Beruflich Dokumente

Kultur Dokumente

Understanding partnership liability and advice for future ventures

Hochgeladen von

Yusuf HusseinOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Understanding partnership liability and advice for future ventures

Hochgeladen von

Yusuf HusseinCopyright:

Verfügbare Formate

Chapter 12 Homework Assignments

Class : EC0-04

CAS E*

A h m e d ( plumber)

had been hard to find, but when he was finally found and the faucet fixed, he had a story

to tell. It seems that he had declared bankruptcy and lost his house in the process. A year before, Ahmed had

had enthusiastic reports of having entered a partnership with Muscab to take on residential and

commercial plumbing contracts on a larger scale.

The partnership terms were agreed upon, and the business w as registered with the Banadir Registrar of

Joint Stock Companies. Operations had started small: a few contracts were completed evenings and

weekends over the next few months with satisfactory prof- its, while both Ahmed and Muscab kept their day

jobs. Then Muscab took ill. Without both partners able to devote sufficient effort to the business, they casually

agreed to each take their own tools and go their separate ways.

Each would complete any jobs they had entered into as if they were individuals. Ahmed had thought no

more of the relationship and proceeded to take on a few jobs in his own name to supplement his income.

Muscab recovered from his illness and returned to work; but then severe illness left him unable to complete

new fixed price contracts he had entered into after the oral agreement to end his partnership with Ahmed.

Unable t o meet the terms of his contracts, M u s c a b was taken to court and Ahmed found himself also

named on court documents.

When a judgment was reached, Muscab divorced, with limited assets, and in poor health was unable to

make good on the losses. Accordingly, Ahmed was held liable for losses associated with these contracts, as

well as court costs. Facing a judgment large enough that his salary would have been garnished by court

order for up to ten years, Ahmed took his lawyers advice and voluntarily declared bankruptcy.

Required:

In your role as Ahmeds friend and occasional advisor, explain to Ahmed what happened in terms of how

the characteristics of the partnership form of organization may have led to the difficulties he faced.

What advice can you give Ahmed with respect to future business ventures?

Chapter 12 Homework Assignments

Class : EC0-04

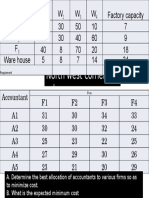

Problem 1

Ahmed and Ali began a partnership by investing $104,000 and $156,000 respectively. During

The first year of operation, the partnership earned $90,000.

Required: Prepare calculations showing how the income should be allocated to the partners under each of

the following plans for sharing net incomes and losses:

A. The partners failed to agree on a method of sharing income.

B. The partners agreed to share income by allowing Ahmed a $40,000 salary and Ali an a $30,000

salary, and by allocating the balance in the ratio 2:3.

C. Repeat the calculations for (b) under the assumption that instead of the $90,000 income, the

partnership experienced a $20,000 loss.

D. Assume that instead of a partnership, Ahmed and Ali incorporated, with Kantor receiving 104 shares

and Freeman 156 shares. Would a division of earnings between Ahmed and Ali be necessary at year

end? Explain.

Problem 2

The following balance sheet is for the partnership of A/aziz, Asho, Faduma, and share profits in Omar,

who

the ratio of 5:2:2:1.

Assets

Cash

$ 90,000

Other assets

594,000

$684,000

Liabilities and capital

Liabilities

$184,000

A/aziz capital

300,000

Asho capital

90,000

Faduma capital

60,000

Omar capital

50,000

$684,000

Required:

PART A

The partners consider that the book values of the partnership net assets are fairly

representative of current market values. They have agreed to admit Earl into the partnership.

Yuusuf will invest $115,000 for a 20% interest in capital.

(a) By means of journal entries, indicate the possible ways of recording the admission of

Yuusuf to the partnership.

(b) Evaluate each of the journal entries you have prepared.

PART B

The partners decide to liquidate the business rather than admit Yuusuf. Omar received a total

of $7,250 during the liquidation process, which is now complete. Calculate how much

A/aziiz, Asho, and Faduma each received.

