Beruflich Dokumente

Kultur Dokumente

Allergan 2017 J.P. Morgan Presentation

Hochgeladen von

medtechyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Allergan 2017 J.P. Morgan Presentation

Hochgeladen von

medtechyCopyright:

Verfügbare Formate

ALLERGAN

GROWTH PHARMA LEADER

JPMORGAN CONFERENCE

January 9, 2017

Brent Saunders

Chairman and CEO

ALLERGAN CAUTIONARY STATEMENTS

FORWARD LOOKING STATEMENTS

This communication includes statements that refer to estimated or anticipated future events and are forward-looking statements. We have based our forward-looking statements on managements beliefs and assumptions

based on information available to our management at the time these statements are made. Such forward-looking statements reflect our current perspective of our business, future performance, existing trends and

information as of the date of this filing. These include, but are not limited to, our beliefs about future revenue and expense levels and growth rates, prospects related to our strategic initiatives and business strategies,

including the integration of, and synergies associated with, strategic acquisitions, express or implied assumptions about government regulatory action or inaction, anticipated product approvals and launches, business

initiatives and product development activities, assessments related to clinical trial results, product performance and competitive environment, and anticipated financial performance. Without limiting the generality of the

foregoing, words such as may, will, expect, believe, anticipate, plan, intend, could, would, should, estimate, continue, or pursue, or the negative or other variations thereof or comparable terminology, are

intended to identify forward-looking statements. The statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. We caution the reader that these

statements are based on certain assumptions, risks and uncertainties, many of which are beyond our control. In addition, certain important factors may affect our actual operating results and could cause such results to differ

materially from those expressed or implied by forward-looking statements. These factors include, among others, the inherent uncertainty associated with financial projections; the anticipated size of the markets and

continued demand for Allergans existing products; Allergans ability to successfully develop and commercialize new products; Allergans ability to conform to regulatory standards and receive requisite regulatory approvals;

availability of raw materials and other key ingredients; uncertainty and costs of legal actions and government investigations; fluctuations in Allergans operating results and financial condition, particularly given our

manufacturing and sales of branded products; risks associated with acquisitions, mergers and joint ventures, such as difficulties integrating businesses, uncertainty associated with financial projections, projected synergies,

restructuring, increased costs, and adverse tax consequences; the results of the ongoing business following the completion of the divestiture of Allergans generics business to Teva; our compliance with federal and state

healthcare laws, including laws related to fraud, abuse, privacy security and others; generic product competition with our branded products; uncertainty associated with the development of commercially successful branded

pharmaceutical products; costs and efforts to defend or enforce technology rights, patents or other intellectual property; the effect of the expiration of patents on our branded products and the potential for increased

competition from generic manufacturers; competition between branded and generic products; Allergans potential infringement of others proprietary rights; our dependency on third-party service providers and third-party

manufacturers and suppliers that in some cases may be the only source of finished products or raw materials that we need; Allergans competition with certain of our significant customers; the impact of our returns,

allowance and chargeback policies on our future revenue; successful compliance with governmental regulations applicable to Allergans and Allergans respective third party providers facilities, products and/or businesses;

the difficulty of predicting the timing or outcome of product development efforts and regulatory agency approvals or actions, if any; Allergans vulnerability to and ability to defend against product liability claims and obtain

sufficient or any product liability insurance; the effect of intangible assets and resulting impairment testing and impairment charges on our financial condition; Allergans ability to obtain additional debt or raise additional

equity on terms that are favorable to Allergan; difficulties or delays in manufacturing; global economic conditions; Allergans ability to continue foreign operations in countries that have deteriorating political or diplomatic

relationships with the United States; Allergans ability to continue to maintain global operations and the exposure to the risks and challenges associated with conducting business internationally; risks associated with tax

liabilities, or changes in U.S. federal or international tax laws to which we are subject, including the risk that the Internal Revenue Service disagrees that Allergan is a foreign corporation for U.S. federal tax purposes; risks of

fluctuations in foreign currency exchange rates; risks associated with cyber-security and vulnerability of our information and employee, customer and business information that Allergan stores digitally; Allergans ability to

maintain internal control over financial reporting; changes in the laws and regulations, affecting among other things, availability, pricing and reimbursement of pharmaceutical products; the highly competitive nature of the

pharmaceutical industry; Allergans ability to successfully navigate consolidation of our distribution network and concentration of our customer base; the difficulty of predicting the timing or outcome of pending or future

litigation or government investigations; developments regarding products once they have reached the market; risks related to Allergans incorporation in Ireland, such as changes in Irish law and such other risks and other

uncertainties detailed in Allergans periodic public filings with the Securities and Exchange Commission, including but not limited to Allergans Annual Report on Form 10-K for the year ended December 31, 2015 and

Quarterly Report on Form 10-Q for the quarter ended September 30, 2016; and from time to time in Allergans other investor communications. Except as expressly required by law, Allergan disclaims any intent or obligation

to update or revise these forward-looking statements.

Final results:

Detailed GAAP and non-GAAP 2016 financial results and 2017 financial outlook will be available along with the Company's fourth quarter and full year 2016 earnings report in February 2017.

