Beruflich Dokumente

Kultur Dokumente

Bir Lecture

Hochgeladen von

Tomoko KatoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bir Lecture

Hochgeladen von

Tomoko KatoCopyright:

Verfügbare Formate

Page 1 of 4

Taxation 01

Exercise: Bureau of Internal Revenue

1. The Bureau of the Internal Revenue is under the control and supervision of

a. The Court of Tax Appeals

b. The Bureau of Customs

c. The Department of Finance

d. The Legislative body

2. The Bureau of Internal Revenue shall be composed of:

a. A chairman and three commissioners

b. A chairman and four commissioners

c. A commissioner and three deputies

d. A commissioner and four deputies

3. Which of the following is not a power vested in the bureau of Internal

Revenue (BIR)?

a. The assessment and collection of all national internal revenue taxes,

fees and charges

b. The enforcement of all forfeitures, penalties and fines

c. The granting of tax exemptions and other incentives to taxpayers

d. The execution of judgments in all cases decided in its favor by the

court of tax appeals and the ordinary courts

4. Which of the following is not an authority granted by law to the

commissioner of the BIR?

a. To interpret tax laws and decide tax cases

b. To obtain information, summon, examine and take testimony of

persons

c. To make assessments and prescribe additional requirements for tax

administration and enforcement

d. To enact tax laws and amend the same

5. The following are expressed powers of the BIR Commissioner under the tax

code:

A. To prescribe real property values

B. To terminate taxable period

C. To inquire into bank deposit accounts

D. To accredit and register tax agent

a. A only c. A & C only

b. A & B only d. A, B, C, and D

6. Which of the following powers of the BIR Commissioner shall not be

delegated:

a. The power to recommend the promulgation of rules and regulations

by the Secretary of finance;

b. The power to issue rulings of first impression or to reverse, revoke or

modify any existing ruling of the Bureau;

c. The power to assign or reassign internal revenue to establishments

where articles subject to excise tax are produced or kept;

d. All of the above.

7. The following are constituted agents of BIR Commissioner for purposes of

collection of National Internal Revenue Taxes under the tax code, except:

Page 2 of 4

a. The Commissioner of Customs and his subordinates with respect to

the collection of national internal revenue taxes on imported goods;

b. The head of the appropriate government office and his subordinates

with respect to the collection of energy taxes;

c. Banks duly accredited by the Commissioner with respect to receipts

of payments of internal revenue taxes authorized to be made

through banks;

d. Individuals and general professional partnerships and their

representatives who prepare and file tax returns, statements,

reports, protests, and other papers with, or who appear before the

Bureau for the taxpayer

8. Which of the following taxes, fees and charges are deemed to be national

internal revenue taxes?

a. Income tax c. Documentary stamps

taxes

b. Excise taxes d. All of these

9. Which of the following taxes, fees and charges are not considered as

national internal revenue taxes?

a. Other percentage taxes c. Donors and estate

taxes

b. Value-added taxes d. Amusement taxes

10. Statement 1. The power to interpret provisions of the

National Internal Revenue Code and other tax laws shall be under the

exclusive and original jurisdiction of the Commissioner of Internal

Revenue, subject to review by the Secretary of Finance.

Statement 2. The power to decide disputed assessment and refunds of

internal revenue taxes is vested in the Commissioner of Internal Revenue,

subject to the exclusive appellate jurisdiction of the Court of Tax Appeals.

a. Only statement 1 is correct. C. Both statements are

correct.

b. Only statement 2 is correct. D. Both statements are

wrong.

11. The following are grounds wherein the Commissioner may

terminate the taxable period?

a. The taxpayer is retiring from business subject to tax.

b. The taxpayer is intending to leave the Philippines.

c. The taxpayer is intending to file a civil case against the Bureau of

Internal Revenue.

d. The taxpayer is intending to hide or conceal his property.

12. Statement 1. The power of the Commissioner of internal

Revenue to recommend the promulgation of rules and regulations by the

Secretary of Finance may not be delegated.

Statement 2. The power of the Commissioner of Internal Revenue to issue

rulings of first impression or to reverse, revoke or modify any existing

ruling of the Bureau of Internal Revenue may not be delegated.

a. Only statement 1 is correct. c. Both statements are

correct.

b. Only statement 2 is correct. d. Both statements are

wrong.

Page 3 of 4

13. Statement 1. The Commissioner of Internal Revenue is

authorized to inquire into the bank deposit of a tax payer who has filed an

application for compromise of his tax liability by reason of financial

incapacity to pay.

