Beruflich Dokumente

Kultur Dokumente

Art 20164109

Hochgeladen von

Sajid Mohy Ul DinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Art 20164109

Hochgeladen von

Sajid Mohy Ul DinCopyright:

Verfügbare Formate

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

Firm Specific Factors and Macroeconomic

Determinant of Life Insurance Companies

Profitability in Indonesia

Irma Oktiani1, DS Priyarsono2, Trias Andati3

1, 2, 3

School of Business, Bogor Agricultural University (IPB), Jl. Raya Pajajaran Bogor Indonesia16151, Indonesia

Abstract: Financial analysis is an important tools for insurance companies to enhance the profitability. In developing country, such

as Indonesia, the empirical studies of firm-specific and macroeconomic factors are not so exhaustively analyzed. Therefore, the aim of

this paper is to analyze the firm-specific factors and macroeconomic determinants of life insurance companies profitability in

Indonesia using panel data during the period 2010 to 2014. The study examines the firm-specifics factors consist of size of company,

equity capital, premium growth, risk based capital ratio, leverage ratio and liquidity ratio, while macroeconomic factor is inflation rate.

The findings indicate negative and significant influence of premium growth and risk based capital on profitability; and significant

positive influence of equity capital, liquidity ratio, leverage ratio and size of company on profitability. Additionally, results reveal that

inflation rate is not significantly influence the profitability of life insurance companies. The other finding iscompanies that have good

level of total assets, equity capital, leverage ratio and liquidity ratios tend to have good achievement ROA ratio. Companies should be

able calculating technical reserves appropriately, construct the optimal portfolio in order to be able to generate maximum profits and

streamline expenses operating expenses to maintain the achievement of good profitability.

Keywords: life insurance, profitability, panel data, firm-specific factors and macroeconomic determinants.

1. Introduction insurance claims, therefore, an understanding of profitability

for life insurance companies is essential. Indicators of

Insurance is a financial institution that serves as an insurance achievement of profitability in this study is the ratio of return

agency or risk management. Insurance also serves as a on assets (ROA). According to Malik (2011), a key indicator

platform collector of funds and can be used to finance of a company's profitability, especially in the insurance sector

economic development. Through the insurance sector, is ROA. ROA measures a company's ability to generate

economic actors can move some or all of the losses suffered, profits comprehensively.

so that financial stability is maintained. This is driving the

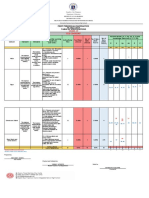

need for the presence of insurance undertakings are resilient Figure 1 shows that return on asset ratio of life insurance

in overcoming various possible risks. companies in Indonesia during the period 2010 to 2014 are

fluctuating (Statistical Reports of Insurance Indonesia) and

Insurance in Indonesia continues to increase with a positive tend to go down in 2014.

trend of the growth rate of insurance penetration. Based on

data released by the Financial Services Authority (FSA) in

the Insurance Statistical Report 2014, insurance penetration

in Indonesia is currently at 2.35 percent. This figure is

greater when compared with previous years (ie about 2.13

percent, 2.06 percent; 1.95 percent). Such increase reflects

the growing awareness of the importance of insurance as part

of risk management activities that can provide security for

property or a person's soul and affect the growth of the

insurance industry in general. For life insurance companies

management, it is a positive signal to obtain premium income

and results greater investment that will affect the

performance of insurance companies.

Insurance business which has the largest contribution in the

national insurance industry is life insurance (FSA 2014),

which is commercial businesses that provide coverage for Figure 1: Return on Asset fluctuation of life insurance

risks insured in accordance with the agreements stipulated in companies

the insurance policy. Risks insured under life insurance

consist of the risk of death, injury and/or disability. Life The same thing happens in big, medium and small

insurance is a business with products and services in order to enterprises. Most of those values are still below the return on

generate long-term profit and depends on the trust of assets of life insurance industry, which is above 3% (see

stakeholders. Profitability greatly affect the company's Table 4).

operations and is part of the company's commitment to pay

Volume 6 Issue 1, January 2017

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20164109 DOI: 10.21275/ART20164109 639

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

Table 4: Return on Assets Ratio of Life-Insurance Industry (in million rupiah)

Tahun

2010 2011 2012 2013 2014

EBIT 6.671.582 8.808.291 10.210.808 8.847.612 14.522.262

Total Asset 141.646.228 221.295.202 221.295.202 280.940.974 349.986.832

ROA (%) 4.71 3.98 4.61 3.15 4.15

It indicates that the insurance company should pay more Size of company and the liquidity ratio has a significant and

attention to the achievement of profit in order to survive in positive effect on profitability (Olaosebikan, 2013;

the long term and able to compete with other companies in Eliskovska 2015; Mehari and Aemiro, 2013; Malik, 2011).

