Beruflich Dokumente

Kultur Dokumente

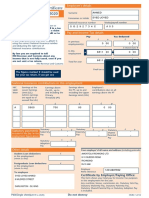

Paye Coding Notice PDF

Hochgeladen von

Nebu MathewsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Paye Coding Notice PDF

Hochgeladen von

Nebu MathewsCopyright:

Verfügbare Formate

PAYE Coding Notice This indicates

the tax year

Tax code for tax year

2008 2009 which runs from

Please keep all your coding notices. You may need to refer to

6 April in the

Your name and them if you have to fill in a tax return. Please also quote your tax first year to 5

address reference and National Insurance number if you contact us. April in the

010000:00000079:001 491/1

H M INSPECTOR OF TAXES second year.

MR I SURNAME OFFICE NAME

ADDRESS LINE 1 OFFICE ADDRESS LINE 1

ADDRESS LINE 2 TOWN

ADDRESS LINE 3 COUNTY Your tax office

TOWN POSTCODE full postal

COUNTY POSTCODE

Employer / Inland Revenue office phone Date of issue address

pension payer 01999 000000 13 FEB 2008

Tax reference National Insurance Number

000/Z1111 XX 00 00 00 Z

This is your

An Allowance copy of the tax

is an amount of Dear MR I SURNAME code for the

income you are

This is your copy of the tax

code for the employer/pension

shown below. The payroll will

use this code against your

income with them.

employer/pensio

entitled to Your tax code for the year 6th April 2008 to 5th April 2009 is 140L n shown below.

before paying The payroll will

tax and is You need a tax code so Your Employer can work out how much tax to take off the payments they use this code

divided in to make to you from 6th April 2008. We have worked out your tax code but need you to check that our against your

information about you is correct. The wrong tax code may mean you pay too much, or too little tax. income with

weekly or Please keep your Coding Notices, you may need them if we send you a Tax Return. them.

monthly sums

dependant on Here is how we worked it out:

your pay.

your personal allowance 5,435 (see Note 1 below) This section

your state pension -4,028 (see Note 2 below) shows

a tax free amount of 1,407 (see Note 3 below) Allowances and

A Deduction is

an amount we Deductions in

If we have got it wrong, or if your circumstances have changed and you think it could

take away from affect the tax you pay, please tell us. Our telephone number and address are above. We

arithmetic

your Allowances turn 1,407 into tax code 140Lto send to Your Employer. They should use this code with the format. The final

to pay the tax on tables they receive from HM Revenue & Customs to take off the right amount of tax each time figure is your tax

various types of they pay you from 6th April 2008. Your Employer does not know the details of 140Lor how it is free sum.

worked out - that is confidential between us.

income

including State Notes

and Company

1 The law allows everyone who lives in the UK to receive some income before tax has to be

benefits and paid - a "tax free amount" of income. That tax free amount starts from a "personal allowance"

sources of that depends on your circumstances. We believe you are entitled to 5,435 for this tax year.

untaxed income. 5,435 is the personal allowance for people who are over 75 at 5th April 2009 with total

income for the year over 29,290. But please read note 3 as well which tells you when

to contact us if your income is likely to change.

The notes in this

section relate to

your personal

circumstances.

They are specific P2(New) Page 1 Please turn over

to you.

2 We have to see if anything should reduce your tax free amount. We know you receive the state

pension or another taxable state benefit and we have estimated that you will receive 4,028 this

year. The pension or state benefit is taxable but the Department for Work and Pensions, who pay

it to you, cannot take tax off the payments. So we have used some of your tax free amount to

take care of the tax due on your state pension or benefits 4,028.

3 If your Your Employment income for the year is more than 1,407 you will pay tax as follows:

- At 20% on the next 34,600

- At 40% on anything over 36,007.

Please tell us if your total income for the year is likely to be less than 29,290. The level of your

income can affect the amount of the allowances you get, so we may have to change your tax

code. You could pay the wrong amount of tax if we do not get your code right.

