Beruflich Dokumente

Kultur Dokumente

Sro Psi 143 PDF

Hochgeladen von

musharat_shafique0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

56 Ansichten5 SeitenOriginaltitel

SRO-PSI-143.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

56 Ansichten5 SeitenSro Psi 143 PDF

Hochgeladen von

musharat_shafiqueCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

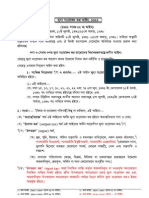

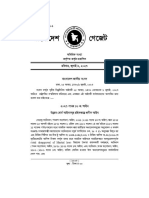

MYcRvZx evsjv`k miKvi

A_ gYvjq

AfixY m` wefvM

()

cvcb

ZvwiL t 22 R, 1415 ev/5 Ryb, 2008 wLv|

Gm,Avi,I bs ........-AvBb/2008/........../| -The Customs Act,

1969 (IV of 1969) Gi section 25B Gi proviso Z c` gZvej miKvi,

AfixY mc` wefvMi 13 Avlvp, 1414 evsjv gvZveK 27 Ryb, 2007 BsiRx

ZvwiLi cvcb Gm,Avi,I bs 143-AvBb/ 2007/2142/ GZviv iwnZ Kwiqv,

wbewYZ evaZvgjK wc-wkcgU BcKkbi AvIZv nBZ AevnwZ c`vb

Kwij, h_v t-

(1) The Customs Act, 1969 Gi First Schedule -G h mg

H.S. Code Gi wecixZ Avg`vwb (customs duty) nvi kY

c`wkZ nBqvQ, Ggb cY Avg`vwb;

(2) The Customs Act, 1969 Gi section 20 gvZveK miKvi

wekl weePbvq h cY Pvjvbi mgy`q -Ki gIKzd KwiqvQ

Ggb cYi Avg`vwb;

(3) miKvix, Avav-miKvix, mi Kcvikb A_ev ^vqZkvwmZ cwZvb

KZK cY Avg`vwb;

(4) RvZxq ivR^ evW KZK c` Av`k viv wbavwiZ cuPbkxj cYi

ZvwjKvfy cY Avg`vwb;

(5) kZfvM ivbxgLx wki Rb eW Iqvi nvDm myweavq cY

Avg`vwb;

(6) cvcb Gm,Avi,I bs ........-AvBb/2008/.........../, ZvwiLt

...../....../2008 wLv Gi Afy H.S. Code fz gjabx

hcvwZ I hvski Avg`vwb;

(7) cvcb Gm,Avi,I bs 202-AvBb/95/1639/, ZvwiLt 28/11/95

Bs Gi Aaxb evsjv`k LwbR Zj I Mvm Abymvb, Dvjb I

Drcv`b Kvhg MnYi Rb Avg`vwbq hcvwZ, hvsk I Abvb

cY Avg`vwb;

(8) cvcb Gm,Avi,I bs 100-AvBb/2000/1832/, ZvwiLt

18/04/2000 Bs Gi Aaxb emiKvix LvZ we`yr Drcv`bi wbwg

we`yr Drcv`b K` vcbi j vqxfve Avg`vwbq cvU I

BKzBcgU Gi hvsk Avg`vwb;

(9) cvcb Gm,Avi,I bs 105-AvBb/99/1784/, ZvwiLt 23/05/99

Bs Gi Aaxb evsjv`k Zj I Mvm Abymvb, Dbqb, Dvjb I

Drcv`b Kvhg cwiPvjbvi Rb hcvwZ, hvsk I Abvb cY

Avg`vwb;

(10) cvcb Gm,Avi,I bs 73-AvBb/97/1700/, ZvwiLt 19/03/97

Bs Gi Aaxb emiKvixLvZ we`yr Drcv`bi wbwg we`yr Drcv`b

K` vcbi j vqxfve Avg`vwbKZ cvU I BKzBcgU Ges

Avqxfve BiKkb gvUwiqvjm&, hcvwZ I hvsk Avg`vwb;

(11) cvcb Gm,Avi,I bs 61-AvBb/92/1444/, ZvwiLt 17/03/92

Bs Gi Aaxb vY mvgMx Avg`vwb;

