Beruflich Dokumente

Kultur Dokumente

An Investment Project Should Be Accepted Only If The NPV

Hochgeladen von

MarcellDariusOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

An Investment Project Should Be Accepted Only If The NPV

Hochgeladen von

MarcellDariusCopyright:

Verfügbare Formate

FIN 571 Week 5 Connect Problems

To Purchase This Material Click below Link

http://www.fin571tutor.com/product-58-FIN-571-Week-5-

Connect-Problems

FOR MORE CLASSES VISIT

www.fin571tutor.com

In 2008 the cash and marketable securities available with the company

was 48020 million dollars, which increased to 48949 million dollars in

2009 and then decreased to 48331 million dollars in 2010.

A financing project should be accepted if, and only if, the NPV is exactly

equal to zero.

Any type of project with greater total cash inflows than total cash

outflows, should always be accepted.

An investment project should be accepted only if the NPV is equal to the

initial cash flow.

3.The primary reason that company projects with positive net present

values are considered acceptable is that:

they create value for the owners of the firm.

the investment's cost exceeds the present value of the cash inflows.

the project's rate of return exceeds the rate of inflation.

the required cash inflows exceed the actual cash inflows.

they return the initial cash outlay within three years or less.

4.Accepting a positive net present value (NPV) project:

indicates the project will pay back within the required period of time.

is expected to increase the stockholders value by the amount of the

NPV.

ignores the inherent risks within the project.

guarantees all cash flow assumptions will be realized.

means the present value of the expected cash flows is equal to the

projects cost.

5.The net present value method of capital budgeting analysis does all of

the following except:

use all of a project's cash flows.

discount all future cash flows.

consider all relevant cash flow information.

incorporate risk into the analysis.

provide a specific anticipated rate of return.

6.What is the net present value of a project with an initial cost of $36,900

and cash inflows of $13,400, $21,600, and $10,000 for Years 1 to 3,

respectively? The discount rate is 13 percent.

7.Maxwell Software, Inc., has the following mutually exclusive projects.

a-1. Calculate the payback period for each project. (Do not round

intermediate calculations and round your answers to 3 decimal places,

e.g., 32.161.)

Payback period

Project A 1.938 years

Project B 2.063 years

________________________________________

a-2. Which, if either, of these projects should be chosen?

b-1. What is the NPV for each project if the appropriate discount rate

is 15 percent? (A negative answer should be indicated by a minus sign.

Do not round intermediate calculations and round your answers to 2

decimal places, e.g., 32.16.)

b-2. Which, if either, of these projects should be chosen if the

appropriate discount rate is 15 percent?

8.Down Under Boomerang, Inc., is considering a new three-year

expansion project that requires an initial fixed asset investment of $2.82

million. The fixed asset will be depreciated straight-line to zero over its

three-year tax life, after which it will be worthless. The project is

estimated to generate $2,120,000 in annual sales, with costs of

$815,000. The tax rate is 30 percent and the required return is 12

percent.

What is the projects NPV? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

9.The Best Manufacturing Company is considering a new investment.

Financial projections for the investment are tabulated here. The

corporate tax rate is 35 percent. Assume all sales revenue is received in

cash, all operating costs and income taxes are paid in cash, and all cash

flows occur at the end of the year. All net working capital is recovered at

the end of the project.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- CFA Mock Exam Lvl1Dokument38 SeitenCFA Mock Exam Lvl1Christopher Diamantopoulos100% (1)

- Specialists Trading Practices by Richard NeyDokument2 SeitenSpecialists Trading Practices by Richard Neyaddqdaddqd100% (2)

- Final ModuleDokument150 SeitenFinal ModuletemedebereNoch keine Bewertungen

- Global BankingDokument448 SeitenGlobal BankingAnirudh Bhatjiwale100% (1)

- Profitability Sustainability RatiosDokument3 SeitenProfitability Sustainability RatiosRhodelbert Rizare Del SocorroNoch keine Bewertungen

