Beruflich Dokumente

Kultur Dokumente

Fra Forumula Book PDF

Hochgeladen von

Cratos_PoseidonCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fra Forumula Book PDF

Hochgeladen von

Cratos_PoseidonCopyright:

Verfügbare Formate

FINANCIAL REPORTING AND ANALYSIS

FINANCIAL REPORTING AND ANALYSIS

2

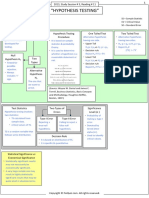

Exhibit 10, pg 72, Vol 3, CFA Program Curriculum 2012

2011 ELAN GUIDES 28

FINANCIAL REPORTING AND ANALYSIS

Basic EPS

Basic EPS = Net income Preferred dividends

Weighted average number of shares outstanding

Diluted EPS

Diluted EPS =

[ Net income -

Preferred

dividends ] +

Convertible

preferred +

dividends

[

Convertible

debt (1 - t)

interest

]

Shares from Shares from

Weighted Shares

conversion of conversion of

average + + + issuable from

convertible convertible

shares stock options

preferred shares debt

Comprehensive Income

Net income + Other comprehensive income = Comprehensive income

Gains and Losses on Marketable Securities

Held-to-Maturity Available-for-sale Trading

Securities Securities Securities

Balance Sheet Reported at cost or Reported at fair value. Reported at fair value.

amortized cost.

Unrealized gains or losses

due to changes in

market values are reported

in other comprehensive

income within owners

equity.

Items recognized Interest income Dividend income. Dividend income.

on the income

statement Realized gains Interest income. Interest income.

and losses.

Realized gains Realized gains and losses.

and losses.

Unrealized gains and

losses due to changes in

market values.

2011 ELAN GUIDES 29

FINANCIAL REPORTING AND ANALYSIS

Cash Flow Classification under U.S. GAAP

CFO

Inflows Outflows

Cash collected from customers. Cash paid to employees.

Interest and dividends received. Cash paid to suppliers.

Proceeds from sale of securities held for trading. Cash paid for other expenses.

Cash used to purchase trading

securities.

Interest paid.

Taxes paid.

CFI

Inflows Outflows

Sale proceeds from fixed assets. Purchase of fixed assets.

Sale proceeds from long-term investments. Cash used to acquire LT investment

securities.

CFF

Inflows Outflows

Proceeds from debt issuance. Repayment of LT debt.

Proceeds from issuance of equity instruments. Payments made to repurchase stock.

Dividends payments.

Cash Flow Statements under IFRS and U.S. GAAP

IFRS U.S. GAAP

Classification of Cash Flows

Interest and dividends received CFO or CFI CFO

Interest paid CFO or CFF CFO

Dividend paid CFO or CFF CFF

Dividends received CFO or CFI CFO

Taxes paid CFO, but part of the tax can be CFO

categorized as CFI or CFF if it is clear

that the tax arose from investing or

financing activities.

Bank overdrafts Included as a part of cash equivalents. Not considered a part of cash equivalents

and included in CFF.

Presentation Format

CFO Direct or indirect method. The former is Direct or indirect method. The former is

(No difference in CFI and preferred. preferred. However, if the direct method

CFF presentation) is used, a reconciliation of net income

and CFO must be included.

Disclosures

Taxes paid should be presented separately If taxes and interest paid are not explicitly

on the cash flow statement. stated on the cash flow statement, details

can be provided in footnotes.