LONG TERM PRIORITIES TO DRIVE GROWTH

AND SHAREHOLDER RETURN

Strong, diversified

sustainable

revenue growth

Growth

Pipeline

Advance and deliver

the pipeline

Execution

Industry

leading margins

Margins

Capital

Allocation

Allocate capital to

maximize

shareholder return

WHAT MAKES ALLERGAN A STRONG SUSTAINABLE

LONG-TERM GROWTH COMPANY

Diverse, broad based revenues with leadership position in 7 therapeutic areas

Strong and sustainable growth in all therapeutic areas with Medical Aesthetics

and IBS growing at 10%+

Low exposure to significant U.S. price pressure1

~40%2 of global revenues not exposed to U.S drug pricing risk

High percentage is cash pay (~20%)

~30% of global revenues is US Medicare/Medicaid/DoD/VA

~30% of global revenues is traditional US commercial

Contribution of new product launches is accelerating

Contribution annualizing at ~$400M in 2016 with strong future growth anticipated

Manageable future LOE headwinds

Minastrin (03/2017); Rapaflo/Canasa (12/2018); Delzicol (3/2020); Saphris (12/2020)

Namenda XR (01/2020)3

1

2

3

All figures based on Non-GAAP 2016 revenues

Includes International, US Medical Aesthetics, US Botox therapeutics

Current planning assumption: Gx launch assumed Q4 2017

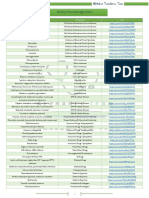

11 NEW PRODUCT LAUNCHES DURING 2016/2017

EXPECTED TO GENERATE ~$5B* IN PEAK SALES

NEW

PRODUCT

LAUNCHES

New

Indications

Launched in 2016

* Includes sales from Linzess 72mcg and Vollure XC and Volbella XC in new markets

All figures based on Non-GAAP

STRONG R&D PIPELINE TO DRIVE FUTURE GROWTH WITH

6 STARS IN PHASE 3 IN 2017

AESTHETIC &

DERMATOLOGY

CNS

14

Atogepant

29

Migraine

Prevention

Mid-to-late

Stage

Programs

WH

22

Acute

Migraine

ESMYA

Fibroids

EYE CARE

MDD

Ubrogepant

65+

Rapastinel

6 Stars

in

Phase 3

Abicipar

AMD

DME

9

Cenicriviroc

NASH

Relamorelin

Diabetic

Gastroparesis

URO

GI

AI, Other

6

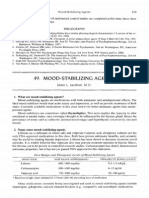

6 STARS IN PHASE 3 WITH POTENTIAL TOTAL PEAK

SALES OF UP TO $13B

Program

ESMYA

ABICIPAR

Cenicriviroc

(CVC)

UBROGEPANT

ATOGEPANT

RAPASTINEL

RELAMORELIN

TA/Indication

MOA

Uterine

Fibroids

Selective progesterone receptor

modulator

AMD

Recombinant designed ankyrin

repeat protein. Potent blocker

of all forms of soluble VEGF-A

DME

NASH

Dual CCR2/CCR5 inhibitor

Acute

(migraine)

Prophylaxis

2018

2020

2022

2021

$1B-$2B

$1.5B-$3B

Oral CGRP antagonism

2022

NMDA receptor modulator

Diabetic

Ghrelin agonist

Gastroparesis

All figures based on Non-GAAP

Key Highlight

$1.5B-$2B

2020

(migraine)

MDD

Year

Estimated

Launch Peak Sales

$1B-$2B

2021

2021

$1B-$2B

$1B-$2B

Potential to offer first oral non-invasive long-term

treatment option for women suffering from UF

Rapid and sustained reduction in bleeding with

marked improvement in quality of life

Reduction in injection burden is a significant

unmet need

Offers sustained efficacy with fewer injections

Foundational therapy for NASH targeting inflammation

and fibrosis and for future combination therapy

Reduction in markers of inflammation

Improvement in fibrosis in patients with fibrosis F2/F3

First oral CGRP drugs for both acute treatment

and prophylaxis of migraine

CGRP antagonists have proven efficacy in

episodic and chronic migraine

Novel NMDA receptor agonist in new paradigm for

the treatment of depression w/ rapid onset of action

Data suggest rapid and sustained antidepressant

effects after single IV doses

No new prokinetic therapy approved in more than 30

years

Improvement in composite endpoint of nausea,

abdominal pain, post-prandial fullness, bloating

ALLERGAN COMMITTED TO MAINTAINING INDUSTRY

LEADING MARGINS

Estimated 2016 Gross Margin

Average

Estimated 2016 Operating Margin

8

Source: 2016 Thomson consensus non-GAAP estimates.

