Beruflich Dokumente

Kultur Dokumente

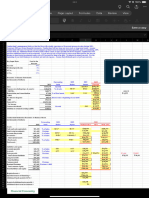

Cash Needed Fee Amount Held Check Amount Annual Percentage Rate

Hochgeladen von

ryanash777Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Needed Fee Amount Held Check Amount Annual Percentage Rate

Hochgeladen von

ryanash777Copyright:

Verfügbare Formate

Check Into Cash of Indiana, LLC

Fee Schedule

Annual

Cash Fee Held Check Percentage

Needed Amount Amount Rate*

$ 50 00

$ 7 50

$ 57 50

391.07%

$10000

$1500

$11500

391.07%

$15000

$2250

$17250

391.07%

$20000

$3000

$23000

391.07%

$25000

$3750

$28750

391.07%

$30000

$4400

$34400

382.38%

$35000

$5050

$40050

376.17%

$40000

$5700

$45700

371.52%

$45000

$6200

$51200

359.21%

$50000

$6700

$56700

349.36%

$55000

$7200

$62200

341.30%

$60000

$7700

$67700

334.58%

$60500

$7750

$68250

333.97%

* Based on a fourteen (14) day advance with one (1) payment.

Advances are available in $10 increments subject to minimum and maximum amounts.

There will be a one-time charge of $25 if your Check is dishonored and

returned by your bank or other depository institution.

ELECTRONIC CHECK CONVERSION AND RETURN CHECK POLICY: When you provide a check as payment, you authorize us either

to use information from your check to make one-time electronic funds transfer from your account or to process the payment as a check

transaction. With electronic funds transfer the funds maybe withdrawn from your account as soon as the same day your payment is

processed. Your check will not be returned to you by your financial institution. You authorize us to collect a fee of $25.00 through

an electronic fund transfer from your account if your payment is returned unpaid. In the event we deposit your paper check and it is

returned unpaid for insufficient or uncollected funds, we may re-present your check electronically. In the ordinary course of business your

check will not be provided to you with your bank statement, but a copy may be obtained by contacting your financial institution.

Customer Notice: A single payday advance is typically for two to four weeks. However, borrowers often use these loans over a period

of months, which can be expensive. Payday advances are not recommended as long-term financial solutions.

INFS061413

Das könnte Ihnen auch gefallen

- X-Treme Dungeon MasteryDokument162 SeitenX-Treme Dungeon MasteryUlfric Haugabrjotr96% (25)

- How To Insulate A Camper VanDokument14 SeitenHow To Insulate A Camper Vanryanash777Noch keine Bewertungen

- Dan Harmon Writing 101Dokument3 SeitenDan Harmon Writing 101ryanash777100% (1)

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Dokument1 SeiteDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaNoch keine Bewertungen

- Understand Your DNA A GuideDokument105 SeitenUnderstand Your DNA A Guideryanash777100% (3)

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Dokument1 SeiteDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Tony PhạmNoch keine Bewertungen

- Dashboard Template 2 - Complete: Strictly ConfidentialDokument2 SeitenDashboard Template 2 - Complete: Strictly ConfidentialKnightspageNoch keine Bewertungen

- Revised Analyst's Dilemma Analysis Pallab MishraDokument2 SeitenRevised Analyst's Dilemma Analysis Pallab Mishrapalros100% (1)

- Regenerative DesignDokument59 SeitenRegenerative DesignMike LojoNoch keine Bewertungen

- Savings Interest CalculatorDokument8 SeitenSavings Interest CalculatorZuhair MasedNoch keine Bewertungen

- Forex Trading Income CalculatorDokument3 SeitenForex Trading Income CalculatorrafiqimtihanNoch keine Bewertungen

- Metro Manila, Philippines: by Junio M RagragioDokument21 SeitenMetro Manila, Philippines: by Junio M RagragiofrancisNoch keine Bewertungen

- Gráfica Trend Pareto Action Paynter SCRAP 031219Dokument1.279 SeitenGráfica Trend Pareto Action Paynter SCRAP 031219alonsoNoch keine Bewertungen

- Forex PlanningDokument4 SeitenForex PlanningAli RidhaNoch keine Bewertungen

- Chapter 19 Homework SolutionDokument3 SeitenChapter 19 Homework SolutionJack100% (1)

- Project CharterDokument8 SeitenProject CharterVicky MandalNoch keine Bewertungen

- Introduction To Town PlanningDokument17 SeitenIntroduction To Town PlanningKripansh Tyagi100% (1)