2011 ELAN GUIDES 30

FINANCIAL REPORTING AND ANALYSIS

Free Cash Flow to the Firm

FCFF = NI + NCC + [Int * (1 tax rate)] FCInv WCInv

FCFF = CFO + [Int * (1 tax rate)] FCInv

Free Cash Flow to Equity

FCFE = CFO - FCInv + Net borrowing

Inventory Turnover

Cost of goods sold

Inventory turnover =

Average inventory

Days of Inventory on Hand

365

Days of inventory on hand (DOH) =

Inventory turnover

Receivables Turnover

Revenue

Receivables turnover =

Average receivables

Days of Sales Outstanding

365

Days of sales outstanding (DSO) =

Receivables turnover

Payables Turnover

Purchases

Payables turnover =

Average trade payables

Number of Days of Payables

365

Number of days of payables =

Payables turnover

Working Capital Turnover

Revenue

Working capital turnover =

Average working capital

Fixed Asset Turnover

Revenue

Fixed asset turnover =

Average fixed assets

Total Asset Turnover

Revenue

Total Asset Turnover =

Average total assets

2011 ELAN GUIDES 31

FINANCIAL REPORTING AND ANALYSIS

Current Ratio

Current assets

Current ratio =

Current liabilities

Quick Ratio

Cash + Short-term marketable investments + Receivables

Quick ratio =

Current liabilities

Cash Ratio

Cash + Short-term marketable investments

Cash ratio =

Current liabilities

Defensive Interval Ratio

Cash + Short-term marketable investments + Receivables

Defensive interval ratio =

Daily cash expenditures

Cash Conversion Cycle

Cash conversion cycle = DSO + DOH Number of days of payables

Debt-to-Assets Ratio

Total debt

Debt-to-assets ratio =

Total assets

Debt-to-Capital Ratio

Total debt

Debt-to-capital ratio =

Total debt + Shareholders equity

Debt-to-Equity Ratio

Total debt

Debt-to-equity ratio =

Shareholders equity

Financial Leverage Ratio

Average total assets

Financial leverage ratio =

Average total equity

Interest Coverage Ratio

EBIT

Interest coverage ratio =

Interest payments

Fixed Charge Coverage Ratio

EBIT + Lease payments

Fixed charge coverage ratio =

Interest payments + Lease payments

Gross Profit Margin

Gross profit

Gross profit margin =

Revenue

2011 ELAN GUIDES 32

FINANCIAL REPORTING AND ANALYSIS

Operating Profit Margin

Operating profit

Operating profit margin =

Revenue

Pretax Margin

EBT (earnings before tax, but after interest)

Pretax margin =

Revenue

Net Profit Margin

Net profit

Net profit margin =

Revenue

Return on Assets

Net income

ROA =

Average total assets

Net income + Interest expense (1 Tax rate)

Adjusted ROA =

Average total assets

Operating income or EBIT

Operating ROA =

Average total assets

Return on Total Capital

EBIT

Return on total capital =

Short-term debt + Long-term debt + Equity

Return on Equity

Net income

Return on equity =

Average total equity

Return on Common Equity

Net income Preferred dividends

Return on common equity =

Average common equity

DuPont Decomposition of ROE

Net income

ROE =

Average shareholders equity

2-Way Dupont Decomposition

Net income Average total assets

ROE =

Average total assets Average shareholders equity

ROA Leverage

3-Way Dupont Decomposition

Net income Revenue Average total assets

ROE =

Revenue Average total assets Average shareholders equity

Net profit margin Asset turnover Leverage

2011 ELAN GUIDES 33

FINANCIAL REPORTING AND ANALYSIS

5-Way Dupont Decomposition

Interest burden Asset turnover

Net income EBT EBIT Revenue Average total assets

ROE =

EBT EBIT Revenue Average total assets Avg. shareholders equity

Tax burden EBIT margin Leverage

Price- to-Earnings Ratio

Price per share

P/E =

Earnings per share

Price to Cash Flow

Price per share

P/CF =

Cash flow per share

Price to Sales

Price per share

P/S =

Sales per share

Price to Book Value

Price per share

P/BV =

Book value per share

Per Share Ratios

Cash flow from operations

Cash flow per share =

Average number of shares outstanding

EBITDA

EBITDA per share =

Average number of shares outstanding

Common dividends declared

Dividends per share =

Weighted average number of ordinary shares

Dividend Payout Ratio

Common share dividends

Dividend payout ratio =

Net income attributable to common shares

Retention Rate

Net income attributable to common shares Common share dividends

Retention Rate =

Net income attributable to common shares

Growth Rate

Sustainable growth rate = Retention rate ROE

2011 ELAN GUIDES 34

FINANCIAL REPORTING AND ANALYSIS

LIFO versus FIFO (with rising prices and stable inventory levels.)

