Beruflich Dokumente

Kultur Dokumente

A Look at Different Measures of Short Term Influences On Prices2

Hochgeladen von

satish sOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Look at Different Measures of Short Term Influences On Prices2

Hochgeladen von

satish sCopyright:

Verfügbare Formate

STOCK FUNDAMENTALS

A LOOK AT DIFFERENT MEASURES OF

SHORT-TERM INFLUENCES ON PRICES

By John Bajkowski

While the long-term

investor with an open

position can treat

short-term supply

and demand

disruptions as market

noise, the profitability

of a given trade

can be strongly

influenced by

short-term supply

and demand

imbalances.

Over the long term, company fundamentals dictate the price people are

willing to pay to purchase a stock or demand to part with their holdings.

However, in the short run, supply and demand disruptions can have a

significant impact on stock prices and help to push prices out of whack.

The principles of supply and demand drive stock prices. Prices adjust to

match buyers and sellers. Any time more shares are put up for sale than

purchase, the price will drop, bringing more investors to the table to buy at a

more appealing price. This article examines some of the more prominent

measures of short-term sentiment and supply and demand influences.

TRACKING TRADES

Traders have long studied the ticker in an attempt to measure the sentiment

of market participants and identify possible stock price trends. The ticker

indicates the price and quantity of every trade, thereby providing the investor

with a map of how a stocks price has traveled.

This historical record is not to be confused with a real-time quote. A

current price quote provides the price of buying a securitythe askand the

price at which you can sell the securitythe bid. The difference between the

markets best offer to buy a stock (bid) and the best offer to sell the same

stock (ask) is known as the inside spread. The price and quantity of each tick

on the ticker does not directly indicate if the trade represented the purchase at

the asked price or a sale at the bid price. However, if the trade price was

higher than the previous trade, it is an uptick. Downticks are trades executed

at a price below the previous trade.

Given the high volume of transactions today it is simply not practical to

directly study every tick (trade) going across the wire. Fortunately, software

programs and Web services allow investors to analyze tick-by-tick data.

THE TICK

One of the most sensitive measures of overall market activity, minute-tominute, is the tick. The tick is calculated continuously and is the number of

stocks trading higher than their previous trade less the number of stocks

trading lower than the previous trade. A positive tickmore stocks are

trading higher than lower from their previous tradeis bullish, and a negative tickmore stocks are trading lower than higher from their previousis

bearish. A large plus tick (greater than 200) indicates that the short-term

direction of the market is up, and a large minus tick (less than a negative

200) is an indication that the market is trending down.

Since the tick is computed continuously, it is very changeable, giving up-tothe-minute readings on the market mood. The market averages may be up,

but the tick can turn negative, indicating that the trading trend has reversed.

The Wall Street Journal reports the closing tick for each of the exchanges,

providing some insight into the ending market sentiment. Many Web sites

providing quotes will also allow you to get the current NYSE tick. $TICK is

John Bajkowski is AAIIs vice president of financial analysis and editor of Computerized

Investing.

AAII Journal/July 2000

25

STOCK FUNDAMENTALS

FIGURE 1. TRACKING MONEY FLOW AT BLOOMBERG.COM

the ticker symbol for the tick on the

AAII Web site.

MONEY FLOW

Money flow analysis closely

examines every trade in an attempt

to measure the amount of money

buying a stock compared to the

amount of money selling a stock.

Money flow considers both the

volume and tick of each trade. An

uptick on 10,000 shares is considered more bullish than an uptick on

100 shares. Money flow considers

the net value of the money moving

into or out of a stock.

If a stocks last trade was at $50.00

and the next trade consists of 1,000

shares at an uptick to $50.25, then

the trade represents positive money

flow. If the next trade is 100 shares

at $49.75, it is considered negative

money flow because it traded on a

downtick. On the surface the stock

price is down a quarter point from

the original $50, but it has actually

experienced positive money flow

because 1,000 shares were purchased

on an uptick while only 100 shares

were sold on a downtick. There has

been net buying of 900 shares

26

AAII Journal/July 2000

(1,000 100). The money

flow is calculated by taking the

cumulative sum of price times

volume on upticks minus price times

volume on downticks. Normally,

zero (unchanged) ticks are ignored.

For our example, the money flow is

calculated as (1,000 50.25) (100

49.75), which is equal to $45,275.

