Beruflich Dokumente

Kultur Dokumente

Oculus Acquisition

Hochgeladen von

sebastoaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Oculus Acquisition

Hochgeladen von

sebastoaCopyright:

Verfügbare Formate

Oculus Acquisition

Acquisition

In march 25th, 2014 Facebook announced the acquisition of an enterprise named

Oculus, which this strategy is willing revolutionize the social network industry.

Facebook has been acquiring enterprises which help to improve the experience of

the users using its social platform in face recognition, games, quality image and

others. Nevertheless, this acquisition is different from the pattern of Facebook

scope which it might jeopardize the stock prices due to the uncertainty of this

Acquisition.

Before going into deeper investigation about this acquisition, lets have a

brief profile of what is Oculus. Oculus is an enterprise which develops technology

for virtual reality like 3-D video games. This acquisition seems to wander everyone

because it is quite off from the Facebook core business.

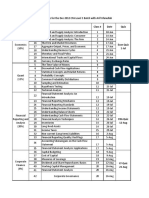

The deal for the acquisition of Oculus was about 2 billion US dollars, which

was made by cash and Facebook stocks. The acquisition was announced on

March but until July of the same year the transaction was completed. The

transaction was about $400 million in cash and issued 23 million shares of our

Class B common stock and $60 million in cash will be payable contingent upon the

completion of certain milestones (Report, 2014). The stock price was fixed taking

as a base the average from the 20 trading days preceding March 21 which was

$69.35.

As we can see on the following chart, there are other factors that could

affect the total amount of the transaction. It was expected to be 2 billion but at the

end the purchase consideration was $1,853.

The capital structure of Facebook will be affected because of the use of

existing stocks and cash for the acquisition affecting its assets as well as the

liabilities, debt will not be affected because they did not raise money from a bank or

a financial institution.

The enterprise Value is: $143,589,386,032

This new evaluation will be assumed in the perfect capital market due to limited

information to calculate the Tax shield.

Stock Price

The stock price of Facebook when the acquisition was announced, the price

at March 25 was at $64.89 after that it dropped to $60.38. To consider this sink of

prices there has to be done some assumptions to see what could have caused this

drop of prices.

The first assumption is when shareholders know that this acquisition might

be risky due to the size of deal vs the size of the acquirer the stock price might be

affected. Nevertheless, in this case Facebook is a big company which has $4,384

million in cash, which represents 9.12% and 574,020,314 shares of class B, which

represents 4%. From this we can see it is not risky.

The second assumption as it is mentioned before, this acquisition is not

risky in terms on level of debt because Facebook did not use debt or ask for a loan

to do the acquisition.

Eliminating this two assumptions, which could have happened to the price

on the market is due to the uncertainty of the new Facebook acquisition. The

lowest price between the announcement and the closure was $56.14, and to

recover back again to the fixed price that was set for the purchase $69.35; it took 4

months, 21 July. Between this period was a lot of vague vision of where Oculus

and Facebook were actually aiming but at the end it succeeded obtaining higher

share values in the long run.

Facebook vs Twitter vs Linkedin

Moving on to comparing these three enterprises which are in the same

industry of social network, it needs to be analysed how the behaviour of Facebook

might or might not affect the others behaviour.

Looking at the graph comparing the three social network platforms by just look at

them, it can be seen there is a correlation among them affecting Twitter and

Linkedin when Facebook acquired Oculus. The other two recovers as well as

Facebook does.

References:

Acquire Media. (2014). Facebook to Acquire Oculus. Recovered from:

https://s21.q4cdn.com/399680738/files/doc_news/2014/FB_News_2014_3_25_Fi

nancial_Releases.pdf

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- How To Use Volume Oscillator To Boost Your ProfitsDokument15 SeitenHow To Use Volume Oscillator To Boost Your ProfitsJoe D100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Sssyuy PDFDokument452 SeitenSssyuy PDFAnonymous HgC3Dx3ybNoch keine Bewertungen

- AirThread G015Dokument6 SeitenAirThread G015Kunal MaheshwariNoch keine Bewertungen

