Beruflich Dokumente

Kultur Dokumente

Corporations PDF

Hochgeladen von

AnitoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporations PDF

Hochgeladen von

AnitoCopyright:

Verfügbare Formate

THE AWESOME NOTES

Page 1 of 8

TAX ON CORP

PRELIMINARY

T H E T E R M C O R P O R AT I O N S H A L L

MINIMUM CORPORATE INCOME TAX

(MCIT)

INCLUDE: RATION: to discourage corp from claiming too

1. partnership, no matt how created or many too many deductions to avoid the

organized

2. joint-stock companies

3. joint accounts

payment of tax

TAX RATE:

4. associations

5. insurance company

2% OF THE GROSS INCOME

( F O R M A N U FA C T U R E R S A N D

IT SHALL NOT INCLUDE

1. GPP

2. joint venture and consortium

TRADERS)

GROSS INCOME

formed for the purpose of gross sales,

undertaking: LESS: sales return, discounts and

construction project

engaging in petroleum, coal,

geothermal and other energy

allowances and cost of goods sold.

COST OF GOODS SOLD

operation all business expense directly incurred to

= pursuant to a consortium produce the merchandise and bring them

agreement under a service

contract with the Gov't

to their present location and use.

for trading and merchandising concern

HENCE: the term corporation is shall include

broader in NIRC than in Corporation 1. invoice of the goods sold

Code. 2. import duties

3. freight in transporting the goods to the

place where the goods are actually

TAX ON DOMESTIC CORP sold

4. insurance while the goods are in transit

for manufacturing concerns

shall include

TAX PAYABLE 1. all cost of production of a finished

goods

2. raw materials used

3. d i r e c t l a b o r a n d m a n u f a c t u r i n g

REGULAR TAX; IN GENERAL overhead

30% CORPORATE INCOME TAX

TAX BASE:

4. freight cost

5. insurance premiums and

6. other costs incurred in bringing the raw

Net Taxable Income

- pertinent items of gross income, from

sources within and without the

materials to the factory or warehouse.

(FOR TAXPAYER ENGAGED IN SALE OR

Philippines, less deductions.

NOTE: personal exemption does not apply to

SERVICE)

GROSS INCOME

corporation, as it only applies to individual tax all direct costs and expenses necessarily

payer. incurred to provide the services required

by the customers and clients

IT SHALL INCLUDE

salaries and employees benefits

- of personnel, consultants and specialist

directly rendering the service

cost of the facilities

- directly utilized in providing the service

such as depreciation or rentalof equipment

used and cost of supplies.

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 2 of 8

TAX ON CORP

NOTE: FOR BANKS; cost of service shall over kasi yung 100k excess of MCIT on the

include expense interest

pervious taxable year to present.

IMPOSITION OF MCIT

MCIT APPLIES ONLY TO THE FF:

RELIEF FROM MCIT UNDER CERTAIN

CONDITIONS

the Sec of Finance is authorized to suspend

1. DC the imposition of MCIT on any corp

2. RFC

APPLICATION OF MCIT IS PROPER WHEN

which suffer losses on account of:

1. prolonged labor dispute

2. force majure

1. when the minimum income tax is greater

than the tax computed under Sec. 27 A for

the taxable year. when MCIT is greater than

3. legitimate business reverse

subject to rules and regulations

NIT promulgations submitted by the same,

2. applicable only beginning on the 4th which shall define the terms and

taxable year immediately following the year conditions under which it may suspend

which the corp started its operations

HENCE: from #1

MCIT in a meritorious cases.

RATIONALE:

- it can be concluded that NIT and kasi, MCIT applies even if the net income is

MCIT cannot be applied negative, kasi nga ang basis is the gross

RR 9-98

simultaneously. income.

- hence; to avoid the danger should the corp is

suffering from business reverse inimical to its

INSTANCES WHEN MCIT IS APPLIED continued existence, the Sec of Finance may

1. when taxable income is zero suspend the application of MCIT. (opinion

2. when taxable income is negative or at loss

3. when net taxable income is positive but is

lamang ito)

lower than 2% of the gross income.

