Beruflich Dokumente

Kultur Dokumente

SV150 Top Ten Lists 04 24 2016

Hochgeladen von

BayAreaNewsGroup0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

60 Ansichten1 SeiteSV150 top 10 lists published April 2016, covering SV150 companies with data from 2015.

Originaltitel

SV150-top-ten-lists-04-24-2016

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenSV150 top 10 lists published April 2016, covering SV150 companies with data from 2015.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

60 Ansichten1 SeiteSV150 Top Ten Lists 04 24 2016

Hochgeladen von

BayAreaNewsGroupSV150 top 10 lists published April 2016, covering SV150 companies with data from 2015.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

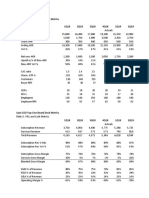

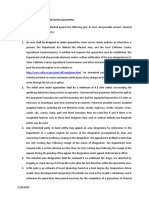

SUNDAY, APRIL 24, 2016 001 BAY AREA NEWS GROUP E9

SV150 TOP 10 LISTS

SALES

Sales growth for the SV150 slipped to 6.8% in 2015 from 10.5%

WORKFORCE

The SV150 boosted total employment in 2015 to a record 1.43

SALES PER EMPLOYEE

Sales per employee among the SV150 grew for a sixth year,

the year before. The number of companies reporting sales gains million jobs, up 4.5% from the year before. It was the biggest rising 2.2% to a record $582,634. Productivity rose at 77

fell to 106, down from 124 in 2014. Two of the top 10 sales gains increase in three years, with 7 out of every 10 SV150 companies companies, 50 of which managed increases in both sales and

were IPOs: Pure Storage, a supplier of cloud computing adding workers. For the third year in a row, the clean tech sector workforce. Five Prime Therapeutics had the biggest increase

technology, and Fitbit, the maker of wearable wireless fitness had the biggest percentage increase in employees, boosting its thanks to a deal with Bristol-Myers Squibb that came with an

monitoring devices. workforce by 13,565, or 50%. upfront payment of $350 million in the 2015 fourth quarter.

Biggest gains Biggest increases Biggest gains

SV150 2015 sales 1-year SV150 2015 1-year SV150 Sales per 1-year

Rank rank Company (millions) change Rank rank Company employees change Rank rank Company employee in 2015 change

1 103 Five Prime Therapeutics $380 1,875% 1 46 Fitbit* 1,101 135% 1 103 Five Prime Therapeutics $2,466,240 1477%

2 92 Silver Spring Networks 490 156% 2 120 Sunrun* 3,380 99% 2 92 Silver Spring Networks 750,857 126%

3 96 Pure Storage* 440 152% 3 49 Cypress Semiconductor 6,279 87% 3 13 eBay 740,690 58%

4 46 Fitbit* 1,858 149% 4 100 SolarCity 15,273 69% 4 96 Pure Storage* 338,718 55%

5 49 Cypress Semiconductor 1,608 122% 5 66 LendingClub 1,382 64% 5 133 Inphi 522,492 49%

6 66 LendingClub 980 99% 6 96 Pure Storage* 1,300 63% 6 40 Twitter 569,018 48%

7 142 Zendesk 209 64% 7 14 Netflix 3,500 60% 7 114 WageWorks 225,889 41%

8 150 TubeMogul 181 58% 8 48 GoPro 1,539 59% 8 148 Penumbra* 169,177 35%

9 40 Twitter 2,218 58% 9 142 Zendesk 1,268 57% 9 95 Rocket Fuel 483,895 33%

10 133 Inphi 247 58% 10 60 Pandora Media 2,219 57% 10 56 Square* 874,478 32%

Biggest drops Biggest cuts Biggest drops

SV150 2015 sales 1-year SV150 2015 1-year SV150 Sales per 1-year

Rank rank Company (millions) change Rank rank Company employees change Rank rank Company employee in 2015 change

1 50 SunPower $1,577 -48% 1 29 Agilent Technologies 11,800 -45% 1 50 SunPower $421,155 -55%

2 138 LeapFrog Enterprises 223 -38% 2 13 eBay 11,600 -38% 2 112 Depomed 1,204,821 -42%