(12) wmGbwR wdwjs kb Ges Kbfvmb IqvKkc vcb I Kvhg

cwiPvjbvi Rb hcvwZ I hvsk Avg`vwb;

(13) RvZxq ivR^ evWi Standing Order No-3(84)NBR(Cus)

11/74/1766-70, dt. 28.01.75 Gi Aaxb cY Avg`vwb;

(14) RvZxq ivR^ evWi Memo No. 9(41) NBR/Cus-IV/72/

246, dated : 10th April, 1981 Gi AvIZvaxb Avg`vwbq

cwZiv mvgMx Avg`vwb;

(15) 1961 mbi wfqbv Kbfbkb c` KUbwZK myweavi AvIZvq

ciiv gYvjq KZK h_vh_fve c` mvwUwdKUi wfwZ

KUbwZK ew I KzUbwZK wgkb KZK cY Avg`vwb;

(16) The Privileged Persons (Customs Procedures) Rules,

2003 Gi AbyQ` 2(b), 2(c) Ges 2(d) G ewYZ msv ev ew

KZK cY Avg`vwb;

(17) gK, ewai, A ev kvixwiK I gvbwmK cwZex`i cybevmbi Rb

cY Avg`vwb;

(18) we`gvb evMR wewagvjv mgni AvIZvq cY Avg`vwb;

(19) cv cvmj Ges evwYwRK bgybv wnmve cY Avg`vwb;

(20) miKvi KZK Abygvw`Z evwYR gjvi Rb cY Avg`vwb;

(21) Avg`vwbKZ hcvwZ givgZi Rb ev Dnvi warranty

replacement Gi Rb cY Avg`vwb;

(22) The Customs Act, 1969 Gi section 21(a) -Gi AvIZvq

evW KZK RvixKZ Av`k Ges miKvi KZK RvixKZ cvcb bs

SRO 542-L/84/ 886/Cus. Dated 10th December, 1984

Gi Aaxb mvgwqKfve cY Avg`vwb;

(23) Abya 500 gvwKb Wjvi gji (wm,G,Gd) RxebivKvix

AZvekKxq Jla I wPwKrmv mvgMx Avg`vwb;

(24) Abya 100 gvwKb Wjvi gji (wm,G,Gd) wevcb/Dcnvi mvgMx

wnmve cY Avg`vwb;

(25) wk cwZvbi Rb Abya 750 gvwKb Wjvi gji (wm,G,Gd)

LyPiv hvsk Avg`vwb;

(26) we`k gj cwikvai wfwZ cwZ Pvjvb Abya 500 gvwKb Wjvi

gji (wm,G,Gd) cY Avg`vwb; Ges

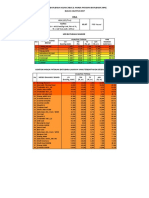

(27) wbi TABLE- fy H.S.Code I Zvi wecixZ eYbvi cY mvgMx

Avg`vwb, h_vt-

TABLE

Heading H.S.Code Description

No.

(1) (2) (3)

10.01 1001.10.10 Wheat

1001.10.20

1001.90.11

1001.90.12

27.01 2701.19.00 Coal, Other than anthracite and bituminous coal

Heading H.S.Code Description

No.

(1) (2) (3)

2710.11.11 Petroleum oils and oils obtained from bituminous

2710.11.19 minerals, other than crude; preparations not

2710.11.20 elsewhere specified or included, containing by

2710.11.31 weight 70% or more of petroleum oils or of oils

27.10 2710.11.32 obtained from bituminous minerals, these oils being

2710.11.41 the basic constituents of the preparation.

2710.11.42

2710.11.43

2710.11.49

2710.11.61

2710.11.62

2710.19.11

2710.19.22

2710.19.39

41.01, All Raw hides and skins

41.02, H.S.Codes

41.03

41.04 4104.11.00 Wet-blue hides and skins

41.05 4104.19.00

41.06 4105.10.00

4106.21.00

4106.31.00

4106.91.00

71.02 All Diamond (Rough or Polished)

H.S.Codes

71.08 7108.12.00 Gold bullion

7108.13.00

49.01 4901.99.20 Books (falling under this H.S.Code)

49.02 All Newspapers, journals and periodicals, whether or

H.S.Codes not illustrated or containing advertising material.

