Beruflich Dokumente

Kultur Dokumente

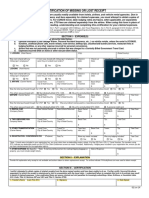

LTA Declaration Form

Hochgeladen von

Ravi KumarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

LTA Declaration Form

Hochgeladen von

Ravi KumarCopyright:

Verfügbare Formate

LEAVE TRAVEL ASSISTANCE - EXEMPTION FORM

Employee Name 0 Company Name 0

Employee Code 0 PAN No. 0 Location 0

1. Period of leave : From To

2. Final destination of journey : From To

3. Mode of Travel : Air Rail Others

(Please tick whichever applicable)

4. Single journey fare to place of travel:

5. No. of Family members accompanying

:

6. Total of actual expenses on fare :

to final destination and back -

I hereby declare that the particulars furnished in the above L.T.A. form are true and correct and confirm that the

period of leave mentioned above has been sanctioned by my Department Head and debited to my Privilege Leave

Place:

Date: Signature of Employee

DETAILS OF ACTUAL EXPENDITURE ON LEAVE TRAVEL ASSISTANCE

Age Relation Traveling Distance in Mode of Air / Rail / Bus Ticket Fare Rs.

Name

From To Kms. Travel No.

Total -

Notes : -

1. LTA exemption should be claimed for only one journey during the financial year

2. If the journey is performed by Airways, e-ticket or boarding pass for both sides of travel issued by the airlines

should be enclosed.

3. If the journey is performed by Railways, e-ticket or copy of rail ticket for both sides of travel should be enclosed.

4. If the journey is performed by Roadways, the original bill of the transport agency should clearly

mention whether the journey was by AC / Non-AC car, the kilometers travelled and the rate per kilometer.

5. Bills of Authorized / Reputed Travel agents will be considered for exemption.

6. Proofs submitted for foreign travel will not be considered for exemption

Das könnte Ihnen auch gefallen

- HR - 22 - Leave Travel Allowance PolicyDokument6 SeitenHR - 22 - Leave Travel Allowance PolicyVipin SinghNoch keine Bewertungen

- Photon Trading - Market Structure BasicsDokument11 SeitenPhoton Trading - Market Structure Basicstula amar100% (2)

- Flight TicketDokument8 SeitenFlight TicketJAYSON CANDELARIANoch keine Bewertungen

- FlightbookingconfirmationDokument3 SeitenFlightbookingconfirmationhassan1989Noch keine Bewertungen

- Travel Agency Invoice TemplateDokument2 SeitenTravel Agency Invoice Templatesreekanth dasariNoch keine Bewertungen

- E Ticket Itinerary TGL 24 Desember Sampai Tanggal 5 Januari 2019Dokument28 SeitenE Ticket Itinerary TGL 24 Desember Sampai Tanggal 5 Januari 2019Ardhiansyah FirdausNoch keine Bewertungen

- 1934 PARIS AIRSHOW REPORT - Part1 PDFDokument11 Seiten1934 PARIS AIRSHOW REPORT - Part1 PDFstarsalingsoul8000Noch keine Bewertungen

- SPH4U Assignment - The Wave Nature of LightDokument2 SeitenSPH4U Assignment - The Wave Nature of LightMatthew GreesonNoch keine Bewertungen

- Deed of Assignment CorporateDokument4 SeitenDeed of Assignment CorporateEric JayNoch keine Bewertungen

- Condition Monitoring of Steam Turbines by Performance AnalysisDokument25 SeitenCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- Office Storage GuideDokument7 SeitenOffice Storage Guidebob bobNoch keine Bewertungen

- Booking Card For TravelDokument3 SeitenBooking Card For TravelJayson Babiera SarcajogaNoch keine Bewertungen

- Leave Travel Assistance Claim FormDokument1 SeiteLeave Travel Assistance Claim FormshivamanojNoch keine Bewertungen

- LTA Declaration Form Form 12BBDokument3 SeitenLTA Declaration Form Form 12BBAmitomSudarshanNoch keine Bewertungen

- LTA Claim FormDokument2 SeitenLTA Claim Formamarsd1987Noch keine Bewertungen

- Lta Declaration FormDokument1 SeiteLta Declaration FormRakshitha BangeraNoch keine Bewertungen

- Travel Processing Remedyforce TutorialDokument22 SeitenTravel Processing Remedyforce TutorialDanielNoch keine Bewertungen

- TNSTCDokument1 SeiteTNSTCSree RamNoch keine Bewertungen

- LTA - FormDokument3 SeitenLTA - FormpowermuruganNoch keine Bewertungen

- Rafiq DohaDokument1 SeiteRafiq DohazuhaibNoch keine Bewertungen

- Air Ticket Booking Form: Business WayDokument2 SeitenAir Ticket Booking Form: Business WayKim Woon jeeNoch keine Bewertungen

- Covering Sheet For LTADokument1 SeiteCovering Sheet For LTAsrinath rao P100% (1)

