Beruflich Dokumente

Kultur Dokumente

Currency Derivatives

Hochgeladen von

RimjhimCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Currency Derivatives

Hochgeladen von

RimjhimCopyright:

Verfügbare Formate

Round Table

Manoj Anand

IIM Lucknow Currency Derivatives:

K P Kaushik

National Institute of

A Survey of Indian Firms

Financial Management, Faridabad

A

large number of firms engage in financial risk management

activities including foreign exchange risk, interest rate risk,

and commodity price risk through the use of derivatives. In

the present study, a comprehensive survey has been conducted to

understand the current practice of foreign currency derivatives use in

India. The results of the study capture the extent to which firms in

India use foreign currency derivatives vis--vis the rest of the world;

Abstract the types of financial risks concerning Indian managers; whether the

usage of foreign currency derivatives in India is driven primarily by

This paper examines management

hedging, arbitrage or speculation; and the motivations of Indian managers

motivations for usage of foreign currency

derivatives in corporate India vis--vis in using foreign currency derivatives for hedging risk.

the rest of the world. It identifies significant The study converges management motivations for using foreign currency

differences in the motivations of firms who

derivatives for hedging risk in a factor-analytic framework into a few

either use foreign currency derivatives or

have a documented foreign exchange risk factors. It is believed that the findings of the present study are of use to

management policy vis--vis firms that do academia and practitioners in learning how corporate India manages

not. The paper studies the types of financial financial risk; and in identifying areas where finance theory has not

risks that are of concern to Indian managers been implemented.

and, using a factor-analytic framework,

reduces the management motivations A detailed discussion of management motivations for use of foreign

studied to a few factors for hedging risk. currency derivatives based on a review of the literature is provided

324 Currency Derivatives: A Survey of Indian Firms

below. The following section discusses research foreign currency derivatives use on equity returns of 325

methodology adopted along with description of data. The US non-financial firms during the period 1990 to 1993.

results with discussion appear in the third section, Corporate risk management has costs too. Managers are

followed by a summary and the conclusions. the agents of the shareholders. In the absence of proper

incentives, managers will not maximise shareholders

Literature Review wealth. Hence managerial incentive compensation

contracts must be designed in such a manner that actions

Existing theories of corporate risk management assume taken to increase value to shareholders also lead to increase

that firms use derivatives solely for hedging purposes. in their expected utility. Managers may chose to hedge

The question arises whether corporate risk management due to their undiversified wealth position in order to

is consistent with the shareholder wealth maximisation maximise their utility. The reduction in earnings volatility

objective, the maximising management utility objective, leads to reduction in the volatility of earnings stream of

or both. management. This may be at a cost to the shareholders.

Finance theory suggests that the value of a firm is The management compensation has an impact on the use

independent of its hedging policy in a competitive market of derivatives. Smith and Stulz7 argue for a positive

situation1. Risk management transactions entered into at relationship between management shareholding and

competitive market prices are at best value neutral. Since derivatives use and a negative relationship between

firms incur transaction costs in an attempt to hedge risk, management option holding and derivatives use. The

the risk management process is expected to be value- empirical relationship between management compensation

destroying. Risk hedging through the use of derivatives and risk management choices has been studied by Tufano8.

creates shareholder value by taking advantage of market Contrary to the general perception, Nguyen and Faff9 and

imperfections such as taxes, bankruptcy cost, agency Heaney and Winata 10 find that both management

cost, financing constraints and undiversified stakeholders. shareholding and management option holding are

Academic literature provides evidence that hedging policies negatively related with derivatives use. Brailsford et al11

do create firm value by reducing expected taxes, expected find that utility-maximising managers in the public sector

costs of financial distress and agency costs2. use derivatives to manage budget constraints (expenditure

equal to allocations) so as to provide the agreed level of

Does financial risk affect expected returns on stocks and

service within the budgeted framework.

hence share price behaviour? Does the use of derivatives

reduce risk? Does the use of derivatives reduce agency Managerial motives drive managerial utility while firm

costs? Does reduction in cash flows volatility increase objectives address shareholder concerns. The cash flow

firm value? Is risk management practice a positive net hedging strategies may be used to destroy shareholder

present value decision? Extensive surveys3 of academic wealth in the presence of agency conflicts between

literature provide evidence on these issues. managers and shareholders 12 . Managers will prefer

financing of projects through internal generated funds in

Cash flow volatility may affect a firms liquidity position order to avoid the scrutiny of capital markets. They may

and thus its ability to meet fixed operating and financing accept projects and go in for acquisitions that may be

costs. The use of financial derivatives can reduce the negative net present value to shareholders and lead to free

probability of such a situation and lower the expected cash flow conflict. Hence, if managers rank certain

value of costs associated with financial distress4. This managerial motives that are inconsistent with firm

results in reduced volatility in the firms free cash flows objectives as high, it can be an indication of agency

and hence improves the value of the firm. The risk concerns.

management process at the firm level, vis--vis the

shareholder level, is more efficient. Firms with a high Economies of scale, financial distress, agency costs,

optimal investment, management compensation and

probability of bankruptcy and financial distress are more

foreign business exposure explain derivatives usage by

likely to benefit from the use of financial derivatives as a

374 large Australian companies, find Heaney and Winata13.

risk management strategy. The benefits of corporate risk

management have been advanced in theory and proven Exhibit 1 provides a comparison of response rates in the

empirically in many research studies globally5. However, best-known field studies in the international arena in

Hentschel and Kothari6 find no impact of interest rate and derivatives use.

IIMB Management Review, September 2008 325

Survey of Indian Firms major motivations are to reduce the volatility in earnings

and cash flows; reduce the probability of bankruptcy

A survey was conducted with the intention of identifying and financial distress and costs associated with it; and

the objectives and management motivations for use of thus reduce the cost of capital and improve firm value

currency derivatives in India. The broad objectives of and reduce volatility in management earnings. The other

using derivatives could be hedging risk, speculation, price motivation could be to reduce agency costs. The possible

discovery or arbitrage. This study examines whether hindrances are complexities in valuation of derivatives;

management motivations differs between users and non- accounting and disclosure requirements; and legal

users of currency derivatives and also between those who restrictions.

have documented foreign exchange risk management

The questionnaire is divided into two parts. The aim of

policy and those who have not. It captures the motivations

the first section is to find out whether management has a

for use of currency derivatives in a factor-analytic

documented risk management plan/policy/programme and

framework.

their ranking of transaction exposure, translation exposure

and economic exposure. It further determines the objective

Research Design

of derivatives use, whether it is for hedging risk or

A questionnaire was developed based on study of speculation or price discovery or arbitrage. The

derivatives use in Australia by Bensen and Oliver14. It lists second section of the survey asks the chief financial

in detail both the motivations and hindrances to the use of officers (CFOs) of the surveyed companies to rate 18

derivatives for achieving the hedging risk objective. The motivations for use of foreign currency derivatives for

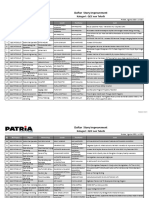

Exhibit 1 Comparison of Response Rate in Derivative Use Studies

Study Country Date of Study Sample Size Number of Response Rate Percentage of

Responses (Percentage) Derivatives Users

Bodner et al17 USA 1994 2000 530 26.5 35

Bodner et al18 USA 1995 2000 350 17.5 41

Bodner et al19 USA 1998 1928 399 20.7 50

Phillips20 USA 1995 3480 657 18.9 63.2

Berkman et al21 New Zealand 1997 124 79 63.7 53.1

Grant and Marshall22 UK 1994 250 91 36.4 89

1995 250 55 22.0 92.7

Alkebach and Hagelin23 Sweden 1996 213 163 76.5 51.5

Bodnar and Gebhardt24 Germany 1997 368 126 34.2 77.8

Fatemi and Glaum25 Germany 1998 153 71 46.4 88.0

26

Jalilvand et al Canada 1996 548 154 28.1 75

Ceuster et al27 Belgium 1997 334 73 21.9 65.8

Lee et al28 UK 1998 200 79 39.5 -

USA 1998 200 47 23.5 -

Asia Pacific 1998 200 53 26.5 -

Benson and Oliver29 Australia 2000 429 100 23.3 76.0

Present study India 2005 640 55 8.6 83.6

This table summarises the findings of earlier research studies in the global context and reports the date of the study, sample size, survey

response rate and extent of derivatives usage and compares it with the present study.

326 Currency Derivatives: A Survey of Indian Firms

hedging risk, irrespective of whether their firm is a 55 completed questionnaires were returned by November

derivatives-user or not. A five-point Likert scale (where 1 2005, resulting in a response rate of 8.59%. This response

means least important and 5 means most important) is rate appears to be low vis--vis other academic surveys

used for this. on the subject (Exhibit 1). However, the sample is

representative of the universe.

