Beruflich Dokumente

Kultur Dokumente

Inves

Hochgeladen von

rodrigo_iii_3Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Inves

Hochgeladen von

rodrigo_iii_3Copyright:

Verfügbare Formate

Incentives and Foreign Investment Law

MIDTERMS Coverage: 2. a sustained increase in the amount of goods and services produced by

1. Omnibus Investments Code the nation for the benefit of the people

2. Foreign Investments Act 3. an expanding productivity as the key to raising the quality of life for all,

3. Cases especially the underprivileged.

i. Garcia cases (due process requirements)

ii. Appealing decisions of the BOI The State shall promote industrialization and full employment based on sound

agricultural development and agrarian reform, through industries that make full

and efficient use of human and natural resources, and which are competitive in

I. Relevant Constitutional Provision both domestic and foreign markets. However, the State shall protect Filipino

ARTICLE II enterprises against unfair foreign competition and trade practices.

Declaration of Principles and State Policies In the pursuit of these goals, all sectors of the economy and all regions of the

Section 9. The State shall promote a just and dynamic social order that will country shall be given optimum opportunity to develop. Private enterprises,

ensure the prosperity and independence of the nation and free the people from including corporations, cooperatives, and similar collective organizations, shall

poverty through policies that provide adequate social services, promote full be encouraged to broaden the base of their ownership.

employment, a rising standard of living, and an improved quality of life for all. Section 2. All lands of the public domain, waters, minerals, coal, petroleum, and

Section 10. The State shall promote social justice in all phases of national other mineral oils, all forces of potential energy, fisheries, forests or timber,

development. wildlife, flora and fauna, and other natural resources are owned by the State.

Section 18. The State affirms labor as a primary social economic force. It shall All natural resourced EXCEPT AGRICULTURAL LAND cannot be alienated.

protect the rights of workers and promote their welfare. The exploration, development, and utilization of natural resources shall

Section 19. The State shall develop a self-reliant and independent national be under the full control and supervision of the State.

economy effectively controlled by Filipinos. The State may directly undertake such activities, or it may enter into co-

Section 20. The State recognizes the indispensable role of the private sector, production, joint venture, or production-sharing agreements with Filipino

encourages private enterprise, and provides incentives to needed investments. citizens, or corporations or associations at least sixty per centum of whose

Section 21. The State shall promote comprehensive rural development and capital is owned by such citizens. Period <= 25 yrs + 25 yrs extension

agrarian reform. The State shall protect the nation's marine wealth in its archipelagic waters,

ARTICLE VI territorial sea, and exclusive economic zone, and reserve its use and

The Legislative Department enjoyment exclusively to Filipino citizens.

Section 28. (1) The rule of taxation shall be uniform and equitable. The The Congress may, by law, allow small-scale utilization of natural resources

Congress shall evolve a progressive system of taxation. by Filipino citizens, as well as cooperative fish farming, with priority to

subsistence fishermen and fish- workers in rivers, lakes, bays, and lagoons.

(4) No law granting any tax exemption shall be passed without the concurrence

of a majority of all the Members of the Congress. The President may enter into agreements with foreign-owned corporations

involving either

ARTICLE VII

Executive Department 1. technical or

Section 20. The President may contract or guarantee foreign loans on 2. financial assistance

behalf of the Republic of the Philippines with the prior concurrence of for large-scale exploration, development, and utilization of minerals, petroleum,

the Monetary Board, and subject to such limitations as may be provided and other mineral oils according to the general terms and conditions provided by

by law. The Monetary Board shall, within thirty days from the end of every law, based on real contributions to the economic growth and general welfare of

quarter of the calendar year, submit to the Congress a complete report of its the country. In such agreements, the State shall promote the development and

decision on applications for loans to be contracted or guaranteed by the use of local scientific and technical resources.

Government or government-owned and controlled corporations which would The President shall notify the Congress of every contract entered into in

have the effect of increasing the foreign debt, and containing other matters as accordance with this provision, within thirty days from its execution.

may be provided by law.

Section 3. Lands of the public domain:

ARTICLE XII

National Economy and Patrimony 1. agricultural (may be further classified, may be alienated)

Section 1. The goals of the national economy are: 2. forest or timber

1. a more equitable distribution of opportunities, income, and wealth; 3. mineral lands and

4. national parks.

Joemyl Baloro Page 1 of 18

Incentives and Foreign Investment Law

Private corporations can only LEASE property the common good so requires. The State shall encourage equity participation in

- Period <= 25 yrs + 25 yrs extension public utilities by the general public. The participation of foreign investors in

the governing body of any public utility enterprise shall be limited to their

- Limit: <= 1000 ha proportionate share in its capital, and all the executive and managing

Citizens LEASE - <=500 ha officers of such corporation or association must be citizens of the Philippines.

OWN - <= 12ha Section 12. The State shall promote the preferential use of Filipino labor,

Taking into account the requirements of conservation, ecology, and domestic materials and locally produced goods, and adopt measures that

development, and subject to the requirements of agrarian reform, the Congress help make them competitive.

shall determine, by law, the size of lands of the public domain which may be Section 16. The Congress shall not, except by general law, provide for the

acquired, developed, held, or leased and the conditions therefor. formation, organization, or regulation of private corporations. Government-

Section 5. The State, subject to the provisions of this Constitution and national owned or controlled corporations may be created or established by special

development policies and programs, shall protect the rights of indigenous charters in the interest of the common good and subject to the test of economic

cultural communities to their ancestral lands to ensure their economic, social, viability.

and cultural well-being. Section 17. In times of national emergency, when the public interest so

Section 6. The use of property bears a social function, and all economic agents requires, the State may, during the emergency and under reasonable terms

shall contribute to the common good. Individuals and private groups, including prescribed by it, temporarily take over or direct the operation of any privately

corporations, cooperatives, and similar collective organizations, shall have the owned public utility or business affected with public interest.

right to own establish, and operate economic enterprises, subject to the duty of Section 18. The State may, in the interest of national welfare or defense,

the State to promote distributive justice and to intervene when the common establish and operate vital industries and, upon payment of just compensation,

good so demands. transfer to public ownership utilities and other private enterprises to be operated

Section 7. Save in cases of hereditary succession, no private lands shall be by the Government.

transferred or conveyed except to individuals, corporations, or associations Section 19. The State shall regulate or prohibit monopolies when the public

qualified to acquire or hold lands of the public domain. interest so requires. No combinations in restraint of trade or unfair competition

- Aliens cannot own land but can own condominiums through a condominium shall be allowed.

corporation (only up to 40% of such corp.). Section 20. The Congress shall establish an independent central monetary

Section 9. The Congress may establish an independent economic and planning authority, the members of whose governing board must be natural-born Filipino

agency headed by the President, which shall, after consultations with the citizens, of known probity, integrity, and patriotism, the majority of whom shall

appropriate public agencies, various private sectors, and local government units, come from the private sector. They shall also be subject to such other

recommend to Congress, and implement continuing integrated and coordinated qualifications and disabilities as may be prescribed by law. The authority shall

programs and policies for national development. provide policy direction in the areas of money, banking, and credit. It shall have

supervision over the operations of banks and exercise such regulatory powers as

Until the Congress provides otherwise, the National Economic and may be provided by law over the operations of finance companies and other

Development Authority shall function as the independent planning agency of institutions performing similar functions.

the government.

