Beruflich Dokumente

Kultur Dokumente

PITSEQ (Eng) Web

Hochgeladen von

FayZ ZabidyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PITSEQ (Eng) Web

Hochgeladen von

FayZ ZabidyCopyright:

Verfügbare Formate

Fund Information

Fund Name

Public Ittikal Sequel Fund (PITSEQ)

Fund Type

Capital Growth

Fund Category

Equity (Shariah-compliant)

Fund Investment Objective

To achieve capital growth over the medium to long term period by investing

in a portfolio of investments that complies with Shariah principles.

Fund Performance Benchmark

The benchmark for PITSEQ is the FTSE Bursa Malaysia EMAS Shariah

Index, a free float adjusted capitalisation-weighted index comprising

constituents of the FTSE Bursa Malaysia EMAS Index, which have been

designated as Shariah-compliant securities by the Shariah Advisory Council

of the Securities Commission Malaysia.

The PITSEQ is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited

(FTSE) or by Bursa Malaysia Berhad (BURSA MALAYSIA) or by the London Stock Exchange Group

companies (the LSEG) and neither FTSE nor BURSA MALAYSIA nor LSEG makes any warranty

or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the

use of the FTSE BURSA MALAYSIA EMAS SHARIAH INDEX (the Index), and/or the figure at which

the said Index stands at any particular time on any particular day or otherwise. The Index is compiled

and calculated by FTSE. However, neither FTSE nor BURSA MALAYSIA nor LSEG shall be liable

(whether in negligence or otherwise) to any person for any error in the Index and neither FTSE nor

BURSA MALAYSIA nor LSEG shall be under any obligation to advise any person of any error therein.

FTSE, FT-SE and Footsie are trade marks of LSEG and are used by FTSE under licence.

BURSA MALAYSIA is a trade mark of BURSA MALAYSIA.

Fund Distribution Policy

Incidental

Breakdown of Unitholdings of PITSEQ as at 30 November 2015

Size of holdings No. of % of No. of units

unitholders unitholders held (million)

5,000 and below 11,413 10.60 41

5,001 to 10,000 14,516 13.48 108

10,001 to 50,000 53,713 49.90 1,343

50,001 to 500,000 27,442 25.49 3,344

500,001 and above 566 0.53 587

Total 107,650 100.00 5,423

Note: Excluding Managers Stock.

Fund Performance

Average Total Return for the Following Years Ended

30 November 2015

Average Total

Return of PITSEQ (%)

1 Year 2.83

3 Years 9.93

Public Ittikal Sequel Fund

Fund Performance Fund Performance

For the Financial Year Ended 30 November 2015 For the Financial Year Ended 30 November 2015

Annual Total Return for the Financial Years Ended 30 November Distribution and Unit Split

Year 2015 2014 2013 2012 Financial year 2015 2014 2013

PITSEQ (%) 2.83 6.70 18.29 10.40* Date of distribution 30.11.15 28.11.14 29.11.13

* The figure shown is for period since Fund commencement (31 October 2011). Distribution per unit

Gross (sen) 0.50 1.75 1.75

The calculation of the above returns is based on computation methods of Lipper. Net (sen) 0.50 1.73 1.74

Unit split - - -

Notes:

1. Total return of the Fund is derived by this formulae: Impact on NAV Arising from Distribution (Final) for the

( )

End of Period FYCurrent Year NAV per unit

Financial Years

-1

End of Period FYPrevious Year NAV per unit 2015 2014 2013

(Adjusted for unit split and distribution paid out for the period)

Sen Sen Sen

per unit per unit per unit

The above total return of the Fund was sourced from Lipper.

Net asset value before distribution 30.42 31.39 31.17

2. Average total return is derived by this formulae: Less: Net distribution per unit (0.50) (1.73) (1.74)

Total Return Net asset value after distribution 29.92 29.66 29.43

Number of Years Under Review

Past performance is not necessarily indicative of future performance and unit

Other Performance Data for the Past Three Financial Years prices and investment returns may go down, as well as up.

Ended 30 November

Asset Allocation for the Past Three Financial Years

2015 2014 2013

As at 30 November

Unit Prices (MYR)* (Per Cent of Net Asset Value)

Highest NAV per unit for the year 0.3158 0.3238 0.3117

2015 2014 2013

Lowest NAV per unit for the year 0.2781 0.2867 0.2634

% % %

Net Asset Value (NAV) and Units in

EQUITY SECURITIES

Circulation (UIC) as at the End of

Quoted

the Year

Malaysia

Total NAV (MYR000) 1,628,407 306,660 148,037

Basic Materials 0.7 1.9 -

UIC (in 000) 5,442,551 1,034,024 503,041

Communications 17.8 23.1 14.3

NAV per unit (MYR) 0.2992 0.2966 0.2943

Consumer, Cyclical 2.3 4.8 8.8

Total Return for the Year (%) 2.83 6.70 18.29 Consumer, Non-cyclical 11.9 16.1 16.5

Capital growth (%) 2.12 5.93 16.74 Diversified 5.1 7.4 6.3

Income (%) 0.70 0.73 1.33 Energy 7.1 6.8 10.5

Financial 3.2 5.9 5.8

Management Expense Ratio (MER) (%) 1.59 1.61 1.63 Industrial 12.5 9.8 8.6

Portfolio Turnover Ratio (time) 0.76 0.63 0.75 Technology 0.4 - -

Utilities 9.1 15.0 13.2

* All prices quoted are ex-distribution.

