Beruflich Dokumente

Kultur Dokumente

The Thriving Malware Industry: Cybercrime Made Easy

Hochgeladen von

Jayesh NowbuthOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Thriving Malware Industry: Cybercrime Made Easy

Hochgeladen von

Jayesh NowbuthCopyright:

Verfügbare Formate

IBM Software

January 2014

Thought Leadership White Paper

The thriving malware industry:

Cybercrime made easy

Technology and processes from Trusteer help your organization combat

malware-driven fraud and achieve sustainable threat prevention

Contents

1 Introduction

1 Seven basic steps for conducting malware-driven

financial fraud

7 Protecting against cybercrime with Trusteer

11 For more information

11 About IBM Security solutions

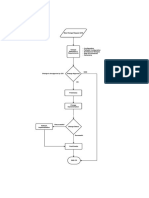

Seven basic steps for conducting

malware-driven financial fraud

A vast array of tools and infrastructure services is available to

aid cybercriminals engaged in fraudulent activities. However,

for the sake of simplicity, this white paper will focus on one

type of fraudulent activityonline banking fraud. Executing

malware-driven fraud from the planning stage to the cash-out

stage requires that cybercriminals follow seven basic steps:

Introduction

The malware industry supplies all the components

cybercriminals need to easily perpetrate malware-driven

financial fraud and data theft. In todays virtual world, the

scope of organizations vulnerable to malware-driven

cybercrime is quite broad. In addition to banks and credit

unions that are subject to online banking fraud, financial fraud

can be perpetrated on insurance companies, payment services,

large e-commerce companies, airlines and many others.

Most attacks do not target an organizations systems directly,

but rather, their customer and employee endpoints. The reason

for this is that organizations have invested substantially in

multiple layers of security, such as firewalls, intrusion

prevention systems and anti-virus gateways, in order to filter

out cybercriminals on the perimeter. Conversely, for endpoint

security, organizations have leveraged anti-virus software,

which often detects less than 40 percent of financial malware.1

Consequently, cybercriminals focus efforts on conducting

malware-driven cybercrime, utilizing malware on user

endpoints to commit financial fraud and steal sensitive data.

Step 1: Understanding online banking attacks

Step 2: Setting up the supporting infrastructure

Step 3: Obtaining and configuring malware

Step 4: Infecting a significant number of end users

Step 5: Avoiding detection by anti-virus applications

Step 6: Malware attacksExecuting fraudulent transactions

Step 7: Cashing outWithdrawing the stolen funds

Step 1: Understanding online banking attacks

Successfully orchestrating fraud requires in-depth understanding of malware technology and how to set up the supporting

infrastructureoften referred to as cybercrime prepping.

As with most other disciplines, materials on how to perpetrate

online banking fraud are readily available for free on the web,

including documents, forums and even training videos. In addition, more formalized training is available for a fee.

Furthermore, recent research by Trusteer, an IBM company,2

has identified training courses for creating malicious botnets

that is, networks of compromised endpoints centrally

The thriving malware industry: Cybercrime made easy

Firewall

revention s

ion p

yst

rus

em

t

n

us gatew

I

ti-vir

a

n

y

A

yp

Encr tion

Anti-virus

Pe

rim

ete

ty

uri

ec

urity

sec

io nt

rs

En

dp

Cybercrime using malware on endpoints

Easy

Endpoint

user

Sensitive data

and applications

Easy

Difficult

Cybercriminals

controlled by malware operators. These courses discuss

malware botnet installation and modification, as well as how to

write web-inject code or web-page alterations and custom

scripts. The training programs are well organized and include

fully developed lessons with training guides and videosall

delivered in English. The companies claim that their customers

do not require any special programming skills. The training

package is equipped with unlimited versions of malware kits

such as Zeus, SpyEye with modules and web injects.

Step 2: Setting up the supporting infrastructure

Like any IT system, malware needs a sophisticated

infrastructure to function effectively. Malware installed on

end-user machines (comprising a botnet) requires an open

communication with a web-based cybercriminal commandand-control center. Upon infection, malware typically contains

a predefined set of malicious configurations that include a

target bank URL and web injects to perpetrate a man-in-thebrowser attack. However, not all information is included in the

initial configuration.

IBM Software

For example, payee or mule account information is extracted

on the fly from the command-and-control center. In some

cases, configurations that include new targeted banks and

modified attacks are also updated post-infection via the

command-and-control center. Malware that captures

credentials needs to send this information to an external

storage location, called a drop zone, which cybercriminals can

access to extract the information.

Effectively operating a malware botnet requires servers to host

command-and-control operations and credential drop sites.

However, a variety of hosting and command-and-control

services are available to cybercriminals online. One recent

service discovered by Trusteer intelligence advertised

bulletproof hosting services and dedicated servers for

hosting malicious malware. The service, according to the

advertisement, provides administrative tools, 24x7 technical

support and an abuse- or distributed-denial-of-service (DDoS)

attack-proof hosting service, which promises unlimited traffic

and anonymity to the owner.