The universe of companies selected for this study consisted

of 640 companies with foreign exchange exposure, which

Data and Summary Statistics

are common across two most widely used Indian stock

market indices namely S&P CNX 500 and BSE 50015 firms Financial statistics of the respondent firms and the sample

as at the end of March 31, 2004. The 640 firms included firms have been collected from the CMIE Prowess

in these two indices are truly representative of Corporate database. Exhibit 2 presents industry-wise composition

India. of the respondent firms.

Financial information on the universe and the sample firms

Delivery and Response on profitability, size, forex exposure, and risk criteria has

The two-page questionnaire was sent to the CFOs of the been culled from CMIE PROWESS database. The variables

640 firms through mail between July and August 2005, considered for profitability of firms are: profits after tax,

with follow-up reminders to those who did not reply, in cash flow from operations, return on net worth, and

order to maximise the response rate16. It was indicated in return on capital employed. Firm size has been captured

the request to the CFOs that the identity of the respondents in terms of: net sales, net worth, and net fixed assets.

companies and the executives will be kept strictly Forex exposure has been looked at in terms of: gross

confidential and only aggregate generalisations will be exposure (imports as a percentage of sales) and net

published in order to have objectivity. Of the 640 requests, exposure (imports net of exports as a percentage of sales).

The variables considered for risk are: interest coverage

Exhibit 2 Industry Profile of the Respond- ratio, current ratio, quick ratio, debt-to-equity ratio,

ent Firms and beta.

Exhibit 3 provides summary statistics. The sample is truly

Number of Percentage Derivatives representative of the universe on all the criteria of

Respondent Users

Firms profitability, size, forex exposure and risk, except on net

sales, profits after tax and beta, where there is a

Automobile &

Ancillaries 9 16 8

significant difference between the mean values of the

universe and the sample. The sample consists of large

Banking & Financial

and less risky firms as compared to the universe. Firms

Services 11 20 10

that hedge risk are expected to be large in size and less

Chemicals & risky. Average firms in the universe are expected to be

Fertilisers 6 11 4

smaller in size and more risky. The findings of Exhibit 3

Computer Software 4 7 4 are consistent with this argument.

Drugs & The sample created from the survey process is consistent

Pharmaceuticals 5 9 4

with the expectations and hence the low response rate is

Plastic Products 3 5 3 not expected to be a serious limitation.

Steel 3 5 3

Textiles 4 7 4 Results and Discussion

Others 10 18 6

Derivatives Use

Total 55 100 46

Of the 55 firms that responded to the present survey, 46

This table reports frequency distribution and proportion of industry

profile of the 55 respondent firms and how many of them are or 84% indicated that they use foreign currency derivatives

derivatives users. to manage risk, and 38 or 70% indicated that they have a

IIMB Management Review, September 2008 327

Exhibit 3 Summary Statistics of Sample

Respondent N Mean Std Deviation Std Error Mean Asymp.

Sig (2-tailed)*

Net Sales (Rs in Crores) Universe 619 1646.04 6821.68 274.19 0.0122

Sample 46 2375.79 5817.61 857.76

PAT (Rs in Crores) Universe 619 146.77 624.92 25.12 0.0284

Sample 46 269.18 626.09 92.31

CFO (Rs in Crores) Universe 619 422.28 1579.88 63.50 0.1386

Sample 46 804.92 2151.99 317.29

Net Worth (Rs in Crores) Universe 619 787.06 2973.94 119.53 0.0640

Sample 46 1166.59 3023.35 445.77

Net Fixed Assets (Rs in Crores) Universe 619 684.75 2682.28 107.81 0.2897

Sample 46 684.29 1451.66 214.04

Gross Forex Exposure Universe 618 0.38 0.44 0.02 0.3659

Sample 46 0.34 0.41 0.06

Net Forex Exposure Universe 618 0.17 0.23 0.01 0.1510

Sample 46 0.13 0.18 0.03

Interest Coverage Ratio Universe 615 23.49 84.30 3.40 0.3693

Sample 46 14.08 22.76 3.36

Current Ratio Universe 619 2.28 4.34 0.17 0.4181

Sample 46 2.20 2.03 0.30

Quick Ratio Universe 619 1.17 2.63 0.11 0.0865

Sample 46 1.16 1.22 0.18

Debt-to-Equity Ratio Universe 611 1.40 5.58 0.23 0.8612

Sample 46 1.07 1.54 0.23

Return on Net Worth (RONW) (%) Universe 608 24.05 231.29 9.38 0.0739

Sample 46 21.64 16.13 2.38

Return on Capital Employed (RONC) (%) Universe 608 25.18 23.57 0.96 0.0280

Sample 46 32.96 25.03 3.69

Beta Universe 545 0.98 0.34 0.01 0.0178

Sample 43 0.84 0.26 0.04

* Mann-Whitney U Test

This table reports descriptive statistics on the representativeness of Indian firms surveyed relative to the universe of 640 Indian companies,

which are common across two most-widely used Indian stock market indices namely S&P CNX 500 and BSE 500, for the financial year

ending March 31, 2004. PAT is profits after tax. Comparison is based on the following variables: Net sales, PAT, cash flows from operating

activities (CFO), Net worth, Net fixed assets, Gross forex exposure, Net forex exposure, Interest coverage ratio, current ratio, quick ratio,

debt-to-equity ratio, RONW, RONC and beta. Net worth, also termed as shareholders funds, is the sum of equity share capital and reserves

and surplus less miscellaneous expenditure to the extent not written off. Net fixed assets are the gross block of assets less accumulated

depreciation. Gross forex exposure is the total of forex earnings and forex spending as a percentage of net sales. Net forex exposure is the net

of forex earnings over forex spending (absolute value) as a percentage of net sales. Interest coverage is the ratio of earnings before interest and

tax to interest. Current ratio is the proportion of current assets to current liabilities. Quick ratio is the proportion of quick assets to current

liabilities. Quick assets are current assets less inventories. Debt-to-equity ratio is based on book values. Return on net worth is the ratio of

profits after tax to shareholders funds. Return on capital employed is the ratio of net operating profits after tax to net capital employed. Net

capital employed is the sum of shareholders funds and loan funds. Beta is a measure of systematic risk. The Mann-Whitney U test has been

used to capture the significant difference, if any, between the mean values of universe and sample firms.

documented foreign exchange risk management plan/ Foreign currency derivatives are the most commonly used

policy/programme (Exhibit 4). The comparative position class of derivatives with 83% of derivatives using firms

in different countries is shown in Exhibit 530. in the US utilising them31. The vast majority of firms in

328 Currency Derivatives: A Survey of Indian Firms

Exhibit 4 Extent of Use of Derivatives and different exposures such as transaction, translation and

Risk Management Plan economic exposure as foreign exchange risk in terms of

their firms exposure33. The present survey finds that

74.51% (38 out of 51) of the respondents assign rank

Question Number of Yes (N) No (N)

Respondent one to transaction exposure, 58.33% (28 out of 48) assign

(N) rank two to translation exposure, and 54.35% (25 out of

Does your firm 54 38 16 46) assign rank three to economic exposure (Exhibit 6).

have a documented

foreign exchange risk Objectives of Using Derivatives

management plan/

policy/ programme? The reasons the firms hedge are volatility in the financial

markets, tax avoidance, to reduce financial distress cost,

Does your firm use 55 46 9

and to reduce the cost of debt and increase the debt

foreign currency

derivatives to manage

capacity34. Most companies in the UK use derivatives for

risk? the conservative role of risk management35. Market risk,

This table reports the frequency distribution of the 55 respondent

followed by accounting treatment of derivatives, appears

firms in respect of use of foreign currency derivatives to manage the to be the most serious concern regarding the use of

risk and having a documented foreign exchange risk management plan. derivatives among US firms. The use of derivatives to

reduce funding costs is a major factor for New Zealand

Australia, Belgium, Germany, New Zealand, Sweden, and firms, besides hedging contractual commitments36.

