Beruflich Dokumente

Kultur Dokumente

Impact of Corporate Governance Practices On Firm Profitability-India

Hochgeladen von

nsrivastav1Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Impact of Corporate Governance Practices On Firm Profitability-India

Hochgeladen von

nsrivastav1Copyright:

Verfügbare Formate

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 53

Impact of Corporate Governance Practices on Firm Profitability: A study of Selected

Industries in India

Puneeta Goel

Amity College of Commerce and Finance,

Amity University, Noida, India

puneetagoel@gmail.com

R S Ramesh

Post Graduate Department of Management Studies,

JSSATE, Bangalore., India

raekawadin@yahoo.com

Abstract

Good corporate governance standards are essential for the integrity of corporations, financial

institutions and markets and have a bearing on the growth and stability of the economy. The new

Companies Act is a major milestone in the corporate governance sphere in India and is likely to

have significant impact on the governance of companies in the country. In the opinion of the

Securities and Exchange Board of India (SEBI), the imperative for corporate governance lies not

merely in having a code of corporate governance, but in practicing it. This study explored the

extent of corporate governance practices being followed and reported by Indian companies in

different industries and analyzed its impact on financial performance. There is a significant

correlation between total corporate governance score and Tobin Q ratio of market valuation,

however, individual parameters of corporate governance doesnt have any significant relationship

and impact on market valuation and profitability of the companies. There in a call for evolving

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 54

corporate accountability movement in India through well framed mandatory corporate reporting

guidelines covering all aspects of social, environment and economic performance.

Key Words: Corporate Governance, Independent Directors, Code of Ethics, Whistle blower,

Financial Performance.

Introduction

Creating strong corporate governance framework encourages flexibility, innovation and risk

management. It helps to ensure that companies take care of the interest of wide range of

stakeholders for whom it operates and makes the boards more accountable (Chatterjee D, 2011).

Over the past decade, India has made significant strides in the areas of corporate governance

reforms, which have improved public trust in the market. These reforms have been well received

by the investors, including the foreign institutional investors (FIIs).

The enactment of the company bill 2012 is major development in the directions of corporate

governance. The new bill replaces the Companies Act, 1956 and aims to improve corporate

governance standards, simplify regulations and enhance the interests of minority shareholders

(Prasanna, 2013). This paper aims at analyzing the corporate governance performance of Indian

companies after the introduction of the reforms in India.

Good Governance in capital market has always been high on the agenda of Security Exchange

Board of India (SEBI). Corporate Governance is looked upon as a distinctive brand and benchmark

in the profile of Corporate Excellence. This is evident from the continuous updating of guidelines,

rules and regulations by SEBI for ensuring transparency and accountability (Sehgal and Mulraj,

2007).

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 55

Corporate governance reforms assume critical significance for developing economies like India,

which is moving towards a more transparent and accountable system of economic governance

(Sanan and Yadav, 2011). Enacting corporate reforms, however, is significantly difficult than

framing those reforms. Thus, if the governance reforms have to occur, they have to take place in

the larger context of political and legal reforms that can enable society to exercise control over

companies (Ananya M R, 2002). In the opinion of the SEBI, the imperative for corporate

governance lies not merely in having a code of corporate governance, but in practicing it. What

counts is the way in which these are put to use.

Prior studies have investigated the relationship between mechanism of corporate governance and

financial performance of the companies. Taking different mechanisms for corporate governance

like size of board, number of independent directors, ownership pattern etc, there have been a

contradicting findings about the relationship between corporate governance disclosures and

financial performance. Therefore, this study identifies different mechanisms of corporate

governance based on past literature review and then explores the relationship between different

mechanisms of corporate governance disclosures and financial performance of the companies in

Indian context.

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 56

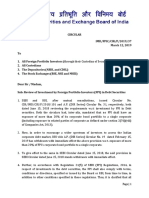

Figure 1: Theoretical Framework

Meetings of

Board

Independent

Directors

Tobin

Q

Risk

Management

Ethics

Committee

Corporate

Governance

ROS

Financial

Performance

Code of Ethics

Communication

of COE

ROCE

Legal cases

Whistle blower

Review of Literature

Corporate Governance disclosures signify the extent of ethical practice followed by the companies.

A lot of research has been done in this field adopting varying methodologies and presenting the

extent of disclosure done by companies and its impact on financial performance of the companies.

According to Sanan & Yadav (2011) India has adopted a series of reforms in corporate governance.

But this has brought only a moderate change in disclosure by the Indian companies. Chatterjee D

(2011) found that the top Indian Companies are providing bare minimum information required as

per regulations and even some of them are not disclosing the mandatory requirement. Sharma and

Singh (2009) reported that voluntary disclosures have improved with the introduction a reforms

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 57

but the extent of disclosure vary among the different companies selected for the study. Kaur and

Misra (2010) found that independent directors and concentrated ownership didnt affect the

ranking of the companies but good relations with external auditors and inspectors are a motivating

factor for effective governance and monitoring.

Bhasin (2012) found that there is no significant difference in the extent and quality of disclosures

made by Indian companies in selected industries. Bhardwaj and Rao (2014) also revealed a mix of

response towards corporate governance disclosure by Indian Companies. On an average 80% of

the companies follow the provisions regulatory.

Abatecola et al (2012) found that association between specific corporate governance variables and

corporate performance variables may be conflicting but overall corporate governance has a

significant statistical relationship with corporate performance variables like ROC, ROA etc. Sarpal

& Singh (2013) have also tried to establish a relationship between board and corporate

performance and found that there is no significant relationship between the two. Gomper et al

(2003) established a positive relationship between share holders rights and value of the companies.

On the other hand, Bauer et al (2004) found a negative relationship between companies having

high corporate governance ratings and performance based on earning and returns. Bhagat & Bolton

(2008) also found that corporate governance measures are not correlated to future stock market

performance.

Klapper & love (2002) found that the markets where legal system are weak, the firms are placed

at low ranking but good governance has positive correlation with performance and valuation even

in weak emerging economies. Maher and Anderson (1999) found that corporate governance

depend on the legal and regulatory framework in different countries. Kumar J. (2004) studied the

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 58

relationship between CG and firm performance in India contest. It was found that there was no

significant relation between foreign shareholding and performance of the companies. Patibandla

(2006) had a contrasting view on foreign shareholdings in Indian companies. He found that as the

investment by foreign investor increases in Indian companies, the profitability increases and thus

has a positive correlation with corporate governance. On the other hand the investment by

government institution investors decreases the performance of the companies.

