Beruflich Dokumente

Kultur Dokumente

Procurement Policy

Hochgeladen von

tessOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Procurement Policy

Hochgeladen von

tessCopyright:

Verfügbare Formate

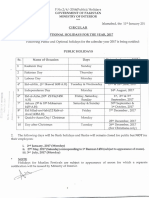

BANK POLICY

Procurement in IPF and

Other Operational

Procurement Matters

Bank Access to Information Policy Designation

Public

Catalogue Number

OPSVP5.05-POL.144

Issued

Issued on June 28th, 2016

Effective

Effective on July 1st , 2016

Content

Sets out Bank Policy governing procurement activities

financed by IPF, the Banks support to Borrowers in the

area of building procurement capacity, and other

operational procurement matters

Applicable to

IBRD and IDA

Issuer

OPSVP

Sponsor

CPO, OPCS

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

1

SECTION I PURPOSE AND APPLICATION

1. This Policy sets out a vision, the key principles, and policy requirements governing the

procurement of goods, works, non-consulting services, and consulting services financed by

the Bank (in whole or in part) through IPF operations, excluding procurement under Bank

guarantees and under Bank-financed loans made by eligible financial intermediaries, for

which the final recipient of loan funds is a private borrower.

2. This Policy applies to the Bank.

SECTION II DEFINITIONS AND ACRONYMS

As used in this Policy, the capitalized terms and acronyms have the meanings set out below.

1. Anti-Corruption Guidelines: the Guidelines on Preventing and Combating Fraud and

Corruption in Projects Financed by IBRD Loans and IDA Credits and Grants.

2. APA: alternative procurement arrangements.

3. Bank: IBRD and IDA (whether acting in its own capacity or as administrator of trust funds

funded by other donors).

4. Board: the Executive Directors of IBRD or IDA, or both, as applicable.

5. Borrower: a borrower or recipient of the IPF, and any other entity involved in the

implementation of the project financed by the IPF.

6. Core Procurement Principles: the principles set out in Section III.C of this Policy.

7. CPO: Chief Procurement Officer.

8. Financing: a loan, credit, or grant made by the Bank from its resources or from trust funds

funded by other donors and administered by the Bank, or a combination of these.

9. IBRD: International Bank for Reconstruction and Development.

10. IDA: International Development Association.

11. IFC: International Finance Corporation.

12. Investment Project Financing (IPF): Bank Financing described in paragraph 1 of OP 10.00.

13. Management: the President or a Manager of the Bank , or a chief officer whose functions and

responsibilities include the authority to issue P&P Documents as set out by Management

through terms of reference or a delegation of authority, or some or all of these persons, as

applicable.

14. Manager: a person identified as a manager in the Banks human resources system.

15. MIGA: Multilateral Investment Guarantee Agency.

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

2

16. OPCS: Operations Policy and Country Services.

17. OPSVP: Operations Policy Vice President.

18. OPSPF: Standards, Procurement, and Financial Management Department, OPCS.

19. P&P Document: a document defined in Section II.10 of the Bank Policy, Policy and

Procedure Framework.

20. Procurement Framework: a framework consisting of this Policy and other procurement

requirements and procurement guidance adopted by Management.

21. Project Procurement Strategy for Development (PPSD): a strategy referred to in Section

III.G of this Policy.

22. Procurement Plan: a plan referred to in Section III.G of this Policy.

23. Procurement Process: a process covering all the stages of procurement.

24. WBG: IBRD, IDA, IFC, MIGA.

25. WBG Sanctions Framework: a framework consisting of WBG Policy, Sanctions for Fraud

and Corruption, and other related P&P Documents adopted by Management.

SECTION III SCOPE

A. Vision

Procurement in IPF operations supports Borrowers to achieve value for money with integrity in

delivering sustainable development. To achieve this vision, the Bank seeks assurance from

Borrowers that acceptable procurement arrangements are applied to the financial resources it

provides to Borrowers, and supports Borrower countries in enhancing and implementing sound

procurement systems and institutions. The Bank may support country capacity building at the

level of the project or as part of the country dialogue, using a range of measuresfunding,

technical support, and hands-on expanded implementation support (in selected cases)

depending on the specific context of the country, sector, agency, or project.

