Beruflich Dokumente

Kultur Dokumente

New Form 15H For Fixed Deposits Editable in PDF

Hochgeladen von

Mutual Funds Advisor ANANDARAMAN 944-529-6519Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Form 15H For Fixed Deposits Editable in PDF

Hochgeladen von

Mutual Funds Advisor ANANDARAMAN 944-529-6519Copyright:

Verfügbare Formate

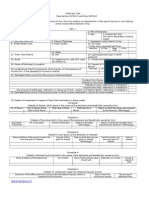

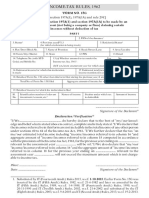

FORM NO.

15H

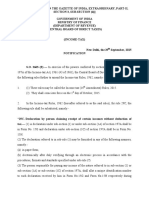

[See section 197A(1C), and rule 29C(1A)] Declaration under section 197A(1C) of the Income-tax Act, 1961 to be made by an individual who is of the age of sixty years or more claiming certain receipts without deduction of tax.

PART I 1. Name of Assessee (Declarant) 2. PAN of the Assessee 3. Age 5. Flat/Door/Block No. 8. Road/Street/Lane 6. Name of Premises 9. Area/Locality 4. Assessment Year 2014 - 2015 (for which declaration is being made)

7. Assessed in which Ward/Circle 10. AO Code (under whom assessed

last time)

Area Code AO Type Range Code AO No.

11. Town/City/District

12. State 13. PIN 14. Last Assessment Year in which assessed 17. Present Ward/Circle 19. Present AO Code (if not same as

above)

Area Code AO Type Range Code AO No.

2011 - 2012

15. Email 18. Name of Business/Occupupation

16. Telephone No. (with STD Code) and Mobile No.

20. Jurisdictional Chief Commissioner of Income-tax or Commissioner of Income-tax (if not assessed to

Income-tax earlier)

21.Estimated total income from the sources mentioned below:

(Please tick the relevant box)

Dividend from shares referred to in Schedule I Interest on securities referred to in Schedule II Interest on sums referred to in Schedule III Income form units referred to in Schedule IV The amount of withdrawal referred to in clause (a) of sub-section 2 of section 80CCA referred to in Schedule V 22.Estimated total income of the previous year in which income mentioned in Column 21 is to be included 23. Details of investments in respect of which the declaration is being made: SCHEDULE-I (Details of shares, which stand in the name of the declarant and beneficially owned by him) Total value of shares Distinctive numbers of the shares Date(s) on which the shares were acquired by the declarant (dd/mm/yyyy)

No. of shares

Class of shares & face value of each share

SCHEDULE-II (Details of the securities held in the name of declarant and beneficially owned by him) Description of securities Number of securities Amount of securities Date(s) of securities (dd/mm/yyyy) Date(s) on which the securities were acquired by the declarant (dd/mm/yyyy)

SCHEDULE-III (Details of the sums given by the declarant on interest) Name and address of the person to whom the sums are given on interest Amount of sums given on interest Date on which the sums were given on interest(dd/mm/yyyy) Period for which sums were given on interest Rate of interest

SCHEDULE-IV (Details of the mutual fund units held in the name of declarant and beneficially owned by him) Name and address of the mutual fund Number of units Class of units and face value of each unit Distinctive number of units Income in respect of units

SCHEDULE-V (Details of the withdrawal made from National Savings Scheme) Particulars of the Post Office where the account under the National Savings Scheme is maintained and the account number Date on which the account was opened(dd/mm/yyyy) The amount of withdrawal from the account

Signature of the Declarant Declaration/Verification

I.do hereby declare that I am resident in India within the meaning of section 6 of the Income-tax Act, 1961. I also, hereby declare that to the best of my knowledge and belief what is stated above is correct, complete and is truly stated and that the incomes referred to in this form are not includible in the total income of any other person u/s 60 to 64 oft he Incometax Act, 1961. I further, declare that the tax on my estimated total income, including *income/incomes referred to in column 21 computed in accordance with the provisions oft he Income-tax Act, 1961, for the previous year ending on .................... relevant to the assessment year ..................will be nil.