industry. It caused due to the global and national economic The level of solvency (RBC) positive effect on the

crisis. Although the economics go slowdown, life insurance profitability of insurance companies in Romania (Burca and

still posted a positive performance as evidenced by the Batrinca 2014), but a negative effect in Ethiopia (Reshid

growth in total assets of23.3% and total premiums of 26.6% 2015). Equity capital and premium growth risk have a

(Indonesian Life Insurance Association 2015). Entering the significant and negative effect on profitability (Charumathi

era of the ASEAN Economic Community (AEC) and the 2012; Olaosebikan 2013; Burca and Batrinca 2014; Reshid

increasing number of life insurance companies in Indonesia 2015). The life insurance industry is very sensitive to

requires insurance companies to be more competitive by changes in macroeconomic conditions, such as GDP and

having the right business strategy to enhance profitability. Attempt

interest rates.toCristeaet

identify factors that affect

al. (2014), GDP perthe capita

profitability required by ma

is a major

influence on the development of life insurance in Romania.

The preparation of the business strategy undertaken by the Increasing of GDP per capita stimulate the life insurance

company's management requires an analysis of the premiums (Eliskovska 2015). Inflation influence significantly

determinants of financial performance, measured by ROA, and negatively to profitability (Kalengkongan 2013; Pervan

both from internal and macroeconomic factors, in order to be 2010), whereas the effect of interest rates on profitability was

used as a basis for making the best decision. positive and significant (Olaosebikan, 2013; Eliskovska

2015; Kalengkongan 2013).

1.1 Problem Statement

3. Data

Profitability is one of the main objectives of life insurance

companies management. Profit attracts investors and Data used in this research is secondary data obtained from

improves the level of solvency. The better financial various relevant website and agencies in Indonesia. The

performance, the better a profile of the company for its profitability (ROA) and firm-specific factors (size of

stakeholders and the company will be able to compete in the company, age of company, equity capital, leverage ratio,

national and global levels. Life insurance companies with premium growth, risk based capital ratio and liquidity ratio)

better profitability level will survive in the long term are counted from financial statement of each life insurance

business. Determinants of profitability have been debated for companies and Indonesian Insurance Statistical Report. The

years, but until now there has been no solution, especially in macroeconomic data is from Central Bank. Statistical

developing country, such as Indonesia. Therefore, the study Descriptive is from Insurance Statistical Report from 2010

to investigate the factors determine profitability is essential, until 2014. The period used during 2010 to 2014. Depending

both firm-specific factors and macroeconomics for on data availability, out of 50 life insurance companies

developing country. registered in Indonesia Financial Services Authority during

2010 to 2014, 32 companies were selected because data

1.2 Research Objective completeness (see Table 1).

The aims of this study is to analyze the firm-specific factors Table 1: List of Life Insurance Companies in Indonesia

and macroeconomics determinants of life insurance Companies Name

companies profitability in Indonesia during the period 2010 PT. AIA Financial PT. Ace Life Assurance

to 2014 and to formulate recommendations decision making PT. Asuransi Allianz Life Indonesia PT. AJ AdisaranaWanaartha

to improve the profitability for the management company PT. Astra Aviva Life PT. BNI Life Insurance

because profitability achievement of most life-insurance PT. Avrist Assurance PT. AJ BRIngin Life Sejahtera

companies is below the industrys profitability. PT. Axa Financial Indonesia PT. AJB Bumiputera

PT. Axa Life Indonesia PT. Central Asia Raya

2. Literature Review PT. AsuransiJiwa Cigna PT. Equity Life Indonesia

PT. CIMB Sunlife PT. HeksaEka Life Insurance

Profitability is the main purpose of insurance company PT. Commonwealth Life PT. IndolifePensiontama

PT. AJ Generali Indonesia PT. AJ MandiriInhealth

management. According Burca and Batrinca (2014), profit is

PT. Great Eastern Life Indonesia PT. AsuransiJiwasraya

an important prerequisite to improve the competitiveness of

PT. AJ Manulife Indonesia PT. AsuransiJiwa Mega Life

the insurance company in national and global markets.

