Beruflich Dokumente

Kultur Dokumente

HSL PCG "Currency Daily": 01 December, 2016

Hochgeladen von

khaniyalalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HSL PCG "Currency Daily": 01 December, 2016

Hochgeladen von

khaniyalalCopyright:

Verfügbare Formate

HSL PCG CURRENCY DAILY

01 December, 2016

PRIVATE CLIENT GROUP [PCG]

MAJOR CURRENCY

VIEW POINT

Prev. Rupee Strengthens on Higher Equity

Close Chg. % Chg.

Close

USDINR 68.389 68.655 -0.266 -0.39% The Indian rupee yesterday closed at a one week high against the US dollar

DXY INDX 101.470 100.96 0.510 0.51% after domestic equity markets gained for the fourth consecutive session.

EURUSD 1.060 1.065 -0.005 -0.48% This was the second consecutive sessions when the rupee closed higher.

GBPUSD 1.252 1.244 0.008 0.67% The rupee closed at 68.39 a dollar--a level last seen on 22 November, up

USDJPY 114.340 113.28 1.060 0.94% 0.39% from its previous close of 68.66. In last four sessions, Sensex

gained 3.1% or 793 points. Yesterday, Benchmark Sensex index closed at

DG USDINR 68.747 68.597 0.150 0.22%

26,652.81 points--up 0.98% or 258.80 points from its previous close.

GLOBAL INDICES The benchmark 10-year government bond yield closed at 6.247%,

compared to Tuesday's close of 6.319%.

The rupees 2.4% plunge in a single month meant an anxious November for

Prev. treasurers at Indian companies that havent hedged their overseas debts.

Close Chg. % Chg.

Close The rupee plunged to an all-time low of 68.8650 per dollar on Nov. 24,

SGX NIFTY 8262.5 8240.0 23 0.27% while a measure of expectations for volatility in the coming month climbed

NIFTY 8224.5 8142.2 82 1.01% 167 basis points in November to 6.21%, the most since August 2015.

Indias GDP Misses the Expectation

SENSEX 26652.8 26394.0 259 0.98%

India's GDP (Gross Domestic Product) for the second quarter of FY17 grew

HANG-SENG 22988.0 22789.8 198 0.87% at 7.3% versus 7.1% quarter-on-quarter and 7.6% year-on-year. There are

NIKKEI 18722.4 18308.5 414 2.26% minor improvements in agriculture, construction and public administration.

SHANGHAI 3270.2 3250.0 20 0.62% The fall in the growth of manufacturing, electricity and services is

particularly disappointing. This may be due to continued weakening of

S&P INDEX 2198.8 2204.7 -6 -0.27% investment demand and near-stagnation of export demand.

DOW JONES 19123.6 19121.6 2 0.01% According to the national income data, private final consumption

NASDAQ 5323.7 5379.9 -56 -1.05% expenditure (PFCE) during July-September at constant 2011-12 prices a

scale to measure household spending was estimated at Rs 16.2 lakh

FTSE 6783.8 6772.0 12 0.17%

crores, or about 54.9% of GDP.

CAC 4578.3 4551.5 27 0.59% The manufacturing sector grew 3.3% during the quarter from 9.2% in the

DAX 10640.3 10620.5 20 0.19% same quarter of the previous year and 9.1% April to June. Growth in the

construction sector, a large employer for unskilled labourers, grew 3.5% in

INSTITUTIONAL ACTIVITY (Provisional Rs. In Cr) July-September from 0.8% in the same period of 2015 and 1.5% in April-

June 2016.

Yen slips to 9-month low vs. dollar

Segment 30-Nov-16 29-Nov-16 The U.S. dollar hits 9 month highs against the yen as oil prices surged

after OPEC agreed to output cuts - lifting inflation expectations and U.S.

Equity -652.75 -1366.85

bond yields. The dollar surpass last week's peak of 113.90 to trade at

Debt -988.00 -3522.25 114.59 yen after hitting a nine-month high of 114.83 yen overnight. Oil

prices jumped around 9% yesterday after OPEC members agreed to cut

production to 32.5 mbpd.

PRIVATE CLIENT GROUP [PCG]

The dollar's index rose to 101.60, edging close to last week's high of 102.05, which was its highest level since March 2003. US Treasury

yields higher, fuelled by demand for the dollar relative to currencies such as the euro and yen, whose government bond yields are still

low-to-negative.