Place: Date: Signature of the Declarant

PART II [For use by the person to whom the declaration is furnished]

1. Name of the person responsible for paying the income referred to in Column 21 of Part I 3. Complete Address 5. Email 8. Date on which Declaration is Furnished (dd/mm/yyyy) 6. Telephone No. (with STD Code) and Mobile No. 9. Period in respect of which the dividend has been declared or the income has been paid/credited

2. PAN of the person indicated in Column 1 of Part II 4. TAN of the person indicated in Column 1 of Part II 7. Status 10. Amount of income paid 11. Date on which the income has been paid/ credited(dd/mm/yyyy)

12. Date of declaration, distribution or payment of dividend/withdrawal under the National Savings Scheme(dd/mm/yyyy)

13. Account Number of National Saving Scheme from which withdrawal has been made

Forwarded to the Chief Commissioner or Commissioner of Income-tax

Place: Date: Signature of the person responsible for paying the income referred to in Column 21 of Part I

Notes: 1. 2. 3. The declaration should be furnished in duplicate. *Delete whichever is not applicable. Before signing the declaration/verification , the declarant should satisfy himself that the information furnished in the declaration form is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under 277 of the Income-tax Act, 1961 and on conviction be punishable: i. ii. 4. In a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which shall not be less than 6 months but which may extend to seven years and with fine; In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two years and with fine.

The person responsible for paying the income referred to in column 21 of Part I, shall not accept the declaration where the amount of income oft he nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or paid during the previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax and deduction(s) under Chapter VI-A, if any, for which the declarant is eligible.";

submit

Das könnte Ihnen auch gefallen

- Form No 15HDokument3 SeitenForm No 15HsaymtrNoch keine Bewertungen

- Senior Citizen Tax FormDokument3 SeitenSenior Citizen Tax FormRajanNoch keine Bewertungen

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDokument3 Seiten"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNoch keine Bewertungen

- OBC Bank Form - 15H PDFDokument2 SeitenOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- FORM 15G DECLARATIONDokument3 SeitenFORM 15G DECLARATIONulhas_nakasheNoch keine Bewertungen

- Form No. 15H: Part - IDokument2 SeitenForm No. 15H: Part - Itoton33Noch keine Bewertungen

- "Form No. 15G: AO No. AO Type Range Code Area CodeDokument2 Seiten"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNoch keine Bewertungen

- FORM 15G DECLARATIONDokument2 SeitenFORM 15G DECLARATIONgrover.jatinNoch keine Bewertungen

- Form 15g NewDokument4 SeitenForm 15g NewnazirsayyedNoch keine Bewertungen

- TAX SAVING Form 15g Revised1 SBTDokument2 SeitenTAX SAVING Form 15g Revised1 SBTrkssNoch keine Bewertungen

- "Form No. 15H: Area Code Range Code AO No. AO TypeDokument2 Seiten"Form No. 15H: Area Code Range Code AO No. AO Typepkw007Noch keine Bewertungen

- 15G FormDokument2 Seiten15G Formsurendar147Noch keine Bewertungen

- PDF Editor: Form No. 15GDokument2 SeitenPDF Editor: Form No. 15GImissYouNoch keine Bewertungen

- 15h Form (1) - CompressedDokument4 Seiten15h Form (1) - Compressedrekha safarirNoch keine Bewertungen

- FORM-15G DECLARATIONDokument4 SeitenFORM-15G DECLARATIONKayam BalajiNoch keine Bewertungen

- PDF 4Dokument3 SeitenPDF 47ola007Noch keine Bewertungen

- PDFDokument4 SeitenPDFushapadminivadivelswamyNoch keine Bewertungen

- Form 15G/15H detailsDokument7 SeitenForm 15G/15H detailsKartikey RanaNoch keine Bewertungen

- New FORM 15H Applicable PY 2016-17Dokument2 SeitenNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Form 15G TDS waiverDokument2 SeitenForm 15G TDS waiverPalaniappan Meyyappan83% (6)

- PAN No.Dokument5 SeitenPAN No.haldharkNoch keine Bewertungen

- Form 15 HDokument2 SeitenForm 15 Hsingh ramanpreetNoch keine Bewertungen

- New Form 15G Form 15H PDFDokument6 SeitenNew Form 15G Form 15H PDFdevender143Noch keine Bewertungen

- "Form No. 15GDokument2 Seiten"Form No. 15GJayvin ShiluNoch keine Bewertungen

- New Form 15G PDFDokument2 SeitenNew Form 15G PDFSoma Sundar50% (2)

- Form 15G/15H ReceiptsDokument6 SeitenForm 15G/15H ReceiptspriyaradhiNoch keine Bewertungen

- Form 15H Format 1Dokument4 SeitenForm 15H Format 1ASHISH KININoch keine Bewertungen

- 15 G Form (Pre-Filled)Dokument2 Seiten15 G Form (Pre-Filled)Pawan Yadav0% (2)

- "Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Dokument2 Seiten"Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2teniyaNoch keine Bewertungen

- Form 15H Declaration for Senior CitizensDokument4 SeitenForm 15H Declaration for Senior CitizensraviNoch keine Bewertungen

- Bonds Form 15gDokument3 SeitenBonds Form 15gRishi TNoch keine Bewertungen

- Form 15GDokument2 SeitenForm 15GSrinivasa RaghavanNoch keine Bewertungen

- FORM 15G DECLARATIONDokument2 SeitenFORM 15G DECLARATIONRahul SahaniNoch keine Bewertungen

