Beruflich Dokumente

Kultur Dokumente

Chapter 1 Hire Purchase Accounts Exercises

Hochgeladen von

Asminawati IsmailOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 1 Hire Purchase Accounts Exercises

Hochgeladen von

Asminawati IsmailCopyright:

Verfügbare Formate

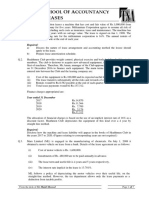

CHAPTER 1: HIRE PURCHASE

TUTORIAL

1. On 1 July 2001, Ahmad bought machinery on hire purchase from Peronda Bhd. The cash price

was RM25,000. Ahmad was required to pay deposit of RM5,000 and the balance will be paid

by equal installment for 12 months with interest rate of 20% per annum.

2. Mr. Zaibo bought a motorcycle on hire purchase from Motor Company on 1 September 2000.

The cash price was RM4,800. He was required to pay deposit of RM1,200. The balances need

to be paid by monthly installment for 3 years including interest of 8% per year charged on the

balance outstanding on 1 September 2000. The depreciation of the motorcycle was 10% per

year based on straight line method. The financial years of the company ends on 31 August.

3. On 1 July 2000, Abu & Co. bought machines on hire purchase from Syarikat Bakar. The cash

price of the machines was RM50,000. Abu & Co. was required to pay deposit of RM5,000

followed by 5 half year installments of RM10,000 each. The final installment was RM12,565.

The interest rate was 20% per annum and charged on the balance outstanding after every

installment. The accounting year ends on 31 December each year.

4. On 1 January 2003, Syarikat Mariam bought a tractor on hire purchase from Sec Co Pvt. Ltd.

The cash price for the asset was RMRM96,000. Under the hire purchase agreement, a sum of

RM115,782 needs to be settled off which consist of deposit of RM32,000 and 2 equal

installments amounting to RM41,891 each and to be paid on 31 December 2003 and 2004. The

interest rate charged was 20% per year on the balance at the end of every year. The

accounting year ends on 31 December every year.

5. On 1 January 2003, GUNGYU Pvt. Ltd. bought a van on hire purchase from NSF Pvt. Ltd. The

cash price was RM70,000. Under the hire purchase agreement, GUNGYU needs to pay

RM75,000 which consists of deposit of RM30,000 and half year installment of RM12,000,

RM11,500, RM11,000 and RM10,500. The first installment will be paid on 30 June 2003.

The hire purchase interest charged at a rate of 10% per annum, based on the balance

outstanding after every installment. The depreciation of the van was 10% based on reducing

balance method.

REQUIRED:

Prepare the relevant accounts involved in the buyers book (except cash account).

DPA3013 FINANCIAL ACCOUNTING 2

CHAPTER 1: HIRE PURCHASE

TUTORIAL: HIRE PURCHASE ACCOUNT

QUESTION 1 (Final Exam July Session 2007)

On 02/01/1998, Kilang Perabot Antik has bought a wood cutter machine from Syarikat Kiara Bhd. Cash

price for the machine is RM40,000.

Besides paying a deposit of RM10,000, Kilang Perabot Antik are required to pay another three

installments amounting RM13,000, RM12,000 and RM11,000. First installment will begin on

31/12/1998.

On 31/08/2000, the machine burned as a result of overhaul.Great Assurance Bhd, has paid a

compensation amounting RM12,000. Kilang Perabot Antik also required to pay RM8,000 to Syarikat

Kiara Bhd.

Interest of hire purchase charged at 10% per annum based on outstanding balance and depreciation

10% charged on cost.

You are required to prepare the following accounts until the disposal date:

a) Machine Accounts

b) Hire Purchase Creditor Account

c) Accumulated Depreciation Account

d) Hire Purchase Interest Suspense Account

e) Machine Disposal Account

QUESTION 2 (Mid Test January Session 2008)

Syarikat Utama Sdn Bhd has bought a van from Syarikat Ali Sdn Bhd. Information for the van is as

follows:

Date of purchase :1 April 2004

Cash price : RM150,000

Deposit : 10% on cash price

Installment : Paid on at the end of the accounting period which is RM45,000 for first

installment, RM55,000 second installment and RM82,556 on the third year.