UK use derivatives to manage foreign currency risk vis-

The respondents to the present study were asked to

-vis the interest rate, commodity risk, and equity risk.

indicate the relative importance of the different objectives

The derivatives use in financial risk management is more

of using derivatives in their organisation37. While 96.1%

among large-size firms vis--vis small firms across the

(49 out of 51) of the respondents consider the primary

globe. This is because of the huge fixed costs associated

objective of the firm in using derivatives is to hedge risk,

with derivatives usage and the ability of large-size firms

63.2% (24 out of 38) of the respondents consider

to bear the same32.

derivatives usage for arbitrage, and 62.1% (18 out of 29)

The derivatives users and non-users were asked to rank of the respondents do not consider speculation as the

Exhibit 5 Derivatives Usage in Different Countries

Derivatives user

92.7%

88%

83.6%

76% 75%

65.8%

53%

50%

UK Germany India Australia Canada Belgium New Zealand USA

This figure shows a histogram of derivatives users in India based on the findings of the present study and compares it with derivatives usage

in the UK, Germany, Canada, Belgium, New Zealand and the US based on a review of the literature. Extensive use of derivatives in India is

because of the fact that US$ is the defacto international currency and thus US firms are relatively shielded from foreign currency risk.

IIMB Management Review, September 2008 329

Exhibit 6 Ranking of Different Foreign Exchange Risk Exposures in Terms

of Firms Exposure

Foreign Exchange Number of Valid Mean Rank Rank (N)

Risk Exposure Respondents (N) 1 2 3

Transaction exposure 51 1.33 38 9 4

Translation exposure 48 2.21 5 28 15

Economic exposure 46 2.33 10 11 25

This table reports the frequency distribution of ranking of transaction exposure, translation exposure and economic exposure done by the

respondent firms, and estimates mean rank in respect of each exposure. Mean rank is the weighted average rank, where ranks have been

assigned weights on the basis of the proportion of the total number of respondents who assigned that rank to the said exposure.

objective of using derivatives (Exhibit 7). risks faced by the management (mean score = 4.21); to

facilitate budgeting and control process in the firm (mean

Motivations for Derivatives Use score = 3.69); to reduce volatility of cash flows (mean

score = 3.64); and to improve value of the firm (mean

The responses of different country managers on managerial

score = 3.53).

motivations for use of foreign currency derivatives and

factors that influence the managers to hedge based on Reducing volatility in profits after tax: The present

review of literature are summarised in Exhibit 8. study finds reducing the volatility in profits after tax the

most important objective amongst Indian firms. However,

The survey questionnaire asked the respondents to

reducing volatility in accounting earnings with the use

consider 18 management motivations regarding the use

of derivatives is the major motivation of US firms (42%),

of foreign currency derivatives for hedging risk38. For

New Zealand firms (62%), German firms (55.3%),

each motivation, users and non-users of foreign currency

Canadian firms, and Belgium firms. It is the second most

derivatives were asked to rank on a five-point Likert scale

important reason for derivative use for hedging amongst

(where one is least important and five is most important),

Australian firms and an important goal of risk management

the importance of derivatives for hedging risk purposes.

amongst German firms. The goal of risk management in

The management motivations and responses are

theory is to focus on free cash flows and maximise the

summarised in Exhibit 9.

value of firm. Firms do not usually focus on an accounting

The major motivations for the use of foreign currency number such as profits after tax. In practice, managers

derivatives for hedging are: to reduce volatility in the across the globe focus on reducing the volatility in

profits after tax (PAT) (mean score = 4.23); to reduce accounting earnings with the use of derivatives as an

Exhibit 7 Relative Importance of Different Objectives of Using Derivatives

N Mean Rank Std Deviation Std Error of Mean Rank (N)

1 2 3 4

Hedging Risk 51 1.04 0.20 0.03 49 2 0 0

Speculation 29 3.41 0.87 0.16 1 4 6 18

Price Discovery 33 2.85 0.87 0.15 1 12 11 9

Arbitrage 38 2.34 0.71 0.11 3 21 12 2

This table reports the frequency distribution of ranking of different objectives of derivatives use according to the respondent firms, and

estimates mean rank, standard deviation and standard error of mean in respect of each objective. Mean rank is the weighted average rank,

where ranks have been assigned weights on the basis of proportion of total number of respondents who assigned that rank to the said

objective.

330 Currency Derivatives: A Survey of Indian Firms

Exhibit 8 Managerial Motivations of Different Country Managers for Hedging Risk

Management Motivations for Use of Foreign Countries

Currency Derivatives for Hedging Risk Most Important Least Important

To reduce volatility in profits after tax Australia, Belgium, Canada,

Germany, India,New Zealand, USA

To reduce volatility of cash flows Australia, Canada, Germany, India, Belgium

New Zealand, UK, USA

To improve value of firm Australia, Germany, India Belgium, New Zealand

To reduce risks faced by management Australia, India

Factors that Influence Managers to Hedge

Firms with high proportion of ESOPs USA Australia, India,

outstanding are more likely to resort to it New Zealand

Firms with high proportion of tax credit

availability are more likely to benefit

Necessary accounting treatment is too complex

Disclosure requirements of accounting standards

This table contrasts the managerial motivations of managers of different countries based on literature review and the findings of the present

study.

objective of risk management. Consistent with reducing cash flows volatility and

reducing earnings volatility, Fatemi and Glaum41 find

Reducing risks faced by the management: Indian

increasing the market value of the firm the second most

respondent firms perceive to reduce the risks faced by

important goal of risk management amongst the German

the management as the second important motivation for

firms, while it is the third most important issue for

risk management with the use of derivatives. Benson and

Australian firms. Berkman et al42 find that only 10% of

Oliver39 find this objective at rank four amongst the

the New Zealand respondent firms indicated reducing

Australian respondent firms.

fluctuations in the market value of firm as a primary

Facilitating budgeting and control process in the firm: objective of risk management with the use of derivatives.

This is the third important motivation among Indian firms Surprisingly 62.5% of the Belgium respondent firms do

for risk management with the use of derivatives. not consider the use of derivatives to increase the market

Reducing cash flows volatility: The present study finds value of firm as important, find Ceuster et al43.

it the fourth major motivation for risk management with The least important motivations for the use of foreign

the use of derivatives among Indian respondent firms. currency derivatives for hedging in India are: firms with

Reducing cash flows volatility is the major motivation high proportion of employee stock ownership plans

of US firms (49%), UK firms, Australian firms, and (ESOPs) outstanding are more likely to resort to it (mean

Canadian firms for risk management. It is another important score = 1.67); firms with high proportion of tax credit

goal of risk management among firms in Germany and availability are more likely to benefit from use of foreign

New Zealand. Ceuster et al40 find that reducing the currency derivatives (mean score = 1.70); necessary

volatility in cash flows is not important to 38.24% of accounting treatment is too complex (mean score = 2.19);

the Belgium respondent firms. disclosure requirements of accounting standards (mean

score = 2.45); and to reduce the political risk (mean

Improving the value of the firm: The findings show

score = 2.48).

that Indian respondent firms do use currency derivatives

for risk management with a view to maximizing the value To improve management/employee compensation

of the firm. The respondents ranked this goal fifth. followed by reduce taxation and complexity of

IIMB Management Review, September 2008 331

accounting treatment are the least important motivations regulators/public. It is of primary concern to 10% of the

of Australian firms using derivatives. None of the New derivative non-user respondent firms with an additional

Zealand respondent firms suggested that minimising 31% citing it as a supporting explanation.

expected taxes is a benefit of using derivatives. The The responses on the importance of the 18 management

accounting treatment of derivatives issue causes the most motivations listed in Exhibit 9 are classified into responses

concern to the derivative-user firms (37%) in the US, applicable to foreign currency derivative users and non-

while disclosure requirements of accounting standards derivative users and are shown in Exhibit 10.

is only a token measure of concern to the derivative non-

users in the US. The UK firms argue for disclosure of The five most important motivations of the derivative users

risk management strategies rather than detailed and non-users are identical. These are to reduce volatility

information. in profits after tax, necessary accounting treatment is

too complex, to reduce risks faced by the management,

Managerial incentives such as reducing cost of capital availability of alternative means to manage the financial

of the firm (mean score = 3.52) and firms with high risk, and high debt in the capital structure. The three

debt ratio are more likely to use foreign currency least important attitudinal issues applicable to foreign

derivatives (mean score = 3) are ranked relatively currency derivative users and non-users are also identical.

important by the Indian respondent firms in the present These are proportion of high tax credit availability, to

study. reduce cost of capital of firm, and to reduce the political

Jalilvand et al44 find reducing cost of funds to be the risk. The results from Mann Whitney U test indicate a

most important objective of using derivatives and strong significant difference at 5% level between users and non-

and negative correlation between the Canadian derivative- users of derivatives for one of the 18 management

user firms and their credit rating. Firms with low credit motivations. These results are consistent with Benson and

rating have an incentive to use derivatives in order to Olivers survey46 of Australian firms.

reduce financial distress costs. The responses on the importance of the 18 management

Motivations such as difficulties in pricing and valuing motivations listed in Exhibit 9 are classified into responses

of firms with a documented risk management plan/policy/

derivatives, perception of derivatives use by investors,

programme and those without one (Exhibit 11). The most

regulators and the public and reducing the probability of

important motivations of the two categories are identical.

bankruptcy and financial distress and costs associated

The results from Mann Whitney U test indicate a significant

with it are ranked as relatively less important by the Indian

difference at 5% level between with and without a

respondent firms in the present study.

documented risk management plan/policy/programme for

Bodnar et al45 find that more than 35% of the derivative- three of the 18 management motivations. These results

user respondent firms in the US have little or no concern are consistent with Benson and Olivers survey47 of

as to how its use will be viewed by the investors/ Australian firms.