Prasana (2013) found that reforms in corporate governance and implementation of clause 49 by

SEBI have made a significant impact on volatility of stock market in India. Bae and Goyal (2010)

found that good corporate governance practice adopted by Korean firm have resulted in improved

equity markets and increased foreign ownership. Li & Yang (2012) stated that improved corporate

governance can help in reducing cost of equity. As corporate governance disclosure increases, the

cost of capital decreases. Botosan (2006) found in an extensive literature review that proper

disclosure of financial reporting and corporate governance practices help in reducing the cost of

equity capital. Misra and Vishnani (2012) are of the view that reforms and changes in corporate

governance have no significant impact on the market risk of the companies listed in Group A of

BSE. Kohli and Saha (2008) found that improvement in corporate governance practices leads to

increase in market valuations. Raithatha and Bapat (2012) reported that corporate governance

score had no significant influence on the different variable of financial performance. Annalisa and

Yosef (2011) did not find any significant relation between independent directors and earning of

the family controlled businesses. Halder et al (2013) reported that the pressure of majority

independent directors on board have a positive impact on the return on equity. But board size has

a negative correlation with ROE and EVA. Bijalwan and Madan (2013) found that following good

corporate governance practice and having transparency in disclosure has a positive impact on

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 59

financial performance of the company. Hermes and Katsigianni (2011) also observed that good

governance practice leads to improved financial performance of the companies. Subramanian and

Reddy (2012) found that the disclosure related to the board practice result in improving market

share and growth rate but the ownership related disclosures are negatively associated with market

share.

Objective of the Study

1. To study the extent of corporate governance practices being followed and reported by the

selected companies on the defined parameters.

2. To analyze the relationship between parameters of corporate governance on financial

performance.

3. To study the impact of corporate governance on financial performance.

Hypothesis

H0: There is no significant relationship between different parameters of corporate governance

and financial performance.

H1: There is a significant relationship between different parameters of corporate governance

and financial performance.

H0: There is no significant impact of different parameters of corporate governance on financial

performance.

H2: There is a significant impact of different parameters of corporate governance on financial

performance.

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 60

Sample Size

A sample of 120 companies has been taken from the list of ET 500, 2012. This study is covering

manufacturing and IT industries in India. The top 15 companies based on revenue from different

sectors of Iron and steel, IT and computers, Engineering and electrical, Auto and ancillaries,

Pharmaceuticals, Chemicals and fertilizers, Oil refineries and power and Diversified and consumer

appliances were taken for the study.

Data Collection

Data regarding corporate governance has been collected using the annual reports, sustainability

reports and business responsibility reports available at the websites of the companies. Financial

data has been collected from moneycontrol.com and prowess database for an average of three years

(2010-11 to 2012-13).

Data Analysis

To address hypothesis, an analysis of corporate governance score of each company in every

industry has been done based on eight parameters of corporate governance. The corporate

governance score was calculated for the selected companies on the basis of following parameters:

1. Number of Meetings of Board of Directors

2. Number of Independent Directors on Board

3. Risk Management

4. Compliance and Ethics Committee

5. Well defined Code of Ethics

6. Communication and Distribution of code of ethics

7. Legal cases pending against company

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 61

8. Whistle blower policy

Item wise score of each industry is calculated for each parameter using the following formula:

Total Score of an Item of all Companies in an Industry

Industry Score for Each Item of Disclosure = ----------------------------------------------------- X 100

Maximum Score of Each Item X Number of Companies

Descriptive statistics like mean and standard deviation have been used for analysis. Correlation

analysis has been done to study the relationship between different parameters of corporate

governance and financial performance. Market valuation ratio of Tobin Q and profitability ratios

of ROS and ROCE have been taken as measures of financial performance. Regression analysis has

been applied to study the impact of corporate governance on financial performance.

Result and Analysis

Table 1: Descriptive Statistics

Std.

Minimum Maximum Mean Deviation

BOD Meetings

2.00

3.00 2.3167

.46713

Ind Directors

1.00

3.00 2.4583

.68472

Risk Management

.00

1.00 .6917

.46374

Ethics Committee

.00

1.00 .2000

.40168

Code of ethics

.00

2.00 1.2000

.46018

1.00

3.00 2.1083

.48152

.00

1.00 .2500

.43483

1.00

3.00 2.0167

.92567

Communicating Ethics

Legal Case

Whistle Blower

Source: Calculated by Author using SPSS 16

Table 1 shows the descriptive statistics of different parameters of corporate governance which

reveal that, independent directors on board and conducting more than requisite number of board

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 62

meetings has been rigorously followed by most of the selected Indian companies. It is very

encouraging to see that following the recent norms many companies have set up whistle blower

policy and communicating the ethical codes to their employees. However, Indian companies show

very poor performance on account of having separate ethics committee and on disclosing legal

cases pending against them. Risk management has not been a separate area of concern among the

functions of board of directors. Higher standard deviation on whistle blower policy signifies

difference in companies in following the norm of corporate governance.

Table 2: Spearman Correlations

Tobin Q

ROS

Total Corporate Governance

Score

CG1

CG2

CG3

CG4

CG5

CG6

CG7

CG8

Number of Board meeting

Number of Independent Directors

Risk Management

Ethics Committee

Code of Ethics

Communication of Code of Ethics

Legal cases Pending

Whistle Blower Policy

ROCE

0.205

0.133

0.085

0.025

0.146

0.354

-0.135

-0.078

-0.099

0.143

0.398

0.282

0.072

0.092

0.027

0.434

0.318

0.766

0.212

-0.013

0.137

0.021

0.885

0.136

0.049

0.128

0.000

0.594

0.163

0.997

0.172

0.070

-0.034

0.062

0.449

0.715

0.208

0.012

-0.013

0.023

0.896

0.885

0.148

0.233

0.127

0.108

0.011

0.167

0.125

0.080

0.052

0.175

0.385

0.574

Table 2 describes the relationship between different parameters of corporate governance and

profitability. It has been observed that there is no significant relation between the individual

parameters of corporate governance and variables of financial performance. However, the total

score of corporate governance has a significant correlation with only the market valuation measure

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 63

of Tobin Q where the p-value 0.025 is less than significant level of 0.05. In all other cases the

significant value is more than 0.05 and thus we can accept the null hypothesis 2 that there is no

significant correlation between different parameters of corporate governance and financial

performance of the companies.

Table 3: Regression Model Summary

R

R

F

Sig.