However, Bloomberg Barclays Global Aggregate total return index fell 4%, biggest decline since index started in 1990. The index market

value fell $1.73 tln to $45.1 tln.

TECHNICAL OUTLOOK

USDINR DEC. FUTURE DAILY CHART

Technical Observations

The USDINR December future registers loss for second consecutive session. The pair closes at 68.56 with the loss of 0.27%.

The pair sustaining above short term moving averages and continues forming higher highs and lows, indicating continuation of

upward move. However, the negative divergence by oscillators on daily scale suggesting short term weakness in the pair.

In short term, pair could fell to level of 68.25 while trading above 69.10 will negate the short term bearish view.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

Near Month Fut. Last Pivot S3 S2 S1 R1 R2 R3 View For The Day

USDINR 68.56 68.63 68.14 68.33 68.44 68.74 68.93 69.04 Consolidation

EURINR 73.12 73.10 72.69 72.82 72.97 73.25 73.38 73.53 Bearish

GBPINR 85.30 85.47 84.41 84.82 85.06 85.71 86.12 86.36 Bullish

JPYINR 60.73 60.88 60.10 60.41 60.57 61.04 61.35 61.51 Bearish

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 68.86 68.02 68.86 66.34 68.86 66.07 68.61 67.68 67.12 67.05 67.12

EURINR 72.96 72.15 75.64 72.07 77.49 70.36 72.78 73.09 73.66 74.20 74.78

GBPINR 85.90 83.88 86.00 80.89 101.87 80.89 85.42 84.26 83.68 85.90 90.52

JPYINR 61.78 60.20 66.11 60.20 68.11 53.86 60.84 62.37 63.76 64.52 63.10

CURRENCY MOVEMENT

Open Chg. In

Currency Open High Low Close Chg. Chg. in OI Volume

Interest Volume

SPOT USDINR 68.68 68.68 68.37 68.39 -0.27 -- -- -- --

USDINR DEC. FUT. 68.82 68.82 68.52 68.56 -0.27 1535340 69970 1638300 878549

SPOT EURINR 73.01 73.03 72.73 72.90 0.10 -- -- -- --

EURINR DEC. FUT. 73.18 73.23 72.95 73.12 0.08 36637 1202 45161 12722

SPOT GBPINR 85.66 85.69 85.02 85.07 -0.53 -- -- -- --

GBPINR DEC. FUT. 85.86 85.88 85.23 85.30 -0.59 24859 -2511 43140 -4408

SPOT JPYINR 60.93 60.98 60.44 60.45 -0.52 -- -- -- --

JPYINR DEC. FUT. 61.16 61.19 60.72 60.73 -0.50 23445 5288 34349 9266

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

11/30/2016 15:30 EC CPI Core YoY Nov A -- 0.80% 0.80%

11/30/2016 16:30 IN Fiscal Deficit INR Crores Oct -- -24481 40168

11/30/2016 17:30 US MBA Mortgage Applications 25-Nov -- -9.40% 5.50%

11/30/2016 17:30 IN GDP YoY 3Q 7.50% 7.30% 7.10%

11/30/2016 17:30 IN GVA YoY 3Q 7.20% 7.10% 7.30%

11/30/2016 18:45 US ADP Employment Change Nov 160k 216k 147k

11/30/2016 19:00 US Personal Income Oct 0.40% 0.60% 0.30%

11/30/2016 19:00 US Personal Spending Oct 0.50% 0.30% 0.50%

11/30/2016 19:00 US PCE Deflator YoY Oct 1.50% 1.40% 1.20%

11/30/2016 20:15 US Chicago Purchasing Manager Nov 52.00 57.6 50.60

11/30/2016 20:30 US Pending Home Sales NSA YoY Oct -- 0.20% 2.00%

12/01/2016 CH Mfg. PMI Nov 51 51.7 51.2

12/01/2016 CH Caixin Mfg. PMI Nov 51 50.9 51.2

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Prior

12/01/2016 10:30 IN Nikkei India PMI Mfg Nov -- 54.4

12/01/2016 14:30 EC Markit Eurozone Manufacturing PMI Nov F -- 53.7

12/01/2016 15:00 UK Markit UK PMI Manufacturing SA Nov 54.2 54.3

12/01/2016 15:30 EC Unemployment Rate Oct -- 10.00%

12/01/2016 19:00 US Initial Jobless Claims 26-Nov -- 251k

12/01/2016 19:00 US Continuing Claims 19-Nov -- 2043k

12/01/2016 20:15 US Markit US Manufacturing PMI Nov F -- 53.9

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

Das könnte Ihnen auch gefallen

- HSL PCG "Currency Daily": 30 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 30 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 29 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 29 November, 2016khaniyalalNoch keine Bewertungen