Notes: MER is calculated by taking the total management expenses expressed as an annual 70.1 90.8 84.0

percentage of the Funds average net asset value.

Outside Malaysia

Portfolio Turnover Ratio is calculated by taking the average of the total acquisitions and Australia

disposals of the investments in the Fund for the year over the average net asset value

of the Fund calculated on a daily basis. Basic Materials 0.1 - -

The Portfolio Turnover Ratio for the financial year 2015 rose to 0.76 time from 0.63 time in Germany

the previous financial year on account of higher level of rebalancing activities performed Industrial - - 1.6

by the Fund during the year.

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Fund Performance Fund Performance

For the Financial Year Ended 30 November 2015 For the Financial Year Ended 30 November 2015

Asset Allocation for the Past Three Financial Years (contd) Asset Allocation for the Past Three Financial Years (contd)

As at 30 November As at 30 November

(Per Cent of Net Asset Value) (Per Cent of Net Asset Value)

2015 2014 2013 2015 2014 2013

% % % % % %

Hong Kong COLLECTIVE INVESTMENT FUNDS

Communications 2.2 1.0 - Quoted

Consumer, Cyclical 0.5 - - Malaysia

Energy 0.4 - - Financial 1.5 2.4 3.1

Industrial 1.7 - -

TOTAL QUOTED COLLECTIVE

4.8 1.0 - INVESTMENT FUNDS 1.5 2.4 3.1

Indonesia WARRANTS

Financial - 0.2 0.3 Quoted

Utilities - 0.4 0.6 Malaysia

Warrants - - 0.1

- 0.6 0.9

TOTAL QUOTED WARRANTS - - 0.1

Korea

Communications 0.9 - - SHARIAH-BASED PLACEMENTS

Consumer, Cyclical 1.3 - - WITH A FINANCIAL INSTITUTION 12.0 7.2 2.5

2.2 - - OTHER ASSETS & LIABILITIES 1.7 -4.7 1.8

Singapore

Communications 2.3 1.7 1.2

Consumer, Non-cyclical 1.6 - -

Industrial 0.2 0.6 1.5

4.1 2.3 2.7

Taiwan

Industrial - - 0.4

Technology 1.3 - -

1.3 - 0.4

Thailand

Communications - - 0.2

Energy 0.3 - -

0.3 - 0.2

United States

Communications 1.6 - 1.3

Consumer, Non-cyclical 0.1 - -

Energy - - 1.4

Technology 0.2 0.4 -

1.9 0.4 2.7

TOTAL QUOTED EQUITY

SECURITIES 84.8 95.1 92.5

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Statement Of Distribution Of Returns Managers Report

For the Financial Year Ended 30 November 2015

Sen Per Unit Overview

Gross Distribution 0.5000 This Annual Report covers the financial year from 1 December 2014 to

Net Distribution 0.5000 30 November 2015.

Total Returns 0.7600

Public Ittikal Sequel Fund (PITSEQ or the Fund) seeks to achieve capital

growth over the medium to long term period by investing in a portfolio of

Effects of Distribution on NAV per unit before and after

investments that complies with Shariah principles.

Distribution:

For the financial year under review, the Fund registered a return of +2.83% as

Before After compared to its Benchmarks return of -4.06%. The Funds Shariah-compliant

Distribution Distribution equity portfolio registered a return of +5.33% while its Islamic money market

NAV per unit (MYR) 0.3042 0.2992 portfolio registered a return of +3.25% during the financial year under review.

A detailed performance attribution analysis is provided in the sections below.

From its commencement on 31 October 2011 (being the last day of the initial

offer period) to 30 November 2015, the Fund registered a return of +43.29%

and outperformed the Benchmarks return of +26.02% over the same period.

Consequently, it is the opinion of the Manager that the Fund has met its

objective to achieve capital growth over the said period.

Performance of PITSEQ from 31 October 2011

(Commencement Date) to 30 November 2015

50%

PITSEQ BENCHMARK

40%

Returns from Start of Period

30%

20%

10%

0%

-10%

Oct-11 Aug-12 Jun-13 Apr-14 Feb-15 Nov-15

The FTSE Bursa Malaysia EMAS Shariah Index (FBMS) is the selected

Benchmark for PITSEQ as it is a free float adjusted capitalisation-weighted

index which comprises constituents of the FTSE Bursa Malaysia EMAS Index,

which have been designated as Shariah-compliant securities by the Shariah

Advisory Council of the Securities Commission Malaysia.