85.17 8517.12.10 Mobile/cellular telephone.

87.01 All Used and reconditioned motor cars and other motor

87.02 H.S.Codes vehicles principally designed for the transportation

87.03 of persons of goods, and tractors.

87.04

Heading H.S.Code Description

No.

(1) (2) (3)

89.08 8908.00.10 Vessels and other floating structure for breaking up.

02| GB cvcY 1 RyjvB, 2008 Lxv/17 Avlvp, 1415 ev ZvwiL KvhKi

nBe|

ivcwZi Av`kg,

( gvnv` Ave`yj gwR` )

mwPe|

Das könnte Ihnen auch gefallen

- Icmci Cmc001 Certification Scheme Manual-Master Aug 2017Dokument27 SeitenIcmci Cmc001 Certification Scheme Manual-Master Aug 2017musharat_shafiqueNoch keine Bewertungen

- CPCL Project ReportDokument15 SeitenCPCL Project ReportSivathangavelu MuruganNoch keine Bewertungen

- Oil From Coal - Free! The Karrick LTC ProcessDokument13 SeitenOil From Coal - Free! The Karrick LTC ProcessE2TGNNoch keine Bewertungen

- VAT - Exemption-199 of 2010Dokument19 SeitenVAT - Exemption-199 of 2010hossainmzNoch keine Bewertungen

- Mycörvzš¿ X Evsjv 'K Mikvi A - © GŠ¿ - Yvjq Af Š@Ixy M C' WefvmDokument14 SeitenMycörvzš¿ X Evsjv 'K Mikvi A - © GŠ¿ - Yvjq Af Š@Ixy M C' WefvmtanziaNoch keine Bewertungen

- Import Policy 2009-2012Dokument61 SeitenImport Policy 2009-2012Shaon RaselNoch keine Bewertungen

- (G J Ms HVRB Ki Avbb, 1991 Gi Aviv 3 ' Óe ) G J Ms HVRB Ki NB Z Ae Vnwzcövß Cy MG NDokument18 Seiten(G J Ms HVRB Ki Avbb, 1991 Gi Aviv 3 ' Óe ) G J Ms HVRB Ki NB Z Ae Vnwzcövß Cy MG NsumondccNoch keine Bewertungen

- Sro Vat 2005Dokument38 SeitenSro Vat 2005Arup DattaNoch keine Bewertungen

- Drawback SRODokument1 SeiteDrawback SROhossainmzNoch keine Bewertungen

- (Related To 62) 17. - SRO179-Law-2014-2517-Cus - 2014Dokument3 Seiten(Related To 62) 17. - SRO179-Law-2014-2517-Cus - 2014naimenimNoch keine Bewertungen

- The Spacial Act Act 2013 GazetteDokument8 SeitenThe Spacial Act Act 2013 GazetteSyadul IslamNoch keine Bewertungen

- Excise DutyDokument1 SeiteExcise DutytanziaNoch keine Bewertungen

- Bank Company Act-2015Dokument32 SeitenBank Company Act-2015Aminul IslamNoch keine Bewertungen

- ORDER120-2001-Cus 2001 PrescribedBillOfEntryAndBillOfExportOrder-2001Dokument3 SeitenORDER120-2001-Cus 2001 PrescribedBillOfEntryAndBillOfExportOrder-2001Kazi Mobaidul Islam ShovonNoch keine Bewertungen

- The Local Government (City Corporation) Act, 2009 (Act No. 60 of 2009)Dokument88 SeitenThe Local Government (City Corporation) Act, 2009 (Act No. 60 of 2009)Sushanta GuptaNoch keine Bewertungen

- SRO 333 (26 October 2021)Dokument1 SeiteSRO 333 (26 October 2021)Mahmudul HasanNoch keine Bewertungen

- Mycörvzš¿ X Evsjv 'K Mikvi RVZXQ Ivr Evw© XVKV - (G-J Ms HVRB Ki) Cöávcb Zvwilt GM - Avi.I Bs-244Ñavbb/2010/564-G-MkDokument12 SeitenMycörvzš¿ X Evsjv 'K Mikvi RVZXQ Ivr Evw© XVKV - (G-J Ms HVRB Ki) Cöávcb Zvwilt GM - Avi.I Bs-244Ñavbb/2010/564-G-MkhossainmzNoch keine Bewertungen