Until the Congress otherwise provides, the Central Bank of the Philippines,

Section 10. The Congress shall, upon recommendation of the economic and operating under existing laws, shall function as the central monetary authority.

planning agency, when the national interest dictates, reserve to citizens of

the Philippines or to corporations or associations at least sixty per Section 21. Foreign loans may only be incurred in accordance with law and the

centum of whose capital is owned by such citizens, or such higher regulation of the monetary authority. Information on foreign loans obtained or

percentage as Congress may prescribe, certain areas of investments. guaranteed by the Government shall be made available to the public.

The Congress shall enact measures that will encourage the formation and Section 22. Acts which circumvent or negate any of the provisions of this Article

operation of enterprises whose capital is wholly owned by Filipinos. shall be considered inimical to the national interest and subject to criminal and

In the grant of rights, privileges, and concessions covering the national economy civil sanctions, as may be provided by law.

and patrimony, the State shall give preference to qualified Filipinos. ARTICLE XIV

The State shall regulate and exercise authority over foreign investments within Education

its national jurisdiction and in accordance with its national goals and priorities. Section 4 (2) Educational institutions, other than those established by

Section 11. Public Utility = Citizens or Corporations established under religious groups and mission boards, shall be owned solely by citizens of the

Philippine Law. Period= <= 50 years. Philippines or corporations or associations at least sixty per centum of the capital

of which is owned by such citizens. The Congress may, however, require

Neither shall any such franchise or right be granted except under the condition increased Filipino equity participation in all educational institutions.

that it shall be subject to amendment, alteration, or repeal by the Congress when

Joemyl Baloro Page 2 of 18

Incentives and Foreign Investment Law

Science and Technology II. Omnibus Investments Code

Section 10. Science and technology are essential for national development and Policies:

progress. The State shall give priority to research and development, invention, 1. Economic Nationalism

innovation, and their utilization; and to science and technology education,

training, and services. It shall support indigenous, appropriate, and self- reliant 2. Planned Economy

scientific and technological capabilities, and their application to the country's 3. Disperse Industries

productive systems and national life. 4. Promote small and medium scale industries

Section 11. The Congress may provide for incentives, including tax deductions, 5. Encourage competition/ discourage monopoly

to encourage private participation in programs of basic and applied scientific

research. Scholarships, grants-in-aid, or other forms of incentives shall be ART. 2. Declaration of Investment Policies. - To accelerate the sound development

provided to deserving science students, researchers, scientists, inventors, of the national economy in consonance with the principles and objectives of

technologists, and specially gifted citizens. economic nationalism and in pursuance of a planned economically feasible and

practical dispersal of industries and the promotion of small and medium scale

Section 12. The State shall regulate the transfer and promote the adaptation of industries, under conditions which will encourage competition and discourage

technology from all sources for the national benefit. It shall encourage the widest monopolies, the following are declared policies of the State:

participation of private groups, local governments, and community-based

organizations in the generation and utilization of science and technology. 1. The State shall encourage private Filipino and foreign investments in

industry, agriculture, forestry, mining, tourism and other sectors of the

Section 13. The State shall protect and secure the exclusive rights of scientists, economy which shall: provide significant employment opportunities

inventors, artists, and other gifted citizens to their intellectual property and relative to the amount of the capital being invested; increase

creations, particularly when beneficial to the people, for such period as may be productivity of the land, minerals, forestry, aquatic and other resources

provided by law. of the country, and improve utilization of the products thereof improve

General Provisions technical skills of the people employed in the enterprise; provide a

Section 11. (1) The ownership and management of mass media shall be foundation for the future development of the economy; meet the tests

limited to citizens of the Philippines, or to corporations, cooperatives or of international competitiveness; accelerate development of less

associations, wholly-owned and managed by such citizens. developed regions of the country; and result in increased volume and

value of exports for the economy.

The Congress shall regulate or prohibit monopolies in commercial mass media

when the public interest so requires. No combinations in restraint of trade or 2. The State shall ensure holistic development by safeguarding the well-

unfair competition therein shall be allowed. being of the social, cultural and ecological life of the people. For this

purpose, consultation with affected communities will be conducted

(2) The advertising industry is impressed with public interest, and shall be whenever necessary.

regulated by law for the protection of consumers and the promotion of the

general welfare. 3. The State shall extend to projects which will significantly contribute to

the attainment of these objectives, fiscal incentives without which said

Only Filipino citizens or corporations or associations at least seventy per centum projects may not be established in the locales, number and/or pace

of the capital of which is owned by such citizens shall be allowed to engage in required for optimum national economic development. Fiscal incentive

the advertising industry. systems shall be devised to compensate for market imperfections, to

The participation of foreign investors in the governing body of entities in such reward performance contributing to economic development, be cost-

industry shall be limited to their proportionate share in the capital thereof, and efficient and be simple to administer.

all the executive and managing officers of such entities must be citizens of the 4. The State considers the private sector as the prime mover for

Philippines. economic growth. In this regard, private initiative is to be encouraged,

with deregulation and self-regulation of business activities to be

Nationalized Industries generally adopted where dictated by urgent social concerns.

5. The State shall principally play a supportive role, rather than a

Public Utilities 100% Filipino

competitive one, providing the framework, the climate and the

Educational Institutions 100% Filipino incentives within which business activity is to take place.

(except those established by

6. The State recognizes that there are appropriate roles for local and

religious organizations)

foreign capital to play in the development of the Philippine economy

Mass Media 100% Filipino and that it is the responsibility of Government to define these roles and

Advertising At least 70% Filipino provide the climate for their entry and growth.

7. The State recognizes that industrial peace is an essential element of

economic growth and that it is a principal responsibility of the State to

Joemyl Baloro Page 3 of 18

Incentives and Foreign Investment Law

ensure that such a condition prevails. of the Code that may arise between registered enterprises or investors therein

8. Fiscal incentives shall be extended to stimulate the establishment and government agencies, within thirty (30) days after the controversy has been

and assist initial operations of the enterprise, and shall terminate after a submitted for decision:

period of not more than 10 years from registration or start-up of Decision = 30 days from submission of controversy

operation unless a specific period is otherwise stated. Appeal to the President = 30 days from receipt of adverse decision

The foregoing declaration of investment policies shall apply to all investment (5) Recommend the entry of foreign nationals into the Philippines for

incentive schemes. employment to the CID

(6) Check by inspection or reports the participation of foreign nationals

CHAPTER II in registered enterprises

BOARD OF INVESTMENTS (7) Periodically check and verify the compliance by registered enterprises

ART. 3. The Board of Investments. - The Board of Investments shall implement with the relevant provisions of this Code, with the rules and regulations

the provisions of Books One to Five of this Code. promulgated under this Code and with the terms and conditions of registration;

ART. 4. Composition of the Board. - The Board of Investments shall be composed (8) After due notice, cancel the registration or suspend the enjoyment of

of seven (7) governors: incentives benefits of any registered enterprise and/or require refund

of incentives enjoyed by such enterprise including interests and monetary

1. The Secretary of Trade and Industry (Chairman) penalties, for

2. three (3) Undersecretaries of Trade and Industry to be chosen by the

President; (Undersecretary of the Department of Trade and Industry for (a) failure to maintain the qualifications required by this Code for

Industry and Investments shall be concurrently the Vice-Chairman of the registration with the Board or

