Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

MPIL CORPORATION LIMITED

(CIN L74199MH1959PLC16J775)

Mailing Address: "The International", 5th Floor, 16, New Marine Lines Cross Road No.1, Churchgate,

Mumbai-400 020. Tel: (022) 2203 3992, 22054196,22001910 Fax: (022) 2208 3984

Date: 8 th November, 2016

To,

The Stock Exchange, Mumbai

]eejeebhoy Towers,

Dalal Street,

Mumbai -400 023

BSE Code: 500450

Sub: Outcome of Board Meeting dated 8 th November. 2016

This is to inform you that the Company's Board has in its meeting held on

November 8, 2016 approved the Un-audited Financial Results and Limited

Review Report for the quarter and half year ended 30 th September, 2016.

Further, please note that the Company has already made necessary arrangement

to publish the same . in the newspapers as required under SEBI (Listing

Obligations and Disclosure Requirements) Regulations, 2015

Pursuant to Regulation 33 . of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015, we enclose a copy of the Un-audited

Financial Results of the Company for the quarter and half year ended 30 th

September, 2016 and copy of the Limited Review Report by the Statutory

Auditors on the said Un-audited Financial Results.

The meeting of the Board of Directors commenced at 2.30 p.m. and concluded at

04.40 p.m.

We request you to take the same on record and acknowledge receipt.

Thanking you,

Yours faithfully,

Regd. Office : Udyog Shavano2nd Floor. 29. Walchand Hirac:hand Marg, Ballard Estate, Mumbai400 001.

lODHA

6, Karim Chambers, 110, 1\. Dosili Marg,

(Slreel Hamam), FOrL,

Mumbai- 400 00 I

Tel: +91-22-226 9 141411 5 15

Fax: +91-22-2265U 126

Email: ll1umbai {/ , I o dila c (l.~olll

C

CHARTERED ACCOUNTANTS

.LI M lIED--R..\ t'lEWJlli.e.O.

Review report

To the Board of Directors

MPIL Corporation Limited

We have reviewed the accompanying statement of unaudited financial results of MPIL Corporation

Limited ('the Company') for the half year ended 30 th September, 2016. This statement is the

responsibility of the Company's management and has been approved by the Board of Directors. Our

responsibility is to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410, "Review

of Interim Financial Information Performed by the Independent Auditor of the Entity" issued by the

Institute of Chartered Accountants of India. This Standard requires that we plan and perform the review

to obtain moderate assurance as to whether the financial statements are free of material misstatement.

A review is limited primarily to inquiries of company personnel and analytical procedures applied to

financial data and thus provide less assurance than an audit. We have not performed an audit and

accordingly, we do not express an audit opinion.

Based on our review, conducted as above, nothing has come to our attention that causes us to believe

that the accompanying statement of unaudited financial results prepared in accordance with Accounting

Standards specified under Section 133 of the Act, read with Rule 7 of the Companies (Accounts) Rules,

2014 and other accounting principles generally accepted in India and other recognized accounting

practices and policies has not disclosed the information required to be disclosed in terms of Regulation

33 of SEBI (Listing Obligation and Disclosure Requirements) Regulations, 2015 including the manner in

which it is to be disclosed, or that it contains any material misstatement.

For Lodha and Co.

Charteref~t~untants

Firm Reg~/:n No. 301051E

Mumbai

November 8,2016

Partner

Membership No. 38323

MPIL CORPORATION LIMITED

Registered Office: Udyog Bhavan, 29 Walchand Hirachand Marg, Ballard Estate, Mumb;)I qOO 001

Website: www.mpilcorporation.com

ClN: L7Q299MH1959PLC163775

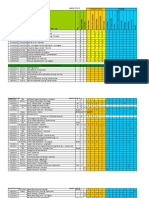

UNAUDITED STANDALONE FINANCIAL RESULTS FOR THE QUARTER & HALF YEAR ENDED SEPT(MOER 30, 2016

(~La cs,except pc r ~ 11,l rc Lbl.l )

No.

1

Half Year ended

Quarter ended

Sr.

