Beruflich Dokumente

Kultur Dokumente

Chapter 7 - Format of Personal Taxation

Hochgeladen von

Anonymous iQuwAQTH0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

81 Ansichten2 Seitentax

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

81 Ansichten2 SeitenChapter 7 - Format of Personal Taxation

Hochgeladen von

Anonymous iQuwAQTHtax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

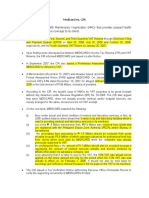

COMPUTATION OF TAX PAYABLE FOR MR A AND MRS A FOR YEAR OF ASSESSMENT 2015

SEPARATE ASSESSMENT JOINT ASSESSMENT

HUSBAND WIFE HUSBAND WIFE

SECTION 4(a) - BUSINESS INCOME

BUZ A BUZ B

ADJUSTED INCOME 1,000 2,000

ADD : BALANCING CHARGE 100 500

LESS : CAPITAL ALLOWANCE (200) (1,000)

STATUTORY BUZ INCOME 900 1,500 2,400

LESS : UNABSORBED BUZ LOSS B/F (100) NIL (100)

NET STATUTORY BUZ INCOME 800 1,500 2,300

SECTION 4(b) -EMPLOYMENT INCOME

SALARIES

GRATUITY

BONUS

SECTION 4 (c) -DIVIDEND & INTEREST

DIVIDEND - ASB - EXEMPTED

FOREIGN DIVIDEND REMITTED TO MALAYSIA - EXEMPTED

INTEREST - MAYBANK - EXEMPTED

SECTION 4(d) - RENTAL, ROYALTY

RENTAL INCOME

LESS : ALLOWABLE EXPENSES

ADJ/STATUTORY INCOME

ROYALTY INCOME

LESS:EXEMPTION (IF ANY)

ADJ/STATUTORY INCOME

SECTION 4(e) -PENSION,ANNUITIES

SECTION 4(f) - OTHERS

HONORORIUM

AGGREGATE INCOME XX XX XX XX

LESS : CURRENT YEAR BUSINESS LOSS (X) (X) (X)

LESS: APPROVED DONATION (Restristed to 7% of AI)

RUMAH ANAK YATIM

CHARITABLE INSTITUTION

TOTAL INCOME XX XX XX XX

COMBINED TOTAL INCOME [H + W] XXX

LESS : RELIEFS

SELF RELIEF 9,000 9,000 9,000 -

DISABLED TAXPAYER 6,000 6,000 6,000 -

WIFE RELIEF (CLAIMED BY HUSBAND) - - 3,000 -

WIFE DISABLED - - 3,500 -

HUSBAND RELIEF - - - 3,000

HUSBAND DISABLED - - - 3,500

MEDICAL EXPENSES FOR PARENTS (EXCLUDE PARENTS IN LAW) 5,000 5,000 5,000 -

SERIOUS DISEASE + MEDICAL EXAMINATION (500) [TAXPAYER, SPOUSE & CHILDREN] 6,000 6,000 6,000 -

SUPPORTING EQUIPMENT [DISABLED TAXPAYER, SPOUSE, CHILDREN AND PARENTS] 6,000 6,000 6,000 -

CHILD RELIEF (UNMARRIED CHILD ONLY) -

- < 18 [1,000 PER CHILD] 1,000 1,000 1,000 -

- > 18 [STUDYING IN IPTA/IPTS - LOCAL/OVERSEAS] - 6,000 PER CHILD 6,000 6,000 6,000 -

- > 18 [DISABLED & STUDYING IN IPTA/SPTS] 12,000 12,000 12,000

- DISABLED CHILD (<18 - 5,000 PER CHILD] 6,000 6,000 6,000 -

SSPN - RESTRICTED TO 6,000 6,000 6,000 6,000 -

EPF (EMPLOYEE'S CONTRIBUTION + PREMIUM ON LIFE INSURANCE) 6,000 6,000 6,000 -

(RESTRICTED TO 6,000)

PREMIUM ON DEFERRED ANNUITY + PRIVATE RETIREMENT SHCEME 3,000 3,000 3,000

(RESTRICTED TO 3,000)

INSURANCE PREMIUM ON EDUCATION + MEDICAL [TAXPAYER, SPOUSE & CHILDREN] 3,000 3,000 3,000

(RESTRICTED TO 3,000)

EDUCATION FEES (RESTRICTED TO 5,000) 5,000 5,000 5,000

PURCHASE OF BOOKS, MAGAZINES JOURNAL AND OTHERS [EXCLUDE NEWSPAPER] 1,000 1,000 1,000

(RESTRICTED TO 1,000)

PERSONAL COMPUTER (RESTRICTED TO ONCE FOR EVERY 3 YEARS) 3,000 3,000 3,000

PURCHASE OF SPORT EQUIPMENT (RESTRICTED TO 300) 300 300 300

CHARGEABLE INCOME XXX XXX XXX

TAX ON THE FIRST RM

TAX ON THE NEXT RM..

