Beruflich Dokumente

Kultur Dokumente

Administrative Remedies Lecture (Summary)

Hochgeladen von

fpaaaa0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

68 Ansichten4 SeitenAdministrative Remedies

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAdministrative Remedies

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

68 Ansichten4 SeitenAdministrative Remedies Lecture (Summary)

Hochgeladen von

fpaaaaAdministrative Remedies

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Administrative Remedies Lecture (Summary)

General audit procedures and documentation

1. When does the audit process begin?

The audit process commences with the issuance of a Letter of Authority

to a taxpayer who has been selected for audit.

2. What is a Letter of Authority?

The Letter of Authority is an official document that empowers a

Revenue Officer to examine and scrutinize a Taxpayers books of accounts

and other accounting records, in order to determine the Taxpayers correct

internal revenue tax liabilities

3. Who issues the Letter of Authority?

Letter of Authority, for audit/investigation of taxpayers:

1. Under the jurisdiction of National Office, shall be issued and

approved by the Commissioner of Internal Revenue

2. Under the jurisdiction of Regional Offices, it shall be issued by the

Regional Director

4. When must a Letter of Authority be served?

A Letter of Authority must be served to the concerned Taxpayer within

thirty (30) days from its date of issuance; otherwise, it shall become

null and void. The Taxpayer shall then have the right to refuse the service

of this Letter of Authority, unless the Letter of Authority is revalidated

5. How often can a Letter of Authority be revalidated?

A Letter of Authority is revalidated through the issuance of a new

Letter of Authority

Letter of Authority can be revalidated only once, for Letter of Authorities

issued in the Revenue Regional Offices or the Revenue District Offices

Twice in the case of Letter of Authorities issued by the National Office

Any suspended Letter of Authorities must be attached to the new

Letter of Authority

6. How much time does a Revenue Officer have to conduct an audit?

A Revenue Officer is allowed only one hundred twenty (120) days from

the date of receipt of a Letter of Authority by the taxpayer to conduct the

audit and submit the required report of investigation

If the Revenue Officer is unable to submit his final report of investigation

within the 120-day period, he must then submit a Progress Report to his

Head of Office, and surrender the Letter of Authority for revalidation

7. How is a particular taxpayer selected for audit?

Officers of the Bureau (Revenue District Officers, Chief, Large Taxpayer

Assessment Division, Chief, Excise Taxpayer Operations Division, Chief,

Policy Cases and Tax Fraud Division) responsible for the conduct of

audit/investigation shall prepare a list of all taxpayer who fall within the

selection criteria prescribed in a Revenue Memorandum Order issued by

the CIR to establish guidelines for the audit program of a particular year

The list of taxpayers shall then be submitted to their respective Assistant

Commissioner for pre-approval and to the Commissioner of Internal

Revenue for final approval

The list submitted by the RDO shall be pre-approved by the Regional

Director and finally approved by Assistant Commissioner, Assessment

Service

8. How many times can a taxpayer be subjected to examination and inspection

for the same taxable year?

A taxpayers books of accounts shall be subjected to examination and

inspection only once for a taxable year, except in the following cases:

1. When the Commissioner determines that fraud, irregularities, or

mistakes were committed by Taxpayer;

2. When the Taxpayer himself request a re-investigation or re-

examination of his books of accounts;

3. When there is a need to verify the Taxpayers compliance with

withholding and other internal revenue taxes as prescribed in a

Revenue Memorandum Order issued by the Commissioner of

Internal Revenue;

4. When the Taxpayers capital gains tax liabilities must be verified;

and

5. When the Commissioner chooses to exercise his power to obtain

information relative to the examination of other Taxpayers

9. What are some of the powers of the Commissioner relative to the audit

process?

In addition to the authority of the Commissioner to examine and inspect

the books of accounts of a Taxpayer who is being audited, the

Commissioner may also:

1. Obtain data and information from private parties other than the

Taxpayers himself (Sec. 5, NIRC); and

2. Conduct Inventory and surveillance, and prescribe presumptive

gross sales and receipts (Sec. 6, NIRC).

