Beruflich Dokumente

Kultur Dokumente

Cost of Capital

Hochgeladen von

Dibakar Das0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten3 SeitenCost of capital

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCost of capital

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten3 SeitenCost of Capital

Hochgeladen von

Dibakar DasCost of capital

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Cost of capital is an integral part of investment decision as it is used to measure the worth of

investment proposal provided by the business concern. It is used as a discount rate in

determining the present value of future cash flows associated with capital projects. Cost of

capital is also called as cut-off rate, target rate, hurdle rate and required rate of return. When the

firms are using different sources of finance, the finance manager must take careful decision with

regard to the cost of capital; because it is closely associated with the value of the firm and the

earning capacity of the firm.

Meaning of Cost of Capital: Cost of capital is the rate of return that a firm must earn on its

project investments to maintain its market value and attract funds. Cost of capital is the required

rate of return on its investments which belongs to equity, debt and retained earnings. If a firm

fails to earn return at the expected rate, the market value of the shares will fall and it will result

in the reduction of overall wealth of the shareholders.

Definitions:

According to the definition of John J. Hampton Cost of capital is the rate of return the firm

required from investment in order to increase the value of the firm in the market place.

According to the definition of Solomon Ezra, Cost of capital is the minimum required rate of

earnings or the cut-off rate of capital expenditure.

Assumption of Cost of Capital:

Cost of capital is based on certain assumptions which are closely associated while calculating

and measuring the cost of capital. It is to be considered that there are three basic concepts:

1. It is not a cost as such. It is merely a hurdle rate.

2. It is the minimum rate of return.

3. It consists of three important risks such as zero risk level, business risk and financial risk.

Cost of capital can be measured with the help of the following equation.

K = rj + b + f.

Where,

K = Cost of capital.

rj = The riskless cost of the particular type of finance.

b = The business risk premium.

f = The financial risk premium.

CLASSIFICATION OF COST OF CAPITAL:

Cost of capital may be classified into the following types on the basis of nature and usage:

Explicit and Implicit Cost.

Average and Marginal Cost.

Historical and Future Cost.

Specific and Combined Cost.

Explicit and Implicit Cost:

The cost of capital may be explicit or implicit cost on the basis of the computation of cost of

capital.

Explicit cost is the rate that the firm pays to procure financing.

Average and Marginal Cost:

Average cost of capital is the weighted average cost of each component of capital employed by

the company. It considers weighted average cost of all kinds of financing such as equity, debt,

retained earnings etc.

Marginal cost is the weighted average cost of new finance raised by the company. It is the

additional cost of capital when the company goes for further raising of finance.

Historical and Future Cost:

Historical cost is the cost which as already been incurred for financing a particular project.

It is based on the actual cost incurred in the previous project.

Future cost is the expected cost of financing in the proposed project. Expected cost is calculated

on the basis of previous experience.

Specific and Combine Cost:

The cost of each sources of capital such as equity, debt, retained earnings and loans is called as

specific cost of capital. It is very useful to determine the each and every specific source of

capital.

The composite or combined cost of capital is the combination of all sources of capital.

It is also called as overall cost of capital. It is used to understand the total cost associated with the

total finance of the firm.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- APA References List ExamplesDokument4 SeitenAPA References List ExamplesDibakar DasNoch keine Bewertungen

- Institution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDokument4 SeitenInstitution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDibakar DasNoch keine Bewertungen

- If Notes PDFDokument36 SeitenIf Notes PDFDibakar DasNoch keine Bewertungen

- Assignment Topic: Program: EMBA Batch: 162 & 163 Course Title: Business Economics Course Code: BUS-407Dokument1 SeiteAssignment Topic: Program: EMBA Batch: 162 & 163 Course Title: Business Economics Course Code: BUS-407Dibakar DasNoch keine Bewertungen

- Lecture-02 Dated: January 06, 2013 The Functions of A Commercial Bank Can Be Grouped Under Three Different HeadsDokument3 SeitenLecture-02 Dated: January 06, 2013 The Functions of A Commercial Bank Can Be Grouped Under Three Different HeadsDibakar DasNoch keine Bewertungen

- Demutualization of Stock Exchanges: NitieDokument4 SeitenDemutualization of Stock Exchanges: NitieDibakar DasNoch keine Bewertungen

- Marketing Management Course OutlineDokument2 SeitenMarketing Management Course OutlineDibakar DasNoch keine Bewertungen

- Course Outline MicroDokument6 SeitenCourse Outline MicroDibakar DasNoch keine Bewertungen

- Assignment IMDokument1 SeiteAssignment IMDibakar DasNoch keine Bewertungen

- Managerial FinanceDokument23 SeitenManagerial FinanceDibakar DasNoch keine Bewertungen

- Obstacles To Women's Participation in ParliamentDokument19 SeitenObstacles To Women's Participation in ParliamentDibakar Das100% (1)

- Business Economics Course OutlineDokument2 SeitenBusiness Economics Course OutlineDibakar DasNoch keine Bewertungen

- Course Outline Managing OperationsDokument3 SeitenCourse Outline Managing OperationsDibakar DasNoch keine Bewertungen