Exhibit 9 Summary of Responses in Relation to Derivatives Use from Non-users

and Users

Management Motivations for Use of Number of Std Std Number of Responses

Foreign Currency Valid Mean Deviation Error Rank Least Most

Derivatives for Hedging Responses of Mean Important Important

(N) 1 2 3 4 5

To reduce volatility in PAT 52 4.23 1.04 0.14 1 2 2 5 16 27

To reduce risks faced by the management 52 4.21 0.91 0.13 2 0 3 8 16 25

To facilitate budgeting and control process

in the firm 51 3.69 1.26 0.18 3 4 6 8 17 16

332 Currency Derivatives: A Survey of Indian Firms

Exhibit 9 continued

Management Motivations for Use of Number of Std Std Number of Responses

Foreign Currency Valid Mean Deviation Error Rank Least Most

Derivatives for Hedging Responses of Mean Important Important

(N) 1 2 3 4 5

To reduce volatility of cash flows 53 3.64 1.19 0.16 4 3 6 14 14 16

To improve value of the firm 53 3.53 1.25 0.17 5 3 11 8 17 14

To reduce cost of capital of the firm 52 3.52 1.18 0.16 6 4 6 12 19 11

Firms with high debt ratio are more likely

to use foreign currency derivatives 49 3.00 1.41 0.20 7 10 10 7 14 8

Firms with alternate means to manage foreign

currency risk are likely to use derivatives 52 2.96 1.28 0.18 8 7 14 13 10 8

Legal restrictions on use of derivatives 52 2.85 1.29 0.18 9 9 13 14 9 7

Alternate means to manage financial risks 47 2.74 1.22 0.18 10 8 13 14 7 5

Difficulties in pricing and valuing derivatives 50 2.74 1.14 0.16 11 8 12 19 7 4

Perception of derivatives use by investors,

regulators and the public 47 2.68 1.16 0.17 12 7 16 13 7 4

To reduce probability of bankruptcy and

financial distress and their costs 52 2.65 1.40 0.19 13 15 10 12 8 7

To reduce the political risk 48 2.48 1.32 0.19 14 16 8 13 7 4

Factors that Influence Managers to Hedge

Disclosure requirements of accounting

standards 51 2.45 1.29 0.18 15 17 8 16 6 4

Necessary accounting treatment is too

complex 52 2.19 1.14 0.16 16 18 15 12 5 2

Firms with a high proportion of tax credit

availability are more likely to benefit from use

of foreign currency derivatives 46 1.70 0.89 0.13 17 25 12 7 2 0

Firms with high proportion of ESOPs

outstanding are more likely to resort to it 46 1.67 0.97 0.14 18 27 11 4 4 0

This table reports management motivations for use of foreign currency derivatives for hedging on a Likert scale of 1 to 5, where 1 is least

important and 5 is most important. For each response, the frequency distribution is reported. The level of importance of each motivation is

obtained by multiplying the number of responses on each Likert value in respect of each motivation. Thereafter, mean and standard deviations

have been calculated. The average rating for each motivation along with its standard deviation and standard error of mean is reported. Finally,

management motivations for use of foreign currency derivatives for hedging purpose are ranked on the basis of mean score.

Factor Analysis Results motivations for derivatives use, the shareholder value

The factor analytic methodology has been used to analyse maximisation hypothesis, and the management utility

management motivation for use of currency derivatives maximisation hypothesis.

in corporate India based on responses received from the The number of factors to be retained has been decided

55 chief financial officers to the survey questionnaire. based on Kaisers criterion of Eigen value e1, Bartletts

The maximum likelihood method of extraction has been test, Cattells secree test, and Bentlers internal consistency

used to explore and confirm the inter-relatedness between coefficients48. The Bartletts test of significance led to the

the occurrences of variables pertaining to management acceptance of seven significant factors. These seven factors

IIMB Management Review, September 2008 333

Exhibit 10 Motivations for Derivatives Use of Users and Non-users of Derivatives A

Comparison

Motivations Does your firm use foreign

currency derivatives

to manage the risk? Standard p-value

N Mean Deviation (2-tailed)

Users Non-users Users Non-users Users Non-users

To reduce volatility in PAT 44 8 4.25 4.1250 0.9912 1.3562 0.970

To reduce volatility of cash flows 45 8 3.6667 3.50 1.1678 1.41421 0.779

To reduce probability of bankruptcy and financial

distress and their costs 44 8 2.7273 2.25 1.38704 1.48805 0.389

Firms with high debt ratio are more likely to use

foreign currency derivatives 41 8 3.0244 2.8750 1.29398 2.03101 0.863

To reduce cost of capital of the firm 44 8 3.5227 3.5000 1.19083 1.19523 0.891

Firms with a high proportion of ESOPs outstanding

are more likely to resort to it 38 8 1.6842 1.6250 0.96157 1.06066 0.831

To improve value of the firm 45 8 3.5556 3.3750 1.2713 1.1877 0.652

To facilitate budgeting and control process in the firm 43 8 3.6512 3.8750 1.3072 0.9910 0.829

To reduce the political risk 40 8 2.4250 2.7500 1.2987 1.4881 0.559

Firm has alternate means to manage financial risks 39 8 2.7949 2.50 1.2393 1.1952 0.478

Difficulties in pricing and valuing derivatives 42 8 2.6905 3.0000 1.1367 1.1952 0.490

Disclosure requirements of accounting standards 43 8 2.4419 2.500 1.2781 1.4142 0.9490.949

Legal restrictions on use of derivatives 44 8 2.8182 3.00 1.2626 1.5119 0.813

Accounting treatment is too complex 44 8 2.2273 2.0000 1.1587 1.06904 0.663

Perception of derivatives use by investors,

regulators and the public 39 8 2.6923 2.6250 1.1275 1.40789 0.835

To reduce risks faced by the management 44 8 4.1818 4.3750 0.94679 0.74402 0.737

Factors that Influence Managers to Hedge

Firms with high proportion of tax credit availability

are more likely to benefit from use of foreign

currency derivatives 38 8 1.7632 1.3750 0.91339 0.74402 0.283

Firms with alternate means (matching, netting, lead,

and lagging) to manage foreign currency risk are

more likely to use derivatives 44 8 2.7955 3.8750 1.24974 1.12599 0.035

This table compares mean scores of management motivations for use of foreign currency derivatives for hedging derivatives user-firms and

non-user firms. The average rating for each motivation and the P-values for statistical tests are reported, in which the null hypothesis is that

there is no significant difference between the mean score of users and non-users. Mann-Whitney U test has been used to capture the

significant difference, if any.

explain 59.28% of the total variance. The application of Maximum likelihood analysis using varimax rotation

secree test resulted in acceptance of five factors. The method with Kaiser Normalization of correlation matrix

factors loaded by variables having significant loading of of 18 variables led to the extraction of five factors. These

the magnitude of 0.50 and above have been interpreted are hedging to improve value of firm, management utility

334 Currency Derivatives: A Survey of Indian Firms

Exhibit 11 Attitudes to Derivatives Use from Respondents With and Without a Risk Manage-

ment Plan: A Comparison

Does your firm have a documented

foreign exchange risk management

plan/ policy/ programme? p-value

N Mean Standard Deviation (2-tailed)

Yes No Yes No Yes No

To reduce volatility in PAT 36 15 4.222 4.333 1.045 1.047 0.568

To reduce volatility of cash flows 37 15 3.730 3.333 1.194 1.175 0.195

To reduce probability of bankruptcy and financial

distress and their costs 36 15 2.639 2.533 1.376 1.407 0.807

Firms with high debt ratio are more likely to use

foreign currency derivatives 34 14 2.824 3.357 1.359 1.550 0.237

To reduce cost of capital of the firm 37 14 3.514 3.500 1.261 1.019 0.702

Firms with a high proportion of ESOPs outstanding

are more likely to resort to it 31 14 1.806 1.286 1.014 0.726 0.039

To improve value of the firm 37 15 3.622 3.267 1.210 1.387 0.398

To facilitate budgeting and control process in the firm 35 15 3.886 3.200 1.132 1.474 0.130

