Beruflich Dokumente

Kultur Dokumente

21 BIR Ruling 440-93

Hochgeladen von

Kyle David IrasustaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

21 BIR Ruling 440-93

Hochgeladen von

Kyle David IrasustaCopyright:

Verfügbare Formate

November 17, 1993

BIR RULING NO. 440-93

TRANSFER OF PROPERTY BY HOMEOWNERS ASSN. TO ITS

MEMBERS NOT SUBJECT TO DONOR'S TAX

50 (b) 398-93 440-93

Christ the King Center

CCF Homeowners Association, Inc.

Christ the King Parian Rectory

Cadlan, Pili, Camarines Sur

Attention: Fr. Renato Y . Ruelos, C . M .

Project Director

This refers to your letter dated August 10, 1993 in effect requesting for a ruling

that the transfer of property by the Christ the King Center CCF Homeowners

Association, Inc. to its members be exempt from donor's tax in accordance with the

Socialized Housing Program and pursuant to Section 20(d)(5) of R.A. 7279 which

was approved on March 24, 1992 and published in the March 28, 1992 issue of the

Philippine Times Journal and Malaya, newspapers of general circulation. LLjur

It appears that Christ the King Center CCF Homeowners Association, Inc., a

non-stock, non-profit corporation duly registered with the Securities and Exchange

Commission received aid from the Christian Children's Fund; that it bought forty

thousand (40,000) square meters of raw land in Cadlan, Pili, Camarines Sur from the

spouses Delfin J. Rodriguez and Ester L. Rodriguez covered by Transfer Certificate of

Title No. 14543 issued by the Register of Deeds of Camarines Sur; that the

aforementioned lot was subsequently subdivided and raffled among the members who

now want to have their shares titled; and that the Municipality of Pili, Camarines Sur,

issued a certification that the said lot was donated to 247 squatter families for

socialized housing purposes.

In reply, please be informed that pursuant to Section 20 of R.A. No. 7279,

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc. Philippine Taxation Encyclopedia 2013 1

pertinent portion of which reads:

"Sec. 20. Incentives for Private Sector Participating in Socialized

Housing. To encourage greater private sector participation in socialized

housing and further reduce the cost of housing units for the benefit of the

underprivileged and homeless, the following incentives shall be extended to the

private sector: cd i

xxx xxx xxx

(d) Exemption from the payment of the following:

xxx xxx xxx

(5) Donor's tax for lands certified by the local government units to

have been donated for socialized housing purposes.

xxx xxx xxx

the association which donates to its underprivileged and homeless members property

certified to by the local government unit concerned to be used for socialized housing

project shall be exempt from the payment of the donor's tax (Revenue Regulations No.

9-93). Upon issuance of this letter of exemption, and registration of the document of

donation, a lien upon the Certificate of Title of the lands to be issued in the name of

the members shall be caused to be annotated by the Register of Deeds having

jurisdiction over the property, to the effect, that the said property shall be used for

socialized housing project pursuant to R.A. No. 7279.

However, the deed of donation shall be subject to the documentary stamp tax

of P3.00 imposed under Section 188 of the Tax Code, as amended. cdpr

LIWAYWAY VINZONS-CHATO

Commissioner of Internal Revenue

Copyright 2014 CD Technologies Asia, Inc. and Accesslaw, Inc. Philippine Taxation Encyclopedia 2013 2

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- CIR Vs Mirant DigestDokument2 SeitenCIR Vs Mirant DigestKyle David IrasustaNoch keine Bewertungen

- Alcantara Vs Alcantara DigestDokument2 SeitenAlcantara Vs Alcantara DigestLeft Hook OlekNoch keine Bewertungen

- RMC 55-19 (Business Style)Dokument2 SeitenRMC 55-19 (Business Style)Kyle David IrasustaNoch keine Bewertungen

- H-Rules On Customer SwitchingDokument23 SeitenH-Rules On Customer SwitchingKyle David IrasustaNoch keine Bewertungen

- RA 9994 Expanded Benefits for Senior CitizensDokument16 SeitenRA 9994 Expanded Benefits for Senior CitizensKyle David IrasustaNoch keine Bewertungen