- A - © Fy Av'Vjz Avbb, 2003: 2003 M Bi 8 Bs AvbbDokument3 SeitenA - © Fy Av'Vjz Avbb, 2003: 2003 M Bi 8 Bs AvbbAnonymous Wf4CEHKNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument4 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Ahasanul AlamNoch keine Bewertungen

- Thenatura Gasrules 1991Dokument33 SeitenThenatura Gasrules 1991Shahedul IslamNoch keine Bewertungen

- Local Government Paurashava Act 2009Dokument101 SeitenLocal Government Paurashava Act 2009Maruf Hasan SakibNoch keine Bewertungen

- SRO188 Law 2016 37 Customs - AdvanceRulingRules - PDFDokument13 SeitenSRO188 Law 2016 37 Customs - AdvanceRulingRules - PDFshakilmagura9424Noch keine Bewertungen

- Land Development Tax - 18!09!2023Dokument12 SeitenLand Development Tax - 18!09!2023Wahid Duz ZamanNoch keine Bewertungen

- SRO-73-Law-97-1700-Cus - Power Generation in Private SectorDokument6 SeitenSRO-73-Law-97-1700-Cus - Power Generation in Private SectorChami LiyanageNoch keine Bewertungen

- Mycörvzš¿X Evsjv 'K Mikvi: Excises and Salt Act, 1944 (Act No. I of 1944) Section 12ADokument1 SeiteMycörvzš¿X Evsjv 'K Mikvi: Excises and Salt Act, 1944 (Act No. I of 1944) Section 12AtanziaNoch keine Bewertungen

- G J Ms HVRB Ki Avbb, 1991: (1991 M Bi 22 Bs Avbb)Dokument44 SeitenG J Ms HVRB Ki Avbb, 1991: (1991 M Bi 22 Bs Avbb)mshazzad_consultantNoch keine Bewertungen

- CWÐG Piv'x QV JWNQV Avwjg Gv'&ivmvDokument2 SeitenCWÐG Piv'x QV JWNQV Avwjg Gv'&ivmvstudio 2020Noch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument1 SeiteEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Mahmudul HasanNoch keine Bewertungen

- VAT Act 1991 in Easy Language Updt 2012Dokument146 SeitenVAT Act 1991 in Easy Language Updt 2012sajibNoch keine Bewertungen

- Finance Act 2023Dokument76 SeitenFinance Act 2023Fv BNoch keine Bewertungen

- 2023 HE Slow or Non-Moving MaterialsDokument818 Seiten2023 HE Slow or Non-Moving MaterialsFrancis DedumoNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument15 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Shamsur RahmanNoch keine Bewertungen

- Narcotics Control Act 1990 (Amendment 2000)Dokument8 SeitenNarcotics Control Act 1990 (Amendment 2000)sbanarjeeNoch keine Bewertungen

- ATV ProceduresDokument5 SeitenATV ProcedureshossainmzNoch keine Bewertungen

- Bangladesh Custom Act 1969 (Bangla)Dokument169 SeitenBangladesh Custom Act 1969 (Bangla)BoroBethaMoneNoch keine Bewertungen

- The Artha Rin Adalat Amendment Ain, 2003Dokument11 SeitenThe Artha Rin Adalat Amendment Ain, 2003snigdha biswasNoch keine Bewertungen

- VDP Estimate CheckingDokument14 SeitenVDP Estimate CheckingBago Region EngineerNoch keine Bewertungen

- 16 Dec 2020Dokument5 Seiten16 Dec 2020SpeedGlobe AviationNoch keine Bewertungen

- Vat Sro 220 SDDokument2 SeitenVat Sro 220 SDbanglauserNoch keine Bewertungen

- Bangladesh Merchant Shipping Officer & Rating Training, Certification, Employment, Working Hours and Watchkeeping Rules 2011Dokument132 SeitenBangladesh Merchant Shipping Officer & Rating Training, Certification, Employment, Working Hours and Watchkeeping Rules 2011Nisshongo MonNoch keine Bewertungen