Income Distribution and Impact on NAV Arising from Distribution

The gross distribution of 0.50 sen per unit (net distribution of 0.50 sen per unit)

for the financial year ended 30 November 2015 had the effect of reducing the

Net Asset Value (NAV) of the Fund after distribution. As a result, the NAV per

unit of the Fund was reduced to RM0.2992 from RM0.3042 after distribution.

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Managers Report Managers Report

Effect of Distribution Reinvestment on Portfolio Exposures Sector Allocations

30-Nov-15 In terms of sector allocation within the Shariah-compliant equity portfolio,

Before Distribution After Distribution the top 5 sectors account for 58.4% of the NAV of the Fund and 67.7% of

Reinvestment* Reinvestment* the Funds Shariah-compliant equity portfolio. The weightings of the top

5 sectors in Malaysia (unless otherwise indicated) are in the following order:

Shariah-compliant Equities 86.3% 84.9% Communications (17.8%), Industrial (12.5%), Consumer, Non-cyclical

Islamic Money Market 13.7% 15.1% (11.9%), Utilities (9.1%) and Energy (7.1%).

* Assumes full reinvestment.

Islamic Money Market Portfolio Review

Change in Portfolio Exposures from 30-Nov-14 to 30-Nov-15 During the financial year under review, the Funds Islamic money market

Average portfolio, which was invested primarily in Islamic deposits, yielded a return of

30-Nov-14 30-Nov-15 Change Exposure +3.25%. In comparison, the 1-Month Islamic Interbank Money Market Rate

(1M-IIMMR) registered a return of +3.58% over the same period.

Shariah-compliant Equities 92.1% 84.9% -7.2% 83.12%

Islamic Money Market 7.9% 15.1% +7.2% 16.88% During the financial year under review, the Funds exposure to Islamic money

market investments increased from 7.9% to 15.1% following the disposal

Returns Breakdown by Asset Class of selected Shariah-compliant equity investments. Based on an average

exposure of 16.88%, the Islamic money market portfolio is estimated to

Market / have contributed +0.55% to the Funds overall returns for the financial year

Returns On Benchmark Benchmark Average Attributed under review.

Investments Returns Index Used Exposure Returns

Stock Market Review

Shariah-

compliant Commencing the financial year under review at 13,036.26 points, the FTSE

Equities 5.33% -4.06% FBMS 83.12% 4.43% Bursa Malaysia EMAS Shariah (FBMS) Index succumbed to renewed

Islamic Money selling and fell below 12,000 points in mid-December 2014 due to lacklustre

Market 3.25% 3.58% 1M-IIMMR 16.88% 0.55% 3Q 2014 corporate earnings releases and the sharp correction in oil prices.

The Index subsequently rebounded in January 2015 in response to an uptrend

less: in oil prices, the European Central Bank (ECB)s decision to undertake a

Expenses -2.15% larger-than-expected Quantitative Easing (QE) program and the Malaysian

Total Net governments release of the revised 2015 budget. The Index continued to

Return for trend higher in February 2015 as oil prices stabilised and on the back of the

the Year 2.83% U.S. Federal Reserves indication that interest rates will not be increased

in the near term.

FBMS = FTSE Bursa Malaysia EMAS Shariah Index

1M-IIMMR = 1-Month Islamic Interbank Money Market Rate Weaker-than-expected domestic corporate earnings releases and economic

data from China caused the FBMS Index to correct in March 2015. The

Shariah-compliant Equity Portfolio Review Index rebounded in April 2015 on the back of a stabilisation in oil prices and

a stronger Ringgit before retracing in May 2015 as selected index stocks

For the financial year under review, the Funds Shariah-compliant equity were sold on the back of lacklustre corporate results. The Index traded

portfolio registered a return of +5.33% and outperformed the equity range-bound in June and July 2015 on uncertainties over the timing of the

Benchmarks return of -4.06%. The Funds Shariah-compliant equity portfolio U.S. interest rate hike, the ongoing Greek sovereign debt crisis and a lack

outperformed the Benchmark as the Funds holdings of selected stocks within of positive catalysts in the domestic market.

the Consumer, Non-cyclical and Communications sectors outperformed the

general market during the financial year under review. The FBMS Index retraced to a low of 10,901.91 points in late August 2015

in tandem with the weaker Ringgit which plunged to a 17-year low as well as

The Fund commenced the financial year under review with a Shariah- the correction in global equity markets amid concerns pertaining to the growth

compliant equity exposure of 92.1% and this was subsequently reduced outlook for the Chinese economy. The Index subsequently rebounded in

to below 75% in August 2015 to weather the market consolidation. The September 2015 in tandem with global equity markets on the back of positive

Fund ended the financial year under review with a Shariah-compliant U.S. economic data. Profit-taking activities following the announcement of

equity exposure of 84.9%. Based on an average Shariah-compliant equity Budget 2016 caused the Index to retrace towards late October 2015. The

exposure of 83.12%, the Shariah-compliant equity portfolio is deemed to FBMS Index closed at 12,506.87 points at the end of November 2015 to

have registered a return of +4.43% to the Fund as a whole for the financial register a decline of 4.06% for the financial year under review.

year under review. A full review of the performance of the equity markets is

tabled in the following sections.