CAPITAL ALLOCATION TO MAXIMIZE SHAREHOLDER VALUE

Friendly shareholder

return actions

DEBT PAYMENT

INVEST FOR GROWTH

Strategic profile of stepping

stones

Completed total of $15

Billion share repurchase

program1

Dividend initiation

beginning Q1 2017

Total debt reduction in

2016 of ~$10B

$6.5B in contractual

maturities over the next 18

months

Strong fit within our 7 TAs

Durable assets with better

potential under AGN

ownership

Pipeline

Transactions

Accretive

Transactions

Commitment to grow

dividend annually

Maintain investment

grade credit rating

ASR settlement to be completed by Q3 2017

All figures are Non-GAAP

Balance among these type

of investments

ADDING ACCRETIVE AND R&D OPPORTUNITIES

THROUGH STEPPING STONE M&A

> Creates world-class aesthetic, regenerative medicine business

in plastic surgery

> Immediately accretive; expected to generate ~$450 million in revenues,

~75% gross margin and ~40% operating margin in 2016

> Licensing agreement for rights to microbiome GI development programs

> Expands Allergans innovative GI pipeline with preclinical compounds

targeting UC, CD and future compounds for IBS

> Option arrangement marks Allergans entry into Parkinsons Disease,

important adjacency to Companys innovative CNS development pipeline

> Lead compound, LTI-291, represents compelling opportunity for treatment

of Parkinsons Disease in a subpopulation with specific genetic mutations

10

MY 2017 PRIORITIES TO DRIVE STRONG SHAREHOLDER

RETURN

> Further advance 6 stars

> Advance and strengthen

all 7 TAs

Mid-single digit revenue

growth*

Growth

> Maintain top tier

operating margin

Operating expenses

grow less than sales,

Downward pressure on

gross margin due to

product mix

Pipeline

> ~14 major pharma and

device submissions

Execution

Margins

Capital

Allocation

> Dividend initiation

> ASR completion

> Balance investments

between pipeline and

accretive deals

> Double-digit EPS growth

* Key assumptions: excludes LifeCell; assumes Namenda XR Gx launch in 4Q 2017 and stable revenues of Restasis

Revenue growth, gross margin, operating expenses and EPS refer to non-GAAP

11

APPENDIX

12

ESMYA (ULIPRISTAL ACETATE) : BREAKTHROUGH TREATMENT

FOR UTERINE FIBROIDS (UF)

Mechanism of Action

Key Differentiators/Market Opportunity

> First in class oral selective

progesterone receptor

modulator (SPRM) for

uterine fibroids

> Acts in endometrium,

fibroids and pituitary

> First and only non-invasive (once daily oral) long-term

medical treatment option for women suffering from

uterine fibroids

> Fast onset of action to absence of bleeding

> No negative effects on Estradiol levels; good safety

profile

> Gives option for women to delay or avoid surgery

> ~8-9M symptomatic moderate to severe patients in the

US1

Phase 3 results: Efficacy in bleeding

control

% of Patients

97.5% CI (%)

First US phase 3 study (VENUS 1) confirmed efficacy observed in EU

registration studies with fast onset of action and improvements in bleeding with

high rates of absence of bleeding after only one treatment cycle (3 months)

80

60

** p<0.0001

compared to placebo

40

**

47.2

**

58.3

20

0

1.8

Placebo (N=56) UPA 5 mg (N=53)

UPA=ulipristal acetate

All revenue figures based on Non-GAAP

UPA 10 mg

(N=48)

Development Status

> Approved in CAN and EU, Phase 3 in US

> 1st Phase 3 study in US met co-primary

endpoints (Venus I); 2nd phase 3 topline results

expected 1H 2017 (Venus II)

> Expected launch in 2018 with peak sales

$1B-$2B US

1Bulun

(NEJM 2013)

13

ABICIPAR : NEXT STEP IN THE STANDARD OF CARE

(ANTI-VEGF) FOR AMD

Mechanism of Action

DARPin

binding to

VEGF

target

Key Differentiators/Market Opportunity

> Recombinant designed

ankyrin repeat protein

(DARPin)

Highly potent blocker of all

forms of soluble VEGF-A

> Current anti-VEGFs require intensive monitoring +

frequent re-administration via intravitreal injection

> Can provide long-term benefits in visual recovery

and reduction of macular edema

> Decreases the number of injections and office visits

> Reduces burden to patients and healthcare

providers

Phase 2 results: Long duration of effect

REACH Stage 3

> Prevalence of late neovascular AMD in North

America estimated ~1.2%

Efficacy: Mean Change in BCVA From Baseline

BCVA Mean Change From Baseline

(Letters SE)

12

Abicipar 2.0 mg (n=23)

Abicipar 1.0 mg (n=25)

10

> AMD:

>

> DME:

>

Ranibizumab 0.5 mg (n=16)

Abicipar 2.0 mg (n = 23)

Abicipar 1.0 mg (n = 25)

Ranibizumab 0.5 mg (n = 16)

4

2

0

Baseline

mITT with LOCF

Week 1

Week 4

Development Status

Week 8

Week 12

Week 16

Week 20

In phase 3. Results expected 2018

Expected launch in 2020

Phase 3 to start 2017

Expected launch in 2022

Klein et al. Ophthalmology 2007; 114: 253-262

Klein et al. Ophthalmology 1992; 99: 933-943

Kahn et al. Am J Epidemiol 1977; 106: 17-32

Assessment Visits (week)