In practice, your tax free amount is spread over the whole year, so you can receive about 117 a

month, or 29 a week before Your Employment takes tax off you.

Check your payment advice to make sure Your Employment has not taken off National Insurance

contributions.

If you want to find out more about what could affect the tax you pay on your Giveus Abreak income go

to www.hmrc.gov.uk or ring us on 01567 3456789 and we will do our best to help you with any

questions about tax.

Your sincerely

Mr T Inspector

Director

Page 2

Das könnte Ihnen auch gefallen

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- Rent ReceiptDokument1 SeiteRent Receiptbathyal28% (43)

- Employer Identification Number (EIN) Application / RegistrationDokument3 SeitenEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- Downloadfile 30 PDFDokument114 SeitenDownloadfile 30 PDFYianniAnd Sophia0% (1)

- Form PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Dokument4 SeitenForm PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Joy100% (1)

- U.S. Individual Income Tax Return: Filing StatusDokument28 SeitenU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- Important information to include before sending your tax returnDokument10 SeitenImportant information to include before sending your tax returnJonNoch keine Bewertungen

- Getting Paid Reinforcement Worksheet 2.3.9.A2Dokument2 SeitenGetting Paid Reinforcement Worksheet 2.3.9.A2Lyndsey BridgersNoch keine Bewertungen

- CLR 2020 Tax ReturnDokument14 SeitenCLR 2020 Tax ReturnAlexander Barno AlexNoch keine Bewertungen

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Dokument16 SeitenPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezNoch keine Bewertungen

- Instructions for Trust Account SetupDokument10 SeitenInstructions for Trust Account SetupVasishtha TeeluckdharryNoch keine Bewertungen

- 2021 Tax Return: Prepared ByDokument4 Seiten2021 Tax Return: Prepared ByDennis0% (1)

- Sanogo 2019 TFDokument40 SeitenSanogo 2019 TFbassomassi sanogoNoch keine Bewertungen

- Tax Return 2018-19Dokument18 SeitenTax Return 2018-19Kasam ANoch keine Bewertungen

- TaxDokument3 SeitenTaxJames Bleeker100% (1)

- P21 Balancing Statement 2018 124615500017Dokument2 SeitenP21 Balancing Statement 2018 124615500017Aurimas AurisNoch keine Bewertungen

- Test B: Calculator AllowedDokument24 SeitenTest B: Calculator AllowedNebu MathewsNoch keine Bewertungen

- Accounting Voucher 289Dokument1 SeiteAccounting Voucher 289rajesh puhanNoch keine Bewertungen

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Dokument1 SeiteAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNoch keine Bewertungen

- Dockercheatsheet-2016 1471635298Dokument12 SeitenDockercheatsheet-2016 1471635298Nebu MathewsNoch keine Bewertungen

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Dokument1 SeiteFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNoch keine Bewertungen

- Fortis Hospital February 2019 PayslipDokument1 SeiteFortis Hospital February 2019 PayslipmkumarsejNoch keine Bewertungen

- 2G KPI Anapysis Problem and SolutionsDokument50 Seiten2G KPI Anapysis Problem and Solutionselahe19100% (5)

- X Western Vs Cir Case Digest OkDokument2 SeitenX Western Vs Cir Case Digest OkIvan Montealegre ConchasNoch keine Bewertungen

- Tax Year To 5 April: P60 End of Year CertificateDokument1 SeiteTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNoch keine Bewertungen

- Important Information To Include On Your Tax Return Before Sending It To UsDokument10 SeitenImportant Information To Include On Your Tax Return Before Sending It To UsGeorge SardisNoch keine Bewertungen

- Sa100 - 2013-2014 - Copy2Dokument10 SeitenSa100 - 2013-2014 - Copy2lucy baikNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument32 SeitenCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNoch keine Bewertungen

- US Internal Revenue Service: F940ez - 1995Dokument4 SeitenUS Internal Revenue Service: F940ez - 1995IRSNoch keine Bewertungen