10.Within what time period must an assessment be made?

An assessment must be made within three (3) years from the last day

prescribed by law for the filing of tax return for the tax that is being

subjected to assessment or from the day the return was filed if late

However, in cases involving tax fraud, the Bureau has ten (10) days from

the date of discovery of such fraud within which to make an assessment

Any assessments issued after the applicable period are deemed to have

prescribed, and can no longer be collected from the Taxpayer, unless the

Taxpayer has previously executed a Waiver of Statute of Limitations

11.What is Jeopardy Assessment?

A Jeopardy Assessment is a tax assessment made by an authorized

Revenue Officer without the benefit of complete or partial audit, in

light of the Revenue Officers belief that the assessment and collection of

deficiency tax will be jeopardized by delay caused by the Taxpayers

failure to:

1. Comply with audit and investigation requirements to present his

books of accounts and/or pertinent records, or

2. Substantiate all or any of the deductions, exemptions or credits

claimed in his return

12.What is a Pre-assessment Notice (PAN)?

The Pre-Assessment Notice is a communication issued by the Regional

Assessment Division, or any other concerned BIR Office, informing a

Taxpayer who has been audited of the findings of the Revenue Officer,

following the review of these findings.

If the taxpayer disagrees with the findings of the PAN, he shall then have

fifteen (15) days from his receipt of the PAN to file a written reply

contesting the proposed assessment

13.Under what instances is PAN no longer required?

A Preliminary Assessment Notice shall not be required in any of the

following cases, in which case, issuance of the formal assessment notice

for the payment of the taxpayers deficiency tax liability shall be

sufficient:

1. When the finding for any deficiency tax is the result of

mathematical error in the computation of the tax appearing on

the face of the tax return filed by the taxpayer; or

2. When a discrepancy has been determined between the tax

withheld and the amount actually remitted by the withholding

agent; or

3. When a taxpayer who opted to claim a refund or tax credit of

excess creditable withholding tax for a taxable period was

determined to have earned over and automatically applied the

same amount claimed against the estimated tax liabilities for the

taxable quarter or quarters of the succeeding taxable year; or

4. When the excise tax due on excisable articles has not been

paid; or

5. When an article locally purchased or imported by an exempt

person, such as, but not limited to, vehicles, capital equipment,

machineries and spare parts, has been sold, traded or transferred

to non-exempt persons

14.What is a Notice of Assessment/Formal Letter of Demand?

A Notice of Assessment is a declaration of deficiency taxes issued to a

Taxpayer who fails to respond to a Pre-Assessment Notice (PAN) within the

prescribed period of time, or whose reply to the PAN was found to be

without merit.

The Notice of Assessment shall inform the Taxpayer of this fact, and that

the report to investigation submitted by the Revenue Officer conducting

the audit shall be given due course

The formal letter of demand calling for payment of the taxpayers

deficiency tax or taxes shall state the facts, the law, rules and regulations,

or jurisprudence on which the assessment is based, otherwise, the formal

letter of demand and the notice of assessment shall be void

Taxpayers Obligations and Privileges

1. What is required of a taxpayer who is being audited?

2. What is the recourse of a Taxpayer who cannot submit the documents being

required of him within the prescribed period of time?

Das könnte Ihnen auch gefallen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Tax Remedies Lecture1aDokument7 SeitenTax Remedies Lecture1acmv mendozaNoch keine Bewertungen

- Audit Procedures & Documentation GuideDokument9 SeitenAudit Procedures & Documentation GuideErlene Compra100% (1)

- Taxpayer Rights Audit GuideDokument9 SeitenTaxpayer Rights Audit Guideabc360shelleNoch keine Bewertungen

- General Audit Procedures and Documentation-BirDokument3 SeitenGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaNoch keine Bewertungen

- Taxation - Procedural Due ProcessDokument3 SeitenTaxation - Procedural Due ProcessjorgNoch keine Bewertungen

