Beruflich Dokumente

Kultur Dokumente

Chapter 4 - Basis of Taxation-Updated

Hochgeladen von

casarokar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteChapter 4- Basis of Taxation-Updated(1)

Originaltitel

Chapter 4- Basis of Taxation-Updated(1)

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenChapter 4- Basis of Taxation-Updated(1)

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteChapter 4 - Basis of Taxation-Updated

Hochgeladen von

casarokarChapter 4- Basis of Taxation-Updated(1)

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

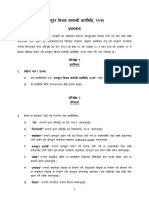

Chapter 4- Basis of Taxation

Question 1 (page 38)

Fact of the case:

In this case, Mr. Pradip Sharma has turnover from business not exceeding Rs. 20 Lakhs from where he

derives profit not exceeding Rs. 2 Lakhs.

Provision of the Act:

As per Sec. 4 (4), in case all the following conditions are satisfied; a person is not required to calculate

tax liability in detail and is required to pay tax as follows (u/s 1 (7) of Schedule 1 of the Act):

a.

b.

c.

d.

The person shall be a resident natural person,

The person shall derive income exclusively from business having source in Nepal,

The person shall not claim Medical Tax credit and advance tax arising out of withholding taxes,

The income (turnover) from business shall not exceed Rs. 20 Lakhs and the profit shall not

exceed Rs. 2 Lakhs during the Income Year,

e. The person shall elect this provision to be applied in writing, and

f. The person shall not be registered for VAT purpose.

The tax applicable is as follows:

a. In case of conduct of business in Metropolitan City/Submetro city- Rs. 5000

b. In case of conduct of business in Municipality- Rs. 2,500

c. In case of conduct of business in VDC- Rs. 1,500

Conclusion:

In this case Mr. Pradip is a natural person and is resident of Nepal as his habitual place of abode is

Birgunj, i.e. Nepal. Assuming he has no other income than business having source in Nepal and in case

he renounces medical tax credit and advance tax arising out of withholding taxes, and he wishes to pay

presumptive taxation; he shall pay tax of Rs. 5,000 merely declaring the revenue and profit for the year. In

forming the conclusion, it is assumed that Mr. Pradip is not registered for VAT purpose.

In case any of the above conditions would not be satisfied, he should have calculated tax as per

Schedule 1 of the Act, i.e. under progressive taxation system

In both the case, Mr. Pradip is required to file an income return.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- Bafia 2063Dokument125 SeitenBafia 2063casarokarNoch keine Bewertungen

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- Finance Act, 2076Dokument32 SeitenFinance Act, 2076casarokarNoch keine Bewertungen

- Computer Billing NoticeDokument1 SeiteComputer Billing NoticecasarokarNoch keine Bewertungen

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- Chapter 11 - Income From Business-UpdatedDokument42 SeitenChapter 11 - Income From Business-UpdatedcasarokarNoch keine Bewertungen

- Chapter 12 - Income From EmploymentDokument22 SeitenChapter 12 - Income From EmploymentcasarokarNoch keine Bewertungen

- Computer Billing NoticeDokument1 SeiteComputer Billing NoticecasarokarNoch keine Bewertungen

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- Computer Billing NoticeDokument1 SeiteComputer Billing NoticecasarokarNoch keine Bewertungen

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- Chapter 21 - Entity & DistributionDokument2 SeitenChapter 21 - Entity & DistributioncasarokarNoch keine Bewertungen

- Chapter 22 - Change in Control & Tax TreatmentDokument1 SeiteChapter 22 - Change in Control & Tax TreatmentcasarokarNoch keine Bewertungen

- Chapter 19 - Final Tax & Final Tax ReturnDokument1 SeiteChapter 19 - Final Tax & Final Tax ReturncasarokarNoch keine Bewertungen

- Chapter 7 - Tax Exempt Organizations & Exempted Amounts-UpdatedDokument9 SeitenChapter 7 - Tax Exempt Organizations & Exempted Amounts-UpdatedcasarokarNoch keine Bewertungen

- कम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMDokument18 Seitenकम्प्यूटर विजक सम्वन्धी कार्यविधि, २०७१6222015 23932 PMBijay PoudelNoch keine Bewertungen

- Chapter 17 - Set Off & Carry Forward of LossesDokument3 SeitenChapter 17 - Set Off & Carry Forward of LossescasarokarNoch keine Bewertungen

- Chapter 18 - Installment Tax & Estimated Tax ReturnDokument1 SeiteChapter 18 - Installment Tax & Estimated Tax ReturncasarokarNoch keine Bewertungen

- Chapter 20 - Tax AssessmentDokument1 SeiteChapter 20 - Tax AssessmentcasarokarNoch keine Bewertungen

- Chapter 4 - Basis of Taxation-UpdatedDokument1 SeiteChapter 4 - Basis of Taxation-UpdatedcasarokarNoch keine Bewertungen

- Chapter 9 - Tax Rates-UpdatedDokument4 SeitenChapter 9 - Tax Rates-UpdatedcasarokarNoch keine Bewertungen

- Chapter 15 - Treatment of DonationDokument1 SeiteChapter 15 - Treatment of DonationcasarokarNoch keine Bewertungen

- Chapter 16 - Miscellaneous Provisions For Characterization & QuantificationDokument3 SeitenChapter 16 - Miscellaneous Provisions For Characterization & QuantificationcasarokarNoch keine Bewertungen

- Chapter 13 - Income From InvestmentDokument2 SeitenChapter 13 - Income From InvestmentcasarokarNoch keine Bewertungen

- Chapter 14 - Disposal of Assets & LiabilitiesDokument5 SeitenChapter 14 - Disposal of Assets & LiabilitiescasarokarNoch keine Bewertungen

- Chapter 10 - Business Concessions & Facilities-UpdatedDokument3 SeitenChapter 10 - Business Concessions & Facilities-UpdatedcasarokarNoch keine Bewertungen

- Chapter 6 - Assessable Income & Source of Income-UpdatedDokument2 SeitenChapter 6 - Assessable Income & Source of Income-UpdatedcasarokarNoch keine Bewertungen