Beruflich Dokumente

Kultur Dokumente

R1

Hochgeladen von

4gen_20 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten7 SeitenOriginaltitel

R1 [1]

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

TXT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als TXT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten7 SeitenR1

Hochgeladen von

4gen_2Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als TXT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

1.

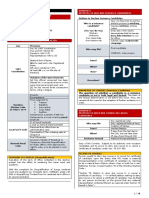

ACKNOWLEDGE CLOCK FOR CERTIFICATION OR METER (FOR AUTHORITY USE ONLY)

R-1

R1P1A03

APPLICATION FOR REGISTRATION OF TAXPAYERS FEDERAL REGISTER

BEFORE YOU START FILLING IN THIS APPLICATION, READ THE INSTRUCTIONS

2

CURP: REGISTRATION KEY PEOPLE ONLY (Individuals Only)

3

LIST THE LETTER REQUEST FOR THE TYPE OF PRESENTING: When it comes APPLICATION FO

LIO NUMBER ASSIGNED BY THE AUTHORITY TO THE PREVIOUS APPLICATION:

N = C = SUPPLEMENTAL NORMAL

ADDITIONAL 03.01, THE STATE

4 4.1

Last Name

TAXPAYER INFORMATION TO REGISTER

ONLY natural persons (see instructions)

MATERNAL SURNAME

NAME (S)

4.2

Name or

ONLY case of moral persons (see instructions)

4.3

RESIDENTS IN TRYING TO TAXPAYERS WITHOUT PERMANENT ESTABLISHMENT ABROAD IN MEXIC

O

ASSIGNED TAX ID NUMBER IN THE COUNTRY IN WHICH RESIDING

COUNTRY OF RESIDENCE TAX

4.4

IF THIS IS THE REGISTRATION OF A TRUST, STATE: NAME OR TRADE NAME OF THE TRUSTEE

OF THE TRUST RFC.