Statement 2. A compromise for tax liability on the ground of financial

incapacity to pay shall still involve a payment of tax from the taxpayer at a

minimum compromise rate of 10% of the basic assessed tax.

a. Only statement 1 is correct. c. Both statements are correct.

b. Only statement 2 is correct. d. Both statements are wrong.

14. Which statement is correct? In case of a tax erroneously

collected

a. A case for refund may be filed with the court simultaneously with

the filing of a claim for refund with the Bureau of Internal Revenue.

b. A case for refund may be filed with the court even without filing a

claim for refund with the Bureau of Internal Revenue.

c. A claim for refund must first be filed with the Bureau of Internal

Revenue and a decision of the Bureau must, under any

circumstance, be awaited before a case for refund may be filed

with the court.

d. A claim for refund must first be filed with the Bureau of Internal

Revenue and, in a given situation; a case for refund may be filed

with the court without awaiting the decision of the Bureau of

Internal Revenue.

15. Fixing the tax rate to be imposed is best described as a (an)

a. Tax administration aspect

b. Tax legislative function

c. Aspect of taxation which could be delegated

d. Function that could be exercised by the legislative branch

16. Which of the following is considered as a tax administrative

function?

a. Collection of taxes

b. Fixing of tax rates

c. Prescribing the date and place of payment of tax

d. Determination of the subject or object of taxation

17. They are issuances signed by the Secretary of Finance, upon

recommendations of the Commissioner of the Internal Revenue that

specify, prescribe or define rules and regulations for the effective

enforcement of the provisions of the National Internal Revenue Code

(NIRC) and related statutes.

a. Revenue regulations c. Revenue Memorandum Circular

b. Revenue Memorandum orders d. All of these

18. They are issuances that provide directives or instructions;

prescribe guidelines; and outline processes, operations, activities,

workflows, methods and procedures necessary in the implementation of

stated policies, goals, objectives, plans and programs of the Bureau in all

areas of operations, except auditing.

Page 4 of 4

a. Revenue regulations c. Revenue Memorandum Circular

b. Revenue Memorandum orders d. All of these

19. They are issuances that publish pertinent and applicable

portions, as well as amplifications, of laws, rules, regulations and

precedents issued by the BIR and other agencies/offices.

a. Revenue regulations c. Revenue Memorandum

Circular

b. Revenue Memorandum orders d. All of these

20. Which of the following statements is correct? A CPA can have

his certificate automatically revoked or cancelled upon conviction in a

criminal case:

a. For offering to the taxpayer the use of wrong

accounting records;

b. For willfully falsifying any audit report;

c. For rendering a report on unconfirmed statements;

d. All of the above.

***END***

Answer key:

1. C

2. D

3. C

4. D

5. D

6. D

7. D

8. D

9. D

10. C

11. C

12. C

13. C

14. D

15. B

16. A

17. A

18. B

19. C

20. D

**end**s

Das könnte Ihnen auch gefallen

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Von EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Noch keine Bewertungen

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Lecture Notes Tax Enforcement PDFDokument7 SeitenLecture Notes Tax Enforcement PDFEstele EstellaNoch keine Bewertungen

- ReSA B42 TAX Final PB Exam Questions Answers Solutions PDFDokument17 SeitenReSA B42 TAX Final PB Exam Questions Answers Solutions PDFNamnam KimNoch keine Bewertungen

- TUGAS Prak. Audit ASSIGNMENT 4 Kel. 4Dokument6 SeitenTUGAS Prak. Audit ASSIGNMENT 4 Kel. 4Alief AmbyaNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Quiz TaxDokument5 SeitenQuiz TaxRaven DahlenNoch keine Bewertungen

- MCQ Dimaampao W Answer Key PDFDokument25 SeitenMCQ Dimaampao W Answer Key PDFThe Chogs100% (1)

- Audit and Assurance - ICAB PDFDokument354 SeitenAudit and Assurance - ICAB PDFMizanur Rahman Babla100% (9)

- Upmost Amended by Laws ADokument28 SeitenUpmost Amended by Laws ACharmicah AquinoNoch keine Bewertungen

- Tax Remedies HandoutssssDokument5 SeitenTax Remedies HandoutssssfantasighNoch keine Bewertungen

- Taxation Sir SalvaDokument235 SeitenTaxation Sir SalvaSofia SanchezNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- Notes in Organization and Functions of The BirDokument5 SeitenNotes in Organization and Functions of The BirNinaNoch keine Bewertungen

- Income Taxation Qualifying Exams 21 June 2020Dokument16 SeitenIncome Taxation Qualifying Exams 21 June 2020Jan ryan100% (4)