PT. Prudential Life Assurance PT. Panin Dai-Chi Life

According to Greene and Segal (2004), profitability for life PT. AJ Sequis Life PT. AJ Sequis Financial

insurance companies becomes crucial because it affects their PT. Sunlife Financial Indonesia PT. AsuransiJiwaRecapital

operations. PT. Zurich Insurance Indonesia PT. AJ TuguMandiri

Volume 6 Issue 1, January 2017

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20164109 DOI: 10.21275/ART20164109 640

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

4. Methodology ratio to produce a better profit level. LEV is one of several

financial measurements that look at how much capital comes

According to Firdaus (2011), the approach of panel data is in the form of debt (loans), or assesses the ability of a

used to see the behavior of various individuals (cross section) company to meet financial obligations.

at various time points (time series). Panel data in this study is Risk-based capital (RBC) requirement refers to a rule that

used to look at the influence of firm-specific factors and establishes minimum required liquid reserves or regulatory

macroeconomic determinants on the profitability of life capital for financial institutions. Risk-based capital

insurance companies in Indonesia during 2010-2014. requirements exist to protect financial firms, their investors,

Regression analysis of panel data has three kinds of models, their clients and the economy as a whole. These requirements

namely: (1) Common Effect Model, (2) Fixed Effect Model ensure that each financial institution has enough capital on

(FEM), and (3) Random Effect Model (REM). hand to sustain operating losses while maintaining a safe and

There are several benefits to using panel data. First, the efficient market.

data panel incorporating information from the data time Size of companies (SIZE) is measured by total assets. The

series and cross section so as to provide more data and better companies with more total assets expects to generate more

to do a regression that will reduce bias. Second, it can profit. So, it is expected that size of companies has

overcome the problems that arise when there is an ommited significant and positive influence to insurance companies

variable or lack of time series data. In addition, this research profitability.

also used descriptive statistics to describe the condition of Equity Capital (EC) derived from share premium, retained

the Indonesian life insurance sector in terms of profitability. earnings and other equity components. The greater the equity

The relationship between firm-specific factors and capital means the company will be able to expand the

macroeconomic variables to return on assets (ROA) will be business, for example, the company will be able to open a

analyzed using the following models: new branch of the company, making and issuing new life

insurance products according to the needs of society,

ROA SIZE EC

ij 0 1 ij 2 ij

3 AGE ij

4 LEV ij

5 PG ij

6

LIQ

ij

purchase new technology, etc.

RBC INF

7 ij 9 j ij

Premium Growth (PG) is the percentage of premium

income changes from year to year. Premium growth can be

Where: positive or negative. The greater the premium growth

ROAij = return on asset insurer i at time j illustrate the growing demand for life insurance. Positive

SIZEij = number of total assets insurer i at time j premium growth is expected to have a positive and

ECij = equity capital insurer i at time j significant impact to the profitability of the life insurance

LEVij = leverage ratio insurer i at time j company.

PGij = premium growth insurer i at time j Inflation (INF) is a phenomenon in which the prices of

LIQij = liquidity ratio insurer i at time j economic goods or services have increased. Inflation

RBCij = risk based capital ratio insurer i at time j indicates weakening purchasing power, followed by the

INFj = inflation rate at time j decline in the real value of the currency of a country. The

ij = error term inflation rate is very low will cause economic growth to be

i = 1,2,3,N ; N = number of observation very sluggish. In addition, the high inflation rate will lower

j = 1,2,3,T ; T = number of time series the price of shares of banking assets, affecting the

profitability of the company. In corporate activity, high

Profitability is used as a proxy for financial performance inflation will cause a decline in the profitability of a

and also an indicator of a company's ability to generate company. According to research Kalengkongan (2013),

profits and guarantee the payment of claims and benefits to inflation has a significant negative effect on the profitability

policyholders. Profitability also reflect the ability of of insurance companies.

insurance companies to grow and invest. Profitability is the

main purpose of insurance company management. According Table 2: Variables Used and The Formulas

to Burca and Batrinca (2014), profit is an important Variables Formula

prerequisite to improve the competitiveness of the insurance ROA = Income (Losses) Before Tax/Total

company in national and global markets. According to Malik Assets

(2011), ROA is a key indicator of a company's profitability, SIZE = Ln (total assets)

especially in the insurance sector. ROA calculated by EC = Ln (equity capital)

dividing a company's annual earnings by its total assets, ROA LIQ = Current Assets/Current Liabilities

is displayed as a percentage. RBC = The Minimum Solvency

Liquidity (LIQ) describes the degree to which an asset or Margin/Minimum Risk-Based Capital

security can be quickly bought or sold in the market without LEV = Total Liabilities/Total Assets

affecting the asset's price. liquidity measures the ease with PG = The Difference Premium Growth

which an individual or company can meet their financial Between This Year And The Previous

obligations with the liquid assets available to them. Year

Leverage ratio (LEV) consists elements of debt and each

INF = Percentage of Inflation Rate based on

debt has a risk, the greater the leverage will give a greater

Central Bank Report

risk as well. The use of debt will reduce the profitability of

the company, therefore the company must reduce the debt

Volume 6 Issue 1, January 2017

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20164109 DOI: 10.21275/ART20164109 641