Step 3: Obtaining and configuring malware

Although cybercriminals require malware to perpetrate attacks,

most cybercriminals do not have the technical skills or appetite

to invest in developing their own malware. This cybercrime

market gap has not escaped the eyes of hungry software

developers, who create and sell off-the-shelf malware

development kits that include the functionality required to

perpetrate financial fraud.

Obtaining malware development kits

Commonly used malware kits such as Zeus include malicious

functionalities that include key-logging, screen capturing,

HTML injections and certificate siphoning. Most malware

development kits also provide application programming

interfaces (APIs) that enable skilled cybercriminals to extend

the basic development kit with additional custom-built code.

As early as 2009, analysts estimated that the Zeus development

kit was used in botnets compromising more than 3.6 million

computers in the US alone.3 During 2012, the FBI arrested

more than 10 members of an international cybercrime network

suspected of using Zeus to steal more than USD70 million

from hacked US computers.4 Eventually, in May 2011, the

Zeus source code was leaked on several underground forums

and other channels, making it readily available at no cost.5

Configuring malware development kitsWeb injects

Malware development kits provide the technical platform

for conducting fraud, but it is still up to cybercriminals to

configure malware to address a specific target. A major

malware component, part of the attack configuration, is

called a web inject. Man-in-the-browser attacks require

cybercriminals to alter web pages of online banking websites

for example, by adding extra fields to collect credentials

information or, in more elaborate social engineering attacks, by

adding a set of pages that instruct users to install software or

provide strong authentication information.

Developing web injects for a fraud requires highly skilled web

developers and in-depth familiarity with the targeted website,

as each web inject is specifically crafted to address a specific

website. Nevertheless, cybercriminals lacking the relevant skill

set can buy web injects in the open market. A typical price for a

single web-inject pack is USD60, while an entire pack to target

several UK banks costs USD800. Typical update costs are

USD20 each. One online forum advertised the price for a large

pack of web injects at only USD15-20.6

The thriving malware industry: Cybercrime made easy

Step 4: Infecting a significant number of end users

Once cybercriminals obtain and configure malware, they need

to distribute the malware to infect their intended victims.

To facilitate this, cybercriminals offer a variety of malwaredistribution services for hire. As just one example, in

2011 Trusteer Intelligence identified cybercriminals who sell

infection services on the open market. For a minimum of

2,000 infections, one such service costs about 0.5 cents to

4.5 cents for each upload, depending on geography.7

Leveraging botnets

Some cybercriminals have been able to infect a large number

of end-user victim machines with malicious software, creating

networks of infected machines that are controlled remotely.

These are called botnets. Botnets are used for various

cybercriminal activities, such as denial-of-service (DoS) attacks

and sending spam. Machines that are part of a botnet are also

infected with malicious software called a downloader. This

software can download and install files on a machine without

the victims knowledge. To further capitalize on botnets,

cybercriminals offer to download and install software on host

machinesallowing cybercriminals, for a price, to provide

botnet owners with preconfigured financial malware to be

installed on botnet machines.

Drive-by downloads

Cybercriminals also infect end-user machines by creating

drive-by downloads, which exploit vulnerabilities in browsers

and operating systems. With this tactic, cybercriminals

incorporate exploit code into websites they set up or break

into. Once a website has been embedded with exploit code,

users are tricked into accessing the infected website instead of

the legitimate website. Spam email, short message service

(SMS) and fake social networking messages are common ways

of luring users to enter exploit-infected websites. Exploit code

kits are readily available for purchase on the open market, and

cybercriminals can take advantage of these tools to create exploit

code. However, not all cybercriminals possess the same level of

expertise or aptitude required to successfully use exploit code.

Instead, cybercriminals offer infection services

that leverage exploit code.

Step 5: Avoiding detection by anti-virus applications

Most end-user machines are protected by anti-virus software

designed to prevent systems from being infected by undesired

software such as financial malware. In response, effective

infection campaigns advertise ways to avoid detection by

anti-virus software. Anti-virus software vendors collect samples

of malware files and apply a mathematical function on them to

generate a unique signature for a given file. The software then

propagates the malware file signatures to all endpoints that

have the anti-virus application installed, so when a known

malicious file tries to infect the machine, it is blocked. Since

anti-virus protection is based on unique file signatures,

cybercriminals have devised ways to frequently change

malware files without changing the underlying Crime Logic

or coding effort.

Polymorphic crypting

Crypting or polymorphic crypting of files is a common

method of generating different malware files with different

signatures. However, the crypting process requires savvy

technical personnel. Cybercriminals have addressed this need

by introducing file-crypting services that are widely advertised

on black market forums. According to a recent advertisement,

cybercriminals offer polymorphic crypting of malware files

with their custom-designed cryptor, which supports all types

of operating systems. The crypted files are used to bypass

anti-virus security, inject system processes and launch other

attacks.

IBM Software

Anti-virus checkers

Anti-virus checker services allow criminals to determineprior

to releasewhether a specific malware file is detectable by

anti-virus solutions. The service includes setting up multiple

virtual environments with a variety of up-to-date versions of

commonly used anti-virus software, and attempting to infect

these environments with a malware sample.

Step 6: Malware attacksExecuting fraudulent

transactions

Online banking malware fraud can require multiple stages of

attack at different stages of the process.

