Beruflich Dokumente

Kultur Dokumente

Section 1

Hochgeladen von

Arvin Glen Beltran0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

45 Ansichten3 SeitenLAW NIL Summary. Look at title for sections containing this document.

Originaltitel

Section-1

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenLAW NIL Summary. Look at title for sections containing this document.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

45 Ansichten3 SeitenSection 1

Hochgeladen von

Arvin Glen BeltranLAW NIL Summary. Look at title for sections containing this document.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

TITLE I

NEGOTIABLE INSTRUMENTS IN GENERAL

CHAPTER 1

FORM AND INTERPRETATION

Section 1. Form of negotiable instruments.

An instrument to be negotiable must conform:

(a) It must be in writing and signed by the

maker or drawer

(b) It must contain an unconditional promise

or order to pay a sum certain in money

(c) Must be payable on demand or at a

fixed or determinable future time

(d) Must be payable to order or bearer

(e) Where the instrument is addressed to a

drawee, he must be named or otherwise

indicated therein with reasonable

certainty

Commercial paper written promises or

obligations that arise out of commercial

transactions

Negotiable Instrument

obligation to pay money

contractual

*negotiable or non-negotiable depends

entirely on its form and content

*a valid instrument is not necessarily

negotiable

In determining negotiability of an instrument, ff.

must be considered:

(1) The whole of the instrument

(2) Only what appears on the face of the

instrument; and

(3) The provisions of the NIL especially

in Section 1 must meet in order to be

negotiable

Applicability of formal requirements

(1) Subsections (a) to (d) are necessary in

order that a promissory note may be

negotiable while subsections (a) to (e)

are necessary in order that a bill of

exchange may be negotiable

(2) Under (a)

Maker person issuing promissory note

Drawer person issuing bill of

exchange

(3) Under (b), instrument must contain

unconditional promise if it is a

promissory note

unconditional order if it is a bill of

exchange

(4) Subsections (c) and (d) are both

applicable to each of the two kinds of

instruments, but subsection (e) is

applicable only to bills of exchange

Formal requirements explained

(1) The instrument must be in writing.

The term instrument indicates writing.

(a) Writing includes also that which is in

print or has been typed. (usual way

written or printed in durable paper)

(b) No such thing as an oral negotiable

instrument. (difficult to determine

liability & create danger of fraud)

(2) The instrument must be signed by

the maker or drawer.

General rule placed at the lower right

hand corner of the instrument

It may appear in any part thereof, it will

be valid and binding as long as it

appears that a person intended to make

the instrument his own.

(a) His signature is prima facie evidence

of his intention

(b) Signature

is

usually

written,

preferable that full name or at least

surname should appear.

(c) Genuineness of signature is denied,

the party against whom it operates

must provide evidence of its

invalidity. (so as the party asserting

its validity)

(3) The instrument must contain an

unconditional promise or order to

pay.

Must contain either a promise to pay or

an order to pay.

(4) The instrument must be payable in a

sum certain in money.

(reason) money is the one standard of

value in actual business

Money medium of exchange

authorized or adopted by a domestic or

foreign government as part of its

currency

Legal tender that currency which a

debtor can legally compel a creditor to

accept

(5) The instrument must be payable at a

fixed or determinable future time or

on demand. (Sec. 4&7)

(6) The instrument must be payable to

order. (Sec. 8)

(7) The instrument must be payable to

bearer. (Sec. 9)

(8) The drawee must be named.

Applies only to bills and checks.

(a) Bill would be sufficient if the drawee

is indicated therein with reasonable

certainty though he is not named.

(b) (reason) to enable the payee or

holder to know upon whom he is call

for acceptance or payment

(c) A promissory note has no drawee.

(payee must be named with

reasonable certainty)

Non-negotiable instrument

Instrument which is not negotiable

Instrument which does not meet the

requirements laid down to qualify an

instrument negotiable

Instrument which in its inception was

negotiable but has lost its quality of

negotiability

(a) N.I. ceases to be negotiable if the

indorsement prohibits the further

negotiation of the instrument.

(b) Non-N.I. may be assigned or transferred

(c) Transfers of non-N.I. are governed by

the provisions of the Civil Code on

assignment of contract rights.

(d) Persons who transfer or assign

contractual or non-negotiable rights

pass only the rights that they had.

Promissory note a written promise to pay a

sum of money. It may be a demand instrument

but it is normally a time instrument.

Original parties to a promissory note

This class of N.I. is a promise paper, or twoparty paper.

(1) 2 parties in a promissory note

Maker one who makes the promise

and signs the instrument

Payee the party to whom the promise

is made or instrument is payable

(2) Payee may be specifically designated

by name, office, title, or may be

unspecified.

(3) He may seek payment personally or

further negotiate the instrument.

(4) Makers signature must appear on the

face of the note for him to be liable

person.