B. Preamble

This Policy is based on and, with other Bank fiduciary rules and practices, fulfils the requirements

of the IBRD Articles of Agreement (Article III, Section 5(b) and IDA Articles of Agreement (Article

V, Section 1(g)) to ensure that the proceeds of Bank Financing are used only for the purposes for

which the Financing was granted, with due attention to considerations of economy and efficiency,

without regard to political or other non-economic influences or considerations.

C. Core Procurement Principles

All procurement actions under this Policy are governed by and are consistent with the following

Core Procurement Principles:

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

3

1. Value for money. The principle of value for money means the effective, efficient, and

economic use of resources, which requires an evaluation of relevant costs and benefits, along

with an assessment of risks, and non-price attributes and/or life cycle costs, as appropriate.

Price alone may not necessarily represent value for money.

2. Economy. The principle of economy takes into consideration factors such as sustainability,

quality, and non-price attributes and/or life cycle cost as appropriate, that support value for

money. It permits integrating into the Procurement Process economic, environmental, and

social considerations that the Bank has agreed with the Borrower. It also permits augmenting

identified sustainability criteria with specific criteria in support of the Borrowers own

sustainable procurement policy.

3. Integrity. The principle of integrity refers to the use of funds, resources, assets, and authority

according to the intended purposes and in a manner that is well informed, aligned with the

public interest, and aligned with broader principles of good governance. The Bank therefore

requires that all parties involved in the Procurement Process, including without limitation,

Borrowers and sub-Borrowers (and other beneficiaries of Bank Financing); bidders,

consultants, contractors, and suppliers; any sub-contractors, sub-consultants, service

providers or suppliers; any agents (whether declared or not); and any of their personnel,

observe the highest standard of ethics during the Procurement Process of Bank-financed

contracts, and refrain from fraud and corruption, as that term is defined in the Anti-Corruption

Guidelines.

4. Fit for Purpose. The principle of fit for purpose applies both to the intended outcomes and

the procurement arrangements in determining the most appropriate approach to meet the

project development objectives and outcomes, taking into account the context and the risk,

value, and complexity of the procurement.

5. Efficiency. The principle of efficiency requires that Procurement Processes be proportional

to the value and risks of the underlying project activities. Procurement arrangements are

generally time-sensitive and strive to avoid delays.

6. Transparency. The principle of transparency requires that the Borrower and the Bank enable

appropriate review of the procurement activities, supported by appropriate documentation and

disclosure. Transparency requires (i) that relevant procurement information be made publicly

available to all interested parties, consistently and in a timely manner, through readily

accessible and widely available sources at reasonable or no cost; (ii) appropriate reporting of

procurement activities; and (iii) the use of confidentiality provisions in contracts only where

justified.

7. Fairness. The principle of fairness refers to (i) equal opportunity and treatment for bidders

and consultants; (ii) equitable distribution of rights and obligations between Borrowers and

suppliers, bidders, consultants, and contractors; and (iii) credible mechanisms for addressing

procurement-related complaints and providing recourse. Open competitive procurement is

the Banks preferred procurement approach, whenever possible, to maximize fairness of

opportunity to bid. Whenever possible, the Bank requires that eligible individuals and firms

be given the same opportunities to compete for Bank-financed activities.

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

4

D. Governance

1. Accountability. The concept of accountability, as it applies to the Bank and Borrowers,

combines the requirements of transparency and responsibility, and holds those involved in

the Procurement Process accountable for their actions (or inactions).

2. Conflict of Interest. The Bank requires that all parties involved in the Procurement Process

not have a conflict of interest, unless such a conflict has been resolved in a manner acceptable

to the Bank.

3. Eligibility. The Bank permits firms and individuals from all countries to offer goods, works,

non-consulting services, and consulting services for Bank-financed projects, subject to other

Bank rules on eligibility and participation.

4. Complaints and Contract-related Communications. Procurement-related complaints and

communications related to contractual matters may be brought to the attention of the Borrower

or the Bank at the appropriate stage of the Procurement Process. They make every effort to

address such complaints and other communications objectively and in a timely manner, with

transparency and fairness.