1. On login, cybercriminals use man-in-the-browser attacks to

steal credentials from users logging in to legitimate banking

websites. These attacks can inject fields into the login screen

and obtain credentials even if they are entered via a virtual

keyboard or two-factor authentication, such as requirements

for one-time passwords.

2. Post-login, immediately after authenticating to an online

banking website, malware can inject and subsequently

capture an HTML page that requests additional credentials

information from the user for security reasons. Other

post-login attacks consist of sophisticated man-in-the-browser

techniques that redirect one-time passwords sent via SMS

to cybercriminals8 or convince end users through social

engineering to perform the fraudulent transaction

themselves.

3. In-transaction malware can piggyback on an authenticated

money transfer transaction, changing its content on the

flyfor example, changing the payee and the amount.

4. Post-transaction malware conceals the fraudulent activity

from the end user. Trusteer research has identified malware

hiding confirmation messages and modifying the balance

and transaction details presented to the end user.9 The FBI

has warned users about a new type of post-transaction attack

that leverages DDoS to prevent fraudulent transactions from

being reversed.10

Login with additional malware-injected fields

(Generated Token Password and Wire PIN)

The thriving malware industry: Cybercrime made easy

Step 7: Cashing outWithdrawing the stolen funds

Eventually, cybercriminals need to access the money they have

stolen and to do so without leaving any trail that would lead

back to them. Since most online banking transfers leave

digital footprints, successful fraud requires cybercriminals

to cash out fundsthat is, withdraw them from ATMs and

via wire transfersafter which the money is not traceable.

Cybercriminals use various techniques to hire people who

perform this cash-out process. Typically unaware of the illegal

nature of their actions, these people are known as mules.

or mule-type services. These criminals, who also sell stolen

credit cards and bank-user details, charge commissions on the

transfers they make. The advertisers mainly offer bank

transfers and online money transfers via electronic money and

online payment systems. The commissions generally depend on

the amount transferred (discounts are often provided for high

amounts), but mostly range from 5 to 10 percent. Mule service

vendors compete with each other on transaction speed. Offered

transaction performance time is 15 to 45 minutes via payment

systems and a few hours via bank transfers.

However, not all cybercriminals have set up their own mule

network. This service is widely available online as well.

Trusteer research has found cybercriminals who advertise bank

transfers and cashing services for money laundering purposes,

Malware forms in a financial institutions web application

This screen appeared in respect to your Credentials confirmation.

Injected forms pretend to gather further credential information from the

customer under the pretense of Extra Identity Verification Required.

IBM Software

Protecting against cybercrime with

Trusteer

Rapid adaptation to emerging threatsThe Trusteer

Adaptive Protection process quickly turns zero-day attacks

into known Crime Logic and automatically integrates new

Crime Logic into Trusteer solutions to promptly detect and

help block these attacks on protected endpoints.

Real-time application protectionTrusteer Application

Protection technology transparently secures the browser

from zero-day advanced malware and phishing attacks. This

unique technology prevents malware from tampering with

the browser while immediately alerting Trusteer of any

abnormal behavior that could represent a new attack.

Hundreds of financial institutions and organizations and tens

of millions of their customers rely on Trusteer to protect their

computers and mobile devices from online fraud and data theft.

The global footprint, industry-standard technology and proven

processes offered by Trusteer enable our customers to achieve

sustainable cybercrime prevention and meet regulatory

compliance requirements.

The Trusteer difference

Crime Logic, not signaturesThrough intelligence

gathered from millions of protected endpoints, Trusteer

processes tens of thousands of fraud attempts every day into

Crime Logica unique, compact and actionable footprint of

fraud targets and tactics.

The Trusteer Adaptive Protection process

Analyze emerging

Crime Logic and create

removal and blocking

countermeasures

Secure applications

against malware and

phishing attacks

E

UR

AN

AL

E

YZ

SE

C

BL

CK

Block future malware

infections, phishing

and account takeover

VE

Adaptive

protection

RE

Remove malware

from infected

endpoints

The thriving malware industry: Cybercrime made easy

Trusteer Cybercrime Prevention Architecture

Trusteer Rapport

Trusteer offers multiple layers of protection across devices and

the transaction lifecycle.

Trusteer Rapport helps prevent malware from infecting

endpoints, secures the browser against tampering and data

theft, and provides automated remediation. The software

can help:

Trusteer Pinpoint

Trusteer Pinpoint provides financial institutions with clientless

detection of fraudulent activity, identifying malware-infected

web sessions and phishing attacks. Trusteer Pinpoint requires a

small change to the online banking application and can be

easily integrated with the banks fraud-prevention processes.

The software can help:

Prevent fraud by detecting malwareTrusteer Pinpoint

Malware Detection can detect malware infection and

underlying Crime Logic on endpoints accessing online

banking sites. The detection is performed in real time

without requiring software installation on the endpoint, is

transparent to the end user and has no impact on application

response time.

Identify phishing incidents in real timeTrusteer

Pinpoint Account Takeover Detection can identify phishing

and spear-phishing incidents in real time. It can detect

credentials lost through phishing and notifies the financial

institution. The user is immediately re-credentialed by the

financial institution to help block the fraudsters access to the

victims account.