Interest : 15% based on outstanding balance

Depreciation : 20% per annum on cost

Year ended : 31 March every year

The van was damaged on 11 August 2006 where compensation of RM80,000 has to be paid and the

insurance company also paid insurance amounting RM70,000.

You are required to prepare those accounts until the disposal date:

a) Van Account

b) Syarikat Ali (Creditor) Account

c) HPIS Account

d) Accumulated Depreciation Account

e) Van Disposal Account

DPA3013 FINANCIAL ACCOUNTING 2

CHAPTER 1: HIRE PURCHASE

QUESTION 3 (Mid Test July Session 2008)

On 6 January 2006, Izzah Bhd had bought a lorry for business use from Irdi Bhd. Accounting period for

Izzah Bhd is on 31 December every year. Information on the purchases transaction is as follows:

Cash price RM52,000

Deposit RM13,000

Installment on 31 December 2006 RM16,900

Installment on 31 December 2007 RM15,600

Installment on 31 December 2008 RM14,300

Interest was charged at 10% per annum based on outstanding balance, and depreciation being

charged at 12% on cost.

However, on 6 June 2008 the lorry was damaged because of accident on the road.

Followings are the information regarding the settlement made:

Insurance Company had paid compensation amounting RM15,000 and Izzah Bhd also being required

to pay RM10,400 to Irdi Bhd.

In assisting Izzah Bhd, prepare following accounts until the disposal date:

(a) Lorry Account

(b) Izzah Bhd Account

(c) Hire Purchase Interest Suspense Account

(d) Accumulated Depreciation Account

(e) Lorry Disposal Account

QUESTION 4 (Mid Test January Session 2009)

Samad had bought a lorry from Syarikat Tai Hua under hire purchase agreement. Followings are

information regarding the hire purchase transaction:

Date of purchase :1 July 2005

Cash price :RM230,000

Deposit :RM30,000

Installment : 5 times annual installment (RM45,000 per installment)

Interest : Distribute equally for every year (straight line)

Depreciation : Straight line method with a useful life of 10 years and scrap

value of RM5,000.

Accounting period is on 31 December every year. On 31 August 2008, the lorry was involved in

accident and cannot be used. Therefore, Samad was required to pay compensation to Syarikat Tai Hua

amounting RM150,000 and also received insurance amounting RM100,000 from ING Insuran Bhd.

Anda dikehendaki/ You are required :

i) Asset Account

ii) Creditor Account

iii) Hire Purchase Interest Suspense Account

iv) Accumulated Depreciation Account

v) Disposal Asset Account

(show the calculation and distribution of HPIS)

DPA3013 FINANCIAL ACCOUNTING 2

CHAPTER 1: HIRE PURCHASE

QUESTION 5 (Assignment: January Session 2009)

On 1 February 2005, Percy Motors Co. sold on hire purchase basis of Mr. Smith, a car which cash price

was RM100,000. The terms of the contract were as follows:

i) RM40,000 to be paid immediately on the signing of the contract.

ii) The balance in the three annual installments (payable on 31 st January) of RM20,000 plus final

installment of RM37,056. First installment was paid on 31 January 2006.

iii) Yearly interest charged at 20% per annum on outstanding balances remaining after each

payment.

Depreciation was charged at the rate of 25% per annum based on diminishing balance. On 31st

January 2008, Mr. Smith was failed to pay the installment and hence Percy Motors Co. took possession

of the car which was valued at RM44,480. Mr. Smith was required to pay the balance including

installment as at that date for RM50,000.

Mr. Smith closes its books of account every year on 31 January. Prepare the following accounts in the

buyers books.

i) Asset Account

ii) Sellers Account

iii) Hire Purchase Interest Suspense Account

iv) Accumulated Depreciation of Asset Account

v) Disposal Account

QUESTION 6 (Mid Test July Session 2009)

X Co. bought a van using hire purchase from Y Sdn Bhd with a cost amounting RM100,000 on 1

January 2005. Based on the agreement made, X Co. need to pay a deposit of 25% out of cost price

and paid installments equally for semi annually within 5 years.

