Beruflich Dokumente

Kultur Dokumente

18.) Top-Management Meeting

Hochgeladen von

Failure of Royal Bank of Scotland (RBS) Risk ManagementCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

18.) Top-Management Meeting

Hochgeladen von

Failure of Royal Bank of Scotland (RBS) Risk ManagementCopyright:

Verfügbare Formate

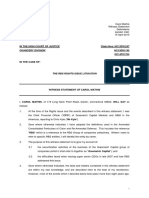

See Top-Management Meeting Minutes

https://drive.google.com/file/d/0BzKpYGA_5moJaE1Iclhtbmkxd2c/view

The ABS CDO trading portfolio is marked via a flawed credit model materially above

observable fair market value, despite FASB and SEC accounting rules and the

Sarbanes-Oxley Act.

Carol Mathis (CM) admits that this model (LSD) substantially under-projects the

subprime mortgage defaults ("too low") which are causing ABS CDOs to default and

depreciate. Carol Mathis discusses moving these ABS CDOs from the US trading

book to the London banking book, hence avoiding independent price verification

and VaR back-testing. Top management falsely claims no market data basis for 2007

ABS CDO writedowns and no mis-marks, despite major simultaneous ABS CDO

writedowns at other banks.

In 2016, RBS admitted to Reuters that such information existed in 2007, as "press

reports, research notes and market information relating to the valuation of SS CDOs

held by other institutions".

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Victor Hong Final Statement Submitted To UK Court, RBS Shareholder Rights LitigationDokument41 SeitenVictor Hong Final Statement Submitted To UK Court, RBS Shareholder Rights LitigationFailure of Royal Bank of Scotland (RBS) Risk Management100% (2)

- 30.) Falsified Price Verification Report, Oct-2007, With IPV Head Sign-OffDokument1 Seite30.) Falsified Price Verification Report, Oct-2007, With IPV Head Sign-OffFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- Timeline: The Failure of The Royal Bank of ScotlandDokument7 SeitenTimeline: The Failure of The Royal Bank of ScotlandFailure of Royal Bank of Scotland (RBS) Risk Management100% (1)

- RBS Shareholder Fraud AllegationsDokument326 SeitenRBS Shareholder Fraud AllegationsFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- 37.) Ian Gaskell Admits To Unreported CDO Losses, Per ABX-based NAVDokument1 Seite37.) Ian Gaskell Admits To Unreported CDO Losses, Per ABX-based NAVFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- 33.) FSA Is Informed That RBS Ignored Public Market Data in 2007 About ABS CDO Price DepreciationDokument1 Seite33.) FSA Is Informed That RBS Ignored Public Market Data in 2007 About ABS CDO Price DepreciationFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- 36.) Carol Mathis Sworn Witness StatementDokument9 Seiten36.) Carol Mathis Sworn Witness StatementFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- 26.) Ian Gaskell, Lauren Rieder, Bruce Jin, Carol Mathis Are Warned of Other Banks Writing Down CDOs To 25:00Dokument1 Seite26.) Ian Gaskell, Lauren Rieder, Bruce Jin, Carol Mathis Are Warned of Other Banks Writing Down CDOs To 25:00Failure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- 28.) Guy Whittaker and Carol Mathis Admit in 2007 That Unreported CDO Losses Imply RBS Insolvency and Illiquidity, Needing RecapitalizationDokument1 Seite28.) Guy Whittaker and Carol Mathis Admit in 2007 That Unreported CDO Losses Imply RBS Insolvency and Illiquidity, Needing RecapitalizationFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- 6.) Victor Hong Justifies 40% Markdowns of ABS CDOs To Ian Gaskell and Bruce Jin 10-12-07Dokument4 Seiten6.) Victor Hong Justifies 40% Markdowns of ABS CDOs To Ian Gaskell and Bruce Jin 10-12-07Failure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Comparative Investment ReportDokument8 SeitenComparative Investment ReportNelby Actub MacalaguingNoch keine Bewertungen