- COA Resolution Number 2015-031Dokument3 SeitenCOA Resolution Number 2015-031gutierrez.dorie100% (7)

- David X - Be Relentless PDFDokument26 SeitenDavid X - Be Relentless PDFryanash777Noch keine Bewertungen

- 3M Knowledge Management-Group 1Dokument22 Seiten3M Knowledge Management-Group 1Siddharth Sourav PadheeNoch keine Bewertungen

- Dashboard Template 2 CompleteDokument2 SeitenDashboard Template 2 CompleteKshitize GuptaNoch keine Bewertungen

- Cootamundra House PricesDokument4 SeitenCootamundra House PricesDaisy HuntlyNoch keine Bewertungen

- Real EstateDokument8 SeitenReal EstatenguyentrantoquynhtqNoch keine Bewertungen

- Dashboard Template 2 - Complete: Strictly ConfidentialDokument2 SeitenDashboard Template 2 - Complete: Strictly ConfidentialKshitize GuptaNoch keine Bewertungen

- Circuit Realty: Shriya Patel 10/20/2018 To Provide An Overview of Home Listings in Tempe, ArizonaDokument17 SeitenCircuit Realty: Shriya Patel 10/20/2018 To Provide An Overview of Home Listings in Tempe, ArizonaJuliana FerraraNoch keine Bewertungen

- Q1 2011 Quarterly EarningsDokument15 SeitenQ1 2011 Quarterly EarningsRip Empson100% (1)

- Forecast 663210613-9Dokument1 SeiteForecast 663210613-99twyp8bpd2Noch keine Bewertungen

- Grant Proposal Template 22Dokument5 SeitenGrant Proposal Template 22fadolamu emmanuelNoch keine Bewertungen

- Wakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars RevenuesDokument10 SeitenWakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars Revenuesmohitgaba19100% (1)

- Q1 2012 Quarterly EarningsDokument15 SeitenQ1 2012 Quarterly EarningsTechCrunchNoch keine Bewertungen

- Resumen Cartera Enero 2018Dokument7 SeitenResumen Cartera Enero 2018yorgen alvarezNoch keine Bewertungen

- 2021 H2 TikTok Ads Rate Card SEADokument27 Seiten2021 H2 TikTok Ads Rate Card SEABảo HuỳnhNoch keine Bewertungen

- Sensitivity Analysis TableDokument3 SeitenSensitivity Analysis TableBurhanNoch keine Bewertungen

- Capital Structure Case Study - Q&ADokument2 SeitenCapital Structure Case Study - Q&Arosario correiaNoch keine Bewertungen

- Q4 2010 Quarterly EarningsDokument15 SeitenQ4 2010 Quarterly EarningsAlexia BonatsosNoch keine Bewertungen

- HB 3739 DatasheetDokument2 SeitenHB 3739 DatasheetvincemperezNoch keine Bewertungen

- Equity CalclutorDokument89 SeitenEquity CalclutorShrinivas ReddyNoch keine Bewertungen

- JB WK 21Dokument6 SeitenJB WK 21Anto LopezNoch keine Bewertungen

- Chapter 9 Case Question Finance SolvedDokument1 SeiteChapter 9 Case Question Finance SolvedOwais Khan KhattakNoch keine Bewertungen

- Sample TestDokument6 SeitenSample TestSajeniNoch keine Bewertungen

- Sample TestDokument6 SeitenSample TestSajeni50% (2)

- TSX Aw-Un 2019Dokument52 SeitenTSX Aw-Un 2019gaja babaNoch keine Bewertungen

- $100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceDokument4 Seiten$100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceAli RidhaNoch keine Bewertungen

- Quant Methods ToolsDokument54 SeitenQuant Methods ToolsRonNoch keine Bewertungen

- Zynga Fin ReportDokument33 SeitenZynga Fin Reportapi-19987738Noch keine Bewertungen

- Royal LePage 2022 Market Survey Forecast TableDokument1 SeiteRoyal LePage 2022 Market Survey Forecast TableCTV CalgaryNoch keine Bewertungen

- The Progressive Coporation: Asset Turnover Rate of 2007-2012 Year Total Asset Total Revenue Asset Turnover RateDokument2 SeitenThe Progressive Coporation: Asset Turnover Rate of 2007-2012 Year Total Asset Total Revenue Asset Turnover RateZhichang ZhangNoch keine Bewertungen