CARRY FORWARD OF EXCESS MINIMUM

CORPORATION EXEMPT FROM MCIT

1. stock and non-profit proprietary educational

institutions and hospitals

TAX 2. int'l air carriers and int'l shipping

any excess of the minimum corporate income 3. offshore banking unit

tax over the normal tax as computed, 4. R/AHQ or ROHQ of multinational company

shall be carried forward and credited

against the normal income tax

5. other entities registered under PEZA

- F O R 3 I M M E D I AT E LY

SUCCEEDING TAXABLE YEAR

RATION: different tax treatment kasi.

APPLICABILITY OF THE MCIT WHERE

KASI; IN MCIT CORPORATION IS GOVERNED BOTH

the payment of tax under MCIT is made UNDER THE REGULAR TAX SYSTEM AND

quarterly.

- so per quarter, titingnan which is higher

between MCIT or NIT.

A SPECIAL TAX SYSTEM

- supposing NIT is higher on the first quarter

then MCIT, NIT shall be applied

- supposing on the end of the taxable year,

twise mas mataas ang NIT and the remaining

quarter mas mataas ang MCIT, at yung total

mas mataas parin MCIT, yung NIT paid shall

be credited to the MCIT liability

IN RE: CARRY FORWARD OF THE EXCESS

- dito, ang titingnan, hindi yung quarterly, pero

yung aggregate nung MCIT at the end of the

taxable year.

so supposing at the end of the taxable year,

MCIT is 200k at NIT is only 100k. MCIT yung

babayaran for that year. on the next taxable

year, mas mataas ng 200k yung NIT,

- bale for that taxable year, the tax liability of

the taxpayer corp shall only be 100k. kinirry

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 3 of 8

TAX ON CORP

ALLOWABLE DEDUCTION

ROYALTIES

TAX RATE

20% FIT

NOTE: the 10% FIT for royalties on

ITEMIZED DEDUCTION books, musical composition and

all items enumerated in Sec. 34 (A) to (J) and literary works only applies to individual

(M). note, Sec. 34 (L) only applies to individual.

OPTIONAL STANDARD DEDUCTION

taxpayer.

CAPITAL GAIN FROM SALE OF SHARES

instead of availing of the itemized deduction, OF STOCK NOT TRADED IN THE STOCK

- to claim a deduction in an amount not

exceeding 40% of their gross income

EXCHANGE

TAX RATE

REQ: taxpayer must signify in his return his 5% FIT; not over 100k

intention to elect the OSD

OTHERWISE: failure to elect, deemed

10% FIT; in excess of 100k

to have chosen itemized deduction

NOTE: once election has been made,

NOTE: to be deemed passive income, the

share of stock traded must be of a Domestic

it shall be irrevocable for the taxable

Corp.

year for which the return was made.

WHO ARE ENTITLED TO AVAIL OSD

TAX ON INCOME DERIVED UNDER EFCDS

IF THE INCOME EARNER IS THE

ONLY:

1. DC

DEPOSITARY BANK

2. RFC

di entitled yung NRFCNET/B

TAX RATE

30% NIT

WHEN EXEMPT FROM NIT

when the depositary bank under the

EFCDS transact with the ff

TAX ON PASSIVE INCOME 1. NR

2. OBU of the Phil

3. local commercial banks

4. branches of foreign banks that

IN GENERAL: the ff passive income subject may be authorized by the BSP to

to tax transact business with foreign

1. interest from deposit and yield or any other currency deposit system units; and

monetary benefit from deposit substitutes 5. other depositary bank under the

and from trust funds and similar

arrangements

2. capital gains from the sale of shares of

HOWEVER:

EFCDS

stock not traded in the stock exchange 10% FIT WILL APPLY

3. income derived under the EFCD System with regard to foreign currency loans granted

4. inter-corporate dividend by such depositary bank under said EFCDS to:

5. capital gains realized from the sale, 1. residents, other than OBU in the Phil

exchange, or disposition of lands and/or 2. other depositary banks under the expanded

buildings.

