalysisDokument4 Seiten27 Swot AnalysismmohancNoch keine Bewertungen

- Buisness Policy Lecture Reviewer PDFDokument6 SeitenBuisness Policy Lecture Reviewer PDFRachel Dela CruzNoch keine Bewertungen

- Business Plan Investment FormatDokument15 SeitenBusiness Plan Investment Formatmeduine2Noch keine Bewertungen

- HeryalDokument4 SeitenHeryalDe ChaneNoch keine Bewertungen

- Environment Analysis: Session - 2Dokument34 SeitenEnvironment Analysis: Session - 2ThamaliNoch keine Bewertungen

- Possible Detailed Questions For The Internship Report 2021Dokument5 SeitenPossible Detailed Questions For The Internship Report 2021Quentin CheretNoch keine Bewertungen

- Chapter 5 Formulation of StrategyDokument99 SeitenChapter 5 Formulation of Strategyminale destaNoch keine Bewertungen

- MGM3115 Assessment 2 DescriptionDokument5 SeitenMGM3115 Assessment 2 DescriptionNguyễn Hải Anh0% (1)

- STRATBUS SEM 1 22-23 Midterm ProjectDokument5 SeitenSTRATBUS SEM 1 22-23 Midterm ProjectSpider PepNoch keine Bewertungen

- FUNDAMENTAL ANALYSIS OF COMPANY AmitDokument8 SeitenFUNDAMENTAL ANALYSIS OF COMPANY Amitamitratha77Noch keine Bewertungen

- ACC561 AccountingDokument21 SeitenACC561 AccountingG JhaNoch keine Bewertungen

- Stock Valuation DissertationDokument7 SeitenStock Valuation DissertationBestCustomPaperWritingServiceReno100% (1)

- STM Mod I Part ADokument34 SeitenSTM Mod I Part AAshish ZutshiNoch keine Bewertungen

- D7360module I PDFDokument43 SeitenD7360module I PDFmohitNoch keine Bewertungen

- Security Analysis and Portfolio ManagementDokument26 SeitenSecurity Analysis and Portfolio ManagementXandarnova corpsNoch keine Bewertungen

- Lecture 13 Revision and Exam Guide-S2 2017Dokument56 SeitenLecture 13 Revision and Exam Guide-S2 2017julieNoch keine Bewertungen

- Roadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideVon EverandRoadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideNoch keine Bewertungen

- Roadmap to Entrepreneurial Success (Review and Analysis of Price's Book)Von EverandRoadmap to Entrepreneurial Success (Review and Analysis of Price's Book)Noch keine Bewertungen

- IcecreamDokument1 SeiteIcecreamHoang PhuNoch keine Bewertungen

- Errata To A Guide To Modern Econometrics / 2edDokument1 SeiteErrata To A Guide To Modern Econometrics / 2edHoang PhuNoch keine Bewertungen

- Errata To A Guide To Modern Econometrics / 2edDokument2 SeitenErrata To A Guide To Modern Econometrics / 2edHoang PhuNoch keine Bewertungen

- EScholarship UC Item 6zn9p98bDokument20 SeitenEScholarship UC Item 6zn9p98bHoang PhuNoch keine Bewertungen

- ARON Company ProfileDokument14 SeitenARON Company ProfileHoang PhuNoch keine Bewertungen

- Economic and Econometric ModelsDokument41 SeitenEconomic and Econometric ModelsHoang Phu100% (1)

- Aviation Presentation - EpinionDokument17 SeitenAviation Presentation - EpinionHoang PhuNoch keine Bewertungen

- Sales Operations PlanningDokument28 SeitenSales Operations PlanningHoang PhuNoch keine Bewertungen

- 07 FDI 04 2015.enDokument1 Seite07 FDI 04 2015.enHoang PhuNoch keine Bewertungen

- Cash Incentive PlanDokument10 SeitenCash Incentive PlanHoang PhuNoch keine Bewertungen

- Management 111204015409 Phpapp01Dokument12 SeitenManagement 111204015409 Phpapp01syidaluvanimeNoch keine Bewertungen