Instruction

Cover page

Manual

Double space

Clear your Hand writing

Date line: March 16, 2014

Das könnte Ihnen auch gefallen

- Law Sample QuestionDokument2 SeitenLaw Sample QuestionknmodiNoch keine Bewertungen

- 1 ACCT 2A&B P. FormationDokument7 Seiten1 ACCT 2A&B P. FormationHillary Grace VeronaNoch keine Bewertungen

- IRAC - Answering Legal QuestionsDokument4 SeitenIRAC - Answering Legal Questionsirfan subairNoch keine Bewertungen

- Partnership and Corporation TheoriesDokument16 SeitenPartnership and Corporation TheoriesYuki kuranNoch keine Bewertungen

- Test Bank - PNC CPARDokument6 SeitenTest Bank - PNC CPARChristian Blanza LlevaNoch keine Bewertungen

- Basic AccountingDokument16 SeitenBasic AccountingronnelNoch keine Bewertungen

- Test 2Dokument4 SeitenTest 2Akmal AkramNoch keine Bewertungen

- Quiz 1Dokument5 SeitenQuiz 1cpacpacpa100% (2)

- 3rd Year PartnershipDokument3 Seiten3rd Year PartnershipJoshua UmaliNoch keine Bewertungen

- Partnership 2Dokument64 SeitenPartnership 2Anis AlwaniNoch keine Bewertungen

- Advacc 1 Quiz 1 With AnswersDokument9 SeitenAdvacc 1 Quiz 1 With AnswersGround ZeroNoch keine Bewertungen

- Midterm Examination in RFBTDokument16 SeitenMidterm Examination in RFBTSherie Love LedamaNoch keine Bewertungen

- Mock Aqe 1Dokument17 SeitenMock Aqe 1Albert Ocno Almine100% (4)

- Law of PartnershipDokument22 SeitenLaw of PartnershipPeter MNoch keine Bewertungen

- Law 2 Test BankDokument4 SeitenLaw 2 Test BankCELRennNoch keine Bewertungen

- Partnership Formation & OperationDokument4 SeitenPartnership Formation & Operationdiane pandoyosNoch keine Bewertungen

- COMPREHENSIVE EXAM TWO PREPDokument13 SeitenCOMPREHENSIVE EXAM TWO PREPYander Marl BautistaNoch keine Bewertungen

- Fundamentals 2024 PDF SPCCDokument82 SeitenFundamentals 2024 PDF SPCCJeetalal GadaNoch keine Bewertungen

- 18bco31c U1Dokument4 Seiten18bco31c U1sc209525Noch keine Bewertungen

- Florence L. Rogers, and Joe W. Stout and Eudora Stout v. Commissioner of Internal Revenue, 281 F.2d 233, 4th Cir. (1960)Dokument7 SeitenFlorence L. Rogers, and Joe W. Stout and Eudora Stout v. Commissioner of Internal Revenue, 281 F.2d 233, 4th Cir. (1960)Scribd Government DocsNoch keine Bewertungen

- Partnership-Formation Answer KeyDokument9 SeitenPartnership-Formation Answer KeyAngelie Jalandoni100% (1)

- BSA BL2 Prelims 2022Dokument6 SeitenBSA BL2 Prelims 2022Joy Consigene100% (1)

- Quiz 4 - p2 Answer KeyDokument16 SeitenQuiz 4 - p2 Answer KeyRish Sharma100% (1)

- Student WorkbookDokument12 SeitenStudent WorkbookKaiWenNgNoch keine Bewertungen

- Take Home QuizDokument2 SeitenTake Home Quizlancelotroyal21Noch keine Bewertungen

- Partnership ReviewerDokument11 SeitenPartnership Reviewerbae joohyun0% (1)

- FAR Assessment-ExamDokument15 SeitenFAR Assessment-ExamJazzy MercadoNoch keine Bewertungen

- Question Tutorial 2Dokument10 SeitenQuestion Tutorial 2Atiyah AliasNoch keine Bewertungen

- ACCOUNTS FIRST TERM REVISION TEST 2013Dokument5 SeitenACCOUNTS FIRST TERM REVISION TEST 2013NivpreeNoch keine Bewertungen

