Beruflich Dokumente

Kultur Dokumente

Share Prices8 PDF

Hochgeladen von

Kyler Greenway0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

121 Ansichten1 SeiteThis document provides a chronology of major financial crises and market panics from the Middle Ages to the present day. Some key events mentioned include banking failures in 1255-1262 in Italy, defaults by English kings Edward I, II, and III to Italian banks during wars in the late 13th and early 14th centuries, and the bankruptcy of the Bardi and Peruzzi banks in 1345 leading to a major crash and depression. Other financial crises listed include those associated with defaults by Philip II of Spain in 1575 and 1596 that severely impacted Genoese creditors, and the Spanish state bankruptcy in 1607 that caused failures of Genoese banks. The chronology extends into

Originalbeschreibung:

Originaltitel

share-prices8.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides a chronology of major financial crises and market panics from the Middle Ages to the present day. Some key events mentioned include banking failures in 1255-1262 in Italy, defaults by English kings Edward I, II, and III to Italian banks during wars in the late 13th and early 14th centuries, and the bankruptcy of the Bardi and Peruzzi banks in 1345 leading to a major crash and depression. Other financial crises listed include those associated with defaults by Philip II of Spain in 1575 and 1596 that severely impacted Genoese creditors, and the Spanish state bankruptcy in 1607 that caused failures of Genoese banks. The chronology extends into

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

121 Ansichten1 SeiteShare Prices8 PDF

Hochgeladen von

Kyler GreenwayThis document provides a chronology of major financial crises and market panics from the Middle Ages to the present day. Some key events mentioned include banking failures in 1255-1262 in Italy, defaults by English kings Edward I, II, and III to Italian banks during wars in the late 13th and early 14th centuries, and the bankruptcy of the Bardi and Peruzzi banks in 1345 leading to a major crash and depression. Other financial crises listed include those associated with defaults by Philip II of Spain in 1575 and 1596 that severely impacted Genoese creditors, and the Spanish state bankruptcy in 1607 that caused failures of Genoese banks. The chronology extends into

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

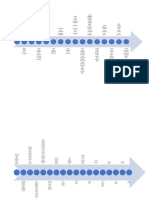

A History of Share Prices

Chronology of financial crises and market panics from the Middle Ages to the present:

1255 Overexpansion of credit led to banking failures in 1255-62 in Italy

1294 Edward I default to the Ricciardi of Lucca during war with France

Great

1298 Seizure of the Gran Tavola of Sienna by Philip IV of France

Reflation

1307 Liquidation of the Knights Templar by Philip IV

1311 Edward II default to the Frescobaldi of Florence Tech, housing 2016

bubbles 2194

1326 Bankruptcy of the Scali of Florence and Asti of Sienna

1342 Edward III default to the Florentine banks during the Hundred Years War 2000 2007

1345 Bankruptcy of the Bardi and Peruzzi; depression, Great crash of the 1340s 1553 1576 1810

1380 Ciompi Revolt in Florence. Crash of the early 1380s 2016

1401 Italian bankers expelled from Aragon in 1401, England in 1403, France in 1410

1433 Fiscal crisis in Florence after wars with Milan and Lucca 1075

2011

1464 Death of Cosimo de Medici: loans called in; wave of bankruptcies in Florence Post Cold

1470 Edward IV default to the Medici during the Wars of the Roses War Era 769

2002 667

1478 Bruges branch of the Medici bank liquidated on bad debts 2009

1494 Overthrow of the Medici after the capture of Florence by Charles VIII of France 1987

1525 Siege of Genoa by Imperial troops; coup in 1527 338 436 Global

1994

1557 Philip II of Spain restructuring of debts inherited from Charles V Financial

Reagan 295 Crisis

1566 Start of the Dutch Revolt against Spain: disruption of Spanish trade Era 1990

1575 Philip II default: Financial crisis of 1575-79 affected Genoese creditors 2007-09

217

1596 Philip II default: Financial crisis of 1596 severely affected Genoese businessmen 1987

1607 Spanish state bankruptcy: failure of Genoese banks 1973

1968 120

1619 Kipper-und-Wipperzeit: Monetary crisis at the outbreak of the Thirty Years War 94.1

1627 Spanish bankruptcy: collapse of Genoese banks and the Fugggers

102

1637 End of the Dutch Tulipmania; also, Dutch East India Company shares, canals Post-War 1982

1648 French state bankruptcy, eliminated the Italian bankers Boom

1652 Outbreak of the First Anglo-Dutch War: attacks by Britain on Dutch shipping Roaring 69.3

Twenties 1970 62.3

1666 Second Anglo-Dutch War: disruption to the Dutch spice fleet 1974

52.3

1672 Rampjaar (Disaster Year) in Holland: French/English invasion 1929 1962

31.9 New 39.0 Oil shocks:

1696 English government debt crisis during the Nine Years War against France

Deal 1957

1705 English crisis during the War of the Spanish Succession against France Mass-production Stagflation

1720 Collapse of the South Sea Bubble in England and Mississippi Bubble in France (Fordism) 1937 1970s

18.7 22.7

1761 English government debt crisis over the Seven Years War against France 1953

1769 Collapse of the Bengal Bubble in East India Company stock Gilded Age

1772 Credit Crisis in London and the American colonies 1909

Vietnam War

1783 Economic depression in Britain and America after the Revolutionary War Reconstruction 1899 10.4 13.6 1955-75

6.85 1949

1792 Boom and bust in the First Bank of the United States after Hamiltons refunding Era

1881

1797 Land speculation bubble burst. Bank run in England on fear of French invasion 6.58

Canal/railroad booms 1869 7.47

1802 Boom and bust after the Peace of Amiens between Britain and France 5.27 1942

6.20

1807 Jeffersons Embargo Act: restriction of trade with Britain 1835 5.91 1921

1852 1914 WWII

1812 Outbreak of the War of 1812 against Britain 3.95

3.55 4.40

1819 Land bubble burst; bank failures. Tightening by the Second Bank of the U.S. Era of Good 4.23 1932 1939-45

1825 Emerging market (Latin America) bubble burst in London Feelings 1824 1885 3.50 WWI

2.42 1897 1914-18

1837 Collapse of bubbles in canals, cotton and land; run on banks Great

South Sea 2.73

1847 Collapse of railway boom in London (following Bank Charter Act) Land booms 1877 Depression

Bubble 2.06 Long

1857 Global market panic; railway bubble; failure of Ohio Life Co 1806

1929-33

1.76 1848 Depression

1866 Failure of Overend Gurney and Co. in London; banking crisis 1720 1.27

1.16 1829 1873-96

1869 Black Friday in NY: collapse of Gould and Fisk gold speculation 1800