- Leave Travel Assistance Reimbursment FormDokument2 SeitenLeave Travel Assistance Reimbursment FormSumanNoch keine Bewertungen

- Application Design: Amit Dalal Gulu Gulu Tour and Travels Pvt. Ltd. 1/1/2020Dokument7 SeitenApplication Design: Amit Dalal Gulu Gulu Tour and Travels Pvt. Ltd. 1/1/2020AMITNoch keine Bewertungen

- Convergys Lta Claim FormDokument3 SeitenConvergys Lta Claim FormZoheb ShaikhNoch keine Bewertungen

- TNSTC PDFDokument2 SeitenTNSTC PDFPistol MariNoch keine Bewertungen

- IRCTC e TicketDokument1 SeiteIRCTC e TicketManasvi Mehta100% (1)

- Tour Bill FormatDokument6 SeitenTour Bill FormatJithin LalNoch keine Bewertungen

- Document 1712754769724Dokument2 SeitenDocument 1712754769724Satyam DashNoch keine Bewertungen

- Leave/Field Break/Permission Application: (Permohonan Cuti/Libur Lapangan / Ijin)Dokument6 SeitenLeave/Field Break/Permission Application: (Permohonan Cuti/Libur Lapangan / Ijin)ADE LESMANANoch keine Bewertungen

- Leave Travel Assistance FormDokument1 SeiteLeave Travel Assistance Formypatil1981Noch keine Bewertungen

- E-Ticket: Itinerary and Reservation DetailsDokument3 SeitenE-Ticket: Itinerary and Reservation DetailsbhobhoNoch keine Bewertungen

- Flight Booking FormDokument2 SeitenFlight Booking FormAndres Felipe Gonzalez Lisca100% (1)

- Travel Service InvoiceDokument2 SeitenTravel Service Invoicemanish.ahujaNoch keine Bewertungen

- Ticket Printing Time: 2/4/2022 10:24:36 AM 43% ? A Re You Aware That 43% of Your Fare Is Borne by The Common Citizens of The Country?Dokument5 SeitenTicket Printing Time: 2/4/2022 10:24:36 AM 43% ? A Re You Aware That 43% of Your Fare Is Borne by The Common Citizens of The Country?Akash shawNoch keine Bewertungen

- Flying Returns Award Request FormDokument1 SeiteFlying Returns Award Request FormSiddharth UpadhyayaNoch keine Bewertungen

- Form TR 20 Gaz TAbill 2018 2Dokument2 SeitenForm TR 20 Gaz TAbill 2018 2abc100% (1)

- RBR1972919Dokument5 SeitenRBR1972919SamNoch keine Bewertungen

- Travel Reimbursement Form HPCLDokument1 SeiteTravel Reimbursement Form HPCLVishwanathNoch keine Bewertungen

- Leave Travel Concession Bill Part-A: Form T.R.25C (LTC)Dokument3 SeitenLeave Travel Concession Bill Part-A: Form T.R.25C (LTC)Kishor Kumar JhaNoch keine Bewertungen

- Flight Booking Receipt: Important InformationDokument3 SeitenFlight Booking Receipt: Important InformationMANISH AJITWALIANoch keine Bewertungen

- Lost Receipt Form (Fillable)Dokument1 SeiteLost Receipt Form (Fillable)Roch SampagaNoch keine Bewertungen

- Traveling Allowance Bill (Institute or Project)Dokument2 SeitenTraveling Allowance Bill (Institute or Project)Rohit GuptaNoch keine Bewertungen

- Departure Arrival Mode of Travel and Class of Accommod Ation Fair Paid Distance in Kms Date & Time From Date & Time TO RsDokument17 SeitenDeparture Arrival Mode of Travel and Class of Accommod Ation Fair Paid Distance in Kms Date & Time From Date & Time TO RsDinesh SinghNoch keine Bewertungen

- Document 1712560760349Dokument2 SeitenDocument 1712560760349iamtheonlysyNoch keine Bewertungen

- Ticket HRDDokument2 SeitenTicket HRDluciferangellordNoch keine Bewertungen

- Go Air DEL - SXRDokument2 SeitenGo Air DEL - SXRJagat PapaNoch keine Bewertungen

- Goibibo DocumentDokument3 SeitenGoibibo DocumentSubhadipChakrabortyNoch keine Bewertungen

- 15 Jun TicketDokument4 Seiten15 Jun TicketSuraj KumarNoch keine Bewertungen

- Ta Bill FormDokument5 SeitenTa Bill FormTapan MohantyNoch keine Bewertungen

- CertificateDokument2 SeitenCertificatemrsahil277Noch keine Bewertungen

- Document 1710255127076Dokument2 SeitenDocument 1710255127076ejaz ahmadNoch keine Bewertungen

- Tickets Rail 11 FebDokument2 SeitenTickets Rail 11 Februdra1040Noch keine Bewertungen