Board and its Managing Head) (b) for violation of any provisions of this Code, of the rules and

3. three (3) representatives from other government agencies and the regulations issued under this Code, of the terms and conditions of

private sector (4-yr term; shall serve until replaced registration, or of laws for the protection of labor or of the consuming

No vacancy shall be filled except for the unexpired portion of any term, and that public:

no one may be designated to be a governor of the Board in an acting capacity Provided, That the registration of an enterprise whose project timetable, as set

but all appointments shall be ad interim or permanent. by the Board is delayed by one year, shall be considered automatically cancelled

ART 5. Qualifications of Governors of the Board. unless otherwise reinstated as a registered enterprise by the Board;

1. at least thirty (30) years old (9) Determine the organizational structure taking into account Article 6 of this

2. of good moral character Code; appoint, discipline and remove its personnel consistent with the

3. and of recognized competence in the fields of economics, finance, provisions of the Civil Service Law and Rules;

banking, commerce, industry, agriculture, engineering, law, (10) Prepare or contract for the preparation of feasibility and other pre-

management or labor. investment studies for pioneer areas either upon its own initiative; or upon

ART. 6. Appointment of Board Personnel. - The Board shall appoint its technical the request of Philippine nationals who commit themselves to invest therein and

staff and other personnel subject to Civil Service Law, rules and regulations. show the capability of doing so.

ART 7. Powers and Duties of the Board. - The Board shall be responsible for the (11) When feasible and considered desirable by the Board, require registered

regulation and promotion of investments in the Philippines. It shall meet enterprises to list their shares of stock in any accredited stock

as often as may be necessary generally once a week on such day as it may exchange or directly offer a portion of their capital stock to the public

fix. Notice of regular and special meetings shall be given all members of the and/or their employees;

Board. (12) Formulate and implement rationalization programs for certain

Four (4) governors = QUORUM industries whose operation may result in dislocation, overcrowding or inefficient

use of resources, thus impeding economic growth.

Four (4) governors = MAJORITY VOTE

(13) In appropriate cases, and subject to the conditions which the Board deems

(1) Prepare annually the Investment Priorities Plan necessary, suspend the nationality requirement provided for in this Code or

(2) Promulgate such rules and regulations as may be necessary to any other nationalization statute in cases of ASEAN projects or investments by

implement the intent and provisions of this Code relevant to the Board; ASEAN nationals in preferred projects, and with the approval of the President,

(3) Process and approve applications for registration with the Board, extend said suspension to other international complementation

imposing such terms and conditions as it may deem necessary to promote the arrangements for the manufacture of a particular product on a regional basis to

objectives of this Code take advantage of economies of scale;

(4) After due hearing, decide controversies concerning the implementation (14) Extend the period of availment of incentives by any registered

Joemyl Baloro Page 4 of 18

Incentives and Foreign Investment Law

enterprise; Provided, That the total period of availment shall not exceed ten (1) To act as Managing Head of the Board;

(10) years, subject to any of the following criteria: (2) To preside over the meetings of the Board in the absence of the

(a) The registered enterprise has suffered operational force majeure that has Chairman;

impaired its viability; (3) Prepare the Agenda for the meetings of the Board and submit for its

(b) The registered enterprise has not fully enjoyed the incentives granted to it consideration and approval the policies and measures which the

for reasons beyond its control; Chairman deems necessary and proper to carry out the provisions of

(c) The project of the registered enterprise has a gestation period which goes this Code;

beyond the period of availment of needed incentives; and (4) Assist registered enterprises and prospective investors to have

(d) The operation of the registered enterprise has been subjected to their papers processed with dispatch by all government offices,

unforeseen changes in government policies, particularly, protectionism agencies, instrumentalities and financial institutions; and

policies of importing countries, and such other supervening factors (5) Perform the other duties of the Chairman in the absence of the

which would affect the competitiveness of the registered firm; latter, and such other duties as may be assigned to him by the Board

(15) Regulate the making of investments by foreigners or business of Governors.

organizations owned in whole or in part by foreigners;

(16) Prepare or contract for the preparation of industry and sectoral INVESTMENTS WITH INCENTIVES

development programs and gather and compile statistical, technical, TITLE I

marketing, financial and other data required for the effective

implementation of this Code; PREFERRED AREAS OF INVESTMENTS

(17) Within four (4) months after the close of the fiscal year, submit annual CHAPTER I DEFINITION OF TERMS

reports to the President which shall cover its activities in the administration ART. 10. Board shall mean the Board of Investments created under this Code.

of this Code, including recommendations on investment policies; ART. 11. REGISTERED ENTERPRISE shall mean any individual, partnership,

(18) Provide information as may be of interest to prospective foreign cooperative, corporation or other entity incorporated and/or organized and

investors: existing under Philippine laws; and registered with the Board in accordance with

(19) Collate, analyze and compile pertinent information and studies this Book; Provided, however, That the term registered enterprise shall not

concerning areas that have been or may be declared preferred areas of include commercial banks, savings and mortgage banks, rural banks, savings

investments; and and loan associations, building and loan associations, development banks, trust

companies, investment banks, finance companies, brokers and dealers in

(20) Enter into agreements with other agencies of government for the securities, consumers' cooperatives and credit unions, and other business

simplification and facilitation of systems and procedures involved in the organizations whose principal purpose or principal source of income is to receive

promotion of investments, operation of registered enterprises and other deposits, lend or borrow money, buy and sell or otherwise deal, trade or invest in

activities necessary for the effective implementation of this Code; common or preferred stocks, debentures, bonds or other marketable instruments

(21) Generally, exercise all the powers necessary or incidental to attain generally recognized as securities, or discharge other similar intermediary, trust

the purposes of this Code and other laws vesting additional functions on the or fiduciary functions.

Board. ART. 12. TECHNOLOGICAL ASSISTANCE CONTRACTS shall mean contracts for:

ART. 8. Powers and Duties of the Chairman. - The CHAIRMAN shall have the (1) the transfer, by license or otherwise, of patents, processes, formulas

following powers and duties: or other technological rights of foreign origin; and/or

(1) To preside over the meetings of the Board; (2) foreign assistance concerning technical and factory management,

(2) To render annual reports to the President and such special reports as design, planning, construction, operation and similar matters.

may be requested; ART. 13. FOREIGN LOANS shall mean any credit facility or financial assistance

(3) To act as liaison between investors seeking joint venture other than equity investment denominated and payable in foreign currency or

arrangements in particular areas of investment; where the creditor has the option to demand payment in foreign exchange and

(4) Recommend to the Board such policies and measures he may deem registered with the Central Bank and the Board.

necessary to carry out the objectives of this Code; and ART. 14. FOREIGN INVESTMENTS shall mean equity investments owned by a

(5) Generally, to exercise such other powers and perform such other non-Philippine national made in the form of foreign exchange or other assets

duties as may be directed by the Board of Governors from time to time. actually transferred to the Philippines and registered with the Central Bank and

the Board, which shall assess and appraise the value of such assets other than

ART. 9. Powers and Duties of the Vice-Chairman. - The VICE-CHAIRMAN shall foreign exchange.

have the following powers and duties:

