Beruflich Dokumente

Kultur Dokumente

Cost of Capital UTM

Hochgeladen von

Arman ShahCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cost of Capital UTM

Hochgeladen von

Arman ShahCopyright:

Verfügbare Formate

Cost of Capital

Question 1

Jozan Company has asked a group of financial consultants to help them determine their component

and average costs of capital. The consultants have been able to gather the following information: The

current price of the firms 40-year, RM1000 face value, 5.4% annual coupon bonds is RM1,200 with

flotation costs of 10%. The price of the firms preferred stock is RM80 but the cost of issuance is 12.5%

and pays dividends of RM7.00 per year. The common stock has a current price of RM16 per share

with flotation costs of 22.5%, expects to pay RM1.24 per share in annual dividends next year, and has

an expected annual growth rate in dividends of 20%. The market value of the sources of financing are

debt at RM5,000,000, common stock at RM1,000,000, and preferred stock at RM4,000,000. The firm is

in a 40% tax bracket.

1. What is the yield to maturity of the firms debt?

54+ (1000 1080) = 52 . = 5%

40 1040

1000 + 1080

2

2. What is the firms cost of preferred stock?

RM7.00 = 10%

RM80 RM10

3. What is the firms cost of equity?

k= RM1.24 . + 20% = 30%

(RM16.00 - RM3.60)

4. What is the firms weighted average cost of capital?

WACC = (0.5)(3.5%) + (0.1)(10%) + (0.4)(30%) = 14.75%

Question 2

Horatio Company has asked a group of financial consultants to help them determine their component

and average costs of capital. The consultants have been able to gather the following information:

i. The capital structure of the firm are 40% debt , 50% common stock and 10% preferred stock.

The firm is in a 30% tax bracket.

ii. The price of the firms preferred stock is RM30 and pays dividends of RM4.80 per annum with

flotation costs amount to 20% of market price.

iii. The current price of the firms RM1,000 par, 4-years bond, annual coupon payments of 4% is

RM900, with flotation costs of RM100 per bond.

iv. Common stock has a current price of RM15.00 per share, with flotation costs of RM0.50. The

stock expected to pay RM2.90 dividend next year. The dividends expected to have an annual

growth rate of 10%.

a) What is the firms cost of preferred stock ?

RM4.80 = 20%

RM30 RM6

b) What is the firms after-tax cost of debt?

40+ (1000 800) = 90 . = 10%

4 900

1000 + 800

2

After tax = 10% (1 0.3) = 7%

c) What is the firms cost of common stock ?

RM2.90 . + 10% = 30%

(RM15.00 0.50)

d) What is the firms weighted average cost of capital?

WACC = (0.4)(7%) + (0.1)(20%) + (0.5)(30%) = 19.80%

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Exercise Final SECTION B 2019Dokument5 SeitenExercise Final SECTION B 2019Arman ShahNoch keine Bewertungen

- CRR Dec 2016Dokument35 SeitenCRR Dec 2016Arman ShahNoch keine Bewertungen

- Answer For Quiz 1 - Partnership AccountsDokument1 SeiteAnswer For Quiz 1 - Partnership AccountsArman ShahNoch keine Bewertungen

- Al Quiz June 2017 Oct 2017 QsDokument3 SeitenAl Quiz June 2017 Oct 2017 QsArman ShahNoch keine Bewertungen

- TUTORIAL: Capital Budgeting: Cash Flow Principles: PurchaseDokument2 SeitenTUTORIAL: Capital Budgeting: Cash Flow Principles: PurchaseArman ShahNoch keine Bewertungen

- State of Economy Probability ReturnDokument1 SeiteState of Economy Probability ReturnArman ShahNoch keine Bewertungen

- Portfolio BetaDokument1 SeitePortfolio BetaArman ShahNoch keine Bewertungen

- Tutorial CashflowDokument2 SeitenTutorial CashflowArman ShahNoch keine Bewertungen

- Stock ValuationDokument3 SeitenStock ValuationArman ShahNoch keine Bewertungen

- PV PMT (Pvifa) + FV (Pvif) : B M N o B M IDokument1 SeitePV PMT (Pvifa) + FV (Pvif) : B M N o B M IArman ShahNoch keine Bewertungen

- Soalan 1Dokument2 SeitenSoalan 1Arman ShahNoch keine Bewertungen

- Appendix B1 Future Value of $1: Fvif (1+i) FV PV (Fvif) Period NDokument4 SeitenAppendix B1 Future Value of $1: Fvif (1+i) FV PV (Fvif) Period NArman ShahNoch keine Bewertungen

- Appendix B1 Future Value of $1: Fvif (1+i) FV PV (Fvif) Period NDokument4 SeitenAppendix B1 Future Value of $1: Fvif (1+i) FV PV (Fvif) Period NArman ShahNoch keine Bewertungen

- Soalan 3Dokument1 SeiteSoalan 3Arman ShahNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Revision in The Covered Critical Illnesses and DefinitionsDokument268 SeitenRevision in The Covered Critical Illnesses and Definitionssyamala malaNoch keine Bewertungen