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Managers Report Managers Report

Commencing the financial year under review at 154.36 points, the U.S. equity

FTSE Bursa Malaysia EMAS Shariah Index market as proxied by the S&P U.S. Shariah Index strengthened further in

(30 November 2014 - 30 November 2015) December 2014 on the back of optimism over global liquidity conditions after

14,000 the U.S. Federal Reserve stated it will be patient about raising interest rates.

13,500

The S&P U.S. Shariah Index eased in early January 2015 as energy stocks

13,000 led the decline in global equity markets on the back of the sharp drop in oil

12,500

prices. The Index subsequently rebounded for the remainder of January 2015

on optimism from the announcement of a larger-than-expected QE program

Index

12,000

by the ECB. Easing concerns over the financial position of Greece, a ceasefire

11,500 agreement in Ukraine and Chinas lowering of the reserve requirement ratio

11,000 for its banks helped global equity markets to rise in February 2015. The Index

10,500

eased in early March 2015 on weak Chinese economic data and concerns

over the end of the U.S. Federal Reserves zero interest rate policy.

10,000

Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15

Following the U.S. Federal Reserves statement that it would take a more

cautious approach to raising interest rates, the S&P U.S. Shariah Index

Starting the financial year under review at 88.16 points, regional equity rebounded in late March and continued to trend higher until late April 2015.

markets as proxied by the S&P Shariah BMI Asia Ex-Japan (S&P SAEJ) The Index edged higher in mid-May 2015 following the U.S. Federal Reserves

Index retraced in tandem with global equity markets in early December statement that it would take a more cautious approach to raising interest

2014 before recovering towards the year end following the U.S. Federal rates. Volatility amid the Greek financial crisis as well as a sharp correction

Reserves statement that it will be patient about raising interest rates. The in commodities and Chinas equity market caused the Index to ease in June

Index further strengthened in January 2015 following the announcement of 2015 before subsequently rebounding in mid-July 2015 over the anticipated

a larger-than-expected QE program by the ECB. Weaker-than-anticipated extension of the Federal Reserve low interest rate policy due to persistent

Chinese economic data and concerns over the impending rise in U.S. interest weakness in the global economy.

rates caused the S&P SAEJ Index to ease in mid-March 2015. The rally in

The S&P U.S. Shariah Index declined in August and September 2015 amid

Chinas H-Shares market subsequently helped the Index to rise above the

a plunge in crude oil price, concerns over Chinas economic growth outlook

100-point level in late April 2015 before easing in May and June 2015 amid

and the timing of a U.S. interest rate rise. The Index subsequently rebounded

a sharp correction in Chinas equity market and an escalation of the Greek

in October and November 2015 amid expectations that the increase in U.S.

sovereign debt crisis in late June 2015.

interest rates will be gradual. The S&P U.S. Shariah Index closed at 156.78

The Index continued to decline in August 2015 on the back of concerns points at the end of November to register a gain of 1.57% (+27.90% in Ringgit

over Chinas economic growth outlook and the timing of a U.S. interest rate terms) for the financial year under review.

rise. Regional markets regained a measure of stability in September 2015

as the U.S. Federal Reserve kept interest rates unchanged but concerns Islamic Money Market Review

of lacklustre corporate earnings outlook continued to weigh on sentiment.

The S&P SAEJ Index rebounded in October 2015 following a statement by The 1-Month Islamic Interbank Money Market Rate increased from 3.15%

the ECB that it was prepared to undertake another large stimulus package. to 3.58% during the financial year under review.

The cut in Chinas interest rates and reserve requirement ratios for banks

as well as the U.S. Federal Reserves stance to keep its interest rate hike Economic Review

on hold in October 2015 also helped bolster market sentiment. However, the Malaysias GDP growth moderated from 6.0% in 2014 to 5.1% in the first

Index eased in mid-November as stronger than expected U.S. job market three quarters of 2015 on the back of a slowdown in the manufacturing

data gave rise to increased expectations of an increase in U.S. interest sectors growth rate from 6.2% to 4.9% amidst lower export demand over

rates in December 2015. The S&P SAEJ Index closed at 82.51 points to

the period. After registering a growth of 6.5% in 2014, growth in the services

register a decline of 6.40% (+17.99% in Ringgit terms) for the financial year

sector moderated to 5.2% in the first three quarters of 2015. Meanwhile,

under review.

the pace of construction sector activities slowed from 11.8% to 8.4% over

Regional markets, namely the South Korea, Hong Kong, Taiwan, Singapore, the same period.

Thailand, Australia and Indonesia markets registered returns of +27.42%,

+19.29%, +15.11%, +6.27%, -0.95%, -3.02% and -9.57% (in Ringgit terms)

respectively for the financial year under review.