Other information is as follows:

a) Interest charged is 12.5% every year based on outstanding balanced and distributed equally.

b) Depreciation charged at 10% based on cost price.

c) On 14 July 2007, the asset involved in accident and X Co. have to pay compensation

amounting RM55,000 to Y Sdn Bhd. Besides that, MAA Insurance have decided to pay

insurance amounting RM40,000 only to the company.

d) Acounting year ended every 31 December.

You are required to prepare the account (buyers book) until the disposal date.

(Round up until RM0.0 decimal points)

i) Asset Account

ii) Creditor Account

iii) Hire Purchase Interest Suspense Account

iv) Asset Depreciation Account

v) Asset Disposal Account

(Show the calculation and distribution of HPIS and installments for every year)

DPA3013 FINANCIAL ACCOUNTING 2

CHAPTER 1: HIRE PURCHASE

QUESTION 7 (Final Exam July Session 2009)

Izzah Enterprise bought two machineries from Irdi Bhd by hire purchase transaction on 2005. The

followings are information regarding the hire purchase agreement on 2005:

Date of agreement : 1st July 2005

Number of purchase item : Two (2) units

Cash price : RM100,000 per unit

Details of payment for ONE unit o machinery:

Deposit : RM32,500

Installment : 6 times (every 6 months)

(First installment was paid on 31 December 2005)

Total : RM16,250 every 5 times installment

RM16,625 final installment

Izzah Enterprise has paid every installment according to schedule. On 1st July 2007, after fourth

installment, both machineries were in bad damaged due to accident in the project site. The insurance

paid compensation of RM102,000 for both machineries. Irdi Bhd has agreed to end the agreement with

the final payment of RM42,660.

The financial year of Izzah Enterprise ended on 30 th June every year. The depreciation of all the

company assets was charged at a rate of 20% on cost.

You are required to prepare:

a) Asset Account

b) Creditor Account

c) Hire Purchase Interest Suspense Account

d) Provision for Depreciation Account

e) Asset Disposal Account

DPA3013 FINANCIAL ACCOUNTING 2

Das könnte Ihnen auch gefallen

- Taxation - Questions Sepr 2012Dokument17 SeitenTaxation - Questions Sepr 2012kannadhassNoch keine Bewertungen

- MFRS 117 Leases Problem and SolutionsDokument10 SeitenMFRS 117 Leases Problem and SolutionsEnnes Yaya100% (2)

- Topic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaDokument58 SeitenTopic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaHazim Badrin100% (1)

- Accounting Policies, Changes in Accounting Estimates and Errors: MFRS 108Dokument9 SeitenAccounting Policies, Changes in Accounting Estimates and Errors: MFRS 108Nurul AsmidaNoch keine Bewertungen

- Capital Allowance 2220Dokument58 SeitenCapital Allowance 2220YanPing AngNoch keine Bewertungen

- FAR 570 Test Mac July 2021 - QQDokument3 SeitenFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNoch keine Bewertungen

- BAC1634 - Tutorial 5 & 6 QDokument18 SeitenBAC1634 - Tutorial 5 & 6 QLee Hau SenNoch keine Bewertungen

- Tutorial 11 PDFDokument9 SeitenTutorial 11 PDFtan keng qi100% (4)

- CHPT 19 Answer MFRS 118 Revenue-180214 - 050144Dokument3 SeitenCHPT 19 Answer MFRS 118 Revenue-180214 - 050144Navin El Nino50% (2)

- Financial Analysis Nestle Malaysia Berhad For The Year 2019 A) Liquidity RatiosDokument13 SeitenFinancial Analysis Nestle Malaysia Berhad For The Year 2019 A) Liquidity RatiosRawan NaderNoch keine Bewertungen

- Advanced Financial Reporting: Semester 2 - Module 2 Cash Flow StatementDokument26 SeitenAdvanced Financial Reporting: Semester 2 - Module 2 Cash Flow Statementmy VinayNoch keine Bewertungen

- Fin430 - Dec2019Dokument6 SeitenFin430 - Dec2019nurinsabyhahNoch keine Bewertungen