14

CVC : FOUNDATIONAL THERAPY FOR NASH AND CORNERSTONE

FOR FUTURE COMBINATION THERAPY

Mechanism of Action

Key Differentiators/Market Opportunity

> First-in-Class once-daily

NAFLD

Oral CCR2/5 Inhibitor

targeting inflammation

and fibrosis

> Additional NASH

Cenicriviroc

Evogliptin AKN-083

therapies in development

targeting key pathways

Adapted from Arun Sanyal, NASH Symposium, Paris, June 2015

of NASH (FRX agonist /

HCC, hepatocellular carcinoma; NAFLD, nonalcoholic fatty liver disease;

NASH, nonalcoholic steatohepatitis

DDP4 inhibitor)

NASH

Inflammation

Fibrosis

Metabolic

Abnormality

Phase 2b results: Phase III endpoint met

> Phase 2b: in patients with NASH and liver fibrosis, improvement in fibrosis

by at least one stage and no worsening of steatohepatitis after 1

year of treatment

Phase III Endpoint

Primary Endpoint

25

Subjects (%)

20

Placebo

CVC

P = 0.519

P = 0.023

20%

19%

15

16%

10

P = 0.494

8%

10%

6%

0

2-point Improvement

in NAS AND No

Worsening of Fibrosis

N=144

N=145

Complete Resolution of

Improvement in

NASH AND No

Fibrosis Stage AND No

Worsening of Fibrosis

Worsening of NASH

N=144

N=145

N=144

> First-in-Class once-daily Oral CCR2/5 Inhibitor targeting

inflammation and fibrosis

> One of the few agents in development directly impacting

fibrosis

> Safety comparable to placebo

> ~10.7M F2/F3 NASH patients expected in the US by 2030

Development Status

> Improvement in fibrosis by at least one stage and

no worsening of steatohepatitis after 1 year of

treatment in patients with fibrosis F2/F3 will be

primary efficacy endpoint in Phase 3

> Phase 3 expected to start 2H 2017

> Expected launch in 2021 with peak sales

$1.5B-$2B in US

N=145

CVC, cenicriviroc; ITT, intent-to-treat (missing data counted as failure); NAS,

nonalcoholic fatty liver disease activity score

All revenue figures based on Non-GAAP

> NASH is becoming the leading cause of liver transplant

and liver cancer surpassing Hepatits C

15

15

UBROGEPANT / ATOGEPANT : FIRST ORAL CGRP ANTAGONISTS IN

MIGRAINE

Mechanism of Action

Key Differentiators/Market Opportunity

Oral CGRP antagonists:

> No major innovations in the migraine field since ~2 decades

> Inhibit vasodilatation

peripherally

> MoA validated, but currently no CGRP antagonists approved

> CGRP antagonism is a migraine specific development

> Oral prophylaxis preferred by a significant segment of patients

> Inhibit migraine pain

transmission centrally

> MoA different from triptans

> Better tolerability than current SOC expected

> Promise acute AND

prophylactic efficacy with

excellent tolerability

> High innovative potential:

> Ubrogepant as first in class treatment of acute migraine

> Atogepant as first oral CGRP antagonists for migraine prophylaxis

Phase 2 results: Efficacy in 2 hour pain

freedom

Ubrogepant 2-Hour Pain Freedom

Development Status

Ubrogepant for treatment of acute migraine:

> Phase 3 started in July 2016 in US

> EU study start planned for 1H 2017

> First results expected 2018

Atogepant for migraine prophylaxis:

1 mg

10 mg

25 mg

50 mg

100 mg

> Large dose range finding study started in August

2016 in episodic migraine prophylaxis

> First results expected 2018

16

RAPASTINEL: A NOVEL NMDA MODULATOR AS A RAPID ACTING

ANTIDEPRESSANT

Mechanism of Action

Key Differentiators/Market Opportunity

> Novel class of NMDA receptor modulators

> Differentiation from current antidepressants

NMDA modulation without direct interaction

with glycine site

Rapid antidepressant activity in animal models

Action via a direct LTP-like, NMDA receptor-triggered

process of enhanced synaptic plasticity

Pharmacology different from ketamine

> IV administration (weekly in Phase 3 acute trials)

as add-on to SOC antidepressants

Phase 2a results: Efficacy with single

dose

Promises antidepressant activity within hours (vs. within

weeks of continued dosing)

> Differentiation from ketamine/esketamine:

> Available preclinical and clinical data indicate

Very good safety and tolerability

Low propensity for psychotic or dissociative side effects

Low abuse liability

Development Status

> Global development program:

Phase 2 single

dose study

US Phase 3 program started in October 2016

(3 acute studies, 1 long term maintenance study)

Ongoing open label safety study

Phase 1 PK study for Japan ongoing

Consultation with EMA planned for 2017

> First Phase 3 results expected 2019

> Additional indications under consideration

Data suggest rapid and sustained antidepressant effects after single

IV doses of 5 mg/ kg or 10 mg/kg

17

RELAMORELIN: NOVEL PROKINETIC TREATMENT

FOR GASTROPARESIS

Mechanism of Action

> Ghrelin receptor agonist to

improve gastric emptying

and gastrointestinal motility

> Enhanced efficacy, better

plasma stability and a

longer circulating half-life

compared to native ghrelin

Phase 2b results: Four-symptom

composite change in baseline

Change from Baseline (SE)

Four-symptom composite1: substantial efficacy from baseline demonstrated by week 12