- 144 - Baggage - Rule - Amend June-2017Dokument2 Seiten144 - Baggage - Rule - Amend June-2017tc19bogura GaibandhaNoch keine Bewertungen

- Act - 16 - Development Boards (Repealed) Act, 2023Dokument3 SeitenAct - 16 - Development Boards (Repealed) Act, 2023Maher NigerNoch keine Bewertungen

- Exam Rule 2011 BanglaDokument89 SeitenExam Rule 2011 BanglaShoaib hossainNoch keine Bewertungen

- BS EN 50525-2-21-2011 Low Voltage Energy Cables of Rated VoltagesDokument46 SeitenBS EN 50525-2-21-2011 Low Voltage Energy Cables of Rated VoltagesSongkunhua SongNoch keine Bewertungen

- Bashundhara Project - 13Dokument17 SeitenBashundhara Project - 13Khalid SaifullahNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument12 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Saiful IslamNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument40 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Textile AcademiaNoch keine Bewertungen

- (KV÷GM) Cöávcb Zvwil T 24 - R Ô, 1419 E Vã/07 Ryb, 2012 WL ÷vã - GM - Avi.I. Bs-172-Avbb/2012/2400/Kv÷GmDokument11 Seiten(KV÷GM) Cöávcb Zvwil T 24 - R Ô, 1419 E Vã/07 Ryb, 2012 WL ÷vã - GM - Avi.I. Bs-172-Avbb/2012/2400/Kv÷GmAshraful FerdousNoch keine Bewertungen

- 2000 02 23 Customs Valuation Rules, 2000Dokument11 Seiten2000 02 23 Customs Valuation Rules, 2000VAT A2ZNoch keine Bewertungen

- Патент RU 2347169C1 Автоматический пистолет (2007)Dokument10 SeitenПатент RU 2347169C1 Автоматический пистолет (2007)Евгений МошонскийNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument16 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1dff_jxNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument7 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Sadkatul BariNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument71 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1IQBALNoch keine Bewertungen

- G J Ms HVRB Ki Wewagvjv, 1991: (Gmavii Bs 178-Avbb/91/3-G MK, Zvwil: 12 Ryb, 1991)Dokument23 SeitenG J Ms HVRB Ki Wewagvjv, 1991: (Gmavii Bs 178-Avbb/91/3-G MK, Zvwil: 12 Ryb, 1991)Ashraf AtiqueNoch keine Bewertungen

- Heba Deed (Brother To Brother) @24!02!2024Dokument11 SeitenHeba Deed (Brother To Brother) @24!02!2024Jahidul IslamNoch keine Bewertungen

- Application PTCDokument2 SeitenApplication PTCregforsoftNoch keine Bewertungen

- Baina Deed - LandDokument11 SeitenBaina Deed - LandtanviriubdNoch keine Bewertungen

- Patent Act 2022Dokument28 SeitenPatent Act 2022sazzatnebir999Noch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument11 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1saiful IslamNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument15 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Osman GoniNoch keine Bewertungen

- Avbbmz MNVQZV Cö'Vb BXWZGVJV, 2014: C:/Users/Nlaso/Desktop/New Web Design/Zip/Act and RulesDokument2 SeitenAvbbmz MNVQZV Cö'Vb BXWZGVJV, 2014: C:/Users/Nlaso/Desktop/New Web Design/Zip/Act and RulesRuhul AminNoch keine Bewertungen

- Navigation Rules and Regulations Handbook: International—InlandVon EverandNavigation Rules and Regulations Handbook: International—InlandBewertung: 5 von 5 Sternen5/5 (1)

- Consumer Act-2009 PDFDokument32 SeitenConsumer Act-2009 PDFmdmonzurh1Noch keine Bewertungen

- Creating A Database With Mysql WorkbenchDokument2 SeitenCreating A Database With Mysql Workbenchmusharat_shafiqueNoch keine Bewertungen

- SAFTA Rules of OriginalDokument7 SeitenSAFTA Rules of Originalmusharat_shafiqueNoch keine Bewertungen

- 169 PSI Exemption PDFDokument5 Seiten169 PSI Exemption PDFmusharat_shafiqueNoch keine Bewertungen