ART. 15. PHILIPPINE NATIONAL shall mean a citizen of the Philippines or a

Joemyl Baloro Page 5 of 18

Incentives and Foreign Investment Law

domestic partnership or association wholly-owned by citizens of the Philippines; preferred area of investment in order to supply the needs of the economy at

or a corporation organized under the laws of the Philippines of which at least reasonable prices, taking into account the export potential of the product,

sixty per cent (60%) of the capital stock outstanding and entitled to vote is including economies of scale which would render such product competitive in the

owned and held by citizens of the Philippines; or a trustee of funds for pension or world market. Measured capacity shall not be less than the amount by which the

other employee retirement or separation benefits, where the trustee is a measurable domestic and country's potential export market demand exceeds the

Philippine national and at least sixty per cent (60%) of the fund will accrue to the existing productive capacity in said preferred areas. For export market industries,

benefit of Philippine nationals: Provided, That where a corporation and its non- when warranted, the Board shall base measured capacity on the availability of

Filipino stockholders own stock in a registered enterprise, at least sixty per cent domestic raw materials after deducting the needs of the domestic market

(60%) of the capital stock outstanding and entitled to vote of both corporations therefor.

must be owned and held by the citizens of the Philippines and at least sixty ART. 21. Tax Credit shall mean any of the credits against taxes and/or duties

percent (60%) of the members of the Board of Directors of both corporations equal to those actually paid or would have been paid to evidence which a tax

must be citizens of the Philippines in order that the corporation shall be credit certificate shall be issued by the Secretary of Finance or his

considered a Philippine national. representative, or the Board, if so delegated by the Secretary of Finance. The tax

ART. 16. PREFERRED AREAS OF INVESTMENTS shall mean the economic credit certificates including those issued by the Board pursuant to laws repealed

activities that the Board shall have declared as such in accordance with Article by this Code but without in any way diminishing the scope of negotiability under

28 which shall be either non-pioneer or pioneer. their laws of issue are transferable under such conditions as may be determined

ART. 17. PIONEER ENTERPRISE shall mean a registered enterprise by the Board after consultation with the Department of Finance. The tax credit

certificate shall be used to pay taxes, duties, charges and fees due to the

(1) engaged in the manufacture, processing or production, of goods, National Government: Provided, That the tax credits issued under this Code shall

products, commodities or raw materials that have not been or are not not form part of the gross income of the grantee/transferee for income tax

being produced in the Philippines on a commercial scale or purposes under Section 29 of the National Internal Revenue Code and are

(2) which uses a design, formula, scheme, method, process or system of therefore not taxable: Provided, further, That such tax credits shall be valid only

production or transformation of any element, substance or raw for a period of ten (10) years from date of issuance.

materials into another raw material or finished goods which is new and ART. 22. Export products shall mean manufactured or processed products the

untried in the Philippines or total F.O.B. Philippine port value of the exports of which did not exceed five

(3) engaged in the pursuit of agricultural, forestry and mining activities million dollars in the United States currency in the calendar year 1968 and which

and/or services including the industrial aspects of food processing meet the local content requirement, if any, set by the Board, and standards of

whenever appropriate, pre-determined by the Board, in consultation quality set by the Bureau of Product Standards,or, in default of such standards,

with the appropriate Department, to be feasible and highly essential to by the Board or by such public or private organization, chamber, group or body

the attainment of the national goal in relation to a declared specific as the Board may designate. The above definition notwithstanding, the

national food and agricultural program for self sufficiency and other Investment Priorities Plan may include other products for exports subject to such

social benefits of the project or conditions and limited incentives as may be determined by the Board.

(4) which produces non-conventional fuels or manufactures equipment ART. 23. Export sales shall mean the Philippine port F.O. B. value, determined

which utilize non-conventional sources of energy or uses or converts to from invoices, bills of lading, inward letters of credit, landing certificates, and

coal or other non-conventional fuels or sources of energy in its other commercial documents, of export products exported directly by a

production, manufacturing or processing operations registered export producer or the net selling price of export products sold by a

Provided, That the final product in any of the foregoing instances, involves or will registered export producer to another export producer, or to an export trader

involve substantial use and processing of domestic raw materials, whenever that subsequently exports the same: Provided, That sales of export products to

available; taking into account the risks and magnitude of investment; Provided, another producer or to an export trader shall only be deemed export sales when

further, That the foregoing definitions shall not in any way limit the rights and actually exported by the latter, as evidenced by landing certificates or similar

incentives granted to less-developed-area enterprises provided under Title V, commercial documents: Provided, further, That without actual exportation the

Book 1 hereof. following shall be considered constructively exported for purposes of this

provision:

ART. 18. NON-PIONEER ENTERPRISE shall include all registered producer

enterprises other than pioneer enterprises. (1) sales to bonded manufacturing warehouses of export-oriented

manufacturers;

ART. 19. EXPANSION shall include modernization and rehabilitation and shall

mean increase of existing volume or value of production or upgrading the quality (2) sales to export processing zones;

of the registered product or utilization of inefficient or idle equipment under such (3) sales to registered export traders operating bonded trading warehouses

guidelines as the Board may adopt. supplying raw materials used in the manufacture of export products

ART. 20. MEASURED CAPACITY shall mean the estimated additional volume of under guidelines to be set by the Board in consultation with the Bureau

production or service which the Board determines to be desirable in each of Internal Revenue and the Bureau of Customs;

Joemyl Baloro Page 6 of 18

Incentives and Foreign Investment Law

(4) sales to foreign military bases, diplomatic missions and other agencies investigation and analysis by the Board.

and/or instrumentalities granted tax immunities, of locally The determination of PREFERRED AREAS OF INVESTMENT to be listed in the

manufactured, assembled or repacked products whether paid for in Investment Priorities Plan shall be based on long-run comparative advantage,

foreign currency or not: Provided, further, That export sales of taking into account the value of social objectives and employing economic

registered export traders may include commission income: and criteria along with market, technical; and financial analyses.

Provided, finally, That exportation of goods on consignment shall not be

deemed export sales until the export products consigned are in fact sold The Board shall take into account the following:

by the consignee. (a) Primarily, the economic soundness of the specific activity as shown by

Sales of locally manufactured or assembled goods for household and personal its economic internal rate of return;

use to Filipinos abroad and other non-residents of the Philippines as well as (b) The extent of contribution of an activity to a specific development goal;

returning Overseas Filipinos under the Internal Export Program of the (c) Other indicators of comparative advantage;

government and paid for in convertible foreign currency inwardly remitted

through the Philippine banking systems shall also be considered export sales. (d) Measured capacity as defined in Article 20; and

ART. 24. Production cost shall mean the total of the cost of direct labor, raw (e) The market and technical aspects and considerations of the activity

materials, and manufacturing overhead, determined in accordance with proposed to be included.

generally accepted accounting principles, which are incurred in manufacturing or In any of the declared preferred areas of investment, the Board may designate as

processing the products of a registered enterprise. pioneer areas the specific products and commodities that meet the requirements

ART. 25. PROCESSING shall mean converting of raw materials into marketable of Article 17 of this Code and review yearly whether such activity, as determined

form through physical, mechanical, chemical, electrical, biochemical, biological by the Board, shall continue as pioneer, otherwise, it shall be considered as non-

or other means or by a special treatment or a series of actions, such as pioneer and accordingly listed as such in the Investment Priorities Plan or

slaughtering, milling, pasteurizing, drying or dessicating quick freezing, that removed from the Investment Priorities Plan.

results in a change in the nature or state of the products. Merely packing or ART. 29. Approval of the Investment Priorities Plan. - The President shall proclaim

packaging shall not constitute processing. the whole or part of such plan as in effect; or alternatively return the whole or

ART. 26. INVESTMENT PRIORITIES PLAN shall mean the overall plan prepared part of the plan to the Board of Investments for revision.

by the Board which includes and contains: Upon the effectivity of the plan or portions thereof, the President shall issue all

(a) The specific activities and generic categories of economic activity wherein necessary directives to all departments, bureaus, agencies or instrumentalities of

investments are to be encouraged and the corresponding products and the government to ensure the implementation of the plan by the agencies

commodities to be grown, processed or manufactured pursuant thereto concerned in a synchronized and integrated manner. No government body shall

for the domestic or export market; adopt any policy or take any course of action contrary to or inconsistent with the

plan.