- Tax Remedies ActDokument8 SeitenTax Remedies ActrobNoch keine Bewertungen

- HOMEWORK 2 Tax AdministrationDokument4 SeitenHOMEWORK 2 Tax Administrationfitz garlitos100% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- TAX Final-PreBoard-ExamDokument12 SeitenTAX Final-PreBoard-ExamCovi LokuNoch keine Bewertungen

- Finals Exam Tax PDFDokument3 SeitenFinals Exam Tax PDFSittieAyeeshaMacapundagDicali100% (1)

- Chapter 8 Valuation of InventoriesDokument39 SeitenChapter 8 Valuation of InventoriesMichelle Joy Nuyad-Pantinople100% (1)

- TAX Preweek Lecture (B42)Dokument24 SeitenTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- Midterm Mockboard ACCOUNTING 601-Integrated Course in TaxationDokument12 SeitenMidterm Mockboard ACCOUNTING 601-Integrated Course in TaxationhyasNoch keine Bewertungen

- Management Accountant March-2016Dokument124 SeitenManagement Accountant March-2016ABC 123Noch keine Bewertungen

- Taxation Material 1Dokument11 SeitenTaxation Material 1Shaira Bugayong100% (1)

- UP Commercial Law Reviewer 2008Dokument351 SeitenUP Commercial Law Reviewer 2008Katrina Montes100% (11)

- Finals Handout TaxDokument3 SeitenFinals Handout TaxFlorenz AmbasNoch keine Bewertungen

- Taxation Law ReviewDokument24 SeitenTaxation Law ReviewYuwi MimiNoch keine Bewertungen

- Taxation ExamDokument7 SeitenTaxation ExamJean PaladaNoch keine Bewertungen

- Role of Financial ManagementDokument25 SeitenRole of Financial Managementmujtaba_momin100% (1)

- MockboardDokument11 SeitenMockboardRandy ManzanoNoch keine Bewertungen

- Income Tax-100 QuestionsDokument5 SeitenIncome Tax-100 QuestionsChez Nicole LimpinNoch keine Bewertungen

- Polytechnic University of The PhilippinesDokument7 SeitenPolytechnic University of The PhilippinesTwinie Mendoza100% (1)

- MCQ Dimaampao W Answer KeyDokument25 SeitenMCQ Dimaampao W Answer KeyJohn Henry Naga100% (3)

- Midterm Examination Gen Principles and Tax RemediesDokument3 SeitenMidterm Examination Gen Principles and Tax RemediesRameinor Tambuli100% (1)

- Check List Iso 17065 2012Dokument35 SeitenCheck List Iso 17065 2012Wahyuningsih JacobNoch keine Bewertungen

- Taxation Challenge - With Answer KeyDokument9 SeitenTaxation Challenge - With Answer Keyariaseg100% (1)

- Psa 700 Notes and SummaryDokument10 SeitenPsa 700 Notes and SummaryEjkNoch keine Bewertungen

- Certified Supplier Quality ProfessionalDokument12 SeitenCertified Supplier Quality ProfessionalSuleman KhanNoch keine Bewertungen

- Notre Dame Educational Association: Mock Board Examination TaxationDokument10 SeitenNotre Dame Educational Association: Mock Board Examination TaxationirishjadeNoch keine Bewertungen

- ReSA B44 TAX Final PB Exam Questions Answers and SolutionsDokument14 SeitenReSA B44 TAX Final PB Exam Questions Answers and SolutionsDhainne EnriquezNoch keine Bewertungen

- 2.1.1 Quiz 2 - Answer KeyDokument7 Seiten2.1.1 Quiz 2 - Answer KeyMark Emil BaritNoch keine Bewertungen

- CPAR B94 TAX Final PB Exam - QuestionsDokument14 SeitenCPAR B94 TAX Final PB Exam - QuestionsSilver LilyNoch keine Bewertungen

- Sample Training Design - Financial ManagementDokument6 SeitenSample Training Design - Financial Managementrey ulysses l. dimaanoNoch keine Bewertungen

- Atty Cabaniero Tax Questions (Not Mine)Dokument21 SeitenAtty Cabaniero Tax Questions (Not Mine)R. BonitaNoch keine Bewertungen

- Handout 102Dokument4 SeitenHandout 102Mila Casandra CastañedaNoch keine Bewertungen

- SW01Dokument8 SeitenSW01Nadi HoodNoch keine Bewertungen

- TAX - Review Remedies ExDokument6 SeitenTAX - Review Remedies Exduguitjinky20.svcNoch keine Bewertungen

- Tax Remedies PDFDokument2 SeitenTax Remedies PDFPlay CinematicNoch keine Bewertungen