1.00 1.34

Bengal 1857

1873 Railroad bubble; Jay Cooke failure; end of silver coinage 1794

Bubble 0.76 0.96

1877 Great Railroad Strike: deflation and wage cuts following the Panic of 1873 U.S. Civil

1842

1884 Tightening by NYC national banks; bank failures in NY 1768 0.74 War

Dutch Golden Age 0.53 1813 Hungry 1861-65

1893 Railroad bubble burst, bank failures, run on gold reserves; Sherman Silver Act 1731

1752

0.60

0.45 Forties

1896 Run on silver reserves; commodity price declines; National Bank of Illinois failure 0.42 0.54 1807

1649 1797 1837-44

1901 Cornering of Northern Pacific Railway stock 1671 1688

1907 Bankers Panic: cornering of United Copper Co; failure of Knickerbocker Trust Co 1641 0.31 0.30 0.31 1703

0.27 0.26 0.35 Napoleonic

1910 Enforcement of Sherman Anti-trust Act: breakup of Standard Oil Co 0.31 0.32 1746 0.31 Wars

1722 1733 0.28 1784

1913 Drain of gold reserves to Europe in lead-up to WWI 1762 1803-15

1921 Depression of 1920-21: demobilisation, monetary tightening; severe deflation

1929 Wall Street Crash/Black Tuesday: collapse of 1920s boom 0.19

0.20

1706

Seven Years American

1614 1657 0.18 War Revolution

1932 Great depression trough: widespread bank failures 1666 0.16

1607 0.111 1672 0.14 1775-83

1938 Monetary and fiscal tightening following New Deal: Roosevelt Recession 0.094 0.13 1696 1754-63

1636

1942 Response to Japanese/German successes in WWII 0.097 Anglo-Dutch

Age of the Genoese Wars against

1948 Monetary tightening by the Federal Reserve; recession of 1949 1624

Wars Louis XIV

1953 Monetary tightening to combat post-Korean War inflation in 1952 1652-74

1585 0.061 1688-1714

1957 Eisenhower Recession: monetary tightening to combat inflation 0.041 1618

1962 Kennedy Slide/Flash Crash; Cuban Missile Crisis

1969 Nixon Recession: monetary and fiscal tightening to combat inflation and deficit 0.041 Thirty Years War

1596

1974 Oil crisis (OPEC embargo). Rising inflation and unemployment: stagflation 1618-48

1509

1979 Energy crisis (Iranian Revolution): monetary tightening under Paul Volcker 0.020 1553 0.026

1982 Continued Fed tightening on energy crisis. Defaults by Mexico, Brazil, Argentina 0.018 1577 Dutch Revolt

1984 Continental Illinois bank failure and seizure by the FDIC 1568-1648

1987 Black Monday: global market crash, collapse of speculative boom

0.015 0.015

1990 Gulf War: spike in oil price; recession of 1990-92 1525 1566 Chart: yearly high-low-close bars (yearly closing data prior to 1709); log-linear scale

0.012

1994 Tequila Crisis: Mexico peso devaluation. Federal Reserve rate hikes 1555

1998 Asia crisis (began 1997), Russia default, LTCM failure Italian Wars Composite index: Genoa 1509-1601, Holland 1602-1692, Great Britain 1693-1788, the United States 1789-2016 (extended S&P 500 Index)

2001 Collapse of dotcom bubble; 9/11 attacks; corporate accounting scandals (Habsburg-Valois)

2008 Collapse of housing bubble; Global Financial Crisis; Lehman, AIG etc. failures 1494-1559

2011 US debt ceiling crisis and credit rating downgrade. Eurozone sovereign debt crisis

2015 End of the Federal Reserves zero interest rate policy (Q.E. ended 2014) Kieron Nutbrown, 2016

1250 1300 1350 1400 1450 1500 1550 1600 1650 1700 1750 1800 1850 1900 1950 2000 2050

Das könnte Ihnen auch gefallen

- A History of the Peninsular War, Volume V: October 1811-August 31, 1812: Valencia, Ciudad Rodrigo, Badajoz, Salamanca, Madrid [Illustrated Edition]Von EverandA History of the Peninsular War, Volume V: October 1811-August 31, 1812: Valencia, Ciudad Rodrigo, Badajoz, Salamanca, Madrid [Illustrated Edition]Noch keine Bewertungen

- Monarchs of The UKDokument1 SeiteMonarchs of The UKpchoiNoch keine Bewertungen

- ARC 110x: The Meaning of Rome Timeline of Events - The 1500sDokument3 SeitenARC 110x: The Meaning of Rome Timeline of Events - The 1500sarabianddrumsNoch keine Bewertungen

- Timeline For HistoryDokument3 SeitenTimeline For HistoryQuin Lasnoski100% (1)

- The Early Modern Modern World WorldDokument34 SeitenThe Early Modern Modern World WorldJoseph N. Lewis JrNoch keine Bewertungen