- PRELIM QUIZ REVIEW TIPSDokument4 SeitenPRELIM QUIZ REVIEW TIPSKrista CandareNoch keine Bewertungen

- BonusDokument4 SeitenBonussunshine100% (1)

- Class 12 Term 1 AccountancyDokument7 SeitenClass 12 Term 1 AccountancyTûshar ThakúrNoch keine Bewertungen

- CHAPTER 5 partDokument9 SeitenCHAPTER 5 partTasebe GetachewNoch keine Bewertungen

- Ast Bsma4-1Dokument4 SeitenAst Bsma4-1Acads PurposesNoch keine Bewertungen

- BLT Final Pre-Boards NCPARDokument12 SeitenBLT Final Pre-Boards NCPARlorenceabad07Noch keine Bewertungen

- Pre Qualifying ExamDokument14 SeitenPre Qualifying ExamGelyn CruzNoch keine Bewertungen

- Fundamentals of Accounting Part 2 ReviewDokument23 SeitenFundamentals of Accounting Part 2 ReviewMon Christian VasquezNoch keine Bewertungen

- WORK SHEET 12 TH STDDokument1 SeiteWORK SHEET 12 TH STDkesar chouhanNoch keine Bewertungen

- Law On Bus Org QUIZDokument2 SeitenLaw On Bus Org QUIZNerizza SomeraNoch keine Bewertungen

- Accounts CH 2 Admission of PartnerDokument5 SeitenAccounts CH 2 Admission of Partnerapsonline8585Noch keine Bewertungen

- Chapter-5-Accounting for Partnerships in EthiopiaDokument17 SeitenChapter-5-Accounting for Partnerships in EthiopiaYasinNoch keine Bewertungen

- Reviewer in FAR Operations and FormationDokument9 SeitenReviewer in FAR Operations and FormationALMA MORENANoch keine Bewertungen

- Contract CasesDokument6 SeitenContract CasesNameera KhanNoch keine Bewertungen

- Worksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerDokument14 SeitenWorksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerRica Jane LlorenNoch keine Bewertungen

- Basic AccountingDokument16 SeitenBasic AccountingMichelle RotairoNoch keine Bewertungen

- Unit 4. Accounting For Partnerships: A PartnershipDokument17 SeitenUnit 4. Accounting For Partnerships: A PartnershipHussen AbdulkadirNoch keine Bewertungen

- PartnershipDokument4 SeitenPartnershipAbigail Ann PasiliaoNoch keine Bewertungen

- Unit 4. Accounting For Partnerships: A PartnershipDokument17 SeitenUnit 4. Accounting For Partnerships: A PartnershipHussen AbdulkadirNoch keine Bewertungen

- 5280MCQ DK GoalDokument285 Seiten5280MCQ DK GoalVAIBHAV BADOLANoch keine Bewertungen

- XII Acct Sample Paper SolvedDokument5 SeitenXII Acct Sample Paper SolvedDeepakPhalkeNoch keine Bewertungen

- Accounting For Special Transactions Part 3 Course AssessmentDokument31 SeitenAccounting For Special Transactions Part 3 Course AssessmentRAIN ALCANTARA ABUGANNoch keine Bewertungen

- First Semester Assiut University Partnership Accounting Test BankDokument8 SeitenFirst Semester Assiut University Partnership Accounting Test BankAbanoub AbdallahNoch keine Bewertungen

- Chap 9 PartnershipDokument77 SeitenChap 9 PartnershipIvhy Cruz EstrellaNoch keine Bewertungen

- QuizDokument3 SeitenQuizKaren GarciaNoch keine Bewertungen

- Partnership AccountsDokument26 SeitenPartnership Accountsoneunique.1unqNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondVon EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondNoch keine Bewertungen

- Final Exam Research Methods ANTH 410/510Dokument7 SeitenFinal Exam Research Methods ANTH 410/510Yusuf HusseinNoch keine Bewertungen

- RSH - Qam11 - Excel and Excel QM Explsm2010Dokument153 SeitenRSH - Qam11 - Excel and Excel QM Explsm2010Yusuf HusseinNoch keine Bewertungen