3 29 Agilent Technologies 4,040 -36% 3 54 Viavi Solutions 3,200 -37% 3 138 LeapFrog Enterprises 625,399 -32%

4 30 Advanced Micro Devices 3,991 -28% 4 118 Aviat Networks 740 -23% 4 82 Ubiquiti Networks 1,947,314 -28%

5 54 Viavi Solutions 1,300 -25% 5 52 Fairchild Semiconductor 6,379 -23% 5 10 Synnex 237,543 -28%

6 21 Symantec 5,424 -18% 6 24 Yahoo 10,400 -17% 6 48 GoPro 1,437,325 -27%

7 59 Atmel 1,173 -17% 7 77 Zynga 1,669 -15% 7 128 Tessera Technologies 1,373,433 -25%

8 20 SanDisk 5,565 -16% 8 86 Extreme Networks 1,351 -14% 8 14 Netflix 2,514,690 -23%

9 104 Harmonic 377 -13% 9 114 WageWorks 1,480 -12% 9 120 Sunrun* 116,798 -23%

10 112 Depomed 343 -12% 10 59 Atmel 4,700 -10% 10 30 Advanced Micro Devices 567,629 -23%

BIGGEST PROFIT GAINS BEST PROFIT MARGINS

Net profit for the SV150 rose 4.1 percent in 2015 to a record Profit margin is net profit divided by sales. The SV150's profit

BEST NET LOSSES

Four out of every 10 companies in the SV150 recorded net

$133 billion. That followed a 23% jump in profits the year before margin dropped to 16% from a record 16.4% the year before, but losses in 2015. The biggest came from Yahoo, which reported a

that was the fastest growth since 2010. The number of was still the third best margin on record. Net profit can be net loss of $4.36 billion due primarily from wrtiting down $4.46

companies that were profitable slipped to 86, down from 87 the dramatically affected by accounting events. Rambus, for billion in the value of its goodwill, but Yahoo also used up $2.4

year before. Gilead Sciences had a $6 billion jump in profits that example, recorded a $151.2 million tax benefit from the release billion of its cash to run operations in 2015 and is currently

was 50% higher than the year before on a 31% increase in sales. of the valuation allowance on deferred taxes. contemplating selling some or all of itself.

2015

SV150 2015 net profit 1-year SV150 2015 net profit profit SV150 2015 net profit 1-year

Rank rank Company (millions) change Rank rank Company (millions) margin Rank rank Company (millions) change

1 1 Apple $53,731 $9,269 1 123 Rambus $211 71% 1 24 Yahoo ($4,359) -$11,881

2 8 Gilead Sciences 18,108 6,007 2 103 Five Prime Therapeutics 250 66% 2 28 Tesla Motors (889) -595

3 6 Cisco Systems 10,333 1,680 3 8 Gilead Sciences 18,108 56% 3 30 Advanced Micro Devices (660) -257

4 13 eBay 1,725 1,679 4 128 Tessera Technologies 117 43% 4 81 FireEye (539) -95

5 2 Alphabet 15,897 1,453 5 51 Linear Technology 502 35% 5 40 Twitter (521) 57

6 12 PayPal Holdings 1,228 809 6 68 Medivation 245 26% 6 49 Cypress Semiconductor (384) -402

7 9 Facebook 3,670 745 7 35 Intuitive Surgical 589 25% 7 61 Workday (290) -42

8 22 Adobe Systems 799 508 8 82 Ubiquiti Networks 149 25% 8 79 Splunk (279) -62

9 4 Hewlett Packard Enterprise 2,181 428 9 41 Xilinx 541 25% 9 96 Pure Storage* (214) -31

10 123 Rambus 211 185 10 7 Oracle 8,844 24% 10 56 Square* (212) -58

BIGGEST CHANGES MARKET VALUE- BALANCE

IN MARKET VALUES TO-SALES RATIO SHEETS

The combined market value of companies in the SV150 rose a One way to see how investors value a company is by looking at The SV150 generated a combined $216 billion in cash from their

scant 0.8% over the last year to $2.94 trillion, after rising more what they are willing to pay for it relative to its sales. Investors operations in 2015, up from the year before by 5.5%. That was

than 20% the year before. The largest company among the top valued the SV150 as a group at 3.5 times sales as of March 31, about a third of the 16.2% gain produced in 2014. The cash