To reduce the political risk 33 14 2.667 2.000 1.216 1.519 0.069

Firm has alternate means to manage financial risks 32 14 2.875 2.429 1.185 1.342 0.210

Difficulties in pricing and valuing derivatives 35 14 2.771 2.714 1.190 1.069 0.881

Disclosure requirements of accounting standards 36 14 2.528 2.286 1.253 1.437 0.522

Legal restrictions on use of derivatives 37 14 2.838 2.857 1.302 1.351 0.914

Accounting treatment is too complex 37 14 2.378 1.643 1.114 1.082 0.019

Perception of derivatives use by investors,

regulators and the public 35 11 2.857 2.182 1.115 1.250 0.079

To reduce risks faced by the management 36 15 4.111 4.467 0.919 0.915 0.137

Factors that Influence Managers to Hedge

Firms with high proportion of tax credit availability

are more likely to benefit from use of foreign currency

derivatives 31 14 1.774 1.357 0.845 0.745 0.074

Firms with alternate means (matching, netting, lead,

and lagging) to manage foreign currency risk are

more likely to use derivatives 37 14 3.189 2.357 1.198 1.393 0.049

This table compares mean scores of management motivations for use of foreign currency derivatives for hedging of firms that have a

documented foreign exchange risk management plan and firms that do not. The average rating for each motivation and the P-values for

statistical tests are reported, in which the null hypothesis is that there is no significant difference between the mean scores of the two sets.

Mann-Whitney U test has been used to capture the significant difference, if any.

and compensation, accounting and disclosure accounted for 9.68%, 9.58%, 9.07%, 8.61% and 8.34%

requirements, strengthening control systems, and avail respectively of the total variance explained. The structure

tax benefits and reduce cost of capital. These factors matrix is reported in Exhibit 12.

IIMB Management Review, September 2008 335

Exhibit 12 Structure (Rotated Factor) Matrix using Factor Analytic Methodology on

Responses on Motivation

Factor 1 Factor 2 Factor 3 Factor 4 Factor 5 Factor 6 Factor 7

To reduce volatility in PAT 0.9323

To reduce volatility of cash flows

To reduce probability of bankruptcy and financial distress

and their costs

Firms with high debt ratio are more likely to use

foreign currency derivatives -0.5026

To reduce cost of capital of the firm 0.6903

Firms with high proportion of ESOPs outstanding are

more likely to resort to it -0.7563

To improve value of the firm 0.5389

To facilitate budgeting and control process in the firm 0.9693

To reduce political risk 0.5209

Firm has alternate means to manage financial risks

Difficulties in pricing and valuing derivatives 0.7702

Disclosure requirements of accounting standards 0.7145 0.5620

Legal restrictions on use of derivatives

Accounting treatment is too complex 0.7102

Perception of derivatives use by investors,

regulators and the public 0.9276

To reduce risks faced by the management 0.6811

Factors that Influence Managers to Hedge

Firms with high proportion of tax credit availability are

more likely to benefit from use of foreign currency derivatives

Firms with alternate means to manage foreign currency

risk are likely to use derivatives

This table reports structure (rotated factor) matrix estimated while using factor analytic methodology on the 55 responses received in respect

of 18 motivations for use of foreign currency derivatives. Varimax with Kaiser Normalisation has been used for rotation. Maximum likelihood

method has been used for extraction. Eigen value e1 criterion has been adopted for identification of factors. The Bartletts test of significance

led to the acceptance of seven significant factors. These seven factors explain 59.28% of the total variance. The application of secree test

resulted in acceptance of five factors. The factors loaded by variables having significant loading of the magnitude of 0.50 and above have been

interpreted.

Factor 1 Hedging to improve value of firm: The first reduce volatility in profits after tax and to improve value

factor, hedging to improve value of firm, is bipolar in of the firm, which have high positive loading of 0.932

nature. On one pole, there is one variable pertaining to and 0.539 respectively.

firm characteristics that necessitate hedging. This variable Factor 2 Management utility and compensation: The

is firm with high debt ratio is more likely to use foreign second factor, management utility and compensation,

currency derivatives, which has a high negative loading is also bipolar in nature. On one pole, there is one variable

of 0.503 using varimax rotation. On the other pole, there pertaining to firm characteristics that necessitate hedging.

are two variables pertaining to hedging. These are to This variable is firm with high proportion of ESOPs

336 Currency Derivatives: A Survey of Indian Firms

outstanding is more likely to use foreign currency of risk) and economic exposure (54.3% judged it a low

derivatives, which has a high negative loading of 0.756 degree of risk). The major objective of using derivatives

using varimax rotation. On the other pole, there is one is hedging risk (96.1% assigned it rank one objective),

variable pertaining to the management utility maximisation for arbitrage (55.3% assigned it rank two) and price

objective, to reduce risks faced by the management, discovery (36.4% assigned it rank two and 33.3% assigned

which has high positive loading of 0.681. It has a it rank three). Speculation as an objective of using foreign

meaningful loading on the variable namely to reduce the currency derivatives is the least preferred option (62.1%

volatility of cash flows of 0.395 using varimax rotation. assigned it rank four).

Factor 3 Accounting and disclosure requirements: To reduce the volatility in profits after tax, volatility in

The third factor, accounting and disclosure requirements, cash flows and cost of capital, and thus increase the value

has significant positive loading of 0.714 and 0.710 on of the firm at one end, and to reduce the risks faced by

two variables, the disclosure requirements of accounting the management at the other end, are the major motivations

standards for use of derivatives and necessary accounting of the firms using foreign currency derivatives in India.

treatment is too complex, respectively using varimax Firms with high debt ratio are more likely to use foreign

rotation. It has a meaningful loading on the variable, legal currency derivatives.

restrictions on use of derivatives of 0.489 using varimax

Increased focus on accounting earnings vis--vis cash

rotation.

flows raises questions on risk management practice vis-

Factor 4 Strengthen control systems: The fourth -vis the theory. Firm characteristics such as high degree

factor, strengthening control systems, encompasses two of debt ratio and ESOPs usage influence the use of foreign

variables namely to facilitate budgeting and control currency derivatives in India. Management motivations

process in the firm, and to reduce political risk. These for the use of foreign currency derivatives captured in

variables have significant positive loading of 0.969 and factor-analytic framework are hedging to improve value

0.521 respectively using varimax rotation. of firm, management utility and compensation,

Factor 5 Avail of tax benefits and reduce cost of accounting and disclosure requirements, strengthen

capital: The fifth factor avail of tax benefits and reduce control systems, and avail tax benefits and reduce cost

cost of capital encompasses two variables namely to of capital. Management motivations for use of foreign

reduce cost of capital of the firm, and firms with high currency derivatives do not differ between derivative users

proportion of tax credit availability are more likely to benefit and non-users.

from the use of foreign currency derivatives. These

variables have significant positive loading of 0.69 and 0.482 References and Notes

respectively using varimax rotation.

1 The rationale of this statement is based on the Modigliani and

Miller theorem. Modigliani, F, and Miller M, 1958, The cost of

Summary and Conclusions capital , corporate finance, and the theory of investment,

American Economic Review, vol. 48, pp 261-97.

This study examines management motivations for foreign 2 Stulz, R, 1984, Optimal Hedging Policies, Journal of Financial

currency derivatives usage in corporate India using survey and Quantitative Analysis, Vol 19, pp 127-140; Stulz, R, 1990,

methodology and identifies significant differences, if any, Managerial Discretion and Optimal Hedging Policies, Journal

of Financial Economics, Vol 26, pp 3-27; Smith, C W, and R M

in the motivations of the firms who either use foreign Stulz, 1985, The Determinants of Firms Hedging Policies,

currency derivatives or have a documented foreign Journal of Financial and Quantitative Analysis, Vol 20, No 4, pp

exchange risk management policy vis--vis firms who do 391-405; Bessembinder, H, 1991, Forward Contracts and Firm

Value: Investment Incentive and Contracting Effects, Journal

not. The sample ranges across nine industries and of Financial and Quantitative Analysis, Vol 26, No. 4, December,

comprises 55 firms. pp 519-532; Scharfstein, David S, Jeremy C Stein, and Kenneth

A Froot, 1993, Risk Management: Coordinating Corporate

Most of the respondent firms (70.4%) have documented Investment and Financing Policies, Journal of Finance, Vol 48,

foreign exchange risk management plan/policy/ No 5, pp 1629-1658; DeMarzo, P, and D Duffie, 1995,

programme. Transaction exposure as a foreign currency Corporate Incentives for Hedging and Hedge Accounting,

Review of Financial Studies, Vol 8, pp 743-772; Mello, A, and J

risk is most critical to the firms (74.5%) followed by Parsons, 2000, Hedging and Liquidity, Review of Financial

translation exposure (58.3% judged it a moderate degree Studies, Vol 13, pp 127-153.