- Royal Government of Bhutan Agency: Travel Allowance Claim FormDokument1 SeiteRoyal Government of Bhutan Agency: Travel Allowance Claim FormSonam PhuntshoNoch keine Bewertungen

- Reg Form For Celtic PilgrimageDokument2 SeitenReg Form For Celtic PilgrimagebridgelmNoch keine Bewertungen

- Ashok Cahdri - Ticket 2019Dokument2 SeitenAshok Cahdri - Ticket 2019sridharbabuNoch keine Bewertungen

- Booking CardDokument3 SeitenBooking CardreighnaNoch keine Bewertungen

- Train Ticket TK18538925N47 PDFDokument3 SeitenTrain Ticket TK18538925N47 PDFNasreenbanu KhadarnayakarNoch keine Bewertungen

- Hyd TicketDokument3 SeitenHyd TicketCLARENCE JAGJIT MICHAEL TAURO 0945005Noch keine Bewertungen

- Document 1695289667937Dokument2 SeitenDocument 1695289667937Satywan RajpootNoch keine Bewertungen

- Print Tickets On UDokument2 SeitenPrint Tickets On UBirender Phalwan KassariyaNoch keine Bewertungen

- SudhirDokument2 SeitenSudhirPratap PratapNoch keine Bewertungen

- Document - 1707663626002 FFFDDokument2 SeitenDocument - 1707663626002 FFFD20mishra.poojaNoch keine Bewertungen

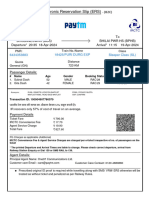

- Electronic Reservation Slip IRCTC E-Ticketing AgentDokument4 SeitenElectronic Reservation Slip IRCTC E-Ticketing AgentSandeep JainNoch keine Bewertungen

- Flying Smart: A Handy Guide for the New Airline TravellerVon EverandFlying Smart: A Handy Guide for the New Airline TravellerNoch keine Bewertungen

- Strobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maDokument2 SeitenStrobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maShane FairchildNoch keine Bewertungen

- BYJU's July PayslipDokument2 SeitenBYJU's July PayslipGopi ReddyNoch keine Bewertungen

- Squirrel Cage Induction Motor Preventive MaintenaceDokument6 SeitenSquirrel Cage Induction Motor Preventive MaintenaceNishantPareekNoch keine Bewertungen

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Dokument2 SeitenCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoNoch keine Bewertungen

- Unit 2Dokument97 SeitenUnit 2MOHAN RuttalaNoch keine Bewertungen

- 2016 066 RC - LuelcoDokument11 Seiten2016 066 RC - LuelcoJoshua GatumbatoNoch keine Bewertungen

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDokument2 SeitenAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfNoch keine Bewertungen

- Shubham RBSEDokument13 SeitenShubham RBSEShubham Singh RathoreNoch keine Bewertungen

- Engineering Management (Final Exam)Dokument2 SeitenEngineering Management (Final Exam)Efryl Ann de GuzmanNoch keine Bewertungen

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Dokument4 SeitenEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNoch keine Bewertungen

- Cabling and Connection System PDFDokument16 SeitenCabling and Connection System PDFLyndryl ProvidoNoch keine Bewertungen

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDokument28 SeitenMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiNoch keine Bewertungen

- L1 L2 Highway and Railroad EngineeringDokument7 SeitenL1 L2 Highway and Railroad Engineeringeutikol69Noch keine Bewertungen

- United Nations Economic and Social CouncilDokument3 SeitenUnited Nations Economic and Social CouncilLuke SmithNoch keine Bewertungen

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Dokument43 SeitenOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanNoch keine Bewertungen

- 1.1. Evolution of Cloud ComputingDokument31 Seiten1.1. Evolution of Cloud Computing19epci022 Prem Kumaar RNoch keine Bewertungen

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsDokument2 SeitenIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisNoch keine Bewertungen

- 1400 Service Manual2Dokument40 Seiten1400 Service Manual2Gabriel Catanescu100% (1)

- Laporan Praktikum Fisika - Full Wave RectifierDokument11 SeitenLaporan Praktikum Fisika - Full Wave RectifierLasmaenita SiahaanNoch keine Bewertungen

- Analysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodDokument5 SeitenAnalysis of Material Nonlinear Problems Using Pseudo-Elastic Finite Element MethodleksremeshNoch keine Bewertungen

- 7 TariffDokument22 Seiten7 TariffParvathy SureshNoch keine Bewertungen

- Schmidt Family Sales Flyer English HighDokument6 SeitenSchmidt Family Sales Flyer English HighmdeenkNoch keine Bewertungen

- Mid Term Exam 1Dokument2 SeitenMid Term Exam 1Anh0% (1)

- Presentation Report On Customer Relationship Management On SubwayDokument16 SeitenPresentation Report On Customer Relationship Management On SubwayVikrant KumarNoch keine Bewertungen