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Managers Report Managers Report

On the international front, U.S. GDP growth firmed from 2.4% in 2014 to 2.6%

Malaysias Annual GDP Growth in the first three quarters of 2015 on the back of higher private consumption

9.0 and investment. Consumer spending strengthened from 2.7% to 3.2%

8.0 7.4 amid improving employment conditions over the same period. Meanwhile,

7.0

5.5

6.0 investment growth rose from 5.4% to 5.7% over the same period.

6.0 5.3

4.8 4.7 4.9

5.0 4.5

The Federal Reserve kept the Federal funds rate target unchanged at 0.25%

4.0

% 3.0 in October 2015, citing the need for a further increase in the inflation rate

2.0 and improvements in labour market conditions before interest rates are

1.0 increased. The unemployment rate, which fell to a 7-year low of 5.0% in

0.0 October 2015, is targeted by the Federal Reserve to sustain at current levels

-1.0

by the end of 2015. However, the U.S. inflation rate remained subdued at

-2.0 -1.5

-3.0

almost zero percent in the first ten months of 2015 compared to the Federal

2008 2009 2010 2011 2012 2013 2014 2015F 2016F Reserves target of 2.0%. The Federal Reserve also stated that international

developments will be closely monitored in its decision on interest rates.

Source: Bloomberg

Following a growth of 0.9% in 2014, the Eurozones GDP growth rose to

Following a growth of 6.4% in 2014, Malaysias exports declined by 0.2% in 1.4% in the first three quarters of 2015 as slower growth in Germany was

the first nine months of 2015 due to lower commodity exports. A decline in mitigated by a faster pace of expansion in France. To further stimulate the

the imports of intermediate goods led to a 0.7% drop in imports for January- economy, the ECB cut the policy rate to a record low of 0.05% in September

September 2015 as compared to an increase of 5.3% in 2014. Malaysias 2014 and commenced its purchase of asset-backed securities (ABS) and

cumulative trade surplus widened to RM63.9 billion in the first nine months of covered bonds in October 2014. On 9 March 2015, the ECB commenced

2015 compared to RM61.5 billion in the same period last year. Due to capital implementation of its expanded sovereign bond-buying program at a pace

outflows, Malaysias foreign reserves decreased to US$94.0 billion as at end of 60 billion per month to fend off deflation and stimulate the economy. The

of October 2015 compared to US$128.1 billion a year ago. 1.1 trillion program will extend until at least September 2016 pending an

After registering an average inflation rate of 3.2% in 2014, Malaysias inflation increase in the inflation rate to just below 2% over the medium term.

rate eased to an average of 2.0% in the first ten months of 2015 following

the downward adjustment in petrol prices over the period. Bank Negara Outlook and Investment Strategy

Malaysia has kept the Overnight Policy Rate (OPR) unchanged at 3.25% Global and regional markets were well-supported in the first five months

since July 2014 to support domestic demand. Loans growth inched lower to of 2015 with the U.S. markets touching record highs in May 2015 amid

9.2% in the first nine months of 2015 from 9.3% in 2014 on lower demand monetary easing measures adopted by the central banks of Europe, Japan

from the household sector. and China. However, market sentiment turned cautious following the

Singapores GDP growth moderated from 2.9% in 2014 to 2.2% in the sell-down in the Chinese equity markets in June. Concerns over Chinas

first three quarters of 2015 amid a slowdown in the manufacturing and devaluation of the Yuans reference level and Chinas slowing economy

construction sectors. Indonesias economic growth slowed from 5.0% in caused regional and global markets to continue easing in the third quarter

2014 to 4.7% in the first three quarters of 2015 on the back of moderating of 2015. After rebounding in October amid improved sentiment, global and

domestic demand and lower exports. Meanwhile, Thailands GDP growth regional markets traded on a mixed note in November following a renewed

rebounded from 0.9% in 2014 to 2.9% in the first three quarters of 2015 sell-down in China-related markets.

amid a recovery in consumer and investment spending. Looking ahead, a moderate recovery in the global economy in 2016 coupled

In North Asia, Chinas GDP growth slowed from 7.3% in 2014 to 6.9% in with broadly supportive monetary conditions should underpin the outlook for

the first three quarters of 2015 amid a moderation in the manufacturing and Asian equities. However, market sentiment may be dampened by continued

construction sectors. Despite a contraction in exports due to a moderation in volatility in regional currencies pending the normalisation of interest rates by

the mainlands economic activities, Hong Kongs GDP growth was sustained the U.S. Federal Reserve.

at 2.5% in the first three quarters of 2015 compared to a similar growth rate Although the U.S. economy is projected to grow at a firmer pace of 2.5% in

in 2014 on the back of firmer domestic demand. 2016 compared to 2.4% estimated in 2015, low inflationary pressures and

South Koreas GDP growth eased from 3.3% in 2014 to 2.4% in the first moderate wage growth in the U.S. may prompt the Federal Reserve to be

three quarters of 2015 due to slower export growth. Taiwans GDP growth cautious in normalising the Federal funds rate.

moderated from 3.8% in 2014 to 1.0% in the first three quarters of 2015 amid Growth in the Eurozone is envisaged to firm from 1.5% in 2015 to 1.7% in

slower domestic demand and export growth. 2016 as investment spending is projected to gain pace in selected core and

Down under, Australias GDP growth moderated from 2.7% in 2014 to 2.2% peripheral countries. Consumer spending in real terms is envisaged to sustain

in 1H 2015 due to the decline in resource-related investment spending and as inflationary pressures are expected to remain low while the outlook for

slower export growth. business activities is expected to improve. Further monetary easing measures

may be undertaken by the ECB if growth in the Eurozone falters.