- New Haven Public Schedule March 27, 2022 Final - 0Dokument2 SeitenNew Haven Public Schedule March 27, 2022 Final - 0mimifreemanNoch keine Bewertungen

- Italian WarsDokument14 SeitenItalian WarsLaura MayoNoch keine Bewertungen

- Timeline of History - 20th Century at A GlanceDokument1 SeiteTimeline of History - 20th Century at A GlanceSÚI - GÉNERISNoch keine Bewertungen

- Ce 100Dokument5 SeitenCe 100Whelance TomboconNoch keine Bewertungen

- Falmouth Coaster TimetableDokument2 SeitenFalmouth Coaster TimetableJoshua RaynerNoch keine Bewertungen

- Arquitectura VignolaDokument27 SeitenArquitectura VignolaAngela SauñeNoch keine Bewertungen

- Key Events of The Renaissance: Created WithDokument3 SeitenKey Events of The Renaissance: Created WithChishmish DollNoch keine Bewertungen

- Chapter 11 - RenaissanceDokument32 SeitenChapter 11 - RenaissanceLekhoni BanerjeeNoch keine Bewertungen

- British HistoryDokument37 SeitenBritish HistoryfreshmendocsNoch keine Bewertungen

- Isabella D'Este - A Renaissance WomanDokument14 SeitenIsabella D'Este - A Renaissance WomansallyreadNoch keine Bewertungen

- Predonzani - Alberici - The Italian Wars - 3 - Francis I and The Battle of Pavia 1525Dokument134 SeitenPredonzani - Alberici - The Italian Wars - 3 - Francis I and The Battle of Pavia 1525belthasarbNoch keine Bewertungen

- Isabella I of CastileDokument18 SeitenIsabella I of CastileTabata SantanaNoch keine Bewertungen

- Art Historical Analysis Class For High School by SlidesgoDokument55 SeitenArt Historical Analysis Class For High School by Slidesgotiagosimoes2911Noch keine Bewertungen

- Centerpop Mean2010Dokument1 SeiteCenterpop Mean2010Anonymous 6wtEuyzO3Noch keine Bewertungen

- Vol 12 - Thehistoryofthep12pastuoftDokument746 SeitenVol 12 - Thehistoryofthep12pastuoftSamuel SantosNoch keine Bewertungen

- All English Claims To The French ThroneDokument6 SeitenAll English Claims To The French ThronehezurazzaNoch keine Bewertungen

- Art Historical Analysis Class For High School by SlidesgoDokument55 SeitenArt Historical Analysis Class For High School by Slidesgotiagosimoes2911Noch keine Bewertungen

- Talking Street LeafletDokument2 SeitenTalking Street Leafletmohana gNoch keine Bewertungen

- Midterm Project 3Dokument1 SeiteMidterm Project 3SANGMIPARKNoch keine Bewertungen

- Da VinciDokument2 SeitenDa VinciAnonymous Eai82qTNoch keine Bewertungen

- MiddagessmlDokument9 SeitenMiddagessmlAina FazlianaNoch keine Bewertungen

- The Art Walk: Prado MuseumDokument3 SeitenThe Art Walk: Prado MuseumjulietaitaliaNoch keine Bewertungen

- Axa Literatura AmaliaPDokument1 SeiteAxa Literatura AmaliaPCristina DinitaNoch keine Bewertungen

- Predonzani - The Italian Wars - 2 - Agnadello 1509 - Ravenna 1512 - Marignano 1515Dokument162 SeitenPredonzani - The Italian Wars - 2 - Agnadello 1509 - Ravenna 1512 - Marignano 1515belthasarbNoch keine Bewertungen

- Margaretolo . : The Venetian Bead Story, Part 2: The BeadsDokument12 SeitenMargaretolo . : The Venetian Bead Story, Part 2: The BeadsJéssica IglésiasNoch keine Bewertungen

- Elizabethan England, c1568-1603Dokument2 SeitenElizabethan England, c1568-1603dladsn1Noch keine Bewertungen