- Resource Usage: Issues Covered in This ChapterDokument21 SeitenResource Usage: Issues Covered in This ChapterYusuf HusseinNoch keine Bewertungen

- Ch02 LeadershipDokument60 SeitenCh02 LeadershipYusuf HusseinNoch keine Bewertungen

- Yaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaDokument4 SeitenYaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaYusuf HusseinNoch keine Bewertungen

- Lesson ThreeDokument14 SeitenLesson ThreeYusuf HusseinNoch keine Bewertungen

- Acc 255 Final Exam Review Packet (New Material)Dokument6 SeitenAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNoch keine Bewertungen

- Statistics and Research MethodsDokument5 SeitenStatistics and Research MethodsYusuf HusseinNoch keine Bewertungen

- Linear Regression Is An Important Concept in Finance and Practically All Forms of ResearchDokument10 SeitenLinear Regression Is An Important Concept in Finance and Practically All Forms of ResearchYusuf HusseinNoch keine Bewertungen

- BankingDokument20 SeitenBankingYusuf HusseinNoch keine Bewertungen

- Except The: Income Sharing RatioDokument1 SeiteExcept The: Income Sharing RatioYusuf HusseinNoch keine Bewertungen

- Data and Process Modeling: Husein OsmanDokument17 SeitenData and Process Modeling: Husein OsmanYusuf HusseinNoch keine Bewertungen

- Lec 1 - Introduction To Wireless CommunicationDokument60 SeitenLec 1 - Introduction To Wireless CommunicationYusuf HusseinNoch keine Bewertungen

- Format of The ResearchDokument2 SeitenFormat of The ResearchYusuf HusseinNoch keine Bewertungen

- Abdc Journal Quality List 2013Dokument32 SeitenAbdc Journal Quality List 2013PratikJainNoch keine Bewertungen

- QuizzDokument1 SeiteQuizzYusuf HusseinNoch keine Bewertungen

- Chapter EightDokument11 SeitenChapter EightYusuf HusseinNoch keine Bewertungen

- Exam 2 Sample SolutionDokument6 SeitenExam 2 Sample SolutionYusuf HusseinNoch keine Bewertungen

- Accounting for Islamic Banks: Mudharabah FinancingDokument32 SeitenAccounting for Islamic Banks: Mudharabah FinancingYusuf Hussein40% (5)

- Ackoff's Management Misinformation SystemsDokument5 SeitenAckoff's Management Misinformation SystemsAnna KarousiotiNoch keine Bewertungen

- Example DVDDokument17 SeitenExample DVDYusuf HusseinNoch keine Bewertungen

- Test OneDokument8 SeitenTest OneYusuf HusseinNoch keine Bewertungen

- Chapter Four: Entering Beginning BalancesDokument4 SeitenChapter Four: Entering Beginning BalancesYusuf HusseinNoch keine Bewertungen

- Chapter 1Dokument29 SeitenChapter 1Yusuf Hussein100% (2)

- Key Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsDokument5 SeitenKey Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsYusuf HusseinNoch keine Bewertungen

- Capital BudgetDokument124 SeitenCapital BudgetYusuf HusseinNoch keine Bewertungen

- Simplex Method Solves Linear Programming ProblemsDokument34 SeitenSimplex Method Solves Linear Programming ProblemsYusuf HusseinNoch keine Bewertungen

- 6 - 2 - Lectures NotesDokument103 Seiten6 - 2 - Lectures NotesYusuf HusseinNoch keine Bewertungen

- Islamic Banking Ideal N RealityDokument19 SeitenIslamic Banking Ideal N RealityIbnu TaimiyyahNoch keine Bewertungen

- Mcom Ac Paper IIDokument282 SeitenMcom Ac Paper IIAmar Kant Pandey100% (1)

- Fraud Tree Focus InventorycompressedDokument64 SeitenFraud Tree Focus InventorycompressedJonathan Navallo100% (1)

- Analyze Portfolio PerformanceDokument48 SeitenAnalyze Portfolio PerformanceMd Zainuddin IbrahimNoch keine Bewertungen