Square

Tobin

Q

ROS

ROCE

0.345264

0.119207

1.860935

0.073404

0.250734

0.062868

0.930805

0.494193

0.266928

0.071251

1.064446

0.393232

Table 4: Regression Coefficients

(Constant)

Standardized

Coefficients

Tobin

Q

ROS

ROCE

CG1

CG2

CG3

CG4

CG5

-0.232

-0.046

0.165

-0.048

0.036

CG6

CG7

CG8

0.101

0.204

-0.078

1.781

-2.419

-0.502

1.709

-0.465

0.225

0.645

2.099

-0.738

Sig.

0.078

0.017

0.617

0.090

0.643

0.822

0.520

0.038

0.462

-0.082

0.102

0.113

0.123

0.029

-0.138

0.146

-0.109

Standardized

Coefficients

T

1.737

-0.836

1.082

1.143

1.150

0.177

-0.862

1.462

-1.004

Sig.

0.085

0.405

0.282

0.256

0.252

0.860

0.391

0.147

0.318

-0.122

0.056

0.184

-0.074

-0.010

0.034

0.174

0.015

Standardized

Coefficients

T

1.666

-1.243

0.594

1.867

-0.693

-0.062

0.214

1.752

0.138

Sig.

0.099

0.217

0.554

0.064

0.490

0.951

0.831

0.082

0.890

Table 3 and 4 show the results of regression analysis for the impact of independent variables of

corporate governance on the dependent variables of financial performance. The analysis clearly

illustrate that there is no significant impact of parameters of corporate governance on market

valuation ratio of Tobin Q and even on profitability ratios of ROS and ROCE as the significant

pvalue in all cases is more than 0.05. Thus the null hypothesis 3 is accepted that there is no

significant impact of corporate governance practices on financial performance of the companies.

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 64

Discussion

The result of the extent of disclosures reveal that refineries and power sector along with I T and

pharmaceutical sector have done maximum disclosure on corporate governance. The result are

consistent with Sharma and Singh (2009) and Bhasin M. (2012) as they have also concluded that

I T Sector has maximum disclosure of corporate governance in India and the degree of disclosure

differs from company to company in different sectors (Chatterjee D, 2011). Since the mean score

of all the industries is nearly 50% - 60% only, the results are consistent with Reddy D M (2013),

Sanan and Yadav (2011) where in they have also found that disclosure have improved after

implementation of corporate governance reforms and clause 49 but most of the Indian companies

are not able to maintain average performance level in disclosure of corporate governance practice.

The presence of risk management, whistle blower policy and ethics committee as special functions

of boards, Indian Companies still have a long way to go to achieve excellence in corporate

governance (Shukla, 2009). Although the code of ethics is defined by every company in its own

way but a comprehensive code of ethics should be made mandatory for better transparency and

sustainable business (NRHC, 2012). Moreover, it has been observed that most of the companies

are disclosing the positive aspect of performance as the number of law cases pending against the

companies have been reported by only approx. 25% of the companies under study.

In consistent with the results of study by Klapper and Love, 2002, Mohanty P., 2003; Bauer et at,

2004, Kumar Jayesh, 2004, there was a positive correlation between corporate governance and

market valuation measurement through Tobin Q ratio. However, only a moderate or low impact of

corporate governance was observed on profitability measures of corporate performance. This study

confirms that good corporate governance offers better market valuations and returns as compared

to the companies with bad corporate governance (Cheung et al, 2010).

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 65

The results are consistent with Sarpal and Singh, 2013, Tata and Sharma, 2012, Annalisa and Yosef

(2011), where the individual parameters of corporate governance have no significant relation with

financial performance. The results of the study show very weak impact of corporate governance

on market valuation. Misra & Vishnavi (2012) also confirm that regulations on corporate

governance have not been able to provide any significant benefit to the investors by way of

reducing market risk or increasing returns. However, the results of this study are inconsistent with

Bae and Goyal (2010), Li and Yang (2012) Botoson (2006) where they have reported that good

corporate governance improves equity market and reduces cost of capital.

The present study is a further enhancement of the study done by Abatecola et al, 2012 where they

have studied the impact of individual attributes of corporate governance on market and profitability

variables. As called by them, this study tries to study the overall impact of corporate governance

and results indicate that although there is a positive and moderate correlation between corporate

governance and market valuation indicator Tobin Q ratio but it was observed that there was no

significant correlation between corporate governance and profitability variables of ROS and

ROCE.

Findings and Conclusion

Most of the companies are conducting more than four meetings of the board of directors every

year and are having requisite number of independent directors on the board. The study found that

risk management is not an integral part of the functions of the board of directors. Very few

companies have a separate ethics committee for taking care of the ethical implication of its

operations. Most of the companies have developed a code of ethics as it is mandatory by SEBI but

only some companies have developed a detailed code of ethics for all levels of management and

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 66

operations. Code of ethics is being communicated to the employees through their website by most

of the companies. It was found that most of the companies have not reported the law suit pending

against them. This implies that companies are trying to report only the positive aspects of their

operations but are concealing the negative aspects from the investors and general public. Although

it has been made mandatory by SEBI to have a whistle blower policy, it was found that only 60%70% of the companies have made a separate whistle blower policy for their organization. Over all

corporate governance score of different industries lies between 60% to70% which implies that

there is lot of scope of improvement and strict compliance with regulations and norms is required.

There is a positive impact of corporate governance practices on market valuation and profitability

although the relationship may not be very strong and significant in all cases. Tshe future study on

the impact of improvement in corporate governance practices and disclosures over the period of

time may highlight its impact on improved financial performance.

India has proactively initiated corporate governance norms but the biggest challenge ahead is its

enforcement and implementation in true sense. The results of the study clearly indicate that most

of the companies have started following the provision of clause 49 and other mandatory provision

of company law act, 2013; however, this is restricted to only top few companies in each sector.

The performance in disclosing and following the corporate governance norms is very poor for rest

of the companies.

This study recommends that market regulators should be made more powerful and given a free

hand to prosecute the companies involved in frauds and high penalties should be imposed for not

following the mandatory requirements on time. Different functional committees of the board of

directors like ethics committee, audit committee, remuneration committee, investor protection

committee etc and also well defined whistle blower policy can play an effective role in ensuring

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 67

good corporate governance. There in a call for evolving corporate accountability movement in

India through well framed mandatory corporate reporting covering all aspects of social,

environment and economic performance. Moreover the corporate needs to understand the

implications of implementing good governance strategies and the actions that would help in

improving financial performance as well.