LIFO versus FIFO when Prices are Rising

LIFO FIFO

COGS Higher Lower

Income before taxes Lower Higher

Income taxes Lower Higher

Net income Lower Higher

Cash flow Higher Lower

EI Lower Higher

Working capital Lower Higher

Effect on Effect on

Type of Ratio Numerator Denominator Effect on Ratio

Profitability ratios. Income is lower Sales are the same Lower under LIFO.

NP and GP margins under LIFO because under both.

COGS is higher

Debt to equity Same debt levels Lower equity under Higher under LIFO

LIFO

Current ratio Current assets are Current liabilities Lower under LIFO

lower under LIFO are the same.

because EI is lower.

Quick ratio Assets are higher as Current liabilities Higher under LIFO

a result of lower are the same

taxes paid

Inventory turnover COGS is higher Average inventory Higher under LIFO

under LIFO is lower under LIFO

Total asset turnover Sales are the same Lower total assets Higher under LIFO

under LIFO

2011 ELAN GUIDES 35

FINANCIAL REPORTING AND ANALYSIS

Financial Statement Effects of Capitalizing versus Expensing

Effect on Financial Statements

Initially when the cost is Noncurrent assets increase.

capitalized Cash flow from investing activities decreases.

In future periods when the asset Noncurrent assets decrease.

is depreciated or amortized Net income decreases.

Retained earnings decrease.

Equity decreases.

When the cost is expensed Net income decreases by the entire after-tax

amount of the cost.

No related asset is recorded on the balance

sheet and therefore, no depreciation or

amortization expense is charged in future

periods.

Operating cash flow decreases.

Expensed costs have no financial statement

impact in future years.

Capitalizing Expensing

Net income (first year) Higher Lower

Net income (future years) Lower Higher

Total assets Higher Lower

Shareholders equity Higher Lower

Cash flow from operations Higher Lower

Cash flow from investing Lower Higher

Income variability Lower Higher

Debt to equity Lower Higher

2011 ELAN GUIDES 36

FINANCIAL REPORTING AND ANALYSIS

Straight Line Depriciation

Original cost - Salvage value

Depreciation expense =

Depreciable life

Accelerated Depriciation

2

DDB depreciation in Year X = Book value at the beginning of Year X

Depreciable life

Estimated Useful Life

Gross investment in fixed assets

Estimated useful life =

Annual depreciation expense

Average Cost of Asset

Accumulated depreciation

Average age of asset =

Annual depreciation expense

Remaining Useful Life

Net investment in fixed assets

Remaining useful life =

Annual depreciation expense

Treatment of Temporary Differences

Carrying amount is greater.

Tax base is greater.

Carrying amount is greater.

Tax base is greater.

2011 ELAN GUIDES 37

FINANCIAL REPORTING AND ANALYSIS

Income Tax Accounting under IFRS versus U.S. GAAP

IFRS U.S. GAAP

ISSUE SPECIFIC TREATMENTS

Revaluation of fixed Recognized in equity as deferred Revaluation is prohibited.

assets and intangible taxes.

assets.

Treatment of Recognized as deferred taxes No recognition of deferred

undistributed profit except when the parent company taxes for foreign subsidiaries

from investment in is able to control the distribution that fulfill indefinite reversal

subsidiaries. of profits and it is probable that criteria.

temporary differences will not No recognition of deferred

reverse in future. taxes for domestic

subsidiaries when amounts

are tax-free.

Treatment of Recognized as deferred taxes No recognition of deferred

undistributed profit except when the investor controls taxes for foreign corporate

from investments in the sharing of profits and it is joint ventures that fulfill

joint ventures. probable that there will be no indefinite reversal criteria.

reversal of temporary differences

in future.

Treatment of Recognized as deferred taxes Deferred taxes are recognized

undistributed profit except when the investor controls from temporary differences.

from investments in the sharing of profits and it is

associates. probable that there will be no

reversal of temporary differences

in future.