- Composer Dictionary February 2021Dokument129 SeitenComposer Dictionary February 2021Len RhodesNoch keine Bewertungen

- Shakespeare - Life and Plays 21.22Dokument18 SeitenShakespeare - Life and Plays 21.22Trick shotNoch keine Bewertungen

- Chronology-Timeline (Phann Sopheaktra)Dokument1 SeiteChronology-Timeline (Phann Sopheaktra)Sopheaktra PhannNoch keine Bewertungen

- Arquitectura PalladioDokument17 SeitenArquitectura PalladioAngela SauñeNoch keine Bewertungen

- Iconographica: Studies in The History of ImagesDokument16 SeitenIconographica: Studies in The History of ImagespspacimbNoch keine Bewertungen

- Week 2 - Eire, Reformations - 3-63Dokument61 SeitenWeek 2 - Eire, Reformations - 3-63onejacarandakamiNoch keine Bewertungen

- Avance Ingles 2 (Autoguardado)Dokument6 SeitenAvance Ingles 2 (Autoguardado)NAOMY LISSETE GUTIERREZ LOPEZNoch keine Bewertungen

- Port Olimpic: Parc de La CiutadellaDokument3 SeitenPort Olimpic: Parc de La CiutadellaanaNoch keine Bewertungen

- Assembling A 14th Century Soft Kit 1Dokument18 SeitenAssembling A 14th Century Soft Kit 1mixthumbNoch keine Bewertungen

- Classical Guitar Convocation: December 10, 2021Dokument1 SeiteClassical Guitar Convocation: December 10, 2021Chandler DillinghamNoch keine Bewertungen

- Medieval/Rennaissance Era Timeline Tutorial 5 - Natasha WalshDokument2 SeitenMedieval/Rennaissance Era Timeline Tutorial 5 - Natasha WalshJasmina MilojevicNoch keine Bewertungen

- Timeline Goya - Od1Dokument3 SeitenTimeline Goya - Od1Lucía FONoch keine Bewertungen

- Wool in 14th Century Florence The AffirmDokument12 SeitenWool in 14th Century Florence The Affirmina kadoNoch keine Bewertungen

- The Rise and Fall of Spain (1270-1850)Dokument37 SeitenThe Rise and Fall of Spain (1270-1850)Luis Alfonso FlorNoch keine Bewertungen

- ITALIAN GARDENS - pdfITALIAN GARDENSDokument49 SeitenITALIAN GARDENS - pdfITALIAN GARDENSSakshi RawatNoch keine Bewertungen

- Fdocuments - in - Verona I Historic Trail Verona Italy Historic Trail Verona Hiking Route StartDokument24 SeitenFdocuments - in - Verona I Historic Trail Verona Italy Historic Trail Verona Hiking Route Startؤآللهہ حہبہيہتہكہNoch keine Bewertungen

- Quennell All in One TreeDokument6 SeitenQuennell All in One TreetrevorskingleNoch keine Bewertungen

- İşci̇ Yatakhanesi̇Dokument1 Seiteİşci̇ Yatakhanesi̇HSNNoch keine Bewertungen

- Chapter 18Dokument33 SeitenChapter 18sara moussallyNoch keine Bewertungen

- Hurwitz Family Tree PDF-R.4Dokument1 SeiteHurwitz Family Tree PDF-R.4ChaseF31ckzwhr100% (1)

- PDFDokument33 SeitenPDFtherenam825Noch keine Bewertungen

- Da VinciDokument2 SeitenDa VinciAnonymous Eai82qTNoch keine Bewertungen

- Reader Pp. 6-10Dokument5 SeitenReader Pp. 6-10zeynepNoch keine Bewertungen

- DWN CD Sem 1402Dokument1 SeiteDWN CD Sem 1402Gourishankar MishraNoch keine Bewertungen

- Proofs: Topic 6 Renaissance Italy (C. 1400-1600)Dokument32 SeitenProofs: Topic 6 Renaissance Italy (C. 1400-1600)junaidiqbalsialNoch keine Bewertungen