Theoretically, as a security is

dropping in price, money should be

flowing out of it. However, in the

short term it is possible for price

action to diverge from the money

flow. For example, large blocks of a

stock may be purchased on a series

of upticks, while small blocks may

be purchased on a larger number of

downticks. The price chart may

show a downtrend, but money flow

has been positive. Traders look for

divergence between price charts and

money flow as an indicator of a

possible price reversal. It is important to look at money flow on a

relative basis and compare its

current level to historical norms.

One should also look for past

patterns of stock price tracking the

money flow. If stock price tends not

to track money flow for a given

stock, then the stock is not a candi-

date for money flow analysis.

Bloomberg is a well known source

for money flow analysis. Every day

it reports on significant divergence

between price activity and money

flow. Stocks featured in Buying on

Weakness have positive money

flow and falling prices, while

Selling on Strength stocks have

negative money flow and rising

prices. You can find this information at www.bloomberg.com/tv/

moneyline/index.html. Figure 1

highlights the positive money flow

of Advanced Micro Devices (AMD)

through mid-June, while its stock

price was showing some recent

weakness. The site provides a

historical record of the highlighted

stocks along with their performance.

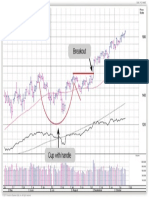

The Web service BigCharts

(www.bigcharts.com) allows users

to plot money flow indications for

any stock, but simplifies its analysis

to look at trading day by day. It

does this by assuming that when a

stock closes higher than its open, all

volume associated with that trading

period results from buyers. It further

assumes that when a stock closes

lower than its open, all volume

associated with that trading period

results from sellers. Although these

assumptions are overly simplistic,

the charts provide an overall indication of buying and selling pressure

on a stock (Figure 2).

BLOCK TRADES

Large block trades help to indicate

the participation of large institutions

in the market. These are single

trades of a stock consisting of at

least 10,000 shares. Block trades are

tracked for the overall market or a

given exchange, looking at the

number of block trades on up ticks,

down ticks, and without change.

This information is an indication of

whether the buyer or seller was

more eager to complete the trade.

An increasing number of block

trades with upticks indicates an

increasing interest in the market by

the institutional marketplace and

STOCK FUNDAMENTALS

FIGURE 2. BUYING & SELLING PRESSURE AT BIGCHARTS.COM

tends to track a rising market. The

Stock Market Laboratory within

Barrons does a nice job of presenting this data.

The Thomson I-Watch Web site

(www.thomsoninvest.net/iwatch)

provides a number of useful tools to

track both institutional and retail

trades. Thomson tracks messages

sent between institutional investors

and broker/dealers indicating the

intention to buy or sell securities.

Total buy and sell figures are

provided for both non-binding

messages and more explicit advertising of big block buy and sell opportunities with the exact price and size

of a proposed trade.

Reports are available for the

market as a whole, broad and

narrow industry segments, and

individual companies. Graphical

reports provide quick clues on major

money flows during the course of a

trading day.

sell a large number of shares for a

given stock. Patient sellers may

exhibit a willingness to wait for

slightly better prices or upward

movement from buyers in order to

avoid pushing down the stock price

too much. This overhang creates a

resistance for price uptrends, even if

company fundamentals are positive.

Traders look for repeated large

block transactions on the ask side of

a trade as a sign that institutional

investors are using rallies as selling

opportunities. The supply must be

absorbed before significant upward

price movements are possible.

The significance of a given overhang varies from stock to stock. The

greater the normal trading activity at

a given company, the greater its

ability to absorb a large overhang in

a reasonable amount of time without

a strong price decline.

OVERHANG

While most investors buy a stock

with the hope of selling it for a

profit at a later date, some investors

reverse the process. Short sellers

hope to profit from stock price

declines by borrowing stock, selling

The Thomson site provides a short

commentary on stocks showing

strong institutional buying or selling.

Overhang describes the intention to

SHORT INTEREST

it first and then buying the stock

later at a lower price, and returning

the borrowed shares. Brokerage

firms have the ability to lend out

shares held by the broker in margin

accounts of other customers.

The traditional process of buying

first and selling later is referred to as

going long. A long position

indicates a belief that the stock will

increase in value. When you sell a

stock hoping to buy it back later at a

lower price, you are shorting the

stock. When you buy back the shares

you cover your short position.