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

These variables cover the main activities of life insurance Table 5(a): Pair wise correlation matrix

sector in Indonesia, both firm-specific factors and ROA EC LIQ PG RBC

macroeconomic determinants, and determine the profitability. ROA 1.0000

The following theoretical hypotheses are checked in this EC 0.2754 1.000

study as follows: LIQ 0.0121 0.0359 1.000

1. There is a significant and positive relationship between PG -0.2926 -0.1578 -0.0629 1.000

the size of company and the profitability. RBC -0.2456 0.1484 0.0542 0.0320 1.000

2. There is a significant and negative relationship between SIZE 0.3084 0.5335 0.0508 -0.2388 -0.0850

the equity capital and the profitability. LEV 0.1972 -0.0647 -0.0176 -0.0823 -0.4864

3. There is a significant and positive relationship between INF 0.0987 0.0357 -0.0978 -0.0198 0.2001

the risk based capital of company and the profitability.

4. There is a significant and negative relationship between Table 5(b): Pair wise correlation matrix

the premium growth and the profitability. SIZE LEV INF

5. There is a significant and positive relationship between SIZE 1.0000

LEV 0.4761 1.0000

the liquidity ratio and the profitability.

INF 0.0896 -0.0357 1.0000

6. There is a significant and negative relationship between

the leverage ratio and the profitability.

Table 5(a) and 5(b) show that there are no multicollinearity,

7. There is a significant and negative relationship between

because there are no high correlations (more than 0.8)

the inflation rate and the profitability.

between explanatory variables. Therefore, panel data can be

used.

5. Result and Empirical Analysis

To choose among estimation methods of panel data models,

Table 3: Statistics Descriptive (in percentage) Likelihood Ratio (LR) test, Hausman test and Lagrange

Var Obs Mean Stdv Min Max Multiplier (LM) test were conducted (see Table 5). The

ROA 160 1.52 7.74 -62.14 18.04 hypothesis of these tests is written below:

SIZE 160 14.78 1.53 11.40 17.80

EC 160 13.07 1.71 0.00 15.70 1. LR test.

LEV 160 73.66 21.48 6.70 151.69 H0: Ordinary Least Square (OLS)

PG 160 60.98 340.14 -100.17 3850.24

H1: Fixed Effect Model (FEM)

LIQ 160 469.32 582.27 89.00 4307.90 2. Hausman test.

RBC 160 558.89 624.74 109.51 5269.00

H0: Random Effect Model (REM)

INF 160 5.64 0.96 4.28 6.97

H1: Fixed Effect Model (FEM)

3. LM test.

Descriptive studies shows the mean, standard deviation, H0:OLS

minimum and maximum value of each variables observed H1: REM

during 2010 to 2014, computed based on the 160 H0 was rejected if the probability value of the test is less than

observations recorded. The return on assets (ROA) fluctuates 0.05.

between -62.14% and 18.04% with an average value 1.52%.

PT. CIGNA has the highest ROA ratio in 2010, 18.04%. The Table 6: The results of LR, Hausman and LM tests

proportion of the company's revenue or earning before tax Test ROA Model

compared to total assets in 2010 is large enough. CIGNA LR test F-statistic 2.397769

also has the highest average ROA than the others companies Probability 0.0004

during period 2010 to 2014, which is 11.13%.On the other Hausman test* Chi-square statistic 0.000000

Probability 1.0000

side, PT. Axa Life Indonesia has the lowest ROA, -62.14% in

*Cross-section test variance is invalid. Hausman statistic set

2012 and also has the lowest average ROA, -10.33%.In

to zero.