Particulars

30-Jun-16

30-Sep-15

30Sep-16

30-Sep-15

31Mor16

Unaudited

Unaudited

Unaudited

Un au dited

Unaudited

Audi t ed

(b) Other Ope rating Income

10

Total income from Operations (net)

10

Income from Operations

(a) Net Sales/Income from Ope rations (Net of excise duty)

"YOJ r ond c)d

30-Sep-16

Expen ses

(a) Cost of materials consumed

(b) Purchase of stock-in-trade

(c) Changes in inventories of finished goods,work-in-progress

and stock-i n-trade

(d) Employee benefits expense

16

16

(e) Depreciation and am ortisation expense

(f) legal & Professional cha rges

10

12

(g) Other expen ses

10

12

18

29

47

Total expenses

24

22

25

46

51

96

(21)

(20)

(22)

(41)

(46)

(86)

26

19

18

45

35

73

(1)

(4)

(11)

(13)

(1)

(4)

(11)

(13)

(1)

(4)

(11)

(13)

Profit/ (Loss) from operations before other income, finance costs

Other Income

Profit/( loss) from ordinary activities before finance Costs and

and exceptional items (1-2)

exceptional items (3

6

7

4)

Finance Costs

Profit/floss) from ordinary activities after finance costs but

before exceptional items (5

32

5

6)

Exceptiona l Items

8)

Profit/floss) from ordinary activities before ta x (7

10

Tax expense

11

Net Profit / (Loss) from ordinary activities afer tax (9

12

Extrao rdinary items (net of tax)

10)

12)

13

Net Profit / (loss) for the period (11

(1)

(4)

(11)

(13)

14

Share of Profit / (loss) of associates

NA

NA

NA

NA

NA

NA

15

Minority Interest

NA

NA

NA

NA

NA

NA

16

Net Profit / (loss) after taxes, minority interest and share of profit

NA

NA

NA

NA

NA

NA

57

57

57

57

57

57

/ (loss) of ass ocia tes (13

14 15)

17

Paid-up equity share capital (Face Value ~ 10/- per share)

18

Reserves excluding Revaluation Reserves as per balance sheet of

19. i

Earnings Per Share (before extraordinary items) (Face value of ~

previous accounting year

1192

10/- each) (not annualised)

a)Basic ~

0.70

(0 .14)

(0.65)

0.52

(1.92)

(2.21)

a)Diluted ~

0.70

(0.14)

(0.65)

0.52

(1.92)

(2.21)

0.70

(0.14)

(0.65)

0.52

(1.92)

(2.21 )

0.70

(0.14)

(0.65)

0.52

(1.92)

(2.21)

19. ii Earnings Per Share (afte r extra ord in ary items) (Fa ce valu e of ~ 10/

each) (not annualised)

a)Basic ~

b)Diluted

, STATEMENT OF ASSETS AND LIABILITI ES

Particulars

EQUITY AND LIABILITIES

Shareholder's Fund

(~ In

30.09.201 6

S7

(a) Share Capital

1,334

Subtotal - Shareholder's funds

1,391

1,331

1,3811

(a) Trade payables

24

41

(b) Other Current Liabilities

8

18

ll:l

Current liabilities

50

Subtotal - Current liabilities

TOTAL - EQUITY AND LIABILITIES

1,441

67

1,454

140

142

ASSETS

Non-cu rrent assets

(a) Fixed assets

16

l4

157

156

(a) Current investments

449

482

(b) Cash and cash equivalents

778

78~

(b) Long-term loans and adva nces

Sub-total - Non-current assets

2

!j l

(b) Reserve & Surplus

(b) Short term provision

L"cs)

31 .03.2016

Current assets

(c) Short-term loans and advances

56

26

Sub -total - Current assets

1,284

1,298

TOTAL - ASSETS

1,441

1,4 54

(d) Other current assets

NOTES:

The above financial results after being reviewed by the Audit Committee, were approved and taken on record by the Board of Directors of the Company at its

meeting held on November 08, 2016.

2

The Results of the quarter ended 30th September, 2016 have been subjected to a "Limited Review" by Statutory Auditors of the Company.

Other Operating Income comprise Income from rent and business support services.

Previous Period / Year figures have been regrouped / re-arranged, wherever necessary, to conform to current year presentation.

There we re no investor complaints pending at the beginning of the quarter. During the quarter, no investor complaints were received and there were no

The above results are available on the Company's website at www.mpilcorporation.com.

investor complaints pending at the end of the quarter.