10 gainers was Netflix, which saw its value rise 75% over the last down from 3.7 times sales the year before. Facebook once again helped the SV150 fund $122.5 billion in stock buybacks and

year to $43.8 billion. Among those that lost the most value was was the most highly valued company at 18 times its current annual dividends, down 9 percent from the year before, and $10 billion in

the social networking and microblogging company Twitter, which sales. Compare that with Apple, the SV150's No. 1 company, which acquisitions, down 65% from 2014. The SV150 also increased

lost nearly two-thirds of its value despite a 58% gain in sales. trades at a relative bargain of 2.6 times annual sales. total debt by more than 30% for the second year in a row to

$285 billion.

Biggest gains Most valued Biggest pile of cash, investments

SV150 Market value 1-year SV150 Market value Value-to- SV150 Cash, investments 1-year

Rank rank Company (millions) change Rank rank Company (millions) sales ratio Rank rank Company (millions) change

1 110 Oclaro $600 178% 1 9 Facebook $324,761 18.1 1 1 Apple $205,666 16%

2 113 NeoPhotonics 577 161% 2 61 Workday 14,984 12.9 2 2 Alphabet 78,249 16%

3 133 Inphi 1,330 97% 3 62 Palo Alto Networks 14,417 12.5 3 6 Cisco Systems 64,274 14%

4 103 Five Prime Therapeutics 1,132 94% 4 102 Guidewire Software 3,926 9.9 4 7 Oracle 54,368 24%

5 14 Netflix 43,763 74% 5 65 ServiceNow 9,875 9.8 5 24 Yahoo 38,005 -24%

6 34 Equinix 22,827 74% 6 79 Splunk 6,477 9.7 6 3 Intel 31,574 36%

7 92 Silver Spring Networks 751 70% 7 35 Intuitive Surgical 22,646 9.5 7 8 Gilead Sciences 26,208 124%

8 23 Nvidia 19,312 68% 8 22 Adobe Systems 46,920 9.3 8 9 Facebook 18,434 65%

9 76 Coherent 2,585 61% 9 142 Zendesk 1,894 9.1 9 13 eBay 9,522 -39%

10 139 Gigamon 1,069 52% 10 98 Cavium 3,504 8.5 10 4 Hewlett Packard Enterprise 8,505 NA**

Biggest declines Least valued Biggest debt levels

SV150 Market value 1-year SV150 Market value Value-to- SV150 Total debt 1-year

Rank rank Company (millions) change Rank rank Company (millions) sales ratio Rank rank Company (millions) change

1 48 GoPro $1,637 -71% 1 118 Aviat Networks $45 0.1 1 1 Apple $64,462 77%

2 95 Rocket Fuel 137 -65% 2 10 Synnex 3,674 0.3 2 7 Oracle 41,958 30%

3 40 Twitter 11,547 -64% 3 17 Sanmina-SCI 1,805 0.3 3 6 Cisco Systems 25,354 24%

4 104 Harmonic 253 -62% 4 95 Rocket Fuel 137 0.3 4 3 Intel 22,670 65%

5 90 Quantum 161 -61% 5 138 Leapfrog Enterprises 71 0.3 5 8 Gilead Sciences 22,180 79%

6 116 Nimble Storage 659 -60% 6 90 Quantum 161 0.3 6 4 Hewlett Packard Enterprise 15,229 NA**

7 119 Barracuda Networks 818 -60% 7 94 Ultra Clean 174 0.4 7 13 eBay 6,779 -11%

8 83 Yelp 1,512 -57% 8 5 HP 21,272 0.4 8 5 HP 6,683 -65%

9 66 LendingClub 3,166 -57% 9 84 Silicon Graphics 254 0.5 9 34 Equinix 6,521 39%

10 146 Natera* 484 -56% 10 126 QuinStreet 155 0.5 10 2 Alphabet 5,220 0%

* Company held its initial public offering in 2015

** Figure not available. Company spun off from Hewlett-Packard in 2015.

Das könnte Ihnen auch gefallen

- 15sv150 ProfitsDokument1 Seite15sv150 ProfitsBayAreaNewsGroupNoch keine Bewertungen