5. Noncompliance. If the Borrower or other parties involved in the Procurement Process do not

comply with the applicable procurement requirements, the Bank may, in addition to the

contractual remedies set out in the relevant legal agreement, take other appropriate actions

consistent with the terms and conditions of the legal agreement and the Banks

implementation support and monitoring role.

E. Roles and Responsibilities

The Banks and Borrowers roles and responsibilities, including in the area of procurement, are

set out in OP 10.00, paragraphs 19 and 21. In seeking to ensure that funds are used only for the

purposes for which the Financing was granted, the Bank carries out its procurement functions,

including procurement oversight, under a risk-based approach.

F. Alternative Procurement Arrangements

1. Subject to paragraph 2 of this Section III.F, at the Borrowers request, the Bank may agree to

(a) rely on and apply the procurement rules and procedures of another multilateral or bilateral

agency or organization, and may agree to such a party taking a leading role in providing the

implementation support and monitoring of project procurement activities; and (b) rely on and

apply the procurement rules and procedures of an agency or entity of the Borrower.

2. The alternative procurement arrangements referred to in paragraph 1 of this Section III.F are

consistent with the provisions set out in Section III.C and Section III.D of this Policy, and

ensure that the WBG Sanctions Framework and Anti-Corruption Guidelines, contractual

remedies set out in its legal agreements with the Borrower, and other terms and conditions

necessary to address the particular circumstances of the proposed APA apply.

G. Project Procurement Strategy for Development and Procurement Plan

The Bank requires the Borrower to develop a Project Procurement Strategy for Development and

a Procurement Plan for each IPF operation. The PPSD describes how the project procurement

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

5

activities support the development objectives of the project. The scope and details of the PPSD

take into account, and are proportional to, the relevant market, scale, risk, value, and country

circumstances, including, when applicable, situations of urgent need of assistance or capacity

constraints, and the specific economic, environmental, and social objectives of the project. The

Procurement Plan is based on the PPSD and sets out the selection methods to be followed by

the Borrower during project implementation in the procurement of goods, works, non-consulting

services, and consulting services financed by the Bank.

H. Interpretation and Modification of the Policy

The Executive Directors of the Bank interpret and, as necessary, modify this Policy. Management

also interprets this Policy, and recommends to the Executive Directors any necessary Policy

modifications.

SECTION IV WAIVER

The provisions of this Policy may be waived in accordance with the Bank Policy Operational

Policy Waivers, and the Bank Procedure Operational Policy Waivers and Waivers of Operational

Requirements.

SECTION V EFFECTIVE DATE

This Policy is effective on July 1, 2016.

SECTION VI ISSUER

The issuer of this Policy is the OPSVP.

SECTION VII SPONSOR

The sponsor of this Policy is the CPO, OPCS.

SECTION VIII RELATED DOCUMENTS

Bank Directive, Policy and Procedure Framework.

Bank Directive, Procurement in IPF and Other Procurement Operational Matters. (E-link)

Bank Policy, Operational Policy Waivers.

Bank Procedure, Early Adopters of the Banks New Procurement Framework.

Bank Procedure, Policy and Procedure Framework.

Bank Procedure, Procurement in IPF and Other Operational Procurement Matters. (E-link)

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

6

Bank Procedure, Working Arrangements among the Global Practices, the Regions, INT and

OPCS Concerning Fraud and Corruption.

BP 10.00 Investment Project Financing.

Bank Procedure, Small Recipient-Executed Trust Fund Grants.

Board Paper, Procurement in World Bank Investment Project Financing Phase II: The New

Procurement Framework,

Guidelines on Preventing and Combating Fraud and Corruption in Projects Financed by IBRD

Loans and IDA Credits and Grants.

Instructions: Additional Financing for Investment Project Financing.

Instructions: Investment Project Implementation Support to Project Completion.

Instructions: Preparation of Investment Project Financing (Track 1).

Instructions: Preparation of Investment Project Financing (Track 2).

Instructions: Preparation of Investment Project Financing - Situations of Urgent Need of

Assistance or Capacity Constraints.