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Managers Report Managers Report

Down under, Australias economic growth is envisaged to rise from 2.3% in Cross-Trade Transactions

2015 to 2.6% in 2016 as growth is expected to be underpinned by a recovery

in exports and firmer household consumption spending. Cross-trade transactions were undertaken by PITSEQ during portfolio

rebalancing activities over the financial year under review.

In North Asia, Chinas GDP growth is projected to ease from 6.9% in 2015

to 6.5% in 2016 as economic growth continues to moderate. Following the Policy on Soft Commissions

fluctuations in the Chinese stock markets in the June to November 2015

period, elevated levels of market volatility are expected to continue as trading The management company may receive goods or services which include

activity is dominated by retail investors in the mainland market. research materials, data and quotation services and investment related

publications by way of soft commissions provided they are of demonstrable

Over in Hong Kong, GDP growth is projected to firm slightly from 2.4% in benefit to the Fund and unitholders.

2015 to 2.5% in 2016 as the slowdown in inbound tourism will be mitigated

by firmer domestic demand. Going forward, the Hong Kong government During the financial year under review, PITSEQ has received data and

is anticipated to maintain its existing tightening stance on the residential quotation services by way of soft commissions. These services were used

property market. However, ample liquidity, demand for better living standards to provide financial data on securities and price quotation information to the

and resilient economic growth will underpin Hong Kongs property market Fund Manager during the financial year under review.

over the long term.

South Koreas GDP growth is projected to rise from 2.5% in 2015 to 2.9%

in 2016 as consumption spending and exports is expected to increase.

Meanwhile, Taiwans GDP growth is projected to gain pace from 1.4% in

2015 to 2.4% in 2016 as exports are envisaged to recover.

In South-East Asia, Singapores GDP growth is projected to increase from

2.0% in 2015 to 2.5% in 2016 as fiscal spending and corporate tax rebates

are expected to support domestic demand. Indonesias GDP growth is

projected to grow at 5.1% in 2016 propelled by government spending on

infrastructure projects.

Thailands GDP growth is envisaged to accelerate from 2.7% in 2015 to

3.3% in 2016 as the tourism and manufacturing sectors benefit from a more

politically stable environment.

On the domestic front, the Ministry of Finance (MOF) forecasts Malaysias

GDP growth to range between 4.0% and 5.0% in 2016 on the back of a

moderate recovery in exports and resilient investment spending.

The 2016 budget deficit/GDP is projected at 3.1% (RM38.8 billion) as

compared to 3.2% (RM37.2 billion) in 2015. Revenue contribution from the

Goods and Services Tax (GST) contributed RM27 billion to government

revenue in 2015 and is projected to rise to RM39 billion in 2016, helping to

offset the decline in oil-related revenues.

At the end of November 2015, the local stock market was trading at a

prospective P/E of 16.5x, which is above its 10-year average P/E ratio of

15.6x. The markets dividend yield of 3.17% is below the 12-Month fixed

deposit rate of 3.35%.

Among the regional markets, South-East Asian markets were generally

trading at a premium while North Asian markets were generally trading at a

discount to their historical averages following their respective performances

over the same period.

Given the above factors, the Fund will continue to rebalance its investment

portfolio accordingly with the objective of achieving capital growth over the

medium to long term period by investing in a portfolio of investments that

complies with Shariah principles.

Notes: Q = Quarter

H = Half

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Statement Of Assets And Liabilities Statement Of Income And Expenditure

As at 30 November 2015 For the Financial Year Ended 30 November 2015

2015 2014 2015 2014

MYR000 MYR000 MYR000 MYR000

Assets Income

Investments 1,405,506 298,966 Profit from Shariah-based placements 3,864 489

Due from the Manager, net 42,203 5,321 Dividend income 22,324 5,307

Tax recoverable 27 27 Dividend income from non-permissible

Other receivables 2,188 412 securities - 36

Cash and cash equivalents 239,560 33,029 Net gain from investments 68 9,386

Net realised gain on sale of

1,689,484 337,755 non-permissible securities 377 4

Liabilities Net realised/unrealised foreign

Due to brokers/financial institutions, net 33,625 13,082 exchange gain 2,896 394

Due to the Trustee 82 16 29,529 15,616

Other payables 157 99

Distribution payable 27,213 17,898 Less: Expenses

Trustees fee 548 136

61,077 31,095 Management fee 13,681 3,396

Total net assets 1,628,407 306,660 Audit fee 7 7

Tax agents fee 3 3

Net asset value (NAV) attributable Brokerage fee 3,931 804

to unitholders (Total equity) 1,628,407 306,660 Administrative fees and expenses 236 101

