Beruflich Dokumente

Kultur Dokumente

Syllabus Corporate Finance Weekend Course

Hochgeladen von

Mhykl Nieves-HuxleyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Syllabus Corporate Finance Weekend Course

Hochgeladen von

Mhykl Nieves-HuxleyCopyright:

Verfügbare Formate

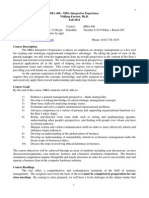

MBA-COURSE SYLLABUS

Corporate Finance

Contact Information

Professor:

E-Mail:

Prof. Dr..

Course Prerequisites

MBA-Prep-Course or equivalent fundamentals of accounting and finance course

Students are expected to have learned the fundamentals of accounting

Introduction to Corporate Finance

The course Corporate Finance is applicable to all forms of business, small and large,

private and public.

Individuals involved in the Corporate Finance arena are concerned with

- strategic corporate decisions

- balance sheets, P&L accounts and cash flow statements

- strategic and competitors analysis

- financial planning

- valuation models

- risk management

- optimizing the capital structure

The ultimate goal of the financial manager is generally to maximize shareholder value. To

succeed in business, profound corporate finance knowledge and its international

perspectives is mandatory. Therefore, the unit focuses on corporate finance. The

following main aspects of corporate finance are covered here:

1. Mergers & Acquisitions (M&A)

2. Initial Public Offering (IPO)

3. Private Equity / Venture Capital

4. Going Private

5. Due Diligence

6. Valuation

Number 1 to 4 gives an overview on major corporate finance topics. Many banks have

respective business unites covering these issues. Valuation (#6) is considered to be the

major tool to carry out a corporate finance analysis. Without profound valuation

knowledge M&A, IPO, Private Equity/Venture Capital and Going Private can not be

carried out. Therefore, the following major valuation techniques are scrutinized:

o Market cap and book value

o Discounted Cash Flow analysis

o Trading Multiples

o Transaction Multiples

MBA-COURSE SYLLABUS: Corporate Finance

Page 2

Others (e.g. Real options, Trade Buyers Approach)

Aims and Objectives

Combine the existing skills of finance with fundamental issues of managerial finance.

Introduce the concepts of Corporate Finance as they apply in todays global world.

After taking the class, you should be able to

- apply the concepts;

- understand the financial implication of financial statements;

- understand the relevant valuation techniques;

- understand how a cash flow analysis works;

- understand Corporate Finance in the domestic and international environment; and

- be prepared to apply advanced methods of integrated financial management.

MBA-COURSE SYLLABUS: Corporate Finance

Page 3

Assessment

Your grade will be composed of three elements: a pre assignment, mid-term assignment, a

final assignment. These requirements are weighted as follows:

Pre-assignment

25%

Mid-term assignment

25%

Final case study

50%

TOTAL

100%

Pre-assignment

You are given a pre-assignment in a word document. This individual examination case

will be to analyze a corporate finance activity of a company based on the latest profit and

loss account and the latest balance sheet. The pre-assignment ought to be handed in

during the first day of class (Friday evening) in form of a word document and a pdf

document on a USB stick as well as a printout. It will be discussed at the end of the first

weekend. In order to support the pre-assignment you will be given a pre-assignment for

testing purposes and a solution sheet in Excel (you dont have to hand in these two

documents). These two documents can help you to solve the actual pre-assignment

because the pre-assignment and the pre-assignment for testing purposes follow the

same pattern. The pre-assignment for testing purposes basically can be considered as

a connecting link between the book and your pre-assignment.

Mid-term assignment

This is a team examination to be presented during the course. Student teams will be

assigned during the first day of class. The cases will be presented to the class and all

team members will actively participate in the presentation and discussion. Contrary to

other classes, the grades will be individual. The team presentation will be the basis for

your grade. However, the core impact on grading will be every team members individual

performance.

This examination case will be to prepare and measure a financing decision using

financial modeling in Excel. The results should be summarized in a PowerPoint

document. The mid-term assignment will be carried out in the first week on Sunday.