- Car Duty Structure 2009-2010 PDFDokument1 SeiteCar Duty Structure 2009-2010 PDFmusharat_shafiqueNoch keine Bewertungen

- Incoterms 2010 EN v2 PDFDokument2 SeitenIncoterms 2010 EN v2 PDFWYNBADNoch keine Bewertungen

- 168 Capital MachinaryDokument15 Seiten168 Capital Machinarymusharat_shafiqueNoch keine Bewertungen

- 171 Computer Accessories PDFDokument2 Seiten171 Computer Accessories PDFmusharat_shafiqueNoch keine Bewertungen

- IntrotoMySQL 2Dokument63 SeitenIntrotoMySQL 2p-jornNoch keine Bewertungen

- SWIFT Trade Extract Standards Messages Implementation Guidelines 200811Dokument168 SeitenSWIFT Trade Extract Standards Messages Implementation Guidelines 200811aleac2Noch keine Bewertungen

- Introduction To Mysql: 1.0 Conventions in This DocumentDokument9 SeitenIntroduction To Mysql: 1.0 Conventions in This DocumentVinay VermaNoch keine Bewertungen

- Budget 2009-10 - Implication On Telecom Equipments PDFDokument1 SeiteBudget 2009-10 - Implication On Telecom Equipments PDFmusharat_shafiqueNoch keine Bewertungen

- Bangla Budget Speech 2009-10Dokument108 SeitenBangla Budget Speech 2009-10musharat_shafiqueNoch keine Bewertungen

- Part IIDokument49 SeitenPart IImusharat_shafiqueNoch keine Bewertungen

- Part IV PDFDokument43 SeitenPart IV PDFmusharat_shafiqueNoch keine Bewertungen

- Fumir I'Ill'I,: Sic.!'1Wll.1Dokument4 SeitenFumir I'Ill'I,: Sic.!'1Wll.1musharat_shafiqueNoch keine Bewertungen

- Part III PDFDokument60 SeitenPart III PDFmusharat_shafiqueNoch keine Bewertungen

- Office Order PDFDokument1 SeiteOffice Order PDFmusharat_shafiqueNoch keine Bewertungen

- Product Specific Rules Under SAFTA Rules of Origin PDFDokument6 SeitenProduct Specific Rules Under SAFTA Rules of Origin PDFmusharat_shafiqueNoch keine Bewertungen

- Export-Policy-2006-09 - English PDFDokument35 SeitenExport-Policy-2006-09 - English PDFmusharat_shafiqueNoch keine Bewertungen

- Operational Certification Procedures For SAFTA Rules of OriginDokument10 SeitenOperational Certification Procedures For SAFTA Rules of Originmusharat_shafique100% (1)

- 168 Capital MachinaryDokument15 Seiten168 Capital Machinarymusharat_shafiqueNoch keine Bewertungen

- S Aft A AgreementDokument12 SeitenS Aft A AgreementSankalp MishraNoch keine Bewertungen

- Export-Policy-2006-09 - English PDFDokument35 SeitenExport-Policy-2006-09 - English PDFmusharat_shafiqueNoch keine Bewertungen

- Budget Speech 2008-2009 EnglishDokument52 SeitenBudget Speech 2008-2009 Englishmusharat_shafiqueNoch keine Bewertungen

- Export Policy - 2006-09 BanglaDokument43 SeitenExport Policy - 2006-09 Banglamusharat_shafiqueNoch keine Bewertungen

- 169 PSI Exemption PDFDokument5 Seiten169 PSI Exemption PDFmusharat_shafiqueNoch keine Bewertungen

- 171 Computer Accessories PDFDokument2 Seiten171 Computer Accessories PDFmusharat_shafiqueNoch keine Bewertungen

- Budget Speech 2008-2009 PDFDokument54 SeitenBudget Speech 2008-2009 PDFmusharat_shafiqueNoch keine Bewertungen

- Wahyu Triaji Rahadianto NIM 061540411904 Dosen Pembimbing: Ahmad Zikri, S.T., M.TDokument15 SeitenWahyu Triaji Rahadianto NIM 061540411904 Dosen Pembimbing: Ahmad Zikri, S.T., M.TfadilahNoch keine Bewertungen