- Rupee Cheers as Carry Intact with RBI’s Status QuoDokument6 SeitenRupee Cheers as Carry Intact with RBI’s Status QuoshobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 16 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 02 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 02 December, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 17 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 17 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 23 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 23 December, 2016shobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 25 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 25 November, 2016khaniyalalNoch keine Bewertungen

- Currency Daily: Rupee Depreciation on Card After Fed's Rate HikeDokument6 SeitenCurrency Daily: Rupee Depreciation on Card After Fed's Rate HikeshobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 18 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 18 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG CURRENCY DAILY MARKET REVIEWDokument6 SeitenHSL PCG CURRENCY DAILY MARKET REVIEWkhaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 06 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 06 December, 2016shobhaNoch keine Bewertungen

- HSL PCG “CURRENCY DAILY” SummaryDokument6 SeitenHSL PCG “CURRENCY DAILY” SummarykhaniyalalNoch keine Bewertungen

- HSL PCG “CURRENCY DAILY” Focuses on Rupee StrengthDokument6 SeitenHSL PCG “CURRENCY DAILY” Focuses on Rupee StrengthDinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 16 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 16 December, 2016shobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 01 March, 2017Dokument6 SeitenHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 06 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 06 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 14 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 14 December, 2016shobhaNoch keine Bewertungen

- Currency Daily: Lower Inflation Supports Stronger RupeeDokument6 SeitenCurrency Daily: Lower Inflation Supports Stronger RupeeDinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 26 October, 2016Dokument6 SeitenHSL PCG "Currency Daily": 26 October, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 03 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- Currency Daily WrapDokument6 SeitenCurrency Daily WrapkhaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 18 October, 2016Dokument6 SeitenHSL PCG "Currency Daily": 18 October, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 03 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 03 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 19 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 19 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 09 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 29 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 29 December, 2016shobhaNoch keine Bewertungen

- HSL PCG Currency Daily BriefingDokument6 SeitenHSL PCG Currency Daily Briefingarun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 27 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 27 December, 2016shobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 28 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 28 December, 2016shobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 28 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG “CURRENCY DAILYDokument6 SeitenHSL PCG “CURRENCY DAILYarun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 02 March, 2017Dokument6 SeitenHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 17 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 05 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 05 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 31 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 31 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 12 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 12 January, 2017shobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 20 December, 2016Dokument6 SeitenHSL PCG "Currency Daily": 20 December, 2016shobhaNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 25 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 25 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG Currency Daily OutlookDokument6 SeitenHSL PCG Currency Daily Outlookarun_algoNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 08 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 17 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 17 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Daily": 23 February, 2017Dokument6 SeitenHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 03 March, 2017Dokument6 SeitenHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 11 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 11 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNoch keine Bewertungen

- HSL PCG "Currency Daily": 18 January, 2017Dokument6 SeitenHSL PCG "Currency Daily": 18 January, 2017arun_algoNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNoch keine Bewertungen

- HSL PCG Currency Daily ReportDokument6 SeitenHSL PCG Currency Daily ReportDinesh ChoudharyNoch keine Bewertungen

- Equities Update: MorningDokument2 SeitenEquities Update: MorningsfarithaNoch keine Bewertungen

- HSL PCG "Currency Daily": 08 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 08 November, 2016khaniyalalNoch keine Bewertungen

- Market Outlook For 09 Dec - Cautiously OptimisticDokument5 SeitenMarket Outlook For 09 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Currency Street: The Greenback Up Amidst Disappointing June DataDokument5 SeitenCurrency Street: The Greenback Up Amidst Disappointing June Dataविवेक कुमार मुकेशNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNoch keine Bewertungen

- Morning Notes 27 July 2010: Mansukh Securities and Finance LTDDokument5 SeitenMorning Notes 27 July 2010: Mansukh Securities and Finance LTDMansukhNoch keine Bewertungen

- Stock Market Outlook by Mansukh Investment & Trading Solutions 06/08/2010Dokument5 SeitenStock Market Outlook by Mansukh Investment & Trading Solutions 06/08/2010MansukhNoch keine Bewertungen