Place and date are not essential to the

negotiability of the instrument except in certain

cases.

for value received consideration given for

the note (consideration is presumed)

I promise to pay absolute and

unconditional promise to pay the payee or to a

holder. (essential)

to the order of or order indicate a

promise to pay as ordered or commanded by

the payee

on or before September 5, 2013 indicate

the date of maturity or the time when the

promise to pay is to be fulfilled

Not all instruments are payable at a

fixed future time.

Where no time for payment is

expressed, an instrument is payable on

demand.

Bill of exchange an order made by one

person to another to pay money to a third

person (check most common type of B.O.E.)

Original parties to a bill of exchange

This class of N.I. is known as order paper, or

three-party paper.

(1) Drawer person who issues and draws

the order bill

(2) Drawee the party upon whom the bill

is drawn, the person to whom the bill is

addressed, who is ordered and

expected to pay

Becomes an acceptor when he

indicates his willingness to pay the bill.

(3) Payee the party in whose favor the bill

is originally issued or is payable

Idea and purpose of a bill of exchange

(1) Drawers funds in hands of drawee.

The drawer has funds in the hands of

the drawee which the former desires to

be paid to the payee.

(2) Liability of drawee for non-payment.

If drawee accepts primarily liable to

holder

If drawee refuses liable to drawer

Das könnte Ihnen auch gefallen

- Afsgrshsgihg RFH JKNRGJKSRH Rhi KNJHRDokument1 SeiteAfsgrshsgihg RFH JKNRGJKSRH Rhi KNJHRArvin Glen BeltranNoch keine Bewertungen

- Toa 34a-3Dokument1 SeiteToa 34a-3Arvin Glen BeltranNoch keine Bewertungen

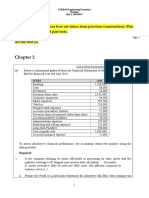

- Journal Entries and Financial StatementsDokument5 SeitenJournal Entries and Financial StatementsArvin Glen BeltranNoch keine Bewertungen

- Sec 14 - 23Dokument5 SeitenSec 14 - 23Arvin Glen BeltranNoch keine Bewertungen

- Acc 5 Course OutlineDokument7 SeitenAcc 5 Course OutlineArvin Glen BeltranNoch keine Bewertungen

- Gov Acc Assignment JuanDokument5 SeitenGov Acc Assignment JuanArvin Glen BeltranNoch keine Bewertungen

- Literature Matrix Math AptitudeDokument3 SeitenLiterature Matrix Math AptitudeArvin Glen BeltranNoch keine Bewertungen

- Sec 30-50 (Negotiation)Dokument10 SeitenSec 30-50 (Negotiation)Arvin Glen BeltranNoch keine Bewertungen

- Background InfoDokument1 SeiteBackground InfoArvin Glen BeltranNoch keine Bewertungen

- Sec 7, 8, 9Dokument2 SeitenSec 7, 8, 9Arvin Glen BeltranNoch keine Bewertungen

- Juan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Dokument6 SeitenJuan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Arvin Glen BeltranNoch keine Bewertungen

- Sec 5,6, 11-13Dokument3 SeitenSec 5,6, 11-13Arvin Glen BeltranNoch keine Bewertungen

- Actg 9 WAFI 1Dokument2 SeitenActg 9 WAFI 1Arvin Glen BeltranNoch keine Bewertungen

- 3rd Year ScheduleDokument2 Seiten3rd Year ScheduleArvin Glen BeltranNoch keine Bewertungen

- 1 Biodata TemplateDokument1 Seite1 Biodata TemplateIanusGwapitusNoch keine Bewertungen

- PASDokument1 SeitePASArvin Glen BeltranNoch keine Bewertungen

- Marketing Strategy PartialDokument3 SeitenMarketing Strategy PartialArvin Glen BeltranNoch keine Bewertungen

- Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursDokument1 SeiteBreak: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursArvin Glen BeltranNoch keine Bewertungen

- Income Tax Exercises IaDokument3 SeitenIncome Tax Exercises IaArvin Glen BeltranNoch keine Bewertungen

- Time Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursDokument3 SeitenTime Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursArvin Glen BeltranNoch keine Bewertungen

- Fola ExercisesDokument1 SeiteFola ExercisesArvin Glen BeltranNoch keine Bewertungen

- De Los Santos vs. de La Cruz (Beltran & Mauna)Dokument2 SeitenDe Los Santos vs. de La Cruz (Beltran & Mauna)Arvin Glen BeltranNoch keine Bewertungen

- Law OutlineDokument11 SeitenLaw OutlineArvin Glen BeltranNoch keine Bewertungen

- IAS12Dokument7 SeitenIAS12Arvin Glen BeltranNoch keine Bewertungen

- Architecture ComplationDokument9 SeitenArchitecture ComplationArvin Glen BeltranNoch keine Bewertungen

- RaspunsuriDokument1 SeiteRaspunsuriRaluca RainNoch keine Bewertungen

- Questioning BeingDokument2 SeitenQuestioning BeingArvin Glen BeltranNoch keine Bewertungen