DATA BY TRUST

NUMBER OF TRUST

4.5

STREET NUMBER AND / OR EXTERIOR POINT

TAXPAYER ADDRESS TAX TO REGISTER OR REPRESENTATIVE OF THE PERSON RESIDENT ABROAD

NUMBER AND / OR INTERIOR POINT

FROM THE STREETS AND COLONIA

LOCATION CODE MUNICIPALITY DELEGATION OR FEDERAL POSTA L COMPANY PHONE EMAIL

5

I declare that I will the data contained in this application are true

SIGNATURE OF TAXPAYER OR FINGERPRINT, associating OF, OR THE LEGAL REPRESENTATIV

E, who stated under oath that TRUTH, WHICH TO THIS DATE WITH THE MANDATE THAT SH

E HAS BEEN He holds modify or revoke

Be submitted in duplicate

R1 Page 2

R1P2A03

INSTRUCTIONS

DOCUMENTS TO ACCOMPANY THIS APPLICATION FOR INDIVIDUALS: - Application for Tax I

dentification Card with single Population Register (twice) and in the same docum

ent states (only in case of natural persons of Mexican nationality by birth, for

eign residents in the country or of Mexican nationality by naturalization). - Bi

rth certificate or certified copy of a photocopy certified by competent official

or notary public. - For foreigners residing in the country, the corresponding c

urrent immigration document issued by competent authority. They must also provid

e where appropriate, duly certified photocopy, or apostille certified by compete

nt authority, the document proving their tax identification number of the countr

y in which they reside when they are required to have it in that country. - In t

he case of Mexicans by naturalization, a certificate of naturalization issued by

competent authority, duly certified or authenticated, as appropriate. INDIVIDUA

LS RESIDENTS ABROAD: - Original and photocopy of current immigration, as appropr

iate, issued by the competent authority. The original will be returned after che

cking with the copy. - If applicable, a photocopy of the document proving their

assigned tax identification number in the country of residence, duly certified,

authenticated or apostille as appropriate, by competent authority, when they are

required to have it in that country. Person: Corporations: - Certified copy of

the document establishing. Corporations people other than: - Document establishi

ng a certified copy or, where appropriate, a photocopy of the publication in the

Official Body. Joint ventures: - Original and photocopy of the Joint Venture co

ntract with autograph of asociante and associates or their legal representatives

. The original will be returned after checking with the copy. TRUSTS: - Original

and photocopy of the trust contract with handwritten signature of the settlor,

trustee or their legal representatives, as well as the legal representative of t

rustee. The original will be returned after checking with the copy. MORALES PERS

ONS RESIDENT ABROAD: - Act or document of incorporation (articles of association

, certificate of registration or other implement in accordance with the legislat

ion in the country of residence) duly apostille or certificate, as appropriate.

When establishing the record or document recorded in the language other than Spa

nish must submit an authorized translation. Where appropriate, a photocopy of th

e document evidencing the tax identification number assigned in the country of r

esidence, duly certified, authenticated or apostille as appropriate, by competen

t authority, when they have this obligation in that country. ADDRESS: - The subj

ects mentioned above,Âmust also provide original and photocopy of proof of resi

dence for tax purposes stated in paragraph 4.4, which has the data requested in

this paragraph: State bank account. This document must not be older than two mon

ths. - Pay stubs: Latest property tax, in the case of partial payment receipt sh

all not be atleast 4 months and since the annual payment it must correspond to t

he current year (this document may be in the name of the taxpayer or a third par

ty); last payment of the electricity, telephone or water, provided that the bill

not older than 4 months (this document may be in the name of the taxpayer or a

third party). - Last liquidation of the Mexican Social Security Institute on beh

alf of the taxpayer. - Contracts for: Hire, accompanied by the latest receipt fo

r the payment of current income that meets the tax requirements or the sublease

agreement with the contract for rental and last payment of rent receipt of curre

nt to comply with tax requirements (this document may be in the name of the taxp

ayer or a third party) duly registered trust, opening bank account not older tha

n 2 months (this document may be in the name of the taxpayer or a third) light s

ervice, telephone or water that is not older than 2 months (this document may be

in the name of the taxpayer or a third party). - Letter of establishment or res

idence issued by the State Governments, Municipal or Federal District, as approp

riate. IDENTIFICATION: - In addition to the above, the individual or the legal r

epresentative of the person concerned must accompany the original and photocopy

of any of the following documents: ID card to vote the Federal Electoral Institu

te, valid passport, Certificate or Professional, where appropriate, the National

Military Service Card. The original will be returned after checking with the co

py. Being foreigners, the corresponding current immigration document issued by c

ompetent authority. ACCREDITATION OF THE PERSONALITY OF THE LEGAL REPRESENTATIVE

: - Original and photocopy of power of attorney or power of attorney signed befo

re two witnesses and ratified the signatures to the tax authorities, notary or n

otary public. The original will be returned after checking with the copy. - For

foreign residents with or without a permanent establishment in Mexico, they shal

l submit a photocopy of the notarized document that has been appointed the legal

representative for tax purposes. - For parents who have joint custody of minors

and to act as representatives of the same, to establish paternity, submit a cer

tified copy of child's birth certificate, issued by the Civil Registry, as well

as any of the documents identification required in the previous point, the fathe

r acting as a representative.

1. This application is for registration. In the case of change in tax status fro

m the RFC, you must use the R-2 tax forms. In the case of request for services,

tax forms must be lodged in May. 2. Only entries made within the fields for this

set. In the case of filling by hand, must use print, using capital letters, bla

ck or blue ink. 3. This application must be filed with the modules of the Local

Government Taxpayer Assistance corresponding to the tax residence of the taxpaye

r. 4. The registration application shall be deemed not filed in the case of not

properly completed or not accompanied by documentation. 5. Foreign residents wit

hout permanent establishment in Mexico, when they have no legal representative i

n the national territory, to submit this application along with Annex 9, except

in cases where only register as partners or shareholders or as partners Partners

hip participation, to the Mexican Consulate nearest to their place of residence.

