Beruflich Dokumente

Kultur Dokumente

Tugas 1 - Problem 1-12

Hochgeladen von

cemkudaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tugas 1 - Problem 1-12

Hochgeladen von

cemkudaCopyright:

Verfügbare Formate

PROBLEM 112 Equity Valuation

Ace Co. is to be taken over by Beta Ltd. at the end of year 2007. Beta agrees to pay the shareholders of Ace the book value per

share at the time of the takeover. A reliable analyst makes the following projections for Ace (assume cost of capital is 10% per

annum):

1 2 3 4 5 6

($ per share) 2002 2003 2004 2005 2006 2007

Dividends $ - $ 1.00 $ 1.00 $ 1.00 $ 1.00 $ 1.00

Operating cash flows $ - $ 2.00 $ 1.50 $ 1.00 $ 0.75 $ 0.50

Capital expenditures $ - ### $ - $ 1.00 $ 1.00 $ -

Debt increase (decrease) $ - $ -1.00 $ -0.50 $ 1.00 $ 1.25 $ 0.50

Net income $ - $ 1.45 $ 1.10 $ 0.60 $ 0.25 $ -0.10

Book value $ 9.00 $ 9.45 $ 9.55 $ 9.15 $ 8.40 $ 7.30

a. Estimate Ace Co.s value per share at the end of year 2002 using the dividend discount model.

Solution

1 2 3 4 5

($ per share) 2003 2004 2005 2006 2007

Dividends $ 1.00 ### $ 1.00 $ 1.00 $ 1.00

Book value $ 9.45 $ 9.55 $ 9.15 $ 8.40 $ 7.30

Cost of capital 10%

$1/(1+10%)1+$1/(1+10%)2+$1/(1+10%)3+$1/(1+10%)4+$1/(1+10%)5+$7,30/(1+10%)5

Intrinsic value =

Intrinsic value = 8.32

c. Attempt to estimate the value of Ace Co. at the end of year 2002 using the free cash flow to equity model.

Solution

1 2 3 4 5

($ per share) 2003 2004 2005 2006 2007

Operating cash flows $ 2.00 $ 1.50 $ 1.00 $ 0.75 $ 0.50

Capital expenditures $ - ### $ 1.00 $ 1.00 $ -

+/- Debt increase (decrease) $ -1.00 $ -0.50 $ 1.00 $ 1.25 $ 0.50

Free Cash Flow to Equity $ 1.00 $ 1.00 $ 1.00 $ 1.00 $ 1.00

Book value $ 9.45 $ 9.55 $ 9.15 $ 8.40 $ 7.30

Cost of capital 10%

$1/(1+10%)1+$1/(1+10%)2+$1/(1+10%)3+$1/(1+10%)4+$1/(1+10%)5+$7,30/(1+10%)5

Intrinsic value =

Intrinsic value = 8.32

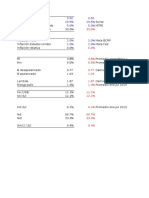

b. Estimate Ace Co.s value per share at the end of year 2002 using the residual income model.

Solution

0 1 2 3 4 5

($ per share) 2002 2003 2004 2005 2006 2007

Book Value $ 9.00 $ 9.45 $ 9.55 $ 9.15 $ 8.40 $ 7.30

Net income $ 1.45 $ 1.10 $ 0.60 $ 0.25 $ -0.10

- Capital charge

(10% k *Beginning BV) $ 0.90 $ 0.95 $ 0.96 $ 0.92 $ 0.84

Residual income $ 0.55 $ 0.16 $ -0.36 $ -0.67 $ -0.94

Gain on sale of equity to Pitbull (terminal value) $ -

because Beta agrees to pay the shareholders of Ace at the book value

$9+$0,55/(1+10%)1+$0,16/(1+10%)2+($(0,36))/(1+10%)3+($(0,67))/(1+10%)4+($(0,94))/(1+10%)5

Intrinsic value =

Intrinsic value = 8.32

Das könnte Ihnen auch gefallen

- P3.5 Different Forms of Business CombinationDokument8 SeitenP3.5 Different Forms of Business CombinationAgnes CahyaNoch keine Bewertungen