- New Form No 15GDokument4 SeitenNew Form No 15GDevang PatelNoch keine Bewertungen

- Icici Form 15GDokument2 SeitenIcici Form 15Grajanikant_singhNoch keine Bewertungen

- INCOME-TAXDokument3 SeitenINCOME-TAXarjunv_14100% (1)

- BLANK IOCL Form 15GDokument3 SeitenBLANK IOCL Form 15Gsaiboyshostel37Noch keine Bewertungen

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Dokument4 SeitenIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNoch keine Bewertungen

- FORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONDokument6 SeitenFORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONRajasekar SivaguruvelNoch keine Bewertungen

- Form15h GH01389401 PDFDokument3 SeitenForm15h GH01389401 PDFNamme KyarakhahaiNoch keine Bewertungen

- Form 15gDokument4 SeitenForm 15gcontactus kannanNoch keine Bewertungen

- 15 G Form (Pre-Filled)Dokument8 Seiten15 G Form (Pre-Filled)pankaj_electricalNoch keine Bewertungen

- Form 15GDokument4 SeitenForm 15GRavi SainiNoch keine Bewertungen

- Form No. 15H: (IT Dept. Copy)Dokument9 SeitenForm No. 15H: (IT Dept. Copy)jpsmu09Noch keine Bewertungen

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDokument3 SeitenFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNoch keine Bewertungen

- Form 15GDokument3 SeitenForm 15Gsriramdutta9Noch keine Bewertungen

- Form 15G Declaration for Receiving Income Without Tax DeductionDokument4 SeitenForm 15G Declaration for Receiving Income Without Tax DeductionMKNoch keine Bewertungen

- TourDokument4 SeitenTourAnup SahNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- 2017 Davis-Stirling Common Interest DevelopmentVon Everand2017 Davis-Stirling Common Interest DevelopmentNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Simple Guide for Drafting of Civil Suits in IndiaVon EverandSimple Guide for Drafting of Civil Suits in IndiaBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnVon EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNoch keine Bewertungen

- 2016 Commercial & Industrial Common Interest Development ActVon Everand2016 Commercial & Industrial Common Interest Development ActNoch keine Bewertungen

- HDFC CHILDREN's GIFT FUND SIP Performance Since Inception Contact Mutual Fund Advisor Anandaraman at 944-529-6519Dokument4 SeitenHDFC CHILDREN's GIFT FUND SIP Performance Since Inception Contact Mutual Fund Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- HDFC Fixed Deposits Application Form For TRUSTS & INSTITUTIONS Contact Wealth Advisor Anandaraman at 944-529-6519Dokument5 SeitenHDFC Fixed Deposits Application Form For TRUSTS & INSTITUTIONS Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Impact Analysis Union Budget 2015-16Dokument5 SeitenImpact Analysis Union Budget 2015-16Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- HDFC Recurring Deposit Application Form For Individuals Contact Wealth Advisor Anandaraman at 944-529-6519Dokument5 SeitenHDFC Recurring Deposit Application Form For Individuals Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- HDFC Fixed Deposits Application Form For NRI (NON-RESIDENT INDIVIDUALS) Contact Wealth Advisor Anandaraman at 944-529-6519Dokument6 SeitenHDFC Fixed Deposits Application Form For NRI (NON-RESIDENT INDIVIDUALS) Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- HDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Dokument5 SeitenHDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- HDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Dokument5 SeitenHDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Reliance Retirement Fund Application Form Wealth Advisor Anandaraman 944-529-6519Dokument28 SeitenReliance Retirement Fund Application Form Wealth Advisor Anandaraman 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Shriram City Union Finance Non Convertible Debentures Issue Details and DocumentationDokument9 SeitenShriram City Union Finance Non Convertible Debentures Issue Details and DocumentationMutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Franklin India Feeder - Franklin European Growth Fund NFO Application Form Wealth Advisor Anandaraman +919843146519Dokument16 SeitenFranklin India Feeder - Franklin European Growth Fund NFO Application Form Wealth Advisor Anandaraman +919843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Reliance Retirement Fund Product Note Wealth Advisor Anandaraman 944-529-6519Dokument12 SeitenReliance Retirement Fund Product Note Wealth Advisor Anandaraman 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDokument7 SeitenBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Franklin India Feeder - Franklin European Growth Fund Fund SnapshotDokument2 SeitenFranklin India Feeder - Franklin European Growth Fund Fund SnapshotMutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Shriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Dokument48 SeitenShriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Handbook FinalDokument24 SeitenHandbook FinalMutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Reliance Gold Savings Fund FormDokument16 SeitenReliance Gold Savings Fund FormChintan DesaiNoch keine Bewertungen