Short sellers represent some of the

biggest risk-takers in the market.

When you buy a stock long, your

loss is limited to the original investment. Even if the company goes

bankrupt and shares become worthless you cannot lose more than what

you paid for the shares. The potential gain, however, is infinite. The

stock price can rise to many times

the original purchase price.

With a short trade the risk-return

profile is reversed. If the stock price

drops to near zero, a short trader

can reverse the short position (cover

the short) and will have gained

nearly 100% on the original investment. However, if the share price

goes up, the loss can conceivably be

infinite. For example, if you sell

short 100 shares of a $100 stock,

your broker will credit $10,000 to

your margin account. (Note that

most individual investors do not

receive interest income on proceeds

of the short sale. The free use of this

money is a profit opportunity for the

broker.) If the stock price drops to

$50, the short seller can cover the

position with a buy order for 100

shares and pocket a $5,000 gain.

However, if the stock price goes up

to $200, the short seller will need to

pony up $10,000 to add to the

$10,000 from the short proceeds to

buy 100 shares at $200 dollars and

cover the short position.

Beyond the risk of an unlimited

loss, short sellers may be caught in a

short squeeze if a stock price increases strongly. Brokerage firms

AAII Journal/July 2000

27

STOCK FUNDAMENTALS

FIGURE 3. SHORT INTEREST HISTORY AS GIVEN AT MARKETGUIDE.COM

reserve the right to call the borrowed security back at any time. If a

large number of short sellers are

forced to cover their short positions

through the purchase of shares, they

can actually push the stock price

even higher.

Many traders track short sale

statistics to measure sentiment for a

given stock and gauge the possibility

and impact of a short squeeze. Short

positions are reported monthly

through most stock information

services. Market Guide provides a

four-month short interest history

with its company performance

report on its Web site at

www.marketguide.com (see Figure

3). Short interest is the number of

shares short, but not yet covered.

The figure is normally compared to

the average daily volume and shares

outstanding to gauge the significance

28

AAII Journal/July 2000

of the figure from company to

company.

Amazon.com had 25.759 million

shares sold short as of May 8,

2000. This represent a significant

decline from 36.448 million shares

on February 8, 2000. Amazon has

351.77 million shares outstanding,

so 7.3% of its outstanding shares

were short as of May (25.759

351.77). So even though both the

stock price and short interest have

declined since February, many

investors still think that the share

price is likely to fall.

The short interest ratio relates

the short interest to the average

daily volume. Dividing short

interest by the average daily

volume indicates the number of

days it would take to cover the

short interest if trading continued

at the average daily volume for the

month. High ratios indicate strong

negative sentiment against the

stock. Amazons short interest

ratio for May was 3.688 days. This

figure is up from its February

figure of 2.922, indicating that

trading volume has slowed down

even more strongly than the

decrease in the short interest.

However, when working with the

short interest ratio, it is important

to take seasonal trading patterns

into account. Volume often slows

down during the summer months

and peaks around the year-end.

Short interest is helpful in

gauging market sentiment toward a

particular stock. Many traders use

it as a contrarian indicator, treating high short levels as an overly

pessimistic view. In whatever way

the short-interest data is used, you

should keep in mind the potential

price uptick from a short squeeze

and the vocal attempts by short

sellers to highlight company

weaknesses to push down a

companys stock price. Message

boards are full of short sellers

actively talking down stocks.

Trading-Ideas.com (www.tradingideas.com) presents lists of stocks

with the largest short-interest

ratios broken down by exchange.

CONCLUSION

While the long-term investor with

an open position can treat short-term

supply and demand disruptions as

market noise, the profitability of a

given trade can be strongly influenced

by a short-term supply and demand

imbalance. This can have significant

impact on stock prices and strongly

influence the profitability of given

trade. As the old Wall Street adage

goes: Dont fight the tape.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Top 20 Day Trading Rules For SuccessDokument4 SeitenTop 20 Day Trading Rules For Successbugbugbugbug100% (3)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Forecasting Stock Returns: What Signals Matter, and What Do They Say Now?Dokument20 SeitenForecasting Stock Returns: What Signals Matter, and What Do They Say Now?dabiel straumannNoch keine Bewertungen