Instructions for Suspension, Cancellation and Placement of Bank Loans in Nonperforming

Status.

OP 10.00 Investment Project Financing.

World Bank Procurement Regulations for IPF Borrowers. (E-link)

WBG Sanctions Framework. (E-link)

Questions about this Policy should be addressed to the CPO, OPCS.

Bank Policy, Procurement in IPF and Other Operational Procurement Matters

7

Das könnte Ihnen auch gefallen

- Agencies That Facilitate International FlowsDokument10 SeitenAgencies That Facilitate International FlowsKamlesh Choudhary100% (1)

- Procurement Compliance ChecklistsDokument8 SeitenProcurement Compliance Checklistsedzky69Noch keine Bewertungen

- Important International OrganizationsDokument4 SeitenImportant International Organizationsuma100% (1)

- Pepsi Company To Achieve GoalsDokument5 SeitenPepsi Company To Achieve GoalsMalik Noman100% (2)

- SOP LogisticsDokument8 SeitenSOP LogisticsMelvin PereiraNoch keine Bewertungen

- Procurement SopDokument24 SeitenProcurement SopFelix Mwanduka100% (2)

- Purchase ProcedureDokument25 SeitenPurchase ProcedureVenothraaj RaajNoch keine Bewertungen

- Nestle Procurement Policy enDokument13 SeitenNestle Procurement Policy enAbid Mehmood100% (2)

- E-Procurnment 1Dokument28 SeitenE-Procurnment 1smilealwplz100% (1)

- Project Risk and Procurement AssignmentDokument14 SeitenProject Risk and Procurement AssignmentMuhammad Faraz Hasan100% (1)

- Simplified Procurement ProcessDokument1 SeiteSimplified Procurement Processduytay94100% (1)

- Procurement ManualDokument14 SeitenProcurement ManualHussein Taofeek OlalekanNoch keine Bewertungen

- How To Appraise Suppliers PDFDokument23 SeitenHow To Appraise Suppliers PDFVishwanath KrNoch keine Bewertungen

- Procurement Policy ManualDokument19 SeitenProcurement Policy ManualJennifer Johnson0% (1)

- Procurement PolicyDokument12 SeitenProcurement PolicyMinhazul AminNoch keine Bewertungen

- General Procurement ManualDokument310 SeitenGeneral Procurement ManualPaul MachariaNoch keine Bewertungen

- Purchase Requisition Policies & Procedures: Title: ScopeDokument4 SeitenPurchase Requisition Policies & Procedures: Title: Scopeadil100% (1)

- Standard Operating Procedure: ProjectsDokument1 SeiteStandard Operating Procedure: ProjectsShena BrittoNoch keine Bewertungen

- Procurement ProceduresDokument13 SeitenProcurement ProceduresGILBERTO YOSHIDANoch keine Bewertungen

- SOP ProcurementDokument22 SeitenSOP ProcurementABie Frya100% (4)

- Procurement PolicyDokument58 SeitenProcurement PolicyBejace NyachhyonNoch keine Bewertungen

- Company Purchase:: Business Organization Goods ServicesDokument14 SeitenCompany Purchase:: Business Organization Goods ServicesNoman KhanNoch keine Bewertungen

- Best Practices Principles in ProcurementDokument14 SeitenBest Practices Principles in ProcurementradoniainaNoch keine Bewertungen

- Actual Procurement ProcessDokument9 SeitenActual Procurement ProcessMark Delos SantosNoch keine Bewertungen

- Chapter 2 - The Financial System in The EconomyDokument24 SeitenChapter 2 - The Financial System in The EconomyVainess S ZuluNoch keine Bewertungen

- SourcingDokument9 SeitenSourcingKailas Sree Chandran100% (1)

- Procurement MaturityDokument80 SeitenProcurement MaturityWisnu Budi SunaryoNoch keine Bewertungen

- Procurement ManagementDokument44 SeitenProcurement ManagementGreatmanNoch keine Bewertungen

- Supplier Selection Policy, Procedures and GuidelinesDokument8 SeitenSupplier Selection Policy, Procedures and GuidelinesCiem Collamat GeromalaNoch keine Bewertungen