2012, PT. Axa Life has suffered a great loss (nearly as big as

the amount of total assets), so that itsreturn on assets ratio According to the result of the LR test, because the F-statistic

became negative.In that year, the company's premium income value is significant at the level 5%, the null hypothesis was

decreased by 90%, whereas the cost of the company rejected so that FEM is the appropriate model. Then, we

increased by almost 30% compared to the previous year. should do the Hausman test. The result shows that cross-

section test variance is invalid or Hausman test cant be

We calculated a large number of potential determinants of applied, so that the appropriate model estimation for ROA is

profitability with 32 cross-sections and five years of time FEM. To determine whether autocorrelation problem exist in

series, so it is required to check the multicollinearity between the fixed effect model, the Durbin-Watson (DW) test was

explanatory variables before use the regression. Table 5(a) employed. DW tests value approaching two, 1.929461,

and 5(b) indicate the correlation between predictors in the shows that there is no autocorrelation between independent

model. variables (see Table 7)

Volume 6 Issue 1, January 2017

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20164109 DOI: 10.21275/ART20164109 642

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

Table 7: The results of Fixed Effects Model Premium Growth (PG)

Variabel Dependent Variable: ROA Premium growth has a significant negative effect to

EC 0.321558 profitability. Excessive premium growth will pose a greater

0.0000* risk underwriting. The greater the risk requires the company

LIQ 0.000585 to provide more funds to cover such risks. Underwriting risks

0.0000* that are too high will erode income earned by the company to

PG -0.003269

cover the magnitude of the risks involved, therefore PG has a

0.0000*

RBC -0.000255

significant and negative impact on ROA.

0.2055*

SIZE 1.479189 Size of Company (SIZE)

0.0000* Size of company has a positive and significant effect of

LEV 0.064998 ROA. According to Malik (2011), size has a significant

0.0000* influence and positive impact on ROA. These results are also

INF 0.091665 supported by research conducted by Chen and Wong (2004),

0.3531 Mehari and Aemiro (2013). Life insurance company's assets

C -29.76091 consist of assets investment and non-investment assets.

0.0000* Investments made by the insurance company in the financial

Adjusted R-squared 0.794380

markets and capital markets. These types of investments

Durbin-Watson statistic 1.929461

undertaken include deposits, bonds, securities, mutual funds,

F-statistic 17.16500

stocks and other investments permitted under the rules of

Probability 0.000000

finance ministers. The investment is expected to create

*significant at level 25%;

profits for the company. The greater and effective the

investment assets, the possibility of acquiring profits will be

Based on the result, the representation model of FEM

greater too.

estimator is:

ROA = 0.322*EC + 0.0650*LEV + 0.00059*LIQ -

Risk Based Capital (RBC)

0.0033*PG - 0.00026*RBC + 1.479*SIZE +

Risk based capital ratio has significant and negative effect on

0.092*INF - 29.76 + [CX=F]

ROA. The income of insurance companies (ROA) influenced

by claim expenses and operating expenses. The increasing of

The result of regression analysis indicate that SIZE, EC, LIQ

total assets will advance the RBC, but it will not necessarily

and LEV have significant and positive influence to ROA at

improve the ROA. So that, increasing of RBC will erode the

significance level of 25%. RBC and PG have significant and

revenues (ROA) of the insurance companies.

negative influence to ROA at a significance level of 25%.

Meanwhile, INF is statistically insignificant. The Adjusted R-

Leverage Ratio (LEV)

squared shows that 79.44% of variations in dependent

Leverage ratio (LEV) has significant and positive effect on

variable (ROA) are explained by the variations in the seven

ROA. Liabilities of life insurance company consists of Debt

independent variables, while 20.56% variations of ROA is

and Technical Reserves account. Technical reserves has the

explained by the other factors outside the model. F-statistic

largest portion of the company's liabilities. The greatest

shows the validity of model as its value 17.165 is well above

element of Technical Reserves is Premium Reserves.

its Probability (F-statistics) value of 0.000.

Premium Reserves is the amount of money collected by the

insurance company obtained from the difference between the

Equity Capital (EC)

value of benefits and cash value insurance payment at a time

Equity capital has a significant and positive effect to

in preparation for the payment of claims.

profitability. The greater the equity capital is owned by the

insurance company, then the company will be able to develop

Companies that are able to calculate the premium reserve

its business better, for example by expanding or opening a

accurately will be able to fulfill all of its obligations properly

new branch of the company, create new life insurance

without erode its profits. So that, the effect of this

products as required by the participants and use the new

determinant is positive to profitability ratio (ROA) of life

technology to reduce cost, etc. These are expected to

insurance companies.

contribute positively and significantly to the level of

profitability of life insurance companies.