(b) Specific public utilities which can qualify for incentives under this Code and

which shall be supported by studies of existing and prospective regional ART. 30. Amendments. - Subject to publication requirements and the criteria for

demands for the services of such public utilities in the light of the level investment priority determination, the Board of Investments may, at any time,

and structure of income, production, trade, prices and relevant add additional areas in the plan, alter any of the terms of the declaration of an

economic and technical factors of the regions as well as the existing investment area or the designation of measured capacities, or terminate the

facilities to produce such services; status of preference. In no case, however, shall any amendment of the plan

impair whatever rights may have already been legally vested in qualified

(c) Specific activities where the potential for utilization of indigenous non- enterprises which shall continue to enjoy such rights to the full extent allowed

petroleum based fuels or sources of energy can be best promoted; and under this Code. The Board shall not accept applications in an area of investment

(d) Such other information, analyses, data, guidelines or criteria as the Board prior to the approval of the same as a preferred area nor after approval of its

may deem appropriate. deletion as a preferred area of investment.

ART. 31. Publication. - Upon approval of the plan, in whole or in part or upon

CHAPTER II approval of an amendment thereof, the plan or the amendment, specifying and

declaring the preferred areas of investment and their corresponding measured

INVESTMENT PRIORITIES PLAN capacity shall be published in at least one (1) newspaper of general circulation

ART. 27. Investment Priorities Plan. and all such areas shall be open for application until publication of an

- BOI must submit to the President the IPP on or before March 31. amendment or deletion thereof, or until the Board approves registration of

President may extend deadline. enterprises which fill the measured capacity.

ART. 28. Criteria in Investment Priority Determination. - No economic activity

shall be included in the Investment Priorities Plan unless it is shown to be CHAPTER III

ECONOMICALLY, TECHNICALLY AND FINANCIALLY SOUND after thorough

Joemyl Baloro Page 7 of 18

Incentives and Foreign Investment Law

REGISTRATION OF ENTERPRISES preferred project if the Board should so require to facilitate proper

Qualifications of a Registered Enterprise. implementation of this Code.

A. Citizenship Criteria for Evaluation of Applications.

a. Filipino citizen a. The extent of ownership and control by Philippine citizens of the

enterprises;

b. Partnership/ Corporation/ Cooperative

b. The economic rates of return;

i. organized under Philippine laws

c. The measured capacity: Provided, That estimates of measured

ii. at least 60% of capital owned and controlled by capacities shall be regularly reviewed and updated to reflect

Filipino citizens changes in market supply and demand conditions: Provided,

iii. at least 60% of the Board of Directors are citizens further, That measured capacity shall not result in a monopoly in

c. Foreign corporation any preferred area of investment which would unduly restrict trade

and fair competition nor shall it be used to deny the entry of any

i. Proposes to engage in a PIONEER PROJECT enterprise in any field of endeavor or activity;

1. Measured capacity cannot be filled in by d. The amount of foreign exchange earned, used or saved in their

Philippine nationals operations;

2. Area of business not within activities e. The extent to which labor, materials and other resources obtained

reserved by the Constitution or other laws to from indigenous sources are utilized;

Philippine citizens or corporations owned and

controlled by Philippine citizens f. The extent to which technological advances are applied and

adopted to local conditions;

ii. OR exports 70% of its total production

g. The amount of equity and degree to which the ownership of such

iii. Obligates to attain PHILIPPINE NATIONAL STATUS equity is spread out and diversified; and

within 30 years from registration

h. Such other criteria as the Board may determine.

EXCEPTION: 100% EXPORT

- applications NOT ACTED UPON within 20 WORKING DAYS shall be

B. Type of Business deemed approved

a. proposing to engage in a preferred project listed or authorized - decision can be appealed to the OFFICE OF THE PRESIDENT within 30

in the current Investment Priorities Plan within a reasonable DAYS from its promulgation

time to be fixed by the Board

- if appealed, decision of the board shall be FINAL and executory after 90

b. at least fifty percent (50%) of its total production is for export DAYS after perfection of appeal unless the OP reverses it

c. it is an existing producer which will export part of production Certificate of Registration.

under such conditions and/or limited incentives as the Board

may determine; - issued a certificate of registration

d. enterprise is engaged or proposing to engage in the sale o under the seal of the Board of Investments

abroad of export products bought by it from one or more o with the signature of its Chairman and/or such other officer or

export producers employee of the Board as it may empower and designate for

e. enterprise is engaged or proposing to engage in rendering the purpose.

technical, professional or other services or in exporting o CONTENTS

television and motion pictures and musical recordings made or

The name of the registered enterprise;

produced in the Philippines, either directly or through a

registered trader. The preferred area of investment in which the

C. Has the capacity to CONTRIBUTE to the development of the preferred registered enterprise is proposing to engage;

are and of the national economy in general The nature of the activity it is undertaking or

D. Proposing to engage in NOT PREFERRED projects proposing to undertake, whether pioneer or non-

pioneer, and the registered capacity of the enterprise;

- it must have installed or undertakes to install an accounting system and

adequate to identify the investments, revenues, costs, and profits or

losses of each preferred project undertaken by the enterprise separately The other terms and conditions to be observed by the

from the aggregate investment, revenues, costs and profits or losses of registered enterprise by virtue of the registration.

the whole enterprise or to establish a separate corporation for each

Joemyl Baloro Page 8 of 18

Incentives and Foreign Investment Law

TITLE II 4 years- non-pioneer enterprises

BASIC RIGHTS AND GUARANTEES Can be EXTENDED for 1 year if:

ART. 38. Protection of Investment. - All investors and registered enterprises are i. the project meets the prescribed ratio of capital equipment to

entitled to the basic rights and guarantees provided in the Constitution. Among number of workers set by the Board;

other rights recognized by the Government of the Philippines are the following: ii. utilization of indigenous raw materials at rates set by the

(a) REPARTRIATION OF INVESTMENTS. - right to repatriate the entire Board;

proceeds of the liquidation of the investment in the currency in which iii. the net foreign exchange savings or earnings amount to at

the investment was originally made and at the exchange rate prevailing least US$500,000.00 annually during the first three(3) years of

at the time of repatriation operation.