- Managerial Accounting and The Business Environment: Garrison, Noreen, Brewer, Cheng & YuenDokument47 SeitenManagerial Accounting and The Business Environment: Garrison, Noreen, Brewer, Cheng & YuenYasmine MagdiNoch keine Bewertungen

- SV150 Top 10 042212Dokument1 SeiteSV150 Top 10 042212Chris FentonNoch keine Bewertungen

- Chap 001 Managerial AccountingDokument47 SeitenChap 001 Managerial AccountingTina Dulla100% (1)

- Annies Way PhilsDokument20 SeitenAnnies Way PhilsgilbertlauengcoNoch keine Bewertungen

- Kellblog SaaS Dashboards, One Slide and Two SlideDokument12 SeitenKellblog SaaS Dashboards, One Slide and Two SlideramblingmanNoch keine Bewertungen

- Name Company Years Data GatheringDokument59 SeitenName Company Years Data GatheringJessa Sabrina AvilaNoch keine Bewertungen

- Project Finance - Test - QuestionDokument18 SeitenProject Finance - Test - QuestionDeepika67% (3)

- Project Finance Test QuestionDokument18 SeitenProject Finance Test QuestionKAVYA GUPTANoch keine Bewertungen

- SaaS Financial Model Template by ChargebeeDokument15 SeitenSaaS Financial Model Template by ChargebeeNikunj Borad0% (1)

- Driving Six Sigma in Business - C R Nagaraj - Wipro LimitDokument47 SeitenDriving Six Sigma in Business - C R Nagaraj - Wipro Limitsandhya vNoch keine Bewertungen

- Cash Flow Real Life Company AnalysisDokument20 SeitenCash Flow Real Life Company AnalysisKedar MangrolaNoch keine Bewertungen

- Dashboard Excel KpiDokument20 SeitenDashboard Excel KpiDaniel PagliardiniNoch keine Bewertungen

- Trend Analysis: Income StatementDokument7 SeitenTrend Analysis: Income StatementHamza AmjedNoch keine Bewertungen

- Accounting Firm PL and KPIs 1Dokument6 SeitenAccounting Firm PL and KPIs 1Creanga GeorgianNoch keine Bewertungen

- ATAR Model 1 1Dokument19 SeitenATAR Model 1 1Randel Christian AmoraNoch keine Bewertungen

- Leoncio PumaDokument7 SeitenLeoncio PumaFaye Arlene Ninez Galano-SandigNoch keine Bewertungen

- Worksheet in GlobalFree-CashBank - Case Study - 2018Dokument2 SeitenWorksheet in GlobalFree-CashBank - Case Study - 2018rashmianand712Noch keine Bewertungen

- Creating Bar Charts With Single Series of Data: Period SalesDokument8 SeitenCreating Bar Charts With Single Series of Data: Period Saleslakshmi PurushothmanNoch keine Bewertungen

- 2 FMC Business Update - 2011 Review - 2012 PreviewDokument4 Seiten2 FMC Business Update - 2011 Review - 2012 PreviewINGENIERIANoch keine Bewertungen

- Case For Project FinanceDokument21 SeitenCase For Project FinanceKARIMSETTY DURGA NAGA PRAVALLIKANoch keine Bewertungen

- Tata Motors PresentationDokument121 SeitenTata Motors PresentationSrikanth Reddy VemulaNoch keine Bewertungen

- Manufacturing Conference & Expo 2017 BOPP Film Lolita Plant ReportDokument54 SeitenManufacturing Conference & Expo 2017 BOPP Film Lolita Plant ReportayaanNoch keine Bewertungen

- Introduction of Company: Manufacturing FacilitiesDokument49 SeitenIntroduction of Company: Manufacturing FacilitiesJigar PatelNoch keine Bewertungen

- Technofunda Investing Excel Analysis - Version 1.0: Go To Overview TabDokument27 SeitenTechnofunda Investing Excel Analysis - Version 1.0: Go To Overview TabHarishNoch keine Bewertungen

