Beruflich Dokumente

Kultur Dokumente

Nego BP22 Cases

Hochgeladen von

eieipayadCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nego BP22 Cases

Hochgeladen von

eieipayadCopyright:

Verfügbare Formate

(1) the making, drawing,

and issuance of any check

to apply for account or for

value

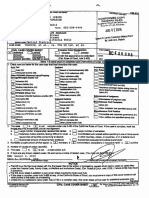

CASE

Resterio v. People

Issuer of check: Amada

Resterio

Issued to: Bernardo Villadolid

Checks issued: 1 Chinabank

check

In payment for: collateral for

Reason for dishonor: Account

closed

Alferez v. People

Issuer of check: Jamie Alferez

Issued to: Cebu ABC Sales

Commercial / Pingping Co

Checks issued: 3 BPI checks

In payment for: the goods

Reason for dishonor: Closed

account

Rico v. People

Issuer of check: Ben Rico

Issued to: Ever Lucky

Commercial / Victor Chan

Checks issued: 5 PCIB checks

In payment for: construction

materials

Reason for dishonor:

insufficiency of funds / closed

account

In the proceedings, Resterio

stated that the check issued

did not belonged to her but to

her friend (she only borrowed

the check) and it was only

issued as a collateral

SC the law does not look on

the actual owner of the check

or at the intention of the

maker, drawer, or issuer

since

BP22

is

malum

prohibitum.

UNDISPUTED FACT

UNDISPUTED FACT

ELEMENTS OF VIOLATION OF B.P. 22

(2) the knowledge of the maker,

drawer, or issuer that at the time of

the issue there were no sufficient

funds in or credit with the drawee

bank for the payment of such check

in full upon its presentment

^prima facie presumption when:

a. check is presented within 90 days

from the date of the check

b. drawer or maker of the check

fails to pay the holder of the check

the amount due thereon, or make

arrangements for payment in full

within

5

banking

days

after

receiving such notice that the check

has not been paid by the drawee

????

SC The state should present the giving

of a written notice of the dishonor to the

drawer, maker or issuer. THERE MUST

BE CLEAR PROOF OF NOTICE.

Only proof given: registry return receipt

There must be: authenticating affidavit

that the notice had been actually sent

and received; signatures must also be

identified. Without such, there is no valid

notice

Verbal notice must be in writing

ADDTL ISSUES/NOTES

(3) the dishonor of the

check by the drawee

bank for insufficiency of

funds or credit or the

dishonor of the same

reason

had

not

the

drawer, without any valid

cause,

ordered

the

drawee bank to stop

payment

The

check

had

been

dishonored

upon

its

presentment through the

BPI. This fact was not denied

by petitioner.

RULING: Acquitted, but still civilly

liable for 50,000Php

????

In this case, the prosecution merely

presented a copy of the demand letter,

together with the registry receipt and

the return card, allegedly sent to the

petitioner. There were no attempt to

authenticate the signature on the

registry return card. REGISTRY RETURN

CARD WITH AN UNAUTHENTICATED

SIGNATURE DOES NOT MEET THE

REQUIRED PROOF BEYOND REASONABLE

DOUBT THAT THE PETITIONER RECEIVED

THE NOTICE.

UNDISPUTED FACT

In this case, petitioner filed for a

Demurrer to Evidence, which MTCC

denied. Hence, he was not allowed

to present evidence. MTC held

petitioner guilty.

Issue raised by petitioner: the

elements of BP22 had not been

sufficiently established

CA petitioner did not testify, he

did not object to the proof of notice

of dishonor

????

The presumption that the issuer had

knowledge of the insufficiency of funds is

brought into existence only after it is

proved that the issuer had received a

notice of dishonor and that 5 days from

such receipt thereof, he failed to pay the

amount of the check or to make

arrangement for its payment.

SC there were no proof that show that

formal and written demand letters or

notices were ever sent to petitioner, they

UNDISPUTED FACT

RULING: Acquitted, but still civilly

liable.