- Tutorial 1 & 2Dokument11 SeitenTutorial 1 & 2Annyi Chan100% (1)

- Chap 1 Basis of Malaysian Income Tax 2022Dokument7 SeitenChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNoch keine Bewertungen

- Taxation I Tutorial: Tax ReliefDokument2 SeitenTaxation I Tutorial: Tax Reliefathirah jamaludinNoch keine Bewertungen

- Tutorial 11 AnswersDokument3 SeitenTutorial 11 AnswershrfjbjrfrfNoch keine Bewertungen

- Tutorial 8 PDFDokument12 SeitenTutorial 8 PDFtan keng qi100% (2)

- Tutorial 12 PDFDokument5 SeitenTutorial 12 PDFtan keng qi100% (1)

- Chapter 3 - Agriculture AllowancesDokument3 SeitenChapter 3 - Agriculture AllowancesNURKHAIRUNNISA100% (2)

- ZuriDokument2 SeitenZuriNur AfiqahNoch keine Bewertungen

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Dokument11 SeitenUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNoch keine Bewertungen

- Exercise (Chapter 3: MFRS 123 Borrowing Cost)Dokument6 SeitenExercise (Chapter 3: MFRS 123 Borrowing Cost)just jumperNoch keine Bewertungen

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Dokument9 SeitenDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860Noch keine Bewertungen

- Step AcquisitionsDokument7 SeitenStep AcquisitionsKelvin Leong100% (1)

- Introduction To Cost Accounting - Week 2Dokument1 SeiteIntroduction To Cost Accounting - Week 2fatin niniNoch keine Bewertungen

- Group Project 2 - Published Account DEC2019 FAR270 - SSDokument6 SeitenGroup Project 2 - Published Account DEC2019 FAR270 - SSHaru BiruNoch keine Bewertungen

- Lecture 1 - Introduction of Malaysia TaxationDokument29 SeitenLecture 1 - Introduction of Malaysia TaxationkantarubanNoch keine Bewertungen

- Far210 Topic 2 Malaysian Conceptual FrameworkDokument79 SeitenFar210 Topic 2 Malaysian Conceptual FrameworkSamurai Hut100% (1)

- The Regulatory Framework For Financial ReportingDokument2 SeitenThe Regulatory Framework For Financial ReportingagungdekaNoch keine Bewertungen

- ACC 4041 Tutorial - Corporate Tax 2Dokument3 SeitenACC 4041 Tutorial - Corporate Tax 2Atiqah DalikNoch keine Bewertungen

- A191 Mini Case Ppe QuestionDokument4 SeitenA191 Mini Case Ppe Questiondini sofiaNoch keine Bewertungen

- Final Assessment S1, 2021Dokument5 SeitenFinal Assessment S1, 2021Dilrukshi WanasingheNoch keine Bewertungen

- FMAForecasting QDokument11 SeitenFMAForecasting QAnisahMahmoodNoch keine Bewertungen

- BBFA2303 Sample Exam QuestionDokument11 SeitenBBFA2303 Sample Exam QuestionAnnieNoch keine Bewertungen

- 10 Capital RationingDokument7 Seiten10 Capital Rationingramkishan8267% (3)

- Tax Q&A - Income From Investment and Other SourcesDokument3 SeitenTax Q&A - Income From Investment and Other SourcesHadifliNoch keine Bewertungen

- Trade and Cash Discount MAT112Dokument2 SeitenTrade and Cash Discount MAT112syafiqahNoch keine Bewertungen

- Solutions: Universiti Teknologi Mara Final ExaminationDokument10 SeitenSolutions: Universiti Teknologi Mara Final Examinationanis izzatiNoch keine Bewertungen

- ACC2054 Tutorial 3Dokument3 SeitenACC2054 Tutorial 3Euvan KumarNoch keine Bewertungen

- Company Segments Market Share Market Share Largest CompetitorDokument2 SeitenCompany Segments Market Share Market Share Largest CompetitorthivahgaranNoch keine Bewertungen

- Final Assessment Far210 Feb2021Dokument8 SeitenFinal Assessment Far210 Feb2021Lampard AimanNoch keine Bewertungen