Final Case

The final examination case will be distributed during class sessions in the first week. This

is a team examination to be presented at the end of the course (in the second week on

Sunday). The final case will be to carry out a fully fledged valuation of a listed company

(the accounts will be based on IFRS) including an analysis of the market cap, the book

value, the DCF value, trading multiples and transaction multiples. The analysis will be

carried out in a strategic corporate finance context analyzing strategic opportunities

such as M&A, IPO or Private Equity funding - including scenarios and a sensitivity

analysis. Contrary to other classes, the grades will be individual. The team presentation

will be the basis for your grade. However, the core impact on grading will be every team

members individual performance.

Class Preparation

Students are expected to actively participate in discussions. Thus, it is essential that all

students read the chapters before class.

Textbook, materials and technologies

Ernst, Dietmar; Hcker, Joachim (2011): Applied International Corporate Finance,

Vahlen Publishers, Munich, 2nd edition.

Reading/activity: Selected chapters, case analyses, class notes, presentations.

Additional material to be assigned as deemed to be necessary.

Copies of the used transparencies will be provided to support the individual notes.

MBA-COURSE SYLLABUS: Corporate Finance

Page 4

A variety of learning strategies will be used in this class, including books, mini-lectures,

discussions, group case analyses, and presentations.

All assignments must be word processed. Presentations must be made using a format

such as PowerPoint. Excel files need to be added.

Grading

The following cutoff points will be used for assigning the grades:

97 100% = A+

94 - 96,99% = A

90 - 93,99% = A-

87 - 89,99% = B+

84 - 86,99% = B

80 - 83,99% = B-

77 - 79,99% = C+

74 - 76,99% = C

70 - 73,99% = C-

67 - 69,99% = D+

64 - 66,99% = D

60 - 63,99% = D<= 59,99% = F

The individual results of the pre-assignment and the midterm assignment will be

announced in a one-on-one in the first week on Sunday.

The individual results of the final assignment will be announced in a one-on-one in

the second week on Sunday.

The grades of recent years fall into the interval between .and ... The most

commonly awarded grade was .

Content of the Course

Pre-assignment and reading of selected chapters in the textbook for preparation

Discussion of pre-assignment

Elements and links between Corporate Finance and international accounting

The process of mergers & acquisitions from pitch to closing

Private equity success factors and market trends

Initial public offering how does it work and what are the necessary steps?

Delisting Going the other way

Optimal capital structure the search for the Holy Grail

Shareholder value everybody knows it but nobody can calculate it. You will!

Preparation, presentation and discussion of mid-term assignment

Preparation, presentations and discussion of final case

Feed-back

Feedback

Pre-assignment: You will be given a solution sheet to the pre-assignment on the second

week on Saturday. The solution sheet points out the correct financial figures where

calculations are involved. Wherever verbal questions are asked, please bear in mind that

there is no such thing as the real answer. The verbal answer pointed out in the solution

sheet just gives a hint about the general skeleton of the potential correct answer. No

liability for the correctness and the completeness can be given.

Midterm-assignment: Individual feedback talks can be carried out after the grades have

been forwarded to all course members.

Final assignment: Individual feedback talks can be carried out after the grades have been

forwarded to all course members.

MBA-COURSE SYLLABUS: Corporate Finance

Page 5

Itinerary

Unit

Date

Time

Content

- Read part 1 (Mergers & Acquisitions, pp. 1- 64) in the textbook and the

provided material for preparation.

- Read part 7 (Valuation, pp. 359 - 516) very carefully. Part 7 is the basis

for the mid-term assignment and the final case. The focus of the

Corporate Finance course is on valuation => this part is core! One

comment on the DCF method you might like (pp. 372 432). There are 3

approaches: The WACC approach, the APV approach and the equity

approach. We only scrutinize the WACC approach and you can neglect

the other two approaches (e.g. dont read page 374 376)!

1

2

3

WEEK 1

FR 15.10.XX

17:45 - 22:00

SA 16.10.XX

09:00 18:00

SO 17.10.XX

09:00 14:00

1) Content:

- The process of M&A

- Valuation techniques

- Links between Corporate Financeand international accounting

2) Assignment:

- Discussion of pre-assignment

- Feedback on pre-assignment

- Preparation for second assignment

- Presentations and discussion of mid-term assignment (Mergers &

Acquisitions, Group work and Cases)

Preparation for final case

Read the following pages in the textbook:

Part 2: pp. 65 82; 105 108;

Part 4: pp. 245 308;

Part 5: pp. 309 330.