INTEREST

system

NOTE: ALWAYS EXEMPT WHEN THE

to be considered as passive income, for banks, INCOME DERIVED BY DEPOSITARY BANK

CAME FROM

it must be derived from sources within.

TAX RATE:

- NR

- and vise versa. as well as the NR's income

20% FIT

NOTE: no exemption for corporation for final

from banks under EFCDS

income tax on interest income derived from

long-term deposit.

- the exemption only applies to individual

taxpayer

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 4 of 8

TAX ON CORP

INTER-CORPORATE DIVIDEND

when a corp is a stock holder of another corp

EXEMPT FROM TAX

TAXATION ON CAPITAL GAINS

- when DC is a stock holder of another DC

WHEN SUBJECT TO GIT INCOME FROM SALE OF SHARES OR

- when it is a SH of a FC

STOCK

EXE: 3 YEARS 50% RULE

CAPITAL GAIN REALIZED FROM SALE,

EXCHANGE OR DISPOSITION OF LAND OR

BUILDING

SAME TREATMENT IN 24(A) TAXPAYER.

ANG NAIBA LANG

- this is limited only to land and buildings, while

for 24(A) Taxpayers, all immovables mentioned

in Art. 415

TAX RATE:

INCOME FROM THE SALE OF REAL

6% FIT

PROPERTY SITUATED IN THE PHILIPPINES

PASSIVE INCOME NOT SUBJECT TO TAX

INCOME FROM THE SALE, EXCHANGE OR

OTHER DISPOSITION OF OTHER CAPITAL

ASSETS

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 5 of 8

TAX ON CORP

TA X AT I O N O F R E S I D E N T

TAX ON PROPRIETARY FOREIGN CORPORATION

EDUCATION INSTITUTION

TAX RATE: GEN RULE

10% NIT

REQUISITES:

1. it must be a stock and non-profit institution TAX RATE IN GENERAL

2. it must be private educational institution or

hospital

3. their gross income from unrelated trade,

30% NIT/RCIT

TAX BASE

business or other activity, if any, does not

exceed 50% of their gross income from all

taxable income from sources within

sources; (dominancy test) and

4. must have been issued a permit to operate

MCIT APPLIES ALSO.

from DECS, CHED or TESDA

NOTE:

WITH RESPECT TO THEIR INCOME FROM

SOURCES WITHIN

if non-stock and non-profit, or it is a govt

educational or hospital institution, it shall be

exempt from tax.

UNRELATED TRADE, BUSINESS OR OTHER

ACTIVITY

any trade, business or other activity, the

conduct of which is not substantially related t

the exercise or performance by such

educational institution or hospital of its primary

purpose or function.

NOTE: if it exceeds 50% of its income from

unrelated trade or business or other activity

TAX ON CERTAIN INCOME

- 30% NIT/RCIT will apply.

IN RE PASSIVE INCOME/CAPITAL GAINS

TAX ON GOCC, AGENCIES OR

INSTRUMENTALITIES

- same treatment sa DC

THE ONLY DIFFERENCE IS:

- if from sources without, exempt from tax na.

- also, for inter-corporate dividend, if dividend

IN GENERAL; from DC, exempt from tax.

LIABLE TO 30% NIT

WHEN EXEMPT FROM TAX:

talaga?

1. SSS

2. GSIS

3. PCSO

4. PHIC

ALSO; MAY BE EXEMPT FROM TAX IF THE

FF CONDITIONS HAS BEEN MET

1. it is a public utility; or

2. exercise of any essential governmental

function accruing both to the Govt of the

Phil or to any of its political subdivision.

query: can LGU tax public utility?