Otherwise, you must take the same form with the Central Administration of Large

Taxpayers Collection. 2 KEY COMPONENT OF REGISTRATION OF POPULATION SINGLE Indi

viduals who have the Unique Key Population Registration (CURP), the recorded at

18 positions in this field. COMPONENT 3 If the request is made for the first tim

e (normal), N being marked with the appropriate field. When submitting the appli

cation to supplement or replace the data of a previous application shall be mark

ed with the appropriate field C, (SUPPLEMENTARY). In this case, the taxpayer wil

l again provide the information requested in this Form Attorney R-1Âaddition to

making the change for the presentation of the Request for Supplementary Registr

ation. In the case of a change in the fiscal situation of the taxpayer and regis

tered, instead of using the R-1 tax forms, you must file Form R-2 Fiscal NOTICES

OF CONTRIBUTORS TO THE FEDERAL REGISTER. CHANGE OF TAX. SUPPLEMENTARY case of S

ection 3.1, indicate the number of pages assigned by the Authority in the earlie

r application, located on the table for the certification or seal break switch c

lock. TAXPAYER DATA COMPONENT 4 which forms Section 4.1 ONLY natural persons Nat

ural persons must enter the full name as it appears on the birth certificate iss

ued by the Civil Registry. In the case of natural persons of foreign nationality

residing in Mexico and Mexican nationality by naturalization, shall enter your

full name as it appears in document immigration or naturalization card as approp

riate. For individuals resident abroad with or without a permanent establishment

in Mexico must enter the full name as it appears on the passport, scoring in th

e first and last name in mother's maiden name, the following, as appropriate. Se

ction 4.2 ONLY case of moral persons Legal entities resident in Mexico as well a

s legal persons resident abroad with or without a permanent establishment in Mex

ico, entered the corporate name as it appears in the document that must accompan

y this application, According to the listing box at the top of this page. In the

case of joint venture contracts shall be entered the name, designation and addr

ess of the asociante, once the legend: Joint ventures, contract number. . . . .

. . . . . . . . . Using an R-1 form for each contract. The entrepreneur will ass

ign the number progressively, according to the date of conclusion of contracts i

n which it participates. In the case of trusts, only will write the name of the

trust, using a form R-1 for each trust. Section 4.3 as residence abroad without

PERMANENT ESTABLISHMENT IN MEXICO addition to scoring in the preceding paragraph

s the details of the person or entity which falls depending on whether, entered

in this section, the tax identification number assigned in the country residence

, except in accordance with the legislation of that State are not required to ob

tain that number, also indicate your country of tax residence. Section 4.4 DATA

BY Trust shall record the name or trade name of the trustee, the RFC of the same

and the number of trust. Section 4.5 TAXPAYER ADDRESS TAX to enroll a) Individu

als: - Business activities, the place in which is the main place of business. -

Domestic services, the local use as a permanent establishment to carry out their

activities. - In all other cases, the place where they have their principal pla

ce of business. b) Moral People: - For residents in the country, the place in wh

ich senior management is the business. - In the case of establishments of legal

persons resident abroad, indicates the address of the establishment in Mexico. I

n the case of several establishments, the place in which senior management is bu

siness in the country or, failing that, the one designated.

-

R1 Page 3

R1P3A03

6

TAXPAYERS FEDERAL REGISTER SURNAME fatherhood, motherhood AND NAME (S)

DETAILS OF LEGAL REPRESENTATIVE (See Instructions)

REGISTRATION KEY PEOPLE ONLY

7

7.1 Dates of Birth of the person or DATE OF SIGNATURE OF INCORPORATION OR WRITIN

G OR DOCUMENT ESTABLISHING THE CELEBRATION OF CONTRACT, IN ACCORDANCE WITH THE D

OCUMENT TO ACCOMPANY

GENERAL INFORMATION (See instructions)

DAY MONTH YEAR DAY MONTH YEAR

7.2 Date START OPERATIONS

DE

8

8.1

Main activity

Indicate the main activity DEVELOP

8.2 INDICATE THE NUMBER OF SECTORS TO WHICH THE APPLICABLE TO DEVELOP main activ

ities: (See instructions)

MARK WITH X IF:

PRODUCE GOODS.