- Exercises On Tax Remedies, CTA Jurisdiction and Local TaxationDokument8 SeitenExercises On Tax Remedies, CTA Jurisdiction and Local TaxationApollo TheodoreNoch keine Bewertungen

- TaxationDokument5 SeitenTaxationAngel Chane OstrazNoch keine Bewertungen

- ARW Online Long Exam Part 3 PDFDokument12 SeitenARW Online Long Exam Part 3 PDFMansour HamjaNoch keine Bewertungen

- TAX 1 - 2nd Sem Income TaxDokument8 SeitenTAX 1 - 2nd Sem Income TaxYella Mae Pariña RelosNoch keine Bewertungen

- 19Dokument9 Seiten19jhouvanNoch keine Bewertungen

- 25494132Dokument7 Seiten25494132Janine LerumNoch keine Bewertungen

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Taxation (Tax)Dokument10 SeitenNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Taxation (Tax)joyceNoch keine Bewertungen

- TAX (1 of 2) Preweek B94 - QuestionnaireDokument13 SeitenTAX (1 of 2) Preweek B94 - QuestionnaireSilver LilyNoch keine Bewertungen

- Tax - First Preboard QuestionnaireDokument14 SeitenTax - First Preboard QuestionnairewithyouidkNoch keine Bewertungen

- Exercise RemediesDokument9 SeitenExercise RemediesJazzd Sy GregorioNoch keine Bewertungen

- Taxation Law - DoneDokument6 SeitenTaxation Law - DoneJam RockyouonNoch keine Bewertungen

- Tax 2 Finals ReviewerDokument19 SeitenTax 2 Finals Reviewerapi-3837022100% (2)

- Activity 3 Income TaxDokument4 SeitenActivity 3 Income Taxkaji cruzNoch keine Bewertungen

- Finals QuizDokument6 SeitenFinals QuizAngel MaghuyopNoch keine Bewertungen

- Cpar 1stpb Tax 2022 QsDokument15 SeitenCpar 1stpb Tax 2022 QsAshely KendraNoch keine Bewertungen

- Activity 3 Income Tax - MangawangDokument5 SeitenActivity 3 Income Tax - MangawangdehnieceNoch keine Bewertungen

- ACC 178 SAS Module 24Dokument13 SeitenACC 178 SAS Module 24maria isayNoch keine Bewertungen

- Chapter 29. Powers Authority of The Commissioner of Internal RevenueDokument5 SeitenChapter 29. Powers Authority of The Commissioner of Internal RevenuePrincess Edelyn CastorNoch keine Bewertungen

- Bureau of Internal Revenue (Bir) BIR Is Under The Executive Supervision and Control of The Department of FinanceDokument1 SeiteBureau of Internal Revenue (Bir) BIR Is Under The Executive Supervision and Control of The Department of FinanceAlexandria DiegoNoch keine Bewertungen

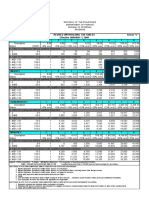

- Withholding Tax Table 1Dokument1 SeiteWithholding Tax Table 1Armel PalerNoch keine Bewertungen

- Exercise Tax AdministrationDokument5 SeitenExercise Tax AdministrationTomoko KatoNoch keine Bewertungen

- Tax On Corporations ExercisesDokument3 SeitenTax On Corporations ExercisesJacqueline SyNoch keine Bewertungen

- ch09 Additional Valuation Issues1Dokument38 Seitench09 Additional Valuation Issues1Tomoko KatoNoch keine Bewertungen

- Exercise RemediesDokument9 SeitenExercise RemediesJazzd Sy GregorioNoch keine Bewertungen

- Exercise BirDokument5 SeitenExercise BirTomoko KatoNoch keine Bewertungen

- Bir LectureDokument4 SeitenBir LectureClarisaJoy SyNoch keine Bewertungen

- Withholding Tax Table 1Dokument1 SeiteWithholding Tax Table 1Armel PalerNoch keine Bewertungen

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) Answer KeyDokument1 SeiteP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) Answer KeyTestNoch keine Bewertungen

- Tax On Corporations ExercisesDokument3 SeitenTax On Corporations ExercisesJacqueline SyNoch keine Bewertungen

- Final ExamDokument12 SeitenFinal ExamTomoko KatoNoch keine Bewertungen

- Comp ExamsDokument28 SeitenComp ExamsTomoko KatoNoch keine Bewertungen

- Chapter 1 - 3Dokument34 SeitenChapter 1 - 3Tomoko KatoNoch keine Bewertungen

- Comp ExamsDokument28 SeitenComp ExamsTomoko KatoNoch keine Bewertungen

- Final ExamDokument12 SeitenFinal ExamTomoko KatoNoch keine Bewertungen

- Polytechnic University of The Philippines: Age Frequency Percentage (%) RankDokument16 SeitenPolytechnic University of The Philippines: Age Frequency Percentage (%) RankTomoko KatoNoch keine Bewertungen