Rico claimed that he has already

paid the amounts covered by the

checks + interest

OSG Rico made payments for

different transaction; it also failed

to prove that the payment was

made within 5 days after receipt of

notice of dishonor

RULING: Acquitted, but still civilly

liable.

merely relied on the testimony of the

prosecution witness Danila Cac

HENCE,

THE

PRIMA

FACIE

PRESUMTIONTION WOULD NOT ARISE

SINCE THERE WOULD BE NO WAY OF

RECKONING

THE

CRUCIAL

50DAY

PERIOD.

Petitioner is not properly notified of

dishonor

And even if it did, there appears to be an

arrangement

for

the

payment/

replacement of the checks between the

parties (allowing the client to redeem

dishonoredchecks)

For the 6 replacement checks, petitioner

could not be blamed for failing to make

good said check due to the negligence of

Livecor because they only notified

Perpetual after 3 years.

Vergara v. People

Issuer of check: Teresita

Vergara / VP of Perpetual

Garments Corp.

Issued to: Livelihood

Corporation / Victor

Hernandez

Checks issued: 1 Metrobank

check

In payment for: continuing

credit line

Reason for dishonor:

insufficiency of funds

Mitra v. People

Issuer of check: Eumelia

Mitra and Cabrera

(deceased) / Lucky Nine

Credit Corporation

Issued to: Felicisimo Tarcelo

Checks issued: 7 Security

bank checks

In payment for: money

placement transactions

invested by Tarcelo

Reason for dishonor: Account

closed

Ongson v. People

Issuer of check: Victor

Ongson

Issued to: Samson Uy

Checks issued: 8 FBTC

checks

In payment for: payment of

loan (check vouchers for

beverage products)

Reason for dishonor:

Payment Stop/ DAIF /

Account Closed

San Mateo v. People

Issuer of check: Erlinda San

Mateo

Issued to: ITSP International /

Sehwani

Checks issued: 11 Metrobank

PDCs

Although petitioners made cash

and checks payments after the said

dishonor, the same was treated by

Livcor as continuing payments of

the outstanding loan: applied first

to interests and penalties

Vergara: she replaced the check

with 6 checks worth 25,000 each,

paid 542000 covering the full

amount of the dishonored check

Contention: the full payment made

2 years prior the filing of the

information justifies her acquittal

RULING: ACQUITTED

Contention: no name, no amount,

no date on the checks, only their

signatures; they did not know when

and to whom the checks were

issued

*Mitra alleges that there was no proper

service on her of the notice of dishonor

SC this is a factual issue and not proper

for review; positive allegation prevails

over denial made by the accused

*Accused refused to sign the evidence of

receipt

SC- the person who actually signed

the corporate check shall be held

liable for violation of BP22.

RULING: GUILTY

Checks should be properly

described.

Hence, for 2 checks =

acquitted

due

to

inconsistencies

of

the

information and evidence;

there being discrepancy in

the identity of the checks

6

checks

=

conviction

affirmed because checks are

presumed to be issued for

valuable

consideration

(whether

it

was

loan,

investment of the business of

the petitioner)

Petitioner through counsel admitted the

receipt of complainants demand letters

via registered mail informing him of the

dishonor of the checks. Hence, it binds

the client.

That only a representative signed the

registry return receipt is of no

consequence because of the unqualified

admission of the latter.

While she may have requested Sehwani

to defer the depositing of her checks, it

does not constitute to an admission that,

when she issued those checks, she knew

that that she would have no sufficient

funds in the drawee bank to pay for

them.

It is shown by the reason for

the dishonor is stamped in

the dorsal portion of the

checks which are also prima

facie presumptions of such

dishonor with the reasons

therefor.

*it is not required for a bank

representative to testify as

witness

RTC rendered a one-page decision

finding petitioner guilty as charged

(no material facts i.e. transaction

that lead to issuance of checks, no

discussion of the elements, etc).

Hence, petitioner contends denial

of due process.