- TAX 467 Topic 4 Capital Allowance - AgricultureDokument11 SeitenTAX 467 Topic 4 Capital Allowance - AgricultureAnis RoslanNoch keine Bewertungen

- TAX Treatment For TAX267 and TAX317 Budget 2019Dokument5 SeitenTAX Treatment For TAX267 and TAX317 Budget 2019nonameNoch keine Bewertungen

- ACC2054 Tutorial 4Dokument3 SeitenACC2054 Tutorial 4Euvan KumarNoch keine Bewertungen

- FIN 370 Final Exam Answers Grade - 100Dokument9 SeitenFIN 370 Final Exam Answers Grade - 100Alegna72100% (4)

- BBFA2303 Take Home Exam - Eng & BM - Jan20Dokument10 SeitenBBFA2303 Take Home Exam - Eng & BM - Jan20AnnieNoch keine Bewertungen

- Chapter 1 IAS 36 Impairment of Assets PDFDokument11 SeitenChapter 1 IAS 36 Impairment of Assets PDFGAIK SUEN TANNoch keine Bewertungen

- 64 YanongDokument25 Seiten64 Yanong嘉慧Noch keine Bewertungen

- ProblemSet Cash Flow EstimationQA 160611 021520 PDFDokument25 SeitenProblemSet Cash Flow EstimationQA 160611 021520 PDFCucumber IsHealthy96Noch keine Bewertungen

- Business Law QuizDokument2 SeitenBusiness Law QuizDaniyal AliNoch keine Bewertungen

- Ch. 14 - The Production CycleDokument4 SeitenCh. 14 - The Production CycleCalvin ChandraNoch keine Bewertungen

- Company Law Tutor 1Dokument4 SeitenCompany Law Tutor 1Karen Christine M. Atong0% (1)

- HEINEKENDokument26 SeitenHEINEKENKana jillaNoch keine Bewertungen

- Financial Accounting & Reporting III ExercisesDokument34 SeitenFinancial Accounting & Reporting III ExercisesMei Chien Yap67% (3)

- Hire Purchase - Example 1 To 10Dokument7 SeitenHire Purchase - Example 1 To 10204 TAN YONG WEINoch keine Bewertungen

- Accounting For Ijarah TransactionDokument3 SeitenAccounting For Ijarah Transactiontiffada86Noch keine Bewertungen

- Extra Exercise Fixed AssetsDokument4 SeitenExtra Exercise Fixed AssetsMohd Rafi JasmanNoch keine Bewertungen

- As - 7 and As - 9 As 10 As 6 As 28 - IdealDokument7 SeitenAs - 7 and As - 9 As 10 As 6 As 28 - IdealLalit JhaNoch keine Bewertungen

- IFRS-16 LeasesDokument7 SeitenIFRS-16 LeasesHuzaifa WaseemNoch keine Bewertungen

- DepreciationDokument15 SeitenDepreciationYash AggarwalNoch keine Bewertungen

- Img 20170518 0002Dokument1 SeiteImg 20170518 0002Asminawati IsmailNoch keine Bewertungen

- Daily Lesson Plan: (Afl) (Afl, Aal, Aol, PBP) DFLDokument1 SeiteDaily Lesson Plan: (Afl) (Afl, Aal, Aol, PBP) DFLAsminawati IsmailNoch keine Bewertungen

- Plot Summary - The Curse SPM 2012Dokument3 SeitenPlot Summary - The Curse SPM 2012Asminawati IsmailNoch keine Bewertungen

- Panduan Rujukan Mengikut Gaya APADokument19 SeitenPanduan Rujukan Mengikut Gaya APANur IzzanieNoch keine Bewertungen

- Parenting-Socio Emotion DevlmtDokument26 SeitenParenting-Socio Emotion DevlmtAsminawati IsmailNoch keine Bewertungen

- Dummies Guide To Writing A SonnetDokument1 SeiteDummies Guide To Writing A Sonnetritafstone2387100% (2)

- Gee 103 L3 Ay 22 23 PDFDokument34 SeitenGee 103 L3 Ay 22 23 PDFlhyka nogalesNoch keine Bewertungen