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 6 of 8

TAX ON CORP

TA X O N N O N - R E S I D E N T which represent the difference

between the regular income tax of

FOREIGN CORPORATION

30% and the 15% tax on dividend

IN SHORT: TAX SPARRING RULE IS

APPLIED WHEN:

GEN RULE 1. the country of domicile of the

NRFC tax its citizens on its

income from sources within and

without, and allows tax credit of

TAX RATE 20% or 15% for the tax deemed

30% FIT

TAX BASE

paid in the Phil; or

2. if the country of domicile of NRFC

does not tax its citizen on its

GROSS INCOME

- from all sources within the Phil received

during the taxable year.

income from sources without

CAPITAL GAIN FROM SALE OF SHARES

OF STOCKS NOT TRADED IN STOCK

EXCHANGE

TAX ON CERTAIN INCOME

same rules for DC

INTEREST ON FOREIGN LOANS

EXEMPT CORPORATION

TAX RATE:

20% FWT

- the lender here is a NRFC and the borrower

see: page 35 NIRC notes

is a DC.

IF THE BORROWER IS NR TAXATION OF PARTNERSHIP

- deemed income without

query: what if the borrower is a RFC, or pasok

- same treatment as a corporation. hence,

subject to RCIT.

- And the share of the partner in the net

sa 3YEAR 50% RULE? income shall be treated as a dividend subject

NOTE: THE FF INCOME ARE EXCLUDED

FROM THE GROSS

to FIT

income received from investment in Philippine

in loans, stocks, bonds, or other domestic TAXATION OF GPP

securities, or from interest in deposits in banks - see notes on NIRC pg. 36

in the Philippines by:

1. foreign govt

2. financing institution owned, controlled or

enjoying refinancing from foreign govt

3. int'l or regional financing institution

established by foreign govt

INTER-CORPORATE DIVIDEND

IN GENERAL

30% FWT

EXE: when 15% FWT

TAX SPARRING RULE/ TAX DEEMED PAID

CREDIT RULE:

- when the country in which the NRFC is

domiciled, shall allow a credit against the tax

due from NRFC.

IN HERE: taxes deemed to have been paid in

the Phil, equivalent to 15%

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 7 of 8

TAX ON CORP

IMPROPERLY ACCUMULATED CLOSELY-HELD CORPORATION

corp at least 50% in value of OCS or at

EARNING TAX least 50% of the total combined voting

power of all classes of stocks entitled to

vote

is owned directly or indirectly

IN GENERAL - by or for not more than 20

individuals.

10% IAETax

imposed for each taxabke year on improperly EXCEPTION

accumulated income of a corporation,

IN ADDITION TO

to other taxes imposed by this title (RCIT/

MCIT/GIT, FIT)

IMPROPERLY ACCUMULATED TAXABLE

IAET SHALL NOT BE APPLIED WITHOUT

QUALIFICATION TO THE FF

1. publicly held corporation

INCOME; defined 2. banks and other non-bank financial

taxable income,

adjusted by:

intermediaries

3. insurance company

1. income exempt from tax RR 2-2001

2. income excluded from gross income IAET SHALL NOT BE APPLIED TO THE FF

3. income subject to FIT WIH QUALIFICATION:

4. amount of net operating loss carry 1. taxable partnership

over deducted

and reduced by the sum of

2. non-taxable joint ventures

3. GPP

4. enterprises located within the PEZA and

1. dividend actually or constructively

paid

2. income tax paid for the taxable year;

other economic zones

IAET SHALL BE IMPOSED IF:

and - reasonable anticipated needs of the

3. the amount reserved for reasonable

needs of the business

business. must be established.

I N S TA N C E S W H E N C O R P M AY

IMMEDIACY TEST ACCUMULATE EARNINGS AND NOT TO BE

for determining reasonable needs of the SUBECT TO IAET

business 1. allowance for the increase in the

- the immediate needs of the business accumulation of earnings up to 10% of the

including reasonably anticipated needs

PURPOSE OF IMPOSITION OF IAET

paid-up capital of the corporation as of

Balance Sheet date, inclusive of

accumulations taken from other years

to compel corporation to declare dividend

as otherwise; it avoids income tax due

2. earnings reserved for definite corporate

expansion projects or programs requiring

considerable capital expenditure as

with respect to shareholders of the corp by approved by the BOD or equivalent body

permitting the earnings to accumulate 3. earning reserved for bldg, plants or

instead of being divided and distributed.