- LopDokument3 SeitenLopWidia Irma Yunita0% (2)

- Assignment 5 Sistem Informasi Akuntansi: SoalDokument4 SeitenAssignment 5 Sistem Informasi Akuntansi: Soalpatrecia 1896Noch keine Bewertungen

- Kuis Akuntansi ManajemenDokument5 SeitenKuis Akuntansi ManajemenBelinda Dyah Tri YuliastiNoch keine Bewertungen

- Group - 4 - Kooistra - Autogroep - MB EnnyDokument24 SeitenGroup - 4 - Kooistra - Autogroep - MB EnnyDiah BauNoch keine Bewertungen

- Maya Meidias P - 01017190005 - Chapter 22Dokument5 SeitenMaya Meidias P - 01017190005 - Chapter 22Kinas AnugrahaningNoch keine Bewertungen

- Chapter 2 - Understanding StrategiesDokument31 SeitenChapter 2 - Understanding StrategiesSarah Laras WitaNoch keine Bewertungen

- Transfer Pricng SolutionDokument3 SeitenTransfer Pricng SolutionchandraprakashNoch keine Bewertungen

- 07 - Measuring and Controlling Assets EmployedDokument8 Seiten07 - Measuring and Controlling Assets EmployedJason KurniawanNoch keine Bewertungen

- Cisco Solution FinalDokument3 SeitenCisco Solution Finalsrp83910% (1)

- Expenditure Cycle Case - GARCIADokument2 SeitenExpenditure Cycle Case - GARCIAARLENE GARCIANoch keine Bewertungen

- WALEED GHILAN - F19401067 The Diamond Model To Analyze TeslaDokument1 SeiteWALEED GHILAN - F19401067 The Diamond Model To Analyze TeslasalanfNoch keine Bewertungen

- New Jersey Insurance CompanyDokument4 SeitenNew Jersey Insurance CompanyParth V. PurohitNoch keine Bewertungen

- BAB 3 Analyzing Financing Activities 071016Dokument64 SeitenBAB 3 Analyzing Financing Activities 071016Haniedar NadifaNoch keine Bewertungen

- Tugas Audit 6 Januari 2018: 8.28 (Objectives 8-2, 8-3, 8-4, 8-5)Dokument13 SeitenTugas Audit 6 Januari 2018: 8.28 (Objectives 8-2, 8-3, 8-4, 8-5)Ditiya PratamaNoch keine Bewertungen

- AC3102 SemGrp 2 Presentation 3Dokument24 SeitenAC3102 SemGrp 2 Presentation 3Melati SepsaNoch keine Bewertungen

- Solved - Excerpts From The Annual Report of Lands' End Follow ($...Dokument2 SeitenSolved - Excerpts From The Annual Report of Lands' End Follow ($...Iman naufalNoch keine Bewertungen

- 11 24 ArensDokument3 Seiten11 24 ArenstsziNoch keine Bewertungen

- Texas Instruments and Hewlett-PackardDokument20 SeitenTexas Instruments and Hewlett-PackardNaveen SinghNoch keine Bewertungen

- Analyzing Investing Activities: Intercorporate Investments: ReviewDokument34 SeitenAnalyzing Investing Activities: Intercorporate Investments: ReviewAli MaksumNoch keine Bewertungen

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDokument3 SeitenMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNoch keine Bewertungen

- Act Part5Dokument1 SeiteAct Part5Moe ChannelNoch keine Bewertungen

- Appendix-A (Solutions To Self-Test Problems)Dokument34 SeitenAppendix-A (Solutions To Self-Test Problems)তি মিNoch keine Bewertungen

- Ringkasan AKL1Dokument98 SeitenRingkasan AKL1BagoesadhiNoch keine Bewertungen

- Introduction To Budgets and Preparing The Master Budget Coverage of Learning ObjectivesDokument44 SeitenIntroduction To Budgets and Preparing The Master Budget Coverage of Learning Objectivesahmed100% (1)

