Beruflich Dokumente

Kultur Dokumente

P010 636211442428322820 T14385011dupD1 PDF

Hochgeladen von

Anonymous pY5EUXUpaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

P010 636211442428322820 T14385011dupD1 PDF

Hochgeladen von

Anonymous pY5EUXUpaCopyright:

Verfügbare Formate

Lyft, Inc

185 Berry Street You may also view your information in the Driver Portal

Suite 5000 http://www.lyft.com/drive

San Francisco, CA 94107 For questions, please visit the Lyft Help Center at

http://www.lyft.com/help

Ndioba Ndiaye

2035 7th Ave Apt 33

New York, NY 10027

Instructions for Payee

You have received this form because you have either: (a) accepted payment cards for payments, or Box 1b. May show the aggregate gross amount of all reportable payment transactions made to you

(b) received payments through a third party network that exceeded $20,000 in gross total reportable through the PSE during the calendar year where the card was not present at the time of the transaction

transactions and the aggregate number of those transactions exceeded 200 for the calendar year. or the card number was keyed into the terminal. Typically, this relates to online sales, phone sales, or

Merchant acquirers and third party settlement organizations, as payment settlement entities (PSE), catalogue sales. If the box for third party network is checked, or if these are third party network

must report the proceeds of payment card and third party network transactions made to you on transactions, card not present transactions will not be reported.

Form 1099-K under Internal Revenue Code section 6050W. The PSE may have contracted with an Box 2. Shows the merchant category code used for payment card/third party network transactions

electronic payment facilitator (EPF) or other third party payer to make payments to you. (if available) reported on this form.

If you have questions about the amounts reported on this form, contact the FILER whose Box 3. Shows the number of payment transactions (not including refund transactions) processed

information is shown in the upper left corner on the front of this form. If you do not recognize the through the payment card/third party network.

FILER shown in the upper left corner of the form, contact the PSE whose name and phone number

are shown in the lower left corner of the form above your account number. Box 4. Shows backup withholding. Generally, a payer must backup withhold if you did not furnish

your taxpayer identification number (TIN) or you did not furnish the correct TIN to the payer. See

See the separate instructions for your income tax return for using the information reported on

Form W-9, Request for Taxpayer Identification Number and Certification, and Publication 505, Tax

this form.

Withholding and Estimated Tax, for information on backup withholding. Include this amount on your

Payees identification number. For your protection, this form may show only the last four digits of income tax return as tax withheld.

your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer

Boxes 5a-5l. Shows the gross amount of payment card/third party network transactions made to you

identification number (ATIN), or employer identification number (EIN). However, the issuer has

for each month of the calendar year.

reported your complete identification number to the IRS.

Boxes 6-8. Shows state and local income tax withheld from the payments.

Account number. May show an account number or other unique number the PSE assigned to

distinguish your account. Future developments. For the latest information about developments related to Form 1099-K and its

Box 1a. Shows the aggregate gross amount of payment card/third party network transactions made instructions, such as legislation enacted after they were published, go to www.irs.gov/form1099k.

to you through the PSE during the calendar year.

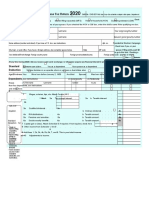

CORRECTED (if checked) REISSUED STATEMENT

FILERS name, street address, city or town, state or province, country, ZIP or FILERS federal identification no. OMB No. 1545-2205

foreign postal code, and telephone no.

Lyft, Inc 20-8809830 Payment Card

185 Berry Street PAYEES taxpayer identification no. and Third Party

Suite 5000 XXX-XX-3375 Network

San Francisco, CA 94107 1a Gross amount of payment Transactions

card/third party network

transactions

$ 27,530.75 Form 1099-K

1b Card Not Present 2 Merchant category code

transactions Copy B

Check to indicate if FILER is a (an): Check to indicate transactions For Payee

Payment settlement entity (PSE) X reported are: $ 0.00 4121

3 Number of payment 4 Federal income tax This is important tax

Payment card transactions withheld

Electronic Payment Facilitator information and is

(EPF)/Other third party Third party network X 1,254 $ being furnished to the

PAYEES name, street address (including apt. no.), city or town, state or province, 5a January 5b February Internal Revenue

country, and ZIP or foreign postal code

$ 649.72 $ 867.90 Service. If you are

Ndioba Ndiaye 5c March 5d April required to file a

2035 7th Ave Apt 33 return, a negligence

$ 1,642.38 $ 5,097.05 penalty or other

New York, NY 10027 5e May 5f June sanction may be

imposed on you if

$ 7,089.25 $ 6,389.63 taxable income

5g July 5h August results from this

$ 5,792.82 $ 2.00 transaction and the

5i September 5j October IRS determines that it

has not been

PSES name and telephone number $ $ reported.