- Dispersion Trading HalleODokument29 SeitenDispersion Trading HalleOHilal Halle OzkanNoch keine Bewertungen

- Strategic Financial Management - Pakistan Cement IndustryDokument21 SeitenStrategic Financial Management - Pakistan Cement IndustryAli AhmedNoch keine Bewertungen

- شرح شابتر 3Dokument27 Seitenشرح شابتر 3Ahmad RahhalNoch keine Bewertungen

- Laporan Keuangan Triwulan 1 Good PDFDokument102 SeitenLaporan Keuangan Triwulan 1 Good PDFRudi Cawir Tuahta GintingNoch keine Bewertungen

- SG - FSDokument20 SeitenSG - FSRoxieNoch keine Bewertungen

- Emerging Value Capital Management, LLC: February 2009 Letter To InvestorsDokument5 SeitenEmerging Value Capital Management, LLC: February 2009 Letter To InvestorsL032090Noch keine Bewertungen

- Quiz 1 - Attempt ReviewDokument7 SeitenQuiz 1 - Attempt ReviewViky Rose EballeNoch keine Bewertungen

- Financial Derivatives in Diff ProspectDokument7 SeitenFinancial Derivatives in Diff ProspectNishantNoch keine Bewertungen

- CA 3 and SolutionsDokument8 SeitenCA 3 and SolutionsKatrin WidjajaNoch keine Bewertungen

- AnswerQuiz - Module 8Dokument4 SeitenAnswerQuiz - Module 8Alyanna AlcantaraNoch keine Bewertungen

- As of 12 AmDokument18 SeitenAs of 12 AmTristan GarciaNoch keine Bewertungen

- Amfi PPT-1Dokument209 SeitenAmfi PPT-1Nilesh TodarmalNoch keine Bewertungen

- CH # 12, Marketing Channels - Delivering Customer ValueDokument41 SeitenCH # 12, Marketing Channels - Delivering Customer ValueSaad MunirNoch keine Bewertungen

- Business Simulation: Rubyrosa C. Nazal Teacher IIDokument22 SeitenBusiness Simulation: Rubyrosa C. Nazal Teacher IINeighvestNoch keine Bewertungen

- Guide To TX3 (Version 1.0.0)Dokument44 SeitenGuide To TX3 (Version 1.0.0)arhagarNoch keine Bewertungen

- Series A, B, C Funding: How It WorksDokument2 SeitenSeries A, B, C Funding: How It WorksSachin KhuranaNoch keine Bewertungen

- Module - 2 Informal Risk Capital & Venture CapitalDokument26 SeitenModule - 2 Informal Risk Capital & Venture Capitalpvsagar2001Noch keine Bewertungen

- Moody's Investor DayDokument44 SeitenMoody's Investor Daymaxbg91Noch keine Bewertungen

- Persistent Systems - One PagerDokument3 SeitenPersistent Systems - One PagerKishor KrNoch keine Bewertungen

- Q3 2022 - Sequoia Fund LetterDokument2 SeitenQ3 2022 - Sequoia Fund LetterjshethNoch keine Bewertungen

- DuPont Profitability ModelDokument1 SeiteDuPont Profitability ModelcwkkarachchiNoch keine Bewertungen

- Gmail - From Dave Hafer - Global Finance LLCDokument2 SeitenGmail - From Dave Hafer - Global Finance LLCSam'ani Suryansyah0% (1)

- Amul PresentationDokument21 SeitenAmul PresentationpkdobariyaNoch keine Bewertungen

- Application of Money - Time RelationshipsDokument8 SeitenApplication of Money - Time RelationshipsMahusay Neil DominicNoch keine Bewertungen

- Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17 Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Dokument38 SeitenTest Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17 Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Karen CaelNoch keine Bewertungen

- Dec 2017 CFA Level 1 ScheduleDokument2 SeitenDec 2017 CFA Level 1 ScheduleSyed AhmadNoch keine Bewertungen

- Mindtree ISDokument6 SeitenMindtree ISAswini Kumar BhuyanNoch keine Bewertungen