Payment to charitable bodies 377 4

Units in circulation (in 000) 5,442,551 1,034,024

18,783 4,451

NAV per unit, ex-distribution (in sen) 29.92 29.66

Net income before taxation 10,746 11,165

Taxation (464) (38)

Net income after taxation 10,282 11,127

Net income after taxation is made up as

follows:

Realised 12,539 11,903

Unrealised (2,257) (776)

10,282 11,127

Final distribution for the financial year 27,213 17,898

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Statement Of Changes In Net Asset Value Statement Of Cash Flows

For the Financial Year Ended 30 November 2015 For the Financial Year Ended 30 November 2015

Unitholders Retained 2015 2014

capital earnings Total MYR000 MYR000

MYR000 MYR000 MYR000

Cash flows from operating activities

As at 1 December 2013 136,399 11,638 148,037 Proceeds from sale of investments 101,553 67,747

Creation of units 166,796 - 166,796 Purchase of investments (1,189,719) (204,121)

Cancellation of units (1,402) - (1,402) Subscription of rights - (890)

Net income after taxation - 11,127 11,127 Profit from Shariah-based placements

Distribution (5,627) (12,271) (17,898) received 3,853 483

Interest received from foreign currency

As at 30 November 2014 296,166 10,494 306,660 accounts 1 2

Net dividend income received 20,186 5,225

As at 1 December 2014 296,166 10,494 306,660 Trustees fee paid (482) (127)

Creation of units 1,339,987 - 1,339,987 Management fee paid (12,013) (3,192)

Cancellation of units (1,309) - (1,309) Audit fee paid (7) (7)

Net income after taxation - 10,282 10,282 Tax agents fee paid (5) (5)

Distribution (16,421) (10,792) (27,213) Taxation recovered - 40

Payment of other fees and expenses (189) (82)

As at 30 November 2015 1,618,423 9,984 1,628,407 Payment to charitable bodies (378) (6)

Net cash outflow from operating

activities (1,077,200) (134,933)

Cash flows from financing activities

Cash proceeds from units created 1,301,437 164,458

Cash paid on units cancelled (1,309) (1,402)

Distribution paid (17,898) (8,745)

Net cash inflow from financing activities 1,282,230 154,311

Net increase in cash and cash

equivalents 205,030 19,378

Effect of change in foreign exchange

rates 1,501 463

Cash and cash equivalents at the

beginning of the financial year 33,029 13,188

Cash and cash equivalents at the end

of the financial year 239,560 33,029

Cash and cash equivalents comprise:

Cash at banks 43,628 10,933

Shariah-based placements with a

financial institution 195,932 22,096

239,560 33,029

Public Ittikal Sequel Fund Public Ittikal Sequel Fund

Das könnte Ihnen auch gefallen

- PBIEF (Eng) WebDokument10 SeitenPBIEF (Eng) WebFayZ ZabidyNoch keine Bewertungen

- Weight Chart: Date Weight (KG) Target Weight (KG) Date Weight (KG) Target Weight (KG) Date Weight (KG) Target Weight (KG)Dokument3 SeitenWeight Chart: Date Weight (KG) Target Weight (KG) Date Weight (KG) Target Weight (KG) Date Weight (KG) Target Weight (KG)FayZ ZabidyNoch keine Bewertungen

- Public Ittikal Sequel FundDokument10 SeitenPublic Ittikal Sequel FundFayZ ZabidyNoch keine Bewertungen

- Master Prospectus - Public Series of Shariah-Based FundsDokument234 SeitenMaster Prospectus - Public Series of Shariah-Based FundsFayZ ZabidyNoch keine Bewertungen

- PR - Declare RM95 M For 9 FundsDokument1 SeitePR - Declare RM95 M For 9 FundsFayZ ZabidyNoch keine Bewertungen

- What If ThinkingDokument1 SeiteWhat If ThinkingFayZ ZabidyNoch keine Bewertungen

- Public China Ittikal FundDokument10 SeitenPublic China Ittikal FundFayZ ZabidyNoch keine Bewertungen

- Brian Tracy - Outselling Your Competition GuideDokument10 SeitenBrian Tracy - Outselling Your Competition GuideFayZ Zabidy100% (2)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Banking Laws Case DigestsDokument61 SeitenBanking Laws Case DigestsMaxi Dominick TahanlangitNoch keine Bewertungen

- Exercise 8 - 1: Tugas Analisis Laporan Keuangan (Alk) Chapter 8 Dosen Pengampu: Dr. Aprilia Beta Suandi, SE., M. SCDokument3 SeitenExercise 8 - 1: Tugas Analisis Laporan Keuangan (Alk) Chapter 8 Dosen Pengampu: Dr. Aprilia Beta Suandi, SE., M. SCArdilla Noor Paramashanti Wirahadikusuma100% (5)