5k November 5l December

$ $

Account number (see instructions) 6 State 7 State identification no. 8 State income tax withheld

NY $

Form 1099-K (Keep for your records) www.irs.gov/form1099k Department of the Treasury - Internal Revenue Service

6H8701 3.000

Das könnte Ihnen auch gefallen

- Request For Taxpayer Identification Number and CertificationDokument4 SeitenRequest For Taxpayer Identification Number and CertificationYut ChiaNoch keine Bewertungen

- LG FFDokument1 SeiteLG FFfeem743Noch keine Bewertungen

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDokument144 SeitenLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNoch keine Bewertungen

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDokument1 SeiteMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNoch keine Bewertungen

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Dokument2 Seiten1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNoch keine Bewertungen

- Driver Record Screening Disclosure: Authorization For Release of Information For Employment ScreeningDokument1 SeiteDriver Record Screening Disclosure: Authorization For Release of Information For Employment ScreeningMucho FacerapeNoch keine Bewertungen

- FIRE 2011 Form 990Dokument36 SeitenFIRE 2011 Form 990FIRENoch keine Bewertungen

- 1Dokument1 Seite1hansNoch keine Bewertungen

- Show 2Dokument2 SeitenShow 2Lexi BrownNoch keine Bewertungen

- Brooklyn Museum 2019 IRS Form 990Dokument64 SeitenBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNoch keine Bewertungen

- 2021 - TaxReturn 2pagessignedDokument3 Seiten2021 - TaxReturn 2pagessignedDedrick RiversNoch keine Bewertungen

- Square 2022 W-2Dokument2 SeitenSquare 2022 W-2Zane CardinalNoch keine Bewertungen

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Dokument6 SeitenU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNoch keine Bewertungen

- VA Attendant EnrollmentDokument2 SeitenVA Attendant EnrollmentJeannie ArringtonNoch keine Bewertungen

- Request For Taxpayer Identification Number and CertificationDokument4 SeitenRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNoch keine Bewertungen

- FD 941 Apr-Jun 2017 PDFDokument3 SeitenFD 941 Apr-Jun 2017 PDFScott WinklerNoch keine Bewertungen

- 0LH47 0LH47 0429 20180101 1095report 001Dokument1 Seite0LH47 0LH47 0429 20180101 1095report 001charly4877Noch keine Bewertungen

- Hynum Greg Angela - 20i - CCDokument76 SeitenHynum Greg Angela - 20i - CCAdmin OfficeNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return: Filing StatuspyatetskyNoch keine Bewertungen

- Claimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Dokument1 SeiteClaimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Jimmy BurtNoch keine Bewertungen

- NY CA 01-01-1953 9984 TXPRDokument98 SeitenNY CA 01-01-1953 9984 TXPRAdmin OfficeNoch keine Bewertungen

- Young Acc 137 Kongai, Tsate 1040Dokument26 SeitenYoung Acc 137 Kongai, Tsate 1040Kathy YoungNoch keine Bewertungen

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDokument3 Seiten05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNoch keine Bewertungen

- M. Giraldo PDFDokument3 SeitenM. Giraldo PDFMayken GiraldoNoch keine Bewertungen

- Form W-4 (2018) : Specific InstructionsDokument4 SeitenForm W-4 (2018) : Specific InstructionsRony MartinezNoch keine Bewertungen

- 0LH47 0LH47 0429 20180101 W2Report W2Report 001Dokument2 Seiten0LH47 0LH47 0429 20180101 W2Report W2Report 001charly4877Noch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Or Wcomp 0.72 or Wcomp 0.72Dokument1 SeiteOr Wcomp 0.72 or Wcomp 0.72aaronNoch keine Bewertungen

- 2022 Schedule 3 (Form 1040)Dokument2 Seiten2022 Schedule 3 (Form 1040)Riley CareNoch keine Bewertungen