(b) REMITTANCE OF EARNINGS. right to remit earnings from the CANNOT EXCEED 8 years

investment in the currency in which the investment was originally made

and at the exchange rate prevailing at the time of remittance, EXPANDING FIRMS- 3 years from commercial operation, proportionate to

expansion

(c) FREEDOM FROM EXPROPRIATION. - There shall be no

expropriation by the government of the property represented by - not entitled to additional deduction due to labor expense

investments or of the property of the enterprise EXCEPT for public use 2. Additional Deduction for Labor Expense

or in the interest of national welfare or defense and upon payment of For the FIRST 5 YEARS

just compensation. In such cases, foreign investors or enterprises shall

have the right to remit sums received as compensation for the Deduction of 50% of wages corresponding to the increment in the

expropriated property in the currency in which the investment was number of direct labor for skilled and unskilled workers

originally made and at the exchange rate at the time of remittance, Additional deduction shall be DOUBLED if the activity is located in less

subject to the provisions of Section 74 of Republic Act. No. 265 as developed areas as defined in Art. 40.

amended; 3. Exemption From Taxes And Duties On Imported

(d) REQUISITION OF INVESTMENT. - There shall be no requisition of Spare Parts

the property represented by the investment or of the property of 100% EXEMPT from customs duties and NIR tax

enterprises, EXCEPT in the event of war or national emergency and

Provided:

only for the duration thereof. Just compensation shall be determined

and paid either at the time of requisition or immediately after cessation a. 70% of products for export

of the state of war or national emergency. b. not manufactured domestically

Payments received as compensation for the requisitioned property may c. reasonably needed and exclusively used by the registered

be remitted in the currency in which the investment was originally made enterprise EXCEPT

and at the exchange rate prevailing at the time of remittance.

upon prior approval for part-time use in a non-

(e) RIGHT TO REMIT registered activity

proportionate taxes are paid on the specific

TITLE III equipment and machinery being permanently used for

INCENTIVES TO REGISTERED ENTERPRISES non-registered activities

When is an enterprise entitled to benefits and incentives? d. Board approval was secured prior to importation of

machinery

GENERAL RULE: when the incentives are made in the PREFERRED AREAS OF

INVESTMENT as defined by the Investment Priorities Plan Board may require INTERNATIONAL CANVASSING but if value exceed $5

Million, the provisions of PD 1764 on INTERNATIONAL COMPETITIVE

EXCEPTIONS: BIDDING shall apply.

1. Filipino-owned enterprise where 50% of products is for export Should the enterprise sell the machinery within 5 YEARS from

2. Not Filipino-owned where 70% of products is for export importation, both the vendor and the vendee shall be liable to pay

TWICE the tax exemption granted to it.

A. Fiscal Incentives EXCEPT if sale within 5 years is made to:

1. Income Tax Holiday to another registered enterprise or registered

domestic producer enjoying similar incentives;

6 years- pioneer enterprises

for reasons of proven technical obsolescence; or

Joemyl Baloro Page 9 of 18

Incentives and Foreign Investment Law

for purposes of replacement to improve and/or Spouse and children below 21 shall be allowed entry to the Philippines

expand the operations of the registered enterprise. A registered enterprise shall train Filipinos as understudies of foreign

4. Exemption From Wharfage Dues And Export Tax, nationals in administrative, supervisory and technical skills.

Duty, Impost And Fees 2. Simplification of customs procedures

5. Tax Exemption On Breeding Stocks And Genetic 3. Importation of consigned equipment

Materials

No restriction as to use of equipment consigned to the registered

Importation of BREEDING STOCKS and GENETIC MATERIALS enterprise

a. not locally available or not available in a comparative price o upon payment of re-importation bond

b. reasonably needed by the enterprise o for the exclusive use of the registered enterprise

c. prior approval by Board secured o if sold or transferred, rule on imported machinery shall apply

6. Tax Credits

4. The privilege to operate a bonded

on domestic equipment manufacturing/trading warehouse

reasonable needed and exclusively used for Access to the utilization of the bonded warehousing system in all areas

registered business required by the project subject to such guidelines as may be issued by

the Board upon prior consultation with the Bureau of Customs.

would have been tax-exempt had they been

imported

prior approval of Board secured TITLE IV

made within 5 years from effectivity of Code INCENTIVES TO LESS-DEVELOPED-AREA REGISTERED ENTERPRISE

exempt from CONTRACTORS TAX

LESS DEVELOPED AREA

on RAW MATERIALS equivalent to tax due on

such - determined by the Board upon consultation with the NEDA and other

government agencies

Board may set a fixed percentage of export

sales as tax - CRITERIA:

on purchase of genetic material and breeding o LOW PER CAPITA GROSS DOMESTIC PRODUCT

stocks o LOW LEVEL OF INVESTMENTS

reasonable needed and exclusively used for o HIGH RATE OF UNEMPLOYMENT AND/OR UNDEREMPLOYMENT

registered business o LOW LEVEL OF INFRASTRUCTURE DEVELOPMENT including its

would have been tax-exempt had they been accessibility to developed urban centers, shall be entitled to

imported the following incentives in addition to those provided in the

preceding article.

prior approval of Board secured

Incentves:

made within 10 years from registration

1. Incentives for Necessary and Major Infrastructure

7. Additional Deductions from Taxable Income and Public Facilities.

Income Tax deduction equal to 100% of costs for

B. Non-Fiscal Incentives necessary and major infrastructure works

1. Employment Of Foreign Nationals prior approval of the Board in consultation with other

Registered enterprise may employ foreign nationals in supervisory, government agencies concerned;

technical or advisory positions for a period not exceeding five (5) years all such infrastructure works shall upon completion, be

from its registration, extendible for limited periods at the discretion of transferred to the Philippine Government

the Board

- any amount not deducted for a particular year may be

o if majority of shares owned by foreign nationals, the positions carried over for deduction for subsequent years not

of PRESIDENT, TREASURER and GENERAL MANAGER maybe exceeding ten (10) years from commercial operation.

retained by foreign nationals.

2. Nationality requirements not as strict in less

Joemyl Baloro Page 10 of 18

Incentives and Foreign Investment Law

developed areas representatives or distributors domiciled in the Philippines

Types of Investment or who in any calendar year stay in the country for a

period or periods totaling one hundred eighty [180] days

a. Pioneer Areas of Investments or more

- (Initially owned by foreigners) Investments that are required to attain 2. participating in the management, supervision or control of

Filipino status (60% Filipino) within thirty (30) years or such longer any domestic business, firm, entity or corporation in the

period as the BOI may determine except enterprises whose production Philippines;

is 100% geared for exports.

3. and any other act or acts that imply a continuity of

b. Non-Pioneer Areas of Investments commercial dealings or arrangements and contemplate to

- Foreign investments are allowed up to forty percent (40%) of the that extent the performance of acts or works, or the

outstanding voting capital stock; may be higher if it exports at least exercise of some of the functions normally incident to, and

70% of its total production. in progressive prosecution of commercial gain or of the

purpose and object of the business organization:

III. Foreign Investments Act 4. not mere investment as a shareholder by a foreign entity

in domestic corporations duly registered to do business,

Philippine National and/or the exercise of rights as such investor; nor having a

1. citizen of the Philippines; of a domestic partnership or nominee director or officer to represent its interests in

association wholly owned by citizens of the Philippines; such corporation; nor appointing a representative or

2. a corporation organized under the laws of the Philippines distributor domiciled in the Philippines which transacts

of which at least sixty percent (60%) of the capital stock business in its own name and for its own account;

outstanding and entitled to vote is owned and held by

citizens of the Philippines

3. a corporation organized abroad and registered as doing Is a foreign corporation required to register with the SEC if it

business in the Philippines under the Corporation Code of wants to do business in the Philippines? NO

which one hundred percent (100%) of the capital stock What are the consequences of not registering with the SEC?