DEFERRED TAX MEASUREMENT

Tax rates. Tax rates and tax laws enacted Only enacted tax rates and

or substantively enacted. tax laws are used.

Deferred tax asset Recognized if it is probable that Deferred tax assets are

recognition. sufficient taxable profit will be recognized in full and then

available in the future. reduced by a valuation

allowance if it is likely that

they will not be realized.

DEFERRED TAX PRESENTATION

Offsetting of deferred Offsetting allowed only if the Same as in IFRS.

tax assets and liabilities. entity has right to legally enforce

it and the balance is related to a

tax levied by the same authority.

Balance sheet Classified on balance sheet as Classified as either current or

classification. net noncurrent with noncurrent based on

supplementary disclosures. classification of underlying

asset and liability.

2011 ELAN GUIDES 38

FINANCIAL REPORTING AND ANALYSIS

Effective Tax rate

Income tax expense

Effective tax rate =

Pretax income

Income Tax Expense

Income tax expense = Taxes Payable + Change in DTL - Change in DTA

Income Statement Effects of Lease Classification

Income Statement Item Finance Lease Operating Lease

Operating expenses Lower Higher

Nonoperating expenses Higher Lower

EBIT (operating income) Higher Lower

Total expenses- early years Higher Lower

Total expenses- later years Lower Higher

Net income- early years Lower Higher

Net income- later years Higher Lower

Balance Sheet Effects of Lease Classification

Balance Sheet Item Capital Lease Operating Lease

Assets Higher Lower

Current liabilities Higher Lower

Long term liabilities Higher Lower

Total cash Same Same

Cash Flow Effects of Lease Classification

CF Item Capital Lease Operating Lease

CFO Higher Lower

CFF Lower Higher

Total cash flow Same Same

2011 ELAN GUIDES 39

FINANCIAL REPORTING AND ANALYSIS

Impact of Lease Classification on Financial Ratios

Numerator Denominator Ratio Better or

under Finance under Finance Worse under

Ratio Lease Lease Effect on Ratio Finance Lease

Asset turnover Sales- same Assets- higher Lower Worse

Return on assets* Net income lower Assets- higher Lower Worse

in early years

Current ratio Current assets- Current Lower Worse

same liabilities-

higher

Leverage ratios Debt- higher Equity same. Higher Worse

(D/E and D/A) Assets higher

Return on equity* Net income lower Equity same Lower Worse

in early years

* In early years of the lease agreement.

Financial Statement Effects of Lease Classification from Lessors Perspective

Financing Lease Operating Lease

Total net income Same Same

Net income (early years) Higher Lower

Taxes (early years) Higher Lower

Total CFO Lower Higher

Total CFI Higher Lower

Total cash flow Same Same

2011 ELAN GUIDES 40

FINANCIAL REPORTING AND ANALYSIS

Definitions of Commonly Used Solvency Ratios

Solvency Ratios Description Numerator Denominator

Leverage Ratios

Debt-to-assets ratio Expresses the percentage Total debt Total assets

of total assets financed by

debt

Debt-to-capital ratio Measures the percentage Total debt Total debt + Total

of a companys total capital shareholders equity

(debt + equity) financed by

debt.

Debt-to-equity ratio Measures the amount of Total debt Total shareholders

debt financing relative to equity

equity financing

Financial leverage ratio Measures the amount of Average total assets Average shareholders

total assets supported by equity

one money unit of equity.

Coverage Ratios

Interest coverage ratio Measures the number of EBIT Interest payments

times a companys EBIT

could cover its interest

payments.

Fixed charge coverage ratio Measures the number of EBIT + Lease Interest payments +

times a companys earnings payments Lease payments

(before interest, taxes and

lease payments) can cover

the companys interest and

lease payments.