HENCE: IMPOSITION OF IAET IS PROPER

equipment acquisition as approved by the

BOD or equivalent body

4. earning reserved for the compliance with

WHEN any loan covenant or pre-existing

no dividend declared and paid or issued for obligation established under a legitimate

more than 1 year following the close of the business agreement

taxable year.

NOTE: if no dividend declared after the lapse

5. earnings acquired by law or applicable

regulations to be retained by the

corporation or in respect of which there is

of 1 year following the close the taxable year legal prohibition against its distribution

- IAET must be paid within 15 days therefrom.

NOTE: IAET APPLIES ONLT TO

6. in case of subsidiaries of FC in the Phil, all

undistributed earnings intended or

reserved for investments within the Phil as

1. DC can be proven by corporate records and/or

2. Closely-Held Corp relevant documentary evidence

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 8 of 8

TAX ON CORP

EVIDENCE OF PURPOSE TO

AVOID INCOME TAX

NOTE:

intention at the time of the accumulation is

controlling,

whether the profit are accumulated

beyond the needs of the business

ESSENTIAL

definiteness of the plan, couples with

actions taken towards its consummation.

PRIMA FACIE EVIDENCE

of the purpose to avoid tax

1. the fact that the company is mere holding

company or investment company

2. the fact that the earnings or profit of the

corporation are permitted to accumulate

beyond the reasonable needs of the

business.

NOTE: intention is material.

UNLESS: established under the circumstances

enumerated in RR 2-2001, which would justify

the accumulation of profit.

AAA - BASTE / ATB

prepared by: ronie ablan

Das könnte Ihnen auch gefallen

- Regular Income TaxationDokument6 SeitenRegular Income TaxationAnabel Lajara Angeles0% (1)

- Regular Income TaxationDokument6 SeitenRegular Income TaxationAnabel Lajara AngelesNoch keine Bewertungen

- Socioeconomic ImpactDokument3 SeitenSocioeconomic ImpactPrecious Nicole SantosNoch keine Bewertungen

- SUMMARY - Intangible AssetsDokument12 SeitenSUMMARY - Intangible AssetsKRESLEY LAUDEEN ORTEGANoch keine Bewertungen

- Management 2Dokument7 SeitenManagement 2elena rossiNoch keine Bewertungen

- Zyna Taxation Reviewer PDFDokument8 SeitenZyna Taxation Reviewer PDFShekinah MonrealNoch keine Bewertungen

- Cost and Revenue Anaylisis EconomicDokument5 SeitenCost and Revenue Anaylisis EconomicShambhavi SinhaNoch keine Bewertungen

- CREBA V Executive SecretaryDokument10 SeitenCREBA V Executive SecretaryseentherellaaaNoch keine Bewertungen

- Tax Reviewer (Mfp-2)Dokument13 SeitenTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- MasterSheet04 IFB SirTariqTunio FinalDokument2 SeitenMasterSheet04 IFB SirTariqTunio FinalKamran MehboobNoch keine Bewertungen

- 1 Introduction To Cost Accounting (2017)Dokument62 Seiten1 Introduction To Cost Accounting (2017)kilogek124Noch keine Bewertungen

- Buscom 2ND Sem Prelims and Midterms Reviewer 1Dokument13 SeitenBuscom 2ND Sem Prelims and Midterms Reviewer 1Accounting MaterialsNoch keine Bewertungen

- RMC 04-2003Dokument6 SeitenRMC 04-2003Lance MorilloNoch keine Bewertungen

- 6 - Deductions From Gross IncomeDokument9 Seiten6 - Deductions From Gross IncomeSamantha Nicole Hoy100% (2)

- Cost Concepts and ClassificationDokument8 SeitenCost Concepts and ClassificationJericho PagsuguironNoch keine Bewertungen