- Declare Salary IncomeDokument4 SeitenDeclare Salary IncomeM. AamirNoch keine Bewertungen

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDokument2 SeitenInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNoch keine Bewertungen

- RPH NowDokument2 SeitenRPH NowBilling ZamboecozoneNoch keine Bewertungen

- 2307 LessorDokument3 Seiten2307 LessorPaul EspinosaNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDokument4 SeitenCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corNoch keine Bewertungen

- US Internal Revenue Service: F8453ol - 2000Dokument2 SeitenUS Internal Revenue Service: F8453ol - 2000IRSNoch keine Bewertungen

- US Internal Revenue Service: F8453ol - 2003Dokument2 SeitenUS Internal Revenue Service: F8453ol - 2003IRSNoch keine Bewertungen

- Dimensional Service Corporation 2307Dokument3 SeitenDimensional Service Corporation 2307Randy RosasNoch keine Bewertungen

- US Internal Revenue Service: F8453ol - 1997Dokument2 SeitenUS Internal Revenue Service: F8453ol - 1997IRSNoch keine Bewertungen

- US Internal Revenue Service: F940ez - 1994Dokument4 SeitenUS Internal Revenue Service: F940ez - 1994IRSNoch keine Bewertungen

- Img 20220411 0006Dokument1 SeiteImg 20220411 0006herb flatherNoch keine Bewertungen

- US Internal Revenue Service: f8453 - 1996Dokument2 SeitenUS Internal Revenue Service: f8453 - 1996IRSNoch keine Bewertungen

- Nicolae Greurus - p60 (2023-24)Dokument1 SeiteNicolae Greurus - p60 (2023-24)danielagonciulea6Noch keine Bewertungen

- U.S. Individual Income Tax Declaration For An IRS E-File Online ReturnDokument2 SeitenU.S. Individual Income Tax Declaration For An IRS E-File Online ReturnIRSNoch keine Bewertungen

- US Internal Revenue Service: f8453 - 2000Dokument2 SeitenUS Internal Revenue Service: f8453 - 2000IRSNoch keine Bewertungen

- Monthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)Dokument4 SeitenMonthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)IRSNoch keine Bewertungen

- Sap Fi AP Manual For Common Daily TransactionsDokument72 SeitenSap Fi AP Manual For Common Daily TransactionsMehmood Ul HassanNoch keine Bewertungen

- US Internal Revenue Service: F8453ol - 2001Dokument2 SeitenUS Internal Revenue Service: F8453ol - 2001IRSNoch keine Bewertungen

- US Internal Revenue Service: f940 - 2003Dokument2 SeitenUS Internal Revenue Service: f940 - 2003IRSNoch keine Bewertungen

- US Internal Revenue Service: F8453ol - 2005Dokument2 SeitenUS Internal Revenue Service: F8453ol - 2005IRSNoch keine Bewertungen

- 1099-r FREE PDFDokument11 Seiten1099-r FREE PDFVenkatSridharan0% (1)

- F1099nec PDFDokument8 SeitenF1099nec PDFĚrick Päpeletas MartinezNoch keine Bewertungen

- Documents (942,202212311058, F99NEE)Dokument2 SeitenDocuments (942,202212311058, F99NEE)LertoraNoch keine Bewertungen

- PC Square2307Dokument3 SeitenPC Square2307SirManny ReyesNoch keine Bewertungen

- Acos0950 21i FCDokument22 SeitenAcos0950 21i FCAna Acosta MezaNoch keine Bewertungen

- Declaration by EmployeeDokument1 SeiteDeclaration by EmployeesaifullahNoch keine Bewertungen

- US Internal Revenue Service: f943 - 1991Dokument4 SeitenUS Internal Revenue Service: f943 - 1991IRS100% (1)

- Important Information To Include On Your Tax Return Before Sending It To UsDokument10 SeitenImportant Information To Include On Your Tax Return Before Sending It To UsHagiNoch keine Bewertungen