TAX ON THE FIRST RM

TAX ON THE NEXT RM..

TAX CHARGED

LESS : REBATES

CHARGEABLE INCOME 35,000 400 400 400

WIFE RELIEF WHEN WIFE RELIEF IS CLAIMED 400

HUSBAND RELIEF WHEN WIFE RELIEF IS CLAIMED 400

ZAKAT/FITRAH ACTUAL AMT ACTUAL AMT ACTUAL AMT

TAX PAYABLE XXX XXX XXX

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Construction Water System Signboard CostDokument60 SeitenConstruction Water System Signboard Costrosecel jayson ricoNoch keine Bewertungen

- Classification of TaxesDokument2 SeitenClassification of TaxesJoliza Calingacion100% (1)

- Impact of Globalization On Indian EconomyDokument32 SeitenImpact of Globalization On Indian EconomyAbhijeet Kulshreshtha88% (24)

- Chapter 5 - Computation of Statutory Business Income LatestDokument3 SeitenChapter 5 - Computation of Statutory Business Income LatestAnonymous iQuwAQTH60% (5)

- Ad30047683 28032020011700 PDFDokument1 SeiteAd30047683 28032020011700 PDFKaran SharmaNoch keine Bewertungen

- Financial Statements TemplateDokument19 SeitenFinancial Statements TemplateAbdullahTufailNoch keine Bewertungen

- READMEDokument1 SeiteREADMEAnonymous iQuwAQTHNoch keine Bewertungen

- Exhibitor's SummaryDokument1 SeiteExhibitor's SummaryAnonymous iQuwAQTHNoch keine Bewertungen

- Financial Statements TemplateDokument19 SeitenFinancial Statements TemplateAbdullahTufailNoch keine Bewertungen

- An Investment Analysis Case Study: The Home Depot: This Case Is A Group Project That Is Due On March 29 Before 10.30 AmDokument13 SeitenAn Investment Analysis Case Study: The Home Depot: This Case Is A Group Project That Is Due On March 29 Before 10.30 AmAnonymous iQuwAQTHNoch keine Bewertungen

- Internal Audit - ACCA Qualification - Students - ACCA Global PDFDokument3 SeitenInternal Audit - ACCA Qualification - Students - ACCA Global PDFAnonymous iQuwAQTHNoch keine Bewertungen

- FC FF Simple Ginzu 2017Dokument21 SeitenFC FF Simple Ginzu 2017sherNoch keine Bewertungen

- Using Slang for CommunicationDokument19 SeitenUsing Slang for CommunicationAnonymous iQuwAQTHNoch keine Bewertungen

- Internal Audit - ACCA Qualification - Students - ACCA Global PDFDokument3 SeitenInternal Audit - ACCA Qualification - Students - ACCA Global PDFAnonymous iQuwAQTHNoch keine Bewertungen

- F7 2014 Dec AnsDokument10 SeitenF7 2014 Dec Ansfattiq_mNoch keine Bewertungen

- 2-5int 2002 Jun ADokument14 Seiten2-5int 2002 Jun Aapi-372879067% (3)

- f5 Examreport s15Dokument5 Seitenf5 Examreport s15Anonymous iQuwAQTHNoch keine Bewertungen

- F4MYS Section B 2015 Jun (QS)Dokument3 SeitenF4MYS Section B 2015 Jun (QS)rayyan darwishNoch keine Bewertungen

- f5 - 2013 - Jun - A. AnsDokument11 Seitenf5 - 2013 - Jun - A. Ansanik1993Noch keine Bewertungen

- Elasticity Concepts Explained for Microeconomics StudentsDokument4 SeitenElasticity Concepts Explained for Microeconomics StudentsAnonymous iQuwAQTHNoch keine Bewertungen

- Eg Oct11 F4-9a PDFDokument33 SeitenEg Oct11 F4-9a PDFAnonymous iQuwAQTHNoch keine Bewertungen