- TAX.2811 Deductions From Gross IncomeDokument10 SeitenTAX.2811 Deductions From Gross IncomeMary Ann Del PradoNoch keine Bewertungen

- CHAPTER 13 - Principles of DeductionDokument5 SeitenCHAPTER 13 - Principles of DeductionDeviane CalabriaNoch keine Bewertungen

- Assignment 2-Zienab MosabbehDokument3 SeitenAssignment 2-Zienab MosabbehZienab MosabbehNoch keine Bewertungen

- Explain The Procedure of Reconciliation of Financial and Cost Accounting DataDokument6 SeitenExplain The Procedure of Reconciliation of Financial and Cost Accounting DataKritika JainNoch keine Bewertungen

- Part 4Dokument17 SeitenPart 4Marc Lester Hernandez-Sta AnaNoch keine Bewertungen

- Intermediate Accounting - Property, Plant, and EquipmentDokument8 SeitenIntermediate Accounting - Property, Plant, and Equipment22100629Noch keine Bewertungen

- Unit 3 - The Organisation of The Firm and IndustryDokument6 SeitenUnit 3 - The Organisation of The Firm and IndustrymqdNoch keine Bewertungen

- Income TaxationDokument15 SeitenIncome TaxationTrixie mae MagdayongNoch keine Bewertungen

- Chapter 2 - Financial Statements and Cash Flow 2Dokument4 SeitenChapter 2 - Financial Statements and Cash Flow 2Mrittika SahaNoch keine Bewertungen

- 04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeDokument22 Seiten04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeRuth MuldongNoch keine Bewertungen

- Deductions From Gross IncomeDokument2 SeitenDeductions From Gross Incomericamae saladagaNoch keine Bewertungen

- COGS Beginning Inventory + Purchases During The Period - Ending InventoryDokument4 SeitenCOGS Beginning Inventory + Purchases During The Period - Ending InventoryGopali AoshieaneNoch keine Bewertungen

- TAX LAW BALA SA BAR SERIES ExportDokument10 SeitenTAX LAW BALA SA BAR SERIES Exportmetrexz17.03Noch keine Bewertungen

- Introducing The Value-Added Tax Considerations For ImplementationDokument8 SeitenIntroducing The Value-Added Tax Considerations For ImplementationdmaproiectNoch keine Bewertungen

- Changes To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingDokument1 SeiteChanges To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingMuhammad KholiqNoch keine Bewertungen

- Costing Formulae Topic WiseDokument81 SeitenCosting Formulae Topic Wiseamit kathaitNoch keine Bewertungen

- Chapter 5 Financial ManagementDokument43 SeitenChapter 5 Financial ManagementfekaduNoch keine Bewertungen

- Modes of Acquisition: Refer To The FV Hierarchy in Impairment of AssetsDokument4 SeitenModes of Acquisition: Refer To The FV Hierarchy in Impairment of AssetsKaryl FailmaNoch keine Bewertungen

- 18 Chamber of Real Estate and Builders Association vs. Alberto RomuloDokument23 Seiten18 Chamber of Real Estate and Builders Association vs. Alberto RomuloAriel Conrad MalimasNoch keine Bewertungen

- Accounting V Tax TreatmentDokument3 SeitenAccounting V Tax TreatmentReena MaNoch keine Bewertungen

- Guerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleDokument6 SeitenGuerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleJenny Brozas JuarezNoch keine Bewertungen

- Characterization in TPDokument13 SeitenCharacterization in TPJKNoch keine Bewertungen

- Notes in Tax On CorporationDokument7 SeitenNotes in Tax On CorporationNinaNoch keine Bewertungen

- SMEs ALE PDFDokument13 SeitenSMEs ALE PDFFranchNoch keine Bewertungen

- Income Tax Part 1Dokument12 SeitenIncome Tax Part 1Chezka CelisNoch keine Bewertungen

- CH 17Dokument28 SeitenCH 17mrssadis66Noch keine Bewertungen

- Chapter 4 - Gross IncomeDokument9 SeitenChapter 4 - Gross Incomechesca marie penarandaNoch keine Bewertungen