- Chapter-01 Overview of Financial System and Financial Markets and InstitutionsDokument5 SeitenChapter-01 Overview of Financial System and Financial Markets and InstitutionsDibakar DasNoch keine Bewertungen

- Digital BangladeshDokument48 SeitenDigital BangladeshDibakar DasNoch keine Bewertungen

- Natural Resources of BangladeshDokument22 SeitenNatural Resources of BangladeshDibakar Das0% (1)

- MBF 720Dokument143 SeitenMBF 720Dibakar DasNoch keine Bewertungen

- Chapter-011: Micro FinanceDokument2 SeitenChapter-011: Micro FinanceDibakar DasNoch keine Bewertungen

- Financial SystemDokument1 SeiteFinancial SystemDibakar DasNoch keine Bewertungen

- Employee BenefitsDokument20 SeitenEmployee BenefitsDibakar DasNoch keine Bewertungen

- Economic Geography 2009Dokument21 SeitenEconomic Geography 2009Dibakar DasNoch keine Bewertungen

- NPV Vs - IRRDokument6 SeitenNPV Vs - IRRDibakar DasNoch keine Bewertungen

- Activity-Based Costing Chapter04NPPTsDokument49 SeitenActivity-Based Costing Chapter04NPPTsDibakar DasNoch keine Bewertungen

- Annual ReportDokument15 SeitenAnnual ReportDibakar DasNoch keine Bewertungen

- Introduction To SWOT AnalysisDokument20 SeitenIntroduction To SWOT AnalysisDibakar DasNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Circular PuzzleDokument72 SeitenCircular PuzzleVishwambarNoch keine Bewertungen

- UdaanDokument39 SeitenUdaanAnkit ButtoliaNoch keine Bewertungen

- HDFC Bank ReportDokument43 SeitenHDFC Bank ReportAnkit SinhaNoch keine Bewertungen

- Vijaya Bank - OkokDokument78 SeitenVijaya Bank - OkokSubramanya DgNoch keine Bewertungen

- Zoltan Pozsar - War and Currency StatecraftDokument7 SeitenZoltan Pozsar - War and Currency StatecraftEric LeonardoNoch keine Bewertungen

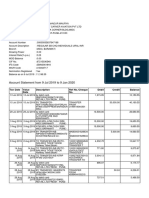

- Account Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument4 SeitenAccount Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancemauryapiaeNoch keine Bewertungen

- 3 Phrasal Verbs + Idioms B2Dokument6 Seiten3 Phrasal Verbs + Idioms B2Abel GordilloNoch keine Bewertungen

- FaysalbankDokument541 SeitenFaysalbankAnnie DollNoch keine Bewertungen

- Punjab National BankDokument4 SeitenPunjab National BankRicky KishoreNoch keine Bewertungen

- Compound InterestDokument4 SeitenCompound InterestMaria JocosaNoch keine Bewertungen

- Conversor de Monedas en ExcelDokument5 SeitenConversor de Monedas en ExcelRaúl RivasNoch keine Bewertungen

- EUR Statement: Account SummaryDokument2 SeitenEUR Statement: Account SummarySW ProjectNoch keine Bewertungen

- Valuation 1Dokument29 SeitenValuation 1Rohan SaxenaNoch keine Bewertungen

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Dokument11 SeitenUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77Noch keine Bewertungen

- Saving AccountDokument9 SeitenSaving AccountpalkhinNoch keine Bewertungen

- The Satyam Case Impact On Indian EconomyDokument21 SeitenThe Satyam Case Impact On Indian EconomyAparna SindujaNoch keine Bewertungen

- Credita CompayDokument6 SeitenCredita CompayasdNoch keine Bewertungen

- Credit Case DigestDokument20 SeitenCredit Case DigestMhayBinuyaJuanzon100% (1)

- SACCO Savings PolicyDokument12 SeitenSACCO Savings PolicyKivumbi William100% (5)

- Chapter 1 Overview of Financial MarketsDokument18 SeitenChapter 1 Overview of Financial MarketsizwanNoch keine Bewertungen

- NMDFC PresentationDokument12 SeitenNMDFC PresentationbhawakshiNoch keine Bewertungen

- KPMG Top 100 FintechDokument112 SeitenKPMG Top 100 FintechJagdeepNoch keine Bewertungen

- RD011 ReceivablesDokument7 SeitenRD011 ReceivablesAnusha ReddyNoch keine Bewertungen

- SDCVDokument6 SeitenSDCVKrishnadeep GuptaNoch keine Bewertungen

- Saptg ReportDokument3 SeitenSaptg ReportThabo MoalusiNoch keine Bewertungen

- Corporate Governance Report Bangladesh PDFDokument311 SeitenCorporate Governance Report Bangladesh PDFAsiburRahmanNoch keine Bewertungen

- Atm Banking Service QualityDokument9 SeitenAtm Banking Service QualityVijayasarathi VNoch keine Bewertungen

- 20181126002166Dokument3 Seiten20181126002166Rafael Dos Anjos MonteiroNoch keine Bewertungen

- Insular Savings Bank Vs CA June 15, 2005Dokument2 SeitenInsular Savings Bank Vs CA June 15, 2005Sam FajardoNoch keine Bewertungen