6. Conclusion

Liquidity Ratio (LIQ)

Liquidity ratio has a positive and significant effect. The life Based on the analysis of the factors that affect the

insurance company with higher liquidity ratios will have a profitability of the life insurance company, it can be

lesser chance for failure of payment obligations to concluded as follows:

policyholders. Companies with good liquidity will be able to 1)Variable equity capital (EC), liquidity ratio (LIQ), size of

meet all its obligations at maturity despite the difficult company (SIZE), premium growth (PG), risk based capital

circumstances due to the large supply current assets. It is (RBC) and leverage ratio (LEV) is an important variable

intended that the company is able to create a larger profit in that must be considered by the management to draw up the

line with the increase in current assets. company's business strategy. EC, LIQ, LEV and SIZE

positive effect on ROA, meaning that an increase in these

Volume 6 Issue 1, January 2017

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20164109 DOI: 10.21275/ART20164109 643

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391

variables will increase ROA of life insurance companies. [12] Kaya EO. 2015. The effects of firm-specific factors on

PG and RBC variables have negative effect on ROA. It is the profitability of non-life insurance companies in

means that an increase in that variables will decrease ROA Turkey. Int J Fin Stud. 3(4): 510-529.

of life insurance companies. The inflation rate has no effect [13] Malik H. 2011. Determinants of insurance companies

on ROA life insurance companies. profitability: an analysis of insurance sector of Pakistan.

2)Profitability is determined by the amount of wealth owned Academic Research Journal Savap Int. 1(3): 315-321.

by the company. Companies that have good level of total [14] Mehari D, Aemiro T. 2013. Firm specific factors that

assets, equity capital, liquidity ratio and leverage ratio tend determine insurance companies; performance in

to have good achievement ROA ratio. Effort to maintain Ethiopia. European Scientific Journal. 9(10): 245-255.

the achievement of good profitability are companies should [15] Olaosebikan O. 2013. The determinants of the

be able calculating technical reserves appropriately, profitability of micro-life insurers in Nigeria. The

construct the optimal portfolio in order to be able to Geneva Papers. (2013)38:140-159.

generate maximum profits and streamline expenses [16] Pervan M. 2010. Determinants of insurance companies

operating expenses. profitability in Croatia. The Business Review,

Cambridge. 16(1): 209-216.

References [17] Reshid S. 2015. Determinants of Insurance Companies

Profitability in Ethiopia [tesis]. Addis Ababa [ET]:

[1] [AAJI]. AsosiasiAsuransiJiwa Indonesia. 2015. AAJI Addis Ababa University.

LaporkanKinerjaAsuransiJiwaPadaKuartalPertama di

Tahun 2015. AAJI Corporate News [Internet].

Downloaded at 9 Februari 2016. Available at:

http://www.aaji.or.id/file/uploads/content/file/AAJI-

corporate-news-press-con-quartal-1-2015-4-juni-

2015.html.

[2] [OJK]. OtoritasJasaKeuangan. StatistikPerasuransian

Indonesia 2014 [Internet]. Downloaded at: 13 Januari

2016. Availeble at:

http://www.ojk.go.id/id/kanal/iknb/data-dan

statistik/asuransi/Pages/Perasuransian-Indonesia-

2014.aspx.

[3] Beck T, Webb I. 2002. Economic, Demographic, and

Institutional Determinants of Life Insurance

Consumption across Countries. The World Bank

Economic Review. 17(1): 5188

[4] Burca AM, Batrinca G. 2014. The determinants of

financial performance in the Romania insurance market.

IJAR AFMS. 4(1): 299-308.

[5] Charumathi B. 2012. On the determinants of profitability

of indian life insurers an empirical study. Proceedings

of the World Congress on Engineering. 2012(1).

[6] Chen R, Wong KA. 2004. The Determinants of Financial

Health of Asian Insurance Companies. J Risk and

Insurance. 71(3): 469-499.

[7] Cristea M, Marcu N, Carstina S. 2014. The relationship

between insurance and economic growth in Romania

compared to the main result in Europe-a theoretical and

empirical analysis. Procedia Economics and Finance.

8(2014): 226-235.

[8] Eliskovska TD. 2015. Microeconomic and

macroeconomic determinants of the profitability of the

insurance sector in Macedonia. Economics and

Bussiness Review. 1(3): 38-57.

[9] Firdaus. 2011. AplikasiEkonometrikauntuk Data Panel

dan Time Series. Bogor (ID): IPB Pr.

[10] Greene WH, Segal. 2004. Profitability and efficiency in

the US life insurance industry. Journal of Productivity

Analysis. 21(2014): 229247.

[11] Kalengkongan G. 2013. Tingkat

sukubungadaninflasipengaruhnyaterhadap return on asset

(roa) padaindustriperbankan yang go public di bursa

efek Indonesia. JEMBA. 1(4):737-747.

Volume 6 Issue 1, January 2017

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

Paper ID: ART20164109 DOI: 10.21275/ART20164109 644

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Insurance Activity and Economic Performance: Fresh Evidence From Asymmetric Panel Causality TestsDokument20 SeitenInsurance Activity and Economic Performance: Fresh Evidence From Asymmetric Panel Causality TestsSajid Mohy Ul DinNoch keine Bewertungen

- Institutional Quality and Initial Public Offering Underpricing: Evidence From Hong KongDokument12 SeitenInstitutional Quality and Initial Public Offering Underpricing: Evidence From Hong KongSajid Mohy Ul DinNoch keine Bewertungen

- Intrinsic and Extrinsic Motivation For University Staff Satisfaction: Confirmatory Composite Analysis and Confirmatory Factor AnalysisDokument27 SeitenIntrinsic and Extrinsic Motivation For University Staff Satisfaction: Confirmatory Composite Analysis and Confirmatory Factor AnalysisSajid Mohy Ul DinNoch keine Bewertungen

- Recent Advances in Liquid Organic Hydrogen Carriers: An Alcohol-Based Hydrogen EconomyDokument15 SeitenRecent Advances in Liquid Organic Hydrogen Carriers: An Alcohol-Based Hydrogen EconomySajid Mohy Ul Din100% (1)

- The Impact of Corporate Social Responsibility On Firms' Financial Performance in South AfricaDokument23 SeitenThe Impact of Corporate Social Responsibility On Firms' Financial Performance in South AfricaSajid Mohy Ul DinNoch keine Bewertungen

- An Inter Disciplinary Review of The Literature On Mental Illness Disclosure in The Workplace Implications For Human Resource ManagementDokument38 SeitenAn Inter Disciplinary Review of The Literature On Mental Illness Disclosure in The Workplace Implications For Human Resource ManagementSajid Mohy Ul DinNoch keine Bewertungen

- A Theoretical Basis For Innovation, Institutions and Insurance Penetration NexusDokument13 SeitenA Theoretical Basis For Innovation, Institutions and Insurance Penetration NexusSajid Mohy Ul DinNoch keine Bewertungen

- Student Teacher Challenges Using The Cognitive Load Theory As An Explanatory Lens PDFDokument16 SeitenStudent Teacher Challenges Using The Cognitive Load Theory As An Explanatory Lens PDFSajid Mohy Ul DinNoch keine Bewertungen

- Linking Anthropology: History ClothingDokument5 SeitenLinking Anthropology: History ClothingSajid Mohy Ul DinNoch keine Bewertungen

- Marceau 2009Dokument36 SeitenMarceau 2009Sajid Mohy Ul DinNoch keine Bewertungen

- Can 2017Dokument29 SeitenCan 2017Sajid Mohy Ul DinNoch keine Bewertungen

- Plenary and Symposium Abstracts: Biological PsychiatryDokument1 SeitePlenary and Symposium Abstracts: Biological PsychiatrySajid Mohy Ul DinNoch keine Bewertungen

- Jacob 2008Dokument37 SeitenJacob 2008Sajid Mohy Ul DinNoch keine Bewertungen

- Ijse 05 2017 0194Dokument23 SeitenIjse 05 2017 0194Sajid Mohy Ul DinNoch keine Bewertungen

- Content ServerDokument6 SeitenContent ServerSajid Mohy Ul DinNoch keine Bewertungen

- U.S. Ssecurity Ppolicy Iin Ssouth Aasia Since 9/11 - Cchallenges Aand Implications Ffor Tthe FfutureDokument16 SeitenU.S. Ssecurity Ppolicy Iin Ssouth Aasia Since 9/11 - Cchallenges Aand Implications Ffor Tthe FfutureSajid Mohy Ul DinNoch keine Bewertungen

- A New Era For Women? Some Reflections On Blind Spots of ICT-based Development Projects For Women's Entrepreneurship and EmpowermentDokument16 SeitenA New Era For Women? Some Reflections On Blind Spots of ICT-based Development Projects For Women's Entrepreneurship and EmpowermentSajid Mohy Ul DinNoch keine Bewertungen

- A Model Predictive Control For Renewable Energy Based AC Microgrids Without Any PID RegulatorsDokument5 SeitenA Model Predictive Control For Renewable Energy Based AC Microgrids Without Any PID RegulatorsSajid Mohy Ul DinNoch keine Bewertungen

- 10 1111@j 1539-6924 2008 01030 X PDFDokument16 Seiten10 1111@j 1539-6924 2008 01030 X PDFSajid Mohy Ul DinNoch keine Bewertungen

- 01443570210414329Dokument108 Seiten01443570210414329Sajid Mohy Ul DinNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Power Control 3G CDMADokument18 SeitenPower Control 3G CDMAmanproxNoch keine Bewertungen

- Rare Malignant Glomus Tumor of The Esophagus With PulmonaryDokument6 SeitenRare Malignant Glomus Tumor of The Esophagus With PulmonaryRobrigo RexNoch keine Bewertungen

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Dokument6 SeitenRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNoch keine Bewertungen

- How To Present A Paper at An Academic Conference: Steve WallaceDokument122 SeitenHow To Present A Paper at An Academic Conference: Steve WallaceJessicaAF2009gmtNoch keine Bewertungen

- Participate in Safe Food Handling Practices SITXFSA002 - PowerpointDokument71 SeitenParticipate in Safe Food Handling Practices SITXFSA002 - PowerpointJuan Diego Pulgarín Henao100% (2)

- Better Photography - April 2018 PDFDokument100 SeitenBetter Photography - April 2018 PDFPeter100% (1)

- Geometry and IntuitionDokument9 SeitenGeometry and IntuitionHollyNoch keine Bewertungen

- Ymrtc LogDokument26 SeitenYmrtc LogVinicius Silveira0% (1)

- What Says Doctors About Kangen WaterDokument13 SeitenWhat Says Doctors About Kangen Waterapi-342751921100% (2)

- PreviewpdfDokument83 SeitenPreviewpdfJohana GavilanesNoch keine Bewertungen

- Discovery and Integration Content Guide - General ReferenceDokument37 SeitenDiscovery and Integration Content Guide - General ReferencerhocuttNoch keine Bewertungen

- Avid Final ProjectDokument2 SeitenAvid Final Projectapi-286463817Noch keine Bewertungen

- Karthik ResumeDokument2 SeitenKarthik ResumeArun Raj ANoch keine Bewertungen

- Lect.1-Investments Background & IssuesDokument44 SeitenLect.1-Investments Background & IssuesAbu BakarNoch keine Bewertungen

- Adverbs of Manner and DegreeDokument1 SeiteAdverbs of Manner and Degreeslavica_volkan100% (1)

- CoSiO2 For Fischer-Tropsch Synthesis Comparison...Dokument5 SeitenCoSiO2 For Fischer-Tropsch Synthesis Comparison...Genesis CalderónNoch keine Bewertungen

- Model TB-16Dokument20 SeitenModel TB-16xuanphuong2710Noch keine Bewertungen

- HemoptysisDokument30 SeitenHemoptysisMarshall ThompsonNoch keine Bewertungen

- A Review of Mechanism Used in Laparoscopic Surgical InstrumentsDokument15 SeitenA Review of Mechanism Used in Laparoscopic Surgical InstrumentswafasahilahNoch keine Bewertungen

- III.A.1. University of Hawaii at Manoa Cancer Center Report and Business PlanDokument35 SeitenIII.A.1. University of Hawaii at Manoa Cancer Center Report and Business Planurindo mars29Noch keine Bewertungen

- NHM Thane Recruitment 2022 For 280 PostsDokument9 SeitenNHM Thane Recruitment 2022 For 280 PostsDr.kailas Gaikwad , MO UPHC Turbhe NMMCNoch keine Bewertungen

- 0 BA Design ENDokument12 Seiten0 BA Design ENFilho AiltonNoch keine Bewertungen

- TRICARE Behavioral Health Care ServicesDokument4 SeitenTRICARE Behavioral Health Care ServicesMatthew X. HauserNoch keine Bewertungen

- LicencesDokument5 SeitenLicencesstopnaggingmeNoch keine Bewertungen

- PCI Bridge ManualDokument34 SeitenPCI Bridge ManualEm MarNoch keine Bewertungen

- IFR CalculationDokument15 SeitenIFR CalculationSachin5586Noch keine Bewertungen

- Antibiotics MCQsDokument4 SeitenAntibiotics MCQsPh Israa KadhimNoch keine Bewertungen

- Christena Nippert-Eng - Watching Closely - A Guide To Ethnographic Observation-Oxford University Press (2015)Dokument293 SeitenChristena Nippert-Eng - Watching Closely - A Guide To Ethnographic Observation-Oxford University Press (2015)Emiliano CalabazaNoch keine Bewertungen

- Buildingawinningsalesforce WP DdiDokument14 SeitenBuildingawinningsalesforce WP DdiMawaheb ContractingNoch keine Bewertungen

- Footing - f1 - f2 - Da RC StructureDokument42 SeitenFooting - f1 - f2 - Da RC StructureFrederickV.VelascoNoch keine Bewertungen