outstanding and entitled to vote is wholly owned by Foreign corporation not registered CANNOT SUE but can counter-sue

Filipinos or a trustee of funds for pension or other should the Domestic Corporation file a case against it first

employee retirement or separation benefits, where the

trustee is a Philippine national and at least sixty percent Summary of Doing Business: The principles regarding the right of a

(60%) of the fund will accrue to the benefit of Philippine foreign corporation to bring suit in Philippine courts may thus be

nationals: Provided, That where a corporation and its non- condensed in four statements: (1) if a foreign corporation does business

Filipino stockholders own stocks in a Securities and in the Philippines without a license, it cannot sue before the Philippine

Exchange Commission (SEC) registered enterprise, at least courts; (2) if a foreign corporation is not doing business in the

sixty percent (60%) of the capital stock outstanding and Philippines, it needs no license to sue before Philippine courts on an

entitled to vote of each of both corporations must be isolated transaction or on a cause of action entirely independent of any

owned and held by citizens of the Philippines and at least business transaction; (3) if a foreign corporation does business in the

sixty percent (60%) of the members of the Board of Philippines without a license, a Philippine citizen or entity which has

Directors of each of both corporations must be citizens of contracted with said corporation may be estopped from challenging the

the Philippines, in order that the corporation, shall be foreign corporations corporate personality in a suit brought before the

considered a "Philippine national. Philippine courts; and (4) if a foreign corporation does business in the

Doing Business Philippines with the required license, it can sue before Philippine courts

on any transaction. MR. Holdings, Ltd. V. Bajar, 380 SCRA 617 (2002);

1. soliciting orders, service contracts, opening offices, Agilent Technolgies Singapore (PTE) Ltd. v. Integrated Silicon

whether called "liaison" offices or branches; appointing Technology Phil. Corp., G.R No. 154618, 14 April (2004).

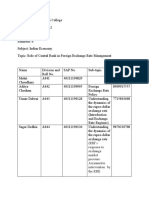

Modes of Definition/ Description Capital Taxes Expenses Liabilitie Deposit of Establishment and

Investment Requirement s Securities Registration Costs:

Subsidiary - incorporated and Minimum capital Corporate Income Tax = Cannot pass Limited to NONE Filing fee: .2% of

existing under the requirement = 30% of NET income or to parent assets of required authorized capital

Joemyl Baloro Page 11 of 18

Incentives and Foreign Investment Law

laws of the Philippines $200K MCIT (2% of GROSS subsidiary stock but not less than

- wholly owned or at EXCEPT: income) P1,000

least majority owned 1. advanced

by a foreign parent technolog Remittance of Legal Research fee:

company y Dividends = 30% 1% of fling fee but not

- separate juridical approved EXCEPT: 15% if country less than P10.00

entity from parent by DOST of parent company

company ($100K) 1. grants 15% By-laws fee: P500

2. direct tax sparing

employme 2. does not DST: P1 for each P200

nt of at impose tax on par value of shares

least 50 dividends

persons Additional Fees:

($100K) a. P2,000 if

3. exports at registering

least 60% under Foreign

of output Investments

Act

b. Fees for

permits and

applications

with BIR and

DTI

Branch - extension of foreign Minimum capital Corporate Income Tax = Parent Parent Deposit Filing fee: .2% of

corporation requirement = 30% of NET income or company answerabl Government authorized capital

- subject to $200K MCIT (2% of GROSS can allocate e to Securities = stock but not less than

NATIONALITY EXCEPT: income) to its branch liabilities at least P1,000

requirements in 1. advanced a incurred P100K with

certain industries technolog Branch Profit proportional by branch SEC within 60 Legal Research fee:

y Remittance Tax = 15% part of days from 1% of fling fee but not

approved of total profits applied branchs issuance of less than P10.00

by DOST or earmarked for expenses license

($100K) remittance without Additional Fees:

2. direct deduction of tax Additional a. P2,000 if

employme component (shall not securities= registering

nt of at include income derived 2% of the under Foreign

least 50 from activity not related gross income Investments

persons to business) in excess of Act

($100K) P5M b. Fees for

- within 6 permits and

months after applications

each fiscal with BIR and

year DTI

Representa - promotes products of Amount initially NO TAX LIABILITY No NONE Filing fee: .1% of

tive Office parent company but remitted = at least allocation required actual inward

cannot enter into $30, 000 from parent remittance but not less

contracts with local than P2,000

entities on behalf of

parent company Legal Research fee:

- does not derive 1% of fling fee but not

income from the less than P10.00

Philippines

Joemyl Baloro Page 12 of 18

Incentives and Foreign Investment Law

- contracts must be Fees for permits and

entered into by the applications with BIR

HEAD OFFICE and the and DTI

local entity

Acceptable activities of a

representative office:

a. dissemination of

foreign market

information;

b. promotion for export

of Philippine products

c. acting as a message

centre or a

communication centre

between interested

parties and the head

office;

d. promotion of products

presently being

distributed in the

Philippines;

e. to render, assist and

give technical know-

how and training to

existing and future

customers of the

Company's products;

f. to provide and

facilitate better

communication and

contact between its

head office and

affiliated companies

on one hand and

present and future

customers on the

other;

g. to inform potential

customers of price

quotations of the head

office and affiliated

companies;

h. to conduct and make

surveys and studies of

the market, economic

and financial

conditions in the

Philippines;

i. attend to the needs of

end-users of its

products in the

Joemyl Baloro Page 13 of 18

Incentives and Foreign Investment Law

Philippines.

Regional or - principally acts as a Not less than NO income tax if it does Expenses Liabilities NONE Filing fee: P5,000

Area supervision, $50,000 or its not derive income from financed by shouldere required

Headquart communications and equivalent in an the Philippines the parent d by Legal Research fee:

ers coordination center for acceptable company; parent 1% of fling fee but not

the subsidiaries, currency Employees of RAH = Not less company less than P10.00

branches or affiliates 15% of gross income or than

of a multinational NIRC rates $50,000 BOI requirement of

company in the Asia- annual inward

Pacific Region. remittance = Not less

- not allowed to do than $50,000 for

business or earn expenses

income from the host

country

- does not deal directly

with the clients of the

parent company,

Regional Branch office established in the Not less than Income Tax = 10% of Expenses Liabilities NONE Filing fee: 1% of actual

Operating Philippines engaged in any one $200K or its taxable income finance by shouldere required remittance but not less

Headquart of the following services: equivalent in an parent d by than 1% of the

ers a. general administration acceptable Branch Profit should parent Philippine currency

and planning; currency Remittance Tax = 15% income company equivalent of $200K

b. business planning and of total profits applied earned from

coordination; or earmarked for operations Legal Research fee:

c. sourcing and remittance without be 1% of fling fee but not

procurement of raw deduction of tax insufficient less than P10.00

materials and component (shall not

components; include income derived

d. corporate finance from activity not related

advisory services; to business)

e. marketing control and

sales promotion; Employees of ROHQ =

f. training and personnel 15% of gross income or

management; NIRC rates

g. logistic services;

research and

development services

and product

development;

h. technical support and

maintenance;

i. data processing and

communication;

j. business

development.