- Opportunity Stages Forecasting: What Is Sales Forecasting?Dokument6 SeitenOpportunity Stages Forecasting: What Is Sales Forecasting?Aleema KhanNoch keine Bewertungen

- CMD Best Practices - 2016Dokument45 SeitenCMD Best Practices - 2016DearRed FrankNoch keine Bewertungen

- Vaibhav Chaurasia PGMB1950 Learning and Case Analysis of Session 19 Topic - Information and Sales ManagementDokument4 SeitenVaibhav Chaurasia PGMB1950 Learning and Case Analysis of Session 19 Topic - Information and Sales Managementvaibhav chaurasiaNoch keine Bewertungen

- BWY Suzanne P L-1Dokument56 SeitenBWY Suzanne P L-1muhammadasif961Noch keine Bewertungen

- Clivet VRFDokument70 SeitenClivet VRFremigius yudhiNoch keine Bewertungen

- Ballerina Tech Assumptions & SummaryDokument48 SeitenBallerina Tech Assumptions & Summaryapi-25978665Noch keine Bewertungen

- Tumble Dry Project Financial ReportDokument3 SeitenTumble Dry Project Financial ReportAkash SanganiNoch keine Bewertungen

- Practise Question Chap 11Dokument20 SeitenPractise Question Chap 11SaadNoch keine Bewertungen

- Chicago SaharsaDokument6 SeitenChicago SaharsaShail DokaniaNoch keine Bewertungen

- Vlookup and HlookupDokument3 SeitenVlookup and Hlookupratnesh86422937Noch keine Bewertungen

- 74 - KPI Dashboard Revisited I - RelationshipsDokument4 Seiten74 - KPI Dashboard Revisited I - RelationshipsMarcelo BuchNoch keine Bewertungen

- Wipro - Presentation To Investors: October 22, 2010Dokument31 SeitenWipro - Presentation To Investors: October 22, 2010Bansi ShahNoch keine Bewertungen

- Pengajuan Dispensasi Promo Lokal Wings Biru, PT. LDR 1Dokument29 SeitenPengajuan Dispensasi Promo Lokal Wings Biru, PT. LDR 1bung bungNoch keine Bewertungen

- October 2016 EIS Tables 8.1-8.5 PDFDokument5 SeitenOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNoch keine Bewertungen

- October 2016 EIS Tables 8.1-8.5 PDFDokument5 SeitenOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNoch keine Bewertungen

- October 2016 EIS Tables 8.1-8.5 PDFDokument5 SeitenOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNoch keine Bewertungen

- Financial AnalysisDokument7 SeitenFinancial AnalysisDead ShotNoch keine Bewertungen

- 7 Measures of Performance in Lean KPI Tool AdaptiveBMSDokument6 Seiten7 Measures of Performance in Lean KPI Tool AdaptiveBMSSadhish KannanNoch keine Bewertungen

- Finance Assessment 2003Dokument19 SeitenFinance Assessment 2003Avinash NarayanaNoch keine Bewertungen

- Case15 SpotfireDokument6 SeitenCase15 SpotfireSteven Gonzalez0% (1)

- Checklist - Roto Pumps Limited FY 18-19Dokument6 SeitenChecklist - Roto Pumps Limited FY 18-19Shubham SinuNoch keine Bewertungen

- The 2010 D.C. 25Dokument1 SeiteThe 2010 D.C. 25NationalLawJournalNoch keine Bewertungen

- Equty Analysis by Rameez Fazal Tayyeba JayanthDokument17 SeitenEquty Analysis by Rameez Fazal Tayyeba JayanthtayyebaNoch keine Bewertungen

- 7 Measures of Performance in Lean KPI Tool AdaptiveBMSDokument6 Seiten7 Measures of Performance in Lean KPI Tool AdaptiveBMSDIEGO2109Noch keine Bewertungen

- Q4-One Page Recovery Plan-2017Dokument72 SeitenQ4-One Page Recovery Plan-2017BilalAwanNoch keine Bewertungen

- PYN Elite Presentation enDokument19 SeitenPYN Elite Presentation enHiep KhongNoch keine Bewertungen