4

5

6

WEEK 2

FR 22.10.XX

17:45 - 22:00

SA 23.10.XX

09:00 18:00

SO 24.10.XX

09:00 - 14:00

1) Content - Topics:

- IPO

- Due Diligence

- Private Equity

- Going Private

- Optimal Capital Structure

2) Assignment - Students activities:

- Final Case Study Team work

- Final Case Study Presentations and Discussions

I am looking forward to seeing you soon.

Prof. Dr. ..

Das könnte Ihnen auch gefallen

- Lazer - Syllabus FSA - OY - 2023 - RUNIDokument5 SeitenLazer - Syllabus FSA - OY - 2023 - RUNIכפיר בר לבNoch keine Bewertungen

- Base On Penman Course OveeviewDokument10 SeitenBase On Penman Course OveeviewPrabowoNoch keine Bewertungen

- Financial Management3161Dokument15 SeitenFinancial Management3161elizabethanhdoNoch keine Bewertungen

- Syllabus 5161 MasterDokument13 SeitenSyllabus 5161 Masterhsnpdr365Noch keine Bewertungen

- Syllabus 4 - Financial Management - Spring 2020Dokument6 SeitenSyllabus 4 - Financial Management - Spring 2020Hayden Rutledge Earle100% (1)

- Corporate Finance Topics: Juan-Pedro GómezDokument4 SeitenCorporate Finance Topics: Juan-Pedro GómezAkki ChoudharyNoch keine Bewertungen

- Applied Value Investing (Duggal) FA2016Dokument3 SeitenApplied Value Investing (Duggal) FA2016darwin12Noch keine Bewertungen

- M&A Course SyllabusDokument8 SeitenM&A Course SyllabusMandip LuitelNoch keine Bewertungen

- UT Dallas Syllabus For Aim6305.ot1 06s Taught by Surya Janakiraman (Suryaj)Dokument9 SeitenUT Dallas Syllabus For Aim6305.ot1 06s Taught by Surya Janakiraman (Suryaj)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Fa11 Fin 650 SagnerDokument7 SeitenFa11 Fin 650 SagnerFuzael AminNoch keine Bewertungen

- Syllabus Finance Ii Course 2017-18: General InformationDokument4 SeitenSyllabus Finance Ii Course 2017-18: General InformationDavidNoch keine Bewertungen

- Fbe 532Dokument5 SeitenFbe 532socalsurfyNoch keine Bewertungen

- MergerDokument7 SeitenMergerivan rickyNoch keine Bewertungen

- EWMBA-202 Financial-Accounting Konchitchki Spring2020 RedactedDokument8 SeitenEWMBA-202 Financial-Accounting Konchitchki Spring2020 RedactedAshley NguyenNoch keine Bewertungen

- Course Outline: Business 2257: Accounting and Business AnalysisDokument9 SeitenCourse Outline: Business 2257: Accounting and Business AnalysistigerNoch keine Bewertungen

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDokument5 SeitenFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohNoch keine Bewertungen

- UT Dallas Syllabus For Fin6301.502.11f Taught by ARZU OZOGUZ (Axo101000)Dokument13 SeitenUT Dallas Syllabus For Fin6301.502.11f Taught by ARZU OZOGUZ (Axo101000)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Fundamental Corporate Valuation For Active InvestorsDokument4 SeitenFundamental Corporate Valuation For Active Investorsluca sacakiNoch keine Bewertungen

- FIN-365 SyllabusDokument7 SeitenFIN-365 SyllabusJohnny GonzalezNoch keine Bewertungen

- IB Semester 2 HandbookDokument17 SeitenIB Semester 2 HandbookFranciscoJavierVazquezPachonNoch keine Bewertungen

- 2015-2016 Rotman Fact SheetDokument114 Seiten2015-2016 Rotman Fact SheetRichmond LauNoch keine Bewertungen