- p17 2Dokument3 Seitenp17 2AryaPratamaPutraNoch keine Bewertungen

- Chapter 1Dokument4 SeitenChapter 1Micaela BakerNoch keine Bewertungen

- SPM Case Tsinghua Tongfang Co. LTDDokument2 SeitenSPM Case Tsinghua Tongfang Co. LTDNur Kumala Dewi100% (2)

- CVP AnalysisDokument5 SeitenCVP AnalysisAnne BacolodNoch keine Bewertungen

- Analyzing Financial Performance ReportsDokument22 SeitenAnalyzing Financial Performance ReportsTia Permata SariNoch keine Bewertungen

- Chapter 11: Strategic Leadership Leadership - Two Capabilities That Are Marks of A Successful Leadership 1. Overcoming Barriers To ChangeDokument3 SeitenChapter 11: Strategic Leadership Leadership - Two Capabilities That Are Marks of A Successful Leadership 1. Overcoming Barriers To ChangecaicaiiNoch keine Bewertungen

- ACCT-UB 3 - Financial Statement Analysis Module 2 HomeworkDokument2 SeitenACCT-UB 3 - Financial Statement Analysis Module 2 HomeworkpratheekNoch keine Bewertungen

- Chapter 3 AdaptasiDokument31 SeitenChapter 3 AdaptasiGerhard Gank Anfield Liverpudlian100% (1)

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDokument14 SeitenSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Exercises Chapter07 PricingDokument11 SeitenExercises Chapter07 PricingQuỳnh ChâuNoch keine Bewertungen

- Financial Statement Analysis, 10e by K. R. Subramanyam & John J. Wild Chapter03Dokument40 SeitenFinancial Statement Analysis, 10e by K. R. Subramanyam & John J. Wild Chapter03RidhoVerianNoch keine Bewertungen

- Breezy CompanyDokument2 SeitenBreezy CompanychrisNoch keine Bewertungen

- Key Ans Master Budget AssignmentDokument13 SeitenKey Ans Master Budget AssignmentNCTNoch keine Bewertungen

- 1.kieso 2020-1118-1183Dokument66 Seiten1.kieso 2020-1118-1183dindaNoch keine Bewertungen

- Foreword: Financial Auditing 1 - 9 Edition - 1Dokument37 SeitenForeword: Financial Auditing 1 - 9 Edition - 1meyyNoch keine Bewertungen

- AKL 1 Tugas 1Dokument3 SeitenAKL 1 Tugas 1Dwi PujiNoch keine Bewertungen

- Assignment Group 3 - LA53 - AOL AISDokument9 SeitenAssignment Group 3 - LA53 - AOL AISGusti PanduNoch keine Bewertungen

- E8-29 Segmented Income Statement: Conceptual ConnectionDokument5 SeitenE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- Castro Maryliam T 3Dokument4 SeitenCastro Maryliam T 3Kyle KuroNoch keine Bewertungen

- Case 4 5 Dana Packaging and Ada PharmaDokument2 SeitenCase 4 5 Dana Packaging and Ada PharmaSoorajKrishnanNoch keine Bewertungen

- Ch24sol PDFDokument5 SeitenCh24sol PDFSandeep MishraNoch keine Bewertungen

- W2 - Disney Theme Park - With NPVDokument15 SeitenW2 - Disney Theme Park - With NPVChip choiNoch keine Bewertungen

- IRR Vs NPV Vs MarginDokument7 SeitenIRR Vs NPV Vs MarginFelice OeyNoch keine Bewertungen

- Flash - Memory - Inc From Website 0515Dokument8 SeitenFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- PorciniDokument2 SeitenPorciniFurqanTariqNoch keine Bewertungen

- Flash Memory IncDokument9 SeitenFlash Memory Incxcmalsk100% (1)

- Assumptions/Data: Unit Price Unit Variable CostDokument7 SeitenAssumptions/Data: Unit Price Unit Variable CostHannan yusuf KhanNoch keine Bewertungen

- Managerial Investment Decisions: Tools and AnalysisDokument40 SeitenManagerial Investment Decisions: Tools and AnalysisRNoch keine Bewertungen

- Palmer Corporation and Subsidiary Consolidated Balance Sheet at December 31,2006 (In Thousands)Dokument3 SeitenPalmer Corporation and Subsidiary Consolidated Balance Sheet at December 31,2006 (In Thousands)m habiburrahman55Noch keine Bewertungen