Defend against a wide range of attacksTrusteer Rapport

helps prevent man-in-the-browser attacks and sensitive data

theft by locking down the browser and blocking malicious

key-logging and screen-capturing attempts. Trusteer

Rapport can block man-in-the-middle attacks by validating

that IP addresses and SSL certificates belong to the

legitimate site.

Prevent malware infections and remove existing

malwareOnce installed, Trusteer Rapport can remove

existing malware from end-user machines and help prevent

future infections by stopping attempts to exploit browser

vulnerabilities and install malware on the endpoint. Trusteer

Rapport also provides a simple way for fraud, IT security and

support teams to remediate threats on endpoints.

Stop phishing of sensitive dataTrusteer Rapport helps

prevent data theft by detecting suspected phishing sites on

first access by a protected user. Trusteer Rapport alerts the

user of a possible phishing attempt to help prevent data loss.

Trusteer experts verify, in near real time, that the site is in

fact malicious. The site is added to the Trusteer Rapport

blacklist to prevent other users from being phished.

IBM Software

Trusteer Cybercrime Prevention Architecture

Cybercrime intelligence

Crime Logic

Fraud alert

Crime

Logic

Analytics and

management

Financial

institutions

Trusteer Rapport

SE

C

Unknown

Crime Logic

BL

Trusteer Mobile Fraud Risk Prevention

Trusteer Mobile Fraud Risk Prevention helps organizations

to mitigate mobile fraud risk by addressing complex crosschannel attacks as well as the unique challenges presented by

the mobile channel. The software can help:

Assess mobile fraud risk and detect high-risk devices

based on multiple device risk factorsTrusteer Mobile

Risk Engine is designed to protect organizations against

mobile account takeover and high-risk mobile devices. It

detects mobile account takeover by correlating mobile device

and account risk factors (including geolocation, device time,

IP address, missing operating system security patches, rooted/

jailbroken device status, risky system configuration settings,

malware infections, use of unsecured WiFi connection and

more) across online and mobile channels, in real time, to

conclusively identify mobile channel fraud attempts.

CK

Known

Crime Logic

Adaptive

protection

AN

A

Adaptive

protection

Adaptive

protection

Trusteer

Intelligence Center

OV

Online

threats

E

UR

ZE

LY

Trusteer Pinpoint

Risk

assessment

RE

Provide secure mobile web accessTrusteer Mobile App

provides end users with a secure mobile browser that ensures

safe web access. Fake websites and man-in-the-middle

attacks are detected by the secure mobile browser, and end

users are prevented from accessing fraudulent sites. Device

risk factors are collected and provided to the organizations

website and Trusteer Mobile Risk Engine for mobile risk

assessment. Users are alerted to the existence of device risk

factors via a dedicated dashboard and receive step-by-step

guidance on how to mitigate them.

10 The thriving malware industry: Cybercrime made easy

Generate a persistent mobile device ID for unique device

identificationTrusteer Mobile SDK creates a persistent

mobile device ID, allowing the organization to uniquely

identify any device using the native mobile banking

application. The persistent device ID is associated with the

users account and uniquely identifies the device, even across

removal and re-installation of the mobile application. This

ensures that new devices are identified, login attempts from

known devices are not challenged and potential fraudster

devices are flagged.

Enable secure out-of-band authentication for login and

transactionsTrusteer Mobile Out-of-Band Authentication

enables secure transaction authorization and self-service

account lockdown. Organizations can push transaction

authorization requests to end users mobile devices to

validate account login and online transactions. End users can

lock down their online accounts to disable criminal access.

Multiple layers of security ensure out-of-band controls are

not compromised by malware on the mobile device.

Trusteer intelligence

Trusteer also offers a cloud-based management and intelligence

platform that provides deep insight into emerging Crime Logic

and helps enable quick mitigation of cybercrimes within the user

base. The platform provides:

Emerging Crime Logic analysis from millions of

endpointsA network of tens of millions of Trusteerprotected endpoints can continuously detect new threats

and propagate Crime Logic information to the Trusteer

cybercrime intelligence cloud. Trusteer Intelligence Center

experts use advanced data-mining and analysis tools to

identify new Crime Logic.

Intelligence for shaping the Trusteer portfolioTrusteer

Intelligence Center creates detection and protection

countermeasures that are immediately integrated into

Trusteer products to address emerging Crime Logic.

Cloud-based management and threat feedsTrusteer

Management Application provides centralized management

of Trusteer products, as well as alerts on malware and

phishing activity. Organizations can monitor endpoint

security, review the use of Trusteer services and respond to

alerts about specific threats. In addition, security teams can

use detection alerts to help stop threats by performing

mitigation activities, such as suspending transactions,

patching endpoints, taking down phishing sites, removing

malware from endpoints and elevating risk scores on risk

engines.