IIMB Management Review, September 2008 337

3 Smithson, Charles, and Betty J Simkins, 2005, Does Risk motivations for use of derivatives in India. It includes firms

Management Add Value? A Survey of Evidence, Journal of with high debt ratio are more likely to use foreign currency

Applied Corporate Finance, Vol 17, No 3, pp 8-17; Bartram, derivatives as A single motivation.

Sohnke M., 2000, Corporate Risk Management as a Lever for

15 S&P CNX 500 and BSE 500 are broad-based market indices

Shareholder Value Creation, Financial Markets, Instruments &

representing 93% of the total market capitalisation at the

Institutions, Vol 9, No 5, pp 279-324.

National Stock Exchange of India Limited and Bombay Stock

4 Smith and Stulz, The Determinants of Firms Hedging Policies. Exchange Limited.

5 Smithson, Charles W, Clifford W Smith Jr, and Deana R Nance, 16 Dillman, D A, 1978, Mail and Telephone Surveys: The Total

1993, On the Determinants of Corporate Hedging, Journal of Design Method, New York, NY: John Wiley & Sons.

Finance, Vol 48, No 1, pp 267-284; Berkman, H, and M E 17 Bodnar, Gordon M, Gregory S Hayt, Richard C Marston, and

Bradbury, 1996, Empirical Evidence on the Corporate Use of Charles W Smithson, 1995,Wharton Survey of Derivatives

Derivatives, Financial Management, Vol 25, No. 2, Summer, Usage by US Non-financial Firms, Financial Management, Vol

pp 5-13; Tufano, Peter, 1996, Who Manages Risk? An 24, No 2, pp 104-114.

Empirical Examination of Risk Management Practices in the

Gold Mining Industry, Journal of Finance, Vol 51, pp 1097- 18 Bodnar, Gordon M, Gregory S Hayt, and Richard C Marston,

1137; Geczy, Christopher, Bernadette A Minton, and Catherine 1996, 1995 Wharton Survey of Derivatives Usage by US Non-

Schrand, 1997, Why Firms use Currency Derivatives, The financial Firms, Financial Management, Vol 25, No 4, pp 113-

Journal of Finance, Vol 52, No 4, pp 1323-1354; Graham, J, and 133.

C Smith, 1999, Tax Incentives to Hedge, Journal of Finance, 19 Bodnar, Gordon M, Gregory S Hayt, and Richard C Marston,

Vol 54, pp 2241-2262; Brown, G, 2001, Managing Foreign 1998, 1998 Wharton Survey of Financial Risk Management by

Exchange Risk with Derivatives, Journal of Financial Economics, US Non-financial Firms, Financial Management, Vol 27, No 4,

Vol 60, pp 401-448; Berkman, H, and M E Bradbury, 1996, pp 70-91.

Empirical Evidence on the Corporate Use of Derivatives,

Financial Management, Vol 25, No. 2, Summer, pp 5-13; 20 Phillips, Aaron L, 1995, 1995 Derivatives Practices and

Graham, J, and D Rogers, 2002, Do Firms Hedge in Response Instruments Survey, Financial Management, Vol 24, No 2, pp

to Tax Incentives?, Journal of Finance, Vol 57, pp 815-839; 115-125.

Nguyen, Hoa, and Robert Faff, 2002, On the Determinants of 21 Berkman, Henk, Michael E Bradbury, and Stephen Magan, 1997,

Derivatives Usage by Australian Companies, Australian Journal An International Comparison of Derivatives Use, Financial

of Management, Vol 27, No 1, pp 1-24; Adam, Tim R, and Management, Vol 26, No 4, pp 69-73.

Chitru S Fernando, 2006, Hedging, Speculation and Shareholder

Value, Journal of Financial Economics, Vol 81, pp 283-309. 22 Grant, Kevin, and Andrew P Marshall, 1997, Large UK

Companies and Derivatives, European Financial Management,

6 Hentschel, L, and S P Kothari, 2001, Are Corporations Reducing Vol 3, No 2, pp 191-208.

or Taking Risks with Derivatives, Journal of Financial and

23 Alkeback, Per, and Niclas Hagelin, 1999, Derivatives Usage by

Quantitative Analysis, Vol 36, pp 93-118.

Non-financial Firms in Sweden with an International

7 Smith and Stulz, The Determinants of Firms Hedging Policies. Comparison, Journal of International Financial Management

and Accounting, Vol 10, No 2, pp 105-120.

8 Tufano, Who Manages Risk? An Empirical Examination of Risk

Management Practices in the Gold mining industry. 24 Bodnar, Gordon M, and Giinther Gebhardt, 1999, Derivatives

Usage in Risk Management by US and German Non-financial

9 Nguyen and Faff, On the Determinants of Derivatives Usage

Firms: A Comparative Survey, Journal of International Financial

by Australian Companies.

Management and Accounting, Vol 10, No 3, pp 153-187.

10 Heaney, Richard, and Henry Winata, 2005, Use of Derivatives

25 Fatemi, Ali, and Martin Glaum, 2000, Risk Management

by Australian Companies, Pacific-Basin Finance Journal, Vol

13, No 4, pp 411-430. Practice in German Firms, Managerial Finance, Vol 26, No 3,

pp 1-17.

11 Brailsford, T, R Heaney, and B Oliver, 2003, Practices and

Attitudes to Derivatives Use in Australian Commonwealth 26 Jalilvand, Abolhassan, Jeannette Switzer, and Caroline Tang,

Organisations, Australian Journal of Public Administration, Vol 2000, A Global Perspective on the Use of Derivatives for

62, No 2, pp 87-100. Corporate Risk Management Decisions, Managerial Finance,

Vol 26, No 3, pp 29-38.

12 Tufano, Peter, 1998, Agency Cost of Corporate Risk

Management, Financial Management, Vol 27, No 1, pp 67-77. 27 Ceuster, Marc, J K De, Edward Durinck, Eddy Laveren, and

Jozed Lodewyckx, 2000, A Survey into the Use of Derivatives

13 Heaney and Winata, Use of Derivatives by Australian by Large Non-financial Firms Operating in Belgium, European

Companies. Financial Management, Vol 6, No 3, pp 301-318.

14 Ibid; Benson, Karen, and Barry Oliver, 2004, Management 28 Lee, Fah Mei, Andrew Marshall, You Koong Szto, and Joan

Motivations for using Financial Derivatives in Australia, Tang, 2001, The Practice of Financial Risk Management: An

Australian Journal of Management, Vol 29, No 2, pp 225-242. International Comparison, Thunderbird International Business

Benson and Oliver in their survey list 19 motivations of Review, Vol 43, No 3, pp 365-378.

management for using the financial derivatives in Australia. It

lists reduce the use of debt finance and increase the use of debt 29 Benson and Oliver, Management Motivations for using Financial

finance as separate motivations. The present study uses 18 Derivatives in Australia.

338 Currency Derivatives: A Survey of Indian Firms

30 Figures are from the studies cited in Exhibit 1. The exhibit suggests the highest possible return adjusted for exchange rate changes.

that more Indian firms use derivatives (83.6%) than US firms The currency futures prices represent the aggregate of all available

(50%). This is because of the fact that US$ is the defacto information that may affect the market, and are viewed as a price

international currency and thus US firms are relatively shielded discovery mechanism.

from foreign currency risk.

38 The issues are similar to those described in Benson and Oliver,

31 Bodnar, Hayt and Marston, 1998 Wharton Survey of Financial Management Motivations for using Financial Derivatives in

Risk Management by US Non-financial Firms. Australia, and have been developed on the basis of the literature

review.

32 Berkman, Bradbury and Magan, An International Comparison

of Derivatives Use; Bodnar, Hayt and Marston, 1998 Wharton 39 Benson and Oliver, Management Motivations for using Financial

Survey of Financial Risk Management by US Non-financial Derivatives in Australia.

Firms.

