Beruflich Dokumente

Kultur Dokumente

Financial Results For June 30, 2013 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Results For June 30, 2013 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

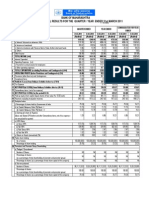

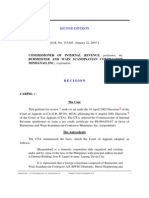

Pretto Leather Industries Limited

Redg. Off:149-A, Civil Lines, Bareilly (UP) India-243001

Phone No, : 011-475863271 Mob: 08882740947

E~mail:info@prettoleather.com

Quarterly

ANNEXURE I TO CLAUSE 41

Financial Resnlts for quarter ended 30/06/2013

(Rs. in lakhs)

3 months ended

(30/06/2013)

Pa rticu la rs

Corresponding

months

3

accounting

year ended

30/06/2012

Preceding 3 months

ended (31/03/2013)

Previous

year

ended

31103/2013

Audited

Unaudited*

LTnaudited*

I Jnaudited

(a) Net Saiesiincomc from Operations

50

50.00

(b) Other Operating Income

NIL

NIL

NIL

NIL

NIL

NfL

NIL

NIL

NIL

4

.3

NIL

.5

4.8

NIL

4

.3

NIL

.5

4,8

NIL

40

3

NIL

5

48

NIL

40

I

NtL

8

49

item exceeding 10% of the total

expenditure

to

be

shown

separately)

3. Profit from Operations before Other

Income,

Interest & Exceptional

Items (1-2)

NIL

NIL

NIL

NIL

4. Other Income

5. Profit before Interest & Exceptiona]

Items (3+4)

I

6. Interest

I

7. Profit after Interest but before

c

I

Exceptional Items (5-6)

8. Exceptional Items

i

9.

Profit (+)/ Loss (-) from Ordinary

I

Activities before tax (7+8)

I

l--] O. Tax expense

]1. Net Profit

(+)lLoss(-)

from

Ordinary Activities after tax (9-10)

]2. Extraordinary Item (net of tax

expense Rs ....... )

,

13. Net Profit U/Loss(-) for the period

(11-12)

14. Paid-up equity share capital

(Face Value of the Share shall be

.

indicated)

0.00

.20

NIL

.20

NIL

2,00

NIL

.20

NIL

.20

NIL

2.00

NIL

.20

NIL

.20

NIL

2.00

NIL

1.00

,06

.14

,06

.14

0.60

lAO

.30

.70

NIL

NIL

NIL

I

I

2, Expenditure

a. lncrease/decrease in stock in trade

and work in progress

b. Consumption of raw materials

c. Purchase of traded goods

d. Employees cost

c. Depreciation

f Other expenditure

a

Total

~.

I

I

I

I

I

(Any

I

I

I

I

I

I

.20

2.00

.20

1.00

-j

c-

+mL-~

~

1.00

1.00

NIl.

'.

.14

. ]4

780

780

lAO

.70

780

780

10/-

101-

I

lOl-

lOl-

-j

------1

_.-i

-41.66

-41.25

-41.25

-41.25

NIL

NIL

NIL

NIL

NIL

NlL

NIL

NIL

NIL

NIL

NIL

NIL

17. Public shareholding

- Number of shares

39.58

20.28

20.28

20.28

- Percentage

50.75%

38.42

49.25%

26%

57.72

74%

26%

57.72

74%

26%

57.72

74%

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

IS.

excluding

Revaluation

Reserve

Reserves as per balance sheet of

previous accounting

year

16. Earnings Per Share (EPS)

(a) BasIc and diluted EPS before

Extraordinary items for the period,

for the year to date and for the

year

previous

(not

to

be

annualized)

(b) Basic and diluted EPS after

Extraordinary items for the period,

for ihe year to date and for the

to

previous

year

(not

be

annualized)

of shareholding

18.

Promoters

Group

and Promoter

Shareholding **

a) Pledged I Encumbered

Number of shares

- Percentage of shares (as a % of the total

shareholding

of

promoter

and

promoter group)

- Percentage of shares (as a % of the total

share capital ofthe company)

I

b) Non - encumbered

- N umber of shares

- Percentage of shares (as a % of the total

shareholding of the Promoter and Promoter

group)

Percentage of shares (as a % of the total

share capital oflhe company)

l

I

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

~I

Note:1. The Company has complied with all relevant accounting standards issued by

ICAI as applicable to the Company.

2. The ahove results were reviewed by an Audit Committee and thereafter

taken on record by the Board of Directors in their Meeting held on 9/0812013.

3. A limited reviews of the above results has been done by the auditors 0 the

Company

4. There were no investor Complaints known to the Company outstanding at

the beginning of the quarter.

5. Previous period figures have been regrouped/restated as per new format.

~

~.'f~

\V'''''

(\

Das könnte Ihnen auch gefallen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Financial Results For June 30, 2014 (Standalone) (Result)Dokument2 SeitenFinancial Results For June 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2012 (Result)Dokument3 SeitenFinancial Results For Dec 31, 2012 (Result)Shyam SunderNoch keine Bewertungen

- Jaihind Synthetics Limited: S BusDokument4 SeitenJaihind Synthetics Limited: S BusShyam SunderNoch keine Bewertungen