IBM Software 11

For more information

To learn more about Trusteer solutions for cybercrime prevention, please contact your IBM representative or IBM Business

Partner, or visit the following website: ibm.com/Security

About IBM Security solutions

IBM Security offers one of the most advanced and integrated

portfolios of enterprise security products and services. The

portfolio, supported by world-renowned IBM X-Force

research and development, provides security intelligence

to help organizations holistically protect their people,

infrastructures, data and applications, offering solutions for

identity and access management, database security, application

development, risk management, endpoint management,

network security and more. These solutions enable

organizations to effectively manage risk and implement

integrated security for mobile, cloud, social media and other

enterprise business architectures. IBM operates one of the

worlds broadest security research, development and delivery

organizations, monitors 15 billion security events per day in

more than 130 countries, and holds more than 3,000 security

patents.

Additionally, IBM Global Financing can help you acquire the

software capabilities that your business needs in the most

cost-effective and strategic way possible. Well partner with

credit-qualified clients to customize a financing solution to suit

your business and development goals, enable effective cash

management, and improve your total cost of ownership. Fund

your critical IT investment and propel your business forward

with IBM Global Financing. For more information, visit:

ibm.com/financing

5 Peter

Kruse, Complete ZeuS sourcecode has been leaked to the masses,

CSIS Blog, May 9, 2011. http://csis.dk/en/csis/blog/3229

6 Amit

Klein, Webinjects for Sale on the Underground Market,

Trusteer Blog, November 02, 2011. http://www.trusteer.com/blog/

webinjects-sale-underground-market

7 Amit

Klein, Cybercrime Services Ramp Up to Provide One-Stop-Shop

to Meet Demand from Fraudsters, Trusteer Blog, November 30, 2011.

http://www.trusteer.com/blog/cybercrime-services-ramp-provide-one-stop

shop-meet-demand-fraudsters

8 Amit

Klein, SpyEye Changes Phone Numbers to Hijack Out-of-band

SMS Security, Trusteer Blog, October 05, 2011. http://www.trusteer.com/

blog/spyeye-changes-phone-numbers-hijack-out-band-sms-security

9 Amit

Klein, Gift Wrapped Attacks Concealed Online Banking Fraud

during 2011 Holiday Season, Trusteer Blog, January 04, 2012.

http://www.trusteer.com/blog/gift-wrapped-attacks-concealed-online

banking-fraud-during-2011-holiday-season

10 Amit

Klein, Post Transaction Attacks Expose Weaknesses in

Fraud Prevention Controls, Trusteer Blog, January 17, 2012.

http://www.trusteer.com/blog/post-transaction-attacks-expose-weaknesses

fraud-prevention-controls

Please Recycle

WGW03046-USEN-00

Das könnte Ihnen auch gefallen

- CEH: Certified Ethical Hacker v11 : Exam Cram Notes - First Edition - 2021Von EverandCEH: Certified Ethical Hacker v11 : Exam Cram Notes - First Edition - 2021Noch keine Bewertungen

- Agent Banking ManualDokument12 SeitenAgent Banking ManualShafiqulHasanNoch keine Bewertungen

- Chapter 1 Cybersecurity and The Security Operations CenterDokument9 SeitenChapter 1 Cybersecurity and The Security Operations Centeradin siregarNoch keine Bewertungen

- JNCIA Junos P2 - 2012 12 20Dokument48 SeitenJNCIA Junos P2 - 2012 12 20hadi_khanNoch keine Bewertungen

- JNCIA Junos P2 - 2012 12 20Dokument48 SeitenJNCIA Junos P2 - 2012 12 20hadi_khanNoch keine Bewertungen

- JNCIA Junos P2 - 2012 12 20Dokument48 SeitenJNCIA Junos P2 - 2012 12 20hadi_khanNoch keine Bewertungen

- The Thriving Malware Industry: Cybercrime Made EasyDokument12 SeitenThe Thriving Malware Industry: Cybercrime Made EasyCao Minh TríNoch keine Bewertungen

- Cyber SecurityDokument74 SeitenCyber SecurityDhamodaran SrinivasanNoch keine Bewertungen

- Typology of Cyber-CrimeDokument7 SeitenTypology of Cyber-CrimeNamit BaserNoch keine Bewertungen

- NS HaDokument9 SeitenNS HaSWAROOP PATILNoch keine Bewertungen

- Cyber CrimeDokument3 SeitenCyber CrimeShibaji BiswasNoch keine Bewertungen

- Cyber SecurityDokument17 SeitenCyber Securitymdiru2323Noch keine Bewertungen

- Materi Chpt.5 E-Commerce Security and Payment SystemsDokument37 SeitenMateri Chpt.5 E-Commerce Security and Payment Systemsdonny antaraNoch keine Bewertungen

- Winning The Online Banking War: Sean Park Senior Malware Scientist TrendmicroDokument32 SeitenWinning The Online Banking War: Sean Park Senior Malware Scientist TrendmicroRadamés T.Noch keine Bewertungen

- What Is RansomwareDokument6 SeitenWhat Is RansomwareGerald TorresNoch keine Bewertungen

- Malware: Iii. Motives To Create Mobile MalwareDokument10 SeitenMalware: Iii. Motives To Create Mobile MalwareNida NawazNoch keine Bewertungen

- MalwaresDokument14 SeitenMalwaresAMY MANSNoch keine Bewertungen

- "Any Crime That Involves A Computer and A Network Is Called A "Computer Crime" or "Cyber Crime"Dokument23 Seiten"Any Crime That Involves A Computer and A Network Is Called A "Computer Crime" or "Cyber Crime"Andy yelweNoch keine Bewertungen