- ASM CũDokument19 SeitenASM CũĐại HoàngNoch keine Bewertungen

- MGMT 2020 Fall 11fDokument7 SeitenMGMT 2020 Fall 11fYunasis AesongNoch keine Bewertungen

- ACCT3114A - Valuation Using Financial Statements - Dr. Jing LiDokument8 SeitenACCT3114A - Valuation Using Financial Statements - Dr. Jing LiTheo GalvannyNoch keine Bewertungen

- SFAD - Course OutlineDokument10 SeitenSFAD - Course OutlineMuhammad Shariq SiddiquiNoch keine Bewertungen

- Assignment InstructionsDokument8 SeitenAssignment InstructionsAtul SharmaNoch keine Bewertungen

- FINANCIAL ACCOUNTING COURSE OUTLINE - HorngrenDokument11 SeitenFINANCIAL ACCOUNTING COURSE OUTLINE - HorngrenAsħîŞĥLøÝåNoch keine Bewertungen

- Unit OutlineDokument11 SeitenUnit OutlinemuhammadmusakhanNoch keine Bewertungen

- Okun - MGMT - GB.3333.30 - Business Startup PracticumDokument6 SeitenOkun - MGMT - GB.3333.30 - Business Startup PracticumaakashchandraNoch keine Bewertungen

- Unit Information Form (UIF) : Page 1 of 5Dokument5 SeitenUnit Information Form (UIF) : Page 1 of 5Radha ThakurNoch keine Bewertungen

- Acct 354 Outline W2016Dokument4 SeitenAcct 354 Outline W2016Woo JunleNoch keine Bewertungen

- Mscfin Derivatives and Risk ManagementDokument6 SeitenMscfin Derivatives and Risk ManagementAbebe Tilahun KNoch keine Bewertungen

- BMA5008 RV 1213 Sem2Dokument4 SeitenBMA5008 RV 1213 Sem2Adnan ShoaibNoch keine Bewertungen

- Eng 111 Syllabus PDFDokument3 SeitenEng 111 Syllabus PDFnadimNoch keine Bewertungen

- Financial Reporting Accounting MBA SyllabusDokument4 SeitenFinancial Reporting Accounting MBA SyllabusMohammed NaderNoch keine Bewertungen

- AcquisitionsDokument8 SeitenAcquisitionsveda20Noch keine Bewertungen

- CO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFDokument12 SeitenCO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFshalabh_hscNoch keine Bewertungen

- Acct 587Dokument6 SeitenAcct 587socalsurfyNoch keine Bewertungen

- BA435Dokument14 SeitenBA435Hope FaithNoch keine Bewertungen

- Financial Analysis and Decision Making OutlineDokument8 SeitenFinancial Analysis and Decision Making OutlinedskymaximusNoch keine Bewertungen

- PSIBEC MSC International Business EconomicsDokument7 SeitenPSIBEC MSC International Business EconomicsPhuNoch keine Bewertungen

- Financial Management (FN-550) : Course IntroductionDokument5 SeitenFinancial Management (FN-550) : Course IntroductionAsadEjazButtNoch keine Bewertungen

- Au Finc 501 Col Fall 2015Dokument8 SeitenAu Finc 501 Col Fall 2015Somera Abdul QadirNoch keine Bewertungen

- AccountingSyllabus Fall 2016 RWEDokument4 SeitenAccountingSyllabus Fall 2016 RWEkennyNoch keine Bewertungen

- Fall 2022 BUS CORE 321 Class SyllabusDokument5 SeitenFall 2022 BUS CORE 321 Class SyllabusWilliam FosterNoch keine Bewertungen

- Fundamentals of Financial Management 2: Mamduhmh@ugm - Ac.idDokument6 SeitenFundamentals of Financial Management 2: Mamduhmh@ugm - Ac.idNiken Arya AgustinaNoch keine Bewertungen

- Amis 823sp08Dokument20 SeitenAmis 823sp08rahuldesai11890% (1)

- Warwick Mba: For Global EnergyDokument8 SeitenWarwick Mba: For Global EnergyClintonDestinyNoch keine Bewertungen