- E1.developments in The Indian Money MarketDokument16 SeitenE1.developments in The Indian Money Marketrjkrn230% (1)

- Acct Practice PaperDokument11 SeitenAcct Practice PaperKrish BajajNoch keine Bewertungen

- Non Current Assets 2019ADokument4 SeitenNon Current Assets 2019AKezy Mae GabatNoch keine Bewertungen

- Hudbay Minerales 2016-2015Dokument94 SeitenHudbay Minerales 2016-2015Anonymous au6UvN92kBNoch keine Bewertungen

- Chapter 2 - Investment Appraisal - Introduction Nature and Stages of Investment Appraisal NatureDokument5 SeitenChapter 2 - Investment Appraisal - Introduction Nature and Stages of Investment Appraisal NatureTeresaBachmannNoch keine Bewertungen

- Philippines National Bank vs. Erlando T. RodriguezDokument2 SeitenPhilippines National Bank vs. Erlando T. RodriguezKen MarcaidaNoch keine Bewertungen

- Acct Statement XX1708 26082022Dokument4 SeitenAcct Statement XX1708 26082022Firoz KhanNoch keine Bewertungen

- Apple and Tesla Have Split Their StocksDokument11 SeitenApple and Tesla Have Split Their Stocksyogesh patilNoch keine Bewertungen

- Punjab Spatial Planning StrategyDokument12 SeitenPunjab Spatial Planning Strategybaloch47Noch keine Bewertungen

- Consultancy Paper FinalDokument20 SeitenConsultancy Paper FinalRosemarie McGuireNoch keine Bewertungen

- MBM 207 QB - DistanceDokument2 SeitenMBM 207 QB - Distancemunish2030Noch keine Bewertungen

- Expand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcDokument18 SeitenExpand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcserradajaviNoch keine Bewertungen

- Supply Chain Management Final Course OutlineDokument6 SeitenSupply Chain Management Final Course OutlinehonestNoch keine Bewertungen

- ACC3201Dokument6 SeitenACC3201natlyh100% (1)

- Retirement QuestionDokument2 SeitenRetirement QuestionshubhamsundraniNoch keine Bewertungen

- AgentsDokument11 SeitenAgentschinchumoleNoch keine Bewertungen

- Enron Company Reaction PaperDokument7 SeitenEnron Company Reaction PaperJames Lorenz FelizarteNoch keine Bewertungen

- V1 INE004 Apunte Semana4Dokument20 SeitenV1 INE004 Apunte Semana4Valentina VeraNoch keine Bewertungen

- Econ Notes From 25Dokument5 SeitenEcon Notes From 25Ayisa YaoNoch keine Bewertungen

- Principles in Halal PurchasingDokument15 SeitenPrinciples in Halal PurchasingIvanPamuji100% (1)

- Partnership CE W Control Ans PDFDokument10 SeitenPartnership CE W Control Ans PDFRedNoch keine Bewertungen

- Chapter 11 ANPVDokument2 SeitenChapter 11 ANPVxuzhu5Noch keine Bewertungen

- Benihana of Tokyo Case AnalysisDokument2 SeitenBenihana of Tokyo Case AnalysisJayr Padillo33% (3)

- E3 Expo Booklet - 2018Dokument22 SeitenE3 Expo Booklet - 2018CoachTinaFJNoch keine Bewertungen

- POL 346 Paper - Ghana and IMFDokument19 SeitenPOL 346 Paper - Ghana and IMFGian-Paolo MendozaNoch keine Bewertungen

- COBECON - Math ProblemsDokument16 SeitenCOBECON - Math ProblemsdocumentsNoch keine Bewertungen

- QualityDokument29 SeitenQualitySotepNoch keine Bewertungen

- FINAL 07 Budget Speech - EngDokument81 SeitenFINAL 07 Budget Speech - EngDefimediagroup LdmgNoch keine Bewertungen

- Costing TheoryDokument26 SeitenCosting TheoryShweta MadhuNoch keine Bewertungen