- Lazy NRR and Cohort NRR J r3.0Dokument15 SeitenLazy NRR and Cohort NRR J r3.0dionNoch keine Bewertungen

- TechnoFunda Investing Screener Excel Template - VFDokument27 SeitenTechnoFunda Investing Screener Excel Template - VFEverything Simplified0% (1)

- Factory - Kpi Dashboard RevistedDokument20 SeitenFactory - Kpi Dashboard RevistedAhmad KhalifaNoch keine Bewertungen

- Align Technologies (ALGN) ReportDokument14 SeitenAlign Technologies (ALGN) ReportMike RousselNoch keine Bewertungen

- Inversión Promedio %Dokument3 SeitenInversión Promedio %Sergio Bautista PeñaNoch keine Bewertungen

- Gemba Kaizen: A Commonsense, Low-Cost Approach to ManagementVon EverandGemba Kaizen: A Commonsense, Low-Cost Approach to ManagementNoch keine Bewertungen

- TPM - A Route to World Class Performance: A Route to World Class PerformanceVon EverandTPM - A Route to World Class Performance: A Route to World Class PerformanceBewertung: 4 von 5 Sternen4/5 (5)

- Life-Cycle Costing: Using Activity-Based Costing and Monte Carlo Methods to Manage Future Costs and RisksVon EverandLife-Cycle Costing: Using Activity-Based Costing and Monte Carlo Methods to Manage Future Costs and RisksNoch keine Bewertungen

- Santa Clara Findings Report FinalDokument11 SeitenSanta Clara Findings Report FinalBayAreaNewsGroup100% (3)

- Complaint For Breach of Pac-12 BylawsDokument16 SeitenComplaint For Breach of Pac-12 BylawsBayAreaNewsGroup100% (2)

- What We Watched A Netflix Engagement Report 2023Jan-JunDokument849 SeitenWhat We Watched A Netflix Engagement Report 2023Jan-JunBayAreaNewsGroupNoch keine Bewertungen

- Follow-Up Letter To SCC Re 16 Uncounted VotesDokument3 SeitenFollow-Up Letter To SCC Re 16 Uncounted VotesBayAreaNewsGroupNoch keine Bewertungen

- Pac-12 Settlement AgreementDokument31 SeitenPac-12 Settlement AgreementBayAreaNewsGroupNoch keine Bewertungen

- 4.28.23 Santa Clara County SSA DFCS Response Letter Re Site VisitDokument21 Seiten4.28.23 Santa Clara County SSA DFCS Response Letter Re Site VisitBayAreaNewsGroupNoch keine Bewertungen

- Darcy Paul Attorney LetterDokument3 SeitenDarcy Paul Attorney LetterBayAreaNewsGroupNoch keine Bewertungen

- Brian Doyle Vs City of Santa ClaraDokument13 SeitenBrian Doyle Vs City of Santa ClaraBayAreaNewsGroupNoch keine Bewertungen

- Antioch Mayor Calls For Immediate Firing of Officers Involved in Racist Text ScandalDokument2 SeitenAntioch Mayor Calls For Immediate Firing of Officers Involved in Racist Text ScandalBayAreaNewsGroupNoch keine Bewertungen

- Cupertino City Attorney ResponseDokument3 SeitenCupertino City Attorney ResponseBayAreaNewsGroupNoch keine Bewertungen

- Read Trump Indictment Related To Hush Money PaymentDokument16 SeitenRead Trump Indictment Related To Hush Money PaymentBayAreaNewsGroup100% (1)

- Sent Via Electronic Mail Only To:: O S S E D Deborah ScrogginDokument3 SeitenSent Via Electronic Mail Only To:: O S S E D Deborah ScrogginBayAreaNewsGroupNoch keine Bewertungen

- Los MeDanos Community Healthcare District ReportDokument44 SeitenLos MeDanos Community Healthcare District ReportBayAreaNewsGroupNoch keine Bewertungen

- California Energy Commission Chair David Hochschild's Letter To Major Oil CompaniesDokument4 SeitenCalifornia Energy Commission Chair David Hochschild's Letter To Major Oil CompaniesBayAreaNewsGroupNoch keine Bewertungen