Key Differentiators/Market Opportunity

> Significant unmet need for alternative therapy

given the limitations of metoclopramide (Reglan)

through risk of tardive dyskinesia and the

withdrawal of cisapride (Propulsid)

> No new prokinetic therapy approved more than 30

years

> Estimated 2.3 million type 1 and type 2 diabetic

patients with moderate or severe gastroparesis

18

Development Status

> Global Phase 3 trial moving forward

Four-Symptom Composite

Change from Baseline Pooled Doses

> FDA has granted fast track review status to

Relamorelin

> Expected Launch Year in 2021 with peak sales

($1B-$2B US)

1. Nausea, abdominal pain, post-prandial fullness, bloating

All revenue figures based on Non-GAAP

18

CONTINUING STEPPING STONE M&A: ASSEMBLY BIOSCIENCES

& LYSOSOMAL THERAPEUTICS

>

Opportunity

Opportunity

Potential next-generation, highly selective

first oral approach to developing microbiome

treatments for leading diseases within one

of Allergans largest TAs (GI)

Entry into Parkinsons Disease with potential

first-in-class compounds and possible utility

across the full spectrum of PD

Key Differentiators/Market Opportunity

Key Differentiators/Market Opportunity

R&D collaboration to develop next-generation microbiome treatments for

gastrointestinal disorders, specifically IBD and IBS

>

Option arrangement to acquire LTI

>

5%-10% of PD patients present with a specific genetic mutation of the

GBA1 gene, causing lack of activity of the enzyme Gcase. These patients

have a more rapid progression of Parkinsons disease

>

Abnormalities in the intestinal microbiome are fundamentally important

to the development of a number of GI disorders including IBS and IBD

>

Potential utility of microbiome technology in treating a number of GI

disorders

>

The LTI compounds are being developed to restore activity of the GCase

enzyme

>

Allergan has significant clinical and commercial leadership experience

in GI

>

May have utility across the entire spectrum of PD

>

Parkinson's affects up to 1 million people in the US and doctors diagnose

as many as 60,000 new cases each year

>

Natural adjacency for Allergan given our significant leadership in CNS

>

Potential for application in other disorders, both in GI and other TAs

Key Terms

>

Upfront payment of $50 Million for WW rights to develop, commercialize

UC, CD and IBS compounds

>

Shared development costs through POC studies; Allergan will assume all

post-POC development costs

1Bulun

(NEJM 2013)

Key Terms

>

Option to acquire LTI for an undisclosed amount following

completion of LTI-291 Phase 1b study

19

Das könnte Ihnen auch gefallen

- Allergan Q1 2017 Earnings Deck 5-8-17 Final PDFDokument40 SeitenAllergan Q1 2017 Earnings Deck 5-8-17 Final PDFmedtechyNoch keine Bewertungen

- Aaaq2 2015 Ir PresentationDokument45 SeitenAaaq2 2015 Ir PresentationguerrezNoch keine Bewertungen

- 2020 Bond Financing Handbook For IndianaDokument87 Seiten2020 Bond Financing Handbook For IndianaalbtrosNoch keine Bewertungen

- Statement of Position 81-1Dokument34 SeitenStatement of Position 81-1Vikas RalhanNoch keine Bewertungen

- mc8 FormDokument6 Seitenmc8 FormthembaNoch keine Bewertungen

- Krispy Kreme Financial Analysis Case StudyDokument4 SeitenKrispy Kreme Financial Analysis Case StudyDaphne PerezNoch keine Bewertungen

- Jarwick v. Wilf Report and Recommendation 11-5-13 PDFDokument132 SeitenJarwick v. Wilf Report and Recommendation 11-5-13 PDFKSTPTVNoch keine Bewertungen

- REMS Abuse and The CREATES ActDokument2 SeitenREMS Abuse and The CREATES ActArnold VenturesNoch keine Bewertungen

- Schwab One Application AgreementDokument4 SeitenSchwab One Application AgreementcadeadmanNoch keine Bewertungen

- 18-O-1480 - Exhibit 1 - DDA - Gulch (EZ Bonds) - Intergovernmental AgreementDokument18 Seiten18-O-1480 - Exhibit 1 - DDA - Gulch (EZ Bonds) - Intergovernmental AgreementmaggieleeNoch keine Bewertungen

- UnitedHealth Vs TeamHealth Fraud Upcoding Lawsuit November 2020Dokument42 SeitenUnitedHealth Vs TeamHealth Fraud Upcoding Lawsuit November 2020Health Care Fraud ResearchNoch keine Bewertungen

- University of Utah Kaplan Lab ReportDokument9 SeitenUniversity of Utah Kaplan Lab ReportLindsay Whitehurst0% (1)

- Pfizer Annual Report 2015Dokument134 SeitenPfizer Annual Report 2015Ojo-publico.comNoch keine Bewertungen

- Terry Lee Stonehocker v. General Motors Corporation, 587 F.2d 151, 4th Cir. (1978)Dokument11 SeitenTerry Lee Stonehocker v. General Motors Corporation, 587 F.2d 151, 4th Cir. (1978)Scribd Government DocsNoch keine Bewertungen

- Asurion Rate FilingDokument130 SeitenAsurion Rate FilingJulian Okuyiga100% (1)