- Mart1552 21i FCDokument23 SeitenMart1552 21i FCOlga M.Noch keine Bewertungen

- 2013 Tax Return (Shep-Ty DBA Embrace)Dokument24 Seiten2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNoch keine Bewertungen

- Gov. Walz 2019 Federal Tax Return - RedactedDokument11 SeitenGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNoch keine Bewertungen

- Frantz Raymond TaxDokument1 SeiteFrantz Raymond Taxjoseph GRAND-PIERRENoch keine Bewertungen

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDokument7 Seiten2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNoch keine Bewertungen

- 2014 Alabama Possible 990Dokument39 Seiten2014 Alabama Possible 990Alabama PossibleNoch keine Bewertungen

- Instructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceDokument13 SeitenInstructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceChristian RiveraNoch keine Bewertungen

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Dokument15 SeitenZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNoch keine Bewertungen

- Preview Copy Do Not File: Profit or Loss From BusinessDokument1 SeitePreview Copy Do Not File: Profit or Loss From BusinessRon KnightNoch keine Bewertungen

- 2019 Leon California FilingDokument18 Seiten2019 Leon California FilingPolo PoloNoch keine Bewertungen

- 0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Dokument2 Seiten0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Ian CabanillasNoch keine Bewertungen

- Request For Taxpayer Identification Number and CertificationDokument4 SeitenRequest For Taxpayer Identification Number and CertificationMichael RamirezNoch keine Bewertungen

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDokument3 SeitenTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNoch keine Bewertungen

- 2010 Psztur R Form 1040 Individual Tax ReturnDokument20 Seiten2010 Psztur R Form 1040 Individual Tax ReturnJaqueline LeslieNoch keine Bewertungen

- Agosto 11Dokument1 SeiteAgosto 11dakpi479Noch keine Bewertungen

- Imigracion 2Dokument15 SeitenImigracion 2erickNoch keine Bewertungen

- FTF 2023-03-20 1679339077907Dokument15 SeitenFTF 2023-03-20 1679339077907ayogbolo100% (1)

- Desmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDDokument2 SeitenDesmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDRed RaptureNoch keine Bewertungen

- 2021TaxReturnPDF 221003 100736Dokument18 Seiten2021TaxReturnPDF 221003 100736Tracy SmithNoch keine Bewertungen

- Will Frost 2013 Tax Return - T13 - For - RecordsDokument146 SeitenWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNoch keine Bewertungen

- Planilla Federal Keyla 2021Dokument2 SeitenPlanilla Federal Keyla 2021Keyla VelezNoch keine Bewertungen

- Wage and Tax Statement Wage and Tax StatementDokument3 SeitenWage and Tax Statement Wage and Tax StatementNathan VosNoch keine Bewertungen

- 2021-2022 Tax ReturnDokument3 Seiten2021-2022 Tax ReturnMmmmmmmNoch keine Bewertungen

- U.S. Individual Income Tax Return: See Separate InstructionsDokument4 SeitenU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- W2 & Earnings: Emma MimsDokument1 SeiteW2 & Earnings: Emma MimsIsaiah MimsNoch keine Bewertungen

- Please To Do Not Use The Back ButtonDokument2 SeitenPlease To Do Not Use The Back ButtonDavid MillerNoch keine Bewertungen

- Cash Business Account 1099kDokument1 SeiteCash Business Account 1099kgarydeservesmithNoch keine Bewertungen

- Robinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Dokument4 SeitenRobinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Jack BotNoch keine Bewertungen

- Form 1099Dokument6 SeitenForm 1099Joe LongNoch keine Bewertungen

- RTMF 990Dokument49 SeitenRTMF 990Craig MaugerNoch keine Bewertungen

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDokument2 SeitenIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNoch keine Bewertungen

- Solved A Section 20 Subsidiary of A Major U S Bank IsDokument1 SeiteSolved A Section 20 Subsidiary of A Major U S Bank IsM Bilal SaleemNoch keine Bewertungen

- Official Registration and Assessment FormDokument1 SeiteOfficial Registration and Assessment FormMacapobre, Neall Deaniell CampilananNoch keine Bewertungen

