Beruflich Dokumente

Kultur Dokumente

293 ABHISHEK BHATTACHARYA Form16 2014-2015 PDF

Hochgeladen von

debjaniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

293 ABHISHEK BHATTACHARYA Form16 2014-2015 PDF

Hochgeladen von

debjaniCopyright:

Verfügbare Formate

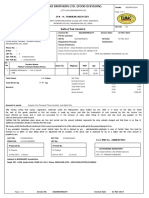

ABHISHEK BHATTACHARYA - 293

FORM NO. 16

[See rule 31(1) (a)]

PART B

Certificate under section 203 of the Income-tax Act, 1961 for Tax Deducted at Source on Salary

Name and Address of the Employer Name and Designation of the Employee

Armstrong International Private Limited

ABHISHEK BHATTACHARYA

Mahindra World City, P, 46, Eighth Avenue

ENGINEER- SOLUTION SALES

Domestic Tariff Area,Anjur Village,Natham Sub

Chengalpattu-603 002

PAN of the Deductor TAN of the Deductor PAN of Employee

AAGCA6963P CHEA13051D BWWPB1523J

CIT(TDS) Period Assessment Year

TDS I (5),Aayakar Bhavan

From To

New Block,7th Floor,No.121 MG Road

Nungabakkam,Chennai -600 034 01-Apr-2014 31-Mar-2015 2015-2016

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

Particulars Rs. Rs. Rs.

1. Gross Salary

(a) Salary as per provisions contained in Section 17(1) 261645

( Gross Salary includes HRA of Rs.49,056 )

(b) Value of Perquisites under Section 17(2)

( as per Form No 12BA, wherever applicable )

(c) Profits in lieu of salary under Section 17(3)

( as per Form No 12BA, wherever applicable )

Total (1) 261645

2. Less: Allowance to the extent exempted

(a) Conveyance Allowance 9600

(b) House Rent Allowance 39245

48845

3. Balance (1-2) 212800

4. Deductions:

(a) Entertainment allowance

(b) Tax on employment 2190

(c) Tax on Employment - Previous Employer

5. Aggregate of 4 (a),4 (b) and 4 (c) 2190

6. Income Chargeable Under the Head Salaries (3-5) 210610

7. Add: Any other income reported by the employee

8. Gross Total Income (6+7) 210610

9. Deduction Under Chapter VI-A

(A) Section 80C,80CCC and 80CCD Gross Amount Deductible Amount

(a) Under Section 80C

Provident fund 17505

ABHISHEK BHATTACHARYA - 293

Life Insurance Premium 11760

29265 29265

(b) Under Section 80CCC

(c) Under Section 80CCD

(B) Other Sections(for e.g. 80E,80G, etc.) under Chapter VI-A Gross Amount Qualifying Amount Deductible Amount

10. Aggregate of deductible amounts under Chapter VI-A 29265

11. Total Income (8-10) (Rounded Off) 181350

12. Tax on Total Income

13. LESS :DEDUCTION U/S 87A(Maximum: 0 Taxable Income Upto

500000)

14. NET TAX DUE

15. Education Cess (on tax at S.No. 14 )

16. Tax Payable (14+15)

17. Relief under section 89 (attach details)

18. Total Tax Payable (16-17)

19. Less:

(a) Tax Deducted At Source u/s 192(1)

(b) Tax paid by the Employer on behalf of the

Employee u/s 192(1A) on perquisites u/s 17(2)

(c) Tax paid by Previous Employer

20. Tax Payable / Refundable (18-19)

ABHISHEK BHATTACHARYA - 293

FORM NO. 12BA

[See rule 26A(2)(b)]

Statement showing particulars of Perquisites, Other Fringe Benefits or Amenities and Profits in lieu of Salary with Value thereof

1. Name and Address of the Employer Armstrong International Private Limited

Mahindra World City, P, 46, Eighth Avenue

Domestic Tariff Area,Anjur Village,Natham Sub

Chengalpattu-603 002

2. TAN CHEA13051D

3. TDS Assessment Range of the employer TDS I (5),Aayakar Bhavan

New Block,7th Floor,No.121 MG Road

Nungabakkam,Chennai -600 034

4. Name of the Employee ABHISHEK BHATTACHARYA

Designation ENGINEER- SOLUTION SALES

Permanent Account Number BWWPB1523J

5. Is the employee a Director or a person with substantial interest No

in the company (where the employer is a company)

6. Income under the head "Salaries" of the Employee Rs. 210,610.00

(other than from Perquisites)

7. Financial Year 2014 - 2015

8. Value of the Perquisites

S.No. Nature of Perquisites ( See Rule 3) Value of Perquisite as Amount if any paid by Amount of Perquisite

per Rules Employee chargeable to Tax

1 Accommodation

2 Cars/Other automotive

3 Sweeper,gardener,watchman or personal attendant

4 Gas,electricity,water

5 Interest free or concessional loans

6 Holiday expenses

7 Free or concessional travel

8 Free meals

9 Free education

10 Gifts,vouchers, etc

11 Credit card expenses

12 Club expenses

13 Use of movable assets by employees

14 Transfer of assets to employees

15 Value of any other benefit/amenity/service/privilege

16 Stock options (non-qualified options)

17 Other benefits or amenities

18 Total Value of Perquisites

19 Total value of profits in lieu of salary as per Section 17(3)

9. Details of Tax

(a) Tax Deducted from salary of the employee under section 192(1) 0.00

(b) Tax paid by employer on behalf of the Employee under section 192(1A) 0

(c) Total Tax paid 0.00

(d) Date of payment into Government treasury As Per Form No. 16 issued to the employee

Declaration By Employer Signature Not Verified

I SRIVATHSAN R, S/o RANGANATHAN T S working as DIRECTOR Digitally signed by R SRIVATHSAN

Date: 2015.05.29 17:39:16 +05:30

-FINANCE do hereby declare on behalf of Armstrong International Private

Limited that the information given above is based on the books of

account,documents and other relevant records or information Signature of the person responsible for deduction of tax

available with us and the details of value of each such perquisite

are in accordance with section 17 and rules framed there under For Armstrong International Private Limited

and such information is true and correct. Signed by SRIVATHSAN R

:

Place CHENNAI Date 27-05-2015 Designation : DIRECTOR -FINANCE

: :

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Bill 2Dokument1 SeiteBill 2Divya ThomasNoch keine Bewertungen

- TSF 5108235026014504 R PosDokument3 SeitenTSF 5108235026014504 R PosJoy MondalNoch keine Bewertungen

- Rod Pana Quotation DetailsDokument1 SeiteRod Pana Quotation Detailsgourav vyasNoch keine Bewertungen

- GSTR1 03ajdpk8658g1z5 032023Dokument7 SeitenGSTR1 03ajdpk8658g1z5 032023SANJEEV KUMARNoch keine Bewertungen

- CIR Vs Inter PublicDokument3 SeitenCIR Vs Inter PublicArrianne ObiasNoch keine Bewertungen

- Oneplus Buds Z2 With Active Noise Cancellation Bluetooth HeadsetDokument2 SeitenOneplus Buds Z2 With Active Noise Cancellation Bluetooth HeadsetAvinash Chandra MishraNoch keine Bewertungen

- Situs of Taxation on Online SalesDokument1 SeiteSitus of Taxation on Online SalesAngelie SaavedraNoch keine Bewertungen

- Affidavit Income DeclarationDokument1 SeiteAffidavit Income Declarationjoahnabulanadi0% (1)

- View CertificateDokument1 SeiteView CertificateSatyanarayana NandulaNoch keine Bewertungen

- Exam - Taxation MSA 206Dokument4 SeitenExam - Taxation MSA 206Juan FrivaldoNoch keine Bewertungen

- Aishwarya Food Production - 274Dokument1 SeiteAishwarya Food Production - 274kkundan52Noch keine Bewertungen

- Chiong, Mary Desiree Way 103-315-877-0000Dokument1 SeiteChiong, Mary Desiree Way 103-315-877-0000Calvin LeeNoch keine Bewertungen

- Income Tax Questions AnsweredDokument2 SeitenIncome Tax Questions AnsweredRica Mae BorjalNoch keine Bewertungen

- Invoice Original 5873Dokument1 SeiteInvoice Original 5873Prakhar KesharNoch keine Bewertungen

- SS Line 1Dokument3 SeitenSS Line 1marlenemartinez119Noch keine Bewertungen

- Form VAT003Dokument1 SeiteForm VAT003Tamara WilsonNoch keine Bewertungen

- Commissioner of Internal Revenue Vs Soriano y CIADokument1 SeiteCommissioner of Internal Revenue Vs Soriano y CIAAmor5678Noch keine Bewertungen

- 2023 24 SARS ElogbookDokument17 Seiten2023 24 SARS ElogbookSiphesihleNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSHAIK AJEESNoch keine Bewertungen

- What Is My Salary StructureDokument2 SeitenWhat Is My Salary Structuredvenky85Noch keine Bewertungen

- Foreign Tax Credit CalculationDokument2 SeitenForeign Tax Credit CalculationTanasha FlandersNoch keine Bewertungen

- Family Dollar Paystub 24-04-2020 PDFDokument1 SeiteFamily Dollar Paystub 24-04-2020 PDFLuis MartinezNoch keine Bewertungen

- 2197F10 1Dokument1 Seite2197F10 1Saad KhanNoch keine Bewertungen

- Moving Bill Title Under 40Dokument2 SeitenMoving Bill Title Under 40Ridha GuptaNoch keine Bewertungen

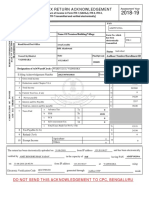

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokument1 SeiteIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNoch keine Bewertungen

- Delhi cargo terminal bill supply riceDokument1 SeiteDelhi cargo terminal bill supply riceHuskee CokNoch keine Bewertungen

- Church Pay Stubs QuarterlyDokument6 SeitenChurch Pay Stubs Quarterlydae ChoNoch keine Bewertungen

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Dokument2 SeitenJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Hotel RecepitDokument1 SeiteHotel RecepitparameshNoch keine Bewertungen

- P21 Balancing Statement 2018 124615500017Dokument2 SeitenP21 Balancing Statement 2018 124615500017Aurimas AurisNoch keine Bewertungen