- PIP Working Group ReportDokument65 SeitenPIP Working Group ReportPeter SchorschNoch keine Bewertungen

- FACD Project - Allergan-Pfizer DealDokument5 SeitenFACD Project - Allergan-Pfizer DealSaksham SinhaNoch keine Bewertungen

- Catalyst Pharmaceuticals Vs FDA JudgementDokument19 SeitenCatalyst Pharmaceuticals Vs FDA JudgementTradeHawkNoch keine Bewertungen

- WTO Patent Rules and Access To Medicines: The Pressure MountsDokument11 SeitenWTO Patent Rules and Access To Medicines: The Pressure MountsOxfamNoch keine Bewertungen

- National Drug Control Strategy 2022Dokument152 SeitenNational Drug Control Strategy 2022Medicinal ColoradoNoch keine Bewertungen

- PRESCRIBER RxChange v10.6 20130501 Certification Test Scenarios 2013 V 1.0Dokument9 SeitenPRESCRIBER RxChange v10.6 20130501 Certification Test Scenarios 2013 V 1.0Rabindra P.SinghNoch keine Bewertungen

- Bioethical Guide-1-63 PDFDokument63 SeitenBioethical Guide-1-63 PDFandres.zamoraa95Noch keine Bewertungen

- A Comprehensive Study On Regulatory Requirements For Development and Filing of Generic Drugs GloballyDokument7 SeitenA Comprehensive Study On Regulatory Requirements For Development and Filing of Generic Drugs GloballyAtikur RonyNoch keine Bewertungen

- 2013-10-15.inquiry Report - Redacted - Reduced SizeDokument46 Seiten2013-10-15.inquiry Report - Redacted - Reduced Sizenewshound_50309Noch keine Bewertungen

- FDA 101 Dietary SupplementsDokument3 SeitenFDA 101 Dietary SupplementsFI8TZNoch keine Bewertungen

- Cvs Caremark Vs WalgreensDokument17 SeitenCvs Caremark Vs Walgreensapi-316819120Noch keine Bewertungen

- "Branded" Generic Drugsc: C CCCC CCCDokument16 Seiten"Branded" Generic Drugsc: C CCCC CCCliyakath_ashrafNoch keine Bewertungen

- Interpreting Oil Analysis ReportDokument5 SeitenInterpreting Oil Analysis ReportAbdul AzisNoch keine Bewertungen

- Case 2 - The Global Biopharmaceutical IndustryDokument5 SeitenCase 2 - The Global Biopharmaceutical IndustryTran Bao DuongNoch keine Bewertungen

- FDA Theranos Inspection 1Dokument4 SeitenFDA Theranos Inspection 1SarahNoch keine Bewertungen

- Expanding Access To Emergency Contraceptive Pills: Promoting Pharmacist/Prescriber Collaborative AgreementsDokument57 SeitenExpanding Access To Emergency Contraceptive Pills: Promoting Pharmacist/Prescriber Collaborative AgreementsRobert CantemprateNoch keine Bewertungen

- The Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidanceDokument53 SeitenThe Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidancesandydocsNoch keine Bewertungen

- LKQ v. GM - Order On ExpertsDokument2 SeitenLKQ v. GM - Order On ExpertsSarah BursteinNoch keine Bewertungen

- Filed Order EQCE087085Dokument14 SeitenFiled Order EQCE087085Local 5 News (WOI-TV)Noch keine Bewertungen

- Severn Trent Case Study AnalysisDokument10 SeitenSevern Trent Case Study AnalysisShenRamanNoch keine Bewertungen

- DexCom Investor Presentation 01-12-17Dokument32 SeitenDexCom Investor Presentation 01-12-17medtechyNoch keine Bewertungen

- AON WLTW ComplaintDokument35 SeitenAON WLTW ComplaintXDL1Noch keine Bewertungen

- JPM Deck-1!8!18 FinalDokument25 SeitenJPM Deck-1!8!18 FinalMaiaNoch keine Bewertungen

- Allergan Q2 2018 Earnings PresentationDokument52 SeitenAllergan Q2 2018 Earnings PresentationmedtechyNoch keine Bewertungen

- For Immediate Release: Labcorp ContactsDokument2 SeitenFor Immediate Release: Labcorp ContactsDavid BriggsNoch keine Bewertungen

- Wright Medical Investor Presentation - 11-2-2016Dokument29 SeitenWright Medical Investor Presentation - 11-2-2016medtechyNoch keine Bewertungen

- 35th Annual J.P. Morgan Healthcare Conference PresentationDokument18 Seiten35th Annual J.P. Morgan Healthcare Conference PresentationmedtechyNoch keine Bewertungen

- JNJ Earnings Presentation 4Q2015Dokument33 SeitenJNJ Earnings Presentation 4Q2015medtechyNoch keine Bewertungen

- ENR Energizer Sept 2016 PresentationDokument49 SeitenENR Energizer Sept 2016 PresentationAla BasterNoch keine Bewertungen

- Our Business RisksDokument21 SeitenOur Business Riskshani856Noch keine Bewertungen

- Fogo Investor Presentation - June 2015Dokument29 SeitenFogo Investor Presentation - June 2015Ala BasterNoch keine Bewertungen