- NBA 2K16 Keyboard MappingDokument1 SeiteNBA 2K16 Keyboard MappingArvin Glen BeltranNoch keine Bewertungen

- English Motivation OutlineDokument2 SeitenEnglish Motivation OutlineArvin Glen BeltranNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hlurb ComplaintDokument11 SeitenHlurb Complaintjeremie nunez100% (1)

- Bolbok Tuy Final EditDokument202 SeitenBolbok Tuy Final EditJewel higuitNoch keine Bewertungen

- Garuda Indonesia Case AnalysisDokument8 SeitenGaruda Indonesia Case AnalysisPatDabz67% (3)

- 01 Country Bankers Insurance Corporation vs. LagmanDokument11 Seiten01 Country Bankers Insurance Corporation vs. LagmanPMVNoch keine Bewertungen

- Corporations Statutes and RegulationsDokument246 SeitenCorporations Statutes and Regulationsddreifuerst1984Noch keine Bewertungen

- Betma Cluster RevisedDokument5 SeitenBetma Cluster RevisedSanjay KaithwasNoch keine Bewertungen

- Slide 3 - Retail Banking OperationsDokument73 SeitenSlide 3 - Retail Banking OperationsRashi JainNoch keine Bewertungen

- Credit Management in BanksDokument10 SeitenCredit Management in BanksmarufNoch keine Bewertungen

- CSC Practice QS PDFDokument304 SeitenCSC Practice QS PDFDavid Young0% (1)

- Anti-Corruption GuidelinesDokument7 SeitenAnti-Corruption GuidelinestessNoch keine Bewertungen

- Software Services AgreementDokument2 SeitenSoftware Services AgreementqasimranaNoch keine Bewertungen

- 172 Victoria v. Pidlaoan PDFDokument1 Seite172 Victoria v. Pidlaoan PDFMingNoch keine Bewertungen

- G.R. No. 187769 (Digest)Dokument6 SeitenG.R. No. 187769 (Digest)Davy Pats100% (1)

- Microeconomics concepts and principles explainedDokument4 SeitenMicroeconomics concepts and principles explainedSoniya Omir VijanNoch keine Bewertungen

- Motor Car Insurance Proposal SummaryDokument1 SeiteMotor Car Insurance Proposal SummaryRaymondArancilloNoch keine Bewertungen

- SEC Contact Details - 2020 NoticeDokument1 SeiteSEC Contact Details - 2020 NoticeAika Reodica AntiojoNoch keine Bewertungen

- Financial Ratio and Prediction of Corporate FailureDokument15 SeitenFinancial Ratio and Prediction of Corporate Failureits4krishna3776Noch keine Bewertungen

- RBIDokument29 SeitenRBIAakanksha Sanctis100% (1)

- Innovations in Electronic Banking Systen: RTGS (Real Time Gross Settlement)Dokument21 SeitenInnovations in Electronic Banking Systen: RTGS (Real Time Gross Settlement)Narinder BhasinNoch keine Bewertungen

- The Effect of Financial Constraints, Investment Opportunity Set, and Financial Reporting Aggressiveness On Tax AggressivenessDokument16 SeitenThe Effect of Financial Constraints, Investment Opportunity Set, and Financial Reporting Aggressiveness On Tax AggressivenessmuchlisNoch keine Bewertungen

- Pagtalunan Vs Dela Cruz Vda de ManzanoDokument8 SeitenPagtalunan Vs Dela Cruz Vda de ManzanoAviLopezNoch keine Bewertungen

- CA FOUNDATION BILLS OF EXCHANGE GUIDEDokument13 SeitenCA FOUNDATION BILLS OF EXCHANGE GUIDEAshish VermaNoch keine Bewertungen

- Indian Weekender 22 May 2015Dokument32 SeitenIndian Weekender 22 May 2015Indian WeekenderNoch keine Bewertungen

- Transfer of Property Act 1882Dokument22 SeitenTransfer of Property Act 1882balakishan_01Noch keine Bewertungen

- Eurozone CrisisDokument10 SeitenEurozone CrisisalkadreNoch keine Bewertungen

- Complaint Against Zions BankDokument56 SeitenComplaint Against Zions BankThe Salt Lake TribuneNoch keine Bewertungen

- CitiFinancial Consumer Finance India Limited-FPCDokument2 SeitenCitiFinancial Consumer Finance India Limited-FPCRadhikarao ErrabelliNoch keine Bewertungen

- Cheat Sheet For Final Summary PDFDokument2 SeitenCheat Sheet For Final Summary PDFQuy TranNoch keine Bewertungen

- Engineering Economics RevisionDokument43 SeitenEngineering Economics RevisionDanial IzzatNoch keine Bewertungen

- Tax Professionals’ Academy Mock ExamDokument3 SeitenTax Professionals’ Academy Mock ExamMuhammad Hassan AliNoch keine Bewertungen