- FM - Bond & Stock ValuationDokument10 SeitenFM - Bond & Stock ValuationSeneca GonzalesNoch keine Bewertungen

- PDFDokument240 SeitenPDFHrishabh BharatiNoch keine Bewertungen

- Fin 3507 Note 8 SDokument14 SeitenFin 3507 Note 8 SChiNoch keine Bewertungen

- Nama: Rina Elizabeth Ritonga NIM: 2001677595 Tugas Personal Ke - (1) Minggu 2Dokument6 SeitenNama: Rina Elizabeth Ritonga NIM: 2001677595 Tugas Personal Ke - (1) Minggu 2GKB CGIC PALEMBANGNoch keine Bewertungen

- TradeZero GuideDokument2 SeitenTradeZero GuideKelvin Lim Wei LiangNoch keine Bewertungen

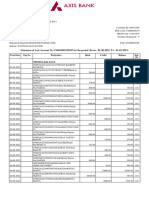

- Statement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)Dokument18 SeitenStatement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)rahulbhasinNoch keine Bewertungen

- A Guide To The Stock Exchange For Beginners - Part 2 PDFDokument5 SeitenA Guide To The Stock Exchange For Beginners - Part 2 PDFAnil Yadavrao GaikwadNoch keine Bewertungen

- First Hour of Trading - How To Trade Like A Seasoned Pro + Video Tutorial!Dokument26 SeitenFirst Hour of Trading - How To Trade Like A Seasoned Pro + Video Tutorial!kalpesh katharNoch keine Bewertungen

- WACC - WorksheetDokument4 SeitenWACC - Worksheetvwfn8f7xmtNoch keine Bewertungen

- Nifty Futures Lot Sizes Information - Dec 2013Dokument8 SeitenNifty Futures Lot Sizes Information - Dec 2013justtrade013926Noch keine Bewertungen

- Company Profile SharekhanDokument7 SeitenCompany Profile Sharekhangarima_rathi0% (2)

- 定时福利1126Dokument5 Seiten定时福利1126Ozzy Lina100% (3)

- FMGT212-Financial Management 2: FMGT212 Week 11: Dividends, Share Repurchase, and Other Payouts Short Quiz 009Dokument3 SeitenFMGT212-Financial Management 2: FMGT212 Week 11: Dividends, Share Repurchase, and Other Payouts Short Quiz 009Mark John Paul CablingNoch keine Bewertungen

- JRG Securities Ltd. Is One of India's Leading Financial Services Providers With Strong PresenceDokument1 SeiteJRG Securities Ltd. Is One of India's Leading Financial Services Providers With Strong PresenceRuchi KapoorNoch keine Bewertungen

- Corporation Problems-1Dokument18 SeitenCorporation Problems-1Avia Chelsy DeangNoch keine Bewertungen

- Odn 25 - CCRKDokument1 SeiteOdn 25 - CCRKNate TobikNoch keine Bewertungen

- IT Applications in Stock MarketDokument3 SeitenIT Applications in Stock MarketAhsan MalikNoch keine Bewertungen

- Sync Prob Solvng Derivative Secs SY22 - 23Dokument4 SeitenSync Prob Solvng Derivative Secs SY22 - 23Gailee VinNoch keine Bewertungen

- BIS Quarterly Review, December 2019Dokument154 SeitenBIS Quarterly Review, December 2019ed_nycNoch keine Bewertungen

- Stock Market Analysis With The Usage of Machine Learning and Deep Learning AlgorithmsDokument9 SeitenStock Market Analysis With The Usage of Machine Learning and Deep Learning Algorithmstushar sundriyalNoch keine Bewertungen

- Chapter 5. Equity MarketsDokument150 SeitenChapter 5. Equity MarketsHiếu Nhi TrịnhNoch keine Bewertungen

- Assurance SP Reviewer PremidDokument14 SeitenAssurance SP Reviewer PremidMica Bengson TolentinoNoch keine Bewertungen

- FIN515 Hw4JDVDokument7 SeitenFIN515 Hw4JDVvalderramadavid100% (1)

- Here Are A Few Relevant ExamplesDokument6 SeitenHere Are A Few Relevant ExamplesTeddy RusliNoch keine Bewertungen

- Fin440 Chapter 17Dokument21 SeitenFin440 Chapter 17Md. Shaikat Alam Joy 1421759030Noch keine Bewertungen

- Profitability RatiosDokument2 SeitenProfitability RatiosMeghan Kaye LiwenNoch keine Bewertungen

- 2020 Dividend Schedule: 2020 Record Date 2020 Reinvest Ex-Dividend Date 2020 Payable DateDokument27 Seiten2020 Dividend Schedule: 2020 Record Date 2020 Reinvest Ex-Dividend Date 2020 Payable DateAmer MadaniNoch keine Bewertungen

- A Project ProposalDokument10 SeitenA Project ProposalRam PandeyNoch keine Bewertungen