- Procurement PolicyDokument5 SeitenProcurement PolicyarjunkaushikNoch keine Bewertungen

- Quality Control and Quality Assurance SystemDokument9 SeitenQuality Control and Quality Assurance SystemSathi shNoch keine Bewertungen

- Purchasing PolicyDokument30 SeitenPurchasing PolicytechnicalvijayNoch keine Bewertungen

- Joint Venture Standard FormDokument14 SeitenJoint Venture Standard FormtessNoch keine Bewertungen

- Faster Procurement Process Study ReportDokument24 SeitenFaster Procurement Process Study ReportkeyspNoch keine Bewertungen

- Foreign Direct Investment in BangladeshDokument21 SeitenForeign Direct Investment in Bangladeshsauvik84in100% (5)

- Procurement Management PlanDokument11 SeitenProcurement Management PlanJohn Elmer LoretizoNoch keine Bewertungen

- Environmental and Social Review Procedure Manual - October 2016Dokument88 SeitenEnvironmental and Social Review Procedure Manual - October 2016IFC SustainabilityNoch keine Bewertungen

- Procurement Risk RegisterDokument3 SeitenProcurement Risk RegisterYogender Singh Rawat100% (2)

- Local Procurement Policy PDFDokument20 SeitenLocal Procurement Policy PDFmaruf_tanmimNoch keine Bewertungen

- Procurement Management PlanDokument9 SeitenProcurement Management PlanbotchNoch keine Bewertungen

- Procurement and Supply ManagementDokument36 SeitenProcurement and Supply ManagementCipaidunkNoch keine Bewertungen

- Procurement Guidelines 2018Dokument117 SeitenProcurement Guidelines 2018janithbogahawattaNoch keine Bewertungen

- Procurement ProcessDokument73 SeitenProcurement ProcessShivaniSharma100% (1)

- Facilities Management Service and Customer Satisfaction in Shopping Mall Sector - Converted - by - AbcdpdfDokument15 SeitenFacilities Management Service and Customer Satisfaction in Shopping Mall Sector - Converted - by - AbcdpdfKar Yau MakNoch keine Bewertungen

- Procurement ManualDokument59 SeitenProcurement ManualAshis Daskanungo100% (1)

- International Financial InstitutionsDokument5 SeitenInternational Financial Institutionsangelverma100% (1)

- Tender Waiver Form 2015Dokument6 SeitenTender Waiver Form 2015ahtin618Noch keine Bewertungen

- Strategic Procurement Plan TemplateDokument9 SeitenStrategic Procurement Plan TemplateMuhammad AdeelNoch keine Bewertungen

- Contract Act 1872, Pakistan. An Applicable Law in PakistanDokument19 SeitenContract Act 1872, Pakistan. An Applicable Law in Pakistantess100% (4)

- Procurement ReportDokument12 SeitenProcurement ReportMwasNoch keine Bewertungen

- CIPs Master UK PressQualityDokument52 SeitenCIPs Master UK PressQualityJavier MNoch keine Bewertungen

- Procurement and Contract Management StrategyDokument22 SeitenProcurement and Contract Management StrategymohmedNoch keine Bewertungen

- D3 Sourcing in Procurement and SupplyDokument4 SeitenD3 Sourcing in Procurement and SupplyAhmed HasanNoch keine Bewertungen

- PROJ 598 Contract and Procurement ManagementDokument2 SeitenPROJ 598 Contract and Procurement ManagementAlan MarkNoch keine Bewertungen

- Code of ConductDokument8 SeitenCode of Conductyulyana90Noch keine Bewertungen

- The Procurement Cycle: First ExampleDokument12 SeitenThe Procurement Cycle: First ExampleAnamaria Popescu AnamariapopescuNoch keine Bewertungen

- Goods Spend Analysis ReportDokument5 SeitenGoods Spend Analysis Reporty-hammoudNoch keine Bewertungen

- Legal Framework Course OutlineDokument2 SeitenLegal Framework Course OutlineAUGUSTINE ANANE100% (1)