- LIC New Jeevan Nidhi - Plan 812 Call Ur LIC Agent Anandaraman +919843146519 For Privileged ServiceDokument11 SeitenLIC New Jeevan Nidhi - Plan 812 Call Ur LIC Agent Anandaraman +919843146519 For Privileged ServiceMutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- LIC Jeevan Anand Policy Call Your LIC Agent Anandaraman R Mob: +919843146519Dokument12 SeitenLIC Jeevan Anand Policy Call Your LIC Agent Anandaraman R Mob: +919843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- INVESTMENTSDokument9 SeitenINVESTMENTSKrisan RiveraNoch keine Bewertungen

- The Nature and The Laws On The Formation of A CorporationDokument7 SeitenThe Nature and The Laws On The Formation of A CorporationMary Tyfanie QuilantangNoch keine Bewertungen

- Solved The Hyperion Company Has An Authorized Capital Stock of OneDokument1 SeiteSolved The Hyperion Company Has An Authorized Capital Stock of OneAnbu jaromiaNoch keine Bewertungen

- Certificate restrictions invalidDokument1 SeiteCertificate restrictions invalidmimiyuki_Noch keine Bewertungen

- Homework Chapter 11Dokument8 SeitenHomework Chapter 11Trung Kiên NguyễnNoch keine Bewertungen

- Ecoextreme FinalDokument87 SeitenEcoextreme FinalFernando Barreto Guzman100% (1)

- Investment in Equity Securities 2Dokument2 SeitenInvestment in Equity Securities 2miss independentNoch keine Bewertungen

- COA Unit 2 Issue of Shares - ProblemsDokument3 SeitenCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNoch keine Bewertungen

- Dividends declaration and payment impact on retained earningsDokument29 SeitenDividends declaration and payment impact on retained earningsJoshua CabinasNoch keine Bewertungen

- Leverage and Capital Structure SolutionsDokument10 SeitenLeverage and Capital Structure SolutionsmaazNoch keine Bewertungen

- Company Law: Kinds of CompaniesDokument14 SeitenCompany Law: Kinds of CompaniesRonan FerrerNoch keine Bewertungen

- EU VAT Treatment of SharesDokument34 SeitenEU VAT Treatment of SharesJORGESHSSNoch keine Bewertungen

- ElforgefinallofDokument170 SeitenElforgefinallofDivya PinchaNoch keine Bewertungen

- Financial analysis and dividend policy calculationsDokument4 SeitenFinancial analysis and dividend policy calculationskumail zaidiNoch keine Bewertungen

- 9 Bonus & Right IssueDokument9 Seiten9 Bonus & Right Issueanilrj14pc8635jprNoch keine Bewertungen

- Quizzes - Chapter 16 - Accounting For DividendsDokument7 SeitenQuizzes - Chapter 16 - Accounting For DividendsAmie Jane Miranda67% (3)

- Week 7 AUDIT PreTestDokument19 SeitenWeek 7 AUDIT PreTestCale HenituseNoch keine Bewertungen

- Principles of Corporate Finance 10th Edition Brealey Test BankDokument38 SeitenPrinciples of Corporate Finance 10th Edition Brealey Test Bankhoadieps44ki100% (25)

- Corporate Finance Firm Value ComparisonDokument32 SeitenCorporate Finance Firm Value ComparisonVAISHALI HASIJA 1923584Noch keine Bewertungen

- DA-402-07 - Restricted Stock Award Under A Stock Incentive PlanDokument4 SeitenDA-402-07 - Restricted Stock Award Under A Stock Incentive PlanJerwin DaveNoch keine Bewertungen

- BASF Annual Report 2000Dokument72 SeitenBASF Annual Report 2000邹小胖Noch keine Bewertungen

- Dividends Exercises Chapter 9 For AssignmentDokument3 SeitenDividends Exercises Chapter 9 For AssignmentYami Sukehiro100% (1)

- Understanding Retained EarningsDokument72 SeitenUnderstanding Retained EarningsItronix MohaliNoch keine Bewertungen

- HW On Book Value Per ShareDokument4 SeitenHW On Book Value Per ShareCharles TuazonNoch keine Bewertungen

- Investment Reviewer With Answer SolutionsDokument39 SeitenInvestment Reviewer With Answer SolutionsYmmymmNoch keine Bewertungen

- Cma GR-2 Part-3 Marathon PDFDokument63 SeitenCma GR-2 Part-3 Marathon PDFvivekNoch keine Bewertungen

- BCD CorporationDokument3 SeitenBCD CorporationJohn Rey GalichaNoch keine Bewertungen

- Module 16Dokument3 SeitenModule 16AstxilNoch keine Bewertungen

- Share Price List: Cost BasisDokument13 SeitenShare Price List: Cost BasisChristian Baldonado AngelesNoch keine Bewertungen