2011 ELAN GUIDES 41

FINANCIAL REPORTING AND ANALYSIS

Adjustments related to inventory:

EIFIFO = EILIFO + LR

where

LR = LIFO Reserve

COGSFIFO = COGSLIFO - (Change in LR during the year)

Net income after tax under FIFO will be greater than LIFO net income after tax by:

Change in LIFO Reserve (1 - Tax rate)

When converting from LIFO to FIFO assuming rising prices:

Equity (retained earnings) increase by:

LIFO Reserve (1 - Tax rate)

Liabilities (deferred taxes) increase by:

LIFO Reserve (Tax rate)

Current assets (inventory) increase by:

LIFO Reserve

Adjustments related to property, plant and equipment:

Gross investment in fixed assets Accumulated depreciation Net investment in fixed assets

= +

Annual depreciation expense Annual depreciation expense Annual depreciation expense

Estimated useful or depreciable Average age of asset Remaining useful life

life

Annual depreciation expense times The book value of the asset divided

The historical cost of an asset the number of years that the asset by annual depreciation expense

divided by its useful life equals has been in use equals equals the number of years the asset

annual depreciation expense under accumulated depreciation. has remaining in its useful life.

the straight line method. Therefore, Therefore, accumulated

the historical cost divided by annual depreciation divided by annual

depreciation expense equals the depreciation equals the average

estimated useful life. age of the asset.

2011 ELAN GUIDES 42

FINANCIAL REPORTING AND ANALYSIS

Categories of Marketable Securities and Accounting Treatment

Unrealized and

Balance Sheet Realized Gains and Income (Interest &

Classification Value Losses Dividends)

Held-to-maturity Amortized cost Unrealized: Not Recognized on

(Par value +/- reported income statement.

unamortized Realized:

premium/ discount). Recognized on

income statement.

Held-for-trading Fair Value. Unrealized: Recognized on

Recognized on income statement.

income statement.

Realized:

Recognized on

income statement.

Available-for-sale Fair Value. Unrealized: Recognized on

Recognized in other income statement.

comprehensive

income.

Realized:

Recognized on

income statement.

2011 ELAN GUIDES 43

FINANCIAL REPORTING AND ANALYSIS

Inventory Accounting under IFRS versus U.S. GAAP

Permitted Cost Changes in Balance

Balance Sheet Recognition Methods Sheet Value

U.S. GAAP Lower of cost or LIFO. Permits inventory

market. FIFO. write downs,

Weighted average but not reversal of

cost. write downs.

Permits inventory

IFRS Lower of cost or net FIFO.

realizable value. Weighted Average write downs,

Cost. and also reversals of

write downs.

Property, Plant and Equipment

Effects of Changes

Changes in Balance in Balance Sheet

Balance Sheet Sheet Value Value

U.S. GAAP Cost minus Does not permit upward No effect.

accumulated revaluation.

depreciation.

IFRS Cost minus Permits upward The increase in the assets

accumulated revaluation. value from revaluation is

depreciation. reported as a part of equity

Asset is reported at fair unless it is reversing a

value at the revaluation previously-recognized

date less accumulated decrease in the value of the

depreciation following asset.

the revaluation.

A decrease in the value of

the asset is reported on the

income statement unless it

is reversing a previously-

reported upward

revaluation.

2011 ELAN GUIDES 44

FINANCIAL REPORTING AND ANALYSIS

Long-Term Investments

Percent Ownership Extent of Control Accounting Treatment

Less than 20% No significant control Classified as held-to-maturity, trading,

or available for sale securities.

20% - 50% Significant Influence Equity method.

More than 50% Significant Control Consolidation.

Shared (joint ventures) Joint Control Equity method/ proportionate

consolidation.

Treatment of Identifiable Intangible Assets

Changes in Effects of Changes in

Balance Sheet Balance Sheet

Balance Sheet Value Value

U.S. GAAP Only purchased intangibles Does not permit No effect.

may be recognized as upward

assets. Internally developed revaluation.

items cannot be recognized

as assets.

Reported at cost minus

accumulated amortization

for assets with finite useful

lives.

Reported at cost minus

impairment for assets with

infinite useful lives.