- ProjectDokument50 SeitenProjectRaveen DormyNoch keine Bewertungen

- The Purchasing Cycle ExplainedDokument9 SeitenThe Purchasing Cycle Explaineddhananjay407Noch keine Bewertungen

- Procurement and NGOsDokument6 SeitenProcurement and NGOsMAGOMU DAN DAVID100% (1)

- Dufu Anti Bribery and Corruption PolicyDokument10 SeitenDufu Anti Bribery and Corruption Policyseliper biruNoch keine Bewertungen

- Paper Viii.9 Internal Factors Affecting Procurement Process of Supplies in The Public Sector PDFDokument31 SeitenPaper Viii.9 Internal Factors Affecting Procurement Process of Supplies in The Public Sector PDFshumaiylNoch keine Bewertungen

- Vendor Management Process A Complete Guide - 2020 EditionVon EverandVendor Management Process A Complete Guide - 2020 EditionNoch keine Bewertungen

- Session 1 NPF Overview & Introduction PDFDokument32 SeitenSession 1 NPF Overview & Introduction PDFRico SamuelNoch keine Bewertungen

- Aiib Procurement PolicyDokument10 SeitenAiib Procurement PolicyWilliam LauNoch keine Bewertungen

- Adb Procurement PolicyDokument10 SeitenAdb Procurement Policychandan kumarNoch keine Bewertungen

- National Holidays in Pakistan For The 2017 PDFDokument2 SeitenNational Holidays in Pakistan For The 2017 PDFtessNoch keine Bewertungen

- Analysis of Technique in LateDokument40 SeitenAnalysis of Technique in LatesabithqsatNoch keine Bewertungen

- National Holidays in Pakistan For The 2017Dokument3 SeitenNational Holidays in Pakistan For The 2017tessNoch keine Bewertungen

- Woman Protection Bill PakistanDokument19 SeitenWoman Protection Bill PakistantessNoch keine Bewertungen

- Government of Pakistan Labour Policy 2010Dokument22 SeitenGovernment of Pakistan Labour Policy 2010Nouman Ahmed SiddiqueNoch keine Bewertungen

- Gaz. of Pakistan Part 1 November 2016Dokument216 SeitenGaz. of Pakistan Part 1 November 2016tessNoch keine Bewertungen

- Cooperation Agreement Between Construcors - SPECIMENDokument7 SeitenCooperation Agreement Between Construcors - SPECIMENtessNoch keine Bewertungen

- Labour Agreement With Mr. ..... (LABOUR PROVIDER)Dokument6 SeitenLabour Agreement With Mr. ..... (LABOUR PROVIDER)tessNoch keine Bewertungen

- Purchase Agreement CRFG PAKDokument19 SeitenPurchase Agreement CRFG PAKtessNoch keine Bewertungen

- Non Disclosure AgreementDokument3 SeitenNon Disclosure AgreementtessNoch keine Bewertungen

- World Bank Manual - Disputes-External DebtDokument2 SeitenWorld Bank Manual - Disputes-External DebttessNoch keine Bewertungen

- Declaration of Association For COnsultancy ServicesDokument1 SeiteDeclaration of Association For COnsultancy ServicestessNoch keine Bewertungen

- Employment Agreement Tehseen CRFGDokument4 SeitenEmployment Agreement Tehseen CRFGtessNoch keine Bewertungen

- PsuDokument6 SeitenPsutess100% (1)

- Bidding PEC Criteria: Pakistan Engineering CounsilDokument10 SeitenBidding PEC Criteria: Pakistan Engineering CounsiltessNoch keine Bewertungen

- Determination Clauses Under SCL 3.5 - Fidic 1999Dokument4 SeitenDetermination Clauses Under SCL 3.5 - Fidic 1999tessNoch keine Bewertungen

- Clause-2 - (1) by Edward Corbett @coDokument18 SeitenClause-2 - (1) by Edward Corbett @cotess100% (1)

- Megger Earth Resistance Testing PDFDokument41 SeitenMegger Earth Resistance Testing PDFtess100% (1)