- Operations ResearchDokument2 SeitenOperations Researchced_mosbyNoch keine Bewertungen

- Personal Finance Essay - Tashira BryantDokument4 SeitenPersonal Finance Essay - Tashira Bryantapi-540946017Noch keine Bewertungen

- Fua Cun vs. SummersDokument3 SeitenFua Cun vs. SummersRivera Meriem Grace MendezNoch keine Bewertungen

- Investment & Portfolio Management Chapter 1: Investing Is An Important Activity Worldwide InvestmentDokument6 SeitenInvestment & Portfolio Management Chapter 1: Investing Is An Important Activity Worldwide InvestmentMuhammad Adil HusnainNoch keine Bewertungen

- Adjudication Order Against Hooghly Mills Project Ltd. and Hooghly Stocks & Bonds Pvt. Ltd. in The Matter of Waverly Investments Ltd.Dokument7 SeitenAdjudication Order Against Hooghly Mills Project Ltd. and Hooghly Stocks & Bonds Pvt. Ltd. in The Matter of Waverly Investments Ltd.Shyam SunderNoch keine Bewertungen

- Warrant AgreementDokument44 SeitenWarrant Agreementlcdo1958Noch keine Bewertungen

- UBS - Year Ahead 2021Dokument63 SeitenUBS - Year Ahead 2021Jayaraman Rathnam100% (1)

- Equity Valuation ModelsDokument58 SeitenEquity Valuation ModelsSarang GuptaNoch keine Bewertungen

- Investing ComoditiesDokument4 SeitenInvesting ComoditiesSarthak AroraNoch keine Bewertungen

- QWAFAFEW Models Behaving Badly Derman U 2011 PDFDokument19 SeitenQWAFAFEW Models Behaving Badly Derman U 2011 PDFscribdszNoch keine Bewertungen

- 2019 Pardee Annual Report - Low ResolutionDokument36 Seiten2019 Pardee Annual Report - Low ResolutionNate Tobik100% (2)

- Mba Project Report On Online Trading DerivativesDokument94 SeitenMba Project Report On Online Trading DerivativesKishoriNoch keine Bewertungen

- FINAL PROSPECTUS - ATRAM Alpha Opportunity Fund (UPDATED June 4, 2018)Dokument55 SeitenFINAL PROSPECTUS - ATRAM Alpha Opportunity Fund (UPDATED June 4, 2018)Mai Whill TolentinoNoch keine Bewertungen

- Evercore Partners 8.6.13 PDFDokument6 SeitenEvercore Partners 8.6.13 PDFChad Thayer VNoch keine Bewertungen

- FAR 4320 Book Value Per Share Earnings Per Share PDFDokument3 SeitenFAR 4320 Book Value Per Share Earnings Per Share PDFAnjolina BautistaNoch keine Bewertungen

- 35 Bank Organization20221031232239Dokument59 Seiten35 Bank Organization20221031232239Alyssa Oreiro IgrosNoch keine Bewertungen

- EA PPT IFMR SIBMB AdroitsDokument12 SeitenEA PPT IFMR SIBMB AdroitsHomo SapienNoch keine Bewertungen

- A. People vs. QuashsaDokument8 SeitenA. People vs. QuashsaTomas FloresNoch keine Bewertungen

- En Fin - M1Dokument12 SeitenEn Fin - M1Jade June Lobino CaliboNoch keine Bewertungen

- PIS Stores Managment Inventory Control Synopsis)Dokument9 SeitenPIS Stores Managment Inventory Control Synopsis)Vikram AroraNoch keine Bewertungen

- Koutons Retail India (KOURET) : Dismal PerformanceDokument6 SeitenKoutons Retail India (KOURET) : Dismal Performancevir_4uNoch keine Bewertungen

- Icard Vs Council of Baguio Facts:: ViresDokument41 SeitenIcard Vs Council of Baguio Facts:: ViresNLainie OmarNoch keine Bewertungen

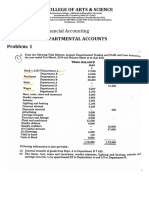

- Departmental Account Problems & AnswerDokument7 SeitenDepartmental Account Problems & Answeranand dpiNoch keine Bewertungen

- Module 16 Share-Based PaymentDokument8 SeitenModule 16 Share-Based PaymentryanNoch keine Bewertungen

- Chapter 7 Exercise Stock ValuationDokument3 SeitenChapter 7 Exercise Stock ValuationShaheera Suhaimi100% (3)

- Study On Intrinsic Value of PseDokument84 SeitenStudy On Intrinsic Value of PseApoorv MudgilNoch keine Bewertungen

- Corporation - Transactions Subsequent To FormationDokument7 SeitenCorporation - Transactions Subsequent To FormationJohncel Tawat100% (1)

- Retail Industry Terminology and IT TrendsDokument30 SeitenRetail Industry Terminology and IT TrendsksnangethNoch keine Bewertungen

- Internet Case Studies FinmarDokument17 SeitenInternet Case Studies FinmarXyza Faye RegaladoNoch keine Bewertungen