RULING:

AQCUITTAL

FOR

COUNTS; GUILTY FOR 6 COUNTS

Whenever the check matures, San

Mateo would request not to deposit

the checks for lack of sufficient

funds. But still continued to fail to

settle her account. Hence, Sehwani

was forced to deposit the checks.

Registered mail: returned with

In payment for: assorted

yarns

Reason for dishonor: Stop

payment order then account

closed

Prosecution failed to show that the letter

ever reached San Mateo.

Morillo v People

Issuer of check: Richard

Natividad / RB Custodio

Construction

Issued to: Armilyn Morillo /

Amasea General

Merchandise

Checks issued: 2 Metrobank

PDCs

In payment for: construction

materials

Reason for dishonor: closed

account

Happened in Pampanga

Svensden v. People

Issuer of check: James

Svensden

Issued to: Cristina Reyes

Checks issued: 1

International Exchange Bank

pd check

In payment for: loan

Reason for dishonor: DAIF

Ting v. CA

Issuer of check: Victor Ting

and Emily Chang-Azajar

Issued to: Josefina Tagle

Checks issued: 19 Producers

Bank check (7 were

presented)

In payment for: replacement

for Juliet Tings 11 PDCs

Reason for dishonor: DAIF

Llenado v People

Issuer of check: Eleanor de

leon Llenado

Issued to: Editha Villaflores

Checks issued:

In payment for: to secure

loans

Reason for dishonor:

Petitioner

admits

issued the PDC

having

Also transpired in Pampanga

The registry return receipt was not

authenticated

notation N/S Party Out and San

Mateo did not claim despite 3

notices

Dishonor also happened in

Pampanga; the complainant

deposited the checks in her

savings account in Equitable

PCIBank, Makati branch she

was subsequently informed

that

the

checks

were

dishonored by the drawee

bank.

The check was dishonored

upon presentment in BDO

RULING: ACQUITTED BUT CIVILLY

LIABLE

Agreement: 20% paid w/in 1st

delivery; 80% to be paid on the last

delivery

ISSUE: VENUE

Petitioner contention: MeTC of

Makati had no jurisdiction because

the checks were issued, drawn and

delivered

in

Subic(?)

(Nieva

doctrine)

RTC: BP22 is a continuing offense.

CA: Reversed

SC: CA Reversed, RTC affirmed

It is well settled that violations of

BP22 cases are categorized as

transitory and continuing crimes,

meaning that some acts material

and essential thereto and requisite

in their consummation occur in one

municipality or territory, while

some occur in another. (See page 9

of decision)

*The 10%/month interest is

iniquitous

RULING: AQCUITTED, CIVILLY

LIABLE

No attempt was made to show that the

demand letter was indeed sent through

registered mail nor was the signature on

the

registry

return

receipt

aunthenticated or identified

Petitioner alleges that responded failed

to prove that there was actual receipt of

the notice of dishonor

SC it is a question of fact in which the

SC cannot rule upon

ACQUITTED.

CA AFFIRMED.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Bar Exam Suggested AnswersDokument11 SeitenBar Exam Suggested AnswersRheinhart PahilaNoch keine Bewertungen

- Agtarap V AgtarapDokument3 SeitenAgtarap V AgtarapeieipayadNoch keine Bewertungen

- Family of Daniel McCoy vs. Williamson CountyDokument70 SeitenFamily of Daniel McCoy vs. Williamson CountyAnonymous Pb39klJNoch keine Bewertungen

- Compendium For SubmissionDokument13 SeitenCompendium For SubmissioneieipayadNoch keine Bewertungen

- 00 Collated (Module 1)Dokument8 Seiten00 Collated (Module 1)eieipayadNoch keine Bewertungen

- 03 Fruit of The Loom V CADokument2 Seiten03 Fruit of The Loom V CAeieipayadNoch keine Bewertungen

- Provisions Insurable InterestDokument2 SeitenProvisions Insurable InteresteieipayadNoch keine Bewertungen

- 01 Etepha A.G. v. Director of PatentsDokument2 Seiten01 Etepha A.G. v. Director of PatentseieipayadNoch keine Bewertungen