- Kalaw v. Relova - Alcid (D2017)Dokument1 SeiteKalaw v. Relova - Alcid (D2017)Kyle David IrasustaNoch keine Bewertungen

- 43) CORPIN - Avelino v. Cuenco (D2017)Dokument2 Seiten43) CORPIN - Avelino v. Cuenco (D2017)Kyle David IrasustaNoch keine Bewertungen

- Chi Ming Tsoi v. CA YES: DoctrineDokument1 SeiteChi Ming Tsoi v. CA YES: DoctrineKyle David IrasustaNoch keine Bewertungen

- PALS Civil ProcedureDokument150 SeitenPALS Civil ProcedureLou Corina Lacambra100% (2)

- For Mae - Nov 7 2017Dokument8 SeitenFor Mae - Nov 7 2017Kyle David IrasustaNoch keine Bewertungen

- Ajero v. CA-Lim (D2017)Dokument2 SeitenAjero v. CA-Lim (D2017)Kyle David IrasustaNoch keine Bewertungen

- RMO 10-2013 Revised SDT GuidelinesDokument8 SeitenRMO 10-2013 Revised SDT GuidelinesJoanna MandapNoch keine Bewertungen

- Mesina V FianDokument9 SeitenMesina V FianKyle David IrasustaNoch keine Bewertungen

- 32 Bpi Leasing Vs CADokument5 Seiten32 Bpi Leasing Vs CAMalolosFire BulacanNoch keine Bewertungen

- WEEK 4 & 5 (Ownership)Dokument21 SeitenWEEK 4 & 5 (Ownership)Kyle David IrasustaNoch keine Bewertungen

- Tweet Share: Chanrobles On-Line Bar ReviewDokument4 SeitenTweet Share: Chanrobles On-Line Bar ReviewKyle David IrasustaNoch keine Bewertungen

- Prosecution TSN 23 February 2016 NoelDokument116 SeitenProsecution TSN 23 February 2016 NoelKyle David IrasustaNoch keine Bewertungen

- REYES Bar Reviewer On Taxation I (v.3)Dokument158 SeitenREYES Bar Reviewer On Taxation I (v.3)Glory Be88% (8)

- The Family Code of The Philippines: Semper Praesumitur Pro Matrimonio (Always Presume Marriage)Dokument11 SeitenThe Family Code of The Philippines: Semper Praesumitur Pro Matrimonio (Always Presume Marriage)Kyle David IrasustaNoch keine Bewertungen

- R.A. 9504Dokument4 SeitenR.A. 9504Kyle David IrasustaNoch keine Bewertungen

- BIR Revenue Regulation 5-2012Dokument1 SeiteBIR Revenue Regulation 5-2012Yen MoradaNoch keine Bewertungen

- Ong V OngDokument1 SeiteOng V OngKyle David IrasustaNoch keine Bewertungen

- RR 1-2011Dokument3 SeitenRR 1-2011Jaypee LegaspiNoch keine Bewertungen

- Labor2 Digest - Cathay v. CADokument1 SeiteLabor2 Digest - Cathay v. CAKyle David IrasustaNoch keine Bewertungen

- Philamgen v. HeungDokument3 SeitenPhilamgen v. HeungKyle David IrasustaNoch keine Bewertungen

- Philamgen v. HeungDokument3 SeitenPhilamgen v. HeungKyle David IrasustaNoch keine Bewertungen

- APPEALS Online HandoutDokument75 SeitenAPPEALS Online HandoutKyle David IrasustaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Revenue Circular Amends Real Property Transfer RequirementsDokument1 SeiteRevenue Circular Amends Real Property Transfer RequirementsReymund BumanglagNoch keine Bewertungen

- Electronic Reservation Slip (ERS)-Normal UserDokument2 SeitenElectronic Reservation Slip (ERS)-Normal UserK s koushar TechNoch keine Bewertungen

- s5 PDFDokument5 Seitens5 PDFKeshav KumarNoch keine Bewertungen

- Official Receipt: Global Indian International SchoolDokument1 SeiteOfficial Receipt: Global Indian International SchoolBadal BhattacharyaNoch keine Bewertungen