- Cooper Companies Factsheet-2014Dokument2 SeitenCooper Companies Factsheet-2014IlyaLevtovNoch keine Bewertungen

- GSK Annual Report With DetailsDokument252 SeitenGSK Annual Report With DetailsReal Will SelfNoch keine Bewertungen

- It 1Dokument3 SeitenIt 1mohammedakbar88Noch keine Bewertungen

- Curaleaf Presentation 10.2.19 FINALDokument24 SeitenCuraleaf Presentation 10.2.19 FINALstonerhinoNoch keine Bewertungen

- GSK Strategic Report 2015Dokument75 SeitenGSK Strategic Report 2015nolovNoch keine Bewertungen

- Novartis NVS Q4 2016 Ir PresentationDokument84 SeitenNovartis NVS Q4 2016 Ir PresentationmedtechyNoch keine Bewertungen

- Regulations: Risk Description: Risk of Interruption of Product SupplyDokument5 SeitenRegulations: Risk Description: Risk of Interruption of Product SupplySagar RaghorteNoch keine Bewertungen

- 4Q23 Earnings DeckDokument26 Seiten4Q23 Earnings DeckAbhijeet HakeNoch keine Bewertungen

- Biogen Q416 Earnings PresentationDokument44 SeitenBiogen Q416 Earnings PresentationmedtechyNoch keine Bewertungen

- Biggs Fls Slides For 1145am Et Presentation at Evercore Isi Conference Jun 15Dokument3 SeitenBiggs Fls Slides For 1145am Et Presentation at Evercore Isi Conference Jun 15Oprescu Claudiu Cosmin TonyNoch keine Bewertungen

- Zimmer-Biomet (ZBH) JP Morgan Presentation 2017Dokument15 SeitenZimmer-Biomet (ZBH) JP Morgan Presentation 2017medtechyNoch keine Bewertungen

- Cipher Presentation Q4 2022 Final Website 03.27.23 Updated With BB SlidesDokument20 SeitenCipher Presentation Q4 2022 Final Website 03.27.23 Updated With BB SlidesBen2pop170686Noch keine Bewertungen

- VTRS Q1 2023 Earnings Presentation - FINALDokument46 SeitenVTRS Q1 2023 Earnings Presentation - FINAL123456789Noch keine Bewertungen

- Helius Presentation Sedar Final - For MarketingDokument30 SeitenHelius Presentation Sedar Final - For MarketingMartin TsankovNoch keine Bewertungen

- Amarin ICER CVD Final Evidence Report 101719Dokument161 SeitenAmarin ICER CVD Final Evidence Report 101719medtechyNoch keine Bewertungen

- Amgen 2019 JP Morgan PresentationDokument32 SeitenAmgen 2019 JP Morgan PresentationmedtechyNoch keine Bewertungen

- Celgene January 2019 Investor-PresentationDokument26 SeitenCelgene January 2019 Investor-PresentationmedtechyNoch keine Bewertungen

- Transform Olympus 2019Dokument12 SeitenTransform Olympus 2019medtechyNoch keine Bewertungen

- Conmed and Buffalo Filter Acquisition PresentationDokument6 SeitenConmed and Buffalo Filter Acquisition PresentationmedtechyNoch keine Bewertungen

- Boston Scientific / BTG Acquisition PresentationDokument18 SeitenBoston Scientific / BTG Acquisition PresentationmedtechyNoch keine Bewertungen

- Stereotaxis Investor Presentation 4Q2018Dokument17 SeitenStereotaxis Investor Presentation 4Q2018medtechy100% (1)

- Endologix Investor Meeting 10-02-18Dokument45 SeitenEndologix Investor Meeting 10-02-18medtechyNoch keine Bewertungen

- Cardinal Health Q4 FY18 Earnings DeckDokument22 SeitenCardinal Health Q4 FY18 Earnings DeckmedtechyNoch keine Bewertungen

- Otonomy OTO-413 Presentation (November 5, 2018)Dokument10 SeitenOtonomy OTO-413 Presentation (November 5, 2018)medtechyNoch keine Bewertungen

- CB Insights Amazon in Healthcare BriefingDokument83 SeitenCB Insights Amazon in Healthcare BriefingmedtechyNoch keine Bewertungen

- RTI Surgical Acquires Paradigm SpineDokument13 SeitenRTI Surgical Acquires Paradigm SpinemedtechyNoch keine Bewertungen

- NUVA Second Quarter 2018 Supplemental SlidesDokument14 SeitenNUVA Second Quarter 2018 Supplemental SlidesmedtechyNoch keine Bewertungen

- CB Insights Amazon in Healthcare BriefingDokument83 SeitenCB Insights Amazon in Healthcare BriefingmedtechyNoch keine Bewertungen

- Allergan Q2 2018 Earnings PresentationDokument52 SeitenAllergan Q2 2018 Earnings PresentationmedtechyNoch keine Bewertungen

- 2018 ADA Analyst Meeting FINALDokument29 Seiten2018 ADA Analyst Meeting FINALmedtechyNoch keine Bewertungen

- Link Drug Class NameDokument2 SeitenLink Drug Class NameIrma RahayuNoch keine Bewertungen