Place : Mu mbai

Date : November 08,2016

<r:e;'""

Um",d

Sanjeev Jain

Whole time Director

Das könnte Ihnen auch gefallen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument15 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument4 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument4 SeitenAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument11 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument3 SeitenAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument6 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Dokument3 SeitenAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument3 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesVon EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Entity-Resolution Report QuantexaDokument39 SeitenEntity-Resolution Report QuantexaRajiv sharma100% (2)

- Search Engine MarketingDokument6 SeitenSearch Engine MarketingSachinShingoteNoch keine Bewertungen

- Chap 012Dokument14 SeitenChap 012HassaanAhmadNoch keine Bewertungen

- Llanos de Juna Resort Project Feasibility Study (BSA-5A) 2014-2015Dokument208 SeitenLlanos de Juna Resort Project Feasibility Study (BSA-5A) 2014-2015snsdean100% (1)

- Aditya Birla Money Mart LTD.: Wealth Management DivisionDokument25 SeitenAditya Birla Money Mart LTD.: Wealth Management DivisionAbhijeet PatilNoch keine Bewertungen

- Air Line Industry Business EthicsDokument18 SeitenAir Line Industry Business EthicsSameer SawantNoch keine Bewertungen

- A Brief History of Wal-MartDokument8 SeitenA Brief History of Wal-MartLeena PalavNoch keine Bewertungen

- Rakuten - Affiliate Report 2016 - Forrester ConsultingDokument13 SeitenRakuten - Affiliate Report 2016 - Forrester ConsultingtheghostinthepostNoch keine Bewertungen

- Fas 142 PDFDokument2 SeitenFas 142 PDFRickNoch keine Bewertungen

- Commercial Classic Report: Federal Mortgage Bank of Nigeria W-0001549417/2018 20-Feb-2018Dokument5 SeitenCommercial Classic Report: Federal Mortgage Bank of Nigeria W-0001549417/2018 20-Feb-2018Boyi EnebinelsonNoch keine Bewertungen

- Total Business - Model1Dokument1 SeiteTotal Business - Model1mohd.hanifahNoch keine Bewertungen

- Bovee CH02Dokument24 SeitenBovee CH02Malik WajihaNoch keine Bewertungen

- 04 - Invesco European Bond FundDokument2 Seiten04 - Invesco European Bond FundRoberto PerezNoch keine Bewertungen

- Internal Audit & Verification ScheduleDokument1 SeiteInternal Audit & Verification ScheduleSean DelauneNoch keine Bewertungen

- CV Asif Hamid Sales ExecutiveDokument4 SeitenCV Asif Hamid Sales Executivelubnaasifhamid100% (1)

- Kasus ANTAM Chapter 6 MBA 78EDokument9 SeitenKasus ANTAM Chapter 6 MBA 78EIndra AdiNoch keine Bewertungen

- What Is A Job Safety AnalysisDokument2 SeitenWhat Is A Job Safety AnalysisAnonymous LFgO4WbIDNoch keine Bewertungen

- How To Apply For Pag IBIG Housing Loan in 2019 - 8 StepsDokument48 SeitenHow To Apply For Pag IBIG Housing Loan in 2019 - 8 StepsJhanese Bastes SarigumbaNoch keine Bewertungen

- OR2 Review 2013 PDFDokument17 SeitenOR2 Review 2013 PDFhshshdhdNoch keine Bewertungen

- AC17-602P-REGUNAYAN-Midterm Examination Chapters 3 & 4Dokument13 SeitenAC17-602P-REGUNAYAN-Midterm Examination Chapters 3 & 4Marco RegunayanNoch keine Bewertungen

- Knight Frank - Dubai Residential Market Review Summer 2023Dokument14 SeitenKnight Frank - Dubai Residential Market Review Summer 2023levtargNoch keine Bewertungen

- 04 Facility LayoutDokument83 Seiten04 Facility Layoutsakali aliNoch keine Bewertungen

- Chapter 1Dokument38 SeitenChapter 1CharleneKronstedtNoch keine Bewertungen

- Report On VoltassDokument37 SeitenReport On VoltassDharmendra Pratap SinghNoch keine Bewertungen

- Chapter 8 - Direct Investment and Collaborative StrategiesDokument34 SeitenChapter 8 - Direct Investment and Collaborative StrategiesGia GavicaNoch keine Bewertungen

- IOSA Program Manual (IPM) Edition 14Dokument151 SeitenIOSA Program Manual (IPM) Edition 14Eurico RodriguesNoch keine Bewertungen

- 9708 s04 QP 4Dokument4 Seiten9708 s04 QP 4Diksha KoossoolNoch keine Bewertungen

- Types of InterestDokument4 SeitenTypes of InterestUmar SheikhNoch keine Bewertungen

- SpringDokument12 SeitenSpringEmma Zhang0% (2)

- Project List (Updated 11 30 12) BADokument140 SeitenProject List (Updated 11 30 12) BALiey BustamanteNoch keine Bewertungen