References

1. Abatecola, G. Caputo, A. Mari, M. & Poggesi, S. (2012). Relations Among Corporate

Governance, Codes of Conduct, And The Profitability of Public Utilities: An Empirical

Study of Companies on The Italian Stock Exchange. International Journal of Management.

29 (2), 611-625. [In the text citation: Abatecola et al, 2012]

2. Ajanthan, A. (2013). Impact of Corporate Governance Practices on Firm Capital Structure

and Profitability: A Study of Selected Hotels and Restaurant Companies in Sri Lanka.

Research Journal of Finance and Accounting , 4(10), 115-128.[In the text citation:

Ajanthan A,

2013]

3. Ananya, M. R. (2002). Corporate governance reforms in india. Journal of Business

Ethics, 37(3),

249-268.

Retrieved

from

http://search.proquest.com/docview/198065175?accountid=164287 [In the text citation:

Ananya M R, 2002]

4. Annalisa, P. & Yosef, S. (2011). Corporate Governance and Earnings Management in

Family-Controlled Companies. Journal of Accounting, Auditing & Finance. 26: 199227, doi:10.1177/0148558X11401212. [In the text citation: Annalisa and Yosef, 2011]

5. Bae, K. H. & Goyal, V. K. (2010 ) Equity market liberalization and corporate governance

. Journal of Corporate Finance 16 (5): 609 621. [In the text citation: Bae and Goyal, 2010]

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 68

6. Bauer, R., Guenster, N., & Otten, R. (2004). overnance in Europe: The effecton stock

returns, firm valueand performance. Journal of Asset Management. 5(2), 91-104. [ In the

text citation: Bauer et al, 2004]

7. Beiner, S., Drobetz, W., M. Schmid, M., & Zimmermann, H. (2006). An Integrated

Framework of CorporateGovernance and Firm Valuation. European Financial

Managemennt. 249-283. [ In the text citation: Beiner et al, 2006]

8. Bhalla, J. (2012). Corporate governance: Perception of executives in India. Review of

Management, 2(1),

35-43.

Retrieved

from

http://search.proquest.com/docview/1272287498?accountid=164287 [ In the text citation:

Bhalla, 2012]

9. Bhardwaj, N., & Raghvendra Rao, D. (2014). Corporate Governance Practices in India- A

Case Study. Asia Pacific Journal of Research, I(XIII), 43-43. [ In the text citation:

Bhardwaj and Rao, 2014]

10. Bijalwan, J. G., & Madan, P. (2013). Corporate governance practices, transparency and

performance of indian companies.IUP Journal of Corporate Governance, 12(3), 45-79.

Retrieved from http://search.proquest.com/docview/1431390798?accountid=164287. [ In

the text citation: Bijalwan and Madan, 2013]

11. Bhagat, S. and Bolton, B. (2008). Corporate governance and firm performance. Journal of

Corporate Finance. 14(3), 257-273. [ In the text citation: Bhagat and Bolton, 2008]

12. Bhasin, M. (2012). 'Voluntary' corporate governance disclosures made in the annual

reports: An empirical study. International Journal of Management and Innovation, 4(1),

46-67.

Retrieved

from

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 69

http://search.proquest.com/docview/1019286675?accountid=164287 . [ In the text citation:

Bhasin, 2012]

13. Bose, I. (2009). Corporate governance and law-role of independent directors: Theory and

practice

in

India. Social

Responsibility

Journal. 5(1),

94-111.

doi:http://dx.doi.org/10.1108/17471110910940032. [ In the text citation: Bose, 2009]

14. Botosan, C. (2006). Disclosure and the cost of capital: what dowe know? Accounting and

Business Researrch, Intemational Aecounting Policy Forum , 31-40. [In the text citation:

Botosan, 2006]

15. Brown, L.D. & Caylor, M.L. (2006). Corporate governance and firm valuation. Journal of

Accounting and Public Policy. 25(4), 409-434. [ In the text citation: Brown and Caylor,

2006]

16. Chatterjee, D. (2011). A content analysis study on corporate governance reporting by

indian

companies. Corporate

Reputation

Review, 14(3),

234-246.

doi:http://dx.doi.org/10.1057/crr.2011.13

17. Cheung, Y.-L., Stouraitis, A. and Tan, W. (2010). Does the Quality of Corporate

Governance Affect Firm Valuation and Risk? Evidence from a Corporate Governance

Scorecard

in

Hong

Kong.

International

Review

of

Finance.

10: 403432.

DOI: 10.1111/j.1468-2443.2010.01106.x [ In the text citation: Cheung et al, 2010]

18. Gompers, P., Ishi, J. L. & Metrick, A. ( 2003 ). Corporate governance and equity prices.

Quarterly Journal of Economics. 118 (1), 107155. [ In the text citation: Gompers et al,

2003]

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 70

19. Halder, A., Shah, R., & Rao, S. (2013). Does Board Independence Matters? Evidences

from India. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2350561 [ In the text

citation: Halder et al, 2013]

20. Hermes, N. and Katsigianni, V. (2011). Corporate Governance and Company Performance:

Evidence

from

Greece.

Retrieved

from:

http://ssrn.com/abstract=1980331 orhttp://dx.doi.org/10.2139/ssrn.1980331. [In the text

citation: Hermes and Katsigianni, 2011]

21. Kaur, G., & Mishra, R. (2010). Corporate governance failure in india: A study of

academicians perception. IUP Journal of Corporate Governance, 9(1), 99-112. Retrieved

from http://search.proquest.com/docview/197590635?accountid=164287. [ In the text

citation: Kaur and Mishra, 2010]

22. Klapper, L. F., & Love, I. (2002). Corporate Governance, Investor Protection, and

Performancein Emerging Markets. World Bank Policy Research Working Paper No. 2818.