- FlipkartDokument18 SeitenFlipkartravisittuNoch keine Bewertungen

- Models of InternationaisationDokument8 SeitenModels of InternationaisationShreyas RautNoch keine Bewertungen

- Motorola - Strategic OverviewDokument18 SeitenMotorola - Strategic OverviewjklsdjkfNoch keine Bewertungen

- Chapter 5 - External AuditDokument11 SeitenChapter 5 - External AuditJesus ObligaNoch keine Bewertungen

- qjs005-1908JA02 2 Day Training CourseDokument1 Seiteqjs005-1908JA02 2 Day Training Coursekechaouahmed81Noch keine Bewertungen

- Decision-Making ToolsDokument17 SeitenDecision-Making ToolsLovely Bueno Don-EsplanaNoch keine Bewertungen

- Audit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZDokument3 SeitenAudit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZShaz NagaNoch keine Bewertungen

- Case Study (Solved)Dokument10 SeitenCase Study (Solved)Aditya DsNoch keine Bewertungen

- Electives Term 5&6Dokument28 SeitenElectives Term 5&6GaneshRathodNoch keine Bewertungen

- Techm Work at Home Contact Center SolutionDokument11 SeitenTechm Work at Home Contact Center SolutionRashi ChoudharyNoch keine Bewertungen

- Bangalore JustDial & OthersDokument56 SeitenBangalore JustDial & OthersAbhishek SinghNoch keine Bewertungen

- Formation of The Shariah Supervisory CommitteeDokument3 SeitenFormation of The Shariah Supervisory Committeeapi-303511479Noch keine Bewertungen

- Workshop On Training Needs AssessmentDokument113 SeitenWorkshop On Training Needs AssessmentMike PattersonNoch keine Bewertungen

- Sample Questions For Itb Modular ExamDokument4 SeitenSample Questions For Itb Modular Exam_23100% (2)

- Small & Medium-Sized Entities (Smes)Dokument8 SeitenSmall & Medium-Sized Entities (Smes)Levi Emmanuel Veloso BravoNoch keine Bewertungen

- Case 2 9 Coping With Piracy in ChinaDokument3 SeitenCase 2 9 Coping With Piracy in ChinaChin Kit YeeNoch keine Bewertungen

- BfinDokument3 SeitenBfinjonisugandaNoch keine Bewertungen

- BNI Bank StatementDokument1 SeiteBNI Bank Statementelisio.silvaNoch keine Bewertungen

- TPM PresentationDokument40 SeitenTPM PresentationRahul RajpalNoch keine Bewertungen

- PWC Insurtechs Transforming ReinsurersDokument7 SeitenPWC Insurtechs Transforming ReinsurersRezky Naufal PratamaNoch keine Bewertungen

- Capital Budgeting On Mercedes BenzDokument3 SeitenCapital Budgeting On Mercedes Benzashusingh9339Noch keine Bewertungen

- Presidential Decree No 442Dokument10 SeitenPresidential Decree No 442Eduardo CatalanNoch keine Bewertungen

- Cost Volume Profit Analysis Lecture NotesDokument34 SeitenCost Volume Profit Analysis Lecture NotesAra Reyna D. Mamon-DuhaylungsodNoch keine Bewertungen

- Business Leadership Dissertation TopicsDokument6 SeitenBusiness Leadership Dissertation TopicsWhereToBuyPapersSingapore100% (1)

- Mg1401 Total Quality Management 3 0 0 100Dokument1 SeiteMg1401 Total Quality Management 3 0 0 100ganku001Noch keine Bewertungen

- Types of Maintenance and Their Characteristics: Activity 2Dokument7 SeitenTypes of Maintenance and Their Characteristics: Activity 2MusuleNoch keine Bewertungen

- HS ComProDokument7 SeitenHS ComProgabrielNoch keine Bewertungen

- SME Guide For The Implementation of ISO/IEC 27001 On Information Security ManagementDokument38 SeitenSME Guide For The Implementation of ISO/IEC 27001 On Information Security Managementjorgegutierrez810% (1)