- Federal Analysis of The BART's San Jose ExtensionDokument145 SeitenFederal Analysis of The BART's San Jose ExtensionBayAreaNewsGroupNoch keine Bewertungen

- Read Trump Indictment Statement of Facts Related To Hush Money PaymentDokument13 SeitenRead Trump Indictment Statement of Facts Related To Hush Money PaymentBayAreaNewsGroup100% (1)

- George Santos IndictmentDokument20 SeitenGeorge Santos IndictmentBayAreaNewsGroupNoch keine Bewertungen

- Memo From Outgoing Interim SJSU President Sue Martin To Incoming President Papazian in 2016Dokument5 SeitenMemo From Outgoing Interim SJSU President Sue Martin To Incoming President Papazian in 2016BayAreaNewsGroupNoch keine Bewertungen

- San Jose State Investigation of Former Gymnastics CoachDokument40 SeitenSan Jose State Investigation of Former Gymnastics CoachBayAreaNewsGroupNoch keine Bewertungen

- Personnel Complaint Opa 2018-012 Investigator: Sergeant Josh ClarkDokument25 SeitenPersonnel Complaint Opa 2018-012 Investigator: Sergeant Josh ClarkBayAreaNewsGroupNoch keine Bewertungen

- Richmond Police Department: MemorandumDokument11 SeitenRichmond Police Department: MemorandumBayAreaNewsGroupNoch keine Bewertungen

- Marie Tuite Response 02.04.22Dokument3 SeitenMarie Tuite Response 02.04.22BayAreaNewsGroupNoch keine Bewertungen

- Richmond PD Use of Force Report: Nathan Tanner MyersDokument32 SeitenRichmond PD Use of Force Report: Nathan Tanner MyersBayAreaNewsGroupNoch keine Bewertungen

- Case # 2019-00014491 - Supplement - 2 Report: NarrativeDokument4 SeitenCase # 2019-00014491 - Supplement - 2 Report: NarrativeBayAreaNewsGroupNoch keine Bewertungen

- Richmondpolicedeptbrandonhodges02132018 - Report RedactedDokument32 SeitenRichmondpolicedeptbrandonhodges02132018 - Report RedactedBayAreaNewsGroupNoch keine Bewertungen

- March 9, 2019 - KhalfanDokument24 SeitenMarch 9, 2019 - KhalfanBayAreaNewsGroupNoch keine Bewertungen

- Mlslistings Inc - Recent Solds Data: Complied For: Bay Area News Group (Bang) For Week ofDokument14 SeitenMlslistings Inc - Recent Solds Data: Complied For: Bay Area News Group (Bang) For Week ofBayAreaNewsGroupNoch keine Bewertungen

- Fly QuarantineDokument14 SeitenFly QuarantineBayAreaNewsGroupNoch keine Bewertungen

- 10.03.21 SJMNDokument24 Seiten10.03.21 SJMNBayAreaNewsGroupNoch keine Bewertungen

- Richmondpolicedeptbrandonhodges12282019 Officer Hodges k9 Supp RedactedDokument4 SeitenRichmondpolicedeptbrandonhodges12282019 Officer Hodges k9 Supp RedactedBayAreaNewsGroupNoch keine Bewertungen

- B Cisco Nexus 9000 Series NX-OS System Management Configuration Guide 7x Chapter 011100Dokument16 SeitenB Cisco Nexus 9000 Series NX-OS System Management Configuration Guide 7x Chapter 011100RiyanSahaNoch keine Bewertungen

- Econstruct Issue 2Dokument40 SeitenEconstruct Issue 2ArNushiMahfodzNoch keine Bewertungen

- Nadir Qaiser Zong ProjectDokument42 SeitenNadir Qaiser Zong Projectloverboy_q_s80% (5)

- Study of Possibilities of Joint Application of Pareto Analysis and Risk Analysis During Corrective ActionsDokument4 SeitenStudy of Possibilities of Joint Application of Pareto Analysis and Risk Analysis During Corrective ActionsJoanna Gabrielle Cariño TrillesNoch keine Bewertungen

- DirectionalEQManual PDFDokument2 SeitenDirectionalEQManual PDFdorutNoch keine Bewertungen