PROPERTY FOR SALE.

PROVIDE

8.3 ACTIVITIES WILL WITH THE PUBLIC IN GENERAL

We have machines FISCAL CHECK REGISTER

9

MARK WITH X SI 9.1 was recorded in RFC AS:

OTHER

PARTNER OR SHAREHOLDER OF MORAL PERSON (See Instructions)

MARK WITH X SI 9.2 was recorded in RFC AS:

In case you are registered, RFC INDICATE THE MORAL OF THE PERSON (If necessary a

ccompanying list)

Associating ASSOCIATION IN PARTICIPATION IN THE ASSOCIATION MEMBER PARTICIPATION

10

MARK WITH X IF STRANDED ON: RFC STATE MERGER OF THE COMPANIES MERGED (If necessa

ry accompanying list).

RFC INDICATE THE ASSOCIATION IN PARTICIPATION (If necessary accompanying list) R

FC INDICATE THE ASSOCIATION IN PARTICIPATION (If necessary accompanying list)

Merger Treaty and division of companies

EXCISING

IN division of companies, the case of company being divided APPOINTED, STATE OF

THE SOCIETY RFC original Company:

11

STREET NUMBER AND / OR EXTERIOR POINT

OPENING OF ESTABLISHMENT (Only if the address is different from that stated in i

tem 4.4)

NUMBER AND / OR INTERIOR POINT

FROM THE STREETS AND

COLONIA CITY OR TOWN COMPANY FEDERAL DELEGATION

POSTAL CODE

PHONE

12

CHECK WITH ACCOMPANYING X ANNEXES: ANNEX 1 Persons Regime General Morales and Mo

rales Personal Status non-profit. ANNEX 2 People Simplified Regime Morales and M

orales Staff Members. ANNEX 3 Individuals with income from wages, Lease, Sale an

d Purchase of Property, premium and interest.

ANNEXES

ANNEX 4 Individuals with business and professional activities. ANNEX 5 individua

ls with business activities Intermediate Regime. ANNEX 6 individuals with busine

ss activities Small Taxpayers Regime. ANNEX 7 individuals with other income.

ANNEX 8 persons morally and physically. IEPS, ISAN, ISTUV (Tenure) and right on

Grant and / or allocation Minera. ANNEX 9 Foreign residents permanent establishm

ent in Mexico. without

R1 Page 4

R1P4A03

I N S T R U C T I O N E S (Continued)