- LORL Write UpDokument5 SeitenLORL Write UpAIGswap100% (1)

- Modelo Brazos LBO CoMark - F ColinDokument1 SeiteModelo Brazos LBO CoMark - F ColinPaco ColínNoch keine Bewertungen

- Control AccionesDokument4 SeitenControl AccionescarlosNoch keine Bewertungen

- EOQ Formula Excel TemplateDokument6 SeitenEOQ Formula Excel TemplateAna Marie100% (1)

- 2008-2009 2007-2008 Committee Item Proposed Budgets Actuals Annual Monthly Annual MonthlyDokument3 Seiten2008-2009 2007-2008 Committee Item Proposed Budgets Actuals Annual Monthly Annual Monthlyapi-2717027Noch keine Bewertungen

- 2.0 FIN Plan & Forecasting v1Dokument62 Seiten2.0 FIN Plan & Forecasting v1Omer CrestianiNoch keine Bewertungen

- Manual On Effective Mutual Agreement Procedures (Memap) : Organisation For Economic Co-Operation and DevelopmentDokument55 SeitenManual On Effective Mutual Agreement Procedures (Memap) : Organisation For Economic Co-Operation and DevelopmentcemkudaNoch keine Bewertungen

- ASIO4ALL v2 Instruction ManualDokument11 SeitenASIO4ALL v2 Instruction ManualDanny_Grafix_1728Noch keine Bewertungen

- HqwewewDokument1 SeiteHqwewewcemkudaNoch keine Bewertungen

- PribndDokument1 SeitePribndcemkudaNoch keine Bewertungen

- Manual On Effective Mutual Agreement Procedures (Memap) : Organisation For Economic Co-Operation and DevelopmentDokument55 SeitenManual On Effective Mutual Agreement Procedures (Memap) : Organisation For Economic Co-Operation and DevelopmentcemkudaNoch keine Bewertungen

- Finance Accounting CemkudaDokument1 SeiteFinance Accounting CemkudacemkudaNoch keine Bewertungen

- Rewe WewDokument1 SeiteRewe WewcemkudaNoch keine Bewertungen

- Competing On Resources, Collins and MontgomeryDokument5 SeitenCompeting On Resources, Collins and MontgomeryMansi BaranwalNoch keine Bewertungen

- ONY Usic Ntertainment: B By: Hien Vu Shawn GarnerDokument33 SeitenONY Usic Ntertainment: B By: Hien Vu Shawn Garnerjeeves_31Noch keine Bewertungen

- Semantic Business Intelligence - Dinu AIRINEIDokument9 SeitenSemantic Business Intelligence - Dinu AIRINEIcemkudaNoch keine Bewertungen

- ONY Usic Ntertainment: B By: Hien Vu Shawn GarnerDokument33 SeitenONY Usic Ntertainment: B By: Hien Vu Shawn Garnerjeeves_31Noch keine Bewertungen

- Costing Methods For Supply Chain Management - Anna Surowiec PHDDokument7 SeitenCosting Methods For Supply Chain Management - Anna Surowiec PHDcemkudaNoch keine Bewertungen

- Enhancing Lean Supply Chain Maturity PDFDokument19 SeitenEnhancing Lean Supply Chain Maturity PDFcemkudaNoch keine Bewertungen

- Chapter 1 QuestionsDokument3 SeitenChapter 1 Questionscemkuda100% (2)

- Crown Entities Act 2004Dokument259 SeitenCrown Entities Act 2004cemkudaNoch keine Bewertungen

- 2011 Indonesia Selected Issue - IMFDokument47 Seiten2011 Indonesia Selected Issue - IMFcemkudaNoch keine Bewertungen

- Problems in MacroeconomicsDokument5 SeitenProblems in MacroeconomicsAmit ChauhanNoch keine Bewertungen

- Fetal Growth CurvesDokument40 SeitenFetal Growth CurvescemkudaNoch keine Bewertungen

- Shasta County Project: Privatization of Public ServicesDokument33 SeitenShasta County Project: Privatization of Public Servicesreltih18Noch keine Bewertungen