- Tax 01-Lesson 02 - Tax RemediesDokument42 SeitenTax 01-Lesson 02 - Tax RemediesShannise Dayne Chua0% (1)

- Tax RemediesDokument5 SeitenTax RemediesNoroNoch keine Bewertungen

- TAX REMEDIES NotesDokument66 SeitenTAX REMEDIES NotesJane BiancaNoch keine Bewertungen

- Tax RemediesDokument16 SeitenTax RemediesJoshua Catalla Mabilin100% (1)

- TX102 Topic 1 Module 3Dokument21 SeitenTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.Noch keine Bewertungen

- Tax 2 Questions and AnswersDokument13 SeitenTax 2 Questions and AnswersJoan Francine Pio ParrochaNoch keine Bewertungen

- A. Assessment B. Collection: Remedies of The GovernmentDokument10 SeitenA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaNoch keine Bewertungen

- Notes in Tax RemediesDokument104 SeitenNotes in Tax RemediesJeremae Ann CeriacoNoch keine Bewertungen

- Tax RemediesDokument12 SeitenTax RemediesPhoenix WinxNoch keine Bewertungen

- Tax2 Finals REMDokument16 SeitenTax2 Finals REMAlexandra Castro-SamsonNoch keine Bewertungen

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Dokument13 Seiten1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- Tax DiscussionDokument4 SeitenTax DiscussionRawr rawrNoch keine Bewertungen

- Assessment Process Flowchart GuideDokument3 SeitenAssessment Process Flowchart Guideattymaneka100% (1)

- Tax Remedies Under The NIRCDokument7 SeitenTax Remedies Under The NIRCmaeprincess100% (1)

- Tax Remedies ReviewerDokument9 SeitenTax Remedies ReviewerheirarchyNoch keine Bewertungen

- Taxpayers Bill of RightsDokument7 SeitenTaxpayers Bill of RightsbubblingbrookNoch keine Bewertungen

- Required Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Dokument6 SeitenRequired Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Jade CoritanaNoch keine Bewertungen

- Taxpayer Bill of Rights 2018Dokument14 SeitenTaxpayer Bill of Rights 2018Llerry Darlene Abaco RacuyaNoch keine Bewertungen

- TAX REMEDIES AND DISPUTESDokument2 SeitenTAX REMEDIES AND DISPUTESAngelica Jem Ballesterol CarandangNoch keine Bewertungen

- Penalties and RemediesDokument3 SeitenPenalties and RemediesAerl XuanNoch keine Bewertungen

- Tax REv NotesDokument23 SeitenTax REv NotesCti Ahyeza DMNoch keine Bewertungen

- TopicsDokument40 SeitenTopicsDa Yani ChristeeneNoch keine Bewertungen

- Summary of Tax RemediesDokument15 SeitenSummary of Tax Remediesquinn ezekielNoch keine Bewertungen

- Income Tax Assessment TypesDokument2 SeitenIncome Tax Assessment TypesJNVU WEBINARNoch keine Bewertungen

- Tax 2 (Remedies & CTA Jurisdiction)Dokument13 SeitenTax 2 (Remedies & CTA Jurisdiction)Monice RiveraNoch keine Bewertungen

- Taxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationDokument4 SeitenTaxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationKristen StewartNoch keine Bewertungen

- UNIT II Tax RemediesDokument17 SeitenUNIT II Tax RemediesAl BertNoch keine Bewertungen

- Reviewer On Tax Administration and Procedures (For Submission)Dokument44 SeitenReviewer On Tax Administration and Procedures (For Submission)Miguel Anas Jr.Noch keine Bewertungen

- 2async023 REMEDIESDokument27 Seiten2async023 REMEDIESBogs QuitainNoch keine Bewertungen

- GROUP 1 Tax RemediesDokument6 SeitenGROUP 1 Tax RemediesEunice Kalaw VargasNoch keine Bewertungen

- PM Reyes Tax Audit Assessment Primer PDFDokument6 SeitenPM Reyes Tax Audit Assessment Primer PDFAnge Buenaventura SalazarNoch keine Bewertungen