- US Internal Revenue Service: f8879s - 2003Dokument2 SeitenUS Internal Revenue Service: f8879s - 2003IRSNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDokument4 SeitenCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasthekidthatcantNoch keine Bewertungen

- US Internal Revenue Service: f8453 - 2002Dokument2 SeitenUS Internal Revenue Service: f8453 - 2002IRSNoch keine Bewertungen

- US Internal Revenue Service: f8453 - 2001Dokument2 SeitenUS Internal Revenue Service: f8453 - 2001IRSNoch keine Bewertungen

- SA100 Tax Return English 2020Dokument10 SeitenSA100 Tax Return English 2020Mal WilliamsonNoch keine Bewertungen

- Main - Form Sa100 Tax Return United KingdomDokument10 SeitenMain - Form Sa100 Tax Return United KingdomadminNoch keine Bewertungen

- Ace HardwareDokument2 SeitenAce HardwareMarion TabingNoch keine Bewertungen

- US Internal Revenue Service: f8404 - 2000Dokument2 SeitenUS Internal Revenue Service: f8404 - 2000IRSNoch keine Bewertungen

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Dokument3 SeitenD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNoch keine Bewertungen

- Formular 200 Anaf EngDokument14 SeitenFormular 200 Anaf Enguzuneanu ralucaNoch keine Bewertungen

- US Internal Revenue Service: F8453ol - 1996Dokument2 SeitenUS Internal Revenue Service: F8453ol - 1996IRSNoch keine Bewertungen

- 2307 Thedeleons Co LTDDokument2 Seiten2307 Thedeleons Co LTDRACHEL DAMALERIONoch keine Bewertungen

- Income Tax Seventh Amend Rule 2009Dokument6 SeitenIncome Tax Seventh Amend Rule 2009api-19806985Noch keine Bewertungen

- Form 12Dokument16 SeitenForm 12Diego RozulNoch keine Bewertungen

- Half Marathon Training Program - Novice Athlete - Mileage BasedDokument3 SeitenHalf Marathon Training Program - Novice Athlete - Mileage BasedNebu MathewsNoch keine Bewertungen

- Doubles Worksheet with Answers to Double 10Dokument1 SeiteDoubles Worksheet with Answers to Double 10Nebu MathewsNoch keine Bewertungen

- 2-Digit Addition With Some Regrouping (A) Addition WorksheetDokument2 Seiten2-Digit Addition With Some Regrouping (A) Addition WorksheetharyanizolkifliNoch keine Bewertungen

- Mad Maths Minutes Mad Maths Minutes: 9. Making 10 Set C 9. Making 10 Set DDokument1 SeiteMad Maths Minutes Mad Maths Minutes: 9. Making 10 Set C 9. Making 10 Set DNebu MathewsNoch keine Bewertungen

- Benson PaperfoldableDokument1 SeiteBenson PaperfoldableNebu MathewsNoch keine Bewertungen

- Set Up A Basic Website With Apache - TechRepublicDokument6 SeitenSet Up A Basic Website With Apache - TechRepublicNebu MathewsNoch keine Bewertungen

- 2-Digit Addition With Some Regrouping (A) Addition WorksheetDokument2 Seiten2-Digit Addition With Some Regrouping (A) Addition WorksheetharyanizolkifliNoch keine Bewertungen

- Mad Maths Minutes Mad Maths Minutes: 9. Making 10 Set C 9. Making 10 Set DDokument1 SeiteMad Maths Minutes Mad Maths Minutes: 9. Making 10 Set C 9. Making 10 Set DNebu MathewsNoch keine Bewertungen

- Mad Maths Minutes Doubles Worksheet Sets C and DDokument1 SeiteMad Maths Minutes Doubles Worksheet Sets C and DNebu MathewsNoch keine Bewertungen

- Test App Master Ikt 2006 OrstadDokument99 SeitenTest App Master Ikt 2006 Orstadvphuc1984Noch keine Bewertungen

- Glue and Place Wheel Here Glue and Place Wheel Here: SP EEDokument1 SeiteGlue and Place Wheel Here Glue and Place Wheel Here: SP EENebu MathewsNoch keine Bewertungen