- BTIT603: Cyber and Network Security: BotnetDokument15 SeitenBTIT603: Cyber and Network Security: BotnetKajalNoch keine Bewertungen

- Cyber CrimesDokument19 SeitenCyber Crimesmalik hadiaNoch keine Bewertungen

- Eb 5Dokument17 SeitenEb 5Md. Wahid Abdul HoqueNoch keine Bewertungen

- Cyber Security AssignmentDokument7 SeitenCyber Security AssignmentAhmaddNoch keine Bewertungen

- Topic 5 Malware and Cyber AttackDokument6 SeitenTopic 5 Malware and Cyber AttackJohn Mark DaludadoNoch keine Bewertungen

- RP HOD NewDokument14 SeitenRP HOD NewkhyatiNoch keine Bewertungen

- Unit Internet SecurityDokument29 SeitenUnit Internet Securitykapinga0609Noch keine Bewertungen

- RISKSDokument5 SeitenRISKSCarleen Grace DeleonNoch keine Bewertungen

- 01-05 Pds Cyber Crime Its Types 3rd GdeDokument57 Seiten01-05 Pds Cyber Crime Its Types 3rd GdeMANOJ KUMARNoch keine Bewertungen

- E Business AnswersDokument20 SeitenE Business AnswersNIKHIL ARORANoch keine Bewertungen

- Data AlterationDokument13 SeitenData AlterationVicky SharmaNoch keine Bewertungen

- Debate TopicDokument5 SeitenDebate Topicdenielnaceno76Noch keine Bewertungen

- Cyber Attack NotesDokument4 SeitenCyber Attack NotesCindy The GoddessNoch keine Bewertungen

- Cyber SecurityDokument3 SeitenCyber Securitykschauhan8007Noch keine Bewertungen

- Cyber Related Challenges and SolutionDokument5 SeitenCyber Related Challenges and Solutionfelix feluNoch keine Bewertungen

- Modlue 4: Cybersecurity Awareness: ObjectivesDokument9 SeitenModlue 4: Cybersecurity Awareness: ObjectivesJulie RamosNoch keine Bewertungen

- Cyber SecurityDokument5 SeitenCyber Securityjoel pabadoraNoch keine Bewertungen

- Seminar ReportDokument19 SeitenSeminar ReportSahil Sethi100% (1)

- 01-05 Pds Cyber Crime Its Types 3rd GdeDokument57 Seiten01-05 Pds Cyber Crime Its Types 3rd GdeKumar GauravNoch keine Bewertungen

- Let The Picture SpeakDokument6 SeitenLet The Picture SpeakASHA KAINDALNoch keine Bewertungen

- Computer Internet Compromised Hacker Computer Virus Trojan Horse BotnetDokument6 SeitenComputer Internet Compromised Hacker Computer Virus Trojan Horse BotnetHaider AbbasNoch keine Bewertungen

- COM 426 COMPUT4R SECURITY COURSE NOTEpdfDokument18 SeitenCOM 426 COMPUT4R SECURITY COURSE NOTEpdfAhmed SaliuNoch keine Bewertungen

- Network Security (Cao S Minh-19071616)Dokument18 SeitenNetwork Security (Cao S Minh-19071616)Sy Minh CaoNoch keine Bewertungen

- TYPES OF COMPUTER ATTACKS Group#5Dokument27 SeitenTYPES OF COMPUTER ATTACKS Group#5Kathryn Ann Garro FlorentinoNoch keine Bewertungen

- DocumentDokument16 SeitenDocumentVaibhav BhardwajNoch keine Bewertungen

- ITB 2021-22 - Session 5-6 - Cybersecurity and PrivacyDokument54 SeitenITB 2021-22 - Session 5-6 - Cybersecurity and Privacyriya lakhotiaNoch keine Bewertungen

- Ransom WareDokument20 SeitenRansom WareAri WibowoNoch keine Bewertungen

- Topic-Types of Cyber Crime Submitted To: Ms. Mahima Dabas Submitted By: Ashish Rathi Roll No. 170118546Dokument11 SeitenTopic-Types of Cyber Crime Submitted To: Ms. Mahima Dabas Submitted By: Ashish Rathi Roll No. 170118546SANSKRITINoch keine Bewertungen

- Clop RansomwareDokument20 SeitenClop RansomwareJohn Kenneth CabreraNoch keine Bewertungen

- Cybersecurity: Categories of CybercrimeDokument6 SeitenCybersecurity: Categories of Cybercrimeamna100% (1)

- Information Assurance and CybersecurityDokument18 SeitenInformation Assurance and Cybersecurityzahra zahidNoch keine Bewertungen

- What Is Cybersecurity and Why It Is ImportantDokument22 SeitenWhat Is Cybersecurity and Why It Is ImportantOgieva ElvisNoch keine Bewertungen

- Security PrivacyDokument54 SeitenSecurity PrivacyMabini, Michael Ray M.Noch keine Bewertungen

- FOC Unit-5 Part-IIDokument7 SeitenFOC Unit-5 Part-IINarendra SahuNoch keine Bewertungen