- Revenue Regulations on Tax Compromise SettlementDokument11 SeitenRevenue Regulations on Tax Compromise SettlementBobby Olavides SebastianNoch keine Bewertungen

- RemediesDokument45 SeitenRemediesCzarina100% (1)

- LEGAL REMEDIES TAX REVIEW FinalDokument266 SeitenLEGAL REMEDIES TAX REVIEW FinalAlgen S. Gomez100% (1)

- RR 12-1999Dokument21 SeitenRR 12-1999anorith8867% (6)

- Revenue Regulations No 12-99Dokument3 SeitenRevenue Regulations No 12-99Zoe Dela CruzNoch keine Bewertungen

- RR 12-99 Rules On Assessments PDFDokument19 SeitenRR 12-99 Rules On Assessments PDFJeremeh PenarejoNoch keine Bewertungen

- Tax Remedies For Bir Cases and Compliance TrainingDokument29 SeitenTax Remedies For Bir Cases and Compliance TrainingCenon AquinoNoch keine Bewertungen

- Tax RemediesDokument4 SeitenTax RemediesrbsacayNoch keine Bewertungen

- Tax RemediesDokument13 SeitenTax RemediesYan MoretzNoch keine Bewertungen

- Tax Remedies - Part IDokument11 SeitenTax Remedies - Part IRamon AngelesNoch keine Bewertungen

- TAXATION REMEDIESDokument63 SeitenTAXATION REMEDIESLoueljie AntiguaNoch keine Bewertungen

- Tanzania Revenue Authority - VAT RefundDokument1 SeiteTanzania Revenue Authority - VAT RefundMICHAEL MBILINYINoch keine Bewertungen

- Tax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersDokument7 SeitenTax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersJeni ManobanNoch keine Bewertungen

- Tax Clearance Procedures for BiddingDokument13 SeitenTax Clearance Procedures for BiddingBobbit C ArninioNoch keine Bewertungen

- Tax Clearance Procedures for BiddingDokument13 SeitenTax Clearance Procedures for BiddingCzarina UmilinNoch keine Bewertungen

- Tax2 RemediesDokument15 SeitenTax2 RemediesValianted07Noch keine Bewertungen

- Tax RemediesDokument5 SeitenTax RemediesTruman TemperanteNoch keine Bewertungen

- Tax Assessment WaiverDokument24 SeitenTax Assessment WaiverbidanNoch keine Bewertungen

- Revenue Regulations on Tax AssessmentDokument16 SeitenRevenue Regulations on Tax AssessmentI.G. Mingo MulaNoch keine Bewertungen

- Abci V Cir DigestDokument9 SeitenAbci V Cir DigestSheilaNoch keine Bewertungen

- Duties and liabilities of withholding agentsDokument2 SeitenDuties and liabilities of withholding agentsAnselmo Rodiel IVNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- SEC Regulated Entities Code & Corporate GovernanceDokument4 SeitenSEC Regulated Entities Code & Corporate GovernancefpaaaaNoch keine Bewertungen

- Consolidation EquationsDokument4 SeitenConsolidation EquationsfpaaaaNoch keine Bewertungen

- Income TaxDokument67 SeitenIncome TaxfpaaaaNoch keine Bewertungen

- Schedule of Graduation Activities (172 Commencement Exercises)Dokument2 SeitenSchedule of Graduation Activities (172 Commencement Exercises)Joaquin GonzalezNoch keine Bewertungen

- Papi AdbDokument50 SeitenPapi AdbSilvio Figueiredo0% (1)

- Accor vs Airbnb: Business Models in Digital EconomyDokument4 SeitenAccor vs Airbnb: Business Models in Digital EconomyAkash PayunNoch keine Bewertungen

- ID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFDokument11 SeitenID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFAmelia AmelNoch keine Bewertungen

- Loans and AdvanceDokument8 SeitenLoans and AdvanceDjay SlyNoch keine Bewertungen