- Topic: Major Depression: Symptoms and SignsDokument16 SeitenTopic: Major Depression: Symptoms and SignsnaviNoch keine Bewertungen

- Generalized Anxiety Disorder: Clinical Practice Guidelines Management of Anxiety DisordersDokument6 SeitenGeneralized Anxiety Disorder: Clinical Practice Guidelines Management of Anxiety DisordersDaciana DumitrescuNoch keine Bewertungen

- Case Study of A Client Diagnosed With Major Depressive Disorder PDFDokument103 SeitenCase Study of A Client Diagnosed With Major Depressive Disorder PDFAnonymous vfp4bjGL100% (1)

- Postmenopausal Syndrome: Pronob K. Dalal, Manu AgarwalDokument11 SeitenPostmenopausal Syndrome: Pronob K. Dalal, Manu Agarwalwidya astutyloloNoch keine Bewertungen

- Modafinil AnnotatedDokument13 SeitenModafinil AnnotatedMistah RoflcopterNoch keine Bewertungen

- APA Well Being Ambassador Toolkit Challenges and OpportunitiesDokument90 SeitenAPA Well Being Ambassador Toolkit Challenges and OpportunitiesHồ Q. ThuậnNoch keine Bewertungen

- Schizoaffective Disorder FactsheetDokument6 SeitenSchizoaffective Disorder FactsheetYusnida RahmawatiNoch keine Bewertungen

- Ibs JurnalDokument11 SeitenIbs JurnalimuhammadfahmiNoch keine Bewertungen

- Hypericum Perforatum, Known As Perforate ST John's-WortDokument6 SeitenHypericum Perforatum, Known As Perforate ST John's-WortIoana Mădălina BrînzăNoch keine Bewertungen

- Psychiatric Nursing Bullets (Nle & Nclex)Dokument21 SeitenPsychiatric Nursing Bullets (Nle & Nclex)Richard Ines Valino100% (24)

- Alzheimer Disease EngDokument35 SeitenAlzheimer Disease EngAna IantucNoch keine Bewertungen

- Positive Islamic Psychology:: A Transcendent Model To Achieve Peace, Happiness and Success in The 21 CenturyDokument605 SeitenPositive Islamic Psychology:: A Transcendent Model To Achieve Peace, Happiness and Success in The 21 CenturymohamadrezaNoch keine Bewertungen

- HeadStrong Curriculum Resource - TeachingDokument82 SeitenHeadStrong Curriculum Resource - TeachingStaas SearleNoch keine Bewertungen

- Geriatric Psychiatry Group CDokument77 SeitenGeriatric Psychiatry Group Cchew weijianNoch keine Bewertungen

- Conduct Disorder Diagnosis and Treatment in Primar PDFDokument11 SeitenConduct Disorder Diagnosis and Treatment in Primar PDFhopeIshanzaNoch keine Bewertungen

- Mood-Stabilizing AgentsDokument9 SeitenMood-Stabilizing AgentsRoci ArceNoch keine Bewertungen

- Dissertation Titles - PharmacologyDokument46 SeitenDissertation Titles - PharmacologyVijendra R100% (3)

- APA Eating Disorder Clinical Practice Guideline Training SlidesDokument66 SeitenAPA Eating Disorder Clinical Practice Guideline Training SlidesayyuuafufaaNoch keine Bewertungen

- Antipsychotic Agents: CNS DrugsDokument44 SeitenAntipsychotic Agents: CNS DrugsJo Hn VengzNoch keine Bewertungen

- Psilocybin May Help Treat Depression, A Small Study FindsDokument3 SeitenPsilocybin May Help Treat Depression, A Small Study FindsAnnisaNoch keine Bewertungen

- Antianxiety DrugsDokument41 SeitenAntianxiety Drugsirina22_alessNoch keine Bewertungen

- Olympic 11 Xxiv 2018 Linh 2Dokument17 SeitenOlympic 11 Xxiv 2018 Linh 2Bảo TrâmNoch keine Bewertungen

- Chlorpheniramine SNRI Paper PDFDokument5 SeitenChlorpheniramine SNRI Paper PDFAmanda HillNoch keine Bewertungen

- CNS Drugs Pharmaceutical Form Therapeutic Group: 6mg, 8mgDokument7 SeitenCNS Drugs Pharmaceutical Form Therapeutic Group: 6mg, 8mgCha GabrielNoch keine Bewertungen

- Pharmacology Related To Psychiatric NursingDokument7 SeitenPharmacology Related To Psychiatric NursingGlenn Daryll SantosNoch keine Bewertungen

- CHT Psyc AntidepressantDokument3 SeitenCHT Psyc AntidepressantRicardo Lugon ArantesNoch keine Bewertungen

- Pharmacotherapy of Anxiety Disorders: Current and Emerging Treatment OptionsDokument21 SeitenPharmacotherapy of Anxiety Disorders: Current and Emerging Treatment OptionsGabriel Vargas CuadrosNoch keine Bewertungen

- Warnick-Prescribing Meds For Anxiety and Depression PlenaryDokument33 SeitenWarnick-Prescribing Meds For Anxiety and Depression PlenaryAKNTAI002Noch keine Bewertungen