- Financial Results For March 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Dokument1 SeiteAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDokument5 SeitenParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument6 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For March 31, 2013 (Audited) (Result)Dokument3 SeitenFinancial Results For March 31, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2015 (Company Update)Dokument7 SeitenFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For December 31, 2015 (Result)Dokument2 SeitenFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Sebi MillionsDokument2 SeitenSebi MillionsNitish GargNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Dokument2 SeitenFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- FY11 - Investor PresentationDokument11 SeitenFY11 - Investor Presentationcooladi$Noch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For March 31, 2013 (Result)Dokument3 SeitenFinancial Results For March 31, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- GUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSDokument2 SeitenGUJARAT APOLLO INDUSTRIES LIMITED FINANCIAL RESULTSTushar PatelNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- BATA INDIA 1Q FY2011 Earnings ReportDokument1 SeiteBATA INDIA 1Q FY2011 Earnings ReportSagar KadamNoch keine Bewertungen

- Audited Result 2010 11Dokument2 SeitenAudited Result 2010 11Priya SharmaNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument12 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Dokument4 SeitenColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraNoch keine Bewertungen

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Dokument1 SeitePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument5 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument4 SeitenAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- MRF PNL BalanaceDokument2 SeitenMRF PNL BalanaceRupesh DhindeNoch keine Bewertungen

- Audited Financial 2011Dokument1 SeiteAudited Financial 2011gayatri9324814475Noch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2013 (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument5 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Avt Naturals (Qtly 2010 03 31) PDFDokument1 SeiteAvt Naturals (Qtly 2010 03 31) PDFKarl_23Noch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokument11 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Dokument4 SeitenAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Dokument1 SeiteRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Dokument3 SeitenComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNoch keine Bewertungen

- Taxation EvolutionDokument7 SeitenTaxation EvolutionSherry Mhay BongcayaoNoch keine Bewertungen

- Tax Notes On Capital GainsDokument15 SeitenTax Notes On Capital GainsGarima GarimaNoch keine Bewertungen

- Phil Hawk Vs Vivian Tan Lee DigestDokument2 SeitenPhil Hawk Vs Vivian Tan Lee Digestfina_ong62590% (1)

- CIR v. MarubeniDokument31 SeitenCIR v. Marubenimceline19Noch keine Bewertungen

- Tax incentives for BioNexus companiesDokument41 SeitenTax incentives for BioNexus companiesagasthia23Noch keine Bewertungen

- Paraguru Transaction Report 2021-2022Dokument2 SeitenParaguru Transaction Report 2021-2022Mostafa MahmoudNoch keine Bewertungen

- Avt Naturals (Qtly 2010 12 31) PDFDokument1 SeiteAvt Naturals (Qtly 2010 12 31) PDFKarl_23Noch keine Bewertungen

- Local Tax Notes on Limitations, Impositions and ProceduresDokument12 SeitenLocal Tax Notes on Limitations, Impositions and ProceduresIsaac Joshua AganonNoch keine Bewertungen

- Commissioner Vs ManningDokument2 SeitenCommissioner Vs ManningLudy Jane FelicianoNoch keine Bewertungen

- Taxation Drill 1 ReviewDokument11 SeitenTaxation Drill 1 ReviewROMAR A. PIGANoch keine Bewertungen

- PP On Sales Tax Refund and RecoveriesDokument11 SeitenPP On Sales Tax Refund and RecoveriesMA AttariNoch keine Bewertungen

- FINAL 421-A Hearing PowerpointDokument22 SeitenFINAL 421-A Hearing PowerpointJanet BabinNoch keine Bewertungen

- Notification No. 16/2021 - Central Tax (Rate)Dokument2 SeitenNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNoch keine Bewertungen

- Constitutional Limitations On The Power of TaxationDokument24 SeitenConstitutional Limitations On The Power of TaxationMogierick MoranNoch keine Bewertungen

- Saving ProformaDokument2 SeitenSaving ProformaRamyasree BadeNoch keine Bewertungen

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDokument6 SeitenInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNoch keine Bewertungen

- RA-NH Tie Up FareDokument11 SeitenRA-NH Tie Up FareSanjog PandeyNoch keine Bewertungen

- Consolidated/Classified Abstract Report: (Actuals)Dokument17 SeitenConsolidated/Classified Abstract Report: (Actuals)Ashish Singh NegiNoch keine Bewertungen

- Do Restaurant Owners Have To Pay GST On The Entire Amount of The Bill If Delivery Is Done by Zomato?Dokument2 SeitenDo Restaurant Owners Have To Pay GST On The Entire Amount of The Bill If Delivery Is Done by Zomato?pratyusha_3Noch keine Bewertungen

- Answers 10Dokument5 SeitenAnswers 10Ash KaiNoch keine Bewertungen

- KZ Edx ProDokument1 SeiteKZ Edx ProA KNoch keine Bewertungen

- Taxation EADokument14 SeitenTaxation EALhulaan OrdanozoNoch keine Bewertungen

- Hdfcbank Credit CtalogueDokument1 SeiteHdfcbank Credit CtalogueDrSudhanshu MishraNoch keine Bewertungen

- PWC Tax Facts and Figures 2014Dokument76 SeitenPWC Tax Facts and Figures 2014Steven GalfordNoch keine Bewertungen

- CIR vs. BurmeisterDokument13 SeitenCIR vs. BurmeisterMaan MabbunNoch keine Bewertungen

- Withholding Taxes T4061-10eDokument22 SeitenWithholding Taxes T4061-10eMartin McTaggartNoch keine Bewertungen

- Pov 5509783Dokument3 SeitenPov 5509783Sameer MahajanNoch keine Bewertungen

- Excise Tax - Taxable Person Guide - EnglishDokument33 SeitenExcise Tax - Taxable Person Guide - EnglishpennacchiettiNoch keine Bewertungen

- NRI TaxationDokument9 SeitenNRI TaxationTekumani Naveen KumarNoch keine Bewertungen