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDokument8 SeitenLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNoch keine Bewertungen

- Data Driven Decision Making - Course 3 Scenario Analysis Student WorkbookDokument5 SeitenData Driven Decision Making - Course 3 Scenario Analysis Student WorkbookSharys Mea MaglasangNoch keine Bewertungen

- Exercises 1 - Plant Assets, Natural Resources, and Intangible Assets - Jeremy MichaelDokument10 SeitenExercises 1 - Plant Assets, Natural Resources, and Intangible Assets - Jeremy MichaelJeremy Michael HariantoNoch keine Bewertungen

- Mining Royalites and Municipalities ReeleitionsDokument6 SeitenMining Royalites and Municipalities ReeleitionsAlexandre RodriguesNoch keine Bewertungen

- Net After Tax Rate of Return 2018Dokument1 SeiteNet After Tax Rate of Return 2018cherry LiNoch keine Bewertungen

- SCMR Salary Survey Exec Ed 2023Dokument55 SeitenSCMR Salary Survey Exec Ed 2023Bobby K. H. OngNoch keine Bewertungen

- 2013 Tax Bracket CalculatorDokument1 Seite2013 Tax Bracket Calculatorsalauddin1979Noch keine Bewertungen

- NP EX19 9b JinruiDong 2Dokument10 SeitenNP EX19 9b JinruiDong 2Ike DongNoch keine Bewertungen

- FM of DellDokument11 SeitenFM of DellKunal GarudNoch keine Bewertungen

- Credit Approval Decisions CodedDokument7 SeitenCredit Approval Decisions CodedvarunNoch keine Bewertungen

- Gráfica de Línea Base: Costo Costo AcumuladoDokument1 SeiteGráfica de Línea Base: Costo Costo Acumuladofiliberto martinezNoch keine Bewertungen

- Art N Consumo Anual (Unidades) Costo Unitario ($)Dokument3 SeitenArt N Consumo Anual (Unidades) Costo Unitario ($)yerson león carranzaNoch keine Bewertungen

- IC Marketing KPI Dashboard 11183Dokument6 SeitenIC Marketing KPI Dashboard 11183Ahmad FuadNoch keine Bewertungen

- SG Research Report Apt 1Q10Dokument1 SeiteSG Research Report Apt 1Q10siegelgallagherNoch keine Bewertungen

- F Wall Street 4-MSFT-Analysis (2010) 20100817Dokument1 SeiteF Wall Street 4-MSFT-Analysis (2010) 20100817smith_raNoch keine Bewertungen

- Sol TallerDokument13 SeitenSol TallerDav1d Pad1llaNoch keine Bewertungen

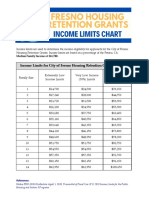

- Fresno Housing Retention Grants Income Limits ChartDokument1 SeiteFresno Housing Retention Grants Income Limits ChartSteve HawkinsNoch keine Bewertungen

- Examen FinalDokument2 SeitenExamen FinalKELVIN REYESNoch keine Bewertungen

- CFPDokument5 SeitenCFPHARSHITA DEVNANINoch keine Bewertungen

- FinalDokument29 SeitenFinalKool KingNoch keine Bewertungen

- Evaluación Financiera Real BessDokument21 SeitenEvaluación Financiera Real BessrolandogaraysalazarNoch keine Bewertungen

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDokument7 SeitenSavings Interest Calculator: Savings Plan Inputs Summary of ResultsmorrisioNoch keine Bewertungen

- 2019 01 01 Computer ShopperDokument140 Seiten2019 01 01 Computer Shopperryanash777Noch keine Bewertungen

- PP and ManiaDokument157 SeitenPP and Maniaryanash777Noch keine Bewertungen

- Bobby Adkins Symptom ListDokument1 SeiteBobby Adkins Symptom Listryanash777Noch keine Bewertungen

- Look Beyond The Narrative. Ask Too Many Questions. Find A Deeper Meaning. View The Mire With Pity. Learn From The Mistakes. Suffer For Knowledge. Read Old Books. Get Papercuts. LearnDokument1 SeiteLook Beyond The Narrative. Ask Too Many Questions. Find A Deeper Meaning. View The Mire With Pity. Learn From The Mistakes. Suffer For Knowledge. Read Old Books. Get Papercuts. Learnryanash777Noch keine Bewertungen