- CSCI5273 PS3 KiranJojareDokument11 SeitenCSCI5273 PS3 KiranJojareSales TeamNoch keine Bewertungen

- Infineon ICE3BXX65J DS v02 - 09 en PDFDokument28 SeitenInfineon ICE3BXX65J DS v02 - 09 en PDFcadizmabNoch keine Bewertungen

- Which Delivery Method Is Best Suitable For Your Construction Project?Dokument13 SeitenWhich Delivery Method Is Best Suitable For Your Construction Project?H-Tex EnterprisesNoch keine Bewertungen

- 132KV Siemens Breaker DrawingDokument13 Seiten132KV Siemens Breaker DrawingAnil100% (1)

- Ies RP 7 2001Dokument88 SeitenIes RP 7 2001Donald Gabriel100% (3)

- Capital Asset Pricing ModelDokument11 SeitenCapital Asset Pricing ModelrichaNoch keine Bewertungen

- CSCE 3110 Data Structures and Algorithms NotesDokument19 SeitenCSCE 3110 Data Structures and Algorithms NotesAbdul SattarNoch keine Bewertungen

- ZirakDokument4 SeitenZiraktaibzirakchamkani81Noch keine Bewertungen

- Gustilo Vs Gustilo IIIDokument1 SeiteGustilo Vs Gustilo IIIMoon BeamsNoch keine Bewertungen

- Make $50 A Day Autopilot MethodDokument4 SeitenMake $50 A Day Autopilot MethodJadon BoytonNoch keine Bewertungen

- CIGB B164 Erosion InterneDokument163 SeitenCIGB B164 Erosion InterneJonathan ColeNoch keine Bewertungen

- Activity Problem Set G4Dokument5 SeitenActivity Problem Set G4Cloister CapananNoch keine Bewertungen

- RIE 2013 Dumping and AD DutiesDokument21 SeitenRIE 2013 Dumping and AD Dutiessm jahedNoch keine Bewertungen

- The Little Book of Deep Learning: An Introduction to Neural Networks, Architectures, and ApplicationsDokument142 SeitenThe Little Book of Deep Learning: An Introduction to Neural Networks, Architectures, and Applicationszardu layakNoch keine Bewertungen

- Socomec EN61439 PDFDokument8 SeitenSocomec EN61439 PDFdesportista_luisNoch keine Bewertungen

- Virtual Content SOPDokument11 SeitenVirtual Content SOPAnezwa MpetaNoch keine Bewertungen

- MA5616 V800R311C01 Configuration Guide 02Dokument741 SeitenMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoNoch keine Bewertungen

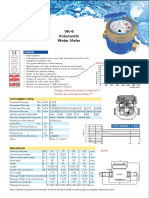

- Baylan: VK-6 Volumetric Water MeterDokument1 SeiteBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNoch keine Bewertungen

- Integrated Project Management in SAP With Noveco EPMDokument34 SeitenIntegrated Project Management in SAP With Noveco EPMrajesh_das3913Noch keine Bewertungen

- E4PA OmronDokument8 SeitenE4PA OmronCong NguyenNoch keine Bewertungen

- Key Payment For Japan EcomercesDokument9 SeitenKey Payment For Japan EcomercesChoo YieNoch keine Bewertungen

- Corephotonics Dual-Camera LawsuitDokument53 SeitenCorephotonics Dual-Camera LawsuitMikey CampbellNoch keine Bewertungen

- Linde E18P-02Dokument306 SeitenLinde E18P-02ludecar hyster100% (4)

- Find The Minimal Sum of Products For The Boolean Expression F Using Quine-Mccluskey MethodDokument15 SeitenFind The Minimal Sum of Products For The Boolean Expression F Using Quine-Mccluskey MethodSaira RasulNoch keine Bewertungen

- Habawel V Court of Tax AppealsDokument1 SeiteHabawel V Court of Tax AppealsPerry RubioNoch keine Bewertungen

- Converted File d7206cc0Dokument15 SeitenConverted File d7206cc0warzarwNoch keine Bewertungen