- Group 4 - Regional and Social DialectDokument12 SeitenGroup 4 - Regional and Social DialectazizaNoch keine Bewertungen

- Security Questions in UPSC Mains GS 3 2013 2020Dokument3 SeitenSecurity Questions in UPSC Mains GS 3 2013 2020gangadhar ruttalaNoch keine Bewertungen

- Trenching Shoring SafetyDokument29 SeitenTrenching Shoring SafetyMullapudi Satish KumarNoch keine Bewertungen

- StatisticsAllTopicsDokument315 SeitenStatisticsAllTopicsHoda HosnyNoch keine Bewertungen

- Final Module in Human BehaviorDokument60 SeitenFinal Module in Human BehaviorNarag Krizza50% (2)

- Espn NFL 2k5Dokument41 SeitenEspn NFL 2k5jojojojo231Noch keine Bewertungen

- Motion and Time: Check Your Progress Factual QuestionsDokument27 SeitenMotion and Time: Check Your Progress Factual QuestionsRahul RajNoch keine Bewertungen

- Coordination Compounds 1Dokument30 SeitenCoordination Compounds 1elamathiNoch keine Bewertungen

- Learner's Material: ScienceDokument27 SeitenLearner's Material: ScienceCarlz BrianNoch keine Bewertungen

- Deadlands - Dime Novel 02 - Independence Day PDFDokument35 SeitenDeadlands - Dime Novel 02 - Independence Day PDFDavid CastelliNoch keine Bewertungen

- Chapin Columbus DayDokument15 SeitenChapin Columbus Dayaspj13Noch keine Bewertungen

- Nikulin D. - Imagination and Mathematics in ProclusDokument20 SeitenNikulin D. - Imagination and Mathematics in ProclusannipNoch keine Bewertungen

- DHBVNDokument13 SeitenDHBVNnitishNoch keine Bewertungen

- B. Inggris Narrative TeksDokument11 SeitenB. Inggris Narrative TeksDew FitriNoch keine Bewertungen

- DMemo For Project RBBDokument28 SeitenDMemo For Project RBBRiza Guste50% (8)

- Student Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDokument2 SeitenStudent Worksheet Task 1 - Long Reading: Fanny Blankers-KoenDANIELA SIMONELLINoch keine Bewertungen

- Project TitleDokument15 SeitenProject TitleadvikaNoch keine Bewertungen

- GE 110HP DC Trolley MotorDokument10 SeitenGE 110HP DC Trolley MotorAnthony PetersNoch keine Bewertungen

- Pon Vidyashram Group of Cbse Schools STD 8 SCIENCE NOTES (2020-2021)Dokument3 SeitenPon Vidyashram Group of Cbse Schools STD 8 SCIENCE NOTES (2020-2021)Bharath Kumar 041Noch keine Bewertungen

- Soal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Dokument3 SeitenSoal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Ika Endah MadyasariNoch keine Bewertungen

- SQ1 Mogas95Dokument1 SeiteSQ1 Mogas95Basant Kumar SaxenaNoch keine Bewertungen

- Purposeful Activity in Psychiatric Rehabilitation: Is Neurogenesis A Key Player?Dokument6 SeitenPurposeful Activity in Psychiatric Rehabilitation: Is Neurogenesis A Key Player?Utiru UtiruNoch keine Bewertungen

- Introduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTDokument27 SeitenIntroduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTMelvin J. Reyes100% (2)

- Discrete Probability Distribution UpdatedDokument44 SeitenDiscrete Probability Distribution UpdatedWaylonNoch keine Bewertungen

- Government by Algorithm - Artificial Intelligence in Federal Administrative AgenciesDokument122 SeitenGovernment by Algorithm - Artificial Intelligence in Federal Administrative AgenciesRone Eleandro dos SantosNoch keine Bewertungen

- Grammar For TOEFLDokument23 SeitenGrammar For TOEFLClaudia Alejandra B0% (1)

- CAP214 Web Devlopment PDFDokument9 SeitenCAP214 Web Devlopment PDFAlisha AgarwalNoch keine Bewertungen

- Materials System SpecificationDokument14 SeitenMaterials System Specificationnadeem shaikhNoch keine Bewertungen