- Chapter-2 Answer KeyDokument18 SeitenChapter-2 Answer KeyKylie sheena MendezNoch keine Bewertungen

- Costing Formulas NewDokument62 SeitenCosting Formulas Newvenky_1986100% (6)

- 2 Index For Withholding TaxDokument16 Seiten2 Index For Withholding TaxabbelleNoch keine Bewertungen

- Illes18 ReportDokument10 SeitenIlles18 ReportCristina CpNoch keine Bewertungen

- KPMG Flash News Roche Diagnostics India PVT LTDDokument4 SeitenKPMG Flash News Roche Diagnostics India PVT LTDAvinash GarjeNoch keine Bewertungen

- Income Tax 11-14 PDFDokument1 SeiteIncome Tax 11-14 PDFJemna AryanaNoch keine Bewertungen

- Regular Income Taxation Exclusions and Inclusions To Gross IncomeDokument22 SeitenRegular Income Taxation Exclusions and Inclusions To Gross IncomeKatrina MaglaquiNoch keine Bewertungen

- IND As 115 - Bhavik Chokshi - FR ShieldDokument18 SeitenIND As 115 - Bhavik Chokshi - FR ShieldESWAR REDDY Chintam ReddyNoch keine Bewertungen

- (Eit LBDD CRP) : (As Amended by R.A. 9504 Which Took Effect July 6, 2008)Dokument16 Seiten(Eit LBDD CRP) : (As Amended by R.A. 9504 Which Took Effect July 6, 2008)Lyca VNoch keine Bewertungen

- DEDUCTIONSDokument13 SeitenDEDUCTIONSmigueltanfelix149Noch keine Bewertungen

- Cost Concepts and ClassificationsDokument3 SeitenCost Concepts and ClassificationsCONCORDIA RAFAEL IVANNoch keine Bewertungen

- Costing Formulae Topic WiseDokument83 SeitenCosting Formulae Topic WiseViswanathan SrkNoch keine Bewertungen

- Overheads - Absorption Costing Method: Learning OutcomesDokument89 SeitenOverheads - Absorption Costing Method: Learning Outcomessamyak bafnaNoch keine Bewertungen

- CACC021 IAS 16 - Slides (2024)Dokument20 SeitenCACC021 IAS 16 - Slides (2024)chabalalalesedi254Noch keine Bewertungen

- Chapter 2 Answer PDFDokument19 SeitenChapter 2 Answer PDFCris VillarNoch keine Bewertungen

- Ca NotesDokument36 SeitenCa Notesretchiel love calinogNoch keine Bewertungen

- Pil-Ey Vs PeopleDokument11 SeitenPil-Ey Vs PeopleAnitoNoch keine Bewertungen

- CIR Vs Magsaysay LinesDokument1 SeiteCIR Vs Magsaysay LinesAnitoNoch keine Bewertungen

- CIR Vs Magsaysay LinesDokument1 SeiteCIR Vs Magsaysay LinesAnitoNoch keine Bewertungen

- Motion For ReconsiderationDokument3 SeitenMotion For ReconsiderationAnitoNoch keine Bewertungen

- May Novation Extinguish Criminal Liability For BP 22?Dokument1 SeiteMay Novation Extinguish Criminal Liability For BP 22?AnitoNoch keine Bewertungen

- Change of NameDokument10 SeitenChange of NameAnitoNoch keine Bewertungen

- Solman PortoDokument26 SeitenSolman PortoYusuf Raharja0% (1)

- Contact Information Focus Areas Geological Survey of FinlandDokument2 SeitenContact Information Focus Areas Geological Survey of Finlandhabibi1328Noch keine Bewertungen

- Characteritics of An EntrepreneurDokument3 SeitenCharacteritics of An EntrepreneurjonadhemondejaNoch keine Bewertungen

- Gilaninia and MousavianDokument9 SeitenGilaninia and Mousavianpradeep110Noch keine Bewertungen