- It refers to a foreign

business entity which

is allowed to derive

income in the

Philippines by

performing qualifying

Joemyl Baloro Page 14 of 18

Incentives and Foreign Investment Law

services to its

affiliates, subsidiaries

or branches in the

Philippines, in the

Asia-Pacific Region and

in other foreign

markets.

- Regional operating

headquarters are

prohibited from

offering qualifying

services to entities

other than their

affiliates, branches or

subsidiaries

Joint - a cooperative If foreign interest Corporate Income Tax =

Venture arrangement of exceeds 40%, 30% of NET income or

corporations, whether minimum capital MCIT (2% of GROSS

foreign or domestic, to requirement = income)

jointly perform a $200K

single, specific EXCEPT: Dividends = 30%

undertaking or project 1. advanced EXCEPT: 15% if country

with each of the technolog of parent company

partners contributing y 1. grants 15%

to the performance approved tax sparing

- subject to by DOST 2. does not

NATIONALITY ($100K) impose tax on

requirements for 2. direct dividends

certain industries employme

nt of at

least 50

persons

($100K)

3. exports at

least 60%

of output

Purchase - the foreign corporation Corporate Income Tax = NONE DST: P1 for each P200

of stocks in may take advantage 30% of NET income or Required par value of shares

Existing of the goodwill already MCIT (2% of GROSS

Corporatio generated by the income) Subsequent sale:

n domestic corporation, DST = .75 centavos for

as an ongoing concern Tax on the Sale of each or fractional part

- subject to Shares of Stock: of par value

NATIONALITY Unlisted corporation,

requirements Capital Gains Tax = 5%

of the first P

100,000.00 and 10%

for the excess above P

100,000.00 of net gain.

traded and listed in the

Philippine Stock

Joemyl Baloro Page 15 of 18

Incentives and Foreign Investment Law

Exchange, = 1/2 of 1%

of the value of the

stock sold

Exchange of property

for stock where party

gains control of stock

TAX FREE

Dividends = 30%

EXCEPT: 15% if country

of parent company

1. grants 15%

tax sparing

2. does not

impose tax on

dividends

Merger or - merger occurs when Merger or consolidation shouldered shouldere NONE Filing fee: .2% of

Consolidati one or more existing NOT TAXABLE by surviving d by required authorized capital

on corporations are corporation surviving stock but not less than

absorbed by another New corporation liable corporatio P3,000

corporation which for CIT= 30% n

survives and continues Merger with

the combined application to increase

business. capital stock: .2% of

- Consolidation occurs increase in capital

when two or more stock or subscription

existing corporations price OR .2% of

consolidate or join authorized capital

their businesses to stock but not less than

form a new, single, P3,000 whichever is

consolidated higher

corporation.

- Subject to Consolidated

constitutional companys authorized

prohibition against capital stock different

monopolies and from total equity of

restraint of trade constituent

corporations: 2% of

capital stock in

constituent

corporations OR .2% of

capital stock or

subscription price but

not less than P1,000

whichever is higher

Legal Research fee:

1% of fling fee but not

less than P10.00

Joemyl Baloro Page 16 of 18

Incentives and Foreign Investment Law

By-laws fee: P500

DST: P1 for each P200

par value of shares

Fees for permits and

applications with BIR

and DTI

Technology Refers to contracts or Income Tax = 30% No NOT NONE Filing fee: P2,500

Transfer agreements entered into - can be allocation shouldere required Registration fee:

Arrangeme involving the: reduced to at d by P2,500

nt most 10% by foreign

a. transfer of systematic treaty corporatio

knowledge for the n

manufacture of a Royalty subject to 12%

product or the VAT

application of a

process;

b. rendering of a service,

including management

contracts;

c. transfer, assignment

or licensing of all

forms of intellectual

property rights,

including licensing of

computer software,

except computer

software developed for

mass market.

- no longer required to

be registered if it

complies with IP Code

- should not have

adverse effects on

competition and trade

- must provide for

effective quality

control by the licensor

over the product or

service covered by the

contract

- must allow continued

access to

improvements in the

transferred technology

Manageme - foreign corporation Only Only NONE Need not be registered

nt Contract shall undertake to expenses of liabilities required because it is a PRIVATE

manage all or foreign of foreign CONTRACT.

substantially all of the corporation corporatio - must be

Joemyl Baloro Page 17 of 18

Incentives and Foreign Investment Law

business of a domestic n disclosed

corporation.

- Period: only 5 years/

term

- Domestic enterprises

engaging in wholly or

partially nationalized

activities cannot enter

into a management

contract with a foreign

corporation.

Joemyl Baloro Page 18 of 18

Das könnte Ihnen auch gefallen

- Provisional RemediesDokument12 SeitenProvisional Remediesrodrigo_iii_3Noch keine Bewertungen

- Fallacies in Legal Reasoning (A To H)Dokument8 SeitenFallacies in Legal Reasoning (A To H)rodrigo_iii_3100% (1)

- Victorias Milling Vs PPADokument1 SeiteVictorias Milling Vs PPArodrigo_iii_3Noch keine Bewertungen

- Pascual vs. de La Cruz, 28 Scra 421, No. L-24819 May 30, 1969Dokument2 SeitenPascual vs. de La Cruz, 28 Scra 421, No. L-24819 May 30, 1969rodrigo_iii_3Noch keine Bewertungen

- Pascual vs. de La Cruz, 28 Scra 421, No. L-24819 May 30, 1969Dokument2 SeitenPascual vs. de La Cruz, 28 Scra 421, No. L-24819 May 30, 1969rodrigo_iii_3Noch keine Bewertungen

- Warrantless ArrestsDokument6 SeitenWarrantless Arrestsrodrigo_iii_3Noch keine Bewertungen

- Rem 1 Rev 1Dokument65 SeitenRem 1 Rev 1rodrigo_iii_3Noch keine Bewertungen

- 139 SCRA 206, No. L-62952 October 9, 1985Dokument2 Seiten139 SCRA 206, No. L-62952 October 9, 1985rodrigo_iii_3Noch keine Bewertungen

- L/epublic of Tbe: First Division Asia Brewery, Inc. and G. R. No. 190432 Charlie S. GoDokument9 SeitenL/epublic of Tbe: First Division Asia Brewery, Inc. and G. R. No. 190432 Charlie S. Gorodrigo_iii_3Noch keine Bewertungen

- L/epublic of Tbe: First Division Asia Brewery, Inc. and G. R. No. 190432 Charlie S. GoDokument9 SeitenL/epublic of Tbe: First Division Asia Brewery, Inc. and G. R. No. 190432 Charlie S. Gorodrigo_iii_3Noch keine Bewertungen

- Dlvitl! e K: Supreme CourtDokument9 SeitenDlvitl! e K: Supreme Courtrodrigo_iii_3Noch keine Bewertungen

- BT TalongDokument4 SeitenBT Talongrodrigo_iii_367% (3)

- Resident Marine Mammals of The Protected Seascape Tanon Strait v. Secretary Angelo Reyes GR No. 180771 April 21 2015Dokument16 SeitenResident Marine Mammals of The Protected Seascape Tanon Strait v. Secretary Angelo Reyes GR No. 180771 April 21 2015rodrigo_iii_3Noch keine Bewertungen

- Tan v. CaDokument1 SeiteTan v. Carodrigo_iii_3Noch keine Bewertungen

- BOOK 2-LGU GuidebookDokument140 SeitenBOOK 2-LGU Guidebookrodrigo_iii_3Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)