- 02.damodaran - Corporate FinanceDokument239 Seiten02.damodaran - Corporate Financessj9Noch keine Bewertungen

- Opc and Corporate VeilDokument12 SeitenOpc and Corporate Veilmugunthan100% (1)

- Neda3 PDFDokument9 SeitenNeda3 PDFowenNoch keine Bewertungen

- Notice of Winding Up Final 230420Dokument1 SeiteNotice of Winding Up Final 230420gopalkpsahuNoch keine Bewertungen

- Business CombinationDokument4 SeitenBusiness CombinationNicole AutrizNoch keine Bewertungen

- MJ 2021Dokument11 SeitenMJ 2021Yusuf MohamedNoch keine Bewertungen

- Accounting For ValueDokument15 SeitenAccounting For Valueolst100% (5)

- Belarusian Grocery Retail Market BCG - July2018 - English - tcm26 196435 PDFDokument158 SeitenBelarusian Grocery Retail Market BCG - July2018 - English - tcm26 196435 PDFmaxNoch keine Bewertungen

- CSSEPDokument136 SeitenCSSEPAbhinay KumarNoch keine Bewertungen

- 1 TaxplanningchapterDokument60 Seiten1 TaxplanningchapterGieanne Prudence Venculado100% (1)

- Jurnal Inter SintyaDokument7 SeitenJurnal Inter SintyaAbhimana NegaraNoch keine Bewertungen

- Jurnal 2 - Alaeto Henry Emeka (2020) - Determinants - of - Dividend - Polic - NigeriaDokument31 SeitenJurnal 2 - Alaeto Henry Emeka (2020) - Determinants - of - Dividend - Polic - NigeriaGilang KotawaNoch keine Bewertungen

- Solucionario - PC1 2019-02 EF71Dokument37 SeitenSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeNoch keine Bewertungen

- Tesla Case PDFDokument108 SeitenTesla Case PDFJeremiah Peter100% (1)

- F6 InterimDokument7 SeitenF6 InterimSad AnwarNoch keine Bewertungen

- Liu NguyenDokument33 SeitenLiu NguyenYulianita AdrimaNoch keine Bewertungen

- General InsuranceDokument48 SeitenGeneral InsurancePreeti PurohitNoch keine Bewertungen

- Chapter 4 QuestionsDokument6 SeitenChapter 4 QuestionsMariam HeikalNoch keine Bewertungen

- Industry and Company AnalysisDokument4 SeitenIndustry and Company AnalysisAchirangshu MukhopadhyayNoch keine Bewertungen

- BizWhiz Weekly Business Quiz IIDokument4 SeitenBizWhiz Weekly Business Quiz IIrajeevreddyaNoch keine Bewertungen

- 05 Lecture - The Time Value of Money PDFDokument26 Seiten05 Lecture - The Time Value of Money PDFjgutierrez_castro7724Noch keine Bewertungen

- Mid MCQDokument7 SeitenMid MCQtrinh tranNoch keine Bewertungen

- Hog Production and Marketing in Caramay-Highway, Pulot Center Sofronio Espanola, PalawanDokument31 SeitenHog Production and Marketing in Caramay-Highway, Pulot Center Sofronio Espanola, PalawanEarl Timothy O. MalvasNoch keine Bewertungen

- Dr.G.R.Damodaran College of ScienceDokument23 SeitenDr.G.R.Damodaran College of ScienceAbdullahNoch keine Bewertungen

- CG 2016Dokument263 SeitenCG 2016Setianingsih SENoch keine Bewertungen

- Letter Petronilo YangcoDokument2 SeitenLetter Petronilo YangcoRg JakosalemNoch keine Bewertungen

- New Microsoft Word DocumentDokument3 SeitenNew Microsoft Word DocumentFarhan TyeballyNoch keine Bewertungen

- Corporate Level StrategiesDokument110 SeitenCorporate Level StrategiesNitika Abhishek Dahiya100% (2)

- Final Proposal (Chee)Dokument13 SeitenFinal Proposal (Chee)Faraliza JumayleezaNoch keine Bewertungen