- Course Outline Iapm-Prof.p.saravananDokument6 SeitenCourse Outline Iapm-Prof.p.saravananNicholas DavisNoch keine Bewertungen

- FSA-BE SyllabusDokument14 SeitenFSA-BE SyllabusThanh Trúc Nguyễn NgọcNoch keine Bewertungen

- SyllabusDokument9 SeitenSyllabusBala ThandapaniNoch keine Bewertungen

- MBA 406 Syllabus Fall 2011Dokument13 SeitenMBA 406 Syllabus Fall 2011Syed Fahad AhmedNoch keine Bewertungen

- EMBA Asset Management (Bekaert) SP2021Dokument11 SeitenEMBA Asset Management (Bekaert) SP2021Sumalya BhattaacharyaaNoch keine Bewertungen

- FINE482-1 ABRAMSON Winter 2018 SyllabusDokument7 SeitenFINE482-1 ABRAMSON Winter 2018 SyllabusKhyati GandhiNoch keine Bewertungen

- Finance 351Dokument5 SeitenFinance 351Bhavana KiranNoch keine Bewertungen

- Family Business Management CurriculamDokument9 SeitenFamily Business Management CurriculamRamalingam ChandrasekharanNoch keine Bewertungen

- Indian School of Business Corporate Control, Mergers and AcquisitionsDokument8 SeitenIndian School of Business Corporate Control, Mergers and AcquisitionsAranab RayNoch keine Bewertungen

- EMBA Financial Statement Analysis and Valuation (Katz) FA2016Dokument5 SeitenEMBA Financial Statement Analysis and Valuation (Katz) FA2016darwin12Noch keine Bewertungen

- Accounting and Finance for Business Strategic PlanningVon EverandAccounting and Finance for Business Strategic PlanningNoch keine Bewertungen

- Training - Day 3 Restatement & ReclassificationDokument4 SeitenTraining - Day 3 Restatement & ReclassificationMhykl Nieves-HuxleyNoch keine Bewertungen

- Personnel Economics: Chapter 2 - Chapter 6 (Reviewer)Dokument7 SeitenPersonnel Economics: Chapter 2 - Chapter 6 (Reviewer)Mhykl Nieves-Huxley100% (3)

- Personnel Economics-Answers Exercise 1Dokument9 SeitenPersonnel Economics-Answers Exercise 1Mhykl Nieves-Huxley67% (3)

- 15 Advertising GenresDokument3 Seiten15 Advertising GenresMhykl Nieves-HuxleyNoch keine Bewertungen

- Social Pred in Marketing BehaviorDokument18 SeitenSocial Pred in Marketing BehaviorMhykl Nieves-HuxleyNoch keine Bewertungen

- Specto5 TaiwanDokument15 SeitenSpecto5 TaiwanMhykl Nieves-HuxleyNoch keine Bewertungen

- Marketing Research For ShellDokument76 SeitenMarketing Research For ShellMhykl Nieves-Huxley100% (1)

- COMALGEDokument2 SeitenCOMALGEMhykl Nieves-HuxleyNoch keine Bewertungen

- Le Sommeil AnalysisDokument1 SeiteLe Sommeil AnalysisMhykl Nieves-HuxleyNoch keine Bewertungen

- DLSU HUMAART Policies (Third Term 2013)Dokument3 SeitenDLSU HUMAART Policies (Third Term 2013)Mhykl Nieves-HuxleyNoch keine Bewertungen

- DLSU Waiver FormDokument1 SeiteDLSU Waiver FormMhykl Nieves-HuxleyNoch keine Bewertungen

- Horlicks NoodlesDokument9 SeitenHorlicks NoodlesdhawalearchanaNoch keine Bewertungen

- Answers To Practice Set I: AR RentalsDokument13 SeitenAnswers To Practice Set I: AR RentalsDin Rose Gonzales100% (1)

- Parking Garage Case PaperDokument10 SeitenParking Garage Case Papernisarg_Noch keine Bewertungen

- Categorized List of Certified CompaniesDokument17 SeitenCategorized List of Certified CompaniesNLainie OmarNoch keine Bewertungen