- 100 Keyboard Shortcuts For Moving Faster in Windows 7Dokument5 Seiten100 Keyboard Shortcuts For Moving Faster in Windows 7Umi Ghozi-gazaNoch keine Bewertungen

- LTA Paper PDFDokument8 SeitenLTA Paper PDFWatchrara BoonyodNoch keine Bewertungen

- Getopts TutorialDokument5 SeitenGetopts TutorialNebu MathewsNoch keine Bewertungen

- Ipr2020 - Rosales, Josha IzzavelleDokument2 SeitenIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNoch keine Bewertungen

- Payment of Bonus Act 1965Dokument11 SeitenPayment of Bonus Act 1965KNOWLEDGE CREATORS100% (2)

- 1202 Second Details Rental Tax Books of AcctDokument1 Seite1202 Second Details Rental Tax Books of AcctMaddahayota CollegeNoch keine Bewertungen

- TED Accountant - Sales and Expenses 102023Dokument10 SeitenTED Accountant - Sales and Expenses 102023jonjonNoch keine Bewertungen

- City Treasury Office: Togan, Juliet PDokument1 SeiteCity Treasury Office: Togan, Juliet PJerik ElesioNoch keine Bewertungen

- F6 ACCA TX - UK Worked Examples Open TuitionDokument37 SeitenF6 ACCA TX - UK Worked Examples Open TuitionRich KishNoch keine Bewertungen

- 2001 TasDokument279 Seiten2001 TasIRSNoch keine Bewertungen

- International Tax EnvironmentDokument14 SeitenInternational Tax EnvironmentAnonymous VstguMKrb50% (2)

- Salary Slip For The Month of December 2019: Sukhbir Agro Energy LTDDokument1 SeiteSalary Slip For The Month of December 2019: Sukhbir Agro Energy LTDkamaleshsNoch keine Bewertungen

- Icici Bank Gstinvoice May 2021 Xxxxxxxx2165Dokument1 SeiteIcici Bank Gstinvoice May 2021 Xxxxxxxx2165Solomon PasulaNoch keine Bewertungen

- Filing of Returns and PaymentDokument10 SeitenFiling of Returns and PaymentOmie Jehan Hadji-AzisNoch keine Bewertungen

- Hirakud Express Sleeper (SL) : Electronic Reserva On Slip (ERS)Dokument1 SeiteHirakud Express Sleeper (SL) : Electronic Reserva On Slip (ERS)phaneendhra1999Noch keine Bewertungen

- ChandanDokument2 SeitenChandanchandan kumarNoch keine Bewertungen

- Tax Invoice (Original For Recipient) : Item Description Qty Rate Total Disc Taxable Value Igst CessDokument2 SeitenTax Invoice (Original For Recipient) : Item Description Qty Rate Total Disc Taxable Value Igst Cessiamshivamsingh24Noch keine Bewertungen

- 2551Q Jan 2018 ENCS Final Rev 3 - Copy BIR WebsiteDokument9 Seiten2551Q Jan 2018 ENCS Final Rev 3 - Copy BIR Websitedindi genilNoch keine Bewertungen

- Hema Urban Heaven Cost SheetDokument1 SeiteHema Urban Heaven Cost Sheetitjob65Noch keine Bewertungen

- Solved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonDokument1 SeiteSolved Cosimo Enterprises Issues A 260 000 45 Day 5 Note To DixonAnbu jaromiaNoch keine Bewertungen

- MObile InvoiceDokument1 SeiteMObile Invoicechandra kiran KodavatiNoch keine Bewertungen

- MDDCore Lock FileDokument3 SeitenMDDCore Lock FileShin LimNoch keine Bewertungen

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument4 SeitenForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNoch keine Bewertungen

- Ecorea 2 Invoice Copy 06-09-2023Dokument1 SeiteEcorea 2 Invoice Copy 06-09-2023Jai Narayan TemhurkarNoch keine Bewertungen