- Full Download:: Test BankDokument16 SeitenFull Download:: Test BankRohan Dwivedi100% (1)

- The Models and Practices of Token Economy-V0.1Dokument32 SeitenThe Models and Practices of Token Economy-V0.1The Hamilton SpectatorNoch keine Bewertungen

- Turnaround ManagementDokument14 SeitenTurnaround ManagementAlkaNoch keine Bewertungen

- Management 8th Edition Kinicki Test Bank DownloadDokument25 SeitenManagement 8th Edition Kinicki Test Bank DownloadGloria Jones100% (24)

- Herbert Simon Model of Decision MakingDokument3 SeitenHerbert Simon Model of Decision MakingSachin Raikar100% (2)

- IBM CloudDokument2 SeitenIBM CloudNihar RoutrayNoch keine Bewertungen

- MCQ Supply chain management multiple choice questionsDokument53 SeitenMCQ Supply chain management multiple choice questionsmoniNoch keine Bewertungen

- Training AND DevelopmentDokument62 SeitenTraining AND DevelopmentUmbraSeriiNoch keine Bewertungen

- Fi HR Integration PDFDokument2 SeitenFi HR Integration PDFBrentNoch keine Bewertungen

- Supplier ScorecardDokument1 SeiteSupplier ScorecardJoe bilouteNoch keine Bewertungen

- Overview of Indian Securities Market: Chapter-1Dokument100 SeitenOverview of Indian Securities Market: Chapter-1tamangargNoch keine Bewertungen

- BSBOPS601 Task 1 Student AssessmentDokument14 SeitenBSBOPS601 Task 1 Student AssessmentAyu PuspitaNoch keine Bewertungen

- An Innovative Step in Loyalty programs-LOYESYSDokument18 SeitenAn Innovative Step in Loyalty programs-LOYESYSJason MullerNoch keine Bewertungen

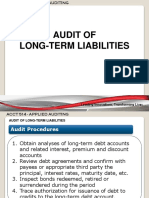

- Audit of Long-Term LiabilitiesDokument43 SeitenAudit of Long-Term LiabilitiesEva Dagus0% (1)

- The Main Elements of A Good SLADokument6 SeitenThe Main Elements of A Good SLAFranz Lawrenz De TorresNoch keine Bewertungen

- Kalaari Fintech Report 2016 PDFDokument28 SeitenKalaari Fintech Report 2016 PDFPuneet MittalNoch keine Bewertungen

- WEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFDokument29 SeitenWEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFMoca ΔNoch keine Bewertungen

- BDRRM Reso & SB Reso Adoptng BDRRM 2022-2026 - PitaDokument4 SeitenBDRRM Reso & SB Reso Adoptng BDRRM 2022-2026 - PitaRocel Castro PaguiriganNoch keine Bewertungen

- SivaDokument5 SeitenSivaLokkhi BowNoch keine Bewertungen

- ISOM 2700 - Operations ManagementDokument29 SeitenISOM 2700 - Operations ManagementLinh TaNoch keine Bewertungen

- Sample Quiz QuestionsDokument2 SeitenSample Quiz QuestionsSuperGuyNoch keine Bewertungen

- Module 7 CVP Analysis SolutionsDokument12 SeitenModule 7 CVP Analysis SolutionsChiran AdhikariNoch keine Bewertungen

- The British Computer Society: The Bcs Professional Examinations BCS Level 5 Diploma in ITDokument4 SeitenThe British Computer Society: The Bcs Professional Examinations BCS Level 5 Diploma in ITOzioma IhekwoabaNoch keine Bewertungen

- Executive Summary of Teatime Cafe-BookstoreDokument2 SeitenExecutive Summary of Teatime Cafe-BookstoreRay FaustinoNoch keine Bewertungen

- Pasdec Holdings Berhad (Assignment)Dokument22 SeitenPasdec Holdings Berhad (Assignment)Nur IzaziNoch keine Bewertungen

- Banking ProjectDokument82 SeitenBanking ProjectJemini Patil76% (17)