- BIR Ruling 023-09Dokument5 SeitenBIR Ruling 023-09Juno Geronimo100% (1)

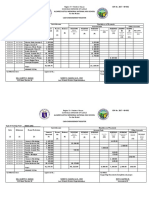

- Schools Division of Iloilo: Alcarde Gustilo Memorial National High SchoolDokument6 SeitenSchools Division of Iloilo: Alcarde Gustilo Memorial National High SchoolLOUEDA MAY Z. CARADONoch keine Bewertungen

- ICMAP Business Law Past PapersDokument2 SeitenICMAP Business Law Past Papersmuhzahid786Noch keine Bewertungen

- What is Letter of Credit? Bank Payment Tool for ExportersDokument2 SeitenWhat is Letter of Credit? Bank Payment Tool for ExportersCarlos KarmunNoch keine Bewertungen

- GPR 2020Dokument133 SeitenGPR 2020Jugal Asher0% (1)

- State Bank of IndiaDokument2 SeitenState Bank of Indiakiran gemsNoch keine Bewertungen

- Account Maintenance and Transaction Fees L BPIDokument4 SeitenAccount Maintenance and Transaction Fees L BPISebastian GarciaNoch keine Bewertungen

- G.R. No. 187485 CIR v. San Roque Power CorporationDokument24 SeitenG.R. No. 187485 CIR v. San Roque Power CorporationPaul Joshua SubaNoch keine Bewertungen

- Calculate Completing A 1040Dokument2 SeitenCalculate Completing A 1040api-4921774500% (1)

- Shree Lekshmy Herbal and Cosmetic Products LLP Chennai India Super Stockist Oredr FormDokument3 SeitenShree Lekshmy Herbal and Cosmetic Products LLP Chennai India Super Stockist Oredr Formk.madhuNoch keine Bewertungen

- Gale Force SurfingDokument18 SeitenGale Force SurfingKhris Keleher50% (4)

- 365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsDokument3 Seiten365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsMihir HareetNoch keine Bewertungen

- e-StatementBRImo NEW 1Dokument3 Seitene-StatementBRImo NEW 1dealut123456Noch keine Bewertungen

- CPA Review Problems on Operating Segment and Interim ReportingDokument3 SeitenCPA Review Problems on Operating Segment and Interim ReportingLui100% (2)

- PDFDokument4 SeitenPDFAmit vohraNoch keine Bewertungen

- Bustax Midterm Exam-2021Dokument26 SeitenBustax Midterm Exam-2021Nhel Alvaro100% (3)

- Bir Ruling (Da 146 04)Dokument4 SeitenBir Ruling (Da 146 04)cool_peachNoch keine Bewertungen

- Ey 2022 WCTG WebDokument2.010 SeitenEy 2022 WCTG WebPedro J Contreras ContrerasNoch keine Bewertungen

- Action For Difference in ITC Between 3B and 2ADokument46 SeitenAction For Difference in ITC Between 3B and 2Aphani raja kumarNoch keine Bewertungen

- CFAS: Petty Cash Fund AccountingDokument3 SeitenCFAS: Petty Cash Fund AccountingSteffanie OlivarNoch keine Bewertungen

- Tax Notes Chapter 4Dokument3 SeitenTax Notes Chapter 4Sam ReyesNoch keine Bewertungen

- Problem 1 Current Liability Entries and Adjustments: InstructionsDokument6 SeitenProblem 1 Current Liability Entries and Adjustments: Instructionsbeeeeee100% (1)

- Chapter 4Dokument25 SeitenChapter 4crackheads philippinesNoch keine Bewertungen

- Worksheet 14 ColumnsDokument1 SeiteWorksheet 14 ColumnsPrincess AudhrieNoch keine Bewertungen

- TD Bank Statement SummaryDokument3 SeitenTD Bank Statement SummaryJohn Bean100% (4)

- FSRS NetBenefits AccessCardSM FAQSDokument6 SeitenFSRS NetBenefits AccessCardSM FAQSKris LymanNoch keine Bewertungen