- ResumeTemplate 5Dokument1 SeiteResumeTemplate 5Dipesh BardoliaNoch keine Bewertungen

- Polytechnic University of The Philippines Presentation, Analysis and Interpretation of DataDokument16 SeitenPolytechnic University of The Philippines Presentation, Analysis and Interpretation of DataTomoko KatoNoch keine Bewertungen

- John W. Smith: 5 Years Experience in The Industry's Most Competitive FirmsDokument1 SeiteJohn W. Smith: 5 Years Experience in The Industry's Most Competitive FirmsDipesh BardoliaNoch keine Bewertungen

- ResumeTemplate 1 InspirationDokument1 SeiteResumeTemplate 1 InspirationSoraya AyaNoch keine Bewertungen

- Financial Statement Analysis: Lesson 5.2Dokument29 SeitenFinancial Statement Analysis: Lesson 5.2Rein BalicogNoch keine Bewertungen

- Analysis of The Financial Performance of A Banking Sector - BOIDokument2 SeitenAnalysis of The Financial Performance of A Banking Sector - BOIchandiaNoch keine Bewertungen

- QA - QC Basic Knowledge For Civil EngineersDokument58 SeitenQA - QC Basic Knowledge For Civil EngineersMahar FarooqNoch keine Bewertungen

- DDDaudit SYSDauditDokument12 SeitenDDDaudit SYSDauditicturnerNoch keine Bewertungen

- Journal of Global Responsibility: Systematic Literature Review On The Evolution of Integrated Reporting ResearchDokument32 SeitenJournal of Global Responsibility: Systematic Literature Review On The Evolution of Integrated Reporting ResearchsaddamNoch keine Bewertungen

- CH 09 ImaimDokument27 SeitenCH 09 Imaimkevin echiverriNoch keine Bewertungen

- WP Annual Report AnalysisDokument3 SeitenWP Annual Report AnalysisAvishek GhosalNoch keine Bewertungen

- CA Intermediate Auditing & Assurance Dec 2021 Suggested AnswersDokument11 SeitenCA Intermediate Auditing & Assurance Dec 2021 Suggested AnswersAshish KansalNoch keine Bewertungen

- IDT Last Day Revision Notes Free VersionDokument11 SeitenIDT Last Day Revision Notes Free Versionmanognap33Noch keine Bewertungen

- Overall Descriptive StatisticsDokument127 SeitenOverall Descriptive StatisticsMind CoolerNoch keine Bewertungen

- RayeesDokument52 SeitenRayeesAnshid ElamaramNoch keine Bewertungen

- Fixed Assets Management: Activity Based Process Work FlowDokument5 SeitenFixed Assets Management: Activity Based Process Work FlowMuneer HussainNoch keine Bewertungen

- Profile of Mehrotra MehrotraDokument38 SeitenProfile of Mehrotra MehrotraRahul BhanNoch keine Bewertungen

- Chapter-16 Audit of Co-Operative Societies: CA Ravi Taori Co-Op SocietyDokument8 SeitenChapter-16 Audit of Co-Operative Societies: CA Ravi Taori Co-Op SocietyArpit ShuklaNoch keine Bewertungen

- Arpak Annual 2019 PDFDokument63 SeitenArpak Annual 2019 PDFFaria AlamNoch keine Bewertungen

- Original PDF Accounting For Corporate Combinations and Associations 8th PDFDokument42 SeitenOriginal PDF Accounting For Corporate Combinations and Associations 8th PDFmarth.fuller529100% (41)

- F1 Set 1 Question PDFDokument22 SeitenF1 Set 1 Question PDFPunleu HorNoch keine Bewertungen

- Fabm Midterm ReviewerDokument3 SeitenFabm Midterm ReviewerRaineee hatdogNoch keine Bewertungen

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Dokument9 SeitenAllama Iqbal Open University, Islamabad: (Department of Commerce)muhammad tahirNoch keine Bewertungen

- Narayan Murthy Committee Report, 2003Dokument12 SeitenNarayan Murthy Committee Report, 2003Gaurav Kumar50% (2)

- Oil and Petrochemical Overview - Solutions For Your ... - Spirax SarcoDokument12 SeitenOil and Petrochemical Overview - Solutions For Your ... - Spirax SarcoAli NorouziNoch keine Bewertungen