Available

at

SSRN:http://ssrn.com/abstract=303979 or http://dx.doi.org/10.2139/ssrn.303979. [ In the

text citation: Klapper and Love, 2002]

23. Kohli, N., & Saha, G. C. (2008). Corporate governance and valuations: Evidence from

selected indian companies.International Journal of Disclosure and Governance, 5(3), 236251. doi:http://dx.doi.org/10.1057/jdg.2008.10 [ In the text citation: Kohli and Saha, 2008]

24. Kraus, P., & Britzelmaier, B. (2012). Corporate Governance and Corporate Performance:

A German Perspective. International journal of Management Cases. 327-340. [ In the text

citation: Kraus and Britzelmaier, 2012]

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 71

25. Kumar, J. (2004). Does corporate governance influence firm value? Evidence from Indian

firms. The Journal of Entrepreneurial Finance & Business Ventures, 9(2), 61-91. Retrieved

from http://search.proquest.com/docview/1030136017?accountid=164287 [ In the text

citation: Kumar, J. 2004]

26. Li, Y., & Yang, H. (2012). Disclosure and the Cost of Equity Capital: An Analysis at the

Market Level. [In the text citation: Li and Yang, 2012]

27. Maher, M., & Andersson, T. (1999). Corporate Governance: Effects on Firm Performance

and Economic Growth Organisation for Economic Co-Operation and Development. [ In

the text citation: Maher and Andersson, 1999]

28. Misra, D. and Vishnani, S. (2012). Impact Of Corporate Governance Regulation On Market

Risk.

Vikalpa.

37(2),

19-32.

Retrieved

from:

http://www.vikalpa.com/pdf/articles/2012/Pages-from-Vikalpa37.2-19-32.pdf [ In the text

citation: Misra and Vishnani, 2012]

29. Mohanty, P. (2003). Institutional Investors and Corporate Governance in India. National

Stock Exchange of

India

Research

Initiative Paper No. 15.

Available at

SSRN: http://ssrn.com/abstract=353820 orhttp://dx.doi.org/10.2139/ssrn.353820. [ In the

text citation: Mohanty P., 2003]

30. Monda, B., & Giorgino, M. (2013). Corporate Governance and ShareholderValue in Listed

Firms: An EmpiricalAnalysis in Five Countries (France, Italy,Japan, UK, USA). Retrieved

from http://mpra.ub.uni-muenchen.de/45422/. [ In the text citation: Monda and Giorgino,

2013]

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 72

31. Narayanaswamy, R., Raghunandan, K., & Rama, D. V. (2012). Corporate Governance in

Indian Context. Accounting Horizons. American Accounting Association. 26(3), 583599.

[ In the text citation: Narayanaswamy et al, 2012]

32. National Human Rights Commission (2012), Developing Code of Ethics for Indian

Industry, Final Report Institute for Corporate Sustainability Management Trust. Retrieved

from: http://issuu.com/icsmindia/docs/misc_dev_code_of_ethics_for_indian_

33. Nicosia, C., & Mudambi, R. (1998). Ownership structure and firm performance: evidence

from the UK financial services industry. Applied Financial Economics. 8, 175-180.

34. Patibandla M (2006), Equity Pattern, Corporate Governance and Performance: A Study

of Indias Corporate Sector, Journal of Economic Behavior & Organization, Vol. 59, No.

1, pp. 29-44. [ In the text citation: Patibandla, 2006]

35. Prasanna, P. K. (2013). Impact of corporate governance regulations on Indian stock market

volatility and efficiency. International Journal of Disclosure and Governance. 10(1), 1-12.

doi: http://dx.doi.org/10.1057/jdg.2011.28. [ In the text citation: Prasanna, 2013]

36. Raithatha, P. M., & Bapat, D. V. (2012). Corporate Governance Compliance Practices of

Indian Companies. Research Journal of Finance and Accounting , 19-26. [In the text

citation: Raithatha and Bapat, 2012]

37. Reddy, D. M. (2013). Corporate governance disclosures in indian industry: A critical

evaluation. Sumedha

Journal

of

Management, 2(4),

114-132.

Retrieved

from

http://search.proquest.com/docview/1462209070?accountid=164287. [In the text citation:

Reddy, 2013]

38. Roodposhti, F. R., & Chashmi, S. A. (2010). The Effect of Board Composition and

Ownership Concentration on Earnings Management: Evidence from IRAN. World

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 73

Academy of Science, Engineering and Technology , 135-141. [In the text citation:

Roodposhti and Chashmi, 2010]

39. Ruppen, D. A. (2002): Corporate Governance bei Venture-Capital-finanzierten

Unternehmen, Deutscher Universitts-Verlag, Wiesbaden. [In the text citation: Ruppen,

2002]

40. Sanan, N., & Yadav, S. (2011). Corporate governance reforms and financial disclosures:

A case of indian companies. IUP Journal of Corporate Governance, 10(2), 62-81.

Retrieved from http://search.proquest.com/docview/863851444?accountid=164287. [In

the text citation: Sanan and Yadav, 2011]

41. Sarpal, S. & Singh, F. (2013). Board size and Corporate Performance: An Empirical

Investigation. International Journal of Business Ethics in developing economies, 2(1), 1-8.

[In the text citation: Sarpal and Singh, 2013]

42. Sehgal, A., & Mulraj, J. (2008). Corporate governance in india: Moving gradually from a

regulatory model to a market-driven model -- A survey. International Journal of Disclosure

and Governance, 5(3), 205-235. doi: http://dx.doi.org/10.1057/jdg.2008.9. [In the text

citation: Sehgal and Mulraj, 2008]

43. Sharma, R., & Singh, F. (2009). Voluntary corporate governance disclosure: A study of

selected companies in india. IUP Journal of Corporate Governance, 8(3), 91-108.

Retrieved from http://search.proquest.com/docview/89164168?accountid=164287. [In the

text citation: Sharma and Singh, 2009]

44. Shukla, H. J. (2009). Corporate governance and Indian FMCG industry. IUP Journal of

Corporate

Governance, 8(1),

43-63.

Retrieved

from

Journal of Finance, Accounting and Management, 7(2), 53-74, July 2016 74

http://search.proquest.com/docview/197589945?accountid=164287. [In the text citation:

Shukla, 2009]

45. Subramanian, S., & Reddy, V. N. (2012). Corporate governance disclosures and

international

competitiveness:

study

of

indian

firms. Asian

Management, 11(2), 195-218. doi: http://dx.doi.org/10.1057/abm.2012.1.

Business

&

[In the text

citation: Subramanian and Reddy, 2012]

46. Tata, S. V., & Sharma, M. (2012). Corporate governance mechanisms and firm

performance: A study of indian firms.Journal of Commerce and Accounting

Research, 1(1),

11-17.

Retrieved

from

http://search.proquest.com/docview/1490668725?accountid=164287. [In the text citation:

Tata and Sharma, 2012]

47. Yami, R. P., Garkaz, M., & Saeeddi, P. (2014). Corporate Governance and Stock Liquidity.

International

Journal

Of

Current

Life

Sciences.