- Do: Get Outlet Covers Get House Inspected Turn On Gas? Turn On Electric Pay Property Taxes (Fall)Dokument1 SeiteDo: Get Outlet Covers Get House Inspected Turn On Gas? Turn On Electric Pay Property Taxes (Fall)ryanash777Noch keine Bewertungen

- Some People Liken Visits From Friends To A Bad Snow Storm. Optimistically, I Disagree, My Friends Only Visit When The Weather Is FairDokument1 SeiteSome People Liken Visits From Friends To A Bad Snow Storm. Optimistically, I Disagree, My Friends Only Visit When The Weather Is Fairryanash777Noch keine Bewertungen

- ExogamyDokument2 SeitenExogamyryanash777Noch keine Bewertungen

- StupidityDokument1 SeiteStupidityryanash777Noch keine Bewertungen

- RPG GetDokument3 SeitenRPG Getryanash777Noch keine Bewertungen

- Russian Naming ConventionsDokument19 SeitenRussian Naming Conventionsryanash777100% (1)

- Skin Candy MsdsDokument132 SeitenSkin Candy Msdsryanash777Noch keine Bewertungen

- Consent TATDokument1 SeiteConsent TATryanash777Noch keine Bewertungen

- Green Soap MsdsDokument2 SeitenGreen Soap Msdsryanash777Noch keine Bewertungen

- Books For TNPSCDokument9 SeitenBooks For TNPSCAiam PandianNoch keine Bewertungen

- 12 CONFUCIUS SY 2O23 For Insurance GPA TemplateDokument9 Seiten12 CONFUCIUS SY 2O23 For Insurance GPA TemplateIris Kayte Huesca EvicnerNoch keine Bewertungen

- The Pioneer 159 EnglishDokument14 SeitenThe Pioneer 159 EnglishMuhammad AfzaalNoch keine Bewertungen

- SBI Clerk Prelims Previous Year Paper 2018Dokument14 SeitenSBI Clerk Prelims Previous Year Paper 2018Caroline JuliyatNoch keine Bewertungen

- Womens Hostel in BombayDokument5 SeitenWomens Hostel in BombayAngel PanjwaniNoch keine Bewertungen

- Family Dollar ReleaseDokument1 SeiteFamily Dollar ReleaseNewzjunkyNoch keine Bewertungen

- Cir v. Citytrust InvestmentDokument12 SeitenCir v. Citytrust InvestmentJor LonzagaNoch keine Bewertungen

- Ol NW Mock 2022 Economics 2Dokument2 SeitenOl NW Mock 2022 Economics 2Lukong EmmanuelNoch keine Bewertungen

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDokument14 SeitenAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNoch keine Bewertungen

- Dalal Street Investment Journal PDFDokument26 SeitenDalal Street Investment Journal PDFShailesh KhodkeNoch keine Bewertungen

- BCG Tata GroupDokument3 SeitenBCG Tata GroupChetanTejani100% (2)

- MBBS MO OptionsDokument46 SeitenMBBS MO Optionskrishna madkeNoch keine Bewertungen

- Rhula Mozambique Weekly Media Review - 17 February To 24 February 2017Dokument90 SeitenRhula Mozambique Weekly Media Review - 17 February To 24 February 2017davidbarskeNoch keine Bewertungen

- Internship Project BSLDokument58 SeitenInternship Project BSLRajesh Kumar100% (1)

- Delegation of Powers As Per DPE GuidelinesDokument23 SeitenDelegation of Powers As Per DPE GuidelinesVIJAYAKUMARMPLNoch keine Bewertungen

- Credit CreationDokument17 SeitenCredit Creationaman100% (1)

- Global Affairs CH - 3 @Dokument34 SeitenGlobal Affairs CH - 3 @Bererket BaliNoch keine Bewertungen

- Filetype PDF Journal of Real Estate Finance and EconomicsDokument2 SeitenFiletype PDF Journal of Real Estate Finance and EconomicsJennaNoch keine Bewertungen

- Economic Development Complete NotesDokument36 SeitenEconomic Development Complete Notessajad ahmadNoch keine Bewertungen

- Maruti SuzukiDokument17 SeitenMaruti SuzukiPriyanka Vaghasiya0% (1)

- CIVIL Green BuildingDokument17 SeitenCIVIL Green Buildingyagna100% (1)

- Important InformationDokument193 SeitenImportant InformationDharmendra KumarNoch keine Bewertungen

- Chapter 18Dokument16 SeitenChapter 18Norman DelirioNoch keine Bewertungen