- B Symantec Web Security Threat Report 1 en UsDokument41 SeitenB Symantec Web Security Threat Report 1 en UsChico MtzNoch keine Bewertungen

- IETE-COE - PPT - Overview of Cybersecurity Threats, Vunerabilities and AttacksDokument33 SeitenIETE-COE - PPT - Overview of Cybersecurity Threats, Vunerabilities and AttacksreshmiprNoch keine Bewertungen

- Reading Organizer Answer Key: Name - DateDokument8 SeitenReading Organizer Answer Key: Name - DateFrancis Carlo de GuzmanNoch keine Bewertungen

- ETL2020 - Web Based Attacks A4Dokument20 SeitenETL2020 - Web Based Attacks A4marsilioficinusNoch keine Bewertungen

- Lab 1 - Cybersecurity at A GlanceDokument9 SeitenLab 1 - Cybersecurity at A GlancePhạm Trọng KhanhNoch keine Bewertungen

- CybercrimeDokument15 SeitenCybercrimeKunaal SaxenaNoch keine Bewertungen

- Web SecurityDokument8 SeitenWeb SecurityAniket ShetyeNoch keine Bewertungen

- Finals Acis Reviewer TOPIC: Robot Network (BOTNET) Botnet (Short For Robot Network)Dokument7 SeitenFinals Acis Reviewer TOPIC: Robot Network (BOTNET) Botnet (Short For Robot Network)lonely ylenolNoch keine Bewertungen

- Cybercrime Understanding The Online Business Model (NCSC)Dokument12 SeitenCybercrime Understanding The Online Business Model (NCSC)Hema OganiaNoch keine Bewertungen

- 10 Tips To Prevent Malware and Computer Viruses - Reader ModeDokument15 Seiten10 Tips To Prevent Malware and Computer Viruses - Reader Modeedward nodzoNoch keine Bewertungen

- BS (Hons.) Information Technology: University of OkaraDokument9 SeitenBS (Hons.) Information Technology: University of OkaraAbdul Manan SajidNoch keine Bewertungen

- E Commerce 10Dokument65 SeitenE Commerce 10premaNoch keine Bewertungen

- Server Room StandardDokument3 SeitenServer Room Standardphoenix021Noch keine Bewertungen

- 312 50Dokument286 Seiten312 50Jayesh NowbuthNoch keine Bewertungen

- Change ManagementDokument1 SeiteChange ManagementJayesh NowbuthNoch keine Bewertungen

- Cisco Asa Book 2401Dokument4 SeitenCisco Asa Book 2401Jayesh NowbuthNoch keine Bewertungen

- Huawei Cisco Xref Switch CLI PDFDokument83 SeitenHuawei Cisco Xref Switch CLI PDFZoyeb ManasiyaNoch keine Bewertungen

- Server Room StandardDokument3 SeitenServer Room Standardphoenix021Noch keine Bewertungen

- Armani Casa Interior Design CatalogueDokument45 SeitenArmani Casa Interior Design CatalogueSimona David100% (1)

- SB On Demand Cloud Security MicrosoftAzureDokument3 SeitenSB On Demand Cloud Security MicrosoftAzureJayesh NowbuthNoch keine Bewertungen

- Internet Protocol Journal Vol2 Issue 3Dokument32 SeitenInternet Protocol Journal Vol2 Issue 3Jayesh NowbuthNoch keine Bewertungen

- Fort I Net BrochDokument12 SeitenFort I Net BrochJayesh NowbuthNoch keine Bewertungen

- Ebook ENT FW PDFDokument14 SeitenEbook ENT FW PDFJayesh NowbuthNoch keine Bewertungen

- NSE 1: The Threat Landscape: Study GuideDokument30 SeitenNSE 1: The Threat Landscape: Study Guidejosu_rc67% (3)

- Ebook ENT FW PDFDokument14 SeitenEbook ENT FW PDFJayesh NowbuthNoch keine Bewertungen

- WP SDN Security Framework UpdatedDokument5 SeitenWP SDN Security Framework UpdatedJayesh NowbuthNoch keine Bewertungen

- Huawei DslamsDokument53 SeitenHuawei DslamsMMohamed274100% (2)

- BMPL Tower 3Dokument1 SeiteBMPL Tower 3Jayesh NowbuthNoch keine Bewertungen

- CEB IT Infrastructure ITIL V3 Cheat Sheets PreviewDokument2 SeitenCEB IT Infrastructure ITIL V3 Cheat Sheets PreviewJayesh NowbuthNoch keine Bewertungen

- AdslDokument3 SeitenAdslJayesh NowbuthNoch keine Bewertungen

- HCNA-HNTD Intermediate Training Guide v2.1Dokument362 SeitenHCNA-HNTD Intermediate Training Guide v2.1MiztliCanekNoch keine Bewertungen

- CEB IT Infrastructure ITIL V3 Cheat Sheets PreviewDokument6 SeitenCEB IT Infrastructure ITIL V3 Cheat Sheets PreviewThuyaNoch keine Bewertungen

- Internet Protocol Journal Vol2 Issue 3Dokument32 SeitenInternet Protocol Journal Vol2 Issue 3Jayesh NowbuthNoch keine Bewertungen