- WORLD BANK Guidelines How To File For WebDokument6 SeitenWORLD BANK Guidelines How To File For WebtessNoch keine Bewertungen

- Anti-Corruption GuidelinesDokument7 SeitenAnti-Corruption GuidelinestessNoch keine Bewertungen

- Red Flags World Bank - Bidders Stay AlertDokument2 SeitenRed Flags World Bank - Bidders Stay AlerttessNoch keine Bewertungen

- FDI-Outline (2019 - Olivia)Dokument40 SeitenFDI-Outline (2019 - Olivia)Luis Miguel Garrido MarroquinNoch keine Bewertungen

- World BankDokument121 SeitenWorld Bankbivek kumarNoch keine Bewertungen

- AR2006 Volume2Dokument181 SeitenAR2006 Volume2Mgn SanNoch keine Bewertungen

- Globalization and The Climate of Foreign Direct Investment: A Case For BangladeshDokument19 SeitenGlobalization and The Climate of Foreign Direct Investment: A Case For BangladeshSaiful Islam KajolNoch keine Bewertungen

- Microsoft Word - Company Registration Requirements & ProceduresDokument11 SeitenMicrosoft Word - Company Registration Requirements & ProceduresMarko AnticNoch keine Bewertungen

- Edited Imf ProjectDokument32 SeitenEdited Imf ProjectAkash Kumar DhakoliyaNoch keine Bewertungen

- Bangladesh Export Processing ZoneDokument10 SeitenBangladesh Export Processing ZoneFakrul Hasan Khan100% (2)

- 11 Business Studies SP 1Dokument11 Seiten11 Business Studies SP 1Meldon17Noch keine Bewertungen

- Gemstone KenyaDokument12 SeitenGemstone KenyajohnmaunduNoch keine Bewertungen

- International Marketing EnvironmentDokument29 SeitenInternational Marketing EnvironmentsujeetleopardNoch keine Bewertungen

- International Flow of FundsDokument25 SeitenInternational Flow of FundsNadiraIslamovićNoch keine Bewertungen

- 19th SMC Academic Guidelines InstructionsDokument17 Seiten19th SMC Academic Guidelines InstructionsAnwarulhaq ShahNoch keine Bewertungen

- Namma Kalvi Economics Unit 8 Surya Economics Guide emDokument28 SeitenNamma Kalvi Economics Unit 8 Surya Economics Guide emAakaash C.K.Noch keine Bewertungen

- Credit Enhancement PracticesDokument30 SeitenCredit Enhancement PracticesWondim TesfahunNoch keine Bewertungen

- World Bank Data CatalogDokument29 SeitenWorld Bank Data CatalogSiba PrasadNoch keine Bewertungen

- 5 Institutions of The World Bank GroupDokument3 Seiten5 Institutions of The World Bank GroupFakhriyya GaflanovaNoch keine Bewertungen

- Fdi 2Dokument78 SeitenFdi 2Tharindu PereraNoch keine Bewertungen

- NFTP PresentationDokument32 SeitenNFTP PresentationDeepti MangalNoch keine Bewertungen

- ICSID Fedax v. VenezuelaDokument13 SeitenICSID Fedax v. VenezuelaPaolaNoch keine Bewertungen

- Israel: - Benny Axt - Kumar Arunachala - Story Tweedie Yates - Wei-Wen Chen - Sanchita DharaDokument11 SeitenIsrael: - Benny Axt - Kumar Arunachala - Story Tweedie Yates - Wei-Wen Chen - Sanchita DharaBenny AxtNoch keine Bewertungen

- Csat Gs Almost Revision ManualDokument483 SeitenCsat Gs Almost Revision ManualVarun Mohanakumaran RajambikaNoch keine Bewertungen

- What Is The World BankDokument4 SeitenWhat Is The World BankPrincess KanchanNoch keine Bewertungen

- Global Interstate System: PrmalitiiiDokument57 SeitenGlobal Interstate System: PrmalitiiiJanlex Perry R. OrqueNoch keine Bewertungen

- Complete Thesis - (07.04.2018)Dokument341 SeitenComplete Thesis - (07.04.2018)Oladayo SiyanbolaNoch keine Bewertungen