IFRS Only purchased intangibles Permits upward An increase in value is

may be recognized as revaluation. recognized as a part of

assets. Internally developed equity unless it is a

items cannot be recognized Assets are reversal of a

as assets. reported at fair previously recognized

value as of the downward revaluation.

Reported at cost minus revaluation date

accumulated amortization less subsequent A decrease in value is

for assets with finite useful accumulated recognized on the

lives. amortization. income statement

unless it is a reversal

Reported at cost minus of a previously

impairment for assets with recognized upward

infinite useful lives. revaluation.

2011 ELAN GUIDES 45

FINANCIAL REPORTING AND ANALYSIS

Long-Term Contracts

Outcome can be reliably Outcome cannot be reliably

estimated estimated

U.S. GAAP Percentage-of-completion Completed contract

method. method.

IFRS Percentage-of-completion Revenue is recognized to the

method. extent that it is probable to

recover contract costs.

Profit is only recognized at project

completion.

2011 ELAN GUIDES 46

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Economics Formula SheetDokument10 SeitenEconomics Formula SheetCratos_Poseidon100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Tutorial 3 QuestionsDokument4 SeitenTutorial 3 Questionswilliamnyx0% (2)

- Cfa Level 1 Mock Test 1Dokument44 SeitenCfa Level 1 Mock Test 1Jyoti Singh50% (2)

- Cfa Level 1 Mock Test 1Dokument44 SeitenCfa Level 1 Mock Test 1Jyoti Singh50% (2)

- Investor Database MumbaiDokument9 SeitenInvestor Database MumbaiVishal JwellNoch keine Bewertungen

- CFA MindmapDokument98 SeitenCFA MindmapHongjun Yin92% (12)

- Cfa Level 1 Mock TestDokument71 SeitenCfa Level 1 Mock TestJyoti Singh100% (1)

- L 1 Mock V 42016 December Am SolutionsDokument76 SeitenL 1 Mock V 42016 December Am SolutionsCratos_PoseidonNoch keine Bewertungen

- Accounting Theory - Chapter 10 Summary/NotesDokument7 SeitenAccounting Theory - Chapter 10 Summary/NotesloveNoch keine Bewertungen

- CFA Level 1 Review - Quantitative MethodsDokument10 SeitenCFA Level 1 Review - Quantitative MethodsAamirx6450% (2)

- Feasibility RestaurantDokument38 SeitenFeasibility Restaurantlendiibanez56% (9)

- Kyle Bass Presentation Hayman Global Outlook Pitfalls and Opportunities For 2014Dokument20 SeitenKyle Bass Presentation Hayman Global Outlook Pitfalls and Opportunities For 2014ValueWalk100% (1)

- L1ss13los46 PDFDokument6 SeitenL1ss13los46 PDFCratos_Poseidon100% (1)

- L 1 Mockv 42016 DecemberpmquestionsDokument44 SeitenL 1 Mockv 42016 Decemberpmquestionsislamasif0% (1)

- Study Plan Cfa Level I 2017Dokument3 SeitenStudy Plan Cfa Level I 2017Cratos_PoseidonNoch keine Bewertungen

- Benefits FinQuiz Question BankDokument3 SeitenBenefits FinQuiz Question BankCratos_PoseidonNoch keine Bewertungen

- L1ss13los46 PDFDokument6 SeitenL1ss13los46 PDFCratos_Poseidon100% (1)

- HypothesisDokument3 SeitenHypothesisCratos_PoseidonNoch keine Bewertungen

- Quantitative Aptitude Formulae SheetDokument15 SeitenQuantitative Aptitude Formulae SheetCratos_Poseidon0% (1)

- FRA Study Session ChartsDokument18 SeitenFRA Study Session ChartsCratos_PoseidonNoch keine Bewertungen

- Sampling & EstimationDokument3 SeitenSampling & EstimationCratos_PoseidonNoch keine Bewertungen

- Net Present Value (NPV) : Orporate InanceDokument27 SeitenNet Present Value (NPV) : Orporate InanceCratos_PoseidonNoch keine Bewertungen

- Probability CompressedDokument2 SeitenProbability CompressedCratos_PoseidonNoch keine Bewertungen