40 Ceuster et al, A Survey into the Use of Derivatives by Large

33 Translation exposure or accounting exposure arises during Non-financial Firms Operating in Belgium.

financial reporting and consolidation of financial statements to

41 Fatemi and Glaum, Risk Management Practice in German Firms.

convert financial statements of foreign operations from the local

currency involved to home currency. Transactions involving 42 Berkman, Bradbury and Magan, An International Comparison

known future contractually binding foreign-currency of Derivatives Use.

denominated cash inflows and cash outflows result in to

43 Ceuster et al, A Survey into the Use of Derivatives by Large

transaction exposure. Operating exposure captures the impact

Non-financial Firms Operating in Belgium.

of foreign currency changes on a firms revenues and cost. The

combined effect of transaction exposure and operating exposure 44 Jalilvand, Switzer and Tang, A Global Perspective on the Use

is termed as economic exposure. of Derivatives for Corporate Risk Management Decisions.

34 Smith, C W, C Smithson, and D S Wilford, 1989, Managing 45 Bodnar, Hayt and Marston, 1998 Wharton Survey of Financial

Financial Risk, Journal of Applied Corporate Finance, Vol 1, Risk Management by US Non-financial Firms.

No 4, pp 27-48; Smithson, Smith and Nance, 1993, On the

Determinants of Corporate Hedging. 46 Benson and Oliver, Management Motivations for using Financial

Derivatives in Australia.

35 Grant and Marshall, Large UK Companies and Derivatives.

47 Ibid.

36 Berkman, Bradbury and Magan, An International Comparison

of Derivatives Use. 48 Bentler, P M, 1968, Alpha Maximised Factor Analysis (Alpha

Max): Its Relation to Alpha and Caronical Factor Analysis,

37 The management of different exposures requires hedging to protect Psycometrica, Vol 31, pp 77; Cattel, R B, 1966, The Secree Test

a firms cash flows against unexpected exchange rate changes. for Number of Factors, Multivariate Behavioural Research, Vol

Hedging a particular currency exposure means establishing an 1, pp 245-276; Kaiser, H F, 1958, The Varimax Criterion for

offsetting currency position so that whatever is lost or gained on Analytic Rotation in Factor Analysis, Psycometrica, Vol 23,

original currency exposure is exactly offset by corresponding No 3, pp 187-200; Kaiser, H F, and J C Caffrey, 1965, Alpha

foreign exchange gain or loss on the currency hedge. The hedging Factor Analysis, Psycometrica, Vol 30, p 1.

objective is most consistent with the shareholder wealth

maximisation objective. Speculation refers to the deliberate

creation of a position involving foreign currency exposure with Manoj Anand is Professor, Indian Institute of Management,

an objective to profit from it, while accepting the added risk. Lucknow. manand@iiml.ac.in

The speculator challenges the markets forecasts as reflected in

forward currency rates and attempts to benefit by creating an K P Kaushik is Professor, National Institute of Financial

open position. Arbitrage refers to a set of transactions in choosing Management, Faridabad. kp_kaushik@hotmail.com

between assets denominated in different currencies and taking a

position in the forward market to hedge currency risk and target

Reprint No 08306

IIMB Management Review, September 2008 339

Das könnte Ihnen auch gefallen

- Group 1 PDFDokument8 SeitenGroup 1 PDFMahmood KhanNoch keine Bewertungen

- Foreign Exchange Risk Management Practices - A Study in Indian ScenarioDokument11 SeitenForeign Exchange Risk Management Practices - A Study in Indian ScenariobhagyashreeNoch keine Bewertungen

- Widi Pramesia Utami - 221015200088 (Pertemuan 11)Dokument3 SeitenWidi Pramesia Utami - 221015200088 (Pertemuan 11)kedaicemilannnNoch keine Bewertungen

- Final-Project Mba HRDokument108 SeitenFinal-Project Mba HRMaryam ali KazmiNoch keine Bewertungen

- The Exchange Rate Exposure of Indian Companies: August 2016Dokument11 SeitenThe Exchange Rate Exposure of Indian Companies: August 2016Bheemu patilNoch keine Bewertungen

- 1.1. Identification of ProblemDokument45 Seiten1.1. Identification of ProblemAditya AgarwalNoch keine Bewertungen

- Hedging of Forex Exposure Through Currency Derivatives-Evidence From Select Indian CorporateDokument10 SeitenHedging of Forex Exposure Through Currency Derivatives-Evidence From Select Indian CorporateKumarJyotindra SharanNoch keine Bewertungen

- An Empirical Investigation Into Enterprise Risk Management in India - IimcalDokument25 SeitenAn Empirical Investigation Into Enterprise Risk Management in India - Iimcalsarvjeet_kaushalNoch keine Bewertungen

- Proposal (Derivatives & Risk Management Techniques)Dokument10 SeitenProposal (Derivatives & Risk Management Techniques)Wasfi TawfiqNoch keine Bewertungen

- Risk Management of Financial Derivatives Grand ProjectDokument127 SeitenRisk Management of Financial Derivatives Grand ProjectMohit Bhendarkar60% (5)

- Corporate Risk Management: Costs and Benefits: Depaul UniversityDokument12 SeitenCorporate Risk Management: Costs and Benefits: Depaul UniversityJuan RicardoNoch keine Bewertungen

- Impact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaDokument3 SeitenImpact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaBilal AhmedNoch keine Bewertungen

- Factors Influencing Derivatives Usage by Selected Listed Companies in The PhilippinesDokument12 SeitenFactors Influencing Derivatives Usage by Selected Listed Companies in The PhilippinesJustine Kate BascoNoch keine Bewertungen

- Foreign Exchange Risk Management Karvy-2017-18Dokument80 SeitenForeign Exchange Risk Management Karvy-2017-18Vamsi Sakhamuri100% (2)

- Determinants of Corporate ForeignDokument13 SeitenDeterminants of Corporate Foreignfenny maryandiNoch keine Bewertungen

- IJRPR7350Dokument6 SeitenIJRPR7350Munna Kumar YadavNoch keine Bewertungen

- A Study On Derivatives and Risk ManagementDokument77 SeitenA Study On Derivatives and Risk ManagementShabeerNoch keine Bewertungen

- Four Swaps, Forwards, Futures, and OptionsDokument11 SeitenFour Swaps, Forwards, Futures, and OptionsjoekhannazNoch keine Bewertungen

- WASJ1Dokument7 SeitenWASJ1Bista BishalNoch keine Bewertungen

- Case Study of Capital BudetingDokument4 SeitenCase Study of Capital BudetingMaunilShethNoch keine Bewertungen

- Capital Structure and Financial Performance: Evidence From IndiaDokument17 SeitenCapital Structure and Financial Performance: Evidence From IndiaanirbanccimNoch keine Bewertungen

- Financial Management 17 317Dokument301 SeitenFinancial Management 17 317hungrywing0Noch keine Bewertungen

- Enterprise Risk Management in The Nigerian Insurance IndustryDokument7 SeitenEnterprise Risk Management in The Nigerian Insurance IndustryBOHR International Journal of Advances in Management ResearchNoch keine Bewertungen

- Derivative Market AnalysisDokument96 SeitenDerivative Market AnalysisMaza StreetNoch keine Bewertungen

- Global Hedge Fund: Valuation and Risk Management SurveyDokument12 SeitenGlobal Hedge Fund: Valuation and Risk Management SurveyRajiv AhluwaliaNoch keine Bewertungen

- Financial EngineeringDokument42 SeitenFinancial Engineeringqari saibNoch keine Bewertungen

- Introduction of RSD Sem IIDokument4 SeitenIntroduction of RSD Sem IIop bolte broNoch keine Bewertungen

- 2023 CFA L2 Book 2 FRA - CI-2Dokument100 Seiten2023 CFA L2 Book 2 FRA - CI-2PR100% (1)

- Why Hedge? Rationales For Corporate Hedging and Value ImplicationsDokument17 SeitenWhy Hedge? Rationales For Corporate Hedging and Value ImplicationsRishabh JainNoch keine Bewertungen

- The Analysis Hedging and Derivative Instrument On Firm ValueDokument4 SeitenThe Analysis Hedging and Derivative Instrument On Firm ValueRianNoch keine Bewertungen

- Corporate FinanceDokument56 SeitenCorporate Financeskspankaj08Noch keine Bewertungen

- 4322 12351 1 PBDokument9 Seiten4322 12351 1 PBRianNoch keine Bewertungen

- Financial Engineering AnuDokument11 SeitenFinancial Engineering AnuThaiseer MohammedNoch keine Bewertungen

- Derivatives Title - Impact of Derivatives On The Non-Financial Firms in UKDokument15 SeitenDerivatives Title - Impact of Derivatives On The Non-Financial Firms in UKPankaj KhannaNoch keine Bewertungen

- Financial Management NotesDokument34 SeitenFinancial Management NotesNalugo LeilahNoch keine Bewertungen