- Uniform CPA Examination. Questions and Unofficial Answers 1989 N PDFDokument97 SeitenUniform CPA Examination. Questions and Unofficial Answers 1989 N PDFJeremie RealinoNoch keine Bewertungen

- National Transmission Corp. v. Province of AgusanDokument12 SeitenNational Transmission Corp. v. Province of AgusanArren RelucioNoch keine Bewertungen

- Chapter 13 Managerial AccountingDokument168 SeitenChapter 13 Managerial AccountingChandler Schleifs100% (4)

- Taxguru - In-How To Prepare Directors Report As Per Companies Act 2013Dokument9 SeitenTaxguru - In-How To Prepare Directors Report As Per Companies Act 2013g26agarwalNoch keine Bewertungen

- Business Name: Address Line 1 Phone Address Line 2 Email City, State, Zip WebDokument2 SeitenBusiness Name: Address Line 1 Phone Address Line 2 Email City, State, Zip WebJear ComerosNoch keine Bewertungen

- Tender Document PDFDokument111 SeitenTender Document PDFalekyaNoch keine Bewertungen

- Public Finance and Public Policy 5th Edition Gruber Solutions ManualDokument9 SeitenPublic Finance and Public Policy 5th Edition Gruber Solutions Manualmagnusorborneshw5Noch keine Bewertungen

- Supreme Court: Republic of The Philippines ManilaDokument6 SeitenSupreme Court: Republic of The Philippines ManilaJopan SJNoch keine Bewertungen

- Medicard vs. CIRDokument4 SeitenMedicard vs. CIRAnneNoch keine Bewertungen

- VAT Zero Rated Transactions PhilippinesDokument8 SeitenVAT Zero Rated Transactions PhilippineskmoNoch keine Bewertungen

- Moldova's Path to Increased Competitiveness and Shared GrowthDokument122 SeitenMoldova's Path to Increased Competitiveness and Shared GrowthOlga SicoraNoch keine Bewertungen

- The Effects of Education On CrimeDokument12 SeitenThe Effects of Education On CrimeMicaela FORSCHBERG CASTORINONoch keine Bewertungen

- Citizens Charter Provides Timelines for Tax ServicesDokument7 SeitenCitizens Charter Provides Timelines for Tax ServicesAnonymous tmtyiZANoch keine Bewertungen

- Unit 1 Business and Its EnvironmentDokument28 SeitenUnit 1 Business and Its EnvironmentMaham ButtNoch keine Bewertungen

- C U S T O M S: Boc Single Administrative DocumentDokument2 SeitenC U S T O M S: Boc Single Administrative DocumentNaj MusorNoch keine Bewertungen

- Tax SparingDokument8 SeitenTax SparingtaranNoch keine Bewertungen

- Income Tax Classification Guide for Individuals & BusinessesDokument15 SeitenIncome Tax Classification Guide for Individuals & BusinessesclaraNoch keine Bewertungen

- Od 116572688556921000Dokument1 SeiteOd 116572688556921000Shubham guptaNoch keine Bewertungen

- CA PRANAV CHANDAK'S ERRORLESS TAXATION QUESTION BANKDokument8 SeitenCA PRANAV CHANDAK'S ERRORLESS TAXATION QUESTION BANKSimran MeherNoch keine Bewertungen

- PD 2026Dokument2 SeitenPD 2026Lv AvvaNoch keine Bewertungen

- State Life Building: Supply, Installation, Commissioning Testing of 150 Kva Diesel Generator SetDokument43 SeitenState Life Building: Supply, Installation, Commissioning Testing of 150 Kva Diesel Generator SetZia Ur Rehman100% (1)

- HRCPC - LTC - LFC Reimbursement FormatDokument4 SeitenHRCPC - LTC - LFC Reimbursement FormatAtul GuptaNoch keine Bewertungen

- Dost It Di 2017 Technologies Compen DereDokument217 SeitenDost It Di 2017 Technologies Compen DereRcs CheNoch keine Bewertungen

- IASbaba's March Monthly Magazine PDFDokument203 SeitenIASbaba's March Monthly Magazine PDFsmilealways20Noch keine Bewertungen

- Assignment Pa 504Dokument14 SeitenAssignment Pa 504Rolando Cruzada Jr.Noch keine Bewertungen

- Castle Plc Financial StatementsDokument3 SeitenCastle Plc Financial StatementsSteve IdnNoch keine Bewertungen