- Position SizingDokument29 SeitenPosition SizingIan Moncrieffe94% (18)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Power PatternsDokument41 SeitenPower Patternsedmond1100% (1)

- Receiving, Inspection, Acceptance Testing and Acceptance or Rejection ProcessesDokument18 SeitenReceiving, Inspection, Acceptance Testing and Acceptance or Rejection ProcessesjeswinNoch keine Bewertungen

- Completing-Your-Copy-With-Captions-And-Headlines Lesson-1Dokument24 SeitenCompleting-Your-Copy-With-Captions-And-Headlines Lesson-1api-294176103Noch keine Bewertungen

- Shore Activities and Detachments Under The Command of Secretary of Navy and Chief of Naval OperationsDokument53 SeitenShore Activities and Detachments Under The Command of Secretary of Navy and Chief of Naval OperationskarakogluNoch keine Bewertungen

- Es130617 1Dokument4 SeitenEs130617 1satish sNoch keine Bewertungen

- Metabical Positioning and CommunicationDokument15 SeitenMetabical Positioning and CommunicationJSheikh100% (2)

- Richard Herrmann-Fractional Calculus - An Introduction For Physicists-World Scientific (2011)Dokument274 SeitenRichard Herrmann-Fractional Calculus - An Introduction For Physicists-World Scientific (2011)Juan Manuel ContrerasNoch keine Bewertungen

- Sharpening Skills WyckoffDokument16 SeitenSharpening Skills Wyckoffsatish s100% (1)

- Money Management Controlling Risk and Capturing Profits by Dave LandryDokument20 SeitenMoney Management Controlling Risk and Capturing Profits by Dave LandryRxCapeNoch keine Bewertungen

- The Bachelor of ArtsDokument6 SeitenThe Bachelor of ArtsShubhajit Nayak100% (2)

- Ganzon Vs CADokument3 SeitenGanzon Vs CARaymond RoqueNoch keine Bewertungen

- The Art of Timing The TradeDokument1 SeiteThe Art of Timing The Tradesatish s0% (3)

- Rhodes Solutions Ch4Dokument19 SeitenRhodes Solutions Ch4Joson Chai100% (4)

- Edukasyon Sa Pagpapakatao (Esp) Monitoring and Evaluation Tool For Department Heads/Chairmen/CoordinatorsDokument3 SeitenEdukasyon Sa Pagpapakatao (Esp) Monitoring and Evaluation Tool For Department Heads/Chairmen/CoordinatorsPrincis CianoNoch keine Bewertungen

- Unusual Options Activity Halftime Report - : There Is A Risk of Loss in All TradingDokument3 SeitenUnusual Options Activity Halftime Report - : There Is A Risk of Loss in All Tradingsatish sNoch keine Bewertungen

- 1208452Dokument4 Seiten1208452satish sNoch keine Bewertungen

- Simple Supper Trading SystemDokument3 SeitenSimple Supper Trading Systemsatish sNoch keine Bewertungen

- News Release: Nomura Individual Investor SurveyDokument17 SeitenNews Release: Nomura Individual Investor Surveysatish sNoch keine Bewertungen

- Raschke0204 PDFDokument10 SeitenRaschke0204 PDFAnonymous xU5JHJe5Noch keine Bewertungen

- The Stock Market Update: September 11, 2012 © David H. WeisDokument1 SeiteThe Stock Market Update: September 11, 2012 © David H. Weissatish sNoch keine Bewertungen

- Get More Out of Trading with PPO Indicator ManualDokument4 SeitenGet More Out of Trading with PPO Indicator Manualsatish sNoch keine Bewertungen

- Crystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural InformationDokument3 SeitenCrystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural Informationsatish sNoch keine Bewertungen

- Greatness SurveyDokument14 SeitenGreatness SurveyNew York PostNoch keine Bewertungen

- BattenBook Chapter7Enhanced PDFDokument55 SeitenBattenBook Chapter7Enhanced PDFsatish sNoch keine Bewertungen

- ETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst FundsDokument5 SeitenETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst Fundssatish sNoch keine Bewertungen

- An Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange MarketDokument7 SeitenAn Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange Marketsatish sNoch keine Bewertungen

- Wabash National Corp WNC: Last Close Fair Value Market CapDokument4 SeitenWabash National Corp WNC: Last Close Fair Value Market Capsatish sNoch keine Bewertungen