- The Building and Other Constn Workers Rules, A100507Dokument183 SeitenThe Building and Other Constn Workers Rules, A100507Josh Ch100% (1)

- Introduction AccountingDokument103 SeitenIntroduction AccountingSheekuttyNoch keine Bewertungen

- Resolución de Consentimiento Unánime Designando Comité Especial de La Junta para La Investigación de La Deuda de Puerto RicoDokument3 SeitenResolución de Consentimiento Unánime Designando Comité Especial de La Junta para La Investigación de La Deuda de Puerto RicoEmily RamosNoch keine Bewertungen

- Curled Metal Inc.-Engineered Products Division: Case Study AnalysisDokument7 SeitenCurled Metal Inc.-Engineered Products Division: Case Study AnalysisRabia JavaidNoch keine Bewertungen

- Simple and Compound InterestDokument5 SeitenSimple and Compound InterestAnonymous ZVbwfc0% (1)

- Rothstein Studio Spring 2013Dokument4 SeitenRothstein Studio Spring 2013gsappcloudNoch keine Bewertungen

- MCO-05 ENG IgnouDokument51 SeitenMCO-05 ENG Ignousanthi0% (1)

- Alternative Strategies in Financing Working CapitalDokument16 SeitenAlternative Strategies in Financing Working CapitalCharm MendozaNoch keine Bewertungen

- Advanced Financial ManagementDokument201 SeitenAdvanced Financial ManagementNarendra Reddy LokireddyNoch keine Bewertungen

- Entrepreneurship 2nd ExamDokument2 SeitenEntrepreneurship 2nd ExamMerben Almio100% (1)

- The American Taxpayer Relief Act of 2012Dokument2 SeitenThe American Taxpayer Relief Act of 2012Janet BarrNoch keine Bewertungen

- Accounting Framework and ConceptsDokument30 SeitenAccounting Framework and Conceptsyow jing peiNoch keine Bewertungen

- The HP Business Intelligence Maturity Model: Describing The BI JourneyDokument8 SeitenThe HP Business Intelligence Maturity Model: Describing The BI Journeyaiamb4010Noch keine Bewertungen

- Case MapDokument23 SeitenCase MapVidya ChokkalingamNoch keine Bewertungen

- Full Report Ubs Group Ag and Ubs Ag Consolidated 2019 en PDFDokument776 SeitenFull Report Ubs Group Ag and Ubs Ag Consolidated 2019 en PDFMakuna NatsvlishviliNoch keine Bewertungen

- BP010 Business and Process StrategyDokument13 SeitenBP010 Business and Process StrategyparcanjoNoch keine Bewertungen

- FMR Feb08Dokument5 SeitenFMR Feb08Salman ArshadNoch keine Bewertungen

- Rothschilds Inter Alpha GroupDokument3 SeitenRothschilds Inter Alpha Groupradu victor Tapu100% (1)

- ST Telemedia and Tata Communications Complete The Singapore Data Centre Joint Venture Transaction (Company Update)Dokument3 SeitenST Telemedia and Tata Communications Complete The Singapore Data Centre Joint Venture Transaction (Company Update)Shyam SunderNoch keine Bewertungen

- Citigroup Credit Suisse J.P. Morgan Morgan Stanley Standard Chartered BankDokument5 SeitenCitigroup Credit Suisse J.P. Morgan Morgan Stanley Standard Chartered BankhjsfdrNoch keine Bewertungen

- 2009 MFI BenchmarksDokument281 Seiten2009 MFI BenchmarksRogelio CuroNoch keine Bewertungen

- Financial Management I - Chapter 6Dokument34 SeitenFinancial Management I - Chapter 6Mardi UmarNoch keine Bewertungen

- StartUp CompanyDokument7 SeitenStartUp CompanyMiruna Daniela VasileNoch keine Bewertungen

- Taxation Pac Mock s13 PDFDokument3 SeitenTaxation Pac Mock s13 PDFMuhammad Hassan AliNoch keine Bewertungen