- Computer Science AICTEDokument2 SeitenComputer Science AICTEchirag suresh chiruNoch keine Bewertungen

- Philippines National Bank vs. Erlando T. RodriguezDokument2 SeitenPhilippines National Bank vs. Erlando T. RodriguezKen MarcaidaNoch keine Bewertungen

- Quantitative Strategic Planning Matrix (QSPM) For AirasiaDokument4 SeitenQuantitative Strategic Planning Matrix (QSPM) For AirasiamaliklduNoch keine Bewertungen

- TaxDokument4 SeitenTaxMendoza KelvinNoch keine Bewertungen

- Financial Literacy of Micro, Small, and Medium Enterprises of Consumption Sector in Probolinggo CityDokument8 SeitenFinancial Literacy of Micro, Small, and Medium Enterprises of Consumption Sector in Probolinggo CityRIFALDI MaulanaNoch keine Bewertungen

- 17.08 Employment OrdinanceDokument123 Seiten17.08 Employment OrdinanceNatalie Douglas100% (1)

- Acct Practice PaperDokument11 SeitenAcct Practice PaperKrish BajajNoch keine Bewertungen

- FIN211 Financial Management Lecture Notes Text Reference: Chapter 1 Topic: Role of Financial ManagementDokument8 SeitenFIN211 Financial Management Lecture Notes Text Reference: Chapter 1 Topic: Role of Financial ManagementAnonymous y3E7iaNoch keine Bewertungen

- Avrio PLT Corporate ProfileDokument16 SeitenAvrio PLT Corporate Profilemiss anuarNoch keine Bewertungen

- MGT 314Dokument21 SeitenMGT 314Tonmoy Proffesional100% (1)

- Fund Card Sample PDFDokument4 SeitenFund Card Sample PDFSandeep SoniNoch keine Bewertungen

- Jetblue Airlines: (Success Story)Dokument23 SeitenJetblue Airlines: (Success Story)Mantombi LekhuleniNoch keine Bewertungen

- Controller Investor Relations RoleDokument4 SeitenController Investor Relations RoleNoel MiñanoNoch keine Bewertungen

- Oman - Corporate SummaryDokument12 SeitenOman - Corporate SummarymujeebmuscatNoch keine Bewertungen

- Comparative Investment ReportDokument8 SeitenComparative Investment ReportNelby Actub MacalaguingNoch keine Bewertungen

- Porter Five Forces AnalysisDokument3 SeitenPorter Five Forces Analysisazazel28Noch keine Bewertungen

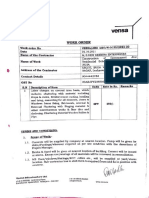

- Vensa WorkorderDokument9 SeitenVensa WorkorderAshutosh Kumar DwivediNoch keine Bewertungen

- Syllabus Marketing Management MBA ITBDokument18 SeitenSyllabus Marketing Management MBA ITBAndi A Fauzan ParewangiNoch keine Bewertungen

- Structure and Composition of Foreign Exchange Management SystemDokument28 SeitenStructure and Composition of Foreign Exchange Management SystemParthadeep SharmaNoch keine Bewertungen

- Sponsorship ProposalDokument10 SeitenSponsorship ProposalCreative EventsNoch keine Bewertungen

- J. P Morgan - NMDCDokument12 SeitenJ. P Morgan - NMDCvicky168Noch keine Bewertungen

- Chapter 13 Human Resource ManagementDokument37 SeitenChapter 13 Human Resource ManagementKashif Ullah KhanNoch keine Bewertungen

- Work ImmersionDokument10 SeitenWork ImmersionKathy Sarmiento100% (1)

- Tck-In Day 9Dokument3 SeitenTck-In Day 9Julieth RiañoNoch keine Bewertungen

- Leadership Whitepaper Darden ExecutiveDokument20 SeitenLeadership Whitepaper Darden ExecutiveZaidNoch keine Bewertungen

- International Tax PrimerDokument196 SeitenInternational Tax PrimerMuhammadNoch keine Bewertungen