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaVon EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNoch keine Bewertungen

- HSL PCG "Currency Daily": 08 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 08 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 26 October, 2016Dokument6 SeitenHSL PCG "Currency Daily": 26 October, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 03 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 03 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 17 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 17 November, 2016khaniyalalNoch keine Bewertungen

- Currency Daily WrapDokument6 SeitenCurrency Daily WrapkhaniyalalNoch keine Bewertungen

- Indian Currency Market: Retail ResearchDokument6 SeitenIndian Currency Market: Retail ResearchkhaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 18 October, 2016Dokument6 SeitenHSL PCG "Currency Daily": 18 October, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Dokument16 SeitenHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNoch keine Bewertungen

- HSL PCG CURRENCY DAILY MARKET REVIEWDokument6 SeitenHSL PCG CURRENCY DAILY MARKET REVIEWkhaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 03 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 03 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG "Currency Daily": 18 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 18 November, 2016khaniyalalNoch keine Bewertungen

- HSL PCG “CURRENCY DAILY” SummaryDokument6 SeitenHSL PCG “CURRENCY DAILY” SummarykhaniyalalNoch keine Bewertungen

- Indian Currency Market: Retail ResearchDokument6 SeitenIndian Currency Market: Retail ResearchkhaniyalalNoch keine Bewertungen

- Indian Currency Market: Retail ResearchDokument6 SeitenIndian Currency Market: Retail ResearchshobhaNoch keine Bewertungen

- HSL PCG "Currency Daily": 25 November, 2016Dokument6 SeitenHSL PCG "Currency Daily": 25 November, 2016khaniyalalNoch keine Bewertungen

- Dish TV (Dishtv) : Continues To Disappoint On ARPUDokument10 SeitenDish TV (Dishtv) : Continues To Disappoint On ARPUarun_algoNoch keine Bewertungen

- Idirect Bel Q4fy16Dokument13 SeitenIdirect Bel Q4fy16khaniyalalNoch keine Bewertungen

- Bharat Electronics - ICICI DirectDokument5 SeitenBharat Electronics - ICICI DirectanjugaduNoch keine Bewertungen

- Bharat Electronics - ICICI DirectDokument5 SeitenBharat Electronics - ICICI DirectanjugaduNoch keine Bewertungen

- Sky high slippages dent Oriental Bank of Commerce marginsDokument11 SeitenSky high slippages dent Oriental Bank of Commerce marginsDinesh ChoudharyNoch keine Bewertungen

- Container Corporation (CONCOR) : Short Lived Temporary Problems Recovery AwaitedDokument10 SeitenContainer Corporation (CONCOR) : Short Lived Temporary Problems Recovery AwaitedkhaniyalalNoch keine Bewertungen

- Growth Sustains in May!!!: Motogaze June 2016Dokument16 SeitenGrowth Sustains in May!!!: Motogaze June 2016umaganNoch keine Bewertungen

- Near term trading pick KANSAI NEROLACDokument2 SeitenNear term trading pick KANSAI NEROLACkhaniyalalNoch keine Bewertungen

- Container Corporation (CONCOR) : Higher Exim Volume Buoys Earnings!!!Dokument10 SeitenContainer Corporation (CONCOR) : Higher Exim Volume Buoys Earnings!!!khaniyalalNoch keine Bewertungen

- Uvs & Scooters Drive Growth in June!!!: Motogaze July 2016Dokument16 SeitenUvs & Scooters Drive Growth in June!!!: Motogaze July 2016khaniyalalNoch keine Bewertungen

- Kasp Kas PrashnaDokument15 SeitenKasp Kas Prashnacarlos_heredia_10Noch keine Bewertungen

- Nhmfc-Waiver 2017 BlankDokument1 SeiteNhmfc-Waiver 2017 BlankSterling SamNoch keine Bewertungen

- The Tools of Monetary PolicyDokument53 SeitenThe Tools of Monetary Policyrichard kapimpaNoch keine Bewertungen

- 1.effect of Conv, Ease of Use in e WalletDokument10 Seiten1.effect of Conv, Ease of Use in e WalletHBC ONE SOLUTIONNoch keine Bewertungen

- Chapter-2 Review of Literature 110-143Dokument34 SeitenChapter-2 Review of Literature 110-143city9848835243 cyberNoch keine Bewertungen

- Nazi Monetary PolicyDokument5 SeitenNazi Monetary Policyapi-268107541Noch keine Bewertungen