- Property Surveyor CVDokument2 SeitenProperty Surveyor CVMike KelleyNoch keine Bewertungen

- Beginner Tutorials: Salesforce Coding Lessons For The 99%Dokument85 SeitenBeginner Tutorials: Salesforce Coding Lessons For The 99%Ram KumarNoch keine Bewertungen

- ArcGIS For AutoCADDokument2 SeitenArcGIS For AutoCADsultanNoch keine Bewertungen

- Pegboard Minutes MeetingDokument2 SeitenPegboard Minutes MeetingSuparman StNoch keine Bewertungen

- UCC Article 2-PocketGuideDokument2 SeitenUCC Article 2-PocketGuidesuperxl2009Noch keine Bewertungen

- MM 2011Dokument4 SeitenMM 2011Ak LandNoch keine Bewertungen

- Gmail - Thanks For Your Order (Order# 1101830340)Dokument3 SeitenGmail - Thanks For Your Order (Order# 1101830340)Luis Vargas AvalosNoch keine Bewertungen

- Television Quality AssuranceDokument4 SeitenTelevision Quality AssurancepartibanNoch keine Bewertungen

- Commercial Dispatch Eedition 1-27-19Dokument28 SeitenCommercial Dispatch Eedition 1-27-19The DispatchNoch keine Bewertungen

- Definition of Distributation ChannelDokument11 SeitenDefinition of Distributation ChannelrituparnaNoch keine Bewertungen

- Callistus Moses CV19042010Dokument5 SeitenCallistus Moses CV19042010Callistus MosesNoch keine Bewertungen

- Success Strategies in IslamicDokument21 SeitenSuccess Strategies in IslamicMaryamKhalilahNoch keine Bewertungen

- Linux Vs Windows Tco ComparisonDokument44 SeitenLinux Vs Windows Tco Comparisoncontactlucky12329Noch keine Bewertungen

- Wharton Casebook 2005 For Case Interview Practice - MasterTheCaseDokument48 SeitenWharton Casebook 2005 For Case Interview Practice - MasterTheCaseMasterTheCase.comNoch keine Bewertungen

- WSMDokument4 SeitenWSMWaseem MughalNoch keine Bewertungen

- Ticks Hunter Bot GuideDokument7 SeitenTicks Hunter Bot GuideKingtayNoch keine Bewertungen

- Singapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationDokument3 SeitenSingapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationWeR1 Consultants Pte LtdNoch keine Bewertungen

- (English (Auto-Generated) ) Ethics Case Study - Do Not Let Your Friends Suffer (DownSub - Com)Dokument3 Seiten(English (Auto-Generated) ) Ethics Case Study - Do Not Let Your Friends Suffer (DownSub - Com)Bình LưuNoch keine Bewertungen

- AC 506 Midterm ExamDokument10 SeitenAC 506 Midterm ExamJaniña NatividadNoch keine Bewertungen

- Recognition Journey ExamplesDokument4 SeitenRecognition Journey ExamplesJosie SpencerNoch keine Bewertungen

- Anna University - B.Tech - BIOTECHNOLOGY Syllabus - GE1451 Total Quality Management 1. IntroductionDokument79 SeitenAnna University - B.Tech - BIOTECHNOLOGY Syllabus - GE1451 Total Quality Management 1. IntroductionSakib ShaikhNoch keine Bewertungen

- Sawan Kulkarni: Professional SummaryDokument3 SeitenSawan Kulkarni: Professional Summaryamit12289Noch keine Bewertungen

- Netsuite Vendor Prepayment ProcessDokument17 SeitenNetsuite Vendor Prepayment ProcessOmg JrosieNoch keine Bewertungen

- 2011 Accenture Technical Interview QuestionsDokument5 Seiten2011 Accenture Technical Interview QuestionsPuneet KaushikNoch keine Bewertungen

- Corporate IdentityDokument64 SeitenCorporate IdentityGeetanshi Agarwal100% (1)

- Lion Air Eticket Itinerary / ReceiptDokument2 SeitenLion Air Eticket Itinerary / ReceiptMuzakkir SyamaunNoch keine Bewertungen