- CH 4Dokument38 SeitenCH 4satish sNoch keine Bewertungen

- Kuhn FEMADokument1 SeiteKuhn FEMAsatish sNoch keine Bewertungen

- Pega 7 1 Sla1Dokument3 SeitenPega 7 1 Sla1satish sNoch keine Bewertungen

- Uniti Group Inc UNIT: Last Close Fair Value Market CapDokument4 SeitenUniti Group Inc UNIT: Last Close Fair Value Market Capsatish sNoch keine Bewertungen

- Trading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLDokument8 SeitenTrading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLsatish sNoch keine Bewertungen

- How To Buy Common Patterns1 2Dokument1 SeiteHow To Buy Common Patterns1 2satish sNoch keine Bewertungen

- Smartbuild - Smart Design For Smart SystemsDokument1 SeiteSmartbuild - Smart Design For Smart Systemssatish sNoch keine Bewertungen

- Greenhill & Co Inc GHL: DividendsDokument5 SeitenGreenhill & Co Inc GHL: Dividendssatish sNoch keine Bewertungen

- Cultural Practices and Academic Performance of Blaan Pupils in Sinapulan Elementary SchoolDokument15 SeitenCultural Practices and Academic Performance of Blaan Pupils in Sinapulan Elementary SchoolLorNoch keine Bewertungen

- Duah'sDokument3 SeitenDuah'sZareefNoch keine Bewertungen

- Midterms and Finals Topics for Statistics at University of the CordillerasDokument2 SeitenMidterms and Finals Topics for Statistics at University of the Cordillerasjohny BraveNoch keine Bewertungen

- Social Marketing PlanDokument25 SeitenSocial Marketing PlanChristophorus HariyadiNoch keine Bewertungen

- Review Unit 10 Test CHP 17Dokument13 SeitenReview Unit 10 Test CHP 17TechnoKittyKittyNoch keine Bewertungen

- Reducing Healthcare Workers' InjuriesDokument24 SeitenReducing Healthcare Workers' InjuriesAnaNoch keine Bewertungen

- DNS Mapping and Name ResolutionDokument5 SeitenDNS Mapping and Name ResolutionAmit Rashmi SharmaNoch keine Bewertungen

- 1st PU Chemistry Test Sep 2014 PDFDokument1 Seite1st PU Chemistry Test Sep 2014 PDFPrasad C M86% (7)

- The Great Idea of Brook TaylorDokument7 SeitenThe Great Idea of Brook TaylorGeorge Mpantes mathematics teacherNoch keine Bewertungen

- Listening LP1Dokument6 SeitenListening LP1Zee KimNoch keine Bewertungen

- Cartha Worth SharingDokument27 SeitenCartha Worth SharingtereAC85Noch keine Bewertungen

- Ice Task 2Dokument2 SeitenIce Task 2nenelindelwa274Noch keine Bewertungen

- My Testament On The Fabiana Arejola M...Dokument17 SeitenMy Testament On The Fabiana Arejola M...Jaime G. Arejola100% (1)

- HexaflexDokument10 SeitenHexaflexCharlie Williams100% (1)

- Second Periodic Test - 2018-2019Dokument21 SeitenSecond Periodic Test - 2018-2019JUVELYN BELLITANoch keine Bewertungen

- Practical and Mathematical Skills BookletDokument30 SeitenPractical and Mathematical Skills BookletZarqaYasminNoch keine Bewertungen

- AREVA Directional Over Current Relay MiCOM P12x en TechDataDokument28 SeitenAREVA Directional Over Current Relay MiCOM P12x en TechDatadeccanelecNoch keine Bewertungen

- Modul Kls XI Sem IDokument6 SeitenModul Kls XI Sem IAnonymous WgvOpI0CNoch keine Bewertungen

- Grammar activities and exercisesDokument29 SeitenGrammar activities and exercisesElena NicolauNoch keine Bewertungen

- ReportDokument7 SeitenReportapi-482961632Noch keine Bewertungen

- Ductile Brittle TransitionDokument7 SeitenDuctile Brittle TransitionAndrea CalderaNoch keine Bewertungen

- Chapter 1 Introduction To Management and OrganisationDokument34 SeitenChapter 1 Introduction To Management and Organisationsahil malhotraNoch keine Bewertungen