- A Macroeconomic View of The Current Economy PDFDokument3 SeitenA Macroeconomic View of The Current Economy PDFSSamoNoch keine Bewertungen

- P&S Bylaw 2072 II Amendment in NepaliDokument27 SeitenP&S Bylaw 2072 II Amendment in NepaliNarayanPrajapatiNoch keine Bewertungen

- Solved in The Documentary Movie Expelled No Intelligence Allowed TherDokument1 SeiteSolved in The Documentary Movie Expelled No Intelligence Allowed TherAnbu jaromiaNoch keine Bewertungen

- Bank Statement June-August 2019Dokument1 SeiteBank Statement June-August 2019sathish skNoch keine Bewertungen

- Ips ImfpaDokument12 SeitenIps ImfpaArif ShaikhNoch keine Bewertungen

- RecoveriesDokument45 SeitenRecoveriesSona ElvisNoch keine Bewertungen

- Atm Using FingerprintDokument5 SeitenAtm Using FingerprintShivaNoch keine Bewertungen

- Islamic Banking Exam QuestionsDokument24 SeitenIslamic Banking Exam Questionsshopno100% (1)

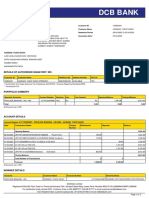

- DCB Bank: Statement of AccountDokument2 SeitenDCB Bank: Statement of AccounthasnainNoch keine Bewertungen

- Construction Equipment ManagementDokument18 SeitenConstruction Equipment ManagementAjay Malik75% (4)

- FACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS.) ISLAMIC BANKING ADVANCE FIQH MUAMALAT (ISB548) GROUP PROJECT SHARI’AH CONTRACT AND ISSUESDokument29 SeitenFACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS.) ISLAMIC BANKING ADVANCE FIQH MUAMALAT (ISB548) GROUP PROJECT SHARI’AH CONTRACT AND ISSUESNurin HannaniNoch keine Bewertungen

- Group Assignment Business Law: Prof. M. C. GuptaDokument13 SeitenGroup Assignment Business Law: Prof. M. C. GuptaNishit GarwasisNoch keine Bewertungen

- GRC - Governance, Risk Management, and ComplianceDokument16 SeitenGRC - Governance, Risk Management, and ComplianceBhavesh RathodNoch keine Bewertungen

- SAP Payment MethodsDokument3 SeitenSAP Payment MethodsEdaero BcnNoch keine Bewertungen

- Wolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicDokument1 SeiteWolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicAlkNoch keine Bewertungen

- Neemyl KitDokument3 SeitenNeemyl KitBhupendra Pratap SinghNoch keine Bewertungen

- Indian Institute of Banking & FinanceDokument8 SeitenIndian Institute of Banking & FinanceAnonymous QqGiVVKwDGNoch keine Bewertungen

- MBFM 5 PDFDokument13 SeitenMBFM 5 PDFMANISHA GARGNoch keine Bewertungen

- Departamento Del Tesoro de Estados Unidos: Notificación de Hallazgo Sobre La Banca Privada de Andora Es Una Institución Financiera de Preocupación de Lavado de Dinero.Dokument10 SeitenDepartamento Del Tesoro de Estados Unidos: Notificación de Hallazgo Sobre La Banca Privada de Andora Es Una Institución Financiera de Preocupación de Lavado de Dinero.ProdavinciNoch keine Bewertungen

- Ips FormDokument2 SeitenIps FormKrishna Kumar MishraNoch keine Bewertungen

- Annexure - 2 COS 38 Joint Hindu Family LetterDokument2 SeitenAnnexure - 2 COS 38 Joint Hindu Family LetterRahul Kumar50% (2)

- Blockchain and FinTech - Lecture 1 Courses 2022Dokument75 SeitenBlockchain and FinTech - Lecture 1 Courses 2022puhao yeNoch keine Bewertungen

- Domestic International Wire Transfers Info SheetDokument2 SeitenDomestic International Wire Transfers Info Sheetjude orjiNoch keine Bewertungen

- Course Outline FINA 482 Winter 21 DIARRA - GDokument8 SeitenCourse Outline FINA 482 Winter 21 DIARRA - GpopaNoch keine Bewertungen

- New Words and Expressions: BBC Learning English QuiznetDokument4 SeitenNew Words and Expressions: BBC Learning English QuiznetGAURAV SHARMA0% (1)