COMPONENT 6 LEGAL REPRESENTATIVE INFORMATION data shall be recorded when the leg

al representative submitting the application in the following cases: the case of

natural persons, provide the information requested in this area only when they

have a legal representative and acted on behalf of the taxpayer. In the case of

legal entities shall indicate the details of your legal representative. In the c

ase of contracts for Joint Venture, if the entrepreneur is an individual shall b

e entered this data. If the entrepreneur is an entity, it must record the detail

s of the legal representative of such legal entity. Residents abroad with or wit

hout a permanent establishment in Mexico, entered the data resident's legal repr

esentative in Mexico, designated for tax purposes. The above subjects will be id

entified and, where appropriate, credited his personality with the documents acc

ompanying this application, in accordance with the listing box at the top of thi

s page. - The application must be signed by the taxpayer or, where appropriate,

their legal representative. In case you do not know or can not sign, print your

fingerprint. COMPONENT 7 Section 7.1 GENERAL INFORMATION DATE OF BIRTH OF PERSON

OR PHYSICAL SIGNATURE OF THE DATE OF INCORPORATION OR WRITING OR DOCUMENT ESTAB

LISHING THE CELEBRATION OF CONTRACT, IN ACCORDANCE WITH THE DOCUMENT TO ACCOMPAN

Y. - Individuals living in Mexico and abroad with or without a permanent establi

shment in Mexico, date of birth recorded on the document that must accompany thi

s application, in accordance with the listing of the table at the top of this pa

ge. - The juridical persons residing in Mexico and abroad with or without a perm

anent establishment in Mexico, entered the date you signed the document that mus

t accompany this application in accordance with the listing box at the top of pa

ge. - In both cases, used four Arabic numerals for the year, two for the month a

nd two for the day. Example: DAY MONTH YEAR DAY MONTH YEAR Date of birth: 1 June

1972 1972 June 1901 signing of the document Date: May 23, 2002 2002 May 23 Augu

st predominant activity COMPONENT Section 8.2 - In accordance with the predomina

nt activity to develop , referred to in paragraph 8.1, will write the sector num

ber corresponding to that activity, according to the following list: 1 Agricultu

re, forestry, fishing. 2 Mining and extraction of oil. March Manufacturing. 4 El

ectricity and natural gas distribution. 5 Construction and services related ther

eto. 6 Trade, restaurants and hotels. 7 Transport, brokers and travel agents. 8

Financial services, real estate and rental property. 9 Community, social and per

sonal.

Paragraph 8.3 - The scheme individual taxpayers through business, whose revenues

in excess of the exercise of 1,750,000 pesos, will be required to have cash reg

isters, computers or electronic systems for tax.ÂCOMPONENT 9 OTHER - If in addi

tion to the tax liability indicated in (the) Annex (s) if accompanying this Form

Prosecutor says the RFC which falls as a partner or shareholder, or member of a

n active Partner Joint Venture, should dial (the) field (s) concerned (s) as app

licable, must also record (s) (s) of registration (s) request (s). In the case o

f a partner or shareholder, or associated asociante, more than a moral person mu

st accompany addition (s) Annex (s) and document (s) concerned (s), an open lett

er with the list containing the RFC keys of each of these legal entities. COMPON

ENT 10 deals with mergers and divisions of companies - In the case of mergers be

tween companies, the company which is part shall indicate the RFC of companies d

isappear because of the merger. If societies are disappearing more than three, m

ust accompany addition (of) Annex (s) and document (s) concerned (s), an open le

tter with the list containing the keys to the RFC for each of the companies disa

ppear. - If the registration is the dividing company designated to meet the obli

gations of the original Company shall indicate the RFC society disappears becaus

e of the division. COMPONENT 12 ANNEXES - must accompany this request (s) Annex

(s) corresponding (n) according to the tax system which taxed, duly filled (s),

and marked with the X in this area ( the) field (s) for (s) at (the) Annex (s) e

nclosed. * For any clarification in filling out this application, you can get in

formation on the Internet at the following addresses: www.shcp.gob.mx www.sat.go

b.mx asisnet@shcp.gob.mx asisnet@sat.gob.mx or communicate in the Federal Distri

ct at 5227-0297, in the Monterrey metropolitan area (81) 8329-6660, in the metro

politan area of Guadalajara (33) 3678-7140, Puebla (audiorespuesta) at (222) 246

-45 -14, in the rest of the country 01-800-90-450-00 no cost, or else go to the

Local Government Taxpayer Assistance. Complaints to the telephone 01-800-728-200

0.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Art in PaintDokument8 SeitenArt in Paint4gen_2Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Tutorial BloggerDokument2 SeitenTutorial Blogger4gen_2Noch keine Bewertungen