Retrieved

from:

http://bretjournals.com/sites/default/files/issues-pdf/ijcls2014122381_1417515158.pdf

In the text citation: Yami et al, 2014]

Das könnte Ihnen auch gefallen

- EMH AssignmentDokument8 SeitenEMH AssignmentJonathanNoch keine Bewertungen

- West, Ford & Ibrahim: Strategic MarketingDokument14 SeitenWest, Ford & Ibrahim: Strategic MarketingPreeti SrivastavaNoch keine Bewertungen

- UNIT-2 - of BPSDokument27 SeitenUNIT-2 - of BPSNishath NawazNoch keine Bewertungen

- Limitations and Conclusion IntroDokument3 SeitenLimitations and Conclusion Intropasign inNoch keine Bewertungen

- HRMS Portal (Synopsis)Dokument9 SeitenHRMS Portal (Synopsis)sanjaykumarguptaaNoch keine Bewertungen

- PRELIMINARIES FOR EXPORTS: MEANINGS, CLASSIFICATIONS, AND STRATEGYDokument16 SeitenPRELIMINARIES FOR EXPORTS: MEANINGS, CLASSIFICATIONS, AND STRATEGYAnkit Tyagi0% (1)

- Mutual Fund AssignmentDokument7 SeitenMutual Fund AssignmentBhargav PathakNoch keine Bewertungen

- M.M Case. (McCain Food)Dokument5 SeitenM.M Case. (McCain Food)Roksana LipiNoch keine Bewertungen

- Concept of MNCDokument12 SeitenConcept of MNCPavankocherlakota KocherlakotaNoch keine Bewertungen

- Best Sellers Apparels PVT LTDDokument11 SeitenBest Sellers Apparels PVT LTDgashwinjainNoch keine Bewertungen

- Comply or ExplainDokument87 SeitenComply or ExplainAntonio Mon0% (1)

- Porter's Five Forces ModelDokument3 SeitenPorter's Five Forces ModelDokte Baulu Bangkit100% (1)

- Capital Structure Theory - Net Operating Income ApproachDokument6 SeitenCapital Structure Theory - Net Operating Income ApproachDhruv JoshiNoch keine Bewertungen

- Sek 20Dokument16 SeitenSek 20Salam Salam Solidarity (fauzi ibrahim)Noch keine Bewertungen

- PUR 3000 Fall2010 - FarberDokument4 SeitenPUR 3000 Fall2010 - FarberMark FiorentinoNoch keine Bewertungen

- Audit Expectation Gap in AuditorDokument3 SeitenAudit Expectation Gap in AuditorTantanLeNoch keine Bewertungen

- List of Indian Accounting Standards Along With Comparative Accounting Standard (AS)Dokument6 SeitenList of Indian Accounting Standards Along With Comparative Accounting Standard (AS)Krishna PrasadNoch keine Bewertungen

- Code of Conduct and Its Impact On Corporate GovernanceDokument19 SeitenCode of Conduct and Its Impact On Corporate GovernanceSandarva PalNoch keine Bewertungen

- Demand Forecasting Using QualitativeDokument2 SeitenDemand Forecasting Using QualitativeSri Krishna KuttipaiyaNoch keine Bewertungen

- Contributing Disciplines To The Field of OBDokument1 SeiteContributing Disciplines To The Field of OBSaloni AnandNoch keine Bewertungen

- Income and Substitution Effects of A Wage ChangeDokument24 SeitenIncome and Substitution Effects of A Wage ChangemanashchoudhuryNoch keine Bewertungen

- Consumer Behavior - NotesDokument7 SeitenConsumer Behavior - NotesGaurav MalikNoch keine Bewertungen

- MCom Types of StrategiesDokument63 SeitenMCom Types of StrategiesViraj BalsaraNoch keine Bewertungen

- KEYDokument7 SeitenKEYMinh Thuy NguyenNoch keine Bewertungen

- BCG Matrix Portfolio Analysis Definition: Portfolio Analysis Is An Examination of The Components Included in A Mix of Products With TheDokument6 SeitenBCG Matrix Portfolio Analysis Definition: Portfolio Analysis Is An Examination of The Components Included in A Mix of Products With TheJite PiteNoch keine Bewertungen

- Rationale for Human Services DegreeDokument9 SeitenRationale for Human Services Degreecubalove18Noch keine Bewertungen

- Jan. 26 CSLEA v. DPA Ruling, 3rd District Court of AppealDokument29 SeitenJan. 26 CSLEA v. DPA Ruling, 3rd District Court of Appealjon_ortizNoch keine Bewertungen

- Industrial DisputesDokument2 SeitenIndustrial DisputesVishal AgarwalNoch keine Bewertungen

- Classification of RatiosDokument10 SeitenClassification of Ratiosaym_6005100% (2)

- CORPORATE SOCIAL RESPONSIBILITY UNDER COMPANIES ACT 2013Dokument24 SeitenCORPORATE SOCIAL RESPONSIBILITY UNDER COMPANIES ACT 2013Naveen MettaNoch keine Bewertungen

- Strategy and Structure Reexamined PDFDokument26 SeitenStrategy and Structure Reexamined PDFSeethalakshmy NagarajanNoch keine Bewertungen

- Food Additive Manufacturer Senomyx (SNMX,$SNMX) Leads ValuEngine - Com Forecast ScreenDokument2 SeitenFood Additive Manufacturer Senomyx (SNMX,$SNMX) Leads ValuEngine - Com Forecast ScreenValuEngine.comNoch keine Bewertungen

- Importance of Environment of An OrganizationDokument8 SeitenImportance of Environment of An OrganizationKhalid Khan100% (3)

- Environmental Appraisal: 2 Year MBA Group 3Dokument37 SeitenEnvironmental Appraisal: 2 Year MBA Group 3Megha ThackerNoch keine Bewertungen

- Inside Stakeholders Are People Who Are Closest To An Organization andDokument4 SeitenInside Stakeholders Are People Who Are Closest To An Organization andArshad MohdNoch keine Bewertungen

- Regulation of Banking and Financial MarketsDokument50 SeitenRegulation of Banking and Financial MarketsM Bilal K BilalNoch keine Bewertungen

- Chapter 7 - Sources of FinanceDokument12 SeitenChapter 7 - Sources of FinanceSai SantoshNoch keine Bewertungen

- Group NormsDokument13 SeitenGroup NormsAnushriAdarshRathiNoch keine Bewertungen