- Hertz LBO CaseDokument3 SeitenHertz LBO Casejen1861233% (6)

- Banking-Laws MCQsDokument5 SeitenBanking-Laws MCQsLeny Joy DupoNoch keine Bewertungen

- Lecture 5312312Dokument55 SeitenLecture 5312312Tam Chun LamNoch keine Bewertungen

- CHAPTER 10 - Questions and ProblemsDokument12 SeitenCHAPTER 10 - Questions and ProblemsMrinmay kunduNoch keine Bewertungen

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDokument3 SeitenQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNoch keine Bewertungen

- Payables - Sample ProblemsDokument2 SeitenPayables - Sample ProblemsPanda ErarNoch keine Bewertungen

- Dealogic IntroductionDokument7 SeitenDealogic IntroductionAndrás ÁcsNoch keine Bewertungen

- SSLM in GenMath For G11 Q2 Module 6Dokument5 SeitenSSLM in GenMath For G11 Q2 Module 6OmarieNoch keine Bewertungen

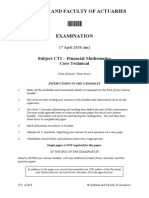

- Institute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalDokument6 SeitenInstitute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalfeererereNoch keine Bewertungen

- Acctg1205 - Chapter 7Dokument28 SeitenAcctg1205 - Chapter 7Elj Grace BaronNoch keine Bewertungen

- 30 5K USD Promotion v1 0Dokument5 Seiten30 5K USD Promotion v1 0Max PlanckNoch keine Bewertungen

- SPM CH 02 - 1 - Corporate Level StrategyDokument7 SeitenSPM CH 02 - 1 - Corporate Level StrategyHelmy Fitria SagitaNoch keine Bewertungen

- Ace AnalyserDokument4 SeitenAce AnalyserRahul MalhotraNoch keine Bewertungen

- India BullsDokument12 SeitenIndia Bullswww_roopk4u74220% (1)

- Project Report On "Comparative Analysis of Stock Brokers"Dokument19 SeitenProject Report On "Comparative Analysis of Stock Brokers"Kunal KhandelwalNoch keine Bewertungen

- The Tata Corus MergerDokument13 SeitenThe Tata Corus MergerRanjit KarnaNoch keine Bewertungen

- Retirement and Death of A Partner WorksheetDokument4 SeitenRetirement and Death of A Partner WorksheettherealsadbroccoliNoch keine Bewertungen

- 9.403 Chapter 4: Efficient Securities MarketsDokument10 Seiten9.403 Chapter 4: Efficient Securities MarketsYanee ReeNoch keine Bewertungen

- Fundamental Equity Analysis - S&P 100 Index Components (OEX Index)Dokument205 SeitenFundamental Equity Analysis - S&P 100 Index Components (OEX Index)Q.M.S Advisors LLCNoch keine Bewertungen

- Technical Derivatives 03-04-2024Dokument6 SeitenTechnical Derivatives 03-04-2024fazalrehanNoch keine Bewertungen

- Chapter 2Dokument13 SeitenChapter 2eswariNoch keine Bewertungen

- (2012) Currency Derivatives and The Disconnection Between Exchange Rate Volatility and International TradeDokument28 Seiten(2012) Currency Derivatives and The Disconnection Between Exchange Rate Volatility and International TradeEmre GulsenNoch keine Bewertungen

- An Empirical Study On Investment Pattern of Salaried People in Davangere CityDokument11 SeitenAn Empirical Study On Investment Pattern of Salaried People in Davangere CityarcherselevatorsNoch keine Bewertungen

- Behavioural Finance & Investment ProcessesDokument33 SeitenBehavioural Finance & Investment ProcessesMoizAliMemonNoch keine Bewertungen

- GPB Capital: Massachusetts ComplaintDokument47 SeitenGPB Capital: Massachusetts ComplaintTony OrtegaNoch keine Bewertungen