- Contents For Odawa Language and LegendsDokument2 SeitenContents For Odawa Language and LegendsTracey LaneNoch keine Bewertungen

- PDF 20230216 122101 0000Dokument1 SeitePDF 20230216 122101 0000ra rollNoch keine Bewertungen

- Turner Counsel Inventors Improvements 1850Dokument56 SeitenTurner Counsel Inventors Improvements 1850Marc PerlmanNoch keine Bewertungen

- Vol 06 - Historyofthepope06pastuoftDokument710 SeitenVol 06 - Historyofthepope06pastuoftSamuel SantosNoch keine Bewertungen

- An 10302Dokument14 SeitenAn 10302Kyler GreenwayNoch keine Bewertungen

- (NATO ASI Series 274) Xxxxxxxxxxxxs (Eds.) - C2014.14 (1994)Dokument736 Seiten(NATO ASI Series 274) Xxxxxxxxxxxxs (Eds.) - C2014.14 (1994)Kyler GreenwayNoch keine Bewertungen

- TT ch7 Using Teaching Aids PDFDokument2 SeitenTT ch7 Using Teaching Aids PDFKyler GreenwayNoch keine Bewertungen

- Piet Christof Wölcken, Michael Papadopoulos (Eds.) - Smart Intelligent Aircraft Structures 2014.14Dokument1.025 SeitenPiet Christof Wölcken, Michael Papadopoulos (Eds.) - Smart Intelligent Aircraft Structures 2014.14Kyler Greenway100% (1)

- Suggested Problems CH 16Dokument2 SeitenSuggested Problems CH 16Kyler GreenwayNoch keine Bewertungen

- Learn Power Point: One Step at A TimeDokument8 SeitenLearn Power Point: One Step at A TimeKyler GreenwayNoch keine Bewertungen

- COM (2016) 763 AnnexDokument4 SeitenCOM (2016) 763 AnnexKyler GreenwayNoch keine Bewertungen

- Pärt Mozart-Adagio PDFDokument7 SeitenPärt Mozart-Adagio PDFKyler GreenwayNoch keine Bewertungen

- Assign1n Nds ConceptsDokument2 SeitenAssign1n Nds ConceptsKyler GreenwayNoch keine Bewertungen

- Teaching ChessDokument36 SeitenTeaching ChessKyler GreenwayNoch keine Bewertungen

- Development of T0urism Facilities in Soon Valley (KHABBEKI LAKE) Plumbing WorksDokument4 SeitenDevelopment of T0urism Facilities in Soon Valley (KHABBEKI LAKE) Plumbing WorksKyler GreenwayNoch keine Bewertungen

- Track Sheet: Session InformationDokument1 SeiteTrack Sheet: Session InformationKyler GreenwayNoch keine Bewertungen

- Track Sheet: Session InformationDokument1 SeiteTrack Sheet: Session InformationKyler GreenwayNoch keine Bewertungen

- ISavi IsatHub Users Manual Guide v2Dokument49 SeitenISavi IsatHub Users Manual Guide v2Kyler GreenwayNoch keine Bewertungen

- Doctrine of Ultra Vires - Doc Sid 1Dokument14 SeitenDoctrine of Ultra Vires - Doc Sid 1Angna DewanNoch keine Bewertungen

- Evidence C13Dokument29 SeitenEvidence C13Aditya SubbaNoch keine Bewertungen

- Ressistance WeldingDokument12 SeitenRessistance WeldingGautam KumarNoch keine Bewertungen

- The Unbecoming of Mara DyerDokument6 SeitenThe Unbecoming of Mara DyerKasshika Nigam75% (4)

- CH 02Dokument60 SeitenCH 02kevin echiverriNoch keine Bewertungen

- The History of Origin and Growth of Merchant Banking Throughout The WorldDokument18 SeitenThe History of Origin and Growth of Merchant Banking Throughout The WorldJeegar Shah0% (1)