- Glossary of energy and financial termsDokument2 SeitenGlossary of energy and financial termsJoseAndresCarreñoNoch keine Bewertungen

- Cs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentDokument5 SeitenCs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentsandeeprainaNoch keine Bewertungen

- Safety Video Attendance Sheet and List of MoviesDokument7 SeitenSafety Video Attendance Sheet and List of MoviesGlen MacNoch keine Bewertungen

- Well Injurious ConstituentDokument117 SeitenWell Injurious ConstituentJohannes ForstpointnerNoch keine Bewertungen

- Employment Agencies in QatarDokument18 SeitenEmployment Agencies in QatarEngineer AlviNoch keine Bewertungen

- Filling Up India's Strategic Crude Oil ReservesDokument1 SeiteFilling Up India's Strategic Crude Oil ReservesShaishav MistryNoch keine Bewertungen

- UNIT 1 - An International IndustryDokument6 SeitenUNIT 1 - An International IndustryBrenda AcuñaNoch keine Bewertungen

- Gasoline StationDokument39 SeitenGasoline StationrjunaoNoch keine Bewertungen

- Harga Patokan Batu Bara PDFDokument4 SeitenHarga Patokan Batu Bara PDFErik HermawanNoch keine Bewertungen

- 19 TTG Conventional OG PDFDokument48 Seiten19 TTG Conventional OG PDFRahmat HidayatNoch keine Bewertungen

- Back To Index: Prefix UnitDokument4 SeitenBack To Index: Prefix UnitchandirandelhiNoch keine Bewertungen

- Petron Corporation: Philippines' Largest Oil Refining CompanyDokument3 SeitenPetron Corporation: Philippines' Largest Oil Refining CompanyERWIN CAYL CABANGALNoch keine Bewertungen

- Forecasting OPEC Crude Oil Production Using A Variant Multicyclic Hubbert Model (Ebrahimi 2015) Journal of Petroleum Science and EngineeringDokument6 SeitenForecasting OPEC Crude Oil Production Using A Variant Multicyclic Hubbert Model (Ebrahimi 2015) Journal of Petroleum Science and EngineeringCliffhangerNoch keine Bewertungen

- En - 180502 - AWE - Attach - 1 - Mitsui Acquisition of AWE PDFDokument11 SeitenEn - 180502 - AWE - Attach - 1 - Mitsui Acquisition of AWE PDFredevils86Noch keine Bewertungen

- Coal (Makarwal) : Approximate Analysis: Ultimate AnalysisDokument3 SeitenCoal (Makarwal) : Approximate Analysis: Ultimate AnalysisAli AhsanNoch keine Bewertungen

- Energy: United StatesDokument4 SeitenEnergy: United StatesMichael WarnerNoch keine Bewertungen

- Oily WatersDokument8 SeitenOily WatersRAGHU MALLEGOWDANoch keine Bewertungen

- Assignment 7 FUELSDokument4 SeitenAssignment 7 FUELSKester Yuree L. GimongalaNoch keine Bewertungen

- Refinery Units PDFDokument2 SeitenRefinery Units PDFPTKBTNoch keine Bewertungen

- IHS StudyDokument36 SeitenIHS StudyRobert DsouzaNoch keine Bewertungen

- Coal Bed MethaneDokument9 SeitenCoal Bed Methanepartha das sharma100% (2)

- Thermal Recovery Methods for Enhanced Oil RecoveryDokument53 SeitenThermal Recovery Methods for Enhanced Oil Recoverydina mutia sari100% (1)

- Oil and Gas Translation ServicesDokument3 SeitenOil and Gas Translation Serviceshappy_tridindiaNoch keine Bewertungen

- Major Project SynopsisDokument4 SeitenMajor Project SynopsisAbhimanyuGangulaNoch keine Bewertungen

- Lecture Plan - Petroleum Production Operations-IIDokument2 SeitenLecture Plan - Petroleum Production Operations-IIJatin RamboNoch keine Bewertungen

- Platts BrochureDokument8 SeitenPlatts BrochureRohit HarlalkaNoch keine Bewertungen

- List of Projects ExecutedDokument6 SeitenList of Projects ExecutedarnolhariNoch keine Bewertungen