- ArtDokument9 SeitenArtsdudekulaNoch keine Bewertungen

- Financial Treasury and Forex ManagementDokument641 SeitenFinancial Treasury and Forex Managementcharus289100% (1)

- Manuscript Technical and Fundamental Analysis For Risk ManagementDokument30 SeitenManuscript Technical and Fundamental Analysis For Risk ManagementRa HulNoch keine Bewertungen

- An Empirical Study On Capital Budgeting With Reference To Selected Cement Companies in Andhra PradeshDokument5 SeitenAn Empirical Study On Capital Budgeting With Reference To Selected Cement Companies in Andhra PradeshBhoopal BaluNoch keine Bewertungen

- BM1602 013Dokument7 SeitenBM1602 013Intel One-pieceNoch keine Bewertungen

- Financial Engineering Section A Definition of Financial EngineeringDokument10 SeitenFinancial Engineering Section A Definition of Financial Engineeringqari saibNoch keine Bewertungen

- Special Topics in Financial Management ReviewerDokument4 SeitenSpecial Topics in Financial Management ReviewerJoelan AbdulaNoch keine Bewertungen

- An Analysis of Foreign Exchange Risk Management: Techniques Employed in Indian Pharma IndustryDokument16 SeitenAn Analysis of Foreign Exchange Risk Management: Techniques Employed in Indian Pharma IndustryKuppagal SurendraNoch keine Bewertungen

- (Review Artikel Jurnal) HedgingDokument38 Seiten(Review Artikel Jurnal) HedgingGusi Putu Pratita IndiraNoch keine Bewertungen

- Summary of Jason A. Scharfman's Private Equity Operational Due DiligenceVon EverandSummary of Jason A. Scharfman's Private Equity Operational Due DiligenceNoch keine Bewertungen

- Financialriskmgt SDIMT Rita 2013Dokument18 SeitenFinancialriskmgt SDIMT Rita 2013sibiNoch keine Bewertungen

- Scan 2Dokument12 SeitenScan 2madhpanNoch keine Bewertungen

- Capital BudgetingDokument15 SeitenCapital BudgetingKiki Sidharta TahaNoch keine Bewertungen

- Arthance Risk Management White Paper August 20131Dokument7 SeitenArthance Risk Management White Paper August 20131tabbforumNoch keine Bewertungen

- Financial Risk Management Thesis TopicsDokument4 SeitenFinancial Risk Management Thesis Topicsdwsmpe2q100% (2)

- Pradeep Kumar Gupta22020091612606Dokument12 SeitenPradeep Kumar Gupta22020091612606log10Noch keine Bewertungen

- Research Paper On Foreign Exchange Risk ManagementDokument4 SeitenResearch Paper On Foreign Exchange Risk ManagementafmcmuugoNoch keine Bewertungen

- Corporate Governance in IndiaDokument9 SeitenCorporate Governance in IndiaRama KrishnanNoch keine Bewertungen

- Index: S.No: Contents Page NoDokument70 SeitenIndex: S.No: Contents Page NoaksjdhfkasdhfaNoch keine Bewertungen

- The Financial Environment: Miss Wan Shahzlinda Shah Binti ShaharDokument39 SeitenThe Financial Environment: Miss Wan Shahzlinda Shah Binti ShaharMaizatul ShahizaNoch keine Bewertungen

- Asaduzzamanroman - 18133028 - Asaduzzaman NurDokument10 SeitenAsaduzzamanroman - 18133028 - Asaduzzaman NurAjit DasNoch keine Bewertungen

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationVon EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNoch keine Bewertungen

- Synopsis On Capital StructureDokument11 SeitenSynopsis On Capital StructureSanjay MahadikNoch keine Bewertungen

- Foreign Exchange Risk Management Practices A Study On Ludhiana Textile ExportersDokument9 SeitenForeign Exchange Risk Management Practices A Study On Ludhiana Textile ExportersrohanNoch keine Bewertungen

- Sandesh Sir: Anuj NairDokument55 SeitenSandesh Sir: Anuj NairAnuj NairNoch keine Bewertungen

- Theory of DemandDokument17 SeitenTheory of DemandkkNoch keine Bewertungen

- Customer-Driven Marketing Strategy OnDokument19 SeitenCustomer-Driven Marketing Strategy OnDipta Chowdhury 1811951630100% (1)

- FeaturesDokument2 SeitenFeaturesNaga Mani MeruguNoch keine Bewertungen

- Initiating Coverage Report - YES BankDokument35 SeitenInitiating Coverage Report - YES Bankarnabmoitra11Noch keine Bewertungen

- Assignment U5Dokument2 SeitenAssignment U5Shaon IslamNoch keine Bewertungen

- FHBM1124 Marketing Chapter 6-Segmentation Targeting PositioningDokument55 SeitenFHBM1124 Marketing Chapter 6-Segmentation Targeting PositioningBenkingcyeoh50% (2)

- Consumer Behavior 2nd Edition by Kardes Cronley Cline ISBN Test BankDokument44 SeitenConsumer Behavior 2nd Edition by Kardes Cronley Cline ISBN Test Bankjoseph100% (27)

- Assignment 1: Variable CostingDokument4 SeitenAssignment 1: Variable CostingWinoah HubaldeNoch keine Bewertungen

- Adam CHAPTER1-8Dokument62 SeitenAdam CHAPTER1-8AMER MAYATONoch keine Bewertungen

- Foresight: Article InformationDokument20 SeitenForesight: Article InformationAtharva DangeNoch keine Bewertungen

- Odc Zappos AssignmentDokument5 SeitenOdc Zappos AssignmentAnisha Mishra100% (1)

- McVitie's Digestive BiscuitsDokument28 SeitenMcVitie's Digestive BiscuitsAnkit Goyal14% (7)

- AFM Module 5 ProblemsDokument4 SeitenAFM Module 5 ProblemskanikaNoch keine Bewertungen

- References QuantiDokument2 SeitenReferences Quantikarel Grace ColotNoch keine Bewertungen

- FAR - Contribution No AnsDokument4 SeitenFAR - Contribution No AnsSherrydelle Gwen BeleganioNoch keine Bewertungen

- Accounting For PPE Part 1Dokument20 SeitenAccounting For PPE Part 1Keenly ChokeNoch keine Bewertungen

- Operations Capacility, Productivity and Business PerformanceDokument18 SeitenOperations Capacility, Productivity and Business PerformanceSah AnuNoch keine Bewertungen

- Syllabus of Introduction of Commerce For Economic & Finance PDFDokument7 SeitenSyllabus of Introduction of Commerce For Economic & Finance PDFNaveed Whatsapp StatusNoch keine Bewertungen

- Case Study-FormatDokument5 SeitenCase Study-Formatjhell de la cruzNoch keine Bewertungen

- Problem IV ExamDokument2 SeitenProblem IV ExamLJ AggabaoNoch keine Bewertungen

- Rekapitulasi Pendaftar QCC Non Teknik PIA 2021Dokument3 SeitenRekapitulasi Pendaftar QCC Non Teknik PIA 2021surya ginanjarNoch keine Bewertungen

- (Quantitative Perspectives On Behavioral Economics and Finance) James Ming Chen (Auth.) - Finance and The Behavioral Prospect - Risk, Exuberance, and Abnormal Markets-Palgrave Macmillan (2016)Dokument350 Seiten(Quantitative Perspectives On Behavioral Economics and Finance) James Ming Chen (Auth.) - Finance and The Behavioral Prospect - Risk, Exuberance, and Abnormal Markets-Palgrave Macmillan (2016)van tinh khuc100% (1)

- Far410 Lesson Plan Oct 2023 - Feb 2024Dokument2 SeitenFar410 Lesson Plan Oct 2023 - Feb 2024syamimiazmiNoch keine Bewertungen

- JEENYO CCC UpdateDokument30 SeitenJEENYO CCC UpdateEng-Hussein MohamedNoch keine Bewertungen

- ECON 1050 Midterm 2 2013WDokument20 SeitenECON 1050 Midterm 2 2013WexamkillerNoch keine Bewertungen

- Mod EDokument18 SeitenMod ESaroj Kumar RaiNoch keine Bewertungen

- Multiple-Choice Questions: AnswerDokument162 SeitenMultiple-Choice Questions: Answersuhayb_1988Noch keine Bewertungen

- Working Together For Healthier WorldDokument25 SeitenWorking Together For Healthier WorldKathy RomanNoch keine Bewertungen

- Ammar Abbasi Assignment 5Dokument8 SeitenAmmar Abbasi Assignment 5Usman SiddiquiNoch keine Bewertungen

- Achievement Test QuestionsDokument3 SeitenAchievement Test QuestionsglamfactorsalonspaNoch keine Bewertungen