- Appointment of Beneficiary FormDokument2 SeitenAppointment of Beneficiary FormAnkithaNoch keine Bewertungen

- Role of Ethics in Corporate GovernanceDokument11 SeitenRole of Ethics in Corporate GovernancepranjalNoch keine Bewertungen

- The Lion of Judah PDFDokument19 SeitenThe Lion of Judah PDFMichael SympsonNoch keine Bewertungen

- Request For Dismissal Form Civ 110Dokument2 SeitenRequest For Dismissal Form Civ 110soyjairoNoch keine Bewertungen

- Topic 3 - Overview: Licensing Exam Paper 1 Topic 3Dokument16 SeitenTopic 3 - Overview: Licensing Exam Paper 1 Topic 3anonlukeNoch keine Bewertungen

- Transfer of Property Act ProjectDokument10 SeitenTransfer of Property Act ProjectAshirbad SahooNoch keine Bewertungen

- SFA HANDBOOK 201-280 Registration ProceduresDokument80 SeitenSFA HANDBOOK 201-280 Registration ProceduresGraeme NichollsNoch keine Bewertungen

- Freedom - What Is Bible Freedom. What Does John 8:32 Promise?Dokument64 SeitenFreedom - What Is Bible Freedom. What Does John 8:32 Promise?kgdieckNoch keine Bewertungen

- 4ATDokument3 Seiten4ATPaula Mae DacanayNoch keine Bewertungen

- CV 18112019Dokument1 SeiteCV 18112019Gocha KhudoianNoch keine Bewertungen

- Handling Order: To-Write-Acknowledgement-Letter - Htm. DownloadDokument15 SeitenHandling Order: To-Write-Acknowledgement-Letter - Htm. DownloadNomica Eka PutriNoch keine Bewertungen

- Primary Resources:: in Communist China. New York: Atlantic Monthly, 1993. PrintDokument3 SeitenPrimary Resources:: in Communist China. New York: Atlantic Monthly, 1993. PrintJennifer DavisNoch keine Bewertungen

- Tertiary ActivitiesDokument5 SeitenTertiary Activitieshimanshu singhNoch keine Bewertungen

- Latin Legal TermsDokument5 SeitenLatin Legal TermsBrassette BalenciagaNoch keine Bewertungen

- Shipping and Trade in Rammeside EgyptDokument40 SeitenShipping and Trade in Rammeside EgyptIain EatonNoch keine Bewertungen

- MCSO Sheriff Baxter EssayDokument2 SeitenMCSO Sheriff Baxter EssayNews 8 WROC100% (1)

- RangeRover P38Dokument75 SeitenRangeRover P3812logapoloNoch keine Bewertungen

- DEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezDokument2 SeitenDEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezJaime Gonzales73% (15)

- Core Issues in EconomyDokument8 SeitenCore Issues in EconomyInstitute of Policy Studies100% (3)

- Position, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inDokument6 SeitenPosition, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inamrit singhNoch keine Bewertungen

- Market Power: Monopoly and Monopsony: Chapter OutlineDokument34 SeitenMarket Power: Monopoly and Monopsony: Chapter OutlineLolaNoch keine Bewertungen

- PH F and BenefactorDokument4 SeitenPH F and BenefactorRamiro RacelisNoch keine Bewertungen

- 01 Baguio Country Club Corp. v. National Labor Relations CommissionDokument4 Seiten01 Baguio Country Club Corp. v. National Labor Relations CommissionGina RothNoch keine Bewertungen

- NEW TimelineDokument11 SeitenNEW TimelineoldpaljimNoch keine Bewertungen

![A History of the Peninsular War, Volume V: October 1811-August 31, 1812: Valencia, Ciudad Rodrigo, Badajoz, Salamanca, Madrid [Illustrated Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/259901130/149x198/a5b53e61d2/1617227776?v=1)