- Truman Boyes-Next Generation BRASDokument25 SeitenTruman Boyes-Next Generation BRASJayesh NowbuthNoch keine Bewertungen

- NationDokument1 SeiteNationJayesh NowbuthNoch keine Bewertungen

- Wawa - Docx ManuelDokument1 SeiteWawa - Docx ManuelJayesh NowbuthNoch keine Bewertungen

- JavaDokument2 SeitenJavaJayesh NowbuthNoch keine Bewertungen

- Balance Sheet Question CAIIB ExamDokument8 SeitenBalance Sheet Question CAIIB ExamRaja J SahuNoch keine Bewertungen

- Wst1034 Chess Sponsorship and Issuer Sponsored TransferDokument2 SeitenWst1034 Chess Sponsorship and Issuer Sponsored Transferadam sandsNoch keine Bewertungen

- UCP600Dokument21 SeitenUCP600MingHDynasty100% (1)

- A Study On AtmDokument143 SeitenA Study On AtmAbhishek PandeyNoch keine Bewertungen

- PDFDokument7 SeitenPDFClaytonNoch keine Bewertungen

- Case Hamilton Jacobs JPYDokument3 SeitenCase Hamilton Jacobs JPYAndré Felipe de MedeirosNoch keine Bewertungen

- R35 The Term Structure and Interest Rate Dynamics Slides PDFDokument53 SeitenR35 The Term Structure and Interest Rate Dynamics Slides PDFPawan RathiNoch keine Bewertungen

- Memorandum of UnderstandingDokument2 SeitenMemorandum of UnderstandingAnmolNoch keine Bewertungen

- BHPetrol Reload PromoDokument10 SeitenBHPetrol Reload PromoAhmad FadzilNoch keine Bewertungen

- 14 PPT-Slides-Sept-14-2023Dokument28 Seiten14 PPT-Slides-Sept-14-2023valmadridhazelNoch keine Bewertungen

- Elements of Accounting LectureDokument43 SeitenElements of Accounting LectureRaissa Mae100% (1)

- G.R. No. 187769 (Digest)Dokument6 SeitenG.R. No. 187769 (Digest)Davy Pats100% (1)

- 1 (Read)Dokument259 Seiten1 (Read)Edris YawarNoch keine Bewertungen

- Law Finals ReviewerDokument4 SeitenLaw Finals ReviewerJohn Villacorte CondesNoch keine Bewertungen

- PAGE 19 and 22 Need To Sign: Uob Kay Hi An Se Curities (M) SDN BH DDokument24 SeitenPAGE 19 and 22 Need To Sign: Uob Kay Hi An Se Curities (M) SDN BH DTong Yen ChinNoch keine Bewertungen

- Working CapitalDokument72 SeitenWorking CapitalSyaapeNoch keine Bewertungen

- HDFCDokument18 SeitenHDFCMiral VadhanNoch keine Bewertungen

- Amin, Rahman, Razak, 2014, Theory of Islamic Consumer Behaviour An Empirical Study of Consumer Behaviour of Islamic Mortgage in MalaysiaDokument29 SeitenAmin, Rahman, Razak, 2014, Theory of Islamic Consumer Behaviour An Empirical Study of Consumer Behaviour of Islamic Mortgage in MalaysiaHanudin AminNoch keine Bewertungen

- Name Family Members & Friends Phone NombersDokument36 SeitenName Family Members & Friends Phone NombersNagaraj HalabhaviNoch keine Bewertungen

- Prime Bank LimitedDokument29 SeitenPrime Bank LimitedShouravNoch keine Bewertungen

- Acctg405 Q6Dokument2 SeitenAcctg405 Q6Baron MirandaNoch keine Bewertungen

- "New Customer Acquisition of IDBI Bank": A Project Report OnDokument55 Seiten"New Customer Acquisition of IDBI Bank": A Project Report OnGaganpreet SinghNoch keine Bewertungen

- 02 Time Value of MoneyDokument50 Seiten02 Time Value of MoneyFauziah Husin HaizufNoch keine Bewertungen

- Financial InstrumentsDokument15 SeitenFinancial InstrumentsSeo NguyenNoch keine Bewertungen

- Bank of Baroda Acquires Local Area Bank LTD: GujaratDokument8 SeitenBank of Baroda Acquires Local Area Bank LTD: GujaratAnkush BhoriaNoch keine Bewertungen

- Table No. 4.1: Capital & Liabilities of MEGA BANKDokument4 SeitenTable No. 4.1: Capital & Liabilities of MEGA BANKRawmess PanditNoch keine Bewertungen

- 10 Suico vs. Philippine National Bank 531 SCRA 514, August 28, 2007 PDFDokument20 Seiten10 Suico vs. Philippine National Bank 531 SCRA 514, August 28, 2007 PDFSamantha NicoleNoch keine Bewertungen

- People Soft Bundle Release Note 9 Bundle21Dokument21 SeitenPeople Soft Bundle Release Note 9 Bundle21rajiv_xguysNoch keine Bewertungen

- Final Project With FindingsDokument51 SeitenFinal Project With FindingsDivya PatelNoch keine Bewertungen