- RPG - The Vaccine RevoltDokument4 SeitenRPG - The Vaccine Revolt4gen_2Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- La Casa Ecologica AlbengaDokument7 SeitenLa Casa Ecologica Albenga4gen_2Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- BTT Mecanica Basica v22Dokument1 SeiteBTT Mecanica Basica v224gen_2Noch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Thermomix Tricks CompilationDokument8 SeitenThermomix Tricks Compilation4gen_2Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The Second World WarDokument10 SeitenThe Second World War4gen_2Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Causalidad y en Epidemiology DentistryDokument5 SeitenCausalidad y en Epidemiology Dentistry4gen_2Noch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Secret Code of The Bible and KabbalahDokument8 SeitenThe Secret Code of The Bible and Kabbalah4gen_2100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Bachelor White 2007-2008Dokument5 SeitenBachelor White 2007-20084gen_2Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Dream Boy DreamDokument6 SeitenDream Boy Dream4gen_2Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Environment and SustainabilityDokument6 SeitenEnvironment and Sustainability4gen_2Noch keine Bewertungen

- Water Laboratory and Other Special PurposeDokument13 SeitenWater Laboratory and Other Special Purpose4gen_2Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Outsourcing Jorge Souto November 20Dokument9 SeitenOutsourcing Jorge Souto November 204gen_2Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- SUCCESSIONDokument4 SeitenSUCCESSION4gen_2Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Protocol For The Evaluation of Physical TestsDokument1 SeiteProtocol For The Evaluation of Physical Tests4gen_2Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Catalog CeedDokument9 SeitenCatalog Ceed4gen_2Noch keine Bewertungen

- Help FeedburnerDokument13 SeitenHelp Feedburner4gen_2Noch keine Bewertungen

- Traffic ReportsDokument2 SeitenTraffic Reports4gen_2Noch keine Bewertungen

- Business Plan To Undertake BackgroundDokument3 SeitenBusiness Plan To Undertake Background4gen_2Noch keine Bewertungen

- File Extensions (Source: WinMagazine)Dokument20 SeitenFile Extensions (Source: WinMagazine)4gen_2Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Track 8 Russian Revolution, SchemeDokument4 SeitenTrack 8 Russian Revolution, Scheme4gen_2Noch keine Bewertungen

- Tax OfficeDokument3 SeitenTax Office4gen_2Noch keine Bewertungen

- Engineering Wonders of The XXI CenturyDokument2 SeitenEngineering Wonders of The XXI Century4gen_2Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- CO2 Emissions of Foods and DietsDokument2 SeitenCO2 Emissions of Foods and Diets4gen_2Noch keine Bewertungen

- 3x3 Rubik's Cube SolveDokument2 Seiten3x3 Rubik's Cube Solve4gen_2Noch keine Bewertungen

- Penfield e Os HomúnculosDokument1 SeitePenfield e Os Homúnculos4gen_2Noch keine Bewertungen

- 1932-2007 Law On Animal Care, Operating, Transportation, Testing and SacrificeDokument9 Seiten1932-2007 Law On Animal Care, Operating, Transportation, Testing and Sacrifice4gen_2Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- As Calculations Ici 2008Dokument1 SeiteAs Calculations Ici 20084gen_2Noch keine Bewertungen

- POEMSDokument2 SeitenPOEMS4gen_2Noch keine Bewertungen

- Cover-Up of Corruption at The Center of The World's Financial System Twitter1.26.19Dokument27 SeitenCover-Up of Corruption at The Center of The World's Financial System Twitter1.26.19karen hudesNoch keine Bewertungen

- Tortious Interference: Tort LawDokument4 SeitenTortious Interference: Tort LawAmerigo VespucciNoch keine Bewertungen

- Adel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesDokument10 SeitenAdel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesJoesil Dianne0% (1)

- Mabuhay Miles Program Participation AgreementDokument18 SeitenMabuhay Miles Program Participation AgreementLuigi Marvic FelicianoNoch keine Bewertungen

- Mishel Escaño - EH 407Dokument2 SeitenMishel Escaño - EH 407Ace Asyong AlveroNoch keine Bewertungen