- Best Execution and Client Order Handling PolicyDokument6 SeitenBest Execution and Client Order Handling PolicyLiliko Shergelashvili100% (1)

- Living Well With Dementia Bulletin, Issue 4, February 2011Dokument16 SeitenLiving Well With Dementia Bulletin, Issue 4, February 2011rowanpurdyNoch keine Bewertungen

- Business Environment RelodedDokument99 SeitenBusiness Environment RelodedSaurabh GuptaNoch keine Bewertungen

- Office Lease Checklist for Business OwnersDokument19 SeitenOffice Lease Checklist for Business OwnersLeah KoomeNoch keine Bewertungen

- Overview On Merger and AcquisitionDokument4 SeitenOverview On Merger and AcquisitionraihanNoch keine Bewertungen

- Fund Based ActivitiesDokument35 SeitenFund Based Activitiesyaminipawar509100% (3)

- International Investment TheoriesDokument3 SeitenInternational Investment Theoriessibiqwerty1100% (3)

- SEBI Clause 49Dokument23 SeitenSEBI Clause 49NikiNoch keine Bewertungen

- Managerial Issues Concerning AppraisalsDokument13 SeitenManagerial Issues Concerning AppraisalsEcha FafaNoch keine Bewertungen

- Chapter 6 The Ethics of Consumer Production and MarketingDokument59 SeitenChapter 6 The Ethics of Consumer Production and MarketingKrisha Mae CapitleNoch keine Bewertungen

- Understand Interest Rates and Bonds for Accounting, Finance CareersDokument7 SeitenUnderstand Interest Rates and Bonds for Accounting, Finance CareersMarlon A. RodriguezNoch keine Bewertungen

- Importance of NegotiationDokument18 SeitenImportance of NegotiationEkta P Manghwani100% (1)

- IAPM AnswersDokument3 SeitenIAPM AnswersSukhchain patel PatelNoch keine Bewertungen

- Course Outline, Advanced Contracts, PG, 2016 - DR - RK Singh - Final - Jan-June, Sem 2Dokument24 SeitenCourse Outline, Advanced Contracts, PG, 2016 - DR - RK Singh - Final - Jan-June, Sem 2Varun PaiNoch keine Bewertungen

- Derivatives Learning ResourcesDokument13 SeitenDerivatives Learning ResourcesPrasadNoch keine Bewertungen

- Pricing StratagyDokument47 SeitenPricing StratagyKranthiNalla100% (1)

- Objectives of Pricing Policy for Profit and Market ShareDokument3 SeitenObjectives of Pricing Policy for Profit and Market SharePrasanna Hegde100% (1)

- Swot Analysis of Nestle ScribdDokument2 SeitenSwot Analysis of Nestle Scribdsreeya100% (1)

- ICAO Procurement CodeDokument14 SeitenICAO Procurement CodeCarlos PanaoNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 37, Setting Up a Health-Care Compliance ProgamVon EverandTextbook of Urgent Care Management: Chapter 37, Setting Up a Health-Care Compliance ProgamNoch keine Bewertungen

- Impact of Corporate Governance Practices On Firm Profitability-India PDFDokument22 SeitenImpact of Corporate Governance Practices On Firm Profitability-India PDFnsrivastav1Noch keine Bewertungen

- Board characteristics impact on Indian manufacturing firms' performanceDokument11 SeitenBoard characteristics impact on Indian manufacturing firms' performanceSri VarshiniNoch keine Bewertungen

- Budget Planning: This Work Is Licensed Under A License (CC-BY) - Chapter 12: Budget PlanningDokument23 SeitenBudget Planning: This Work Is Licensed Under A License (CC-BY) - Chapter 12: Budget Planningnsrivastav1Noch keine Bewertungen

- 10 - Chapter 3Dokument24 Seiten10 - Chapter 3nsrivastav1Noch keine Bewertungen

- Chapter-09human Resource MGMTDokument64 SeitenChapter-09human Resource MGMTnsrivastav1Noch keine Bewertungen

- Chapter-16 Risk Management PlanningDokument25 SeitenChapter-16 Risk Management Planningnsrivastav1Noch keine Bewertungen

- Tata Motors-Ar-14-15 PDFDokument270 SeitenTata Motors-Ar-14-15 PDFnsrivastav1Noch keine Bewertungen

- Ryan International School Noida Maths Assignment Class 2Dokument1 SeiteRyan International School Noida Maths Assignment Class 2nsrivastav1Noch keine Bewertungen

- Eng 7 PDFDokument1 SeiteEng 7 PDFnsrivastav1Noch keine Bewertungen

- Problem Set Time Value of MoneyDokument1 SeiteProblem Set Time Value of Moneynsrivastav1Noch keine Bewertungen

- Eng 9Dokument1 SeiteEng 9nsrivastav1Noch keine Bewertungen

- Eng 28 PDFDokument1 SeiteEng 28 PDFnsrivastav1Noch keine Bewertungen

- Insurance Industry & Career ProspectsDokument29 SeitenInsurance Industry & Career Prospectsnsrivastav1Noch keine Bewertungen

- Case BDokument1 SeiteCase Bnsrivastav1Noch keine Bewertungen

- English assignment for class 2 with questions about a dog named MokaDokument1 SeiteEnglish assignment for class 2 with questions about a dog named Mokansrivastav1Noch keine Bewertungen

- Unit 2co Operativebankinginindia 170828075205Dokument29 SeitenUnit 2co Operativebankinginindia 170828075205Rammohanreddy RajidiNoch keine Bewertungen

- Ryan International School, Noida Evs Assignment 2 (L 14)Dokument1 SeiteRyan International School, Noida Evs Assignment 2 (L 14)nsrivastav1Noch keine Bewertungen

- Sustainable Development: Implications For Management Research and PracticeDokument1 SeiteSustainable Development: Implications For Management Research and Practicensrivastav1Noch keine Bewertungen

- Synergies in M&A: P.V. ViswanathDokument14 SeitenSynergies in M&A: P.V. Viswanathnsrivastav1Noch keine Bewertungen

- Receipt PDFDokument1 SeiteReceipt PDFnsrivastav1Noch keine Bewertungen

- Fintech in IndiaDokument56 SeitenFintech in Indiansrivastav1100% (1)

- National Institute of Educational Planning and AdministrationDokument5 SeitenNational Institute of Educational Planning and Administrationnsrivastav1Noch keine Bewertungen