- 0432 Merkblatt Zur Anmeldepflicht Von Barmitteln - Englisch - (2012) Seite - 1 - Von 3Dokument3 Seiten0432 Merkblatt Zur Anmeldepflicht Von Barmitteln - Englisch - (2012) Seite - 1 - Von 3Эльзар МаликовNoch keine Bewertungen

- LogDokument149 SeitenLogPop Tudor CristianNoch keine Bewertungen

- gst44 Fill 23eDokument4 Seitengst44 Fill 23ePreetpaul ThiaraNoch keine Bewertungen

- Aspl Invoice 2019-20 Jan'20 To Mar'20Dokument20 SeitenAspl Invoice 2019-20 Jan'20 To Mar'20Gurupada SahooNoch keine Bewertungen

- Taxation Law Exam MCQDokument10 SeitenTaxation Law Exam MCQSong Ong0% (1)

- MATCVS Application Form (New)Dokument3 SeitenMATCVS Application Form (New)dr bolaNoch keine Bewertungen

- Calamba Steel Center v. CIR - DigestDokument2 SeitenCalamba Steel Center v. CIR - Digestcmv mendozaNoch keine Bewertungen

- Oct 2023Dokument5 SeitenOct 2023AnkitNoch keine Bewertungen

- MT103, Kinpro vs. Claudio de SanctisDokument1 SeiteMT103, Kinpro vs. Claudio de SanctisGrehim IT consulting and Training LtdNoch keine Bewertungen

- Platinum CatalogueDokument17 SeitenPlatinum CataloguePSC.CLAIMS1Noch keine Bewertungen

- Lbhyd00002731694 IciciDokument1 SeiteLbhyd00002731694 IciciSurya GoudNoch keine Bewertungen

- Lic Premium ReceiptDokument1 SeiteLic Premium ReceiptMallarsu MaheshNoch keine Bewertungen

- Account Statement From 1 Jan 2018 To 31 Dec 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument5 SeitenAccount Statement From 1 Jan 2018 To 31 Dec 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkNoch keine Bewertungen

- RandomDokument4 SeitenRandomBarnendu SarkarNoch keine Bewertungen

- 1.1 Slides - Income Statements - Components and Format of An Income Statement PDFDokument13 Seiten1.1 Slides - Income Statements - Components and Format of An Income Statement PDFascentcommerceNoch keine Bewertungen

- AB Farming - CERTIFICATE OF ENTERPRISE REGISTRATIONDokument2 SeitenAB Farming - CERTIFICATE OF ENTERPRISE REGISTRATIONAmedeeAbNoch keine Bewertungen

- System Flowchart of The Cash Receipts Process Is 630Dokument4 SeitenSystem Flowchart of The Cash Receipts Process Is 630lordaiztrandNoch keine Bewertungen

- GOODS & SERVICE TAX IN INDIA - Concepts and Constitutional Framework Paper IDokument9 SeitenGOODS & SERVICE TAX IN INDIA - Concepts and Constitutional Framework Paper ISharique RazaNoch keine Bewertungen

- Tax On Salary: Income Tax Law & CalculationDokument7 SeitenTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNoch keine Bewertungen

- Account Number: 06290010022785770016 Account Title: IRUM ZULNOORAIN Currency: PKR Opening Balance: 1,235,418.27 Closing Balance: 454.87Dokument7 SeitenAccount Number: 06290010022785770016 Account Title: IRUM ZULNOORAIN Currency: PKR Opening Balance: 1,235,418.27 Closing Balance: 454.87MentoriansNoch keine Bewertungen

- Guest AccountingDokument8 SeitenGuest Accountingjhen01gongonNoch keine Bewertungen

- Tax Invoice: Billed To: Invoice DetailsDokument1 SeiteTax Invoice: Billed To: Invoice Detailsbipin jainNoch keine Bewertungen

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDokument1 SeiteItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNoch keine Bewertungen

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Dokument176 SeitenInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNoch keine Bewertungen

- Debit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedDokument1 SeiteDebit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedVermaNoch keine Bewertungen

- Responsibilities of TaxpayersDokument10 SeitenResponsibilities of Taxpayers'Aisyah Roselan0% (1)

- Travel and Expense PolicyDokument6 SeitenTravel and Expense PolicyLee Cogburn100% (1)

- R12 SEPA Core Direct Debit WhitepaperDokument12 SeitenR12 SEPA Core Direct Debit WhitepaperAliNoch keine Bewertungen