- Contempt of Courts Act 1971Dokument12 SeitenContempt of Courts Act 197108 Manu Sharma A SNoch keine Bewertungen

- G.R. No. 182434 March 5 2010 Tomawis CaseDokument13 SeitenG.R. No. 182434 March 5 2010 Tomawis CaseMarcial SiarzaNoch keine Bewertungen

- German Law Review 06+vol - 19 - No - 04 - GraverDokument34 SeitenGerman Law Review 06+vol - 19 - No - 04 - GraverObservatory Pol. Rights & CitizenshipNoch keine Bewertungen

- PNR Vs CA DigestDokument1 SeitePNR Vs CA DigestMK PCNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Economic Loss DoctrineDokument9 SeitenThe Economic Loss DoctrineK CorNoch keine Bewertungen

- Application For Leave: Republic of The PhilippinesDokument3 SeitenApplication For Leave: Republic of The PhilippinesEva MaeNoch keine Bewertungen

- Gayoso Vs Twenty TwoDokument8 SeitenGayoso Vs Twenty TwoEnnavy YongkolNoch keine Bewertungen

- Motion To Withdraw FundsDokument2 SeitenMotion To Withdraw FundsTenshi FukuiNoch keine Bewertungen

- Itc Model Contract For The Interntional Sale of GoodsDokument20 SeitenItc Model Contract For The Interntional Sale of GoodswebmanyaNoch keine Bewertungen

- BC AttestationDokument1 SeiteBC AttestationEmmerson MoralesNoch keine Bewertungen

- Fossum V FernandezDokument7 SeitenFossum V FernandezcelestialfishNoch keine Bewertungen

- CaveatDokument2 SeitenCaveatsaravananblNoch keine Bewertungen

- Batas Pambansa Blg. 881: Omnibus Election Code of The PhilippinesDokument2 SeitenBatas Pambansa Blg. 881: Omnibus Election Code of The PhilippinesRegion 6 MTCC Branch 3 Roxas City, CapizNoch keine Bewertungen

- Access To Speedy Justice Through Mediation in Family CasesDokument17 SeitenAccess To Speedy Justice Through Mediation in Family CasesGhazaal KhanNoch keine Bewertungen

- Valmonte Vs CADokument4 SeitenValmonte Vs CAchappy_leigh118100% (1)

- 125 Bautista vs. Gonzales - 1990Dokument6 Seiten125 Bautista vs. Gonzales - 1990JanWacnangNoch keine Bewertungen

- Guerrero v. BihisDokument2 SeitenGuerrero v. BihisjrvyeeNoch keine Bewertungen

- Democracy PPT NewDokument11 SeitenDemocracy PPT Newlalit13patilNoch keine Bewertungen

- Final Submissions by The Accused Frank BwalyaDokument28 SeitenFinal Submissions by The Accused Frank Bwalyaapi-238529788100% (1)

- Ltia OrientationDokument16 SeitenLtia OrientationCA T He100% (3)

- 0002773-Florida Laws and RulesDokument151 Seiten0002773-Florida Laws and RulesPDHLibraryNoch keine Bewertungen

- Powerpoint - Sss.pamonte - Updated 1Dokument34 SeitenPowerpoint - Sss.pamonte - Updated 1Kzarina Kim DeGuzman Tenorio0% (1)

- Parents' Religion and Children's Welfare Debunking The Doctrine of Parents' Righ PDFDokument62 SeitenParents' Religion and Children's Welfare Debunking The Doctrine of Parents' Righ PDFJoseph WilliamsNoch keine Bewertungen

- A.C. No. 10911, June 6, 2017 Virgilio Mapalad vs. Atty. Anselmo EchanezDokument1 SeiteA.C. No. 10911, June 6, 2017 Virgilio Mapalad vs. Atty. Anselmo EchanezgsvgsvNoch keine Bewertungen

- Parkin 8e TIF Ch00Dokument3 SeitenParkin 8e TIF Ch00josephNoch keine Bewertungen