- Company, Designation, CTC details for campus placementsDokument10 SeitenCompany, Designation, CTC details for campus placementsnsrivastav1Noch keine Bewertungen

- FDP Cms 2019february19 21 BrochureDokument4 SeitenFDP Cms 2019february19 21 Brochurensrivastav1Noch keine Bewertungen

- Sites Default Files ABDC-Journal PDFDokument65 SeitenSites Default Files ABDC-Journal PDFBinayKPNoch keine Bewertungen

- TVM SolutionsDokument5 SeitenTVM SolutionsvikrammendaNoch keine Bewertungen

- Barriers To Ethical Decision MakingDokument2 SeitenBarriers To Ethical Decision Makingnsrivastav1Noch keine Bewertungen

- Role of Independent Directors in IndiaDokument112 SeitenRole of Independent Directors in Indiansrivastav1Noch keine Bewertungen

- Indianfinancialsystem 120211233627 Phpapp02Dokument57 SeitenIndianfinancialsystem 120211233627 Phpapp02lalitNoch keine Bewertungen

- Corporate RestructuringDokument54 SeitenCorporate Restructuringnsrivastav1Noch keine Bewertungen

- Introduction To Indian Financial System2Dokument9 SeitenIntroduction To Indian Financial System2nsrivastav1Noch keine Bewertungen

- Corporate Restructuring Through Mergers and AcquisitionsDokument58 SeitenCorporate Restructuring Through Mergers and AcquisitionsAsmitPatrapadaNoch keine Bewertungen

- General Insurance Corporation of India DRHPDokument524 SeitenGeneral Insurance Corporation of India DRHPAshok YadavNoch keine Bewertungen

- Check Lists For Listing On SME-ITP Platform PDFDokument4 SeitenCheck Lists For Listing On SME-ITP Platform PDFShruti KirveNoch keine Bewertungen

- Corporate Governance Reforms in IndiaDokument19 SeitenCorporate Governance Reforms in IndiaPrabal TiwariNoch keine Bewertungen

- Instructions / Checklist For Filling KYC FormDokument38 SeitenInstructions / Checklist For Filling KYC FormJeyakumar ANoch keine Bewertungen

- FREE NISM Mock Test - NISM Series VII : Securities Operations and Risk Management by NISM PrepCafe. Study Material and NISM Workbook for NISM Series VII: SORM Certification Examination is also available at www.PrepCafe.inDokument14 SeitenFREE NISM Mock Test - NISM Series VII : Securities Operations and Risk Management by NISM PrepCafe. Study Material and NISM Workbook for NISM Series VII: SORM Certification Examination is also available at www.PrepCafe.inNISM PrepCafe - FREE NISM Mock Tests, Free NISM Study Material Download and much more100% (2)

- Order in Respect of Mr. Vinay Talwar in The Matter of Vital Communications LimitedDokument4 SeitenOrder in Respect of Mr. Vinay Talwar in The Matter of Vital Communications LimitedShyam SunderNoch keine Bewertungen

- Article On SEBI Role in Insider TradingDokument10 SeitenArticle On SEBI Role in Insider TradingUpendra ReddyNoch keine Bewertungen

- APPOINTMENT OF DIRECTORDokument12 SeitenAPPOINTMENT OF DIRECTORvirupakshudu kodiyalaNoch keine Bewertungen

- Alternative Investment Fund.Dokument3 SeitenAlternative Investment Fund.Snigdha DasNoch keine Bewertungen

- AMFI ProjectDokument7 SeitenAMFI ProjectSunny AroraNoch keine Bewertungen

- Evolution of Corporate Governance in IndiaDokument7 SeitenEvolution of Corporate Governance in IndiaVaishnavi VenkatesanNoch keine Bewertungen

- Chapter 16 - : - Corporate Governanace & Audit CommitteeDokument18 SeitenChapter 16 - : - Corporate Governanace & Audit CommitteeHindutav aryaNoch keine Bewertungen

- Kirloskar Industries LTD CP 193 of 2017Dokument14 SeitenKirloskar Industries LTD CP 193 of 2017siddhiNoch keine Bewertungen

- dp17136 PDFDokument280 Seitendp17136 PDFMahamadali DesaiNoch keine Bewertungen

- Investor Protection and Corporate Governance-Dissertation For Seminar Paper IDokument54 SeitenInvestor Protection and Corporate Governance-Dissertation For Seminar Paper Ijjgnlu100% (4)

- AIFs in GIFT City: Understanding the Legal Framework and GrowthDokument12 SeitenAIFs in GIFT City: Understanding the Legal Framework and GrowthAnkitNoch keine Bewertungen

- Idea FinalDokument482 SeitenIdea Finalsatwinder sidhuNoch keine Bewertungen

- Fineotex ChemicalDokument216 SeitenFineotex ChemicaladhavvikasNoch keine Bewertungen

- Shelf ProspectusDokument583 SeitenShelf ProspectussohamNoch keine Bewertungen

- Internet Case Studies FinmarDokument17 SeitenInternet Case Studies FinmarXyza Faye RegaladoNoch keine Bewertungen

- Renewal Form for Mutual Fund Corporate ClientsDokument4 SeitenRenewal Form for Mutual Fund Corporate ClientsSachin KhairnarNoch keine Bewertungen

- Esaf Small Finance Bank LimitedDokument405 SeitenEsaf Small Finance Bank LimitedSuraj PatilNoch keine Bewertungen

- Law of Investments and Securities QbankDokument10 SeitenLaw of Investments and Securities QbankAnil Baddi100% (1)

- Ethics - Group DynamicsDokument32 SeitenEthics - Group Dynamicsallen1191919Noch keine Bewertungen

- FII and FDIDokument24 SeitenFII and FDIbhumika_shah_9Noch keine Bewertungen

- Dit Newipo IpoDokument432 SeitenDit Newipo IpovijaygnluNoch keine Bewertungen

- General Awareness-141: BSC AcademyDokument16 SeitenGeneral Awareness-141: BSC AcademyThakur Rashttra BhushanNoch keine Bewertungen

- FPI Review Debt Investment LimitDokument2 SeitenFPI Review Debt Investment LimitSHIVANI CHOUDHARYNoch keine Bewertungen

- DraftRedHerringProspectus05122018 20181207121758Dokument316 SeitenDraftRedHerringProspectus05122018 20181207121758SubscriptionNoch keine Bewertungen

- Uti Mutual FundDokument64 SeitenUti Mutual Fundcity9848835243 cyberNoch keine Bewertungen