- Immig CasesDokument3 SeitenImmig CaseseieipayadNoch keine Bewertungen

- MV Asilda unseaworthy when it sank with Coca-Cola cargoDokument36 SeitenMV Asilda unseaworthy when it sank with Coca-Cola cargoeieipayadNoch keine Bewertungen

- Provisions Insurable InterestDokument2 SeitenProvisions Insurable InteresteieipayadNoch keine Bewertungen

- 70 Testate Estate of Lim V ManilaDokument10 Seiten70 Testate Estate of Lim V ManilaeieipayadNoch keine Bewertungen

- 04 Del Monte V CADokument2 Seiten04 Del Monte V CAeieipayadNoch keine Bewertungen

- 07 Emerald Garment MAnufacturing Corporation v. CADokument2 Seiten07 Emerald Garment MAnufacturing Corporation v. CAeieipayadNoch keine Bewertungen

- IP CDCompilationDokument4 SeitenIP CDCompilationeieipayadNoch keine Bewertungen

- ESSO Standard Eastern v Court of Appeals Trademark RulingDokument2 SeitenESSO Standard Eastern v Court of Appeals Trademark RulingeieipayadNoch keine Bewertungen

- 23 - Gonzales v. PCIBDokument1 Seite23 - Gonzales v. PCIBeieipayadNoch keine Bewertungen

- Carmela Brobio Mangahas vs. Eufrocina A. BrobioDokument1 SeiteCarmela Brobio Mangahas vs. Eufrocina A. BrobioeieipayadNoch keine Bewertungen

- 25 - Bautista v. Auto Plus TradersDokument1 Seite25 - Bautista v. Auto Plus TraderseieipayadNoch keine Bewertungen

- List of CasesDokument7 SeitenList of CaseseieipayadNoch keine Bewertungen

- 69 - Astro vs. Phil ExportDokument1 Seite69 - Astro vs. Phil ExporteieipayadNoch keine Bewertungen

- 72 - de La Victoria v. BurgosDokument1 Seite72 - de La Victoria v. BurgoseieipayadNoch keine Bewertungen

- REM ForeclosureDokument17 SeitenREM ForeclosureeieipayadNoch keine Bewertungen

- Facts:: G.R. No. 184458 - Jan. 14, 2015 - Perez, JDokument1 SeiteFacts:: G.R. No. 184458 - Jan. 14, 2015 - Perez, JMichelleBanilaEvangelistaNoch keine Bewertungen

- de Guerero V Madrigal ShippingDokument1 Seitede Guerero V Madrigal ShippingeieipayadNoch keine Bewertungen

- BJNBDokument1 SeiteBJNBMichelleBanilaEvangelistaNoch keine Bewertungen

- Cokaliong Shipping Lines v. UCPBDokument2 SeitenCokaliong Shipping Lines v. UCPBeieipayadNoch keine Bewertungen

- Cokaliong Shipping Lines v. UCPBDokument2 SeitenCokaliong Shipping Lines v. UCPBeieipayadNoch keine Bewertungen

- Expro CasesDokument24 SeitenExpro CaseseieipayadNoch keine Bewertungen

- 09 Valenzuela Industrial Supply Vs CADokument2 Seiten09 Valenzuela Industrial Supply Vs CAeieipayadNoch keine Bewertungen

- REM ForeclosureDokument17 SeitenREM ForeclosureeieipayadNoch keine Bewertungen

- PartitionDokument10 SeitenPartitioneieipayadNoch keine Bewertungen

- Motion To Dismiss in Bednar Forfeiture CaseDokument4 SeitenMotion To Dismiss in Bednar Forfeiture CaseThe Heritage FoundationNoch keine Bewertungen

- USA v. KellyDokument31 SeitenUSA v. KellyBillboard100% (1)

- Townley StatementDokument34 SeitenTownley StatementCarlos BassoNoch keine Bewertungen

- ExtraditionDokument2 SeitenExtraditionkrishna6941100% (1)