- Seriales Dimension ProDokument6 SeitenSeriales Dimension ProAndres Obrecht100% (2)

- Excel ExerciseDokument296 SeitenExcel ExerciseshubhamNoch keine Bewertungen

- Flipkart CategoriesDokument15 SeitenFlipkart Categoriesramanjaneya reddyNoch keine Bewertungen

- 95 Shortcuts For Windows Run Commands Keyboard Shortcuts PDFDokument7 Seiten95 Shortcuts For Windows Run Commands Keyboard Shortcuts PDFsreekanthNoch keine Bewertungen

- Feature Evaluation For Web Crawler Detection With Data Mining TechniquesDokument11 SeitenFeature Evaluation For Web Crawler Detection With Data Mining TechniquesSlava ShkolyarNoch keine Bewertungen

- Asml 20110808 Careers Brochure ASML NLDokument12 SeitenAsml 20110808 Careers Brochure ASML NLerkin1989Noch keine Bewertungen

- HP48 RepairsDokument7 SeitenHP48 Repairsflgrhn100% (1)

- Hamidavi Et Al 2020 - Towards Intelligent Structural Design of Buildings ADokument15 SeitenHamidavi Et Al 2020 - Towards Intelligent Structural Design of Buildings ARober Waldir Quispe UlloaNoch keine Bewertungen

- This Release Contains:: How To Upgrade From Previous VersionsDokument8 SeitenThis Release Contains:: How To Upgrade From Previous Versionsayxworks eurobotsNoch keine Bewertungen

- BCI ICT ResilienceDokument57 SeitenBCI ICT ResilienceOana DragusinNoch keine Bewertungen

- Matlab 5Dokument38 SeitenMatlab 5Shruti YashNoch keine Bewertungen

- FAA Safety Briefing Nov-Dec 2017 PDFDokument36 SeitenFAA Safety Briefing Nov-Dec 2017 PDFAllison JacobsonNoch keine Bewertungen

- Devops ResumeDokument5 SeitenDevops ResumeEkant BajajNoch keine Bewertungen

- Lenovo G460e Compal LA-7011P PAW10 Rev1.0A SchematicDokument41 SeitenLenovo G460e Compal LA-7011P PAW10 Rev1.0A Schematicserrano.flia.coNoch keine Bewertungen

- International Molecular Pathology Catalog 2020Dokument222 SeitenInternational Molecular Pathology Catalog 2020nam7124119Noch keine Bewertungen

- Annex 4 (Word Format)Dokument1 SeiteAnnex 4 (Word Format)Amores, ArmandoNoch keine Bewertungen

- Cppsim Primer3Dokument61 SeitenCppsim Primer3jit20088791Noch keine Bewertungen

- Engine Control Unit Type ECU 4/G: MTU/DDC Series 4000 Genset ApplicationsDokument62 SeitenEngine Control Unit Type ECU 4/G: MTU/DDC Series 4000 Genset ApplicationsGeorge Barsoum100% (3)

- Upload 1 Document To Download: Kill Team 2021 - Core BookDokument4 SeitenUpload 1 Document To Download: Kill Team 2021 - Core BookgoneoNoch keine Bewertungen

- Admit CardDokument1 SeiteAdmit CardMohammed ArshadNoch keine Bewertungen

- ETSI TS 138 215: 5G NR Physical Layer Measurements (3GPP TS 38.215 Version 17.3.0 Release 17)Dokument33 SeitenETSI TS 138 215: 5G NR Physical Layer Measurements (3GPP TS 38.215 Version 17.3.0 Release 17)rkaul2763Noch keine Bewertungen

- Winning Lotto Secrets BookDokument157 SeitenWinning Lotto Secrets Bookkhundalini67% (3)

- HRM ProjectDokument26 SeitenHRM ProjectJayShah100% (1)

- Coupling and CohesionDokument2 SeitenCoupling and CohesionDebadatta GadanayakNoch keine Bewertungen

- A New Method For Encryption Using Fuzzy Set TheoryDokument7 SeitenA New Method For Encryption Using Fuzzy Set TheoryAgus S'toNoch keine Bewertungen