Beruflich Dokumente

Kultur Dokumente

Kauffman V GE - Plaintiffs' Brief in Support of Class Certification

Hochgeladen von

Despres, Schwartz & Geoghegan, Ltd.Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Kauffman V GE - Plaintiffs' Brief in Support of Class Certification

Hochgeladen von

Despres, Schwartz & Geoghegan, Ltd.Copyright:

Verfügbare Formate

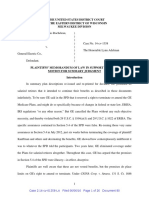

IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF WISCONSIN

MILWAUKEE DIVISION

Evelyn Kauffman and Dennis Rocheleau, )

)

Plaintiffs, )

) Case No. 14-cv-1358

v. )

) The Honorable Lynn Adelman

General Electric Co., )

)

Defendant. )

PLAINTIFFS MEMORANDUM OF LAW IN SUPPORT

OF THEIR MOTION FOR CLASS CERTIFICATION

This case challenges actions taken by Defendant GE to uniformly and entirely exclude

tens of thousands of plan participants from the coverage of plans governed by the Employee

Retirement Income Security Act of 1974 (ERISA), 29 U.S.C. 1001 et seq., in contravention of

a promise made in a summary plan description, and is therefore appropriate for class

certification. Plaintiffs respectfully request that the Court certify a class of all participants who

were eligible or who might have become eligible for benefits under the GE Medicare Plans, but

whose eligibility was cancelled or terminated effective January 1, 2015 as a result of the actions

announced by GE in September 2012 and September 2014.

Prior to 2015, GE provided healthcare benefits to its retirees that were over 65 years old

that supplemented their Medicare coverage. These benefits took the form of various plans (the

GE Medicare Benefit Plans or the Plans), the terms of which applied to all plan participants,

including the plaintiffs Evelyn Kauffman and Dennis Rocheleau, uniformly. In July 2012, GE

issued a Summary Plan Description (SPD) of the plans for its participants that included a

statement that GE expects and intends to continue the GE Medicare Benefit Plans described in

this handbook indefinitely See SPD, Compl. Ex. A (Doc. 1-1), at p. 50, 5.4. However, in

Case 2:14-cv-01358-LA Filed 04/01/16 Page 1 of 10 Document 66

September 2012, GE announced that it was actually cancelling coverage for all salaried retiree

participants that would not attain the age of 65 by January 1, 2015. Letter of 9/24/2012, attached

hereto as Exhibit 1. This group of people includes Plaintiff Evelyn Kauffman. Kauffman Decl.,

attached hereto as Exhibit 2, at 4. At the same time, GE announced that it was substantially

increasing the premiums for certain salaried retiree participants that would attain the age of 65 by

January 1, 2015. Letter of 9/27/2012, attached hereto as Exhibit 3. This second group of people

includes Plaintiff Dennis Rocheleau. Rocheleau Decl., attached hereto as Exhibit 4, at 4. Then,

in September 2014, though it had never issued a new SPD, GE announced that it would actually

be cancelling the plans for all salaried retirees effective January 1, 2015. Letter of 9/8/2014,

attached hereto as Exhibit 5.

These actions announced by GE in September 2012 and September 2014 resulted in a

cancellation of coverage that applied uniformly to all salaried retiree participants and their

spousesthe entire proposed class. As a result of these actions, all of these participants are no

longer eligible to participate in the GE Medicare Benefit Plans. GE suggests that the participants

benefits were somehow replaced by giving them access to the One Exchange program, a

concierge service that helps them find new coverage on the open market. But these participants

always had the option of declining the GE Medicare Benefit Plans and purchasing coverage on

the open market. The effect of GEs actions was to eliminate an optioncoverage by the GE

Plansnot to provide new options.

Plaintiffs allege that GE violated its fiduciary duty as plan administrator to act in the sole

interest of these participants when it represented in the SPD that it expected and intended to

continue their benefits indefinitely when it reality it had no such intention. Plaintiffs seek the

equitable remedy of contract reformation for this misrepresentation; specifically, they seek to the

Case 2:14-cv-01358-LA Filed 04/01/16 Page 2 of 10 Document 66

have the Plans reformed by adding the expects and intends clause from the SPD into the Plans.

See CIGNA Corp. v. Amara, 562 U.S. 421, 440-41 (2011) (a court may order reform of an

ERISA Plan in order to remedy false or misleading information provided by the ERISA

fiduciary); see also Kenseth v. Dean Health Plan, Inc., 722 F.3d 869, 878 (7th Cir. 2013) (citing

Amara). They also seek enforcement of the reformed Plan language, which required GE to at

least continue the effort it was making prior to 2012 to fund these benefits, either through an

order restoring the class members eligibility for the Plans, or if that is not feasible through the

make-whole equitable remedy of a surcharge against GE for the benefits lost. See Amara, 562

U.S. at 441-42 (a court may allow surcharge to charge an ERISA trustee for benefits owed under

a plan as reformed); see also Kenseth, 722 F.3d at 878-80 (citing Amara).

Because the Plans applied uniformly to all participants, the misrepresentation in the SPD

applied to all of the Plans, and all participants in these groups suffered the same loss of coverage

as a result of GEs actions, Plaintiffs seek certification of a class pursuant to Rule 23 of the

Federal Rules of Civil Procedure. As set forth below, Plaintiffs satisfy all of the prerequisites for

certification set forth in Rule 23(a), as well as the requirements set forth in Rules 23(b)(1) and

23(b)(2).

I. Plaintiffs satisfy all of the prerequisites for class certification in Rule 23(a).

A. Numerosity.

According to a declaration offered by Virginia Proestakes, GEs Director of Health

Benefits, and previously filed by GE in this case, there were 65,841 GE retirees and spouses

enrolled in the Plans as of December 1, 2014. Doc. 20 at 12, 50. That number did not include

participants such as Plaintiff Kauffman who had not yet attained the age of 65. Thus, the class

that Plaintiffs seek to certify consists of more than 65,841 GE retirees and spouses. There can be

Case 2:14-cv-01358-LA Filed 04/01/16 Page 3 of 10 Document 66

no question that a class this size satisfies the numerosity requirement of Rule 23(a)(1). The

joinder of more than 65,000 plaintiffs is impracticable.

B. Commonality.

There are also indubitably questions of law and fact common to the class in this case. In

fact, there are no questions of law or fact that are not common to the class. The questions at issue

in this case are: (1) whether GE expected and intended to continue the benefits described in the

SPD when it issued that SPD in July 2012; (2) whether Section 5.4 of the SPD contained a

misrepresentation by GE; (3) if so, whether that misrepresentation constituted a breach of the

fiduciary duty by GE; (4) if so, what the appropriate remedy for the breach of fiduciary duty is.

Each of these questions is common to each and every member of the class. Moreover, the

remedies requested by the Plaintiffsreformation of the Plan and enforcement of the Plan as

reformedmust necessarily be applied on a class-wide basis.

Under ERISA, GE cannot make individualized determinations regarding the continuation

of plan benefitsit cannot make benefits available to some participants, and deny them to

others. Therefore, the question of GEs expectations and intentions with regard to the

continuation of the benefits has to be a question common to the class.

Similarly, if GE did not expect and intend to continue the benefits indefinitely when it

made that statement, then the statement was a misrepresentation to all plan participants.

GE owes the same fiduciary obligations to all plan participants, so the question of

whether a misrepresentation GE made to all class members in the SPD constitutes a breach of its

fiduciary duty must be common to the class.

All class members suffered the same fate in this casethey were excluded from coverage

under the Plans. Thus the question of what remedy is appropriate is also a common question. The

question of whether the Plans should be reformed to incorporate the expects and intends clause

4

Case 2:14-cv-01358-LA Filed 04/01/16 Page 4 of 10 Document 66

is a question that must be resolved on a class wide basis. And if it is resolved in Plaintiffs favor,

the enforcement of that term will also be uniformly applied. It would not be appropriate to

remedy the fiduciary breach by providing different benefits to different class members. But even

if there was some variation in how benefits were provided upon reform of the Plan, class

certification would still be appropriate. When, as here, the main relief sought is injunctive or

declaratory relief regarding the rights of ERISA beneficiaries to Plan benefits, a Rule 23(b)(2)

class action is an ideal mechanism for handling the litigation. See In re Allstate Ins. Co., 400

F.3d 505, 507 (7th Cir. 2005).

C. Typicality.

The claims of Plaintiffs Evelyn Kauffman and Dennis Rocheleau are typical of the claims

of the class. As set forth above, every question raised by their claims is common to the class.

Moreover, to the extent GE may argue that there is any distinction between the claims of those

class members whose coverage was cancelled in 2012 and those whose coverage was cancelled

in 2014, there is a plaintiff to represent each group. Evelyn Kauffman was not yet 65 on January

1, 2015, so the decision GE announced in 2012 rendered her ineligible for the Plans. Dennis

Rocheleau was already 65 and enrolled in the Plans prior to 2015, so the decision GE announced

in 2012 increased his premiums but the decision GE announced in 2014 rendered him ineligible

for the Plans.

D. Adequacy of representatives.

The plaintiffs and their counsel have demonstrated that they are more than adequate class

representatives. Since GEs announcement in September 2012, Mr. Rocheleau in particular has

been actively and publicly protesting GEs decision. Ex. 4. at 9-12. He has spoken at

shareholders meetings and in private conversations with GEs Senior Vice President of Human

Resources in attempts to convince GE that this was an unwise and unfair decision. Id. Notably,

Case 2:14-cv-01358-LA Filed 04/01/16 Page 5 of 10 Document 66

Mr. Rocheleau engaged in this fight from the very beginning, despite the fact that the 2012

decision only increased his premiums. Id. at 11. In other words, he has been advocating on

behalf of class members like Ms. Kauffman, whose benefits were cut in 2012, for more than

three years.

From the beginning, Kauffman and Rocheleau brought this suit not just to benefit

themselves, but to benefit the class as a whole. Even the initial complaint, while not styled as a

class action, sought injunctive relief that would keep the Plans in place for all beneficiaries. See

Compl. (Doc. 1). The plaintiffs immediately sought a preliminary injunction and have since

expended significant resources to continue this litigation. Together, the plaintiffs have produced

almost 5,000 pages of documents, including substantial productions of personal health

information and personal emails. They each sat for a deposition, with Ms. Kauffman flying to

Milwaukee just for that purpose. Although Plaintiffs counsel are conducting this litigation on a

partial contingency basis and have not charged Plaintiffs for most of the work performed, Mr.

Rocheleau has contributed tens of thousands of dollars of his own money to legal fees and costs,

including expert fees. Ex. 4 at 15.

Apart from the fact that they have had their retiree health care benefits slashed by the

employer they dedicated decades to, the plaintiffs are particularly invested in this case for

another reason. Both Ms. Kauffman and Mr. Rocheleau spent significant time during their tenure

with GE working on putting the Plans into place and ensuring retirees familiarity with them. Mr.

Rocheleau was GEs chief labor negotiator for years. Ex. 4 at 1, 16-17. He negotiated with the

unions representing workers at GE over benefits and believed that GE was offering its retirees

the Plans in good faith, with no expectation that GE would later cancel them. Id. at 16-17. Ms.

Kauffman was a benefits counselor at GE that often advised retiring GE employees about the

Case 2:14-cv-01358-LA Filed 04/01/16 Page 6 of 10 Document 66

benefits available to them. Ex. 2 at 9. Both of the plaintiffs feel that GE has undermined its

own integrity, and the integrity of representatives such as themselves, by engaging in this breach

of fiduciary duty. Id. at 8; Ex. 4 at 16. This history with GE contributes to their passion for

this issue and for representing the class, but it also informs their understanding of the issues in

this case. They are ideal class representatives because they are not only pursuing this litigation

with zeal, but with a wealth of knowledge.

Plaintiffs counsel are also adequate class counsel. Plaintiffs have selected the firm of

Despres, Schwartz and Geoghegan, Ltd. to represent the interests of the class. The firm is

experienced in class litigation, especially with respect to labor, employment, and employee

benefits law. In a recent case, Healy v. IBEW, Local Union No. 134, the court stated that it had

no doubt that plaintiffs attorneys will be able to litigate the case fairly and adequately on behalf

of the proposed class. 296 F.R.D. 587, 593 (N.D. Ill. 2013). The court noted that the attorneys

involved in this case have substantial class action experience and have obtained multi-million

dollar recoveries for classes they have represented.Id.

That experience now includes a successful resolution of the Healy matter itself, as the

firm negotiated a settlement that included over $1.8 million in back pay and reinstatement offers

for all 45 members of a class of laid off employees. But the firms history of providing class

representation is far more extensive than that. For example, the firm recovered $19 million in

total for plaintiffs and other employees in the related cases Lumpkin, et al. v. International

Harvester Co., No. 81 C 6674 (N.D. Ill.) and Lumpkin, et al. v. Envirodyne Industries, Ltd., 933

F.2d 449 (7th Cir. 1991), which were concerned in part with a breach of fiduciary duty by an

employer under ERISA. In Baker, et al. v. Kingsley, 387 F.3d 649 (7th Cir. 2004), the firm

achieved a settlement of $5 million to the class. The firm has also obtained large settlements for

Case 2:14-cv-01358-LA Filed 04/01/16 Page 7 of 10 Document 66

employee class members in Phason, et al. v. Meridian Rail Corp., 479 F.3d 527 (7th Cir. 2007),

Hughes v. Merit Lincoln Park LLC, No. 08-cv-6191 (N.D. Ill.), and Local 1239, Intl

Brotherhood of Boilermakers v. Allsteel, Inc., 955 F. Supp. 78 (N.D. Ill. 1996). In Cristiani, et al.

v. Advocate Health Care Network, the firm obtained a settlement for uninsured class members

who should have been entitled to charity care. The firm is also currently negotiating the details of

a settlement in a wage and hour case where it has been appointed class counsel to two

overlapping classes, Brown v. Club Assist Road Services U.S., Inc., No. 12-cv-5710 (N.D. Ill.).

The firm agreed to represent the Plaintiffs in this case on a partial contingency basis. The

firm has already expended a great deal of resources on this case despite the risk that it will not be

compensated fully for those efforts. For all of these reasons, Despres, Schwartz & Geoghegan,

Ltd., will be more than adequate as class counsel.

II. This case requests relief that makes this case proper for adjudication on a classwide

basis under Rule 23(b)(1) or 23(b)(2).

Plaintiffs in this case seek ruling and relief that will necessarily impact the interests of all

class members, and this case should therefore be resolved on a class wide basis under either Rule

23(b)(1) or 23(b)(2).

A class action may be maintained under Rule 23(b)(2), if the party opposing the class

has acted or refused to act on grounds that apply generally to the class, so that final injunctive

relief or corresponding declaratory relief is appropriate respecting the class as a whole[.] As

explained above, there can be no doubt that GE made its misrepresentation in the SPD generally

to all members of the class and that it cancelled coverage generally for all class members.

Plaintiffs seek as a remedy for GEs fiduciary breach a reformation of the Plans to include the

expects and intends clause in Section 5.4, and enforcement of the reformed Plan language as a

Case 2:14-cv-01358-LA Filed 04/01/16 Page 8 of 10 Document 66

best efforts clause. Such equitable relief would necessarily apply on a class wide basis, and the

Court should therefore certify the class under Rule 23(b)(2).

Class certification is similarly appropriate under Rule 23(b)(1). A reformation of the

Plans, as described above, would necessarily impact GEs responsibility to all class members. In

the words of Rule 23(b)(1)(B), such a ruling would be dispositive of the interests of the other

members not parties to the case. Enforcement of this provision as a best efforts clause would

require GE to continue to expend at least the financial efforts it was making for beneficiaries

prior to making its decision to cancel benefits. If the court were to reform the Plans only as they

applied to the plaintiffs, it would, in the words of Rule 23(b)(1)(A), create a risk

ofinconsistent or varying adjudications with respect to individual class members that would

establish incompatible standards of conduct for the party opposing the class. As a fiduciary for

an ERISA plan, GE cannot provide benefits only to two beneficiaries while providing nothing to

the rest of the class.

Conclusion

For all of these reasons, Plaintiffs respectfully request that the Court certify a class of all

participants who were eligible or who might have become eligible for benefits under the GE

Medicare Plans, but whose eligibility was cancelled or terminated effective January 1, 2015 as a

result of the actions announced by GE in September 2012 and September 2014.

Case 2:14-cv-01358-LA Filed 04/01/16 Page 9 of 10 Document 66

Dated: April 1, 2016 Respectfully submitted,

s/ Sean Morales-Doyle

One of Plaintiffs Attorneys

Thomas H. Geoghegan

Michael P. Persoon

Sean Morales-Doyle

Carol T. Nguyen

Despres, Schwartz & Geoghegan, Ltd.

77 West Washington Street, Suite 711

Chicago, Illinois 60602

(312) 372-2511

10

Case 2:14-cv-01358-LA Filed 04/01/16 Page 10 of 10 Document 66

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Kauffman V GE - Plaintiffs' Reply Brief in Support of Their Motion For Class CertificationDokument9 SeitenKauffman V GE - Plaintiffs' Reply Brief in Support of Their Motion For Class CertificationDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Defendant's Reply in Support of Motion For Summary JudgmentDokument20 SeitenKauffman V GE - Defendant's Reply in Support of Motion For Summary JudgmentDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Defendant's Brief in Opposition To Class CertificationDokument36 SeitenKauffman V GE - Defendant's Brief in Opposition To Class CertificationDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Defendant's Brief in Opposition To Summary JudgmentDokument34 SeitenKauffman V GE - Defendant's Brief in Opposition To Summary JudgmentDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Plaintiffs' Brief in Opposition To Summary JudgmentDokument23 SeitenKauffman V GE - Plaintiffs' Brief in Opposition To Summary JudgmentDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Defendant's Brief in Support of Summary JudgmentDokument37 SeitenKauffman V GE - Defendant's Brief in Support of Summary JudgmentDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Plaintiffs' Brief in Support of Summary JudgmentDokument26 SeitenKauffman V GE - Plaintiffs' Brief in Support of Summary JudgmentDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2016-11-30 State Court PI Memo File-StampedDokument19 Seiten2016-11-30 State Court PI Memo File-StampedDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Exhibit A To The ComplaintDokument17 SeitenExhibit A To The ComplaintDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman V GE - Plaintiffs' Reply in Support of Their Motion For Summary JudgmentDokument16 SeitenKauffman V GE - Plaintiffs' Reply in Support of Their Motion For Summary JudgmentDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2016-11-30 Federal Court PI Memo File-StampedDokument29 Seiten2016-11-30 Federal Court PI Memo File-StampedDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2017-1-6 Federal Elected School Board Response/Reply BriefDokument30 Seiten2017-1-6 Federal Elected School Board Response/Reply BriefDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2017-1-6 State Elected School Board Response/Reply BriefDokument19 Seiten2017-1-6 State Elected School Board Response/Reply BriefDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2016-10-4 State Complaint CONFIDENTIAL DRAFT PDFDokument13 Seiten2016-10-4 State Complaint CONFIDENTIAL DRAFT PDFMaureen T. CotterNoch keine Bewertungen

- Federal Elected School Board ComplaintDokument25 SeitenFederal Elected School Board ComplaintDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Kauffman v. GE Decision & OrderDokument7 SeitenKauffman v. GE Decision & OrderDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Coalition For Safe Chicago Communities ComplaintDokument11 SeitenCoalition For Safe Chicago Communities ComplaintDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Coalition For Safe Chicago Communities ComplaintDokument11 SeitenCoalition For Safe Chicago Communities ComplaintDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Coalition For Safe Chicago Communities ComplaintDokument11 SeitenCoalition For Safe Chicago Communities ComplaintDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2015-3-12 Friends of The Parks Opinion & OrderDokument19 Seiten2015-3-12 Friends of The Parks Opinion & OrderDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- 2015-4-2 ATU Memo Opinion and Order Re TRODokument18 Seiten2015-4-2 ATU Memo Opinion and Order Re TRODespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- Castaneda, Et Al. v. Nilkanth Investment Inc. ComplaintDokument8 SeitenCastaneda, Et Al. v. Nilkanth Investment Inc. ComplaintDespres, Schwartz & Geoghegan, Ltd.Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Construction Law - Omission Clause in Fidic, Dear Madam, Educational PurposeDokument2 SeitenConstruction Law - Omission Clause in Fidic, Dear Madam, Educational PurposejcdaouNoch keine Bewertungen

- 49 Gamilla v. Burgundy Realty CorporationDokument1 Seite49 Gamilla v. Burgundy Realty CorporationLloyd Edgar G. ReyesNoch keine Bewertungen

- Hilao V MarcosDokument3 SeitenHilao V MarcosMiggy CardenasNoch keine Bewertungen

- Tax Advocates' Association, GujaratDokument21 SeitenTax Advocates' Association, Gujaratapi-25886395Noch keine Bewertungen

- Da 1Dokument1 SeiteDa 1Deepak JainNoch keine Bewertungen

- Premier Solar Systems Pvt. LTD., (100% Eou) : Limited Warranty For PV-Module(s)Dokument3 SeitenPremier Solar Systems Pvt. LTD., (100% Eou) : Limited Warranty For PV-Module(s)arunkkinNoch keine Bewertungen

- Recovery of Miantenance Shamim AkhtarDokument5 SeitenRecovery of Miantenance Shamim AkhtarfaisalalisiddalNoch keine Bewertungen

- NTC V Heirs of EbesaDokument2 SeitenNTC V Heirs of EbesaJessaMangadlaoNoch keine Bewertungen

- Voucher P2 PDFDokument1 SeiteVoucher P2 PDFColourful PelangiNoch keine Bewertungen

- 06-14-20 Krysten Sheppard and Bobby Gauthier Contract (RI-Matt)Dokument8 Seiten06-14-20 Krysten Sheppard and Bobby Gauthier Contract (RI-Matt)rajatpreet modiNoch keine Bewertungen

- G.R. No. 101847Dokument1 SeiteG.R. No. 101847shezeharadeyahoocomNoch keine Bewertungen

- Larson V Money Control Inc Christopher Clarkson Riverside California FDCPA ComplaintDokument8 SeitenLarson V Money Control Inc Christopher Clarkson Riverside California FDCPA ComplaintghostgripNoch keine Bewertungen

- Fiji Consumer Council - The Small Claims Tribunal An Effectiveness Study - Ganesh Chand - 2009Dokument46 SeitenFiji Consumer Council - The Small Claims Tribunal An Effectiveness Study - Ganesh Chand - 2009Intelligentsiya HqNoch keine Bewertungen

- Extension of ValidityDokument1 SeiteExtension of ValidityShubhang PrasadNoch keine Bewertungen

- 50-State Tax Sale Cheat Sheet: Deedgrabber PresentsDokument67 Seiten50-State Tax Sale Cheat Sheet: Deedgrabber Presentschill main100% (2)

- 10 Question Exam Income TaxDokument1 Seite10 Question Exam Income TaxLei MorteraNoch keine Bewertungen

- Non-Disclosure Agreement: D.M. Wenceslao & Associates INCDokument5 SeitenNon-Disclosure Agreement: D.M. Wenceslao & Associates INCAtty Pia DagdaganNoch keine Bewertungen

- Insurance Law-ContributionDokument5 SeitenInsurance Law-ContributionDavid FongNoch keine Bewertungen

- Determining CompensationDokument4 SeitenDetermining CompensationAiqal Muhammad67% (3)

- SC Judgment in Nandini Deluxe v. Karnataka Co-Operative Milk Producers Federation LTDDokument47 SeitenSC Judgment in Nandini Deluxe v. Karnataka Co-Operative Milk Producers Federation LTDLatest Laws TeamNoch keine Bewertungen

- Paulian ActionDokument3 SeitenPaulian ActionPragash Maheswaran100% (1)

- Planters Association V PonferradaDokument3 SeitenPlanters Association V PonferradaJosh RSNoch keine Bewertungen

- Chetan Devendra SharmaDokument3 SeitenChetan Devendra SharmaDeval BrahmbhattNoch keine Bewertungen

- C&A Mktg. v. GoPro - MSJ of NoninfringementDokument489 SeitenC&A Mktg. v. GoPro - MSJ of NoninfringementSarah BursteinNoch keine Bewertungen

- Valenton V Murciano GR 1413Dokument3 SeitenValenton V Murciano GR 1413MichaelaNoch keine Bewertungen

- The DoctrineDokument10 SeitenThe Doctrinemohammed sherief kNoch keine Bewertungen

- Paray Vs RodriguezDokument3 SeitenParay Vs RodriguezEM RGNoch keine Bewertungen

- Rules and Regulations For All International HousesDokument3 SeitenRules and Regulations For All International HousesHenryy555Noch keine Bewertungen

- Napocor vs. Dela Cruz DigestDokument3 SeitenNapocor vs. Dela Cruz DigestArzaga Dessa BCNoch keine Bewertungen

- Unincorporated AssociationsDokument8 SeitenUnincorporated AssociationsxristianismosNoch keine Bewertungen