- Anton Yelchin Wrongful Death Complaint OCRDokument47 SeitenAnton Yelchin Wrongful Death Complaint OCRLaw&Crime100% (1)

- II. 13. Cdo Landless V CADokument6 SeitenII. 13. Cdo Landless V CALoisse VitugNoch keine Bewertungen

- Luna Case With Other DigestDokument9 SeitenLuna Case With Other DigestCarol JacintoNoch keine Bewertungen

- 3.) People v. Salcedo, 273 SCRA 473 (1997)Dokument32 Seiten3.) People v. Salcedo, 273 SCRA 473 (1997)GioNoch keine Bewertungen

- Kauer Et. Al. v. Nostalgia Products GroupDokument5 SeitenKauer Et. Al. v. Nostalgia Products GroupPriorSmartNoch keine Bewertungen

- Documents For Gilbert Robinson's Appeal of A Second-Degree Murder ConvictionDokument3 SeitenDocuments For Gilbert Robinson's Appeal of A Second-Degree Murder ConvictionAnonymous NbMQ9YmqNoch keine Bewertungen

- People Vs Bocanegra Et AlDokument3 SeitenPeople Vs Bocanegra Et AlJei Essa AlmiasNoch keine Bewertungen

- Motion to Waive Plaintiff's Right to Present EvidenceDokument3 SeitenMotion to Waive Plaintiff's Right to Present EvidenceLeyah JosefNoch keine Bewertungen

- Pierre Collins ComplaintDokument6 SeitenPierre Collins Complaintbpjohnson81Noch keine Bewertungen

- Legislative Purpose: Reason Why A ParticularDokument45 SeitenLegislative Purpose: Reason Why A ParticularHannah IbarraNoch keine Bewertungen

- Unicapital v. Consing (2013)Dokument17 SeitenUnicapital v. Consing (2013)Angeli TristezaNoch keine Bewertungen

- Foucault Truth and Juridical FormsDokument11 SeitenFoucault Truth and Juridical FormsFalalaNoch keine Bewertungen

- JurisprudenceDokument8 SeitenJurisprudencemonaileNoch keine Bewertungen

- Sample Complaint Legal FormsDokument10 SeitenSample Complaint Legal FormsRose Ann VeloriaNoch keine Bewertungen

- Advocate Checklist for Filing SLP in Supreme CourtDokument34 SeitenAdvocate Checklist for Filing SLP in Supreme CourtAkshat KulshreshthaNoch keine Bewertungen

- Political Law ConstitutionDokument10 SeitenPolitical Law ConstitutionIssa GayasNoch keine Bewertungen

- Criminal Law and Self-Defence (Fahad Amjad Hussain Kausar) (2001713)Dokument15 SeitenCriminal Law and Self-Defence (Fahad Amjad Hussain Kausar) (2001713)Fahad AmjadNoch keine Bewertungen

- Order On Change of Venue MotionDokument10 SeitenOrder On Change of Venue MotionLindsay WhitehurstNoch keine Bewertungen

- Antonio Villareal vs. People of the Philippines; G.R. No. 151258 and People of the Philippines vs. Honorable Court of Appeals, et al.; G.R. No. 154954; Fidelito Dizon Vs. People of the Philippines; G.R. No. 155101; GerardaDokument23 SeitenAntonio Villareal vs. People of the Philippines; G.R. No. 151258 and People of the Philippines vs. Honorable Court of Appeals, et al.; G.R. No. 154954; Fidelito Dizon Vs. People of the Philippines; G.R. No. 155101; GerardaOliver Philip Balangue0% (1)

- Important Case Laws and Citations on Bail/TITLEDokument7 SeitenImportant Case Laws and Citations on Bail/TITLEGoharz2Noch keine Bewertungen

- 15 - Chapter 8Dokument45 Seiten15 - Chapter 8sujayNoch keine Bewertungen

- United States v. Taylor, 1st Cir. (1995)Dokument37 SeitenUnited States v. Taylor, 1st Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- CO Appeal - RedactedDokument7 SeitenCO Appeal - RedactedSteve HawkinsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument12 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen